Key Insights

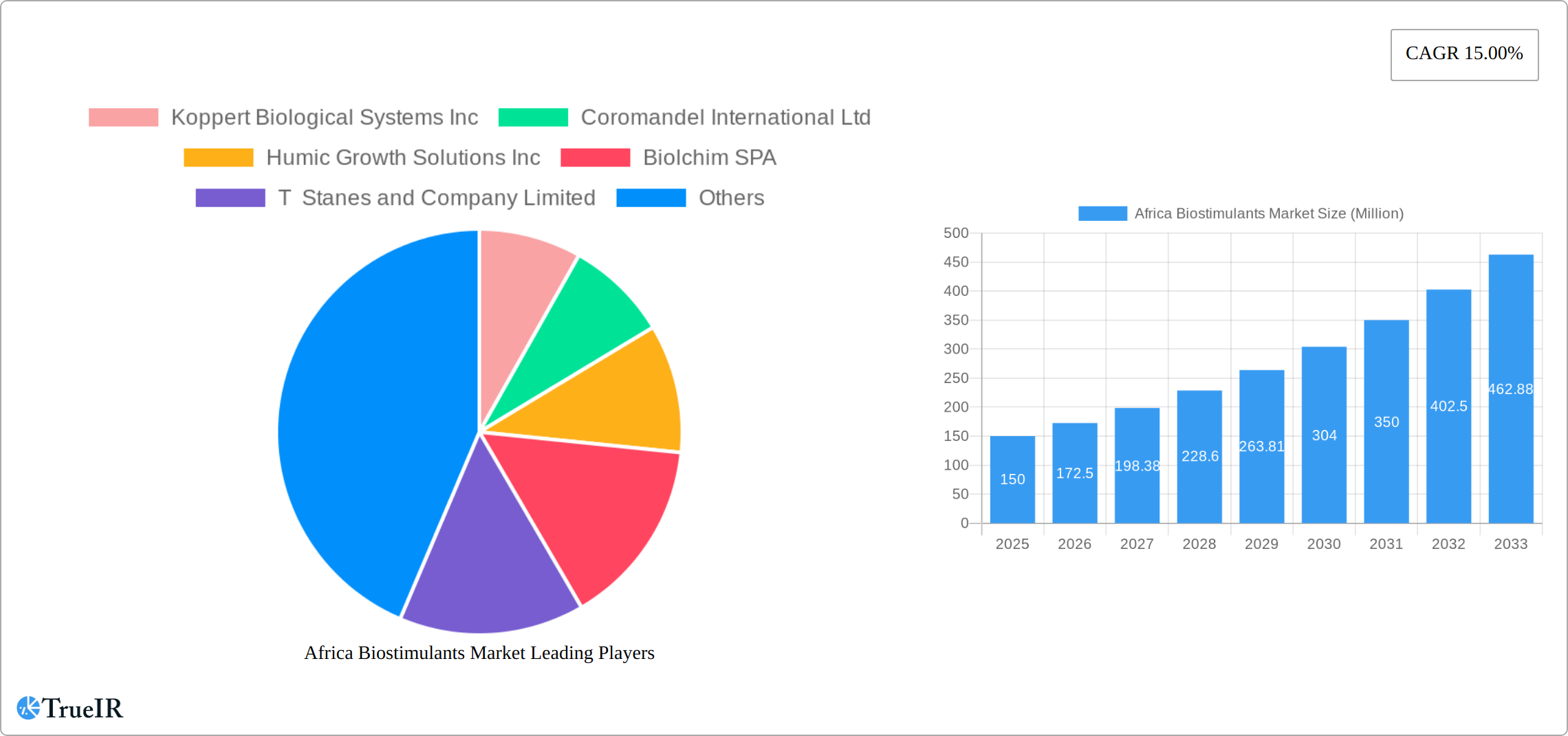

The African biostimulants market is experiencing robust growth, driven by increasing awareness of sustainable agriculture practices and the rising demand for higher crop yields across the continent. The market's Compound Annual Growth Rate (CAGR) of 15% from 2019-2033 signifies a significant expansion, projected to reach substantial value by 2033 (precise figures require further market-specific data but are likely in the hundreds of millions of dollars, based on a 15% CAGR and starting from a substantial base in 2019). Key drivers include the growing adoption of advanced farming techniques, government initiatives promoting agricultural modernization, and favorable climatic conditions in several regions of Africa. The market is segmented by form (Amino Acids, Fulvic Acid, Humic Acid, Protein Hydrolysates, Seaweed Extracts, Other Biostimulants), crop type (Cash Crops, Horticultural Crops, Row Crops), and country (with South Africa, Egypt, and Nigeria representing major markets). The leading players, including Koppert Biological Systems Inc., Coromandel International Ltd., and Haifa Group, are strategically expanding their presence to cater to this growing demand.

However, challenges remain. Access to finance and technology in certain regions, coupled with infrastructure limitations, pose significant restraints. The market's growth is also influenced by fluctuating commodity prices and the potential for inconsistent regulatory frameworks across different African nations. Future growth hinges on overcoming these challenges, fostering collaboration between stakeholders (including governments, research institutions, and private companies), and ensuring equitable access to biostimulant technologies across various farming communities in Africa. Further investment in research and development, specifically focused on adapting biostimulants for the diverse African agro-ecological zones, will be crucial for unlocking the full market potential. The diversification of product offerings tailored to specific crop needs and local conditions will also contribute to market expansion.

This dynamic report provides a comprehensive analysis of the Africa Biostimulants Market, offering invaluable insights for stakeholders across the agricultural value chain. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report leverages robust data and expert analysis to illuminate growth trajectories, market segmentation, competitive dynamics, and future opportunities. The market is projected to reach xx Million by 2033, demonstrating significant growth potential.

Africa Biostimulants Market Market Structure & Competitive Landscape

The Africa biostimulants market exhibits a moderately concentrated structure, with a few key players holding significant market share. The Herfindahl-Hirschman Index (HHI) for 2024 is estimated at xx, indicating a somewhat consolidated landscape. However, the market is characterized by considerable innovation, driven by the ongoing need for sustainable agricultural practices and enhanced crop yields in the face of climate change. Regulatory frameworks vary across African countries, impacting market access and product registration. While the presence of substitute products, such as traditional fertilizers, presents some competition, the increasing awareness of biostimulants' benefits is steadily increasing their market share.

- Market Concentration: HHI of xx in 2024, indicating moderate concentration.

- Innovation Drivers: Growing demand for sustainable agriculture, climate change adaptation, and increasing crop yields.

- Regulatory Impacts: Varying regulations across African nations influencing product approvals and market access.

- Product Substitutes: Traditional fertilizers remain a competitive alternative.

- End-User Segmentation: Primarily focused on cash crops, horticultural crops, and row crops across various countries.

- M&A Trends: A total of xx M&A transactions were recorded between 2019 and 2024, valued at approximately xx Million. This reflects consolidation efforts among larger players and the acquisition of smaller, specialized firms.

Africa Biostimulants Market Market Trends & Opportunities

The African biostimulants market is experiencing robust growth, fueled by a confluence of factors. Rising agricultural production targets across the continent are driving demand for solutions that enhance crop yields and quality. Simultaneously, a growing awareness among farmers of the numerous benefits offered by biostimulants—including improved nutrient uptake, stress tolerance, and enhanced yield—is significantly boosting market adoption. This is further amplified by a burgeoning consumer preference for organically produced food, leading to increased demand for environmentally friendly agricultural inputs. The market is projected to exhibit a robust Compound Annual Growth Rate (CAGR) of [Insert Updated CAGR]% during the forecast period (2025-2033), reaching an estimated [Insert Updated Market Value] by 2033. This expansion is being propelled by continuous technological advancements, such as the development of more efficacious formulations, precise targeted delivery systems, and products tailored to specific crops and regional conditions. Increased competition is also shaping market dynamics, incentivizing innovation and the development of increasingly specialized and effective products. Market penetration within the broader fertilizer market is expected to climb from [Insert Updated 2024 Percentage]% in 2024 to [Insert Updated 2033 Percentage]% by 2033.

Dominant Markets & Segments in Africa Biostimulants Market

South Africa currently holds the largest market share within the African biostimulant market, followed by Egypt and Nigeria. The Rest of Africa segment is also showing promising growth potential. Within the product segments, seaweed extracts and amino acids are currently leading, driven by their effectiveness in various applications and relative affordability. Horticultural crops represent a significant portion of the market demand, followed by cash crops and row crops.

- Key Growth Drivers in South Africa: Established agricultural infrastructure, favorable government policies supporting sustainable agriculture, and a relatively higher level of farmer awareness.

- Key Growth Drivers in Egypt: Significant agricultural sector, large-scale farming practices, and rising demand for high-quality produce.

- Key Growth Drivers in Nigeria: Expanding agricultural sector, growing population, and increasing demand for food security.

- Key Growth Drivers in Rest of Africa: Untapped potential, government initiatives promoting agricultural development, and increasing adoption of advanced farming techniques.

Africa Biostimulants Market Product Analysis

Recent innovations in biostimulant technology are revolutionizing the African agricultural landscape. A significant trend is the development of more efficient formulations, sophisticated targeted delivery systems, and products specifically designed for various crops and diverse environmental conditions prevalent across the continent. Responding to the escalating demand for sustainable agricultural practices, the market is witnessing a notable surge in bio-based and organically sourced biostimulants. These advancements not only enhance product efficacy but also cater to farmers seeking improved crop yields and quality while simultaneously minimizing environmental impact. The focus is increasingly shifting towards solutions that address specific regional challenges, such as drought tolerance or nutrient deficiency in particular soil types.

Key Drivers, Barriers & Challenges in Africa Biostimulants Market

Key Drivers:

- Growing awareness of sustainable agriculture and its benefits.

- Increasing demand for higher crop yields and quality.

- Rising investments in agricultural research and development.

- Government initiatives promoting sustainable farming practices.

Key Challenges:

- High initial investment costs associated with adopting biostimulants.

- Limited availability of reliable supply chains in certain regions.

- Regulatory hurdles and variations in product registration across countries.

- Competition from traditional fertilizers and other agricultural inputs. This is estimated to reduce market growth by an average of xx% annually.

Growth Drivers in the Africa Biostimulants Market Market

The market is propelled by the rising demand for sustainable and efficient agricultural practices, the increasing awareness of biostimulant benefits among farmers, and government initiatives promoting their adoption. Technological advancements, including the development of more efficient and targeted formulations, also contribute significantly to market expansion. Furthermore, favorable climatic conditions and expanding agricultural land suitable for various crops stimulate demand for biostimulants.

Challenges Impacting Africa Biostimulants Market Growth

Despite the promising growth trajectory, several challenges hinder the full realization of the Africa biostimulants market's potential. Uneven infrastructural development across the continent presents a significant obstacle, particularly in accessing inputs and markets in remote areas. Furthermore, inconsistencies in regulatory frameworks across different countries create complexities in market access for certain biostimulants. The relatively higher cost of biostimulants compared to traditional fertilizers also presents a barrier to adoption for some farmers. Finally, intense competition from established players within the agricultural input sector poses a substantial challenge.

Key Players Shaping the Africa Biostimulants Market Market

- Koppert Biological Systems Inc

- Coromandel International Ltd

- Humic Growth Solutions Inc

- Biolchim SPA

- T Stanes and Company Limited

- Haifa Group

- Microbial Biological Fertilizers International

- UP

- Trade Corporation International

- Atlántica Agrícola

Significant Africa Biostimulants Market Industry Milestones

- January 2021: Atlántica Agrícola launched Micomix, a biostimulant formulated with mycorrhizal fungi, rhizobacteria, and chelated micronutrients to enhance nutrient uptake and improve stress tolerance in crops.

- March 2021: Haifa strengthened its presence in the premium biostimulant market with the introduction of its HaifaStim range, emphasizing plant strengthening and yield enhancement.

- September 2021: Tradecorp expanded market offerings with Biimore, a plant fermentation-derived biostimulant uniquely combining amino acids, vitamins, and other beneficial compounds.

- [Add more recent milestones with dates and details]

Future Outlook for Africa Biostimulants Market Market

The future of the African biostimulants market is exceptionally bright. The increasing adoption of sustainable farming practices, coupled with ongoing technological advancements and supportive government initiatives promoting agricultural development, are key drivers of future growth. Significant opportunities exist for companies to capitalize on this growth by focusing on the development of customized products tailored to specific crops and regional conditions. Expanding distribution networks to reach underserved farmers and fostering strong partnerships with local agricultural communities will be crucial for market penetration. The market's potential is substantial, particularly in regions experiencing rapid agricultural sector expansion and increasing consumer demand for sustainably produced food. Further investment in research and development, focusing on addressing specific local needs and challenges, will be crucial for unlocking the full potential of this dynamic market.

Africa Biostimulants Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Africa Biostimulants Market Segmentation By Geography

-

1. Africa

- 1.1. Nigeria

- 1.2. South Africa

- 1.3. Egypt

- 1.4. Kenya

- 1.5. Ethiopia

- 1.6. Morocco

- 1.7. Ghana

- 1.8. Algeria

- 1.9. Tanzania

- 1.10. Ivory Coast

Africa Biostimulants Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 15.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Demand For Landscaping Maintenance; Adoption of Green Spaces and Green Roofs

- 3.3. Market Restrains

- 3.3.1. Shortage of Labor In Landscaping; High Maintenance Cost of Lawn Mowers

- 3.4. Market Trends

- 3.4.1. Row Crops is the largest Crop Type

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa Biostimulants Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Africa

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. South Africa Africa Biostimulants Market Analysis, Insights and Forecast, 2019-2031

- 7. Sudan Africa Biostimulants Market Analysis, Insights and Forecast, 2019-2031

- 8. Uganda Africa Biostimulants Market Analysis, Insights and Forecast, 2019-2031

- 9. Tanzania Africa Biostimulants Market Analysis, Insights and Forecast, 2019-2031

- 10. Kenya Africa Biostimulants Market Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Africa Africa Biostimulants Market Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Koppert Biological Systems Inc

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Coromandel International Ltd

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Humic Growth Solutions Inc

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Biolchim SPA

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 T Stanes and Company Limited

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Haifa Group

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Microbial Biological Fertilizers International

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 UP

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Trade Corporation International

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Atlántica Agrícola

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Koppert Biological Systems Inc

List of Figures

- Figure 1: Africa Biostimulants Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Africa Biostimulants Market Share (%) by Company 2024

List of Tables

- Table 1: Africa Biostimulants Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Africa Biostimulants Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 3: Africa Biostimulants Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 4: Africa Biostimulants Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 5: Africa Biostimulants Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 6: Africa Biostimulants Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 7: Africa Biostimulants Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Africa Biostimulants Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: South Africa Africa Biostimulants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Sudan Africa Biostimulants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Uganda Africa Biostimulants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Tanzania Africa Biostimulants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Kenya Africa Biostimulants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Rest of Africa Africa Biostimulants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Africa Biostimulants Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 16: Africa Biostimulants Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 17: Africa Biostimulants Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 18: Africa Biostimulants Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 19: Africa Biostimulants Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 20: Africa Biostimulants Market Revenue Million Forecast, by Country 2019 & 2032

- Table 21: Nigeria Africa Biostimulants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: South Africa Africa Biostimulants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Egypt Africa Biostimulants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Kenya Africa Biostimulants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Ethiopia Africa Biostimulants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Morocco Africa Biostimulants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Ghana Africa Biostimulants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Algeria Africa Biostimulants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Tanzania Africa Biostimulants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Ivory Coast Africa Biostimulants Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa Biostimulants Market?

The projected CAGR is approximately 15.00%.

2. Which companies are prominent players in the Africa Biostimulants Market?

Key companies in the market include Koppert Biological Systems Inc, Coromandel International Ltd, Humic Growth Solutions Inc, Biolchim SPA, T Stanes and Company Limited, Haifa Group, Microbial Biological Fertilizers International, UP, Trade Corporation International, Atlántica Agrícola.

3. What are the main segments of the Africa Biostimulants Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Demand For Landscaping Maintenance; Adoption of Green Spaces and Green Roofs.

6. What are the notable trends driving market growth?

Row Crops is the largest Crop Type.

7. Are there any restraints impacting market growth?

Shortage of Labor In Landscaping; High Maintenance Cost of Lawn Mowers.

8. Can you provide examples of recent developments in the market?

September 2021: Tradecorp launched Biimore, a biostimulant obtained from a plant fermentation process. Biimore comprises a unique combination of primary and secondary compounds, L-α amino acids, vitamins, sugars, and traces of other natural compounds.March 2021: Haifa launched its new line of plant biostimulants under the HaifaStim trademark. The new HaifaStim range of biostimulants includes premium products formulated to strengthen the plant and enhance its growing environment to support optimal growth, increase yields, and maximize quality.January 2021: Atlántica Agrícola developed Micomix, a biostimulant composed primarily of mycorrhizal fungi, rhizobacteria, and chelated micronutrients. The presence and development of these microorganisms in the rhizosphere create a symbiotic relationship with the plant that favors the absorption of water and mineral nutrients and increases its tolerance to water and salt stress.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa Biostimulants Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa Biostimulants Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa Biostimulants Market?

To stay informed about further developments, trends, and reports in the Africa Biostimulants Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence