Key Insights

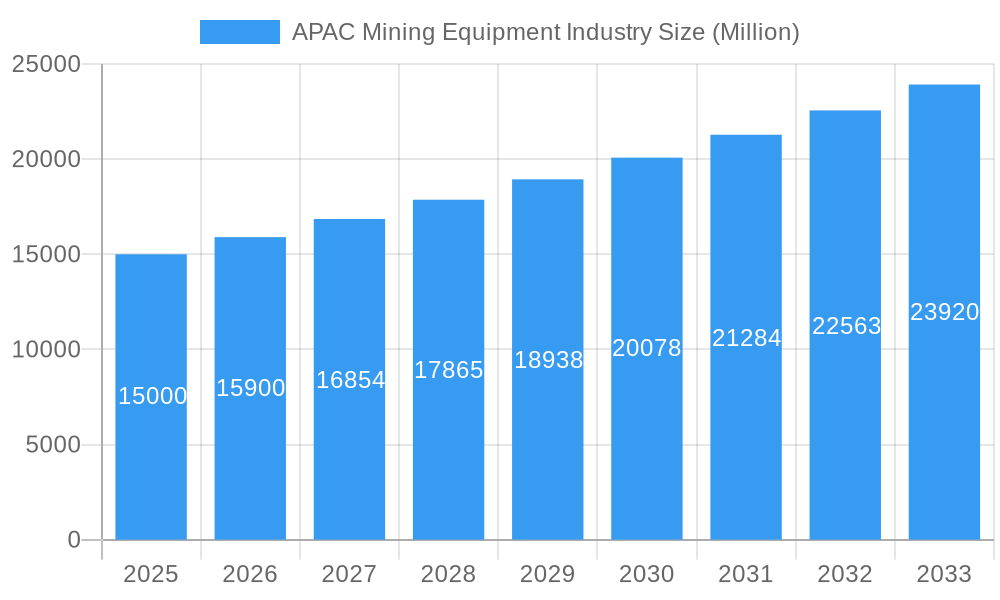

The Asia-Pacific (APAC) mining equipment market is poised for significant expansion, with an anticipated Compound Annual Growth Rate (CAGR) of 6.8% between 2025 and 2033. This growth is propelled by robust infrastructure development in key economies like India and China, driving demand for heavy-duty machinery. The increasing integration of advanced technologies, such as automation and data analytics, is enhancing operational efficiency and productivity. Furthermore, the burgeoning electric vehicle sector is stimulating demand for critical minerals, indirectly boosting the mining equipment market. While market dynamics are influenced by commodity price volatility and environmental regulations, the overall economic resilience and continuous need for raw materials in the APAC region underscore a positive market outlook.

APAC Mining Equipment Industry Market Size (In Billion)

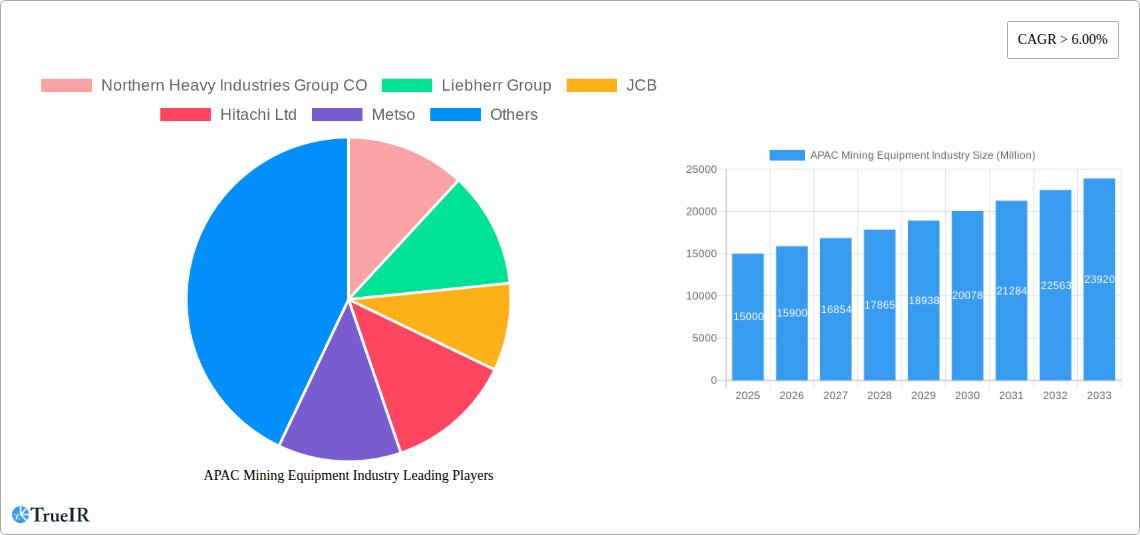

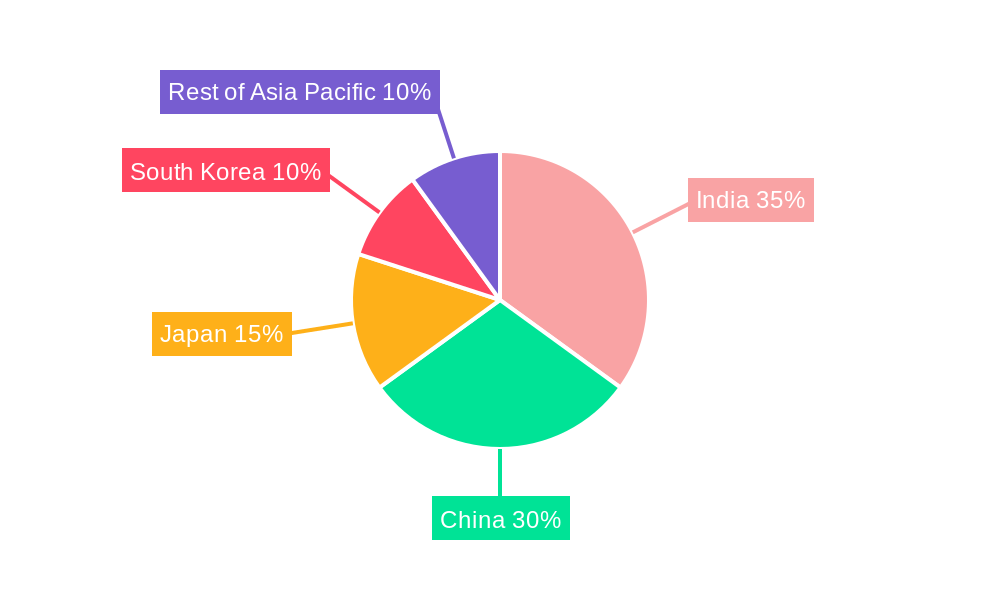

Market segmentation highlights key growth areas. The commercial vehicle segment is expected to outperform passenger vehicles due to its direct correlation with mining activities. The shift towards Lithium-ion batteries presents a substantial opportunity for battery manufacturers and mining equipment providers. Major industry participants including Northern Heavy Industries Group, Liebherr, JCB, Hitachi, Metso, Caterpillar, Sany, Tata Motors, and AB Volvo are actively engaged in this competitive landscape, capitalizing on their technological strengths and market presence. Strategic collaborations, continuous innovation, and market expansion are vital for companies aiming to leverage the projected growth. The APAC region, with a primary focus on India, China, Japan, and South Korea, currently leads market demand, though emerging opportunities exist across the broader APAC territory.

APAC Mining Equipment Industry Company Market Share

APAC Mining Equipment Industry: A Comprehensive Market Report (2019-2033)

This dynamic report provides a detailed analysis of the Asia-Pacific (APAC) mining equipment industry, offering invaluable insights for businesses, investors, and policymakers. Leveraging extensive data from 2019-2024 (historical period) and employing robust forecasting models, we project market trends through 2033 (forecast period), with a base year of 2025 and an estimated year of 2025. The report encompasses market sizing, segmentation, competitive analysis, and key growth drivers, providing a comprehensive understanding of this lucrative sector. The report covers various vehicle types (Passenger Vehicles, Commercial Vehicles) and battery types (Li-ion, Lead Acid) within the APAC mining equipment market.

APAC Mining Equipment Industry Market Structure & Competitive Landscape

The APAC mining equipment market is characterized by a moderately concentrated structure, with several multinational giants and a growing number of regional players vying for market share. The market concentration ratio (CR4) in 2025 is estimated at 45%, indicating a moderately consolidated landscape. Major players such as Caterpillar Inc., Hitachi Ltd., and Komatsu (not explicitly listed but a significant player) exert significant influence. However, the market is witnessing increased participation from Chinese manufacturers, particularly in the lower-cost equipment segments.

Key aspects influencing the market structure:

- Innovation Drivers: Ongoing technological advancements, specifically in automation, electrification, and data analytics, are driving market innovation and creating new competitive advantages.

- Regulatory Impacts: Stringent environmental regulations and safety standards are shaping the product landscape and influencing investment decisions. The increasing emphasis on sustainable mining practices is accelerating the adoption of eco-friendly equipment. Countries like Australia and Indonesia are setting the bar high for environmental compliance.

- Product Substitutes: The limited availability of direct substitutes for specialized mining equipment fosters a relatively stable competitive environment. However, advancements in alternative technologies (e.g., autonomous systems) are posing a potential challenge to traditional equipment manufacturers.

- End-User Segmentation: The market is segmented by mining type (e.g., coal, metal ore, etc.), with varying equipment demands and technology preferences across segments. The growth of the metal ore mining industry fuels significant demand, especially for heavy-duty equipment. Coal mining equipment presents a separate segment, with its own dynamics influenced by global energy policies.

- M&A Trends: The past five years have seen a moderate level of M&A activity, primarily involving smaller players being acquired by larger corporations aiming to expand their market reach and product portfolio. The total value of M&A transactions in the historical period is estimated to be $XX Million. Future consolidation is expected, with larger companies potentially acquiring smaller, specialized firms.

APAC Mining Equipment Industry Market Trends & Opportunities

The APAC mining equipment market is projected to experience robust growth during the forecast period (2025-2033). The market size is estimated at $XXX Million in 2025 and is forecasted to reach $YYY Million by 2033, exhibiting a CAGR of XX%. This growth is fueled by several factors including:

- Infrastructure Development: Massive infrastructure projects across the region, particularly in Southeast Asia, are driving demand for construction and mining equipment.

- Resource Extraction: The continued expansion of the mining sector, driven by demand for raw materials and rising commodity prices, is a key market catalyst.

- Technological Advancements: The growing adoption of advanced technologies such as automation, remote operation, and electric-powered equipment is reshaping the market dynamics and opening new growth avenues. Data analytics is improving operational efficiency across the industry.

- Government Policies: Supportive government policies aimed at improving mining sector efficiency and infrastructure development are creating a favorable business environment.

Dominant Markets & Segments in APAC Mining Equipment Industry

Australia and China are the dominant markets within the APAC region, accounting for approximately 60% of the total market share in 2025.

Australia:

- Key Growth Drivers: Abundant mineral resources, robust mining activities, and stringent safety and environmental regulations are driving significant demand.

- Market Dynamics: A mature market with a focus on advanced technologies and sustainable mining practices.

China:

- Key Growth Drivers: Rapid infrastructure development, expansion of domestic mining operations, and a rising middle class driving increased consumption of goods requiring raw materials are key drivers.

- Market Dynamics: A large and diverse market with both mature and developing segments. Increasing domestic manufacturing capacity is influencing market competition.

Dominant Segments:

- Commercial Vehicles: The commercial vehicle segment represents the largest market share, driven by the need for heavy-duty equipment in large-scale mining operations. This sector is expected to maintain high growth over the forecast period.

- Li-ion Batteries: The demand for Li-ion batteries is growing rapidly, driven by the increasing focus on electric and hybrid mining equipment. This is a key trend in environmentally conscious mining practices.

APAC Mining Equipment Industry Product Analysis

Recent product innovations focus on enhancing efficiency, safety, and sustainability. Advanced automation systems, including autonomous haulage systems and remote operation capabilities, are gaining traction. Electric and hybrid-powered equipment is also gaining popularity, driven by environmental regulations and concerns. These innovations provide improved fuel efficiency, reduced emissions, and increased operational efficiency. The market fit for these advanced products is strong, particularly in large-scale mining operations.

Key Drivers, Barriers & Challenges in APAP Mining Equipment Industry

Key Drivers:

- Rising demand for raw materials globally fueled by infrastructure growth and industrialization

- Government initiatives promoting sustainable mining practices and technological innovation.

- The adoption of Industry 4.0 technologies such as AI and IoT for increased efficiency and productivity.

Challenges:

- Fluctuations in commodity prices impacting investment decisions.

- Supply chain disruptions, especially concerning crucial components and raw materials.

- Stringent environmental regulations requiring costly compliance measures. These challenges are impacting profitability and delaying project timelines. The cumulative effect is reducing market growth by an estimated 3% in the coming decade.

Growth Drivers in the APAC Mining Equipment Industry Market

The APAC mining equipment market is primarily driven by the region's robust economic growth, infrastructure development, and rising demand for raw materials. This is further accelerated by government investments in modernization and the adoption of environmentally friendly mining equipment.

Challenges Impacting APAC Mining Equipment Industry Growth

The APAC mining equipment industry faces a multifaceted landscape of challenges that can significantly influence its growth trajectory. Volatile commodity prices remain a persistent concern, directly impacting the profitability and investment decisions of mining operations, which in turn affects demand for new equipment. Furthermore, complex and often unpredictable supply chain constraints, exacerbated by geopolitical events and logistical bottlenecks, lead to extended lead times and increased costs for both manufacturers and end-users. Compounding these issues are the increasingly stringent environmental regulations across the region. These regulations necessitate significant investments in cleaner technologies, emission control systems, and sustainable operational practices, thereby elevating operational expenditures and potentially slowing down the adoption of new equipment if the return on investment is not immediately apparent. These combined factors contribute to an environment of unpredictability in market growth, creating a more challenging climate for all industry participants, especially smaller companies with fewer resources to absorb market shocks and invest in compliance.

Key Players Shaping the APAC Mining Equipment Industry Market

- Northern Heavy Industries Group CO

- Liebherr Group

- JCB

- Hitachi Ltd

- Metso

- Caterpillar Inc

- Sany Heavy Equipment International Holdings

- Tata Motor

- AB Volvo

- Komatsu Ltd (A significant player with a strong presence in APAC)

- Cummins Inc. (Crucial for engine and power solutions in mining equipment)

- Terex Corporation (Specializing in material handling and mining equipment)

Significant APAC Mining Equipment Industry Milestones

- 2021: Caterpillar Inc. launched its new line of autonomous mining trucks.

- 2022: Metso Outotec introduced a new range of energy-efficient crushing and grinding equipment.

- 2023: Several mergers and acquisitions took place, consolidating market share among key players.

Future Outlook for APAC Mining Equipment Industry Market

The APAC mining equipment market is on a trajectory for sustained and robust growth, propelled by fundamental long-term trends. Intensified infrastructure development across emerging economies, coupled with an ever-increasing global demand for essential raw materials driven by population growth and technological advancements, forms the bedrock of this optimistic outlook. To navigate the evolving operational landscape and competitive pressures, strategic investments in innovation and the adoption of sustainable technologies are paramount and will undoubtedly shape the industry's future. The prevailing focus will continue to be on the integration of automation to enhance efficiency and safety, the widespread adoption of electrification to reduce environmental impact and operational costs, and the implementation of data-driven optimization strategies powered by advanced analytics and IoT. These transformative shifts are not only creating significant opportunities for established global and regional leaders but also paving the way for innovative new entrants to carve out their niche in this dynamic market.

APAC Mining Equipment Industry Segmentation

-

1. Vehicle Type

- 1.1. Passenger Vehicles

- 1.2. Commercial Vehicles

-

2. Battery Type

- 2.1. Li-ion

- 2.2. Lead Acid

-

3. Geography

-

3.1. Asia Pacific

- 3.1.1. India

- 3.1.2. China

- 3.1.3. Japan

- 3.1.4. South Korea

- 3.1.5. Rest of Asia-Pacific

-

3.1. Asia Pacific

APAC Mining Equipment Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. India

- 1.2. China

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

APAC Mining Equipment Industry Regional Market Share

Geographic Coverage of APAC Mining Equipment Industry

APAC Mining Equipment Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing infrastructural development Across the Region

- 3.3. Market Restrains

- 3.3.1. Supply Chain Disruption of Raw Materials Could be a Challenge; High Initial Cost Related to the Purchase of Raw Materials is a Challenge

- 3.4. Market Trends

- 3.4.1. Increase in number of Mineral Exploration Sites

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. APAC Mining Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Passenger Vehicles

- 5.1.2. Commercial Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Battery Type

- 5.2.1. Li-ion

- 5.2.2. Lead Acid

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Asia Pacific

- 5.3.1.1. India

- 5.3.1.2. China

- 5.3.1.3. Japan

- 5.3.1.4. South Korea

- 5.3.1.5. Rest of Asia-Pacific

- 5.3.1. Asia Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Northern Heavy Industries Group CO

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Liebherr Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 JCB

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Hitachi Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Metso

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Caterpillar Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Sany Heavy Equipment International Holdings

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Tata Motor

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 AB Volvo

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Northern Heavy Industries Group CO

List of Figures

- Figure 1: APAC Mining Equipment Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: APAC Mining Equipment Industry Share (%) by Company 2025

List of Tables

- Table 1: APAC Mining Equipment Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 2: APAC Mining Equipment Industry Revenue billion Forecast, by Battery Type 2020 & 2033

- Table 3: APAC Mining Equipment Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: APAC Mining Equipment Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: APAC Mining Equipment Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 6: APAC Mining Equipment Industry Revenue billion Forecast, by Battery Type 2020 & 2033

- Table 7: APAC Mining Equipment Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: APAC Mining Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: India APAC Mining Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: China APAC Mining Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Japan APAC Mining Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: South Korea APAC Mining Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Rest of Asia Pacific APAC Mining Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC Mining Equipment Industry?

The projected CAGR is approximately 6.8%.

2. Which companies are prominent players in the APAC Mining Equipment Industry?

Key companies in the market include Northern Heavy Industries Group CO, Liebherr Group, JCB, Hitachi Ltd, Metso, Caterpillar Inc, Sany Heavy Equipment International Holdings, Tata Motor, AB Volvo.

3. What are the main segments of the APAC Mining Equipment Industry?

The market segments include Vehicle Type, Battery Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 88.2 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing infrastructural development Across the Region.

6. What are the notable trends driving market growth?

Increase in number of Mineral Exploration Sites.

7. Are there any restraints impacting market growth?

Supply Chain Disruption of Raw Materials Could be a Challenge; High Initial Cost Related to the Purchase of Raw Materials is a Challenge.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC Mining Equipment Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC Mining Equipment Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC Mining Equipment Industry?

To stay informed about further developments, trends, and reports in the APAC Mining Equipment Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence