Key Insights

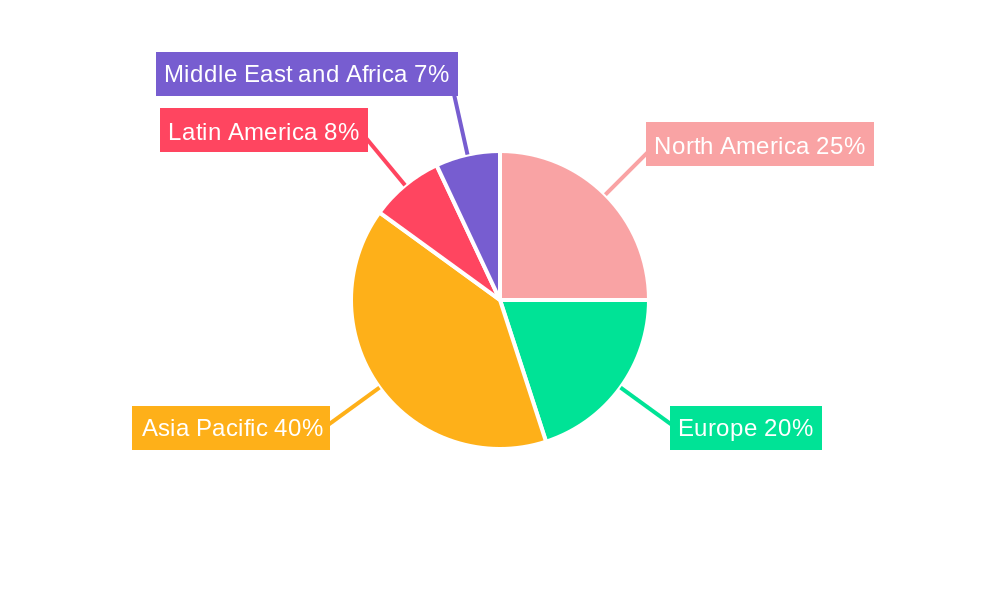

The Asia-Pacific (APAC) next-generation storage market is experiencing robust growth, driven by the increasing adoption of cloud computing, big data analytics, and the proliferation of IoT devices. The region's expanding digital economy, coupled with rising government initiatives promoting digital transformation across various sectors like BFSI, retail, and healthcare, is fueling demand for advanced storage solutions. Specifically, the demand for high-performance, scalable, and secure storage solutions, such as Network Attached Storage (NAS), Storage Area Networks (SAN), and File and Object-based Storage (FOBS), is significantly driving market expansion. Furthermore, the increasing adoption of hybrid cloud strategies and the need for efficient data management are bolstering the market's growth trajectory. While challenges such as high initial investment costs and the complexity of implementing and managing these advanced systems exist, the long-term benefits in terms of improved data security, enhanced operational efficiency, and reduced Total Cost of Ownership (TCO) are outweighing these concerns, leading to continued market expansion.

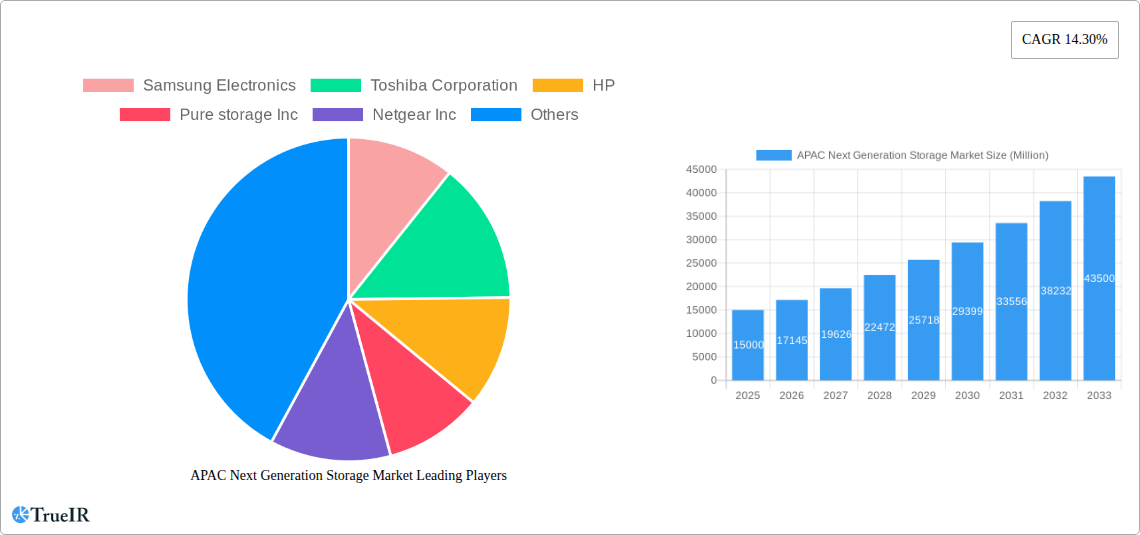

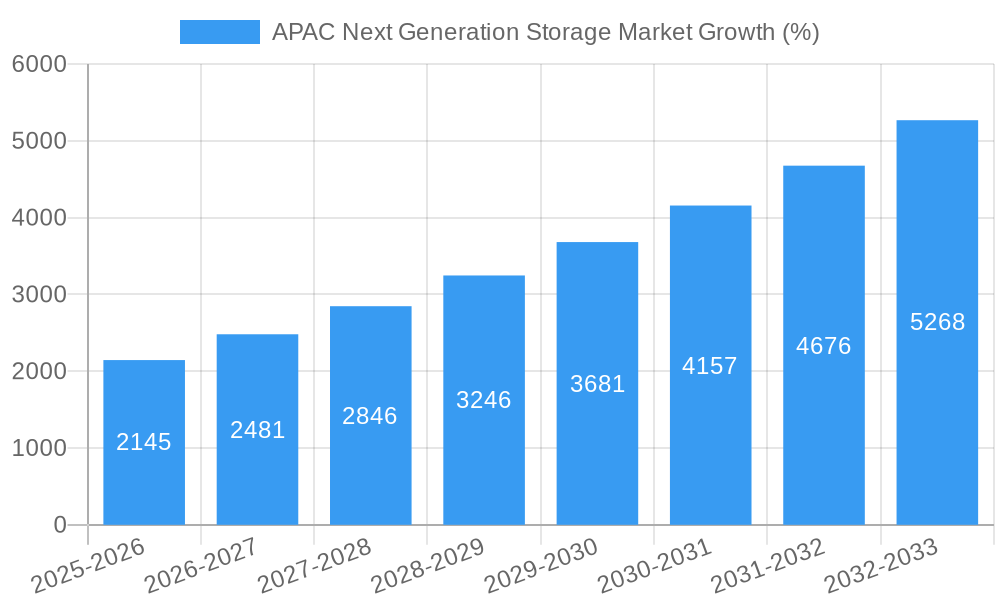

A projected Compound Annual Growth Rate (CAGR) of 14.30% indicates significant growth potential for the APAC next-generation storage market throughout the forecast period (2025-2033). Key players like Samsung, Toshiba, HP, Pure Storage, NetApp, and Dell are actively investing in R&D and strategic partnerships to enhance their market position. The market segmentation reveals a strong demand across various end-user industries, with BFSI and IT & Telecom sectors showing particularly high adoption rates due to their stringent data security and scalability requirements. The dominance of certain storage architectures and systems within specific sectors is also influencing overall market dynamics. Competitive landscape analysis reveals a mix of established players and emerging innovative companies, fostering a dynamic and evolving market environment within the APAC region.

APAC Next Generation Storage Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Asia-Pacific (APAC) Next Generation Storage Market, covering the period 2019-2033. It offers invaluable insights into market size, segmentation, growth drivers, challenges, competitive landscape, and future outlook, enabling businesses to make informed strategic decisions. The report leverages extensive data analysis and incorporates key industry developments to deliver an accurate and current perspective. The market is segmented by storage system (DAS, NAS, SAN), storage architecture (FOBS, Block Storage), end-user industry (BFSI, Retail, IT & Telecom, Healthcare, Media & Entertainment, Others), and country across the APAC region. Key players analyzed include Samsung Electronics, Toshiba Corporation, HP, Pure Storage Inc, Netgear Inc, Dell Inc, NetApp Inc, Hitachi Ltd, SanDisk Corporation, and IBM. The report's base year is 2025, with data projected through 2033.

APAC Next Generation Storage Market Market Structure & Competitive Landscape

The APAC next-generation storage market exhibits a moderately concentrated structure, with a few dominant players capturing a significant market share. The Herfindahl-Hirschman Index (HHI) for 2024 is estimated at xx, indicating a moderately concentrated market. This concentration is influenced by factors such as high barriers to entry (significant R&D investment, economies of scale), brand loyalty, and the presence of established players with extensive distribution networks. Innovation drivers are pivotal, with continuous advancements in areas like flash memory technology, NVMe, and software-defined storage shaping market dynamics. Regulatory factors, including data privacy regulations (e.g., GDPR's influence in certain APAC markets) and cybersecurity standards, significantly impact market participants. Product substitutes, such as cloud storage services, are becoming increasingly competitive, posing challenges to traditional storage vendors.

Mergers and acquisitions (M&A) activity in the APAC region has been relatively moderate in recent years, with approximately xx M&A deals recorded between 2019 and 2024, totaling an estimated value of xx Million. This activity reflects consolidation among smaller players and strategic acquisitions by larger companies to expand their product portfolios and geographic reach. End-user segmentation plays a significant role, with the IT and Telecom sector being a major driver, followed by BFSI and the growing Media and Entertainment segments.

APAC Next Generation Storage Market Market Trends & Opportunities

The APAC next-generation storage market is experiencing robust growth, driven by the increasing adoption of cloud computing, big data analytics, and the proliferation of digital technologies across various industries. The market size is estimated at xx Million in 2025, exhibiting a Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033. This growth is propelled by technological advancements in storage technologies like NVMe, the rising demand for high-performance computing (HPC), and the increasing need for secure and scalable storage solutions. Consumer preferences are shifting toward cloud-based storage options, owing to their scalability, cost-effectiveness, and accessibility. However, concerns surrounding data security and latency remain critical factors influencing consumer choices.

The competitive landscape is highly dynamic, with established players facing intensified competition from emerging cloud providers and specialized storage solution providers. Market penetration rates for various storage technologies vary considerably, with SAN still holding a dominant share in enterprise environments, while NAS and cloud-based storage solutions are witnessing rapid adoption in SMB and consumer markets. The shift towards hybrid cloud models also presents significant opportunities for storage vendors offering flexible and integrated solutions that seamlessly bridge on-premises and cloud environments. The overall market is ripe for disruption by innovative technologies and business models that address the specific needs and challenges of the APAC region.

Dominant Markets & Segments in APAC Next Generation Storage Market

The APAC next-generation storage market exhibits diverse growth patterns across different segments and regions. While the overall market demonstrates strong growth, certain segments and countries show faster expansion.

Leading Countries: China and India are the dominant markets, driven by robust economic growth, increasing digitalization, and government initiatives promoting technological advancement. Other rapidly growing markets include South Korea, Singapore, and Australia.

Leading Storage Systems: Network Attached Storage (NAS) is gaining prominence due to its cost-effectiveness and scalability, particularly among small and medium businesses (SMBs). Storage Area Networks (SAN) continue to dominate the enterprise segment, fueled by high performance requirements and data security needs. Direct Attached Storage (DAS) remains relevant for smaller deployments but is facing competition from other solutions.

Leading Storage Architectures: Block storage is largely preferred in enterprise environments demanding high performance and reliability. File and Object-based storage (FOBS) is experiencing significant traction, driven by the growth of unstructured data and the need for efficient data management in cloud and hybrid environments.

Key Growth Drivers:

- Robust economic growth and rising disposable incomes in key APAC markets.

- Government initiatives promoting digital infrastructure development and technological advancements.

- Increasing adoption of cloud computing and big data analytics.

- Growing demand for high-performance computing (HPC) and AI applications.

- Enhanced cybersecurity requirements driving the need for secure storage solutions.

APAP Next Generation Storage Market Product Analysis

The APAC next-generation storage market is characterized by continuous product innovations, with a focus on improving performance, scalability, and security. Key advancements include the wider adoption of NVMe technology, which offers significantly faster speeds compared to traditional SATA and SAS interfaces. Software-defined storage (SDS) solutions are gaining traction, allowing for greater flexibility and efficiency in managing storage resources. Furthermore, the integration of AI and machine learning capabilities in storage management systems is enhancing data protection and optimizing resource utilization. The market trend favors products that seamlessly integrate with cloud environments and support hybrid cloud deployments, catering to the evolving needs of businesses.

Key Drivers, Barriers & Challenges in APAC Next Generation Storage Market

Key Drivers:

Technological advancements, such as NVMe and Software-Defined Storage (SDS), are driving market growth. Increased adoption of cloud computing and big data analytics necessitate robust storage solutions. Government initiatives supporting digital infrastructure in various APAC countries stimulate market expansion.

Key Challenges & Restraints:

High initial investment costs associated with adopting next-generation storage systems can pose a barrier for some businesses. Data security concerns and the complexity of managing large volumes of data present ongoing challenges. Supply chain disruptions and geopolitical factors can impact product availability and cost. Moreover, intense competition among established players and new entrants, along with the growing availability of cloud-based storage alternatives, creates pricing pressures.

Growth Drivers in the APAC Next Generation Storage Market

The APAC next-generation storage market is fueled by several factors. Technological advancements, especially in NVMe and flash storage, significantly increase storage performance and reduce latency. The rising adoption of cloud computing and big data analytics increases the demand for scalable and secure storage solutions. Furthermore, government initiatives promoting digital infrastructure in several APAC countries are creating a favorable environment for market expansion.

Challenges Impacting APAC Next Generation Storage Market Growth

Several challenges hinder market growth. High initial investment costs for next-generation storage systems can be prohibitive for smaller businesses. Concerns regarding data security and privacy, especially with sensitive information, necessitate robust security measures, potentially increasing costs. Supply chain disruptions and regional geopolitical instability can impact product availability and price fluctuations.

Key Players Shaping the APAC Next Generation Storage Market

- Samsung Electronics

- Toshiba Corporation

- HP

- Pure Storage Inc

- Netgear Inc

- Dell Inc

- NetApp Inc

- Hitachi Ltd

- SanDisk Corporation

- IBM

Significant APAC Next Generation Storage Market Industry Milestones

- October 2021: Alibaba Cloud launched its first local data center in South Korea, expanding cloud services in the region.

- November 2021: Oracle Corporation and Bharti Airtel partnered to offer cloud solutions in India, boosting the country's digital economy and expanding Oracle's capacity.

Future Outlook for APAC Next Generation Storage Market

The APAC next-generation storage market is poised for continued robust growth, driven by persistent technological advancements, increasing digitalization across industries, and supportive government policies. Strategic opportunities exist for companies offering innovative solutions that address data security, scalability, and performance requirements in cloud and hybrid cloud environments. The market's potential is substantial, promising significant growth in the coming years.

APAC Next Generation Storage Market Segmentation

-

1. Storage System

- 1.1. Direct Attached Storage (DAS)

- 1.2. Network Attached Storage (NAS)

- 1.3. Storage Area Network (SAN)

-

2. Storage Architecture

- 2.1. File and Object-based Storage (FOBS)

- 2.2. Block Storage

-

3. End-User Industry

- 3.1. BFSI

- 3.2. Retail

- 3.3. IT and Telecom

- 3.4. Healthcare

- 3.5. Media and Entertainment

- 3.6. Other End-User Industries

APAC Next Generation Storage Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. ASEAN

- 1.6. Oceania

- 1.7. Rest of Asia Pacific

APAC Next Generation Storage Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 14.30% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing digitalization across the banking industry; Rising e-commerce industry

- 3.3. Market Restrains

- 3.3.1. Data security concerns

- 3.4. Market Trends

- 3.4.1. Retail end-use industry is expected to register significant growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. APAC Next Generation Storage Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Storage System

- 5.1.1. Direct Attached Storage (DAS)

- 5.1.2. Network Attached Storage (NAS)

- 5.1.3. Storage Area Network (SAN)

- 5.2. Market Analysis, Insights and Forecast - by Storage Architecture

- 5.2.1. File and Object-based Storage (FOBS)

- 5.2.2. Block Storage

- 5.3. Market Analysis, Insights and Forecast - by End-User Industry

- 5.3.1. BFSI

- 5.3.2. Retail

- 5.3.3. IT and Telecom

- 5.3.4. Healthcare

- 5.3.5. Media and Entertainment

- 5.3.6. Other End-User Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Storage System

- 6. North America APAC Next Generation Storage Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1.

- 7. Europe APAC Next Generation Storage Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1.

- 8. Asia Pacific APAC Next Generation Storage Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1.

- 9. Latin America APAC Next Generation Storage Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1.

- 10. Middle East and Africa APAC Next Generation Storage Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Samsung Electronics

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Toshiba Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 HP

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Pure storage Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Netgear Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Dell Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 NetApp Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Hitachi Lt

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 SanDisk Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 IBM

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Samsung Electronics

List of Figures

- Figure 1: APAC Next Generation Storage Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: APAC Next Generation Storage Market Share (%) by Company 2024

List of Tables

- Table 1: APAC Next Generation Storage Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: APAC Next Generation Storage Market Revenue Million Forecast, by Storage System 2019 & 2032

- Table 3: APAC Next Generation Storage Market Revenue Million Forecast, by Storage Architecture 2019 & 2032

- Table 4: APAC Next Generation Storage Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 5: APAC Next Generation Storage Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: APAC Next Generation Storage Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: APAC Next Generation Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: APAC Next Generation Storage Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: APAC Next Generation Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: APAC Next Generation Storage Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: APAC Next Generation Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: APAC Next Generation Storage Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: APAC Next Generation Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: APAC Next Generation Storage Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: APAC Next Generation Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: APAC Next Generation Storage Market Revenue Million Forecast, by Storage System 2019 & 2032

- Table 17: APAC Next Generation Storage Market Revenue Million Forecast, by Storage Architecture 2019 & 2032

- Table 18: APAC Next Generation Storage Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 19: APAC Next Generation Storage Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: China APAC Next Generation Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: India APAC Next Generation Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Japan APAC Next Generation Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: South Korea APAC Next Generation Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: ASEAN APAC Next Generation Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Oceania APAC Next Generation Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Rest of Asia Pacific APAC Next Generation Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC Next Generation Storage Market?

The projected CAGR is approximately 14.30%.

2. Which companies are prominent players in the APAC Next Generation Storage Market?

Key companies in the market include Samsung Electronics, Toshiba Corporation, HP, Pure storage Inc, Netgear Inc, Dell Inc, NetApp Inc, Hitachi Lt, SanDisk Corporation, IBM.

3. What are the main segments of the APAC Next Generation Storage Market?

The market segments include Storage System, Storage Architecture, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing digitalization across the banking industry; Rising e-commerce industry.

6. What are the notable trends driving market growth?

Retail end-use industry is expected to register significant growth.

7. Are there any restraints impacting market growth?

Data security concerns.

8. Can you provide examples of recent developments in the market?

October 2021 - Alibaba Cloud, a part of Alibaba Group, announced its new and first local data center in South Korea. The initiative aims to offer more secure, scalable, and reliable cloud services to its customers across the region. Moreover, following the development, the new data center will extend the Alibaba Cloud's offerings, that range from a database, storage, elastic compute, network services, and security to ML and data analytics capabilities, in the South Korea region.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC Next Generation Storage Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC Next Generation Storage Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC Next Generation Storage Market?

To stay informed about further developments, trends, and reports in the APAC Next Generation Storage Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence