Key Insights

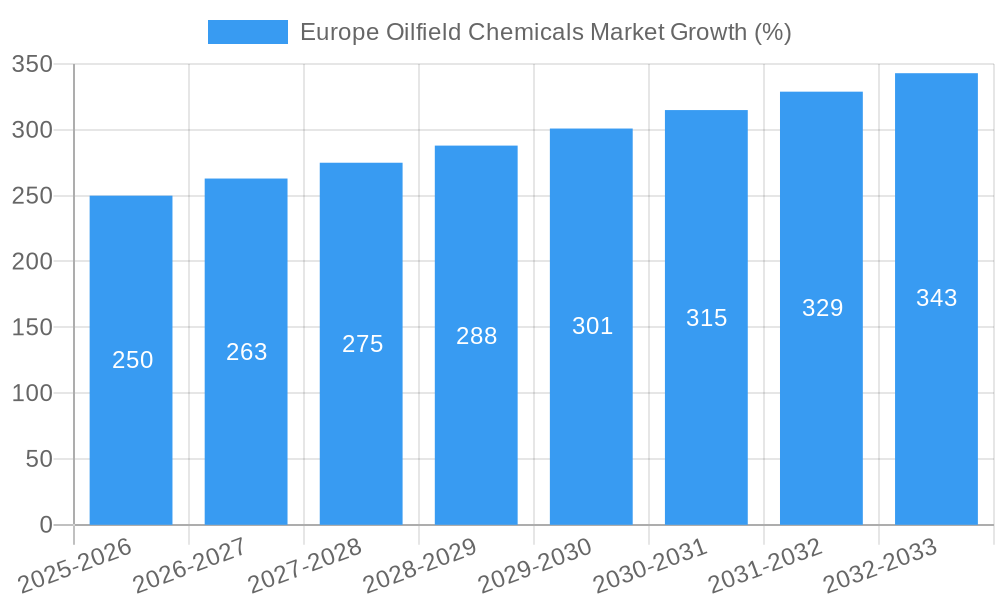

The European oilfield chemicals market, valued at approximately €X billion in 2025, is projected to experience robust growth with a Compound Annual Growth Rate (CAGR) exceeding 5% from 2025 to 2033. This expansion is driven by several key factors. Firstly, increasing oil and gas exploration and production activities across major European nations like the UK, Norway, and the Netherlands fuel demand for diverse chemicals including biocides, corrosion inhibitors, and demulsifiers. Secondly, the ongoing focus on enhanced oil recovery (EOR) techniques, aimed at maximizing output from mature fields, significantly boosts the consumption of specialized polymers and surfactants. Technological advancements leading to the development of environmentally friendly and high-performance oilfield chemicals further contribute to market growth. However, fluctuating oil prices and stringent environmental regulations pose significant challenges, potentially tempering growth in certain segments. The market is segmented by chemical type (biocides, corrosion & scale inhibitors, demulsifiers, polymers, surfactants, and others) and application (drilling & cementing, work-over & completion, well stimulation, production, and EOR). Germany, the UK, France, and the Netherlands represent the most significant national markets within Europe, driven by their established oil and gas infrastructure and ongoing exploration initiatives.

The competitive landscape is marked by the presence of both large multinational corporations like Schlumberger, Halliburton, and Baker Hughes, and specialized chemical companies like Clariant and Nouryon. These players compete based on product innovation, technological expertise, and established distribution networks. The market is likely to witness strategic mergers and acquisitions, as companies seek to expand their product portfolios and geographical reach. Future growth will hinge on factors such as governmental policies promoting sustainable oil and gas production, evolving technological advancements in chemical formulations, and overall global economic conditions. The forecast period of 2025-2033 presents significant opportunities for market players who can effectively adapt to these dynamic conditions and capitalize on the growing demand for high-performance, environmentally responsible oilfield chemicals.

Europe Oilfield Chemicals Market: A Comprehensive Market Report (2019-2033)

This dynamic report provides an in-depth analysis of the Europe Oilfield Chemicals Market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report leverages extensive data and expert analysis to illuminate market trends, competitive dynamics, and future growth potential. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

Europe Oilfield Chemicals Market Market Structure & Competitive Landscape

The Europe Oilfield Chemicals market exhibits a moderately concentrated structure, with several multinational corporations holding significant market share. Key players such as Schlumberger Limited, Halliburton, Baker Hughes a GE Company LLC, and Clariant drive innovation through R&D investments and strategic acquisitions. The market is influenced by stringent environmental regulations aimed at reducing the environmental footprint of oil and gas extraction, driving demand for eco-friendly chemicals. Product substitution, mainly driven by the adoption of more efficient and sustainable solutions, poses a continuous challenge to existing players.

- Market Concentration: The Herfindahl-Hirschman Index (HHI) is estimated at xx, indicating a moderately concentrated market.

- M&A Activity: The past five years have witnessed xx major mergers and acquisitions, primarily focused on expanding product portfolios and geographical reach.

- Innovation Drivers: Focus on enhanced oil recovery (EOR) techniques, development of environmentally friendly chemicals, and advancements in drilling technologies are shaping market innovation.

- Regulatory Impact: EU regulations concerning emissions and waste disposal significantly impact market players, necessitating compliance and investment in sustainable solutions.

- End-User Segmentation: The market is primarily segmented by oil and gas companies, with independent operators accounting for xx% of the total market share.

Europe Oilfield Chemicals Market Market Trends & Opportunities

The Europe Oilfield Chemicals market is poised for significant growth, driven by factors such as rising oil and gas production activities, the increasing adoption of advanced drilling techniques, and the growing demand for enhanced oil recovery (EOR) technologies. Technological advancements, including the development of high-performance chemicals and intelligent automation, are further boosting market expansion. The market witnessed a notable shift towards eco-friendly chemicals in recent years, fueled by stringent environmental regulations and a heightened awareness of sustainability issues. This is leading to the development and adoption of biodegradable and less toxic oilfield chemicals. The competitive landscape is marked by intense rivalry among established players and emerging startups.

The market size is projected to expand significantly in the forecast period, driven primarily by increasing investments in upstream oil and gas projects. The current market penetration rate for biocides and corrosion inhibitors stands at xx%, with a considerable potential for further growth.

Dominant Markets & Segments in Europe Oilfield Chemicals Market

The report identifies Norway, the United Kingdom, and the Netherlands as dominant markets within Europe. The high concentration of oil and gas activities in these regions drives substantial demand for oilfield chemicals.

Key Growth Drivers:

- Robust Oil & Gas Production: The region's significant oil and gas reserves and ongoing exploration activities fuel demand.

- Government Initiatives: Favorable regulatory frameworks and government incentives for energy exploration and production contribute to market growth.

- Investment in EOR: Increased investment in enhanced oil recovery techniques drives the demand for specialized chemicals.

Dominant Segments:

- Chemical Type: Corrosion & Scale Inhibitors holds the largest market share (xx%), followed by Polymers (xx%) and Surfactants (xx%). Growth in the biocide segment is primarily fueled by environmental regulations.

- Application: The Drilling & Cementing segment dominates, driven by increasing onshore and offshore drilling activities. Growth in the enhanced oil recovery (EOR) application is expected due to the increasing demand for maximizing production from mature oil fields.

Europe Oilfield Chemicals Market Product Analysis

The market showcases a diverse range of products tailored to specific applications and operational requirements. Technological advancements are focused on developing environmentally friendly, high-performance chemicals that minimize environmental impact, optimize resource utilization, and improve operational efficiency. Innovative formulations and advanced delivery systems are gaining prominence, offering enhanced efficacy and cost savings. Competition is driven by the introduction of superior products with improved performance characteristics, enhanced safety features, and eco-friendly attributes.

Key Drivers, Barriers & Challenges in Europe Oilfield Chemicals Market

Key Drivers:

The growing demand for oil and gas coupled with investments in EOR techniques are key growth drivers. Stringent environmental regulations necessitate the use of eco-friendly chemicals, driving innovation and market expansion. Technological advancements contribute to enhanced efficiency and performance.

Challenges and Restraints:

Fluctuations in oil prices significantly impact market demand. Environmental regulations, while encouraging innovation, can increase costs for producers. Supply chain disruptions and geopolitical instability pose further challenges. Intense competition and price pressures affect profitability for market players. The estimated impact of these challenges on market growth is approximately xx% over the forecast period.

Growth Drivers in the Europe Oilfield Chemicals Market Market

The increasing exploration and production activities in the region, coupled with investments in EOR technologies, represent significant growth drivers. Stringent environmental regulations are pushing the adoption of eco-friendly chemicals, fostering innovation in the sector. Advancements in drilling techniques are also leading to the higher demand for specialized chemicals.

Challenges Impacting Europe Oilfield Chemicals Market Growth

Price volatility in the oil and gas market poses a significant challenge, impacting overall market demand. Stringent environmental regulations, while crucial, can increase production costs. Furthermore, supply chain disruptions and geopolitical uncertainties can disrupt the market stability and lead to production delays.

Key Players Shaping the Europe Oilfield Chemicals Market Market

- Baker Hughes a GE Company LLC

- Clariant

- Chevron Phillips Chemical Company (Drilling Specialties Company)

- Nouryon

- Zirax Limited

- Solvay

- Exxon Mobil Corporation

- Ecolab (Nalco Champion Technologies Inc)

- Newpark Resources Inc

- Croda International Plc

- Ashland

- BASF SE

- Huntsman International LLC

- ELEMENTIS PLC

- Kemira

- Flotek Industries Inc

- Halliburton

- DowDuPont

- Schlumberger Limited

- Albemarle Corporation

- Innospec

Significant Europe Oilfield Chemicals Market Industry Milestones

- July 2022: Solvay partnered with Bank of America for sales operations of its oilfield chemicals, strengthening its market position.

- September 2021: Exxon Neftegas Limited (ENL) planned a USD 5 Billion investment to boost oil production in Sakhalin-1, impacting demand for oilfield chemicals.

Future Outlook for Europe Oilfield Chemicals Market Market

The Europe Oilfield Chemicals market is projected to experience robust growth over the forecast period, driven by rising oil and gas production, increased investments in EOR technologies, and the growing adoption of eco-friendly chemicals. Strategic collaborations, technological advancements, and favorable government policies will further fuel market expansion. The market presents significant opportunities for innovation and growth, particularly in the development and commercialization of sustainable and high-performance oilfield chemicals.

Europe Oilfield Chemicals Market Segmentation

-

1. Chemical Type

- 1.1. Biocide

- 1.2. Corrosion & Scale Inhibitors

- 1.3. Demulsifiers

- 1.4. Polymers

- 1.5. Surfactants

- 1.6. Other Types

-

2. Application

- 2.1. Drilling & Cementing

- 2.2. Work-over & Completion

- 2.3. Well Stimulation

- 2.4. Production

- 2.5. Enhanced Oil Recovery

Europe Oilfield Chemicals Market Segmentation By Geography

- 1. Russia

- 2. Norway

- 3. United Kingdom

- 4. Rest of Europe

Europe Oilfield Chemicals Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 5.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Shale Gas Exploration and Production; Rising Demand for Petroleum-based Fuel from Transportation Industry

- 3.3. Market Restrains

- 3.3.1. Environmental Sustainability in Shale Gas Extraction; Other Restraints

- 3.4. Market Trends

- 3.4.1. Well Stimulation to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Oilfield Chemicals Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Chemical Type

- 5.1.1. Biocide

- 5.1.2. Corrosion & Scale Inhibitors

- 5.1.3. Demulsifiers

- 5.1.4. Polymers

- 5.1.5. Surfactants

- 5.1.6. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Drilling & Cementing

- 5.2.2. Work-over & Completion

- 5.2.3. Well Stimulation

- 5.2.4. Production

- 5.2.5. Enhanced Oil Recovery

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Russia

- 5.3.2. Norway

- 5.3.3. United Kingdom

- 5.3.4. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Chemical Type

- 6. Russia Europe Oilfield Chemicals Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Chemical Type

- 6.1.1. Biocide

- 6.1.2. Corrosion & Scale Inhibitors

- 6.1.3. Demulsifiers

- 6.1.4. Polymers

- 6.1.5. Surfactants

- 6.1.6. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Drilling & Cementing

- 6.2.2. Work-over & Completion

- 6.2.3. Well Stimulation

- 6.2.4. Production

- 6.2.5. Enhanced Oil Recovery

- 6.1. Market Analysis, Insights and Forecast - by Chemical Type

- 7. Norway Europe Oilfield Chemicals Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Chemical Type

- 7.1.1. Biocide

- 7.1.2. Corrosion & Scale Inhibitors

- 7.1.3. Demulsifiers

- 7.1.4. Polymers

- 7.1.5. Surfactants

- 7.1.6. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Drilling & Cementing

- 7.2.2. Work-over & Completion

- 7.2.3. Well Stimulation

- 7.2.4. Production

- 7.2.5. Enhanced Oil Recovery

- 7.1. Market Analysis, Insights and Forecast - by Chemical Type

- 8. United Kingdom Europe Oilfield Chemicals Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Chemical Type

- 8.1.1. Biocide

- 8.1.2. Corrosion & Scale Inhibitors

- 8.1.3. Demulsifiers

- 8.1.4. Polymers

- 8.1.5. Surfactants

- 8.1.6. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Drilling & Cementing

- 8.2.2. Work-over & Completion

- 8.2.3. Well Stimulation

- 8.2.4. Production

- 8.2.5. Enhanced Oil Recovery

- 8.1. Market Analysis, Insights and Forecast - by Chemical Type

- 9. Rest of Europe Europe Oilfield Chemicals Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Chemical Type

- 9.1.1. Biocide

- 9.1.2. Corrosion & Scale Inhibitors

- 9.1.3. Demulsifiers

- 9.1.4. Polymers

- 9.1.5. Surfactants

- 9.1.6. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Drilling & Cementing

- 9.2.2. Work-over & Completion

- 9.2.3. Well Stimulation

- 9.2.4. Production

- 9.2.5. Enhanced Oil Recovery

- 9.1. Market Analysis, Insights and Forecast - by Chemical Type

- 10. Germany Europe Oilfield Chemicals Market Analysis, Insights and Forecast, 2019-2031

- 11. France Europe Oilfield Chemicals Market Analysis, Insights and Forecast, 2019-2031

- 12. Italy Europe Oilfield Chemicals Market Analysis, Insights and Forecast, 2019-2031

- 13. United Kingdom Europe Oilfield Chemicals Market Analysis, Insights and Forecast, 2019-2031

- 14. Netherlands Europe Oilfield Chemicals Market Analysis, Insights and Forecast, 2019-2031

- 15. Rest of Europe Europe Oilfield Chemicals Market Analysis, Insights and Forecast, 2019-2031

- 16. Competitive Analysis

- 16.1. Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Baker Hughes a GE Company LLC

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Clariant

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Chevron Phillips Chemical Company (Drilling Specialties Company)

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Nouryon

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Zirax Limited

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Solvay

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Exxon Mobil Corporation

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Ecolab (Nalco Champion Technologies Inc )

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Newpark Resources Inc

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Croda International Plc

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 Ashland

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 BASF SE

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.13 Huntsman International LLC

- 16.2.13.1. Overview

- 16.2.13.2. Products

- 16.2.13.3. SWOT Analysis

- 16.2.13.4. Recent Developments

- 16.2.13.5. Financials (Based on Availability)

- 16.2.14 ELEMENTIS PLC

- 16.2.14.1. Overview

- 16.2.14.2. Products

- 16.2.14.3. SWOT Analysis

- 16.2.14.4. Recent Developments

- 16.2.14.5. Financials (Based on Availability)

- 16.2.15 Kemira

- 16.2.15.1. Overview

- 16.2.15.2. Products

- 16.2.15.3. SWOT Analysis

- 16.2.15.4. Recent Developments

- 16.2.15.5. Financials (Based on Availability)

- 16.2.16 Flotek Industries Inc

- 16.2.16.1. Overview

- 16.2.16.2. Products

- 16.2.16.3. SWOT Analysis

- 16.2.16.4. Recent Developments

- 16.2.16.5. Financials (Based on Availability)

- 16.2.17 Halliburton

- 16.2.17.1. Overview

- 16.2.17.2. Products

- 16.2.17.3. SWOT Analysis

- 16.2.17.4. Recent Developments

- 16.2.17.5. Financials (Based on Availability)

- 16.2.18 DowDuPont

- 16.2.18.1. Overview

- 16.2.18.2. Products

- 16.2.18.3. SWOT Analysis

- 16.2.18.4. Recent Developments

- 16.2.18.5. Financials (Based on Availability)

- 16.2.19 Schlumberger Limited

- 16.2.19.1. Overview

- 16.2.19.2. Products

- 16.2.19.3. SWOT Analysis

- 16.2.19.4. Recent Developments

- 16.2.19.5. Financials (Based on Availability)

- 16.2.20 Albemarle Corporation

- 16.2.20.1. Overview

- 16.2.20.2. Products

- 16.2.20.3. SWOT Analysis

- 16.2.20.4. Recent Developments

- 16.2.20.5. Financials (Based on Availability)

- 16.2.21 Innospec

- 16.2.21.1. Overview

- 16.2.21.2. Products

- 16.2.21.3. SWOT Analysis

- 16.2.21.4. Recent Developments

- 16.2.21.5. Financials (Based on Availability)

- 16.2.1 Baker Hughes a GE Company LLC

List of Figures

- Figure 1: Europe Oilfield Chemicals Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Oilfield Chemicals Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Oilfield Chemicals Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Oilfield Chemicals Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 3: Europe Oilfield Chemicals Market Revenue Million Forecast, by Chemical Type 2019 & 2032

- Table 4: Europe Oilfield Chemicals Market Volume K Tons Forecast, by Chemical Type 2019 & 2032

- Table 5: Europe Oilfield Chemicals Market Revenue Million Forecast, by Application 2019 & 2032

- Table 6: Europe Oilfield Chemicals Market Volume K Tons Forecast, by Application 2019 & 2032

- Table 7: Europe Oilfield Chemicals Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Europe Oilfield Chemicals Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 9: Europe Oilfield Chemicals Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Europe Oilfield Chemicals Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 11: Germany Europe Oilfield Chemicals Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Germany Europe Oilfield Chemicals Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 13: France Europe Oilfield Chemicals Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: France Europe Oilfield Chemicals Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 15: Italy Europe Oilfield Chemicals Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Italy Europe Oilfield Chemicals Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 17: United Kingdom Europe Oilfield Chemicals Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: United Kingdom Europe Oilfield Chemicals Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 19: Netherlands Europe Oilfield Chemicals Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Netherlands Europe Oilfield Chemicals Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 21: Rest of Europe Europe Oilfield Chemicals Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Rest of Europe Europe Oilfield Chemicals Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 23: Europe Oilfield Chemicals Market Revenue Million Forecast, by Chemical Type 2019 & 2032

- Table 24: Europe Oilfield Chemicals Market Volume K Tons Forecast, by Chemical Type 2019 & 2032

- Table 25: Europe Oilfield Chemicals Market Revenue Million Forecast, by Application 2019 & 2032

- Table 26: Europe Oilfield Chemicals Market Volume K Tons Forecast, by Application 2019 & 2032

- Table 27: Europe Oilfield Chemicals Market Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Europe Oilfield Chemicals Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 29: Europe Oilfield Chemicals Market Revenue Million Forecast, by Chemical Type 2019 & 2032

- Table 30: Europe Oilfield Chemicals Market Volume K Tons Forecast, by Chemical Type 2019 & 2032

- Table 31: Europe Oilfield Chemicals Market Revenue Million Forecast, by Application 2019 & 2032

- Table 32: Europe Oilfield Chemicals Market Volume K Tons Forecast, by Application 2019 & 2032

- Table 33: Europe Oilfield Chemicals Market Revenue Million Forecast, by Country 2019 & 2032

- Table 34: Europe Oilfield Chemicals Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 35: Europe Oilfield Chemicals Market Revenue Million Forecast, by Chemical Type 2019 & 2032

- Table 36: Europe Oilfield Chemicals Market Volume K Tons Forecast, by Chemical Type 2019 & 2032

- Table 37: Europe Oilfield Chemicals Market Revenue Million Forecast, by Application 2019 & 2032

- Table 38: Europe Oilfield Chemicals Market Volume K Tons Forecast, by Application 2019 & 2032

- Table 39: Europe Oilfield Chemicals Market Revenue Million Forecast, by Country 2019 & 2032

- Table 40: Europe Oilfield Chemicals Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 41: Europe Oilfield Chemicals Market Revenue Million Forecast, by Chemical Type 2019 & 2032

- Table 42: Europe Oilfield Chemicals Market Volume K Tons Forecast, by Chemical Type 2019 & 2032

- Table 43: Europe Oilfield Chemicals Market Revenue Million Forecast, by Application 2019 & 2032

- Table 44: Europe Oilfield Chemicals Market Volume K Tons Forecast, by Application 2019 & 2032

- Table 45: Europe Oilfield Chemicals Market Revenue Million Forecast, by Country 2019 & 2032

- Table 46: Europe Oilfield Chemicals Market Volume K Tons Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Oilfield Chemicals Market?

The projected CAGR is approximately > 5.00%.

2. Which companies are prominent players in the Europe Oilfield Chemicals Market?

Key companies in the market include Baker Hughes a GE Company LLC, Clariant, Chevron Phillips Chemical Company (Drilling Specialties Company), Nouryon, Zirax Limited, Solvay, Exxon Mobil Corporation, Ecolab (Nalco Champion Technologies Inc ), Newpark Resources Inc, Croda International Plc, Ashland, BASF SE, Huntsman International LLC, ELEMENTIS PLC, Kemira, Flotek Industries Inc, Halliburton, DowDuPont, Schlumberger Limited, Albemarle Corporation, Innospec.

3. What are the main segments of the Europe Oilfield Chemicals Market?

The market segments include Chemical Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Shale Gas Exploration and Production; Rising Demand for Petroleum-based Fuel from Transportation Industry.

6. What are the notable trends driving market growth?

Well Stimulation to Dominate the Market.

7. Are there any restraints impacting market growth?

Environmental Sustainability in Shale Gas Extraction; Other Restraints.

8. Can you provide examples of recent developments in the market?

July 2022: Solvay partnered with Bank of America for sales operations of its oilfield chemicals. This move is expected to strengthen the company's position in the oilfield chemicals market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3,950, USD 4,950, and USD 6,950 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Oilfield Chemicals Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Oilfield Chemicals Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Oilfield Chemicals Market?

To stay informed about further developments, trends, and reports in the Europe Oilfield Chemicals Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence