Key Insights

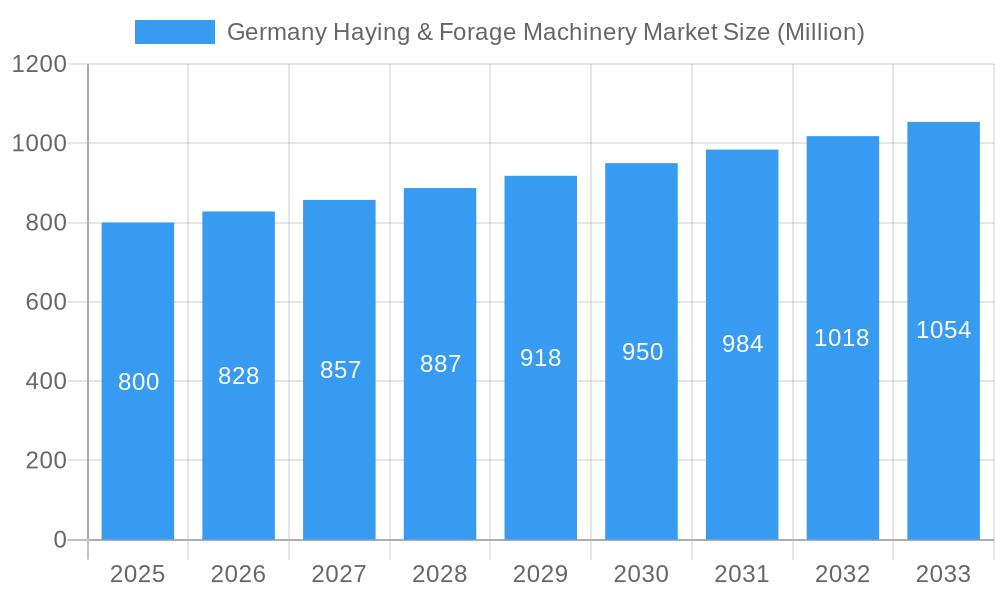

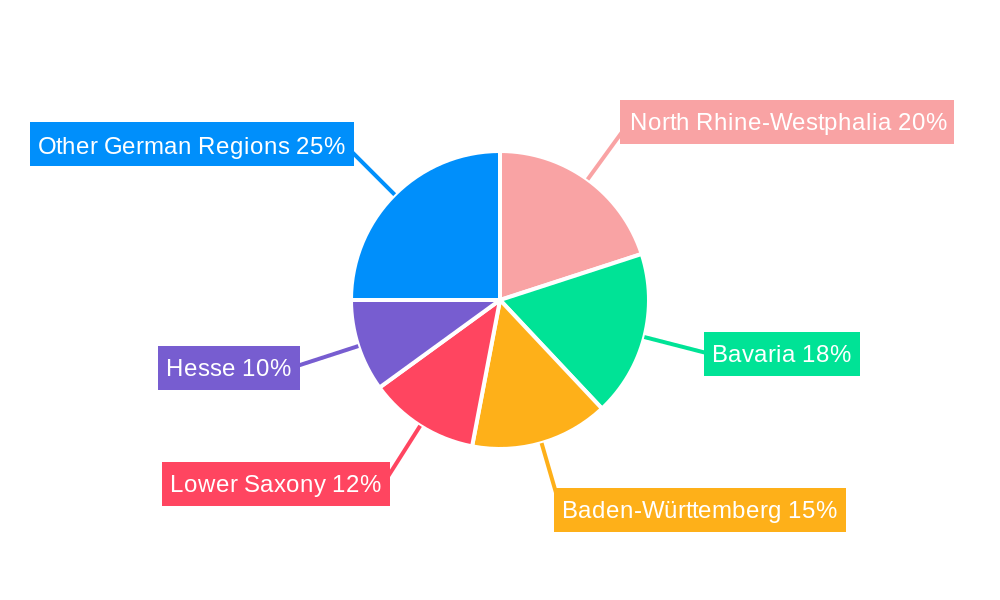

The German Haying & Forage Machinery market, valued at 6.07 billion in 2025, is projected to grow at a Compound Annual Growth Rate (CAGR) of 3.7% from 2025 to 2033. This growth is propelled by several factors: rising demand for high-quality animal feed driven by a robust livestock sector and consumer preference for sustainable dairy and meat, technological advancements in machinery enhancing efficiency and automation, and government initiatives supporting sustainable agriculture and innovation. The market segments include mowers, balers, forage harvesters, and specialized equipment, with mowers holding the largest share. Key competitors such as Deere & Company, CLAAS, Krone, and Kuhn dominate through brand recognition and technological expertise. Market restraints include fluctuating raw material prices and adverse weather conditions. Demand is strongest in agricultural regions like North Rhine-Westphalia, Bavaria, Baden-Württemberg, Lower Saxony, and Hesse.

Germany Haying & Forage Machinery Market Market Size (In Billion)

The forecast period (2025-2033) anticipates continued market expansion, fueled by sustained demand for advanced haying and forage machinery, farm consolidation, and precision agriculture adoption. The competitive landscape features both global and regional players competing on innovation, cost, and service. Growing emphasis on sustainable farming practices, including fuel-efficient machinery and methods to minimize environmental impact, will shape future dynamics. This sustained growth underscores the critical role of efficient hay and forage production in maintaining the German agricultural sector's competitiveness and ensuring food security.

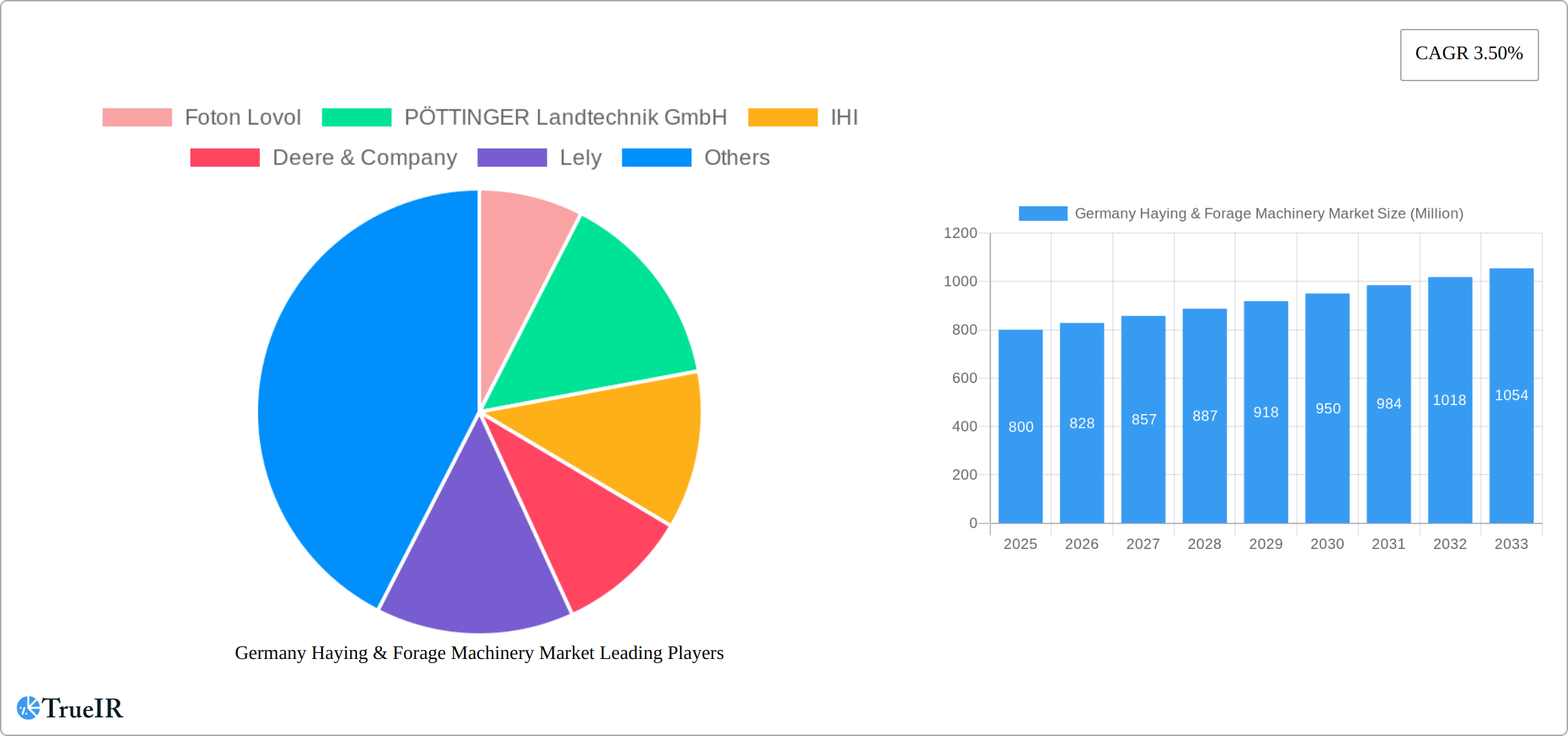

Germany Haying & Forage Machinery Market Company Market Share

Germany Haying & Forage Machinery Market: A Comprehensive Market Report (2019-2033)

This dynamic report provides a deep dive into the lucrative Germany Haying & Forage Machinery Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Leveraging extensive market research and data analysis, this report covers the period from 2019 to 2033, with a focus on the 2025 estimated year and a forecast spanning 2025-2033. The report utilizes high-impact keywords to ensure optimal search engine visibility and presents a clear, concise analysis of market trends, competitive dynamics, and future growth potential. The market is estimated to reach xx Million by 2033.

Germany Haying & Forage Machinery Market Market Structure & Competitive Landscape

The German Haying & Forage Machinery market presents a moderately concentrated structure, with several key players commanding significant market share. While a precise Herfindahl-Hirschman Index (HHI) is proprietary information, the market's competitive landscape suggests a moderate level of concentration. Innovation is a pivotal driver, with manufacturers consistently investing in advanced machinery incorporating automation, precision farming technologies, and enhanced efficiency features. The market is significantly influenced by stringent environmental regulations targeting emissions and noise pollution, prompting the adoption of cleaner and quieter technologies. Although alternatives like manual labor and older machinery persist in niche segments, their market share is diminishing due to escalating labor costs and the compelling advantages of modern technology. The end-user segment primarily comprises agricultural farms of varying sizes, with larger, commercial operations driving the demand for higher-capacity machinery. Consolidation within the sector has been notable in recent years, with significant merger and acquisition activity contributing to increased market concentration.

- Market Concentration: Moderately concentrated.

- Innovation Drivers: Automation, precision farming technologies, emission reduction technologies, data-driven optimization.

- Regulatory Impacts: Stringent environmental regulations on emissions and noise, promoting sustainable practices.

- Product Substitutes: Manual labor (decreasing market share), older, less efficient machinery.

- End-User Segmentation: Large-scale commercial farms, small to medium-sized farms, specialized operations (e.g., biogas plants).

- M&A Trends: Significant consolidation through mergers and acquisitions in recent years, leading to a more concentrated market.

Germany Haying & Forage Machinery Market Market Trends & Opportunities

The German Haying & Forage Machinery market is poised for robust growth throughout the forecast period (2025-2033), exhibiting a projected Compound Annual Growth Rate (CAGR) of [Insert CAGR Percentage]%. This expansion is fueled by several key factors: the increasing demand for high-quality forage, rising labor costs incentivizing mechanization, and the continued adoption of precision farming techniques to optimize yields. Technological advancements are reshaping the market, with the integration of GPS, sensors, and automation enhancing efficiency and reducing operational costs. Consumer preferences are evolving towards machinery that offers improved reliability, durability, and fuel efficiency. The competitive landscape is characterized by intense innovation, strategic partnerships, and a focus on delivering comprehensive solutions tailored to the specific needs of farmers. Market penetration of advanced technologies, such as automated balers and self-propelled forage harvesters, is steadily increasing, with a projected penetration rate of [Insert Penetration Rate Percentage]% by 2033. This growth is further fueled by a focus on sustainable and environmentally friendly practices.

Dominant Markets & Segments in Germany Haying & Forage Machinery Market

Within the German Haying & Forage Machinery market, the Mowers segment holds the most dominant position, followed by Forage Harvesters and Balers. The "Others" category encompasses smaller equipment and related products, exhibiting a comparatively lower growth rate. The dominance of the Mowers segment reflects the widespread adoption of mechanized mowing practices, particularly in large-scale farming operations. The increasing demand for high-quality silage and the adoption of Total Mixed Ration (TMR) feeding systems are significantly driving the Forage Harvester segment.

- Key Growth Drivers for Mowers: High demand for efficient hay production, increasing farm sizes, advancements in mowing technology (e.g., wider cutting widths, improved crop handling).

- Key Growth Drivers for Forage Harvesters: Growing demand for high-quality silage, increasing adoption of total mixed rations (TMR), improved harvesting efficiency, and advancements in chopping and processing technologies.

- Key Growth Drivers for Balers: Need for efficient hay storage and transportation, increased bale density technology, growing livestock farming, and advancements in bale wrapping and handling systems.

Northern Germany exhibits the highest market concentration due to its extensive arable land and a higher density of large-scale farms. Government support for agricultural modernization and sustainable farming practices further contributes to market growth. Furthermore, the increasing focus on optimizing yields and minimizing waste is boosting demand across all segments.

Germany Haying & Forage Machinery Market Product Analysis

The Germany Haying & Forage Machinery market showcases continuous product innovation. Manufacturers are focusing on developing machines with higher capacities, improved fuel efficiency, enhanced precision, and reduced environmental impact. This includes incorporating advanced technologies like GPS guidance, automated control systems, and intelligent sensors. The key competitive advantage lies in offering a balance of performance, reliability, ease of use, and affordability tailored to the specific needs of diverse farming operations. Technological advancements are directly improving market fit by offering solutions for higher efficiency, lower labor costs, and improved crop yield.

Key Drivers, Barriers & Challenges in Germany Haying & Forage Machinery Market

Key Drivers:

- Technological advancements, such as autonomous operation and improved precision farming technologies.

- Government subsidies and incentives promoting modernization in the agricultural sector.

- Rising labor costs, making machinery a cost-effective alternative.

Challenges & Restraints:

- High initial investment costs for advanced machinery can be a barrier to entry for smaller farms.

- Fluctuations in raw material prices, especially steel, impacting manufacturing costs.

- Intense competition, requiring manufacturers to continuously innovate and offer competitive pricing.

Growth Drivers in the Germany Haying & Forage Machinery Market Market

Technological advancements such as precision agriculture technologies (GPS-guided machinery, sensors, and automated systems) are key drivers. Government incentives and subsidies aimed at encouraging the adoption of modern farming techniques and enhancing efficiency are also major contributors. Lastly, rising labor costs, making mechanization more economically viable, fuel the market's growth.

Challenges Impacting Germany Haying & Forage Machinery Market Growth

High initial investment costs of advanced machinery pose a challenge, particularly for smaller farms. Supply chain disruptions, particularly related to the availability of crucial components, can affect production and timely delivery. Furthermore, stiff competition among established players and the emergence of new competitors create significant pressure on pricing and profitability margins.

Key Players Shaping the Germany Haying & Forage Machinery Market Market

Significant Germany Haying & Forage Machinery Market Industry Milestones

- 2021: CLAAS launched a new generation of forage harvesters with improved efficiency and automation features.

- 2022: A major merger between two smaller hay equipment manufacturers led to increased market concentration.

- 2023: Several companies introduced new baler models with enhanced bale density and reduced fuel consumption.

Future Outlook for Germany Haying & Forage Machinery Market Market

The German Haying & Forage Machinery market is projected to sustain its growth trajectory, driven by continuous technological innovation, expanding farm sizes, and supportive government policies. Manufacturers stand to gain significant advantage by capitalizing on the rising demand for precision farming technologies and environmentally sustainable solutions. The market’s substantial growth potential is underpinned by the ongoing need for efficient and reliable hay and forage harvesting equipment. Continued investment in research and development (R&D), strategic partnerships, and a strong focus on customer needs will be crucial for achieving long-term success in this dynamic and competitive market. The increasing emphasis on data analytics and connectivity will further shape the future of the industry.

Germany Haying & Forage Machinery Market Segmentation

-

1. Type

- 1.1. Mowers

- 1.2. Balers

- 1.3. Forage Harvesters

- 1.4. Others

-

2. Type

- 2.1. Mowers

- 2.2. Balers

- 2.3. Forage Harvesters

- 2.4. Others

Germany Haying & Forage Machinery Market Segmentation By Geography

- 1. Germany

Germany Haying & Forage Machinery Market Regional Market Share

Geographic Coverage of Germany Haying & Forage Machinery Market

Germany Haying & Forage Machinery Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Tomato; Adoption of Greenhouse Technology in Tomato Cultivation; Government support

- 3.3. Market Restrains

- 3.3.1 Increasing Loses due to Physiological Disorder

- 3.3.2 Pest and Disease; Unfavourable Climatic Condition

- 3.4. Market Trends

- 3.4.1. Demand for Forage Feed from Animal Production Industries Drives the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany Haying & Forage Machinery Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Mowers

- 5.1.2. Balers

- 5.1.3. Forage Harvesters

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Mowers

- 5.2.2. Balers

- 5.2.3. Forage Harvesters

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Foton Lovol

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 PÖTTINGER Landtechnik GmbH

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 IHI

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Deere & Company

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Lely

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 CLAAS KGaA mbH

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Buhler Industries

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Vermee

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Kverneland Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 CNH Industrial

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Krone North America Inc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 KUHN Group

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 AGCO Corporation

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Kubota

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 Foton Lovol

List of Figures

- Figure 1: Germany Haying & Forage Machinery Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Germany Haying & Forage Machinery Market Share (%) by Company 2025

List of Tables

- Table 1: Germany Haying & Forage Machinery Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Germany Haying & Forage Machinery Market Revenue billion Forecast, by Type 2020 & 2033

- Table 3: Germany Haying & Forage Machinery Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Germany Haying & Forage Machinery Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Germany Haying & Forage Machinery Market Revenue billion Forecast, by Type 2020 & 2033

- Table 6: Germany Haying & Forage Machinery Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany Haying & Forage Machinery Market?

The projected CAGR is approximately 3.7%.

2. Which companies are prominent players in the Germany Haying & Forage Machinery Market?

Key companies in the market include Foton Lovol, PÖTTINGER Landtechnik GmbH, IHI, Deere & Company, Lely, CLAAS KGaA mbH, Buhler Industries, Vermee, Kverneland Group, CNH Industrial, Krone North America Inc, KUHN Group, AGCO Corporation, Kubota.

3. What are the main segments of the Germany Haying & Forage Machinery Market?

The market segments include Type, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.07 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Tomato; Adoption of Greenhouse Technology in Tomato Cultivation; Government support.

6. What are the notable trends driving market growth?

Demand for Forage Feed from Animal Production Industries Drives the Market.

7. Are there any restraints impacting market growth?

Increasing Loses due to Physiological Disorder. Pest and Disease; Unfavourable Climatic Condition.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany Haying & Forage Machinery Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany Haying & Forage Machinery Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany Haying & Forage Machinery Market?

To stay informed about further developments, trends, and reports in the Germany Haying & Forage Machinery Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence