Key Insights

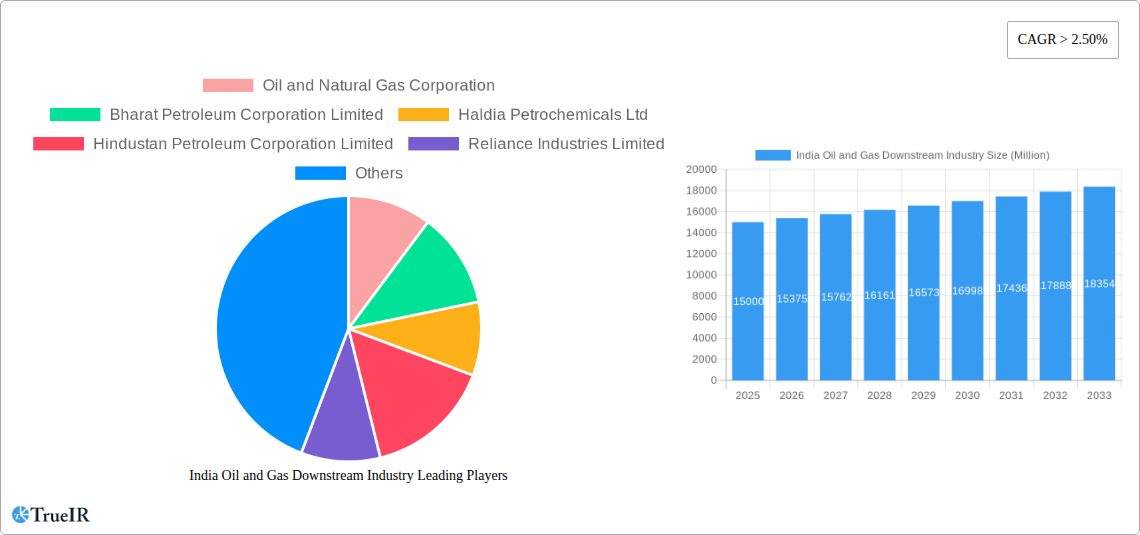

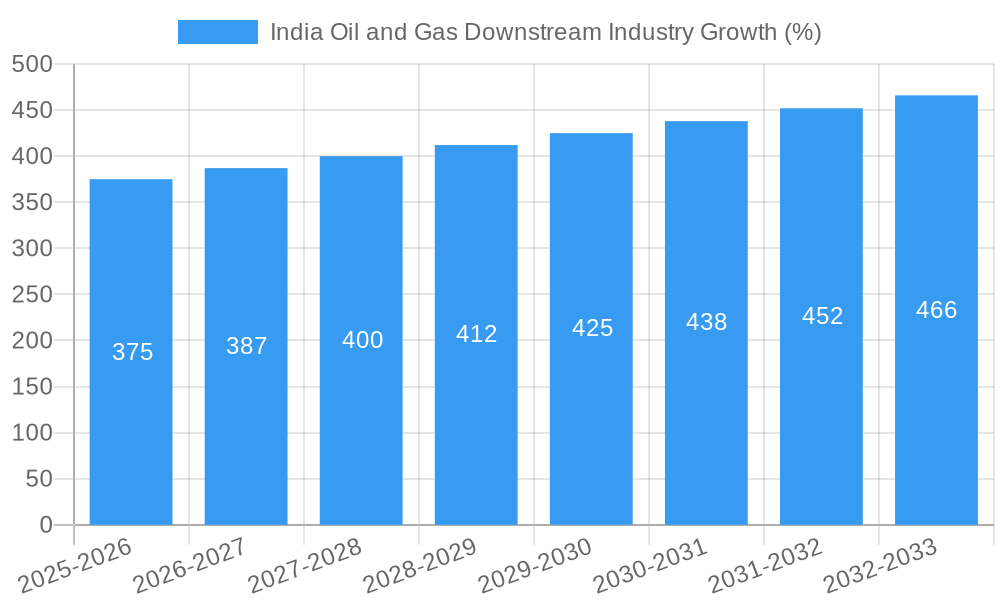

The India oil and gas downstream industry is experiencing robust growth, fueled by rising energy demand from a burgeoning population and expanding industrial sector. The market, valued at approximately $XX million in 2025 (assuming a logical estimation based on the provided CAGR of >2.50% and a study period from 2019-2033), is projected to maintain a healthy growth trajectory throughout the forecast period (2025-2033). Key drivers include increasing urbanization, industrialization, and the government's focus on infrastructure development, which collectively boost fuel consumption. Furthermore, the expansion of petrochemical plants and refinery capacity contribute significantly to market expansion. However, challenges such as fluctuating crude oil prices and environmental concerns related to emissions represent potential restraints on market growth. The industry is segmented into refineries and petrochemical plants, with major players including Oil and Natural Gas Corporation, Bharat Petroleum Corporation Limited, Reliance Industries Limited, and Indian Oil Corporation Limited, competing strategically across various regions of India (North, South, East, and West). These companies are investing heavily in capacity expansions and technological upgrades to meet the growing demand and improve operational efficiency.

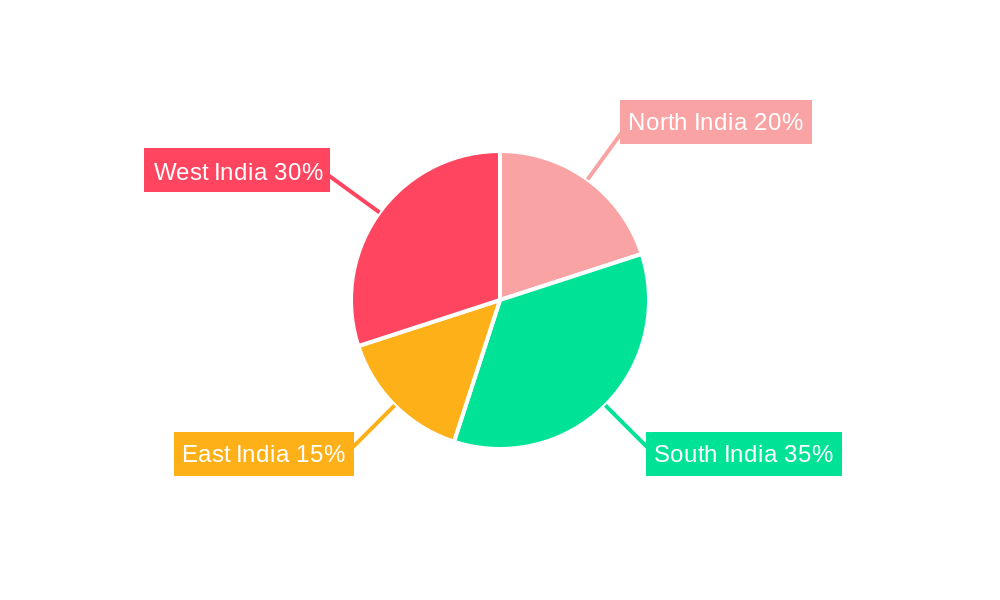

The regional distribution of the market reflects varying levels of industrial development and population density across India. While precise regional market share figures are not provided, it's reasonable to assume that regions with higher industrial activity and population density, such as West and South India, currently hold larger market shares. However, the government's initiatives aimed at balanced regional development could lead to a more even distribution of market share across different regions in the coming years. Future growth hinges on consistent policy support, efficient infrastructure development, and the successful implementation of sustainable practices that mitigate environmental concerns while ensuring reliable energy supply. The industry's performance will be closely linked to national economic growth and global energy market trends.

India Oil and Gas Downstream Industry: A Comprehensive Market Report (2019-2033)

This dynamic report provides a detailed analysis of the Indian oil and gas downstream industry, offering invaluable insights for investors, industry professionals, and strategic planners. The study covers the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. We leverage extensive data and expert analysis to present a comprehensive overview of market structure, trends, opportunities, and challenges. The report values are expressed in Millions.

India Oil and Gas Downstream Industry Market Structure & Competitive Landscape

This section delves into the competitive dynamics of the Indian oil and gas downstream sector. We analyze market concentration, assessing the market share held by key players like Indian Oil Corporation Limited, Reliance Industries Limited, and Bharat Petroleum Corporation Limited. The Herfindahl-Hirschman Index (HHI) for 2024 is estimated at xx, indicating a moderately concentrated market. Innovation drivers, such as the adoption of advanced refining technologies and the push towards cleaner fuels, are examined alongside the regulatory landscape, including government policies on fuel pricing and environmental regulations. The impact of product substitutes, like biofuels and electric vehicles, is also assessed. End-user segmentation, encompassing industrial, transportation, and residential sectors, is analyzed to understand the diverse demand patterns. Finally, we explore M&A trends, noting a total M&A volume of approximately xx Million USD in the historical period (2019-2024), with a projected increase to xx Million USD during the forecast period (2025-2033). Key factors driving M&A activity include economies of scale, market consolidation, and access to new technologies.

India Oil and Gas Downstream Industry Market Trends & Opportunities

The Indian oil and gas downstream market exhibits robust growth, driven by factors like increasing energy demand fueled by rapid economic expansion and urbanization. The market size is projected to reach xx Million USD by 2025, expanding at a Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033. Technological advancements, such as the integration of digital technologies in refinery operations and the development of sustainable fuels, are transforming the industry landscape. Consumer preferences are shifting towards higher-quality fuels and environmentally friendly options, creating opportunities for companies offering such products. Intense competition among existing players, alongside the entry of new entrants, shapes the competitive dynamics, leading to pricing pressures and the need for continuous innovation. Market penetration of cleaner fuels is expected to rise from xx% in 2025 to xx% by 2033, indicating a substantial shift in consumer behavior and market share dynamics.

Dominant Markets & Segments in India Oil and Gas Downstream Industry

Refineries: Market Overview & Key Project Information

Market Overview: The western region of India, particularly Gujarat and Maharashtra, dominates the refinery segment due to established infrastructure and proximity to major consumption centers. Key growth drivers include investments in refinery capacity expansion and upgrading projects to meet evolving fuel specifications.

Key Project Information: Several large-scale refinery modernization and expansion projects are underway, further enhancing refining capacity and efficiency. These projects are contributing significantly to the growth of the refinery market.

Petrochemical Plants: Market Overview & Key Project Information

Market Overview: The petrochemical sector is experiencing rapid growth, driven by the increasing demand for plastics and other petrochemical products across various industries. Gujarat and Maharashtra are again prominent regions, benefiting from existing infrastructure and proximity to feedstock sources.

Key Project Information: Significant investments are flowing into the construction of new petrochemical plants and the expansion of existing ones. This is fueled by the government’s emphasis on promoting the petrochemical industry and the growing domestic demand.

The dominance of Gujarat and Maharashtra in both refinery and petrochemical segments is primarily due to their superior infrastructure, access to raw materials, and proximity to key markets. Government policies promoting industrial growth and infrastructure development in these regions further solidify their leading positions.

India Oil and Gas Downstream Industry Product Analysis

The Indian oil and gas downstream industry is witnessing the introduction of innovative products, such as BS-VI compliant fuels, biofuels blends, and advanced petrochemical products with superior properties. These innovations are driven by stringent environmental regulations and the growing demand for cleaner and higher-performance products. The successful market adoption of these products hinges on their ability to meet evolving consumer needs and comply with regulatory standards, creating a competitive landscape based on product quality, efficiency, and sustainability.

Key Drivers, Barriers & Challenges in India Oil and Gas Downstream Industry

Key Drivers:

Technological advancements in refining processes, increasing energy demand from industrialization and urbanization, and supportive government policies promoting energy security are key drivers.

Challenges:

Stringent environmental regulations and the need for higher capital investment in upgrading facilities pose significant challenges. Supply chain vulnerabilities, particularly in the procurement of crude oil, can impact operational efficiency and profitability. Intense competition from both domestic and international players creates pressure on margins.

Growth Drivers in the India Oil and Gas Downstream Industry Market

The expanding middle class, robust economic growth, and the government's initiatives to boost infrastructure are pivotal growth drivers. These factors lead to increased energy demand and provide opportunities for investment in refinery and petrochemical capacity expansions. Technological advancements, particularly in cleaner fuel production, are also critical.

Challenges Impacting India Oil and Gas Downstream Industry Growth

Regulatory complexities around environmental standards and fuel pricing, alongside supply chain disruptions and fluctuating crude oil prices, pose significant challenges. These uncertainties can impact investment decisions and hinder industry growth. Moreover, the need for large capital expenditure to meet stringent emission norms creates additional pressures.

Key Players Shaping the India Oil and Gas Downstream Industry Market

- Oil and Natural Gas Corporation

- Bharat Petroleum Corporation Limited

- Haldia Petrochemicals Ltd

- Hindustan Petroleum Corporation Limited

- Reliance Industries Limited

- GAIL (India) Limited

- Nayara Energy Limited

- Indian Oil Corporation Limited

- Oman Oil Company

Significant India Oil and Gas Downstream Industry Industry Milestones

- 2020: Introduction of BS-VI fuel standards across India.

- 2021: Several major refinery expansion projects announced.

- 2022: Increased investments in renewable energy sources within the downstream sector.

- 2023: Government initiatives to promote biofuel blending.

- 2024: Merger and acquisition activity among downstream companies increased.

Future Outlook for India Oil and Gas Downstream Industry Market

The Indian oil and gas downstream industry is poised for significant growth, driven by sustained economic expansion, rising energy demand, and the government’s focus on infrastructure development. Strategic investments in capacity expansion, technological upgrades, and cleaner fuel production will shape the industry's future. The market presents significant opportunities for both domestic and international players, although navigating regulatory complexities and supply chain challenges remains crucial for success.

India Oil and Gas Downstream Industry Segmentation

-

1. Refineries

- 1.1. Market Overview

- 1.2. Key Project Information

-

2. Petrochemical Pants

- 2.1. Market Overview

- 2.2. Key Project Information

India Oil and Gas Downstream Industry Segmentation By Geography

- 1. India

India Oil and Gas Downstream Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 2.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Investments in Renewable Energy Generation 4.; Supportive Government Policies Towards Green Energy

- 3.3. Market Restrains

- 3.3.1. 4.; Challenges In Installing Renewable Power in the Circulated Structure

- 3.4. Market Trends

- 3.4.1. Refineries to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Oil and Gas Downstream Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Refineries

- 5.1.1. Market Overview

- 5.1.2. Key Project Information

- 5.2. Market Analysis, Insights and Forecast - by Petrochemical Pants

- 5.2.1. Market Overview

- 5.2.2. Key Project Information

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Refineries

- 6. North India India Oil and Gas Downstream Industry Analysis, Insights and Forecast, 2019-2031

- 7. South India India Oil and Gas Downstream Industry Analysis, Insights and Forecast, 2019-2031

- 8. East India India Oil and Gas Downstream Industry Analysis, Insights and Forecast, 2019-2031

- 9. West India India Oil and Gas Downstream Industry Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Oil and Natural Gas Corporation

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Bharat Petroleum Corporation Limited

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Haldia Petrochemicals Ltd

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Hindustan Petroleum Corporation Limited

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Reliance Industries Limited

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 GAIL (India) Limited

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Nayara Energy Limited

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Indian Oil Corporation Limited

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Oman Oil Company

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.1 Oil and Natural Gas Corporation

List of Figures

- Figure 1: India Oil and Gas Downstream Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Oil and Gas Downstream Industry Share (%) by Company 2024

List of Tables

- Table 1: India Oil and Gas Downstream Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Oil and Gas Downstream Industry Revenue Million Forecast, by Refineries 2019 & 2032

- Table 3: India Oil and Gas Downstream Industry Revenue Million Forecast, by Petrochemical Pants 2019 & 2032

- Table 4: India Oil and Gas Downstream Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: India Oil and Gas Downstream Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: North India India Oil and Gas Downstream Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: South India India Oil and Gas Downstream Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: East India India Oil and Gas Downstream Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: West India India Oil and Gas Downstream Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: India Oil and Gas Downstream Industry Revenue Million Forecast, by Refineries 2019 & 2032

- Table 11: India Oil and Gas Downstream Industry Revenue Million Forecast, by Petrochemical Pants 2019 & 2032

- Table 12: India Oil and Gas Downstream Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Oil and Gas Downstream Industry?

The projected CAGR is approximately > 2.50%.

2. Which companies are prominent players in the India Oil and Gas Downstream Industry?

Key companies in the market include Oil and Natural Gas Corporation, Bharat Petroleum Corporation Limited, Haldia Petrochemicals Ltd, Hindustan Petroleum Corporation Limited, Reliance Industries Limited, GAIL (India) Limited, Nayara Energy Limited, Indian Oil Corporation Limited, Oman Oil Company.

3. What are the main segments of the India Oil and Gas Downstream Industry?

The market segments include Refineries, Petrochemical Pants.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Investments in Renewable Energy Generation 4.; Supportive Government Policies Towards Green Energy.

6. What are the notable trends driving market growth?

Refineries to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Challenges In Installing Renewable Power in the Circulated Structure.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Oil and Gas Downstream Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Oil and Gas Downstream Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Oil and Gas Downstream Industry?

To stay informed about further developments, trends, and reports in the India Oil and Gas Downstream Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence