Key Insights

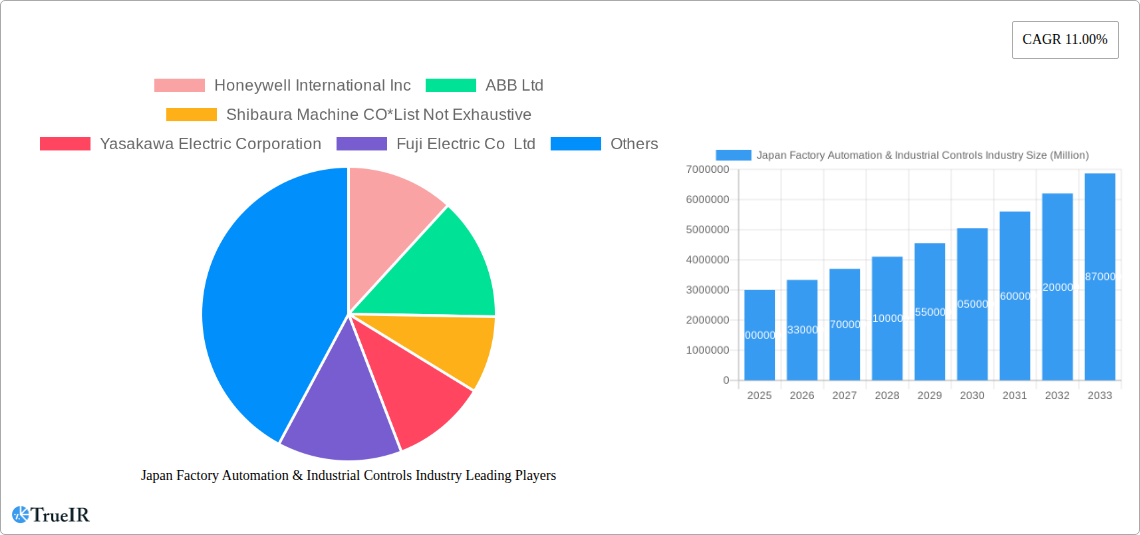

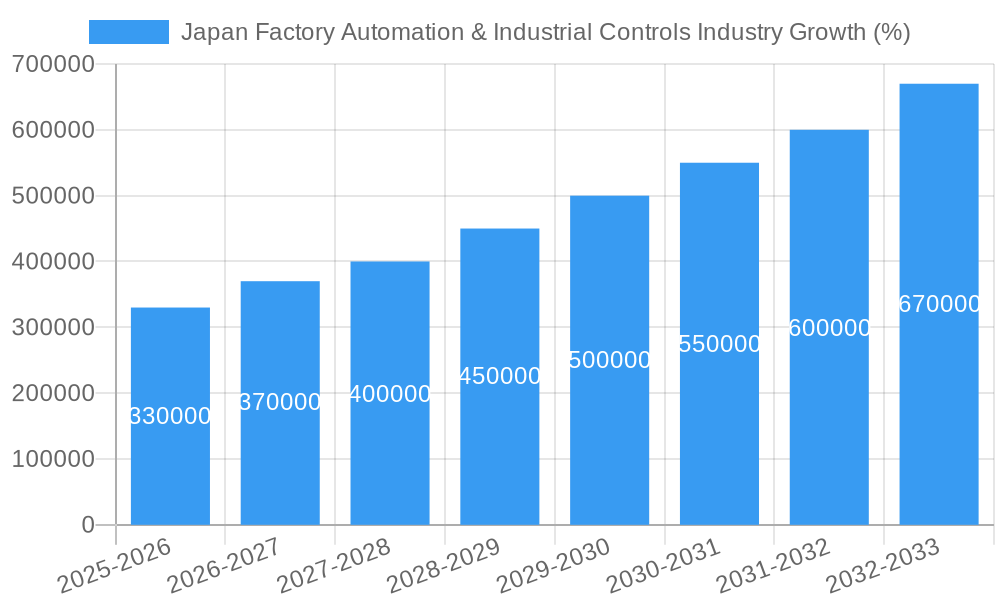

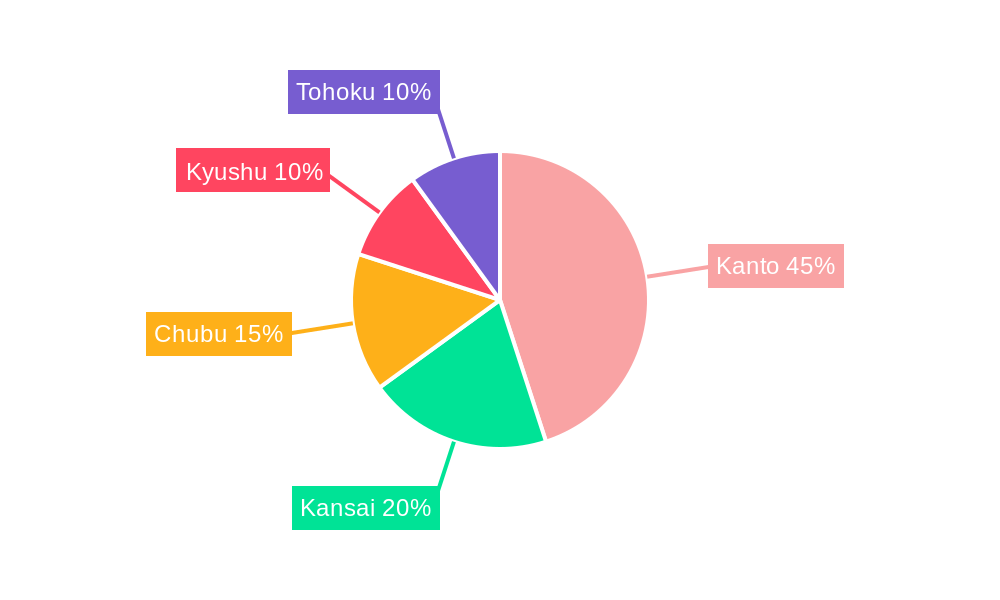

The Japan Factory Automation & Industrial Controls market, valued at approximately ¥3 trillion (assuming a reasonable market size based on global trends and the provided CAGR) in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 11% from 2025 to 2033. This surge is driven by several key factors. Firstly, the increasing adoption of Industry 4.0 technologies, including advanced robotics, AI-powered systems, and the Internet of Things (IoT), is significantly boosting automation across various sectors. The automotive and electronics industries are leading adopters, aiming to enhance production efficiency, improve product quality, and reduce labor costs. Secondly, government initiatives promoting digital transformation and smart manufacturing in Japan are further accelerating market growth. Finally, the rising demand for enhanced safety and reliability in industrial processes is driving investment in advanced control systems across sectors like oil and gas, power and utilities, and food and beverage. Regional variations exist, with the Kanto region, encompassing Tokyo and its surrounding areas, expected to maintain the largest market share due to its high concentration of manufacturing activities.

However, certain challenges restrain market expansion. High initial investment costs associated with implementing factory automation solutions can deter smaller businesses. Furthermore, the need for skilled labor to operate and maintain advanced automation systems poses a significant hurdle. To mitigate these challenges, vendors are focusing on developing user-friendly, cost-effective solutions and investing in robust training programs to address the skills gap. The market segmentation reveals a strong demand for industrial control systems, particularly field devices, across diverse end-user industries. Key players like Honeywell, ABB, Fanuc, and Siemens are leveraging their technological expertise and extensive distribution networks to capitalize on the growth opportunities in this dynamic market. The long-term outlook remains positive, with continuous advancements in automation technologies expected to further propel the market’s expansion throughout the forecast period.

Japan Factory Automation & Industrial Controls Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Japan Factory Automation & Industrial Controls industry, offering crucial insights for businesses, investors, and policymakers. We project a market valued at XX Million in 2025, exhibiting a robust Compound Annual Growth Rate (CAGR) of XX% during the forecast period (2025-2033). The study period covers 2019-2033, with a base year of 2025 and a historical period of 2019-2024.

Japan Factory Automation & Industrial Controls Industry Market Structure & Competitive Landscape

The Japanese factory automation and industrial controls market is characterized by a moderately concentrated structure. Key players such as Fanuc, Omron, and Mitsubishi Electric hold significant market share, but a number of international and domestic players contribute to a competitive landscape. The Herfindahl-Hirschman Index (HHI) for this market in 2024 is estimated at xx, indicating a moderately concentrated market. Innovation is a significant driver, with companies constantly developing advanced robotics, AI-powered systems, and improved industrial control systems. Stringent Japanese regulatory standards, focused on safety and efficiency, influence market dynamics. Substitute technologies, while present, typically offer limited cost advantages compared to established solutions, leading to persistent demand for traditional automation methods.

The market is segmented by end-user industry (Oil and Gas, Chemical and Petrochemical, Power and Utilities, Food and Beverage, Automotive and Transportation, and Other End-user Industries) and by type (Industrial Control Systems and Other Industrial Control Systems: Field Devices). Mergers and acquisitions (M&A) activity remains moderate, with smaller players often acquired by larger corporations to expand product portfolios and geographic reach. The total M&A volume in the period 2019-2024 is estimated at xx Million. This suggests a consolidation trend within the sector and will impact market structure moving forward.

Japan Factory Automation & Industrial Controls Industry Market Trends & Opportunities

The Japanese factory automation and industrial controls market is experiencing strong growth, driven by several factors. Increased automation adoption across various sectors, a focus on improving productivity and efficiency, and the growing integration of advanced technologies like AI and IoT are key drivers. The market size has consistently expanded over the historical period, indicating high demand for advanced automation solutions. The CAGR for the historical period (2019-2024) is estimated at xx%, reflecting this positive trend. Consumer preferences for improved product quality and faster delivery timelines continue to fuel demand. However, the market also faces certain challenges, including supply chain disruptions and fluctuating raw material costs, which impact overall market growth. While market penetration is already high in certain sectors like automotive, there is significant potential for expansion in others such as food and beverage, and other end-user industries via implementation of advanced and increasingly cost-effective solutions.

Technological advancements are pivotal, with the increasing adoption of robotics, industrial internet of things (IIoT), and artificial intelligence (AI) impacting all sectors, driving increased efficiency and automation levels. The competitive dynamics are shaped by the presence of both large multinational corporations and smaller specialized companies, creating a blend of established brands and innovative newcomers.

Dominant Markets & Segments in Japan Factory Automation & Industrial Controls Industry

The Automotive and Transportation sector stands as the dominant end-user segment, driven by high automation needs in vehicle manufacturing and related industries. Within the "By Type" segment, Industrial Control Systems hold the largest market share due to their critical role in managing and controlling industrial processes.

Key Growth Drivers for Automotive and Transportation:

- High levels of automation in vehicle manufacturing.

- Government incentives for automation investments in the automotive sector.

- Demand for improved efficiency and productivity in automotive assembly lines.

Key Growth Drivers for Industrial Control Systems:

- Increasing demand for efficient process control in various industries.

- Technological advancements leading to more sophisticated control systems.

- Government regulations promoting energy efficiency and automation.

The analysis shows that the Kanto region dominates the market within Japan, benefiting from the concentration of manufacturing hubs and associated infrastructure. This is followed by the Kansai region.

Japan Factory Automation & Industrial Controls Industry Product Analysis

Technological advancements in robotics, artificial intelligence (AI), and machine learning (ML) are driving significant innovations in industrial control systems. These advancements include improved precision, greater efficiency, and enhanced adaptability, leading to competitive advantages for manufacturers. The integration of these technologies is leading to more flexible and responsive systems capable of optimizing processes in real-time. These improved systems also enhance overall safety and reduce the risks associated with complex industrial operations.

Key Drivers, Barriers & Challenges in Japan Factory Automation & Industrial Controls Industry

Key Drivers: Technological advancements (AI, IoT, robotics), government policies promoting automation and Industry 4.0, increasing labor costs, and the demand for enhanced productivity and efficiency are major drivers. The government's focus on developing advanced manufacturing technologies continues to fuel growth, leading to significant investments in research and development.

Challenges: Supply chain disruptions have caused delays and increased costs for automation equipment and components. Regulatory complexities and compliance requirements can hinder the adoption of new technologies. Furthermore, intense competition among established players and new entrants adds pressure on pricing and profit margins. The impact of these factors is estimated to reduce market growth by approximately xx% annually in the short term.

Growth Drivers in the Japan Factory Automation & Industrial Controls Industry Market

Continued technological advancements, particularly in AI and robotics, are driving significant growth. Government initiatives to support automation and digital transformation in manufacturing are crucial. Rising labor costs and the need to enhance productivity further spur adoption. Increasing demand for improved product quality and shorter lead times in various end-user industries fuels market expansion.

Challenges Impacting Japan Factory Automation & Industrial Controls Industry Growth

Supply chain vulnerabilities and increased component costs present significant challenges. Stringent regulatory compliance requirements add complexity and increase implementation time. Intense competition and pressure on pricing margins impact profitability. These factors pose challenges to sustained market expansion, particularly in the short term.

Key Players Shaping the Japan Factory Automation & Industrial Controls Industry Market

- Honeywell International Inc

- ABB Ltd

- Shibaura Machine CO

- Yasakawa Electric Corporation

- Fuji Electric Co Ltd

- Nidec Corporation

- Mitsubishi Electric Corporation

- Siemens AG

- Schneider Electric SE

- Fanuc Corporation

- Omron Corporation

- Seiko Epson Corporation

- Rockwell Automation Inc

- Yokogawa Electric Corporation

- Emerson Electric Company

Significant Japan Factory Automation & Industrial Controls Industry Industry Milestones

April 2022: Yaskawa Electric Corporation developed an AI-powered industrial robot capable of identifying object color and shape for precise placement. This showcases advancements in AI integration for improved automation efficiency.

May 2022: Kawasaki Heavy Industries unveiled a humanoid robot, "HINOTORI," designed for applications beyond factory settings, demonstrating advancements in robotics for various sectors, including medical support and disaster relief. The company's "Group Vision 2030" further highlights the strategic importance of robotics in various sectors.

Future Outlook for Japan Factory Automation & Industrial Controls Industry Market

The Japanese factory automation and industrial controls market is poised for continued growth, driven by ongoing technological innovations, supportive government policies, and increasing demand across diverse industries. Strategic investments in AI, robotics, and IoT will further enhance automation capabilities, opening new opportunities for market expansion. The market is projected to experience substantial growth, with opportunities for both established players and emerging companies to capitalize on the evolving industrial landscape. The predicted market value for 2033 is xx Million.

Japan Factory Automation & Industrial Controls Industry Segmentation

-

1. Type

-

1.1. Industrial Control Systems

- 1.1.1. Distributed Control System (DCS)

- 1.1.2. Programable Logic Controller (PLC)

- 1.1.3. Supervisory Control and Data Acquisition (SCADA)

- 1.1.4. Product Lifecycle Management (PLM)

- 1.1.5. Manufacturing Execution System (MES)

- 1.1.6. Human Machine Interface (HMI)

- 1.1.7. Other Industrial Control Systems

-

1.2. Field Devices

- 1.2.1. Machine Vision

- 1.2.2. Industrial Robotics

- 1.2.3. Sensors and Transmitters

- 1.2.4. Motors and Drives

- 1.2.5. Safety Systems

- 1.2.6. Other Field Devices

-

1.1. Industrial Control Systems

-

2. End-user Industry

- 2.1. Oil and Gas

- 2.2. Chemical and Petrochemical

- 2.3. Power and Utilities

- 2.4. Food and Beverage

- 2.5. Automotive and Transportation

- 2.6. Other End-user Industries

Japan Factory Automation & Industrial Controls Industry Segmentation By Geography

- 1. Japan

Japan Factory Automation & Industrial Controls Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 11.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Launch of Stringent Energy Conservation Standards and Drive for Local Manufacturing?

- 3.3. Market Restrains

- 3.3.1. ; Trade Tensions and Implementation Challenges

- 3.4. Market Trends

- 3.4.1. Distributed Control Systems are Expected to Witness a Significant Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan Factory Automation & Industrial Controls Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Industrial Control Systems

- 5.1.1.1. Distributed Control System (DCS)

- 5.1.1.2. Programable Logic Controller (PLC)

- 5.1.1.3. Supervisory Control and Data Acquisition (SCADA)

- 5.1.1.4. Product Lifecycle Management (PLM)

- 5.1.1.5. Manufacturing Execution System (MES)

- 5.1.1.6. Human Machine Interface (HMI)

- 5.1.1.7. Other Industrial Control Systems

- 5.1.2. Field Devices

- 5.1.2.1. Machine Vision

- 5.1.2.2. Industrial Robotics

- 5.1.2.3. Sensors and Transmitters

- 5.1.2.4. Motors and Drives

- 5.1.2.5. Safety Systems

- 5.1.2.6. Other Field Devices

- 5.1.1. Industrial Control Systems

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Oil and Gas

- 5.2.2. Chemical and Petrochemical

- 5.2.3. Power and Utilities

- 5.2.4. Food and Beverage

- 5.2.5. Automotive and Transportation

- 5.2.6. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Kanto Japan Factory Automation & Industrial Controls Industry Analysis, Insights and Forecast, 2019-2031

- 7. Kansai Japan Factory Automation & Industrial Controls Industry Analysis, Insights and Forecast, 2019-2031

- 8. Chubu Japan Factory Automation & Industrial Controls Industry Analysis, Insights and Forecast, 2019-2031

- 9. Kyushu Japan Factory Automation & Industrial Controls Industry Analysis, Insights and Forecast, 2019-2031

- 10. Tohoku Japan Factory Automation & Industrial Controls Industry Analysis, Insights and Forecast, 2019-2031

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Honeywell International Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 ABB Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Shibaura Machine CO*List Not Exhaustive

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Yasakawa Electric Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Fuji Electric Co Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Nidec Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Mitsubishi Electric Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Siemens AG

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Schneider Electric SE

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Fanuc Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Omron Corporation

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Seiko Epson Corporation

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Rockwell Automation Inc

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Yokogawa Electric Corporation

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Emerson Electric Company

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 Honeywell International Inc

List of Figures

- Figure 1: Japan Factory Automation & Industrial Controls Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Japan Factory Automation & Industrial Controls Industry Share (%) by Company 2024

List of Tables

- Table 1: Japan Factory Automation & Industrial Controls Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Japan Factory Automation & Industrial Controls Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Japan Factory Automation & Industrial Controls Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 4: Japan Factory Automation & Industrial Controls Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Japan Factory Automation & Industrial Controls Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Kanto Japan Factory Automation & Industrial Controls Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Kansai Japan Factory Automation & Industrial Controls Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Chubu Japan Factory Automation & Industrial Controls Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Kyushu Japan Factory Automation & Industrial Controls Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Tohoku Japan Factory Automation & Industrial Controls Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Japan Factory Automation & Industrial Controls Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 12: Japan Factory Automation & Industrial Controls Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 13: Japan Factory Automation & Industrial Controls Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan Factory Automation & Industrial Controls Industry?

The projected CAGR is approximately 11.00%.

2. Which companies are prominent players in the Japan Factory Automation & Industrial Controls Industry?

Key companies in the market include Honeywell International Inc, ABB Ltd, Shibaura Machine CO*List Not Exhaustive, Yasakawa Electric Corporation, Fuji Electric Co Ltd, Nidec Corporation, Mitsubishi Electric Corporation, Siemens AG, Schneider Electric SE, Fanuc Corporation, Omron Corporation, Seiko Epson Corporation, Rockwell Automation Inc, Yokogawa Electric Corporation, Emerson Electric Company.

3. What are the main segments of the Japan Factory Automation & Industrial Controls Industry?

The market segments include Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Launch of Stringent Energy Conservation Standards and Drive for Local Manufacturing?.

6. What are the notable trends driving market growth?

Distributed Control Systems are Expected to Witness a Significant Market Growth.

7. Are there any restraints impacting market growth?

; Trade Tensions and Implementation Challenges.

8. Can you provide examples of recent developments in the market?

May 2022 - Kawasaki Heavy Industries developed a humanoid robot that works like humans outside factories and exhibited it in Tokyo. The company sports a Group Vision 2030, appealing for robotics technology in two areas: safety and security in remote societies and mobility in the future. In the area of the safety and security of remote society, the company exhibited the "HINOTORI," a Medic-aid or a surgical support robot.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan Factory Automation & Industrial Controls Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan Factory Automation & Industrial Controls Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan Factory Automation & Industrial Controls Industry?

To stay informed about further developments, trends, and reports in the Japan Factory Automation & Industrial Controls Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence