Key Insights

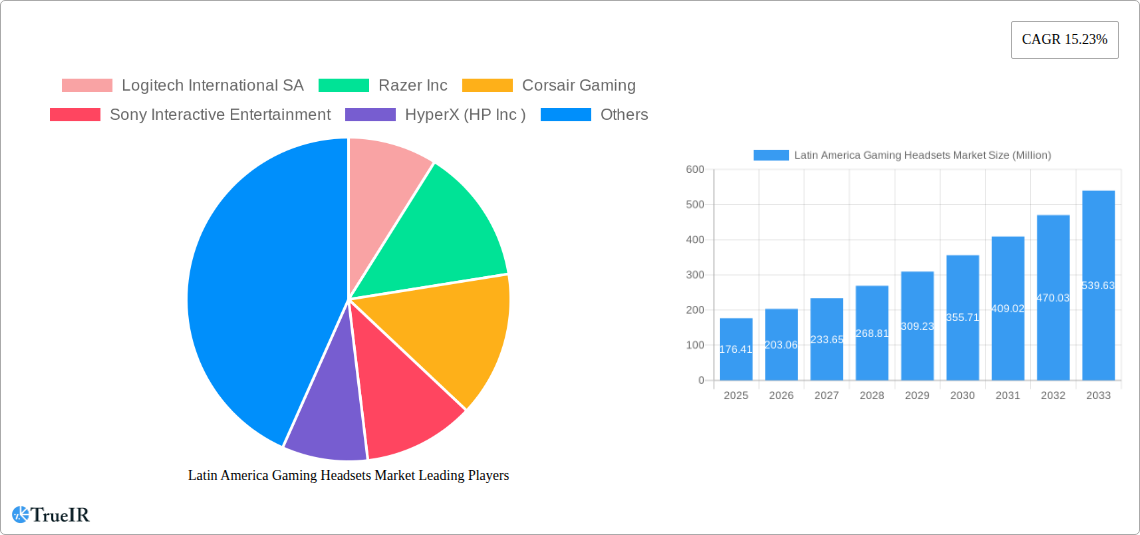

The Latin American gaming headset market, valued at $176.41 million in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 15.23% from 2025 to 2033. This surge is driven by several key factors. The rising popularity of esports and online gaming across Latin America fuels demand for high-quality audio peripherals. Increasing smartphone penetration and affordable internet access further broaden the market's reach, especially among younger demographics. Furthermore, the introduction of innovative features like advanced noise cancellation, customizable sound profiles, and improved comfort are enhancing consumer appeal. The market's growth is also bolstered by the expanding presence of major players like Logitech, Razer, and HyperX, who are investing heavily in marketing and product diversification to cater to the region's specific preferences. The competitive landscape is marked by a blend of established brands and emerging local players, fostering innovation and competitive pricing.

Latin America Gaming Headsets Market Market Size (In Million)

However, certain challenges exist. Economic instability in some Latin American countries can impact consumer spending on discretionary items like gaming headsets. Furthermore, the prevalence of counterfeit products and concerns regarding product quality pose a significant threat. Addressing these challenges requires a focus on building strong distribution networks, strengthening brand loyalty through quality assurance, and leveraging targeted marketing campaigns to reach diverse consumer segments. The segmentation of the market likely reflects variations in price points, features (wired vs. wireless, surround sound capabilities), and brand preferences across different countries within Latin America. Successful players will be those adapting to these regional nuances while effectively capitalizing on the overall market expansion.

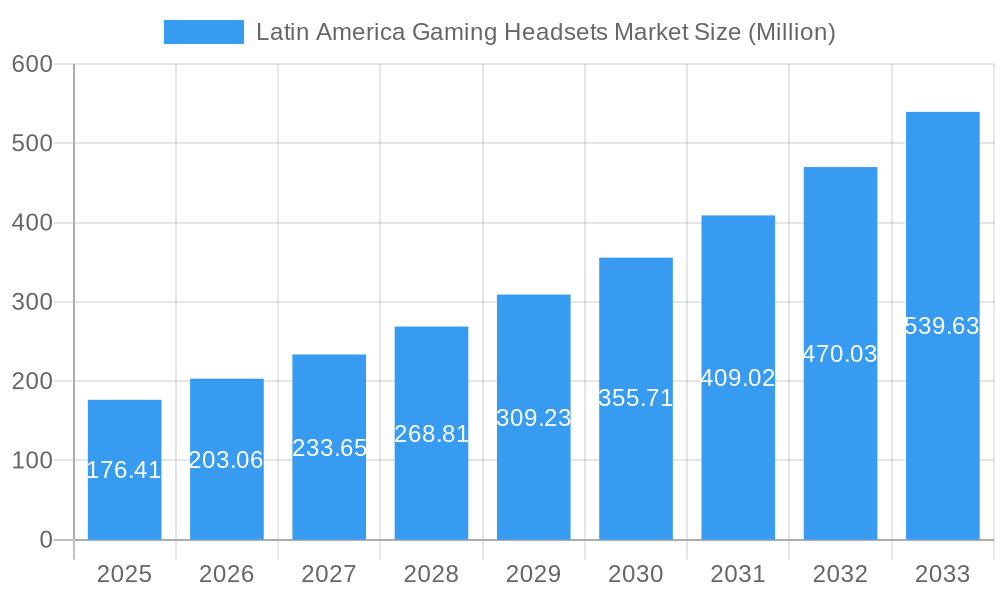

Latin America Gaming Headsets Market Company Market Share

Latin America Gaming Headsets Market: A Comprehensive Report (2019-2033)

This dynamic report provides a deep dive into the burgeoning Latin America gaming headsets market, offering invaluable insights for stakeholders, investors, and industry professionals. Leveraging extensive market research and data analysis spanning the period 2019-2033 (Base Year: 2025, Forecast Period: 2025-2033), this report unveils key trends, opportunities, and challenges shaping this exciting sector. The market is projected to reach xx Million by 2033, presenting substantial growth potential for key players and new entrants alike.

Latin America Gaming Headsets Market Structure & Competitive Landscape

The Latin America gaming headsets market exhibits a moderately concentrated structure, with a few dominant players holding significant market share. Logitech International SA, Razer Inc, Corsair Gaming, and Sony Interactive Entertainment are among the key players shaping the competitive landscape. The Herfindahl-Hirschman Index (HHI) for the market in 2024 was estimated at xx, indicating a moderately concentrated market. However, the market is characterized by constant innovation, with new entrants and emerging technologies driving increased competition.

- Market Concentration: The market concentration ratio (CR4) for the top four players in 2024 was approximately xx%.

- Innovation Drivers: Technological advancements in audio quality, comfort, and wireless connectivity are major drivers of innovation. The rise of esports and the increasing popularity of mobile gaming are also fueling demand for high-performance headsets.

- Regulatory Impacts: Regulations concerning product safety and electronic waste management influence market dynamics. Varying levels of import duties and taxes across Latin American countries also impact pricing and market accessibility.

- Product Substitutes: Traditional headphones and earbuds represent a degree of substitution. However, the specialized features of gaming headsets, such as surround sound and noise cancellation, often create a distinct market segment.

- End-User Segmentation: The market is segmented by platform (PC, console, mobile), price range (budget, mid-range, premium), and features (wired, wireless, noise cancellation). The PC gaming segment is currently the largest, but mobile gaming is rapidly expanding.

- M&A Trends: The past five years have witnessed xx merger and acquisition (M&A) activities in the Latin American gaming peripherals market, suggesting a consolidation trend. These activities primarily focused on enhancing product portfolios and expanding market reach.

Latin America Gaming Headsets Market Trends & Opportunities

The Latin America gaming headsets market is experiencing robust growth driven by multiple factors. The market size increased from xx Million in 2019 to xx Million in 2024, exhibiting a Compound Annual Growth Rate (CAGR) of xx%. This growth is fueled by rising disposable incomes, increasing internet penetration, and the growing popularity of esports and mobile gaming across the region. Technological advancements, such as improved sound quality, advanced features like noise cancellation and haptic feedback, and the proliferation of wireless gaming headsets are further accelerating market expansion. Market penetration rates are increasing steadily, particularly in urban areas with higher internet access. Competitive dynamics are characterized by product differentiation, technological innovation, and pricing strategies. Opportunities exist for companies focusing on cost-effective solutions for budget-conscious consumers and high-performance headsets for the professional gaming segment. The increasing demand for virtual reality (VR) and augmented reality (AR) gaming headsets presents another significant growth opportunity.

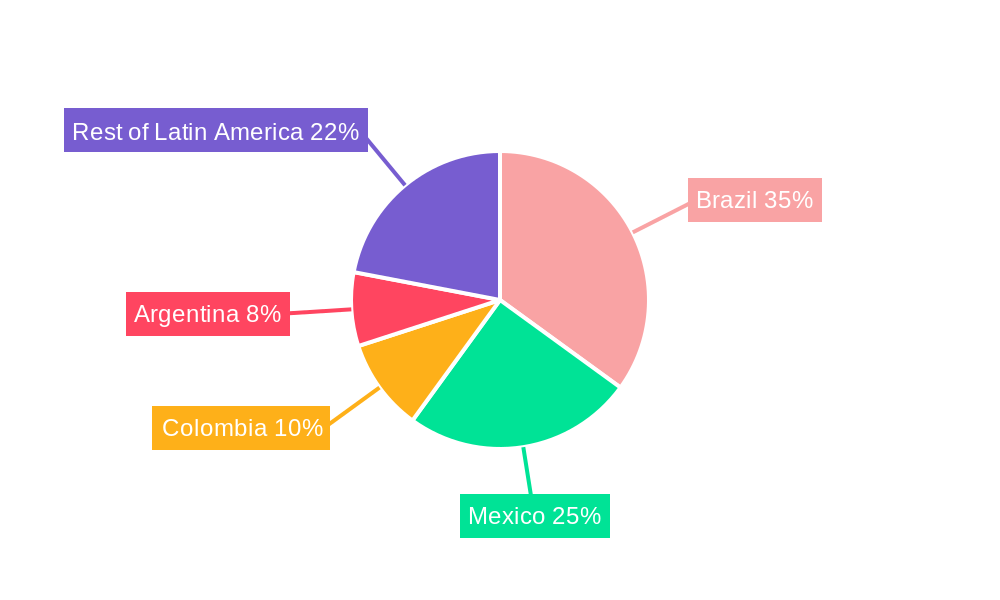

Dominant Markets & Segments in Latin America Gaming Headsets Market

Brazil and Mexico currently dominate the Latin American gaming headsets market, accounting for approximately xx% of the total market share in 2024.

- Key Growth Drivers in Brazil: Strong gaming community, increasing internet penetration, and rising disposable incomes.

- Key Growth Drivers in Mexico: Growing esports scene, expanding mobile gaming market, and increasing affordability of gaming peripherals.

- Other Key Markets: While smaller than Brazil and Mexico, other markets like Colombia, Argentina, and Chile are exhibiting significant growth potential due to expanding digital economies and rising adoption of gaming.

Latin America Gaming Headsets Market Product Analysis

Gaming headsets in Latin America range from basic wired models to high-end wireless headsets with advanced features like surround sound, noise cancellation, and customizable EQ settings. The market showcases a move towards wireless headsets with improved battery life and connectivity. Companies are differentiating themselves through the incorporation of innovative materials for enhanced comfort and durability, and through software integration for personalized audio profiles and features. The integration of haptic feedback into some premium models is another differentiator. The success of a product relies on its ability to meet the specific needs of different gaming platforms and user preferences regarding price, features, and comfort.

Key Drivers, Barriers & Challenges in Latin America Gaming Headsets Market

Key Drivers:

- Rising disposable incomes and increased access to high-speed internet are bolstering consumer spending on gaming accessories.

- The growing popularity of esports is driving demand for high-performance gaming headsets.

- Technological advancements in audio technology, such as improved surround sound and noise cancellation, are enhancing the gaming experience.

Key Challenges and Restraints:

- Economic instability in some Latin American countries can impact consumer spending.

- The high cost of premium gaming headsets limits accessibility for a large segment of the population.

- Currency fluctuations and import tariffs can impact product pricing and profitability.

- Supply chain disruptions can lead to shortages and affect market supply. This has been quantified by an estimated xx% increase in lead times during certain periods in the historical period.

Growth Drivers in the Latin America Gaming Headsets Market

The growth of the Latin American gaming headsets market is primarily driven by the increasing adoption of gaming across various platforms (PC, consoles, mobile), fuelled by rising internet penetration and disposable incomes. Government initiatives promoting digital economies and the burgeoning esports scene also contribute to this expansion. Moreover, ongoing technological advancements in audio quality, comfort, and connectivity are making gaming headsets more appealing to a wider range of consumers.

Challenges Impacting Latin America Gaming Headsets Market Growth

Challenges include fluctuating currency exchange rates making import costs unpredictable; variations in consumer spending power across different countries; and the presence of counterfeit products impacting brand reputation and consumer trust. These factors can hinder market growth if not properly addressed through robust supply chain management, strategic pricing, and proactive brand protection measures.

Key Players Shaping the Latin America Gaming Headsets Market

Significant Latin America Gaming Headsets Market Industry Milestones

- May 2024: Sonos launched the Sonos Ace headphones, introducing a premium offering focused on comfort, durability, and audio quality, impacting the competitive landscape.

- April 2024: Meta's announcement to extend its Meta Horizon OS to external hardware manufacturers signals potential for new VR headset development within the region, expanding the market.

Future Outlook for Latin America Gaming Headsets Market

The Latin America gaming headsets market is poised for continued growth, driven by sustained increases in internet penetration, the growing popularity of esports, and ongoing technological advancements. Opportunities exist for companies to capitalize on the increasing demand for high-quality, affordable gaming headsets, particularly in emerging markets within the region. Strategic partnerships and targeted marketing campaigns will be crucial for achieving success in this dynamic and evolving landscape. The market is expected to experience a CAGR of xx% between 2025 and 2033.

Latin America Gaming Headsets Market Segmentation

-

1. Compatibility Type

- 1.1. Console Headset

- 1.2. PC Headset

-

2. Connectivity Type

- 2.1. Wired

- 2.2. Wireless

-

3. Sales Channel

- 3.1. Retail

- 3.2. Online

Latin America Gaming Headsets Market Segmentation By Geography

-

1. Latin America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Mexico

- 1.6. Peru

- 1.7. Venezuela

- 1.8. Ecuador

- 1.9. Bolivia

- 1.10. Paraguay

Latin America Gaming Headsets Market Regional Market Share

Geographic Coverage of Latin America Gaming Headsets Market

Latin America Gaming Headsets Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15.23% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Popularity of Virtual Reality; Rise in E-sports Gaming to Fuel the Demand for Gaming Accessory Equipment

- 3.3. Market Restrains

- 3.3.1. Growing Popularity of Virtual Reality; Rise in E-sports Gaming to Fuel the Demand for Gaming Accessory Equipment

- 3.4. Market Trends

- 3.4.1. Integration of Newer Technologies Like 3D and AR/VR Gaming is Expected to Drive Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Gaming Headsets Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Compatibility Type

- 5.1.1. Console Headset

- 5.1.2. PC Headset

- 5.2. Market Analysis, Insights and Forecast - by Connectivity Type

- 5.2.1. Wired

- 5.2.2. Wireless

- 5.3. Market Analysis, Insights and Forecast - by Sales Channel

- 5.3.1. Retail

- 5.3.2. Online

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Compatibility Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Logitech International SA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Razer Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Corsair Gaming

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Sony Interactive Entertainment

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 HyperX (HP Inc )

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 ASUS Computer International

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Microsoft Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Harman International Industries Incorporated

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 SteelSeries

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Turtle Beach Corporatio

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Logitech International SA

List of Figures

- Figure 1: Latin America Gaming Headsets Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Latin America Gaming Headsets Market Share (%) by Company 2025

List of Tables

- Table 1: Latin America Gaming Headsets Market Revenue Million Forecast, by Compatibility Type 2020 & 2033

- Table 2: Latin America Gaming Headsets Market Volume Million Forecast, by Compatibility Type 2020 & 2033

- Table 3: Latin America Gaming Headsets Market Revenue Million Forecast, by Connectivity Type 2020 & 2033

- Table 4: Latin America Gaming Headsets Market Volume Million Forecast, by Connectivity Type 2020 & 2033

- Table 5: Latin America Gaming Headsets Market Revenue Million Forecast, by Sales Channel 2020 & 2033

- Table 6: Latin America Gaming Headsets Market Volume Million Forecast, by Sales Channel 2020 & 2033

- Table 7: Latin America Gaming Headsets Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Latin America Gaming Headsets Market Volume Million Forecast, by Region 2020 & 2033

- Table 9: Latin America Gaming Headsets Market Revenue Million Forecast, by Compatibility Type 2020 & 2033

- Table 10: Latin America Gaming Headsets Market Volume Million Forecast, by Compatibility Type 2020 & 2033

- Table 11: Latin America Gaming Headsets Market Revenue Million Forecast, by Connectivity Type 2020 & 2033

- Table 12: Latin America Gaming Headsets Market Volume Million Forecast, by Connectivity Type 2020 & 2033

- Table 13: Latin America Gaming Headsets Market Revenue Million Forecast, by Sales Channel 2020 & 2033

- Table 14: Latin America Gaming Headsets Market Volume Million Forecast, by Sales Channel 2020 & 2033

- Table 15: Latin America Gaming Headsets Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Latin America Gaming Headsets Market Volume Million Forecast, by Country 2020 & 2033

- Table 17: Brazil Latin America Gaming Headsets Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Brazil Latin America Gaming Headsets Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 19: Argentina Latin America Gaming Headsets Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Argentina Latin America Gaming Headsets Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 21: Chile Latin America Gaming Headsets Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Chile Latin America Gaming Headsets Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 23: Colombia Latin America Gaming Headsets Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Colombia Latin America Gaming Headsets Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 25: Mexico Latin America Gaming Headsets Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Mexico Latin America Gaming Headsets Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 27: Peru Latin America Gaming Headsets Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Peru Latin America Gaming Headsets Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 29: Venezuela Latin America Gaming Headsets Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Venezuela Latin America Gaming Headsets Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 31: Ecuador Latin America Gaming Headsets Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Ecuador Latin America Gaming Headsets Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 33: Bolivia Latin America Gaming Headsets Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Bolivia Latin America Gaming Headsets Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 35: Paraguay Latin America Gaming Headsets Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Paraguay Latin America Gaming Headsets Market Volume (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Gaming Headsets Market?

The projected CAGR is approximately 15.23%.

2. Which companies are prominent players in the Latin America Gaming Headsets Market?

Key companies in the market include Logitech International SA, Razer Inc, Corsair Gaming, Sony Interactive Entertainment, HyperX (HP Inc ), ASUS Computer International, Microsoft Corporation, Harman International Industries Incorporated, SteelSeries, Turtle Beach Corporatio.

3. What are the main segments of the Latin America Gaming Headsets Market?

The market segments include Compatibility Type, Connectivity Type, Sales Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 176.41 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Popularity of Virtual Reality; Rise in E-sports Gaming to Fuel the Demand for Gaming Accessory Equipment.

6. What are the notable trends driving market growth?

Integration of Newer Technologies Like 3D and AR/VR Gaming is Expected to Drive Market Growth.

7. Are there any restraints impacting market growth?

Growing Popularity of Virtual Reality; Rise in E-sports Gaming to Fuel the Demand for Gaming Accessory Equipment.

8. Can you provide examples of recent developments in the market?

May 2024: Sonos made its foray into the headphone market with the debut of its inaugural model, the Sonos Ace. These headphones are positioned as a blend of comfort, durability, and top-tier audio quality, appealing to users who value both performance and sustainability. In a direct challenge to heavyweights like Apple's AirPods Max and Bose's QuietComfort Ultra, Sonos Ace headphones feature a construction of lightweight materials and plush memory foam, all wrapped in vegan leather. Moreover, their fold-flat design enhances portability and convenience.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Gaming Headsets Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Gaming Headsets Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Gaming Headsets Market?

To stay informed about further developments, trends, and reports in the Latin America Gaming Headsets Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence