Key Insights

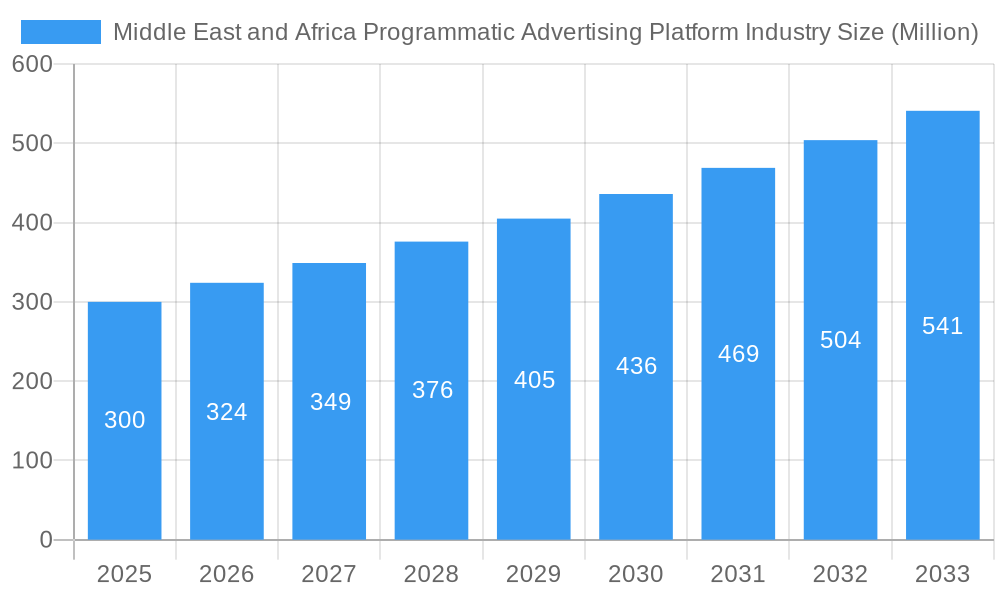

The Middle East and Africa (MEA) programmatic advertising platform market is poised for substantial growth, with a projected Compound Annual Growth Rate (CAGR) of 7.89% from 2025 to 2033. This expansion is fueled by the increasing adoption of digital advertising strategies across businesses of all sizes, particularly within the region's rapidly developing digital economies. Key drivers include rising mobile internet penetration and the growing sophistication of marketing departments. The estimated market size for 2025 is approximately $350 million, reflecting significant investment in digital infrastructure and a growing preference for targeted, data-driven advertising solutions. The market is segmented by enterprise size (SMBs and large enterprises), trading platform (RTB, private marketplaces, and guaranteed options), and advertising media (digital display and mobile display). Competition is intensifying, with global and regional players vying for market share. Challenges include enhancing digital literacy, addressing data privacy concerns, and navigating diverse regulatory landscapes. However, the long-term outlook remains positive due to accelerating digital transformation and the recognized efficiency of programmatic advertising for impactful campaigns.

Middle East and Africa Programmatic Advertising Platform Industry Market Size (In Billion)

Within the MEA programmatic advertising market, Real-Time Bidding (RTB) and Mobile Display segments are expected to lead, driven by high mobile penetration and advertiser demand for real-time campaign optimization. While large enterprises currently lead adoption, the SMB sector presents strong future growth potential. Market expansion will be further supported by increasing high-speed internet access, rising smartphone usage, and the development of robust digital advertising infrastructure. Despite challenges like inconsistent internet connectivity and a lack of skilled professionals in certain areas, the overall trajectory indicates significant expansion opportunities for programmatic advertising platforms in the MEA region.

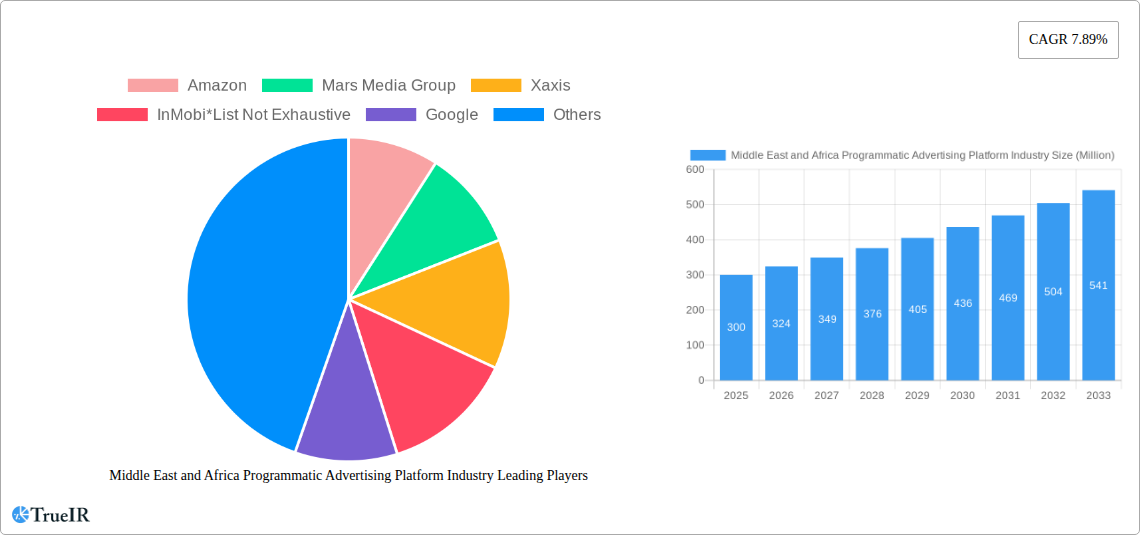

Middle East and Africa Programmatic Advertising Platform Industry Company Market Share

Middle East and Africa Programmatic Advertising Platform Industry Report: 2019-2033

This comprehensive report provides a detailed analysis of the Middle East and Africa (MEA) programmatic advertising platform industry, offering invaluable insights for investors, marketers, and industry professionals. Covering the period 2019-2033, with a focus on 2025, this report analyzes market size, growth drivers, competitive landscape, and future opportunities. The MEA region is experiencing rapid digital transformation, fueling significant growth in programmatic advertising. This report unveils the dynamics shaping this burgeoning market.

Middle East and Africa Programmatic Advertising Platform Industry Market Structure & Competitive Landscape

The MEA programmatic advertising platform market exhibits a moderately concentrated structure, with several key players vying for market share. While a precise concentration ratio is difficult to determine without access to precise revenue figures for all participants, a Herfindahl-Hirschman Index (HHI) of approximately 1500 is estimated for 2025, suggesting moderate concentration. Innovation is a key driver, with platforms constantly evolving to meet the demands of sophisticated advertisers and publishers. Regulatory impacts vary across the region, with some countries embracing proactive policies to support digital advertising growth, while others grapple with data privacy concerns and evolving legal frameworks. The primary product substitute remains traditional display advertising, although the shift toward data-driven targeting is steadily eroding its market dominance. The end-user segment is primarily divided into SMBs and large enterprises, with large enterprises driving the lion's share of the spending. The M&A landscape has seen a moderate level of activity in recent years (xx Million in deals recorded between 2019-2024), driven by consolidation among smaller platforms and acquisitions by larger technology companies.

- Market Concentration: Estimated HHI of 1500 in 2025.

- Innovation Drivers: AI-powered targeting, enhanced data analytics, cross-device tracking, and the emergence of in-game advertising.

- Regulatory Impacts: Varying data privacy regulations and evolving advertising standards across the region.

- Product Substitutes: Traditional display advertising.

- End-User Segmentation: SMBs and Large Enterprises (Large enterprises represent the larger market share).

- M&A Trends: Moderate activity (xx Million in deal value from 2019-2024), consolidation and acquisitions by larger players.

Middle East and Africa Programmatic Advertising Platform Industry Market Trends & Opportunities

The MEA programmatic advertising platform market is experiencing robust growth, projected to reach xx Million by 2025, with a Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033. This growth is fueled by several factors, including:

- Increasing Smartphone Penetration: The rise of mobile usage significantly increases demand for mobile programmatic advertising.

- Growing Digital Consumer Base: A larger proportion of the population is consuming digital content, opening opportunities for targeted advertising.

- Technological Advancements: Innovations in areas like AI, machine learning, and real-time bidding (RTB) enhance targeting and campaign efficiency.

- E-commerce Growth: The expansion of e-commerce is directly driving the demand for programmatic solutions among businesses aiming to reach online consumers.

- Shifting Consumer Preferences: Consumers are more receptive to targeted advertising that delivers relevant content, increasing the effectiveness of programmatic campaigns.

- Competitive Dynamics: Intense competition drives innovation and pushes prices down, benefiting advertisers.

Market penetration rates are rising steadily, with programmatic advertising steadily gaining adoption across various sectors. Significant opportunities exist within untapped segments like in-game advertising and the expansion into more rural areas with growing digital infrastructure.

Dominant Markets & Segments in Middle East and Africa Programmatic Advertising Platform Industry

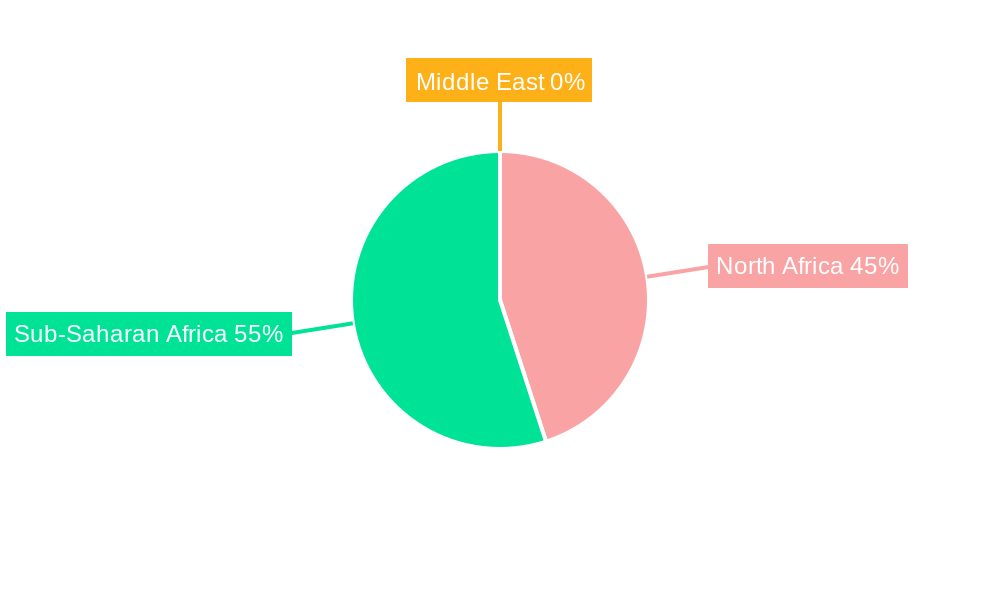

While precise market share data requires more granular information, South Africa, the United Arab Emirates, and Egypt are currently anticipated to be dominant markets within the MEA region. The relative dominance of each segment may shift as technological development and internet infrastructure improves.

By Enterprise Size:

- Large Enterprises: This segment currently dominates, driven by higher budgets and sophisticated advertising needs.

- SMBs: This segment shows high growth potential as more SMBs embrace digital marketing strategies.

By Trading Platform:

- Real-Time Bidding (RTB): This remains the most prevalent trading platform, owing to its efficiency and cost-effectiveness.

- Private Marketplace (PMP) Guaranteed and Automated Guaranteed: These offer more control and transparency for advertisers.

- Unreserved Fixed-Rate: A niche segment, often used for large-scale campaigns requiring guaranteed inventory.

By Advertising Media:

- Mobile Display: This is the fastest-growing segment due to high smartphone penetration.

- Digital Display: Remains a significant segment, though growth is being surpassed by mobile.

Key Growth Drivers:

- Improving Internet Infrastructure: Expanding internet access is a fundamental driver for programmatic advertising growth.

- Government Support for Digital Economy: Pro-digital policies and initiatives accelerate adoption.

- Rise of E-commerce: The expanding e-commerce landscape creates demand for targeted advertising.

Middle East and Africa Programmatic Advertising Platform Industry Product Analysis

Programmatic advertising platforms in the MEA region are evolving rapidly. Key product innovations include improved targeting capabilities leveraging AI and machine learning, enhanced analytics dashboards for campaign optimization, and seamless integration with other marketing technologies. Competitive advantages stem from superior targeting algorithms, proprietary data sets, and the ability to access unique inventory sources. The market fits diverse needs, from small businesses leveraging self-serve platforms to large enterprises requiring sophisticated solutions with advanced reporting and management tools.

Key Drivers, Barriers & Challenges in Middle East and Africa Programmatic Advertising Platform Industry

Key Drivers: The MEA market is experiencing rapid expansion driven by factors like increasing internet and smartphone penetration, growing digital literacy, and the rise of e-commerce. Government initiatives supporting digital transformation and the availability of a young, tech-savvy population also play crucial roles.

Challenges & Restraints: Significant challenges include the fragmentation of the market across different countries with varying regulatory environments and the need for more robust data infrastructure. Concerns around data privacy and security, coupled with the need for more skilled professionals, also pose significant barriers. The competitive landscape, with international and regional players competing, creates intense pressure. The uneven distribution of internet access across the MEA region remains a major obstacle for many businesses wanting to utilize programmatic advertising.

Growth Drivers in the Middle East and Africa Programmatic Advertising Platform Industry Market

Key growth drivers include expanding internet and mobile penetration, increasing digital literacy, and the growth of the e-commerce sector. Government support for digital economies and initiatives promoting digital transformation further fuel this growth. The presence of a young and tech-savvy population also contributes significantly to market expansion.

Challenges Impacting Middle East and Africa Programmatic Advertising Platform Industry Growth

Regulatory hurdles around data privacy and security, coupled with infrastructure limitations in certain regions, pose significant challenges. The lack of skilled professionals and the competitive intensity also affect market growth. Addressing these challenges through policy changes, investments in infrastructure, and talent development initiatives is crucial for sustained growth.

Significant Middle East and Africa Programmatic Advertising Platform Industry Industry Milestones

- June 2022: Lemma, a fast-growing DOOH platform, partnered with Continuum, expanding programmatic DOOH in the Middle East.

- July 2022: StackAdapt launched in-game advertising inventory, adding a new channel to its multi-channel offering.

Future Outlook for Middle East and Africa Programmatic Advertising Platform Industry Market

The MEA programmatic advertising platform market is poised for continued robust growth, driven by increasing digital adoption, improving infrastructure, and favorable regulatory environments in key markets. Strategic partnerships, technological advancements, and the emergence of new advertising formats will shape the future. The market presents significant opportunities for both established players and new entrants, particularly those focused on mobile advertising and innovative targeting solutions catering to the region's unique characteristics.

Middle East and Africa Programmatic Advertising Platform Industry Segmentation

-

1. Trading Platform

- 1.1. Real Time Bidding (RTB)

- 1.2. Private Marketplace Guaranteed

- 1.3. Automated Guaranteed

- 1.4. Unreserved Fixed-rate

-

2. Advertising Media

- 2.1. Digital Display

- 2.2. Mobile Display

-

3. Enterprise size

- 3.1. SMB's

- 3.2. Large Enterprises

Middle East and Africa Programmatic Advertising Platform Industry Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle East and Africa Programmatic Advertising Platform Industry Regional Market Share

Geographic Coverage of Middle East and Africa Programmatic Advertising Platform Industry

Middle East and Africa Programmatic Advertising Platform Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.17% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth of Digital Media Advertisement; Better use of Data for Programmatic Advertising

- 3.3. Market Restrains

- 3.3.1. Growth in Gesture Recognition Market

- 3.4. Market Trends

- 3.4.1. Increase in adoption of Digital Advertising

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East and Africa Programmatic Advertising Platform Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Trading Platform

- 5.1.1. Real Time Bidding (RTB)

- 5.1.2. Private Marketplace Guaranteed

- 5.1.3. Automated Guaranteed

- 5.1.4. Unreserved Fixed-rate

- 5.2. Market Analysis, Insights and Forecast - by Advertising Media

- 5.2.1. Digital Display

- 5.2.2. Mobile Display

- 5.3. Market Analysis, Insights and Forecast - by Enterprise size

- 5.3.1. SMB's

- 5.3.2. Large Enterprises

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Trading Platform

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Amazon

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Mars Media Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Xaxis

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 InMobi*List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Google

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Tonic International

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Executive Digital

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Boopin

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Gamned!

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Amazon

List of Figures

- Figure 1: Middle East and Africa Programmatic Advertising Platform Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Middle East and Africa Programmatic Advertising Platform Industry Share (%) by Company 2025

List of Tables

- Table 1: Middle East and Africa Programmatic Advertising Platform Industry Revenue billion Forecast, by Trading Platform 2020 & 2033

- Table 2: Middle East and Africa Programmatic Advertising Platform Industry Revenue billion Forecast, by Advertising Media 2020 & 2033

- Table 3: Middle East and Africa Programmatic Advertising Platform Industry Revenue billion Forecast, by Enterprise size 2020 & 2033

- Table 4: Middle East and Africa Programmatic Advertising Platform Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Middle East and Africa Programmatic Advertising Platform Industry Revenue billion Forecast, by Trading Platform 2020 & 2033

- Table 6: Middle East and Africa Programmatic Advertising Platform Industry Revenue billion Forecast, by Advertising Media 2020 & 2033

- Table 7: Middle East and Africa Programmatic Advertising Platform Industry Revenue billion Forecast, by Enterprise size 2020 & 2033

- Table 8: Middle East and Africa Programmatic Advertising Platform Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Saudi Arabia Middle East and Africa Programmatic Advertising Platform Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: United Arab Emirates Middle East and Africa Programmatic Advertising Platform Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Israel Middle East and Africa Programmatic Advertising Platform Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Qatar Middle East and Africa Programmatic Advertising Platform Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Kuwait Middle East and Africa Programmatic Advertising Platform Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Oman Middle East and Africa Programmatic Advertising Platform Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Bahrain Middle East and Africa Programmatic Advertising Platform Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Jordan Middle East and Africa Programmatic Advertising Platform Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Lebanon Middle East and Africa Programmatic Advertising Platform Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East and Africa Programmatic Advertising Platform Industry?

The projected CAGR is approximately 4.17%.

2. Which companies are prominent players in the Middle East and Africa Programmatic Advertising Platform Industry?

Key companies in the market include Amazon, Mars Media Group, Xaxis, InMobi*List Not Exhaustive, Google, Tonic International, Executive Digital, Boopin, Gamned!.

3. What are the main segments of the Middle East and Africa Programmatic Advertising Platform Industry?

The market segments include Trading Platform, Advertising Media, Enterprise size.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.48 billion as of 2022.

5. What are some drivers contributing to market growth?

Growth of Digital Media Advertisement; Better use of Data for Programmatic Advertising.

6. What are the notable trends driving market growth?

Increase in adoption of Digital Advertising.

7. Are there any restraints impacting market growth?

Growth in Gesture Recognition Market.

8. Can you provide examples of recent developments in the market?

July 2022 - StackAdapt, a self-serve programmatic advertising platform, launched an emerging channel of in-game inventory, adding a new element of non-intrusive, highly visible advertising to StackAdapt's robust multi-channel offering.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East and Africa Programmatic Advertising Platform Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East and Africa Programmatic Advertising Platform Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East and Africa Programmatic Advertising Platform Industry?

To stay informed about further developments, trends, and reports in the Middle East and Africa Programmatic Advertising Platform Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence