Key Insights

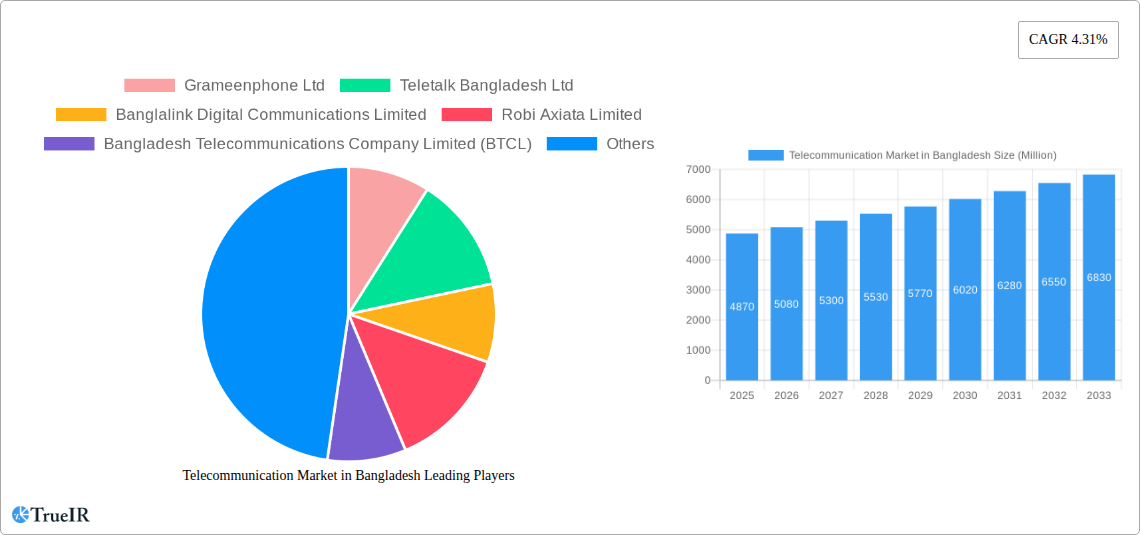

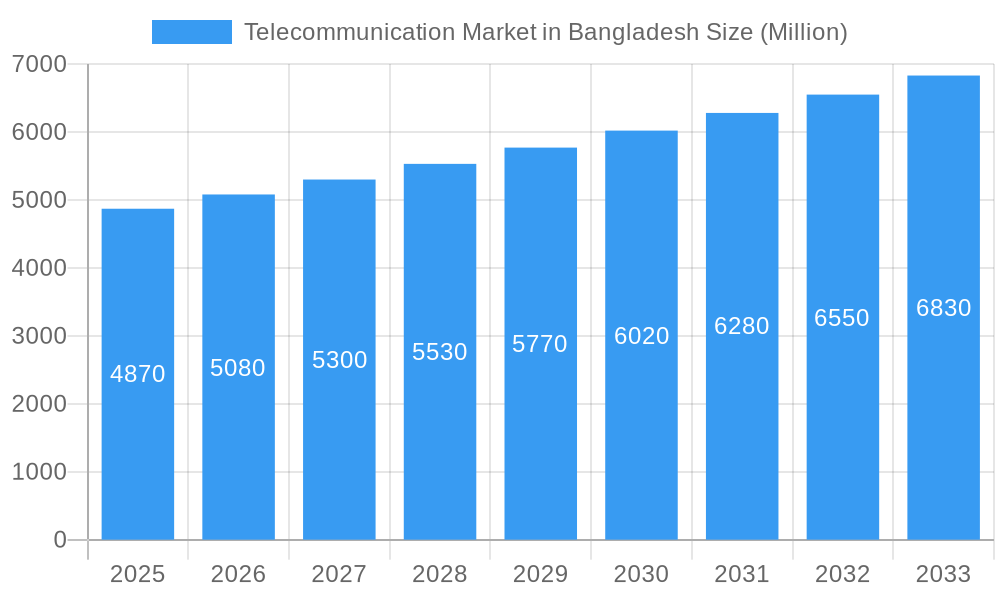

The Bangladesh telecommunication market, valued at $4.87 billion in 2025, is projected to experience robust growth, driven by increasing smartphone penetration, rising data consumption fueled by social media and streaming services, and expanding 4G and 5G network infrastructure. The market's Compound Annual Growth Rate (CAGR) of 4.31% from 2025 to 2033 indicates a steady upward trajectory. Key drivers include government initiatives promoting digital inclusion, the burgeoning e-commerce sector's reliance on reliable connectivity, and the increasing adoption of mobile financial services (MFS). The market is segmented by end-user (Transportation & Logistics, IT & Telecom, Healthcare, Government, BFSI, Hospitality, Manufacturing, Others), component (Hardware, Software, Services), location (Indoor, Outdoor), and application (Mapping & Navigation, Business Intelligence & Analytics, Location-based Advertising, Social Networking & Entertainment, Others). Significant players like Grameenphone, Teletalk, Banglalink, Robi, and BTCL are vying for market share through network expansion, service innovation, and competitive pricing strategies. Challenges include infrastructure limitations in certain regions, the need for greater digital literacy, and cybersecurity concerns. However, the overall outlook remains positive, with substantial growth anticipated throughout the forecast period.

Telecommunication Market in Bangladesh Market Size (In Billion)

The market segmentation offers valuable insights into specific growth areas. The software segment is likely to see strong growth due to increasing demand for advanced telecom solutions, while the services sector will benefit from rising customer support needs and network maintenance requirements. The significant growth in data consumption will fuel demand across all segments. The increasing prevalence of mobile-based applications in various sectors (like healthcare and BFSI) will further propel market expansion. While the 'Other End-Users' segment requires further analysis, its inclusion acknowledges the diverse and expanding applications of telecommunication technology within Bangladesh's economy. The consistent growth predicted across segments suggests a healthy and dynamic market with diverse opportunities for both established and emerging players.

Telecommunication Market in Bangladesh Company Market Share

Telecommunication Market in Bangladesh: A Comprehensive Report (2019-2033)

This dynamic report provides a detailed analysis of the Bangladesh telecommunication market, offering invaluable insights for industry stakeholders, investors, and strategic planners. Covering the period from 2019 to 2033, with a focus on 2025, this comprehensive study explores market size, growth drivers, competitive landscapes, and future trends. Leveraging extensive data analysis and expert insights, the report empowers informed decision-making within this rapidly evolving sector. Key players like Grameenphone Ltd, Teletalk Bangladesh Ltd, Banglalink Digital Communications Limited, Robi Axiata Limited, and Bangladesh Telecommunications Company Limited (BTCL) are thoroughly examined.

Telecommunication Market in Bangladesh Market Structure & Competitive Landscape

The Bangladesh telecommunication market is characterized by a moderately concentrated structure, with the top five operators – Grameenphone Ltd, Teletalk Bangladesh Ltd, Banglalink Digital Communications Limited, Robi Axiata Limited, and Bangladesh Telecommunications Company Limited (BTCL) – holding a significant market share. The concentration ratio (CR5) is estimated to be around 85% in 2025. Innovation is driven by the need to enhance network capacity, expand 4G and 5G coverage, and introduce advanced services like IoT and cloud computing. Regulatory impacts are significant, with the Bangladesh Telecommunication Regulatory Commission (BTRC) playing a key role in shaping market dynamics through licensing, spectrum allocation, and pricing regulations. Product substitution is relatively limited due to the infrastructural complexities of telecommunication networks. However, over-the-top (OTT) services are posing a growing challenge to traditional telecom operators.

The market exhibits strong end-user segmentation across various sectors: Transportation and Logistics, IT and Telecom, Healthcare, Government, BFSI (Banking, Financial Services, and Insurance), Hospitality, Manufacturing, and Other End-Users. Mergers and acquisitions (M&A) activity has been relatively low in recent years, with a total M&A volume estimated at xx Million USD in 2024. However, increasing consolidation is anticipated in the coming years to drive operational efficiencies and expand market share.

Telecommunication Market in Bangladesh Market Trends & Opportunities

The Bangladesh telecommunication market is experiencing robust growth, driven by increasing smartphone penetration, rising internet usage, and government initiatives to promote digital inclusion. The market size is projected to reach xx Million USD by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Market penetration rates for mobile and broadband services are rapidly increasing, with significant potential for further growth in rural areas. Technological shifts towards 5G, fiber optics, and cloud computing are creating new opportunities for service providers. Consumer preferences are shifting towards higher data speeds, greater reliability, and affordable pricing. The competitive landscape remains intense, with operators striving to differentiate their offerings through value-added services, superior customer experience, and strategic partnerships. This dynamic environment presents both opportunities and challenges for telecom operators seeking to capitalize on market expansion and technological innovation.

Dominant Markets & Segments in Telecommunication Market in Bangladesh

The dominant segment in the Bangladesh telecommunication market varies across different classifications.

By End-User: The IT and Telecom sector exhibits the highest market share, followed by the BFSI and Government sectors. These segments are driving significant demand for high-speed internet connectivity and advanced communication solutions. Growth drivers include the expansion of data centers, increasing adoption of cloud computing, and digitalization initiatives by government agencies.

By Component: The Services segment commands the largest market share, primarily due to the high demand for mobile and broadband services. This is complemented by a steadily growing Hardware sector driven by investments in network infrastructure, especially with the push for 5G. The Software segment plays a critical role but maintains a relatively smaller share compared to the other components.

By Location: Outdoor deployments represent a larger portion of the market due to the higher population density in urban areas and ongoing expansion of network infrastructure. However, Indoor deployments are gradually gaining traction with the increasing adoption of in-building solutions for better indoor coverage and faster speeds.

By Application: Social Networking and Entertainment are leading the application segment, with the rise of social media platforms and streaming services. Business Intelligence and Analytics applications are also witnessing strong growth fueled by business needs for data-driven decision-making.

- Key Growth Drivers:

- Increasing smartphone penetration

- Government initiatives promoting digitalization

- Expansion of 4G and 5G networks

- Rising demand for data and internet services

Telecommunication Market in Bangladesh Product Analysis

The Bangladesh telecommunication market is witnessing significant product innovation, primarily driven by the transition to 4G and 5G technologies. Operators are introducing bundled services combining voice, data, and video streaming to enhance customer offerings. Advancements in network infrastructure and virtualization are leading to improved network efficiency, reliability, and cost optimization. The focus is on developing solutions that address specific customer needs and deliver a superior user experience, with a special emphasis on affordability and accessibility for a broad user base.

Key Drivers, Barriers & Challenges in Telecommunication Market in Bangladesh

Key Drivers: Technological advancements (5G deployment, IoT solutions), expanding digital economy, government initiatives promoting digital literacy and infrastructure development.

Challenges: High population density requires significant investment in network infrastructure. Regulatory complexities can slow down network expansion and innovation. Competition intensifies pressure on pricing and margins. Supply chain disruptions can impact equipment procurement and deployment. The estimated impact of these challenges on overall market growth in 2025 is approximately xx Million USD loss.

Growth Drivers in the Telecommunication Market in Bangladesh Market

Key drivers include the government's Digital Bangladesh initiative, rising smartphone penetration, increasing demand for mobile internet and data services, and investment in infrastructure upgrades including expansion of 4G and upcoming 5G networks.

Challenges Impacting Telecommunication Market in Bangladesh Growth

Challenges include regulatory hurdles, competition from over-the-top (OTT) services, infrastructure limitations in less-developed areas, and power supply issues affecting network reliability.

Key Players Shaping the Telecommunication Market in Bangladesh Market

- Grameenphone Ltd

- Teletalk Bangladesh Ltd

- Banglalink Digital Communications Limited

- Robi Axiata Limited

- Bangladesh Telecommunications Company Limited (BTCL)

Significant Telecommunication Market in Bangladesh Industry Milestones

- December 2023: BAIRA Life Insurance Company Limited and Teletalk Bangladesh Limited signed a MoU for digital corporate solutions.

- December 2023: BTCL agreed with Huawei to supply equipment for its 5G Readiness Project (BDT 4.63 Billion estimated equipment cost).

Future Outlook for Telecommunication Market in Bangladesh Market

The Bangladesh telecommunication market is poised for continued growth, driven by increasing digital adoption, infrastructure expansion, and government support. The strategic focus on 5G rollout, IoT applications, and digital services will create significant opportunities for innovation and expansion. The market potential is substantial, promising a vibrant and dynamic sector in the years to come.

Telecommunication Market in Bangladesh Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Telecommunication Market in Bangladesh Segmentation By Geography

- 1. Bangladesh

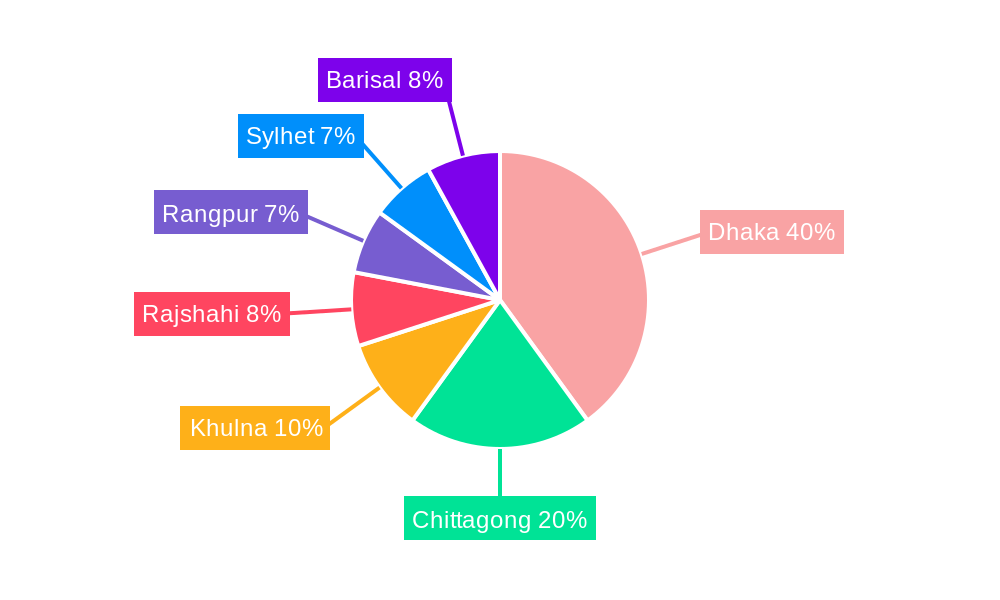

Telecommunication Market in Bangladesh Regional Market Share

Geographic Coverage of Telecommunication Market in Bangladesh

Telecommunication Market in Bangladesh REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.31% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Geo-based Marketing; Emerging Use-cases for LBS due to High Penetration of Social Media and Location-based App Adoption

- 3.3. Market Restrains

- 3.3.1. Rise in the privacy and security issues

- 3.4. Market Trends

- 3.4.1. Growth Trends of 5G in Bangladesh are Expected to Drive Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Telecommunication Market in Bangladesh Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Bangladesh

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Grameenphone Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Teletalk Bangladesh Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Banglalink Digital Communications Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Robi Axiata Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Bangladesh Telecommunications Company Limited (BTCL)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.1 Grameenphone Ltd

List of Figures

- Figure 1: Telecommunication Market in Bangladesh Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Telecommunication Market in Bangladesh Share (%) by Company 2025

List of Tables

- Table 1: Telecommunication Market in Bangladesh Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: Telecommunication Market in Bangladesh Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Telecommunication Market in Bangladesh Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Telecommunication Market in Bangladesh Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Telecommunication Market in Bangladesh Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Telecommunication Market in Bangladesh Revenue Million Forecast, by Region 2020 & 2033

- Table 7: Telecommunication Market in Bangladesh Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: Telecommunication Market in Bangladesh Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Telecommunication Market in Bangladesh Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Telecommunication Market in Bangladesh Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Telecommunication Market in Bangladesh Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Telecommunication Market in Bangladesh Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Telecommunication Market in Bangladesh?

The projected CAGR is approximately 4.31%.

2. Which companies are prominent players in the Telecommunication Market in Bangladesh?

Key companies in the market include Grameenphone Ltd, Teletalk Bangladesh Ltd, Banglalink Digital Communications Limited, Robi Axiata Limited, Bangladesh Telecommunications Company Limited (BTCL).

3. What are the main segments of the Telecommunication Market in Bangladesh?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.87 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Geo-based Marketing; Emerging Use-cases for LBS due to High Penetration of Social Media and Location-based App Adoption.

6. What are the notable trends driving market growth?

Growth Trends of 5G in Bangladesh are Expected to Drive Market Growth.

7. Are there any restraints impacting market growth?

Rise in the privacy and security issues.

8. Can you provide examples of recent developments in the market?

December 2023: BAIRA Life Insurance Company Limited and Teletalk Bangladesh Limited, the state-owned mobile network operator in the country, signed a corporate memorandum of understanding (MoU). Under the agreement, Teletalk Bangladesh Limited would offer its digital corporate solutions, including voice and internet services, to BAIRA Life Insurance Company Limited at an affordable price.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Telecommunication Market in Bangladesh," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Telecommunication Market in Bangladesh report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Telecommunication Market in Bangladesh?

To stay informed about further developments, trends, and reports in the Telecommunication Market in Bangladesh, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence