Key Insights

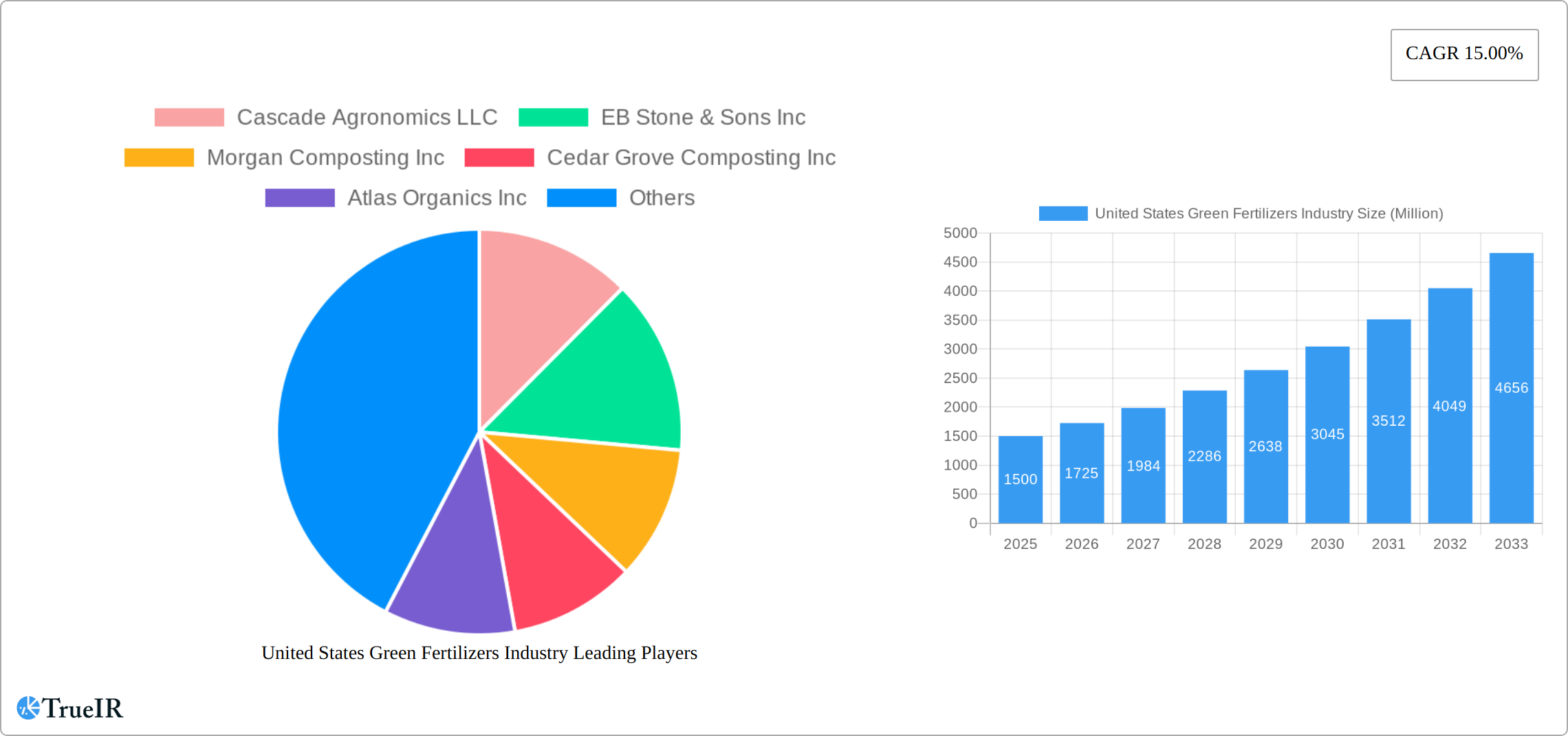

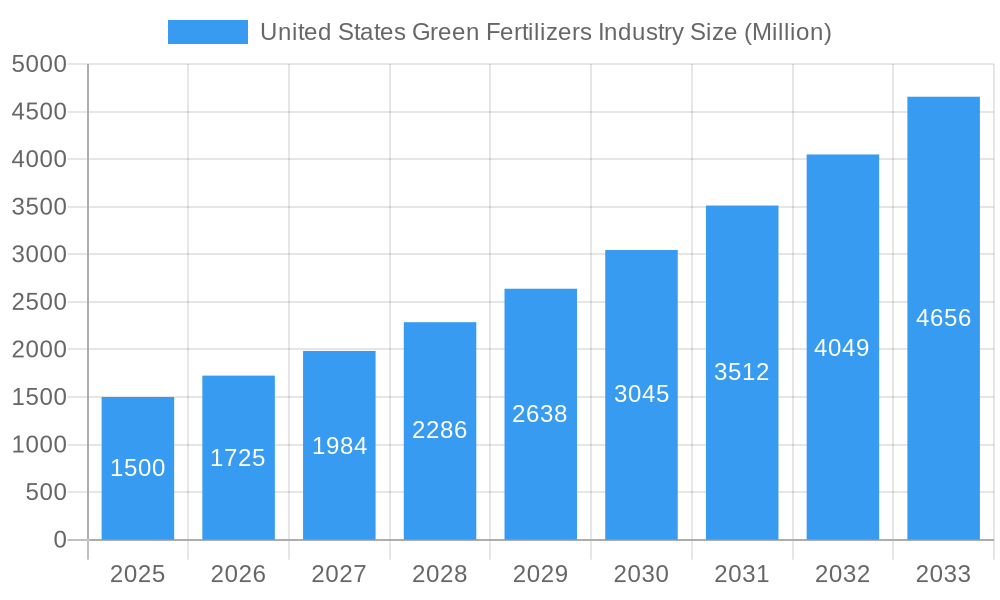

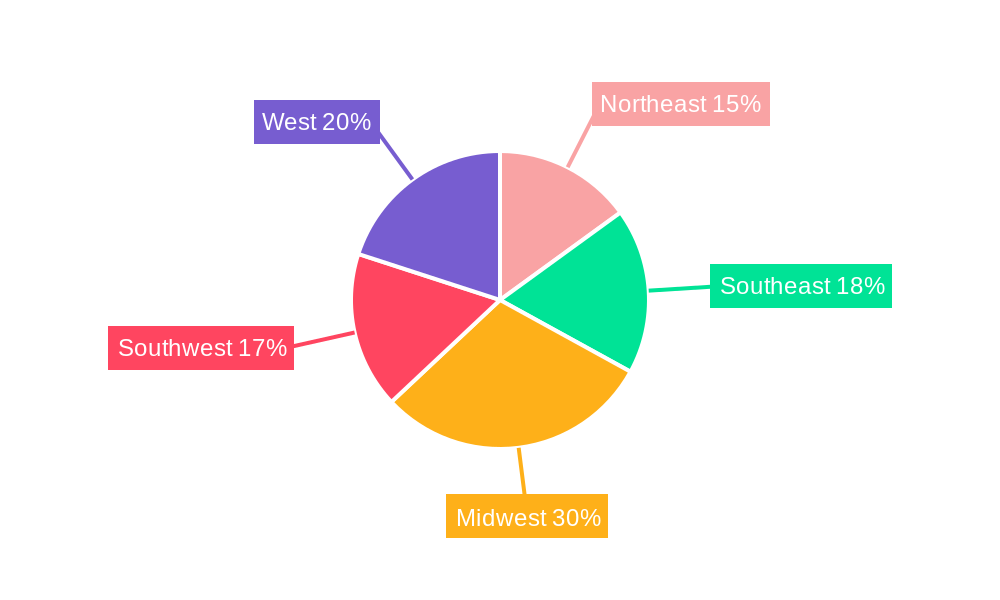

The United States green fertilizers market, valued at approximately $XX million in 2025, is experiencing robust growth, projected to maintain a Compound Annual Growth Rate (CAGR) of 15% from 2025 to 2033. This expansion is fueled by several key drivers. Growing consumer awareness of sustainable agricultural practices and the environmental concerns surrounding synthetic fertilizers are significantly boosting demand for eco-friendly alternatives. The increasing popularity of organic farming, coupled with stringent government regulations promoting sustainable agriculture, further strengthens this market trend. Specific market segments, such as manure-based fertilizers and those catering to cash crops and horticultural crops, are expected to exhibit faster growth rates compared to others. The increasing adoption of precision agriculture techniques, enabling efficient application and optimized usage of green fertilizers, will also contribute to market growth. However, factors such as price volatility of raw materials used in green fertilizer production, inconsistent quality control across different suppliers, and the relatively high initial investment required by farmers to transition to green fertilizers could act as restraints on market expansion. The regional distribution of market share reflects agricultural intensity, with the Midwest and West potentially holding larger shares due to extensive agricultural activity in these regions. Leading players like Cascade Agronomics LLC, EB Stone & Sons Inc., and others are constantly innovating and expanding their product lines to meet the evolving demands of the market.

United States Green Fertilizers Industry Market Size (In Billion)

The forecast period of 2025-2033 anticipates continued growth driven by escalating demand from organic food producers and a greater emphasis on environmental sustainability. Market players are strategically focusing on product diversification, research and development of improved formulations, and expansion into new geographical territories to capitalize on the lucrative opportunities. While challenges related to supply chain management and price fluctuations persist, the long-term outlook for the US green fertilizers market remains highly positive, driven by the sustained growth in organic farming and the global push towards more environmentally friendly agricultural practices. Competitive landscape analysis indicates a mixture of established players and new entrants, fostering innovation and competition. Furthermore, strategic partnerships and mergers & acquisitions are likely to reshape the market landscape in the coming years.

United States Green Fertilizers Industry Company Market Share

United States Green Fertilizers Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the United States green fertilizers industry, offering invaluable insights for investors, industry professionals, and strategic decision-makers. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033, this report meticulously examines market dynamics, competitive landscapes, and future growth potential. The report leverages extensive data analysis and expert insights to provide a clear and concise overview of this rapidly expanding sector. The total market size in 2025 is estimated at xx Million, with a projected CAGR of xx% during the forecast period.

United States Green Fertilizers Industry Market Structure & Competitive Landscape

The United States green fertilizers industry exhibits a moderately fragmented structure, with several key players vying for market share. The Herfindahl-Hirschman Index (HHI) is estimated at xx, indicating a moderately concentrated market. Innovation is a key driver, with companies investing heavily in developing sustainable and high-efficiency fertilizers. Stringent environmental regulations significantly impact the industry, necessitating compliance with standards like the Organic Foods Production Act. Product substitutes, such as synthetic fertilizers, pose a constant competitive threat. The end-user segment is primarily comprised of agricultural businesses (cash crops, horticultural crops, row crops), landscaping companies, and home gardeners. M&A activity in the sector has been moderate, with xx Million in deal value recorded between 2019 and 2024, primarily driven by the consolidation of smaller players by larger ones.

- Market Concentration: Moderately fragmented, HHI estimated at xx.

- Innovation Drivers: Sustainable product development, enhanced nutrient efficiency.

- Regulatory Impacts: Stringent environmental regulations, compliance costs.

- Product Substitutes: Synthetic fertilizers, competition from inorganic options.

- End-User Segmentation: Agriculture (cash crops, horticultural crops, row crops), landscaping, home gardening.

- M&A Trends: Moderate activity, xx Million in deal value (2019-2024), focused on consolidation.

United States Green Fertilizers Industry Market Trends & Opportunities

The United States green fertilizer market is experiencing robust growth, driven by a confluence of factors including the surging consumer demand for organically grown produce, a heightened awareness of environmentally friendly landscaping practices, and increasing regulatory pressure favoring sustainable agriculture. Market projections indicate a significant expansion, with estimates reaching xx Million USD by 2033. This expansion is fueled by several key trends: technological advancements leading to more precise and efficient fertilizer application methods; a definitive consumer shift towards eco-conscious and sustainable products, resulting in higher market penetration for organic options; and intense competition among existing players fostering innovation and operational efficiency. The compound annual growth rate (CAGR) is projected to remain robust at xx% throughout the forecast period, driven by increasing demand from both agricultural and non-agricultural sectors, including the burgeoning home gardening and landscaping markets.

Dominant Markets & Segments in United States Green Fertilizers Industry

Within the dynamic United States green fertilizers market, the agricultural sector, particularly cash crops like fruits, vegetables, and high-value specialty crops, currently holds the dominant position. The unwavering consumer preference for organic produce significantly propels this segment's growth. Analyzing the product landscape, manure-based fertilizers represent the largest segment by volume, followed by compost and meal-based fertilizers. Geographically, the market's strength is concentrated across the nation's fertile agricultural heartland, with California and other states boasting significant agricultural output emerging as key regional hubs.

- Key Growth Drivers (Cash Crops): The escalating demand for organic produce, coupled with government incentives promoting sustainable agriculture and investments in improved infrastructure and irrigation systems, are key drivers for growth in this segment. Furthermore, the increasing awareness among farmers of the long-term benefits of soil health and reduced reliance on synthetic inputs is creating a positive feedback loop.

- Key Growth Drivers (Manure-based Fertilizers): The readily available supply, relatively lower cost compared to other alternatives, increasing availability of animal manure (driven by advancements in livestock management), and continuous improvements in composting technologies are all contributing to the dominance of this segment. Furthermore, advancements in anaerobic digestion are creating opportunities for high-value byproducts.

- Market Dominance Analysis: The synergistic relationship between the high demand for organic cash crops and the widespread use of manure-based fertilizers, along with the growing adoption of compost and other organic amendments, is a key driver of overall market expansion. States with established agricultural sectors, including California, the Midwest, and the Southeast, represent significant regional markets, reflecting their considerable agricultural output and consumer demand.

United States Green Fertilizers Industry Product Analysis

Product innovation in the green fertilizer market focuses on improving nutrient efficiency, reducing environmental impact, and enhancing ease of application. Advanced formulations, including slow-release fertilizers and biofertilizers, are gaining traction. Key competitive advantages include superior nutrient profiles, reduced leaching, and enhanced soil health benefits. Technological advancements in precision agriculture and targeted fertilizer application techniques are enhancing the efficacy and sustainability of green fertilizers.

Key Drivers, Barriers & Challenges in United States Green Fertilizers Industry

Key Drivers: Growing consumer awareness of sustainable agriculture, increasing government regulations favoring organic farming, rising demand for organic produce and landscape maintenance, advancements in fertilizer technology creating more efficient and effective products.

Challenges: The high cost of production compared to synthetic fertilizers, inconsistent supply chains, stringent regulatory requirements, competition from synthetic fertilizer manufacturers. Supply chain volatility has led to price fluctuations and limited availability at certain times, negatively impacting market growth by approximately xx% in 2024.

Growth Drivers in the United States Green Fertilizers Industry Market

The market is propelled by increasing consumer demand for organic products, supportive government policies promoting sustainable agriculture, and technological advancements leading to more efficient fertilizer production and application. These factors contribute significantly to the market's growth trajectory.

Challenges Impacting United States Green Fertilizers Industry Growth

Despite the promising outlook, the United States green fertilizers industry faces several challenges. The relatively higher production costs compared to synthetic alternatives can limit market accessibility, particularly for price-sensitive farmers. Inconsistent supply chain dynamics, particularly concerning the availability of high-quality organic raw materials, can create bottlenecks. Stringent regulatory hurdles and compliance requirements add another layer of complexity. Furthermore, the intense competition from established synthetic fertilizer players, backed by substantial resources and established distribution networks, represents a considerable hurdle to overcome.

Key Players Shaping the United States Green Fertilizers Industry Market

- Cascade Agronomics LLC

- EB Stone & Sons Inc

- Morgan Composting Inc

- Cedar Grove Composting Inc

- Atlas Organics Inc

- Suståne Natural Fertilizer Inc

- The Espoma Company

- California Organic Fertilizers Inc

- Walts Organic Fertilizers Co

- The Rich Lawn Company LLC

Significant United States Green Fertilizers Industry Industry Milestones

- October 2018: The Espoma Company expanded its headquarters, boosting organic fertilizer production capacity.

- August 2021: Cedar Grove Composting expanded its production facility for bulk and yard waste, increasing its supply capacity.

Future Outlook for United States Green Fertilizers Industry Market

The future of the United States green fertilizers market is exceptionally promising. Sustained consumer demand for organic and sustainably produced food and landscaping products, coupled with supportive government policies promoting sustainable agriculture, and ongoing technological innovations in fertilizer production and application, will continue to drive market expansion. Significant opportunities exist for companies developing innovative, high-efficiency fertilizers tailored to specific crop needs and addressing the challenges of precision agriculture. The market's vast potential promises substantial returns for companies committed to providing sustainable and environmentally friendly solutions, contributing to a healthier planet and a more secure food supply.

United States Green Fertilizers Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

United States Green Fertilizers Industry Segmentation By Geography

- 1. United States

United States Green Fertilizers Industry Regional Market Share

Geographic Coverage of United States Green Fertilizers Industry

United States Green Fertilizers Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Demand For Landscaping Maintenance; Adoption of Green Spaces and Green Roofs

- 3.3. Market Restrains

- 3.3.1. Shortage of Labor In Landscaping; High Maintenance Cost of Lawn Mowers

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Green Fertilizers Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Cascade Agronomics LLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 EB Stone & Sons Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Morgan Composting Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Cedar Grove Composting Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Atlas Organics Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Suståne Natural Fertilizer Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 The Espoma Company

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 California Organic Fertilizers Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Walts Organic Fertilizers Co

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 The Rich Lawn Company LLC

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Cascade Agronomics LLC

List of Figures

- Figure 1: United States Green Fertilizers Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United States Green Fertilizers Industry Share (%) by Company 2025

List of Tables

- Table 1: United States Green Fertilizers Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: United States Green Fertilizers Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: United States Green Fertilizers Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: United States Green Fertilizers Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: United States Green Fertilizers Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: United States Green Fertilizers Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 7: United States Green Fertilizers Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: United States Green Fertilizers Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: United States Green Fertilizers Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: United States Green Fertilizers Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: United States Green Fertilizers Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: United States Green Fertilizers Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Green Fertilizers Industry?

The projected CAGR is approximately 15.00%.

2. Which companies are prominent players in the United States Green Fertilizers Industry?

Key companies in the market include Cascade Agronomics LLC, EB Stone & Sons Inc, Morgan Composting Inc, Cedar Grove Composting Inc, Atlas Organics Inc, Suståne Natural Fertilizer Inc, The Espoma Company, California Organic Fertilizers Inc, Walts Organic Fertilizers Co, The Rich Lawn Company LLC.

3. What are the main segments of the United States Green Fertilizers Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Demand For Landscaping Maintenance; Adoption of Green Spaces and Green Roofs.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Shortage of Labor In Landscaping; High Maintenance Cost of Lawn Mowers.

8. Can you provide examples of recent developments in the market?

August 2021: Cedar Grove Composting expanded its production facility for bulk and yard waste in Kenmore, United States.October 2018: The Espoma Company expanded its new 12,500 sq. ft headquarters in Millville. This expansion in the production facility helped the company in the large-scale manufacture of organic fertilizers. The Espoma Company is one of the largest manufacturers and marketers of organic lawn and garden fertilizers in the United States.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Green Fertilizers Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Green Fertilizers Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Green Fertilizers Industry?

To stay informed about further developments, trends, and reports in the United States Green Fertilizers Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence