Key Insights

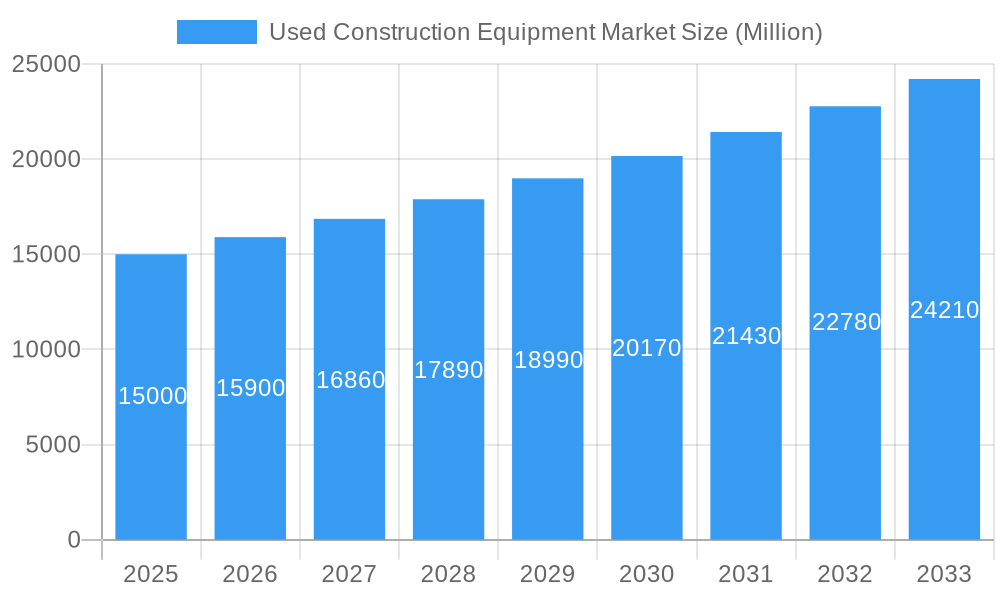

The global used construction equipment market is projected to achieve a CAGR of 5.13%, reaching a market size of $131.38 billion by 2024. This growth is propelled by the increasing demand for cost-effective machinery, especially in developing economies undertaking substantial infrastructure projects. Furthermore, environmental regulations are accelerating the adoption of greener equipment, thereby stimulating the secondary market for existing assets. Key restraints include rapid technological advancements in new equipment and concerns regarding the reliability and maintenance of used machinery. The market is segmented by equipment type, including cranes, excavators, loaders, and material handling equipment, and by power source, such as internal combustion engine, electric, and hybrid. While North America and Europe currently dominate, the Asia-Pacific region is poised for significant expansion due to intensified construction activities and urbanization.

Used Construction Equipment Market Market Size (In Billion)

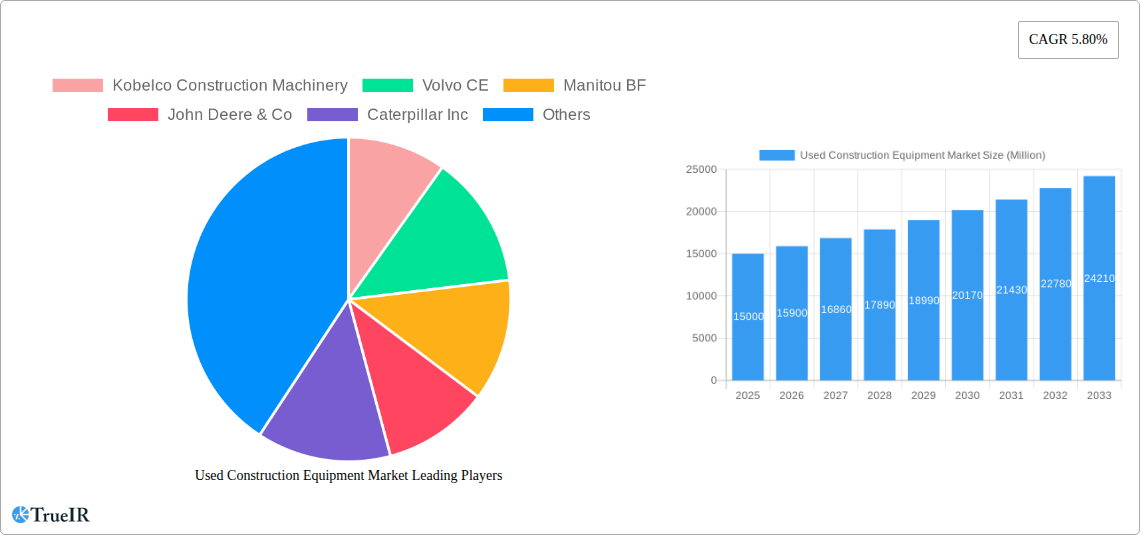

The competitive environment features prominent players including Caterpillar, Komatsu, John Deere, Volvo CE, and Hitachi. These companies are strategically expanding their service networks and offering refurbishment solutions to bolster the value and lifespan of used equipment. The forecast period (2024-2033) anticipates sustained growth driven by global infrastructure development, though economic volatility and technological evolution may influence growth rates. A detailed understanding of regional dynamics and segment-specific preferences is essential for effective strategic planning in this evolving market. The historical period (2019-2024) experienced market fluctuations influenced by global events, providing valuable insights for future projections.

Used Construction Equipment Market Company Market Share

Used Construction Equipment Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the global used construction equipment market, offering invaluable insights for investors, industry professionals, and strategic decision-makers. With a detailed examination of market trends, competitive landscapes, and future projections from 2019 to 2033, this report is an essential resource for understanding this dynamic sector. The market is estimated at $XX Million in 2025 and is projected to experience significant growth during the forecast period (2025-2033).

Used Construction Equipment Market Market Structure & Competitive Landscape

The used construction equipment market is characterized by a moderately concentrated structure, with key players holding significant market share. However, the emergence of online marketplaces and digital platforms is increasing competition and fostering market fragmentation. Key innovation drivers include technological advancements in equipment design, digitalization of sales and rental processes, and the development of sustainable and efficient equipment. Regulatory impacts, such as emission standards and safety regulations, significantly influence market dynamics. Product substitutes, such as alternative construction methods and equipment, pose a moderate threat. The end-user segment is diverse, including construction companies, rental businesses, and individual contractors.

- Market Concentration: The top 5 players account for approximately XX% of the market share (2024). The Herfindahl-Hirschman Index (HHI) is estimated at XX, suggesting a moderately concentrated market.

- M&A Activity: The historical period (2019-2024) witnessed XX major mergers and acquisitions, primarily focused on expanding market reach and technological capabilities.

- Innovation Drivers: Focus on automation, telematics, and sustainable technologies is driving market innovation.

- Regulatory Impact: Stringent emission norms and safety standards influence equipment demand and sales.

- Product Substitutes: The growing popularity of pre-fabricated construction methods presents some level of competitive pressure.

Used Construction Equipment Market Market Trends & Opportunities

The used construction equipment market is experiencing robust expansion, driven by a confluence of strategic factors. The ongoing global construction boom, coupled with an escalating demand for cost-effective machinery solutions, forms the bedrock of this growth. Innovations in technology, particularly in areas like telematics and remote diagnostics, are instrumental in enhancing equipment operational efficiency and significantly extending their service life, which directly boosts the appeal and demand within the pre-owned equipment segment. Furthermore, a heightened global awareness and concern for environmental sustainability are fueling a surge in demand for fuel-efficient and eco-friendly machinery. The digital revolution is also reshaping the landscape, with the proliferation of online marketplaces and digital platforms that are simplifying and demystifying the buying and selling processes, thereby improving market transparency and broadening accessibility for a wider audience. The Compound Annual Growth Rate (CAGR) for this market during the forecast period (2025-2033) is projected to be a significant XX%. The market penetration rates for online platforms are anticipated to grow exponentially, reaching an estimated XX% by 2033. The competitive arena is dynamic, with established market leaders strategically investing in digital transformation and innovative new entrants poised to disrupt conventional sales paradigms.

Dominant Markets & Segments in Used Construction Equipment Market

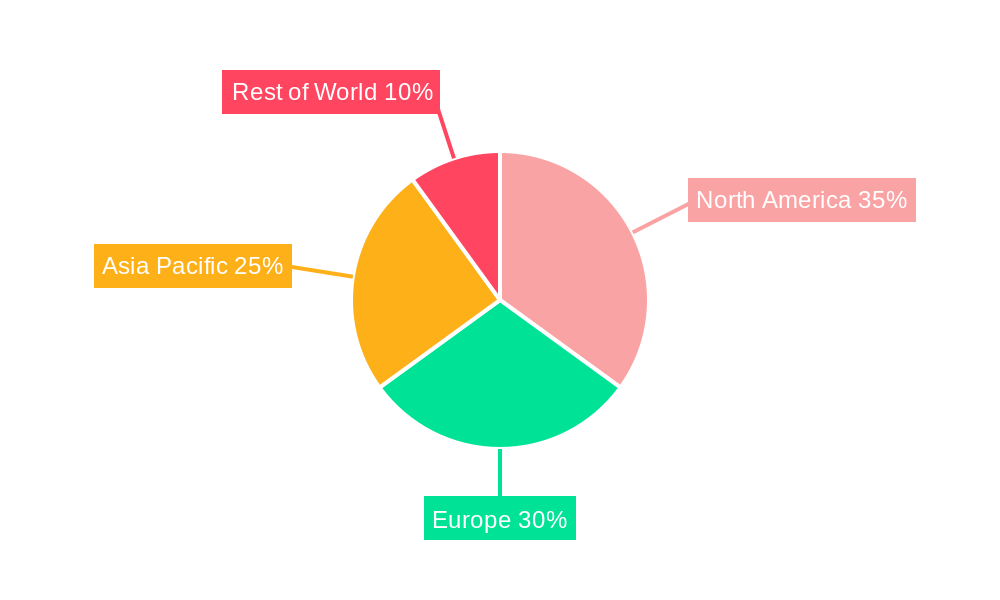

The North American region currently commands the largest share of the used construction equipment market, a position fortified by substantial construction investments and a considerable existing fleet of machinery. However, the Asia-Pacific region is forecast to emerge as the fastest-growing market during the forecast period, propelled by rapid infrastructure development initiatives and robust economic expansion. Examining product categories, Excavators and Loaders & Backhoes continue to hold dominant positions due to their indispensable utility across a broad spectrum of construction projects. While Internal Combustion Engine (ICE) powered equipment still represents the majority, the Electric and Hybrid segments are demonstrating impressive growth trajectories, driven by increasing environmental consciousness and rapid technological advancements in electrification.

Key Market Dominators & Growth Hotspots:

- North America: Characterized by substantial infrastructure spending and a mature, large-scale existing equipment base.

- Asia-Pacific: Experiencing rapid infrastructure development and dynamic economic growth, driving high demand.

- Europe: Benefiting from significant government investments in infrastructure renewal and extensive renovation activities.

- Excavators & Loaders/Backhoes: Their versatility and widespread application across diverse construction needs solidify their market dominance.

- Internal Combustion Engines: Remain a preferred choice for many due to their cost-effectiveness and widespread availability.

- Electric & Hybrid: Witnessing accelerated adoption driven by a growing commitment to sustainability and cutting-edge technological progress.

Used Construction Equipment Market Product Analysis

Technological advancements are driving innovation in used construction equipment. Features such as improved fuel efficiency, enhanced safety systems, and advanced telematics are enhancing the value and appeal of used machines. This is leading to a wider range of applications for these machines, extending beyond traditional construction to other sectors. The competitive advantage lies in offering equipment with optimal performance, reliability, and cost-effectiveness, alongside efficient sales and support services.

Key Drivers, Barriers & Challenges in Used Construction Equipment Market

Key Drivers: A pivotal factor driving the market is the escalating demand for cost-effective equipment solutions, particularly in emerging economies. Government-led initiatives aimed at bolstering infrastructure development further provide a strong impetus for market expansion. Advancements in technology, including the integration of telematics and predictive maintenance, are crucial in enhancing equipment efficiency, extending operational lifespans, and consequently increasing the attractiveness of pre-owned machinery.

Key Challenges: The market is susceptible to fluctuations in construction activity and broader economic downturns, which can directly impact demand. The availability and cost of spare parts for older equipment models can present a challenge, potentially affecting machine longevity and maintenance. Furthermore, increasingly stringent environmental regulations and evolving emission standards represent significant hurdles that manufacturers and users must navigate.

Growth Drivers in the Used Construction Equipment Market Market

The growth trajectory of the used construction equipment market is significantly influenced by the increasing adoption of cutting-edge technologies, a heightened focus on improved fuel efficiency, and the overarching commitment to sustainability within the construction industry. Government-backed initiatives designed to accelerate infrastructure projects and foster economic growth also play a crucial role. Moreover, the rapid evolution and widespread adoption of online marketplaces and digital sales platforms are instrumental in streamlining transactions, enhancing accessibility, and connecting a broader base of buyers and sellers.

Challenges Impacting Used Construction Equipment Market Growth

Several factors hinder the growth of the used construction equipment market. Economic downturns and fluctuations in the construction industry lead to reduced demand. The supply chain disruptions and rising costs of raw materials can impact both the availability and pricing of equipment. Stringent environmental regulations and emission standards require manufacturers to adapt and invest in newer technologies, creating challenges for the used equipment sector.

Key Players Shaping the Used Construction Equipment Market Market

Significant Used Construction Equipment Market Industry Milestones

- January 2021: Kobelco Cranes launched the Kobelco Used Crane Finder service, enhancing the buying and selling of used cranes in the EAME region.

- November 2022: Maxim Crane Works launched Maxim Marketplace™, an online platform for used equipment sales, revolutionizing the sales process within the US rental sector.

- December 2022: MyCrane, a Dubai-based online crane rental service, expanded into the United States, offering a new digital platform for crane procurement, buying and selling.

Future Outlook for Used Construction Equipment Market Market

The used construction equipment market is projected to maintain a robust growth trajectory, driven by continued infrastructure development globally, the increasing demand for cost-effective solutions, and the integration of innovative technologies. Strategic opportunities exist for companies to expand their digital presence, enhance customer service, and invest in sustainable and technologically advanced equipment. The market holds significant potential for growth in developing economies and in segments like electric and hybrid equipment.

Used Construction Equipment Market Segmentation

-

1. Product Type

- 1.1. Crane

- 1.2. Telescopic Handler

- 1.3. Excavator

- 1.4. Material Handling Equipment

- 1.5. Loader and Backhoe

- 1.6. Others

-

2. Drive Type

- 2.1. Internal Combustion Engine

- 2.2. Electric

- 2.3. Hybrid

Used Construction Equipment Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of World

Used Construction Equipment Market Regional Market Share

Geographic Coverage of Used Construction Equipment Market

Used Construction Equipment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.13% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Sales of Forklift; Others

- 3.3. Market Restrains

- 3.3.1. Supply Chain Disruption; Others

- 3.4. Market Trends

- 3.4.1. High Cost of New Construction Equipment is driving the growth of the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Used Construction Equipment Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Crane

- 5.1.2. Telescopic Handler

- 5.1.3. Excavator

- 5.1.4. Material Handling Equipment

- 5.1.5. Loader and Backhoe

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Drive Type

- 5.2.1. Internal Combustion Engine

- 5.2.2. Electric

- 5.2.3. Hybrid

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of World

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Used Construction Equipment Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Crane

- 6.1.2. Telescopic Handler

- 6.1.3. Excavator

- 6.1.4. Material Handling Equipment

- 6.1.5. Loader and Backhoe

- 6.1.6. Others

- 6.2. Market Analysis, Insights and Forecast - by Drive Type

- 6.2.1. Internal Combustion Engine

- 6.2.2. Electric

- 6.2.3. Hybrid

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Used Construction Equipment Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Crane

- 7.1.2. Telescopic Handler

- 7.1.3. Excavator

- 7.1.4. Material Handling Equipment

- 7.1.5. Loader and Backhoe

- 7.1.6. Others

- 7.2. Market Analysis, Insights and Forecast - by Drive Type

- 7.2.1. Internal Combustion Engine

- 7.2.2. Electric

- 7.2.3. Hybrid

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Used Construction Equipment Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Crane

- 8.1.2. Telescopic Handler

- 8.1.3. Excavator

- 8.1.4. Material Handling Equipment

- 8.1.5. Loader and Backhoe

- 8.1.6. Others

- 8.2. Market Analysis, Insights and Forecast - by Drive Type

- 8.2.1. Internal Combustion Engine

- 8.2.2. Electric

- 8.2.3. Hybrid

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Rest of World Used Construction Equipment Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Crane

- 9.1.2. Telescopic Handler

- 9.1.3. Excavator

- 9.1.4. Material Handling Equipment

- 9.1.5. Loader and Backhoe

- 9.1.6. Others

- 9.2. Market Analysis, Insights and Forecast - by Drive Type

- 9.2.1. Internal Combustion Engine

- 9.2.2. Electric

- 9.2.3. Hybrid

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Kobelco Construction Machinery

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Volvo CE

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Manitou BF

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 John Deere & Co

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Caterpillar Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Hitachi Construction Machiner

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Komatsu

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Liebherr International

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Mitsubishi heavy Industries Ltd

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Terex Corporation

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Kobelco Construction Machinery

List of Figures

- Figure 1: Global Used Construction Equipment Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Used Construction Equipment Market Revenue (billion), by Product Type 2025 & 2033

- Figure 3: North America Used Construction Equipment Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Used Construction Equipment Market Revenue (billion), by Drive Type 2025 & 2033

- Figure 5: North America Used Construction Equipment Market Revenue Share (%), by Drive Type 2025 & 2033

- Figure 6: North America Used Construction Equipment Market Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Used Construction Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Used Construction Equipment Market Revenue (billion), by Product Type 2025 & 2033

- Figure 9: Europe Used Construction Equipment Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 10: Europe Used Construction Equipment Market Revenue (billion), by Drive Type 2025 & 2033

- Figure 11: Europe Used Construction Equipment Market Revenue Share (%), by Drive Type 2025 & 2033

- Figure 12: Europe Used Construction Equipment Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Used Construction Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Used Construction Equipment Market Revenue (billion), by Product Type 2025 & 2033

- Figure 15: Asia Pacific Used Construction Equipment Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 16: Asia Pacific Used Construction Equipment Market Revenue (billion), by Drive Type 2025 & 2033

- Figure 17: Asia Pacific Used Construction Equipment Market Revenue Share (%), by Drive Type 2025 & 2033

- Figure 18: Asia Pacific Used Construction Equipment Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Used Construction Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of World Used Construction Equipment Market Revenue (billion), by Product Type 2025 & 2033

- Figure 21: Rest of World Used Construction Equipment Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: Rest of World Used Construction Equipment Market Revenue (billion), by Drive Type 2025 & 2033

- Figure 23: Rest of World Used Construction Equipment Market Revenue Share (%), by Drive Type 2025 & 2033

- Figure 24: Rest of World Used Construction Equipment Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Rest of World Used Construction Equipment Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Used Construction Equipment Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Global Used Construction Equipment Market Revenue billion Forecast, by Drive Type 2020 & 2033

- Table 3: Global Used Construction Equipment Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Used Construction Equipment Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 5: Global Used Construction Equipment Market Revenue billion Forecast, by Drive Type 2020 & 2033

- Table 6: Global Used Construction Equipment Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global Used Construction Equipment Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 8: Global Used Construction Equipment Market Revenue billion Forecast, by Drive Type 2020 & 2033

- Table 9: Global Used Construction Equipment Market Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Global Used Construction Equipment Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 11: Global Used Construction Equipment Market Revenue billion Forecast, by Drive Type 2020 & 2033

- Table 12: Global Used Construction Equipment Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Used Construction Equipment Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 14: Global Used Construction Equipment Market Revenue billion Forecast, by Drive Type 2020 & 2033

- Table 15: Global Used Construction Equipment Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Used Construction Equipment Market?

The projected CAGR is approximately 5.13%.

2. Which companies are prominent players in the Used Construction Equipment Market?

Key companies in the market include Kobelco Construction Machinery, Volvo CE, Manitou BF, John Deere & Co, Caterpillar Inc, Hitachi Construction Machiner, Komatsu, Liebherr International, Mitsubishi heavy Industries Ltd, Terex Corporation.

3. What are the main segments of the Used Construction Equipment Market?

The market segments include Product Type, Drive Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 131.38 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Sales of Forklift; Others.

6. What are the notable trends driving market growth?

High Cost of New Construction Equipment is driving the growth of the market.

7. Are there any restraints impacting market growth?

Supply Chain Disruption; Others.

8. Can you provide examples of recent developments in the market?

December 2022: MyCrane, a Dubai-based online crane rental service, has opened a branch in the United States. It is a new digital platform launched to disrupt and streamline the crane rental procurement process. It also provides the option to buy and sell cranes.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Used Construction Equipment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Used Construction Equipment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Used Construction Equipment Market?

To stay informed about further developments, trends, and reports in the Used Construction Equipment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence