Key Insights

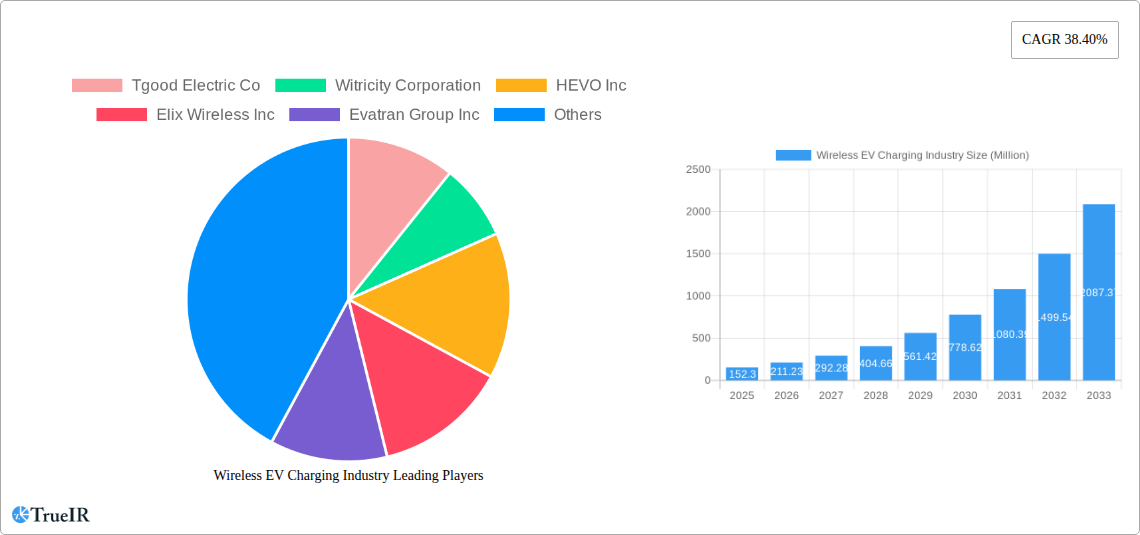

The wireless electric vehicle (EV) charging market is experiencing explosive growth, projected to reach a market size of $152.30 million in 2025 and exhibiting a remarkable Compound Annual Growth Rate (CAGR) of 38.40%. This surge is driven by several key factors. Increasing adoption of electric vehicles globally necessitates more convenient and efficient charging solutions, a demand wireless charging effectively addresses. The elimination of physical connectors enhances user experience, reducing charging time and minimizing wear and tear on vehicle components. Further fueling market expansion is the rising demand for residential and commercial charging infrastructure, particularly in densely populated urban areas where wired solutions are often impractical or inconvenient. Technological advancements, such as improved energy transfer efficiency and the development of robust and scalable systems, are also contributing significantly to market growth. The market is segmented by vehicle type (passenger cars and commercial vehicles) and application type (residential and commercial), with passenger car applications currently dominating, although commercial vehicle adoption is anticipated to grow rapidly. Key players like Tgood Electric Co, Witricity Corporation, and others are actively involved in driving innovation and market penetration.

Wireless EV Charging Industry Market Size (In Million)

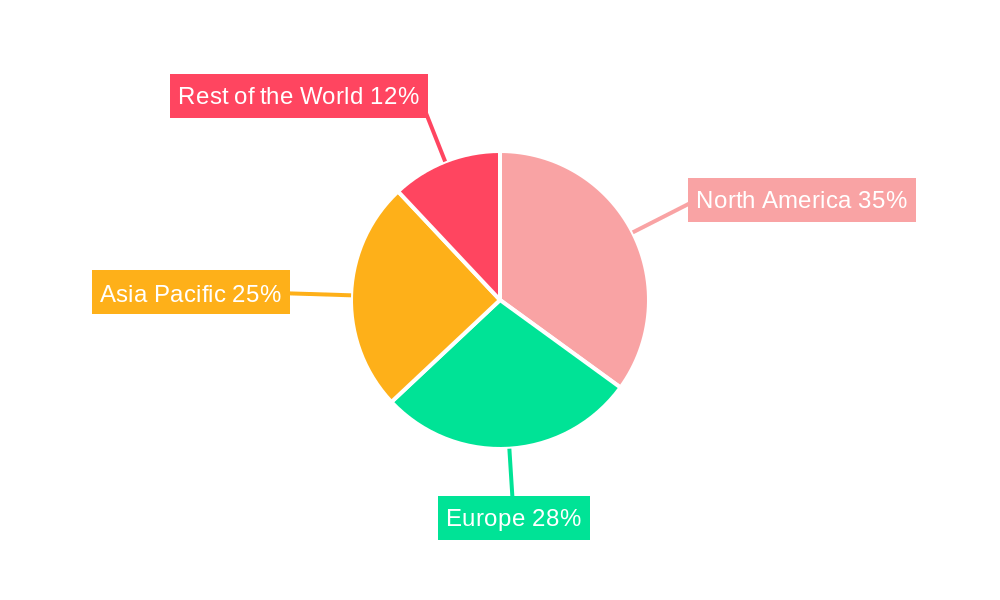

However, the market also faces challenges. High initial investment costs for infrastructure installation can be a deterrent for both consumers and businesses. Concerns about charging efficiency and range anxiety also persist. Standardization issues and regulatory uncertainties could potentially hamper widespread adoption. Despite these challenges, the long-term outlook for the wireless EV charging market remains positive, fueled by continuous technological advancements, increasing government incentives promoting EV adoption, and growing consumer awareness of environmental sustainability. The focus will likely shift towards enhancing charging efficiency, lowering costs, and addressing standardization concerns to facilitate more rapid market expansion throughout the forecast period (2025-2033). Over the next decade, substantial growth is expected across all regions, with North America and Asia Pacific anticipated to be leading markets, driven by strong EV adoption rates and supportive government policies.

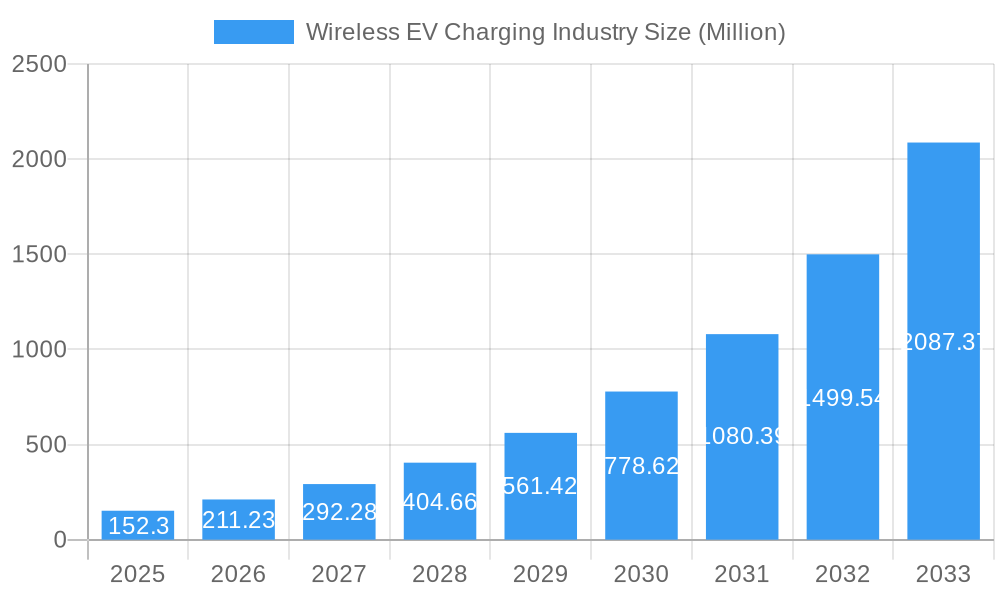

Wireless EV Charging Industry Company Market Share

This comprehensive report provides a detailed analysis of the Wireless EV Charging industry, covering market size, growth drivers, competitive landscape, technological advancements, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers invaluable insights for industry stakeholders, investors, and researchers. The report leverages extensive data and analysis to provide a clear understanding of this rapidly evolving market, projecting a market value exceeding $XX Million by 2033.

Wireless EV Charging Industry Market Structure & Competitive Landscape

The Wireless EV Charging industry exhibits a moderately concentrated market structure, with several key players vying for market share. The Herfindahl-Hirschman Index (HHI) is estimated at xx, indicating a competitive landscape with room for both established players and emerging startups. Innovation plays a crucial role, with companies continuously investing in R&D to improve efficiency, range, and charging speed. Regulatory frameworks, including safety standards and interoperability requirements, significantly influence market dynamics. Product substitutes, primarily conventional wired charging infrastructure, still hold a substantial market share but are facing increasing pressure from the benefits offered by wireless technology. End-user segmentation heavily emphasizes passenger cars, with the commercial vehicle segment exhibiting strong growth potential.

Key aspects influencing the market structure:

- Market Concentration: HHI estimated at xx.

- Innovation Drivers: Focus on increased charging efficiency, power output, and range extension.

- Regulatory Impacts: Safety standards, interoperability protocols, and government incentives significantly impact adoption rates.

- Product Substitutes: Wired charging remains a competitive alternative.

- End-User Segmentation: Passenger cars dominate, with commercial vehicle adoption accelerating.

- M&A Trends: xx M&A deals were recorded during the historical period (2019-2024), indicating considerable consolidation activity within the market.

Wireless EV Charging Industry Market Trends & Opportunities

The global Wireless EV Charging market is experiencing significant growth, driven by the increasing adoption of electric vehicles (EVs) and the inherent convenience and efficiency offered by wireless charging technology. The market size is projected to reach $XX Million by 2025 and is anticipated to witness a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Technological advancements, such as improved charging coils, higher power transfer efficiencies, and dynamic charging systems are further bolstering market growth. Consumer preferences are shifting towards convenience and seamless charging experiences, making wireless charging a compelling proposition. The competitive landscape is dynamic, with both established automotive players and specialized technology firms actively involved in developing and deploying wireless charging solutions. Market penetration is currently at xx%, with projections indicating a substantial increase to xx% by 2033.

Dominant Markets & Segments in Wireless EV Charging Industry

The North American market currently holds a dominant position in the wireless EV charging industry, driven by strong EV adoption rates, supportive government policies, and a robust charging infrastructure development. The passenger car segment represents the largest market share, owing to the high volume of EV passenger car sales.

Key Growth Drivers:

- Government Incentives and Policies: Tax credits, subsidies, and mandates are promoting the adoption of wireless charging infrastructure.

- Rising EV Adoption: Increased sales of electric vehicles globally are fueling demand for convenient charging solutions.

- Technological Advancements: Improved efficiency, range, and power transfer capabilities enhance the appeal of wireless EV charging.

- Infrastructure Development: Public and private sector investments in wireless charging stations are supporting market growth.

Market Dominance Analysis: North America's dominance stems from the early adoption of EVs and substantial investments in charging infrastructure development. The passenger car segment's dominance is a direct reflection of the current market composition, with commercial vehicles expected to exhibit stronger growth in the coming years.

Wireless EV Charging Industry Product Analysis

Wireless EV charging products are evolving rapidly, focusing on improved efficiency, power output, and integration with existing EV charging infrastructure. Technological advancements include the development of more efficient resonant coils, dynamic charging systems for improved charging speed and safety, and integrated wireless charging pads that seamlessly integrate into parking spaces or roadways. Market fit is strongly linked to consumer convenience and cost-effectiveness, requiring the industry to balance technological innovation with practical applications and affordability.

Key Drivers, Barriers & Challenges in Wireless EV Charging Industry

Key Drivers:

- Growing EV Market: The surge in EV adoption directly translates into increased demand for efficient charging solutions.

- Technological Advancements: Continuous innovations in coil design, power transfer technology, and system integration are driving market expansion.

- Government Support: Policy incentives, subsidies, and infrastructure investments accelerate market penetration.

Key Challenges:

- High Initial Costs: The implementation of wireless charging infrastructure demands significant capital investment.

- Regulatory Hurdles: Standardization and regulatory approval processes can slow down market growth.

- Limited Range & Efficiency: Current technologies still have limitations in terms of charging range and overall efficiency compared to wired charging. This translates to a potential revenue loss of approximately $xx million annually due to incomplete charging cycles.

Growth Drivers in the Wireless EV Charging Industry Market

Technological advancements, government policies promoting EV adoption, and the increasing convenience sought by EV owners all contribute to the growth of the wireless EV charging market. Innovations in resonant coupling and dynamic wireless charging are improving efficiency and charging speed. Governments are actively investing in installing public wireless charging infrastructure, encouraging widespread adoption.

Challenges Impacting Wireless EV Charging Industry Growth

High initial setup costs for wireless charging infrastructure, lack of standardization across different systems, and potential safety concerns pose significant challenges to market growth. Concerns over efficiency, charging range, and foreign object detection can hinder adoption. Regulatory uncertainty and a lack of standardized protocols further complicate market expansion.

Key Players Shaping the Wireless EV Charging Industry Market

- Tgood Electric Co

- Witricity Corporation

- HEVO Inc

- Elix Wireless Inc

- Evatran Group Inc

- EFACEC

- Continental AG

- Toshiba Corporation

- Robert Bosch GmbH

- ZTE Corporation

- Momentum Dynamics Corporation

- Hella Kgaa Hueck & Co

- Toyota Motor Corporation

- Hella Aglaia Mobile Vision

- Mojo Mobility

Significant Wireless EV Charging Industry Milestones

- December 2022: Electreon Germany GmbH initiates a public wireless charging infrastructure project in Germany, installing two static charging stations along a 1 km road stretch.

- 2022: WiTricity acquires Qualcomm Halo™, gaining access to valuable WEVC patents and an exclusive license.

Future Outlook for Wireless EV Charging Industry Market

The wireless EV charging market is poised for substantial growth, driven by ongoing technological advancements, supportive government policies, and increasing demand from the burgeoning EV sector. Strategic collaborations between automakers and technology companies are further accelerating market expansion. The market's future hinges on overcoming challenges related to cost, standardization, and efficiency, but the long-term prospects remain very positive, with significant market potential for both established players and new entrants.

Wireless EV Charging Industry Segmentation

-

1. Vehicle Type

- 1.1. Passenger Cars

- 1.2. Commercial Vehicles

-

2. Application Type

- 2.1. Residential

- 2.2. Commercial

Wireless EV Charging Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. Australia

- 3.4. Rest of Asia Pacific

- 4. Rest of the World

Wireless EV Charging Industry Regional Market Share

Geographic Coverage of Wireless EV Charging Industry

Wireless EV Charging Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 38.40% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Adoption Of Electric Vehicles; Government Support And Incentives

- 3.3. Market Restrains

- 3.3.1. Higher Cost May hinder the Market Growth

- 3.4. Market Trends

- 3.4.1. Increasing Passenger Car Sales To Propel The Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Wireless EV Charging Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Passenger Cars

- 5.1.2. Commercial Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Application Type

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. North America Wireless EV Charging Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.1.1. Passenger Cars

- 6.1.2. Commercial Vehicles

- 6.2. Market Analysis, Insights and Forecast - by Application Type

- 6.2.1. Residential

- 6.2.2. Commercial

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7. Europe Wireless EV Charging Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.1.1. Passenger Cars

- 7.1.2. Commercial Vehicles

- 7.2. Market Analysis, Insights and Forecast - by Application Type

- 7.2.1. Residential

- 7.2.2. Commercial

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8. Asia Pacific Wireless EV Charging Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.1.1. Passenger Cars

- 8.1.2. Commercial Vehicles

- 8.2. Market Analysis, Insights and Forecast - by Application Type

- 8.2.1. Residential

- 8.2.2. Commercial

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9. Rest of the World Wireless EV Charging Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.1.1. Passenger Cars

- 9.1.2. Commercial Vehicles

- 9.2. Market Analysis, Insights and Forecast - by Application Type

- 9.2.1. Residential

- 9.2.2. Commercial

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Tgood Electric Co

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Witricity Corporation

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 HEVO Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Elix Wireless Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Evatran Group Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 EFACEC

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Continental AG

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Toshiba Corporation*List Not Exhaustive

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Robert Bosch GmbH

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 ZTE Corporation

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Momentum Dynamics Corporation

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Hella Kgaa Hueck & Co

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Toyota Motor Corporation

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 Hella Aglaia Mobile Vision

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.15 Mojo Mobility

- 10.2.15.1. Overview

- 10.2.15.2. Products

- 10.2.15.3. SWOT Analysis

- 10.2.15.4. Recent Developments

- 10.2.15.5. Financials (Based on Availability)

- 10.2.1 Tgood Electric Co

List of Figures

- Figure 1: Global Wireless EV Charging Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Wireless EV Charging Industry Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 3: North America Wireless EV Charging Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 4: North America Wireless EV Charging Industry Revenue (Million), by Application Type 2025 & 2033

- Figure 5: North America Wireless EV Charging Industry Revenue Share (%), by Application Type 2025 & 2033

- Figure 6: North America Wireless EV Charging Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Wireless EV Charging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Wireless EV Charging Industry Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 9: Europe Wireless EV Charging Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 10: Europe Wireless EV Charging Industry Revenue (Million), by Application Type 2025 & 2033

- Figure 11: Europe Wireless EV Charging Industry Revenue Share (%), by Application Type 2025 & 2033

- Figure 12: Europe Wireless EV Charging Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Wireless EV Charging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Wireless EV Charging Industry Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 15: Asia Pacific Wireless EV Charging Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 16: Asia Pacific Wireless EV Charging Industry Revenue (Million), by Application Type 2025 & 2033

- Figure 17: Asia Pacific Wireless EV Charging Industry Revenue Share (%), by Application Type 2025 & 2033

- Figure 18: Asia Pacific Wireless EV Charging Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Wireless EV Charging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World Wireless EV Charging Industry Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 21: Rest of the World Wireless EV Charging Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 22: Rest of the World Wireless EV Charging Industry Revenue (Million), by Application Type 2025 & 2033

- Figure 23: Rest of the World Wireless EV Charging Industry Revenue Share (%), by Application Type 2025 & 2033

- Figure 24: Rest of the World Wireless EV Charging Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Rest of the World Wireless EV Charging Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Wireless EV Charging Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 2: Global Wireless EV Charging Industry Revenue Million Forecast, by Application Type 2020 & 2033

- Table 3: Global Wireless EV Charging Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Wireless EV Charging Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 5: Global Wireless EV Charging Industry Revenue Million Forecast, by Application Type 2020 & 2033

- Table 6: Global Wireless EV Charging Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Wireless EV Charging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Wireless EV Charging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Rest of North America Wireless EV Charging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global Wireless EV Charging Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 11: Global Wireless EV Charging Industry Revenue Million Forecast, by Application Type 2020 & 2033

- Table 12: Global Wireless EV Charging Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Germany Wireless EV Charging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Wireless EV Charging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: France Wireless EV Charging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Rest of Europe Wireless EV Charging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Global Wireless EV Charging Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 18: Global Wireless EV Charging Industry Revenue Million Forecast, by Application Type 2020 & 2033

- Table 19: Global Wireless EV Charging Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 20: China Wireless EV Charging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Japan Wireless EV Charging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Australia Wireless EV Charging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Rest of Asia Pacific Wireless EV Charging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Global Wireless EV Charging Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 25: Global Wireless EV Charging Industry Revenue Million Forecast, by Application Type 2020 & 2033

- Table 26: Global Wireless EV Charging Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Wireless EV Charging Industry?

The projected CAGR is approximately 38.40%.

2. Which companies are prominent players in the Wireless EV Charging Industry?

Key companies in the market include Tgood Electric Co, Witricity Corporation, HEVO Inc, Elix Wireless Inc, Evatran Group Inc, EFACEC, Continental AG, Toshiba Corporation*List Not Exhaustive, Robert Bosch GmbH, ZTE Corporation, Momentum Dynamics Corporation, Hella Kgaa Hueck & Co, Toyota Motor Corporation, Hella Aglaia Mobile Vision, Mojo Mobility.

3. What are the main segments of the Wireless EV Charging Industry?

The market segments include Vehicle Type, Application Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 152.30 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Adoption Of Electric Vehicles; Government Support And Incentives.

6. What are the notable trends driving market growth?

Increasing Passenger Car Sales To Propel The Market Growth.

7. Are there any restraints impacting market growth?

Higher Cost May hinder the Market Growth.

8. Can you provide examples of recent developments in the market?

In December 2022, Electreon Germany GmbH, a subsidiary of Electreon Wireless LTD, a provider of wireless charging solutions for electric vehicles, started their project of public wireless charging infrastructure for electric cars in Germany. The company will also install two static charging stations along a 1 km stretch of road, and the two locations will be chosen based on the bus route and the stops the bus makes while operating.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Wireless EV Charging Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Wireless EV Charging Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Wireless EV Charging Industry?

To stay informed about further developments, trends, and reports in the Wireless EV Charging Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence