Key Insights

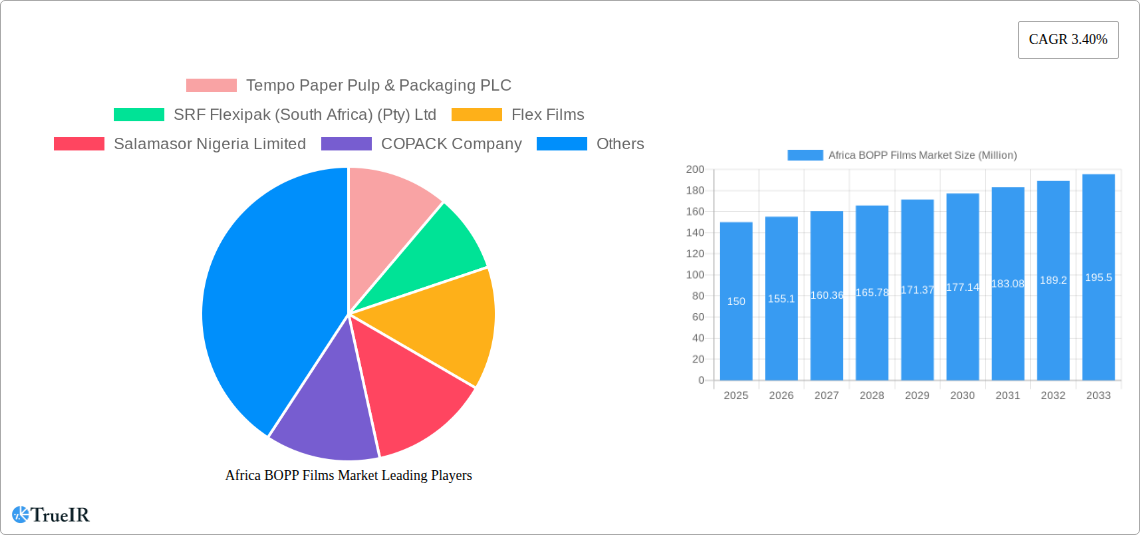

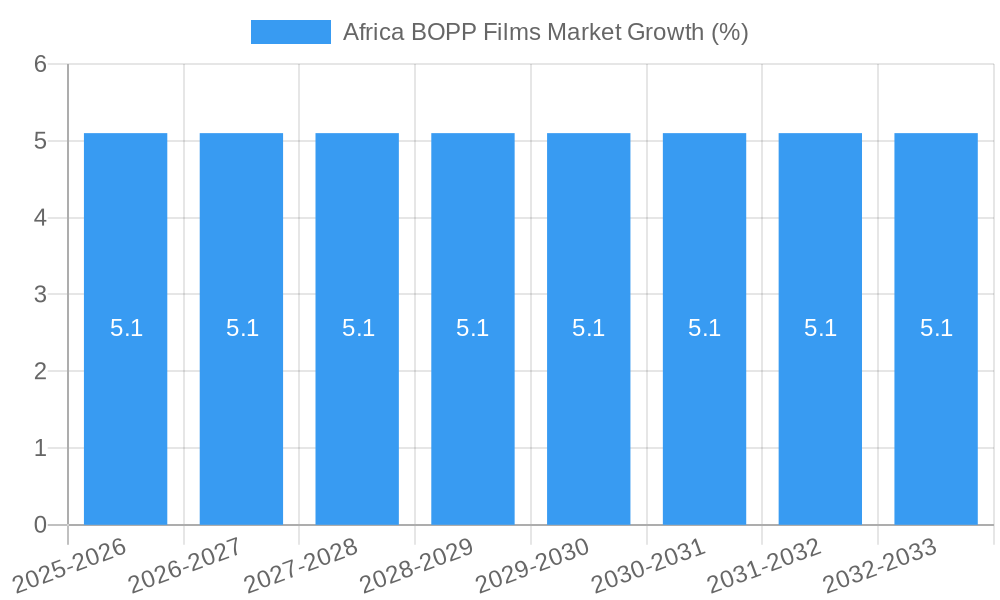

The African BOPP (Biaxially Oriented Polypropylene) films market presents a compelling growth opportunity, driven by the expanding flexible packaging industry across the continent. With a current market size estimated at $XX million in 2025 and a Compound Annual Growth Rate (CAGR) of 3.40%, the market is projected to reach $YY million by 2033. This growth is fueled by several key factors: the rising demand for packaged food and consumer goods, particularly in rapidly urbanizing areas; increasing adoption of modern retail formats requiring attractive and efficient packaging; and a burgeoning manufacturing sector within key African economies like South Africa, Egypt, and Nigeria. The industrial segment, encompassing lamination, adhesives, and capacitor applications, also contributes significantly to market demand, driven by industrialization and infrastructure development across the region. While challenges remain, such as fluctuating raw material prices and inconsistent infrastructure in certain regions, the overall market outlook remains positive. Further segmentation by end-user vertical (flexible packaging dominating) and geography (South Africa holding a significant market share) allows for a detailed analysis of growth drivers and potential investment opportunities.

The competitive landscape is moderately concentrated with key players like Tempo Paper Pulp & Packaging PLC, SRF Flexipak, and Flex Films holding significant market share. However, the presence of several smaller, regional players indicates opportunities for both market expansion and potential mergers and acquisitions. The continued growth trajectory of the African BOPP films market is closely linked to the sustained economic development and urbanization across the continent. Strategic investments in infrastructure improvements and further development of the manufacturing and packaging sectors will significantly enhance the overall growth potential of the BOPP films market in the coming years, creating a favorable environment for both established and emerging players. Furthermore, focusing on sustainable and eco-friendly BOPP film solutions will likely attract environmentally conscious consumers and further stimulate market growth.

This dynamic report provides a comprehensive analysis of the Africa BOPP Films Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. With a detailed study period spanning 2019-2033 (Base Year: 2025, Estimated Year: 2025, Forecast Period: 2025-2033, Historical Period: 2019-2024), this report unveils market trends, growth drivers, challenges, and competitive dynamics, projecting significant growth opportunities in the coming years.

Africa BOPP Films Market Structure & Competitive Landscape

This section delves into the competitive landscape of the Africa BOPP Films Market, analyzing market concentration, innovation drivers, regulatory influences, and prevalent M&A activities. The market exhibits a moderately fragmented structure, with several key players vying for market share. Concentration ratios are estimated at xx% for the top 3 players in 2025, indicating a competitive yet evolving market.

- Market Concentration: The market displays a moderately fragmented structure, with no single dominant player controlling a significant portion of the market. This is attributed to both the presence of several established players and the emergence of smaller, regional players. The Herfindahl-Hirschman Index (HHI) is estimated at xx in 2025.

- Innovation Drivers: Continuous advancements in film technology, such as improvements in barrier properties, enhanced clarity, and improved printability, are driving market growth. The increasing demand for sustainable and eco-friendly packaging solutions is further fostering innovation.

- Regulatory Impacts: Government regulations pertaining to food safety and environmental protection are influencing the adoption of BOPP films. Compliance standards drive the demand for higher-quality, compliant films.

- Product Substitutes: While BOPP films are widely used, they face competition from alternative packaging materials like paper, aluminum foil, and other specialized films. This necessitates continuous innovation to maintain a competitive edge.

- End-user Segmentation: The market is segmented by end-user vertical into flexible packaging (the largest segment), industrial applications (lamination, adhesives, capacitors), and other end-user verticals. The growth of the flexible packaging segment is particularly prominent due to the increasing demand for packaged consumer goods.

- M&A Trends: The market has witnessed a moderate level of mergers and acquisitions (M&A) activity in recent years. The total value of M&A transactions in the past five years is estimated at xx Million. Strategic acquisitions have been focused on expanding geographic reach and enhancing product portfolios.

Africa BOPP Films Market Market Trends & Opportunities

The Africa BOPP Films Market is projected to experience substantial growth during the forecast period (2025-2033), driven by a multitude of factors including rising disposable incomes, population growth, urbanization, and a burgeoning consumer goods sector. The market size is estimated at xx Million in 2025, projected to reach xx Million by 2033, exhibiting a CAGR of xx%.

Technological advancements, specifically in film properties and production processes, are continuously optimizing the efficiency and cost-effectiveness of BOPP film manufacturing and enhancing the final product's quality. Consumer preferences are shifting towards sustainable and convenient packaging options, driving demand for eco-friendly BOPP films. The market also shows potential for growth in specialized applications, such as high-barrier films for food packaging and films with improved functionalities like heat-sealing or anti-fog properties. Competitive dynamics are characterized by a mix of established players and emerging companies, driving innovation and price competition. Market penetration rates in key African countries, particularly in Egypt, South Africa, and Nigeria, are still relatively low, indicating significant untapped potential for growth.

Dominant Markets & Segments in Africa BOPP Films Market

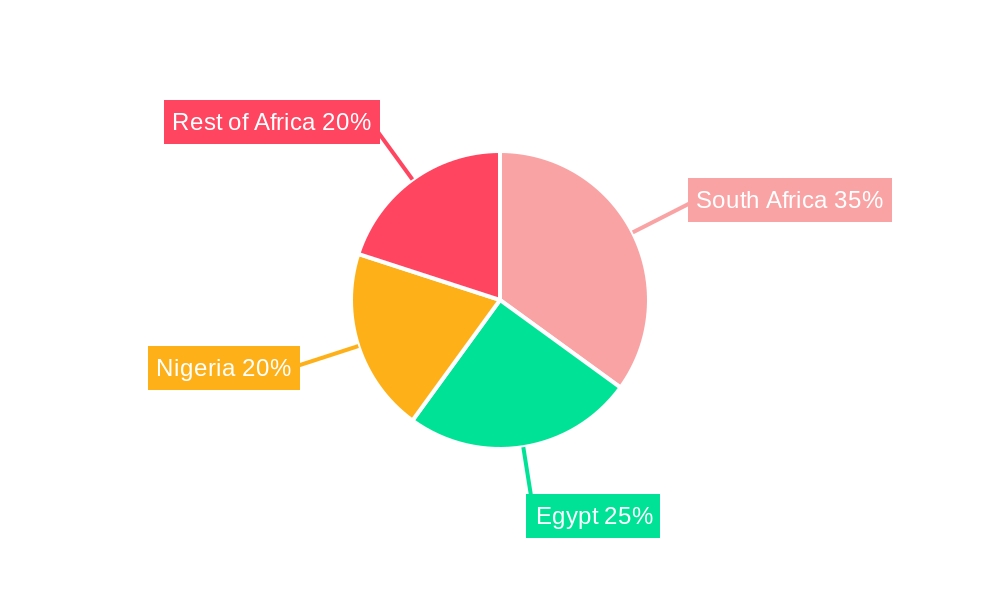

The flexible packaging segment dominates the Africa BOPP Films Market, driven by a surge in demand for packaged food and consumer products. South Africa and Nigeria represent the largest national markets, while Egypt also displays significant growth potential.

By End-user Vertical:

- Flexible Packaging: This segment holds the largest market share, driven by increasing demand for packaged food and consumer goods. Growth is fueled by rising disposable incomes and changing lifestyles across the region.

- Industrial (Lamination, Adhesives, and Capacitor): This segment is relatively smaller but is expected to experience steady growth driven by industrial expansion and infrastructure development.

- Other End-user Verticals: This includes niche applications, which offer potential for future growth.

By Country:

- South Africa: South Africa leads the market due to its well-established manufacturing sector and advanced infrastructure.

- Nigeria: Nigeria shows significant growth potential driven by its large population and growing consumer market.

- Egypt: Egypt's rapidly growing economy and improving infrastructure are driving demand.

- Rest of Africa: The remaining African countries hold considerable potential, albeit with varying degrees of market maturity and infrastructure development.

Key Growth Drivers:

- Rising Disposable Incomes: Increased purchasing power fuels demand for packaged goods.

- Population Growth & Urbanization: Growing populations, particularly in urban centers, drive consumption.

- Infrastructure Development: Improved infrastructure facilitates efficient manufacturing and distribution.

- Government Policies: Favorable government regulations and policies promoting industrial growth play a crucial role.

Africa BOPP Films Market Product Analysis

BOPP film innovation centers on enhanced barrier properties (e.g., moisture, oxygen), improved clarity and printability, and the development of more sustainable and recyclable options. These advancements directly improve product shelf life, aesthetics, and meet evolving consumer preferences for eco-friendly packaging solutions. Competitive advantages lie in superior film quality, cost-effectiveness, and the ability to meet specific end-user needs (e.g., specialized coatings for food applications).

Key Drivers, Barriers & Challenges in Africa BOPP Films Market

Key Drivers:

The market's growth is fueled by rising disposable incomes, increasing demand for packaged goods, and the expansion of the consumer goods sector across Africa. Government initiatives supporting industrial development further bolster growth. Technological advancements in film production methods and improved film properties are driving product innovation and market penetration.

Key Challenges & Restraints:

Infrastructure limitations in certain African countries hinder efficient production and distribution. Fluctuations in raw material prices, particularly resin costs, impact profitability. Stringent regulatory compliance requirements can pose challenges for manufacturers. Intense competition among players, coupled with the entry of new market participants, impacts pricing and profitability. These factors collectively constrain market expansion.

Growth Drivers in the Africa BOPP Films Market Market

Growth is primarily driven by rising disposable incomes and consumer spending, along with the expanding food and beverage and consumer goods industries. Government policies focused on industrial development and infrastructure improvements also contribute significantly to market expansion.

Challenges Impacting Africa BOPP Films Market Growth

Challenges include inconsistent infrastructure, leading to supply chain bottlenecks and high transportation costs. Raw material price volatility and stringent regulatory compliance requirements also hinder consistent growth. The competitive market with numerous players exerts downward pressure on margins.

Key Players Shaping the Africa BOPP Films Market Market

- Tempo Paper Pulp & Packaging PLC

- SRF Flexipak (South Africa) (Pty) Ltd

- Flex Films

- Salamasor Nigeria Limited

- COPACK Company

- Flexible Packages Convertors (Pty) Ltd

- elm films

- Richflex (Pty) Ltd

- Taghleef Industries S A E

- Cosmo Films Ltd

Significant Africa BOPP Films Market Industry Milestones

- February 2022: SRF, an Indian chemical and film conglomerate, announced plans to establish a second BOPP film manufacturing facility in Indore, India, expanding its global production capacity. This significantly increases the supply of BOPP films in the global market and potentially impacts pricing and availability in the African market. The establishment of an additional aluminum foil manufacturing facility at the same site further underscores SRF’s strategic commitment to the packaging films sector.

Future Outlook for Africa BOPP Films Market Market

The Africa BOPP Films Market presents significant growth opportunities driven by expanding economies, rising consumer spending, and urbanization. Strategic investments in infrastructure development and the adoption of sustainable packaging practices will further propel market expansion. New product innovations, such as enhanced barrier films and eco-friendly options, will shape market dynamics and cater to evolving consumer preferences. The market is poised for substantial growth in the coming years.

Africa BOPP Films Market Segmentation

-

1. End-user Vertical

- 1.1. Flexible Packaging

- 1.2. Industrial (Lamination, Adhesives, and Capacitor)

- 1.3. Other End-user Verticals

Africa BOPP Films Market Segmentation By Geography

-

1. Africa

- 1.1. Nigeria

- 1.2. South Africa

- 1.3. Egypt

- 1.4. Kenya

- 1.5. Ethiopia

- 1.6. Morocco

- 1.7. Ghana

- 1.8. Algeria

- 1.9. Tanzania

- 1.10. Ivory Coast

Africa BOPP Films Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.40% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand from Retail Sector; Increasing Demand for Packaged Food

- 3.3. Market Restrains

- 3.3.1. Growing Threat from Other Environmentally Friendly Films

- 3.4. Market Trends

- 3.4.1. Growing Demand from the Retail Sector

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa BOPP Films Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.1.1. Flexible Packaging

- 5.1.2. Industrial (Lamination, Adhesives, and Capacitor)

- 5.1.3. Other End-user Verticals

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Africa

- 5.1. Market Analysis, Insights and Forecast - by End-user Vertical

- 6. South Africa Africa BOPP Films Market Analysis, Insights and Forecast, 2019-2031

- 7. Sudan Africa BOPP Films Market Analysis, Insights and Forecast, 2019-2031

- 8. Uganda Africa BOPP Films Market Analysis, Insights and Forecast, 2019-2031

- 9. Tanzania Africa BOPP Films Market Analysis, Insights and Forecast, 2019-2031

- 10. Kenya Africa BOPP Films Market Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Africa Africa BOPP Films Market Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Tempo Paper Pulp & Packaging PLC

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 SRF Flexipak (South Africa) (Pty) Ltd

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Flex Films

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Salamasor Nigeria Limited

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 COPACK Company

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Flexible Packages Convertors (Pty) Ltd*List Not Exhaustive

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 elm films

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Richflex (Pty) Ltd

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Taghleef Industries S A E

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Cosmo Films Ltd

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Tempo Paper Pulp & Packaging PLC

List of Figures

- Figure 1: Africa BOPP Films Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Africa BOPP Films Market Share (%) by Company 2024

List of Tables

- Table 1: Africa BOPP Films Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Africa BOPP Films Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 3: Africa BOPP Films Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Africa BOPP Films Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: South Africa Africa BOPP Films Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Sudan Africa BOPP Films Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Uganda Africa BOPP Films Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Tanzania Africa BOPP Films Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Kenya Africa BOPP Films Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of Africa Africa BOPP Films Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Africa BOPP Films Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 12: Africa BOPP Films Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: Nigeria Africa BOPP Films Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: South Africa Africa BOPP Films Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Egypt Africa BOPP Films Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Kenya Africa BOPP Films Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Ethiopia Africa BOPP Films Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Morocco Africa BOPP Films Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Ghana Africa BOPP Films Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Algeria Africa BOPP Films Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Tanzania Africa BOPP Films Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Ivory Coast Africa BOPP Films Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa BOPP Films Market?

The projected CAGR is approximately 3.40%.

2. Which companies are prominent players in the Africa BOPP Films Market?

Key companies in the market include Tempo Paper Pulp & Packaging PLC, SRF Flexipak (South Africa) (Pty) Ltd, Flex Films, Salamasor Nigeria Limited, COPACK Company, Flexible Packages Convertors (Pty) Ltd*List Not Exhaustive, elm films, Richflex (Pty) Ltd, Taghleef Industries S A E, Cosmo Films Ltd.

3. What are the main segments of the Africa BOPP Films Market?

The market segments include End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand from Retail Sector; Increasing Demand for Packaged Food.

6. What are the notable trends driving market growth?

Growing Demand from the Retail Sector.

7. Are there any restraints impacting market growth?

Growing Threat from Other Environmentally Friendly Films.

8. Can you provide examples of recent developments in the market?

February 2022: SRF, an Indian chemical and film conglomerate, will expand its global network of BOPP production facilities by opening a second BOPP film manufacturing facility in Indore, Madhya Pradesh. SRF now has BOPP production facilities in South Africa, India, and Thailand. At a new location in Jaitapur, Indore, the company will also establish an aluminium foil manufacturing facility. With a total capacity of 140,000 metric tonnes per year for BOPET and BOPP film capacity in India, 120,000 MTPA in Thailand, 45,000 MTPA in Hungary, and 30,000 MTPA in South Africa, SRF's Packaging Films Business stands out.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa BOPP Films Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa BOPP Films Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa BOPP Films Market?

To stay informed about further developments, trends, and reports in the Africa BOPP Films Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence