Key Insights

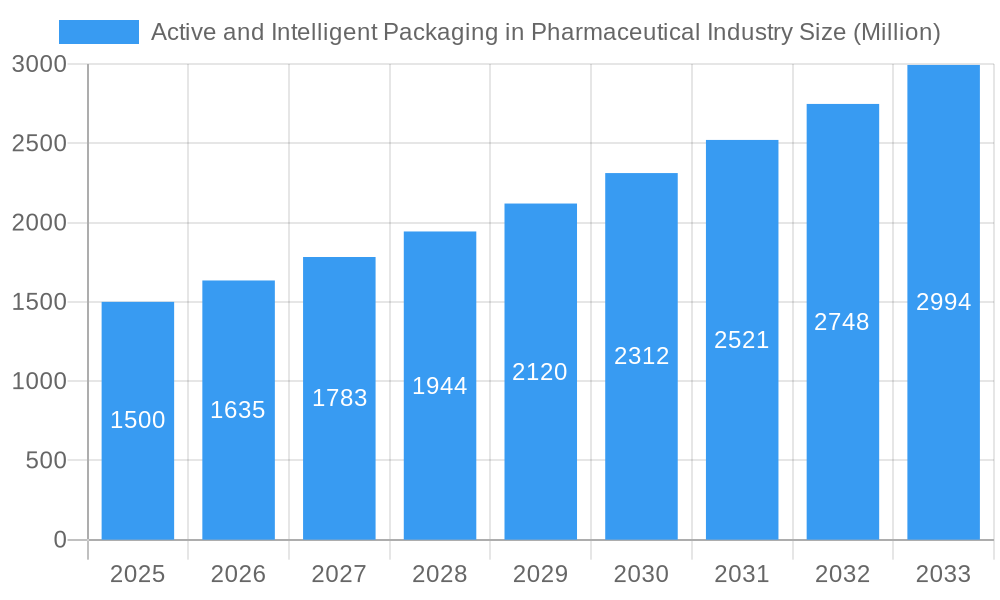

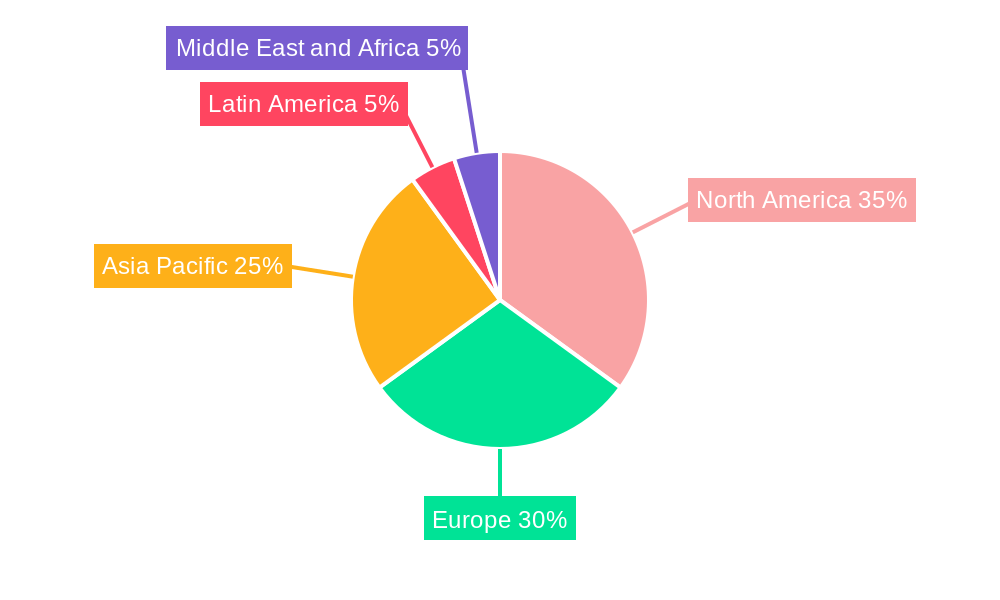

The pharmaceutical active and intelligent packaging market is experiencing significant expansion, driven by escalating demands for enhanced product safety, extended shelf life, and superior supply chain traceability. With a projected CAGR of 10.13%, the market is anticipated to grow from $12.48 billion in 2025 to reach substantial future valuations. Key growth accelerators include stringent regulatory mandates for pharmaceutical product integrity, heightened consumer awareness regarding product authenticity and freshness, and the increasing adoption of advanced technologies for real-time monitoring and data capture. The active packaging segment, featuring oxygen scavengers, moisture absorbers, and antimicrobial solutions, commands a significant market share due to its vital role in preventing degradation and spoilage. Innovations in materials science are further bolstering this segment with more effective and eco-friendly solutions. The intelligent packaging segment, encompassing time-temperature indicators (TTIs), RFID, and NFC technologies, is witnessing rapid adoption driven by the critical need for enhanced product traceability and security throughout the supply chain, enabling real-time condition monitoring, counterfeit prevention, and quality assurance. North America and Europe currently lead market share, with the Asia-Pacific region projected for robust growth fueled by expanding pharmaceutical production and increasing healthcare expenditures. While regulatory challenges and high initial investment costs present hurdles, the market outlook remains highly optimistic, with continuous technological advancements and broadening applications poised to sustain this growth trajectory.

Active and Intelligent Packaging in Pharmaceutical Industry Market Size (In Billion)

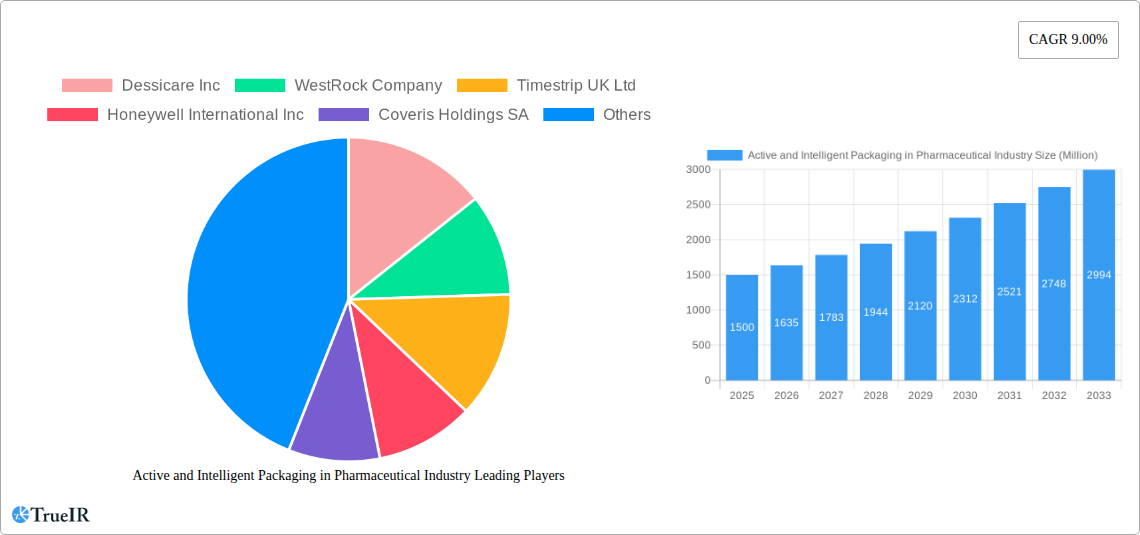

The pharmaceutical sector's embrace of active and intelligent packaging is revolutionizing medication handling and distribution. The integration of advanced sensors, such as TTIs and RFID tags, provides crucial data on temperature excursions and product authenticity, thereby mitigating risks of spoilage and counterfeiting. This enhanced supply chain visibility is indispensable for global pharmaceutical distribution, ensuring medications reach patients in optimal condition. Furthermore, the industry is increasingly prioritizing sustainable packaging materials and environmentally conscious active ingredients, reflecting a growing commitment to corporate responsibility. Intense competition among leading players, including Dessicare Inc., WestRock Company, and Amcor Ltd., is a catalyst for innovation, yielding more sophisticated and cost-effective packaging solutions. Future growth will be shaped by the ongoing development of advanced sensors capable of monitoring a wider array of parameters, the proliferation of connected packaging systems for improved data analytics, and the integration of blockchain technology for fortified supply chain security.

Active and Intelligent Packaging in Pharmaceutical Industry Company Market Share

Active and Intelligent Packaging in Pharmaceutical Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides a detailed analysis of the Active and Intelligent Packaging market within the pharmaceutical industry, covering the period from 2019 to 2033. The report offers invaluable insights into market size, growth drivers, competitive dynamics, and future outlook, enabling stakeholders to make informed strategic decisions. With a base year of 2025 and an estimated year of 2025, the forecast period spans from 2025 to 2033, building upon historical data from 2019 to 2024. The market is valued at $XX Million in 2025 and is projected to reach $XX Million by 2033, exhibiting a CAGR of XX%.

Active and Intelligent Packaging in Pharmaceutical Industry Market Structure & Competitive Landscape

The Active and Intelligent Packaging market in the pharmaceutical industry is characterized by a moderately consolidated structure. While a few major players dominate, a significant number of smaller companies contribute to innovation and niche applications. The Herfindahl-Hirschman Index (HHI) for the market in 2025 is estimated to be around XX, indicating a moderately concentrated market. Key innovation drivers include the need for enhanced product safety, extended shelf life, and improved supply chain traceability. Stringent regulatory environments and increasing consumer demand for sustainable packaging solutions are also influencing market dynamics. Product substitutes, such as traditional packaging materials, pose a competitive challenge, especially for cost-sensitive segments.

End-user segmentation is primarily driven by pharmaceutical manufacturers, distributors, and hospitals. The report analyzes the market share of each segment and predicts the future growth of each segment. Mergers and acquisitions (M&A) activity in this sector has been moderate, with approximately XX deals valued at $XX Million recorded between 2019 and 2024. Future M&A activity is expected to focus on consolidating market share and expanding into new geographical regions.

- Market Concentration: HHI estimated at XX in 2025.

- Innovation Drivers: Enhanced product safety, extended shelf life, supply chain traceability, sustainability.

- Regulatory Impacts: Stringent regulations impacting material selection and labeling.

- Product Substitutes: Traditional packaging materials.

- End-User Segmentation: Pharmaceutical manufacturers, distributors, hospitals.

- M&A Trends: Approximately XX deals between 2019 and 2024, valued at $XX Million.

Active and Intelligent Packaging in Pharmaceutical Industry Market Trends & Opportunities

The Active and Intelligent Packaging market is experiencing significant growth, driven by technological advancements, evolving consumer preferences, and a heightened focus on product integrity and safety within the pharmaceutical industry. The market is witnessing a considerable shift towards advanced packaging solutions that provide real-time data on product condition, location, and authenticity. Technological advancements like the integration of RFID and NFC tags, sensors for temperature monitoring, and smart labels are driving market expansion. Consumer demand for convenience, transparency, and safety is also fueling growth. Furthermore, the pharmaceutical industry’s increasing focus on efficient supply chain management is driving adoption of intelligent packaging for improved traceability and reduced product loss. The market’s competitive landscape is characterized by both established players and emerging innovative companies, leading to intense competition and continuous innovation.

Dominant Markets & Segments in Active and Intelligent Packaging in Pharmaceutical Industry

North America currently holds the largest market share in Active and Intelligent Packaging for the pharmaceutical industry, followed by Europe and Asia-Pacific. Within the Active Packaging segment, Oxygen Scavengers and Moisture/Humidity Absorbers represent the largest shares due to their crucial role in maintaining drug efficacy and stability. In the Intelligent Packaging segment, Time-Temperature Indicators (TTIs) and RFID/NFC technologies are experiencing the fastest growth, driven by increasing demand for enhanced product traceability and monitoring capabilities.

- Key Growth Drivers (North America): Robust pharmaceutical industry, stringent regulatory frameworks, high consumer awareness.

- Key Growth Drivers (Europe): High adoption of advanced technologies, increasing focus on supply chain security.

- Key Growth Drivers (Asia-Pacific): Rapid economic growth, rising healthcare expenditure, growing pharmaceutical industry.

- Dominant Active Packaging Segments: Oxygen Scavengers, Moisture/Humidity Absorbers.

- Dominant Intelligent Packaging Segments: Time-Temperature Indicators (TTIs), RFID/NFC.

Active and Intelligent Packaging in Pharmaceutical Industry Product Analysis

Technological advancements are driving innovation in active and intelligent packaging, leading to the development of more efficient and effective solutions. Oxygen scavengers are evolving to incorporate more effective oxygen absorption materials, while intelligent packaging is incorporating more sophisticated sensors and data-logging capabilities. These advancements provide significant competitive advantages, enabling improved product shelf life, enhanced product protection, and increased supply chain visibility. The market fit for these innovations is strong, particularly within segments requiring enhanced product safety and traceability.

Key Drivers, Barriers & Challenges in Active and Intelligent Packaging in Pharmaceutical Industry

Key Drivers: Stringent regulatory requirements for drug safety and stability, growing consumer demand for product authenticity and traceability, advancements in sensor and data-logging technologies, increasing focus on efficient supply chain management.

Key Challenges: High initial investment costs associated with implementing advanced packaging solutions, complexities in integrating new technologies into existing supply chains, potential regulatory hurdles in different countries, competition from traditional packaging materials. For instance, supply chain disruptions can lead to a XX% increase in production costs.

Growth Drivers in the Active and Intelligent Packaging in Pharmaceutical Industry Market

The key drivers for growth include technological advancements in sensor technology, increasing regulatory scrutiny regarding product authenticity and safety, and heightened demand for enhanced supply chain transparency. The growing adoption of smart packaging solutions that provide real-time data on product conditions is significantly impacting the market. Further, economic factors like growing healthcare expenditure and increasing consumer spending on pharmaceutical products are fueling market expansion.

Challenges Impacting Active and Intelligent Packaging in Pharmaceutical Industry Growth

Significant challenges impacting market growth include the high initial investment costs for advanced packaging technologies, the complexity of integrating new technologies into established supply chains, and potential regulatory hurdles in varying jurisdictions. Furthermore, competition from traditional packaging materials and the need for robust infrastructure to support advanced tracking systems pose ongoing barriers.

Key Players Shaping the Active and Intelligent Packaging in Pharmaceutical Industry Market

Significant Active and Intelligent Packaging in Pharmaceutical Industry Industry Milestones

- 2020: Introduction of new oxygen scavenger technology by Dessicare Inc, extending shelf life by XX%.

- 2021: Acquisition of a sensor technology company by Honeywell International Inc.

- 2022: Launch of a new RFID-enabled packaging solution by Amcor Ltd. for improved supply chain traceability.

- 2023: Implementation of new regulations in the EU impacting the use of certain packaging materials.

- 2024: Strategic partnership between WestRock and a major pharmaceutical company to develop sustainable packaging solutions.

Future Outlook for Active and Intelligent Packaging in Pharmaceutical Industry Market

The Active and Intelligent Packaging market is poised for significant growth over the forecast period, driven by continued technological innovation, increasing regulatory requirements, and growing consumer demand for safe and traceable pharmaceutical products. Strategic partnerships between packaging companies and pharmaceutical manufacturers are expected to drive market expansion. Opportunities lie in the development of more sustainable, eco-friendly packaging solutions and integration of advanced analytics and AI to enhance supply chain visibility and efficiency. The market is expected to witness a sustained growth trajectory in the coming years.

Active and Intelligent Packaging in Pharmaceutical Industry Segmentation

-

1. Active Packaging

- 1.1. Oxygen Scavengers

- 1.2. Microwave Susceptors

- 1.3. Odor Absorbers/Emitters

- 1.4. Moisture/ Humidity Absorbers

- 1.5. Anti-microbial Packaging

- 1.6. Others A

-

2. Intelligent Packaging

- 2.1. Coding and Marking

- 2.2. Sensors

- 2.3. RFID & NFC

- 2.4. Other Intelligent Packaging

Active and Intelligent Packaging in Pharmaceutical Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. Rest of Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Active and Intelligent Packaging in Pharmaceutical Industry Regional Market Share

Geographic Coverage of Active and Intelligent Packaging in Pharmaceutical Industry

Active and Intelligent Packaging in Pharmaceutical Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.13% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Advancements in Pharmaceutical Packaging Industry

- 3.3. Market Restrains

- 3.3.1. ; High Initial Cost for Research Activities

- 3.4. Market Trends

- 3.4.1. RFID & NFC Holds an Important Position in the Active & Intelligent Packaging in Pharmaceutical Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Active and Intelligent Packaging in Pharmaceutical Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Active Packaging

- 5.1.1. Oxygen Scavengers

- 5.1.2. Microwave Susceptors

- 5.1.3. Odor Absorbers/Emitters

- 5.1.4. Moisture/ Humidity Absorbers

- 5.1.5. Anti-microbial Packaging

- 5.1.6. Others A

- 5.2. Market Analysis, Insights and Forecast - by Intelligent Packaging

- 5.2.1. Coding and Marking

- 5.2.2. Sensors

- 5.2.3. RFID & NFC

- 5.2.4. Other Intelligent Packaging

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Active Packaging

- 6. North America Active and Intelligent Packaging in Pharmaceutical Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Active Packaging

- 6.1.1. Oxygen Scavengers

- 6.1.2. Microwave Susceptors

- 6.1.3. Odor Absorbers/Emitters

- 6.1.4. Moisture/ Humidity Absorbers

- 6.1.5. Anti-microbial Packaging

- 6.1.6. Others A

- 6.2. Market Analysis, Insights and Forecast - by Intelligent Packaging

- 6.2.1. Coding and Marking

- 6.2.2. Sensors

- 6.2.3. RFID & NFC

- 6.2.4. Other Intelligent Packaging

- 6.1. Market Analysis, Insights and Forecast - by Active Packaging

- 7. Europe Active and Intelligent Packaging in Pharmaceutical Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Active Packaging

- 7.1.1. Oxygen Scavengers

- 7.1.2. Microwave Susceptors

- 7.1.3. Odor Absorbers/Emitters

- 7.1.4. Moisture/ Humidity Absorbers

- 7.1.5. Anti-microbial Packaging

- 7.1.6. Others A

- 7.2. Market Analysis, Insights and Forecast - by Intelligent Packaging

- 7.2.1. Coding and Marking

- 7.2.2. Sensors

- 7.2.3. RFID & NFC

- 7.2.4. Other Intelligent Packaging

- 7.1. Market Analysis, Insights and Forecast - by Active Packaging

- 8. Asia Pacific Active and Intelligent Packaging in Pharmaceutical Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Active Packaging

- 8.1.1. Oxygen Scavengers

- 8.1.2. Microwave Susceptors

- 8.1.3. Odor Absorbers/Emitters

- 8.1.4. Moisture/ Humidity Absorbers

- 8.1.5. Anti-microbial Packaging

- 8.1.6. Others A

- 8.2. Market Analysis, Insights and Forecast - by Intelligent Packaging

- 8.2.1. Coding and Marking

- 8.2.2. Sensors

- 8.2.3. RFID & NFC

- 8.2.4. Other Intelligent Packaging

- 8.1. Market Analysis, Insights and Forecast - by Active Packaging

- 9. Latin America Active and Intelligent Packaging in Pharmaceutical Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Active Packaging

- 9.1.1. Oxygen Scavengers

- 9.1.2. Microwave Susceptors

- 9.1.3. Odor Absorbers/Emitters

- 9.1.4. Moisture/ Humidity Absorbers

- 9.1.5. Anti-microbial Packaging

- 9.1.6. Others A

- 9.2. Market Analysis, Insights and Forecast - by Intelligent Packaging

- 9.2.1. Coding and Marking

- 9.2.2. Sensors

- 9.2.3. RFID & NFC

- 9.2.4. Other Intelligent Packaging

- 9.1. Market Analysis, Insights and Forecast - by Active Packaging

- 10. Middle East and Africa Active and Intelligent Packaging in Pharmaceutical Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Active Packaging

- 10.1.1. Oxygen Scavengers

- 10.1.2. Microwave Susceptors

- 10.1.3. Odor Absorbers/Emitters

- 10.1.4. Moisture/ Humidity Absorbers

- 10.1.5. Anti-microbial Packaging

- 10.1.6. Others A

- 10.2. Market Analysis, Insights and Forecast - by Intelligent Packaging

- 10.2.1. Coding and Marking

- 10.2.2. Sensors

- 10.2.3. RFID & NFC

- 10.2.4. Other Intelligent Packaging

- 10.1. Market Analysis, Insights and Forecast - by Active Packaging

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Dessicare Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 WestRock Company

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Timestrip UK Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Honeywell International Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Coveris Holdings SA

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Sonoco Products Company

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Landec Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Ball Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Crown Holdings Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Bemis Company Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 BASF SE

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 CCL Industries Inc *List Not Exhaustive

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Graphic Packaging

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Sealed Air Corporation

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Amcor Ltd

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 Dessicare Inc

List of Figures

- Figure 1: Global Active and Intelligent Packaging in Pharmaceutical Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Active and Intelligent Packaging in Pharmaceutical Industry Revenue (billion), by Active Packaging 2025 & 2033

- Figure 3: North America Active and Intelligent Packaging in Pharmaceutical Industry Revenue Share (%), by Active Packaging 2025 & 2033

- Figure 4: North America Active and Intelligent Packaging in Pharmaceutical Industry Revenue (billion), by Intelligent Packaging 2025 & 2033

- Figure 5: North America Active and Intelligent Packaging in Pharmaceutical Industry Revenue Share (%), by Intelligent Packaging 2025 & 2033

- Figure 6: North America Active and Intelligent Packaging in Pharmaceutical Industry Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Active and Intelligent Packaging in Pharmaceutical Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Active and Intelligent Packaging in Pharmaceutical Industry Revenue (billion), by Active Packaging 2025 & 2033

- Figure 9: Europe Active and Intelligent Packaging in Pharmaceutical Industry Revenue Share (%), by Active Packaging 2025 & 2033

- Figure 10: Europe Active and Intelligent Packaging in Pharmaceutical Industry Revenue (billion), by Intelligent Packaging 2025 & 2033

- Figure 11: Europe Active and Intelligent Packaging in Pharmaceutical Industry Revenue Share (%), by Intelligent Packaging 2025 & 2033

- Figure 12: Europe Active and Intelligent Packaging in Pharmaceutical Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Active and Intelligent Packaging in Pharmaceutical Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Active and Intelligent Packaging in Pharmaceutical Industry Revenue (billion), by Active Packaging 2025 & 2033

- Figure 15: Asia Pacific Active and Intelligent Packaging in Pharmaceutical Industry Revenue Share (%), by Active Packaging 2025 & 2033

- Figure 16: Asia Pacific Active and Intelligent Packaging in Pharmaceutical Industry Revenue (billion), by Intelligent Packaging 2025 & 2033

- Figure 17: Asia Pacific Active and Intelligent Packaging in Pharmaceutical Industry Revenue Share (%), by Intelligent Packaging 2025 & 2033

- Figure 18: Asia Pacific Active and Intelligent Packaging in Pharmaceutical Industry Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Active and Intelligent Packaging in Pharmaceutical Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Active and Intelligent Packaging in Pharmaceutical Industry Revenue (billion), by Active Packaging 2025 & 2033

- Figure 21: Latin America Active and Intelligent Packaging in Pharmaceutical Industry Revenue Share (%), by Active Packaging 2025 & 2033

- Figure 22: Latin America Active and Intelligent Packaging in Pharmaceutical Industry Revenue (billion), by Intelligent Packaging 2025 & 2033

- Figure 23: Latin America Active and Intelligent Packaging in Pharmaceutical Industry Revenue Share (%), by Intelligent Packaging 2025 & 2033

- Figure 24: Latin America Active and Intelligent Packaging in Pharmaceutical Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Latin America Active and Intelligent Packaging in Pharmaceutical Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Active and Intelligent Packaging in Pharmaceutical Industry Revenue (billion), by Active Packaging 2025 & 2033

- Figure 27: Middle East and Africa Active and Intelligent Packaging in Pharmaceutical Industry Revenue Share (%), by Active Packaging 2025 & 2033

- Figure 28: Middle East and Africa Active and Intelligent Packaging in Pharmaceutical Industry Revenue (billion), by Intelligent Packaging 2025 & 2033

- Figure 29: Middle East and Africa Active and Intelligent Packaging in Pharmaceutical Industry Revenue Share (%), by Intelligent Packaging 2025 & 2033

- Figure 30: Middle East and Africa Active and Intelligent Packaging in Pharmaceutical Industry Revenue (billion), by Country 2025 & 2033

- Figure 31: Middle East and Africa Active and Intelligent Packaging in Pharmaceutical Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Active and Intelligent Packaging in Pharmaceutical Industry Revenue billion Forecast, by Active Packaging 2020 & 2033

- Table 2: Global Active and Intelligent Packaging in Pharmaceutical Industry Revenue billion Forecast, by Intelligent Packaging 2020 & 2033

- Table 3: Global Active and Intelligent Packaging in Pharmaceutical Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Active and Intelligent Packaging in Pharmaceutical Industry Revenue billion Forecast, by Active Packaging 2020 & 2033

- Table 5: Global Active and Intelligent Packaging in Pharmaceutical Industry Revenue billion Forecast, by Intelligent Packaging 2020 & 2033

- Table 6: Global Active and Intelligent Packaging in Pharmaceutical Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Active and Intelligent Packaging in Pharmaceutical Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Active and Intelligent Packaging in Pharmaceutical Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Global Active and Intelligent Packaging in Pharmaceutical Industry Revenue billion Forecast, by Active Packaging 2020 & 2033

- Table 10: Global Active and Intelligent Packaging in Pharmaceutical Industry Revenue billion Forecast, by Intelligent Packaging 2020 & 2033

- Table 11: Global Active and Intelligent Packaging in Pharmaceutical Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 12: United Kingdom Active and Intelligent Packaging in Pharmaceutical Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Germany Active and Intelligent Packaging in Pharmaceutical Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: France Active and Intelligent Packaging in Pharmaceutical Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Rest of Europe Active and Intelligent Packaging in Pharmaceutical Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Global Active and Intelligent Packaging in Pharmaceutical Industry Revenue billion Forecast, by Active Packaging 2020 & 2033

- Table 17: Global Active and Intelligent Packaging in Pharmaceutical Industry Revenue billion Forecast, by Intelligent Packaging 2020 & 2033

- Table 18: Global Active and Intelligent Packaging in Pharmaceutical Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 19: China Active and Intelligent Packaging in Pharmaceutical Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: India Active and Intelligent Packaging in Pharmaceutical Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Japan Active and Intelligent Packaging in Pharmaceutical Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Rest of Asia Pacific Active and Intelligent Packaging in Pharmaceutical Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Global Active and Intelligent Packaging in Pharmaceutical Industry Revenue billion Forecast, by Active Packaging 2020 & 2033

- Table 24: Global Active and Intelligent Packaging in Pharmaceutical Industry Revenue billion Forecast, by Intelligent Packaging 2020 & 2033

- Table 25: Global Active and Intelligent Packaging in Pharmaceutical Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 26: Global Active and Intelligent Packaging in Pharmaceutical Industry Revenue billion Forecast, by Active Packaging 2020 & 2033

- Table 27: Global Active and Intelligent Packaging in Pharmaceutical Industry Revenue billion Forecast, by Intelligent Packaging 2020 & 2033

- Table 28: Global Active and Intelligent Packaging in Pharmaceutical Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Active and Intelligent Packaging in Pharmaceutical Industry?

The projected CAGR is approximately 10.13%.

2. Which companies are prominent players in the Active and Intelligent Packaging in Pharmaceutical Industry?

Key companies in the market include Dessicare Inc, WestRock Company, Timestrip UK Ltd, Honeywell International Inc, Coveris Holdings SA, Sonoco Products Company, Landec Corporation, Ball Corporation, Crown Holdings Inc, Bemis Company Inc, BASF SE, CCL Industries Inc *List Not Exhaustive, Graphic Packaging, Sealed Air Corporation, Amcor Ltd.

3. What are the main segments of the Active and Intelligent Packaging in Pharmaceutical Industry?

The market segments include Active Packaging, Intelligent Packaging .

4. Can you provide details about the market size?

The market size is estimated to be USD 12.48 billion as of 2022.

5. What are some drivers contributing to market growth?

; Advancements in Pharmaceutical Packaging Industry.

6. What are the notable trends driving market growth?

RFID & NFC Holds an Important Position in the Active & Intelligent Packaging in Pharmaceutical Market.

7. Are there any restraints impacting market growth?

; High Initial Cost for Research Activities.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Active and Intelligent Packaging in Pharmaceutical Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Active and Intelligent Packaging in Pharmaceutical Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Active and Intelligent Packaging in Pharmaceutical Industry?

To stay informed about further developments, trends, and reports in the Active and Intelligent Packaging in Pharmaceutical Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence