Key Insights

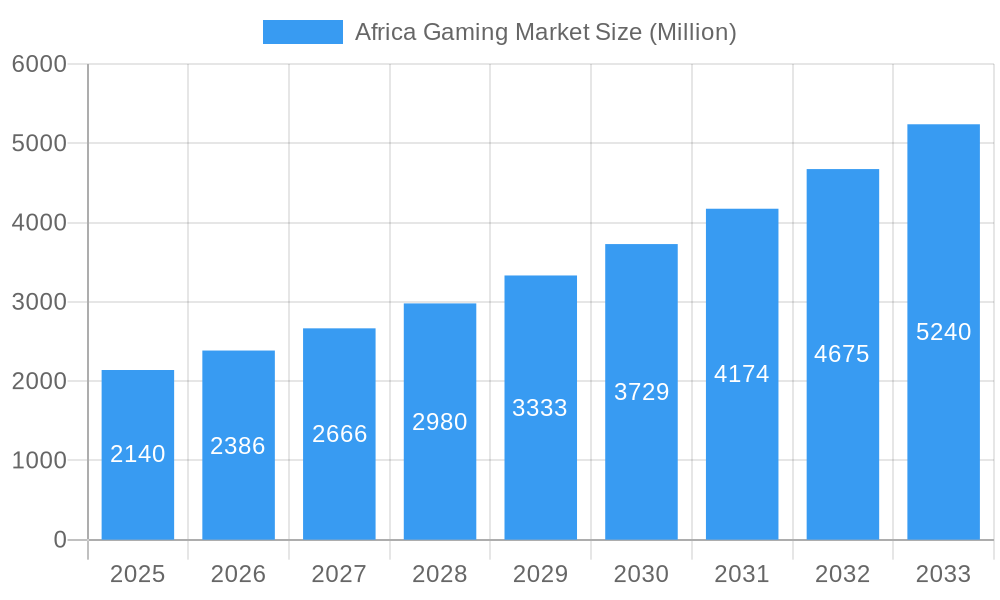

The African gaming market is experiencing robust growth, projected to reach $2.14 billion in 2025 and exhibiting a Compound Annual Growth Rate (CAGR) of 11.62% from 2025 to 2033. This expansion is driven by several key factors. The increasing smartphone penetration across the continent, particularly in countries like Nigeria, Kenya, and South Africa, provides a readily accessible platform for mobile gaming. The burgeoning young population with a strong affinity for digital entertainment fuels demand for diverse gaming experiences. Furthermore, the rise of local game development studios, like Celestial Games and Kucheza, catering to specific cultural preferences and language barriers, is fostering market diversification and growth. The increasing availability of affordable internet access, although still a challenge in certain areas, is significantly contributing to the expansion of the online gaming sector. The popularity of esports and competitive gaming further stimulates engagement and investment within the ecosystem.

Africa Gaming Market Market Size (In Billion)

However, challenges persist. Infrastructure limitations, including inconsistent internet connectivity and limited access to electricity in some regions, remain significant hurdles. The relatively low average income across certain parts of Africa can impact spending on premium games and in-app purchases. Addressing these challenges through investment in infrastructure and the development of innovative, low-bandwidth gaming solutions is crucial for continued market expansion. Future growth will likely be influenced by the success of local game developers in capturing market share, the evolution of mobile gaming technologies adapted for lower-bandwidth environments, and the increasing penetration of high-speed internet access across the continent. The market segmentation by platform (mobile, PC, console) and country (Nigeria, South Africa, Kenya, etc.) offers valuable insights into specific growth opportunities for different stakeholders.

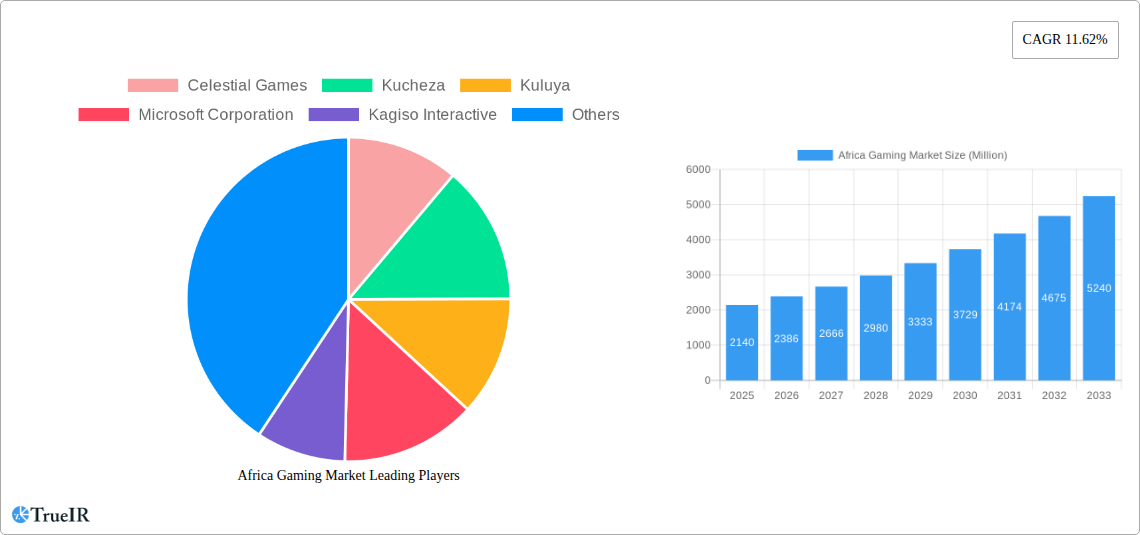

Africa Gaming Market Company Market Share

Africa Gaming Market: A Comprehensive Report (2019-2033)

This dynamic report provides a deep dive into the burgeoning Africa gaming market, offering invaluable insights for investors, industry players, and strategists. We analyze market structure, competitive dynamics, growth drivers, and challenges, projecting market trends through 2033. With detailed segmentation by platform (Browser PC, Smartphone, Tablets, Gaming Consoles, Downloaded/Box PC) and country (Nigeria, Ethiopia, Egypt, Morocco, Kenya, Algeria, South Africa), this report is your essential guide to navigating this rapidly expanding sector. The report leverages extensive data analysis from the historical period (2019-2024), base year (2025), and estimated year (2025), projecting the forecast period (2025-2033). Expect detailed analysis of key players such as Celestial Games, Kucheza, Kuluya, Microsoft Corporation, Kagiso Interactive, Gamesole, Chopup, Nyamakop, Clockwork Acorn, and Sony Corporation. Prepare to uncover lucrative opportunities and navigate the complexities of this dynamic market.

Africa Gaming Market Market Structure & Competitive Landscape

The African gaming market exhibits a fragmented structure, with a multitude of local and international players vying for market share. While larger international corporations like Microsoft Corporation and Sony Corporation hold significant influence, a significant portion of the market is occupied by smaller, regional developers and publishers like Celestial Games, Kucheza, and Kuluya, catering to specific local preferences. This competitive landscape is characterized by increasing innovation, driven by the need to cater to diverse user preferences and technological advancements.

- Market Concentration: The market concentration ratio (CR4) is estimated at xx%, indicating a relatively fragmented landscape. This is primarily due to the prevalence of smaller, nimble companies adapting quickly to evolving local needs.

- Innovation Drivers: The rising penetration of mobile devices and affordable internet access are key drivers of innovation in game development, with a surge in mobile-first games.

- Regulatory Impacts: Regulatory frameworks regarding data privacy, online content, and taxation vary significantly across African nations, influencing market dynamics and potential investment. Inconsistencies pose challenges for scaling operations across the continent.

- Product Substitutes: Other forms of entertainment, like streaming services and social media, compete for consumer time and spending, impacting the overall growth of the gaming market.

- End-User Segmentation: The market comprises diverse segments, including casual gamers, hardcore gamers, and esports enthusiasts, each with unique preferences and spending habits.

- M&A Trends: The volume of mergers and acquisitions in the African gaming sector is relatively low compared to global markets, estimated at xx deals in the past five years, however, there's potential for increased activity as the market matures and larger players seek to expand their reach.

Africa Gaming Market Market Trends & Opportunities

The African gaming market is experiencing exponential growth, fueled by increasing smartphone penetration, improving internet infrastructure, and a burgeoning young population. This expansion presents a wealth of opportunities for both local and international players. Market size is projected to reach xx Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is driven by a number of factors, including rising disposable incomes, increasing access to mobile internet, and a growing demand for localized content.

Technological shifts, such as the adoption of cloud gaming and the rise of esports, are further shaping market dynamics. Consumer preferences are evolving towards mobile gaming and free-to-play models, presenting opportunities for developers who can cater to these trends. The competitive landscape is becoming more dynamic, with increased competition from both local and international companies. Market penetration rates for mobile gaming are expected to increase significantly, exceeding xx% by 2033. This will be driven by increased affordability of smartphones, data plans, and the availability of localized games.

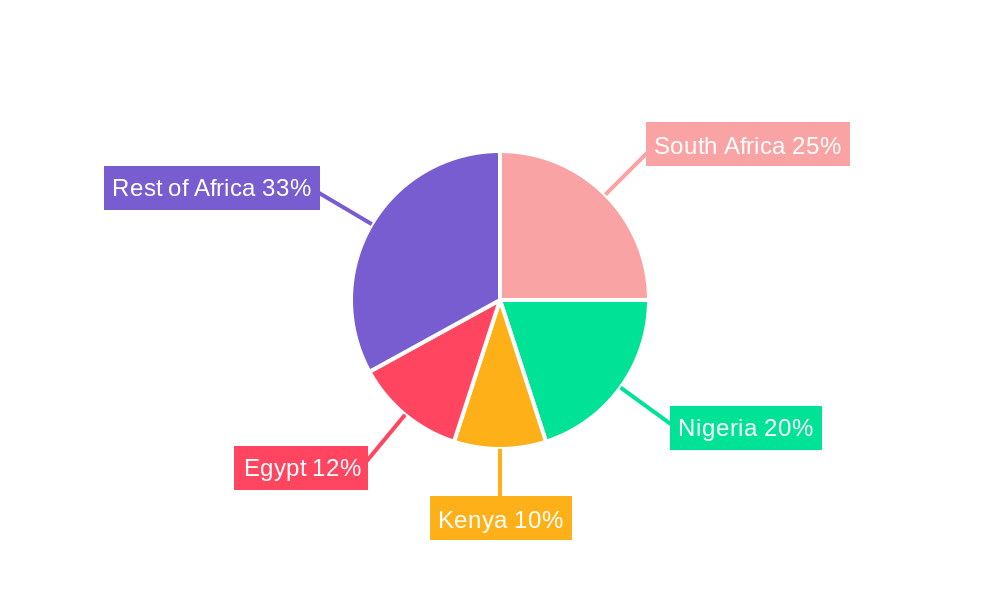

Dominant Markets & Segments in Africa Gaming Market

South Africa, Nigeria, and Egypt represent the dominant markets within the African gaming landscape. These countries boast a larger population base, higher smartphone penetration, and relatively better internet infrastructure compared to other African nations.

- Key Growth Drivers in South Africa: Strong infrastructure, government initiatives promoting digital technologies, and a growing middle class.

- Key Growth Drivers in Nigeria: High smartphone adoption rates, a large youth population, and a rapidly expanding mobile gaming market.

- Key Growth Drivers in Egypt: Growing internet penetration, increasing investment in digital infrastructure, and a sizable population of mobile phone users.

The smartphone segment is the most dominant platform, driving the majority of gaming revenue. The increasing affordability of smartphones coupled with the availability of data plans is driving massive adoption of mobile gaming in Africa. This contrasts with developed markets where gaming consoles hold more relevance. The relatively low cost of entry for mobile gaming also opens the door for greater participation and competition in the market.

Africa Gaming Market Product Analysis

The African gaming market showcases a blend of internationally recognized titles and locally developed games. Innovations focus on adapting game mechanics to accommodate low-bandwidth connections and local preferences. The prevalence of free-to-play models and mobile-first designs highlights the unique needs of the market. The competitive advantage lies in understanding cultural nuances, optimizing games for low-resource devices, and providing localized content. Technological advancements like cloud gaming are poised to disrupt the market by enhancing accessibility.

Key Drivers, Barriers & Challenges in Africa Gaming Market

Key Drivers: The rapid expansion of mobile and internet penetration, increasing disposable incomes, and a growing young population are key drivers, alongside government initiatives to boost the digital economy. Moreover, the rise of mobile money platforms facilitates easier transactions for in-app purchases.

Challenges: Challenges include high levels of internet costs and intermittent connectivity in many regions. Regulatory frameworks vary significantly across countries, creating compliance complexities for companies seeking pan-African expansion. Limited access to high-quality internet and electricity also serves as a major hurdle. Furthermore, piracy remains a major challenge, impacting revenue for game developers and publishers. These factors contribute to the slower growth rate than in developed markets. The estimated revenue loss from piracy is xx Million annually.

Growth Drivers in the Africa Gaming Market Market

Growth in the African gaming market is fueled by increasing smartphone adoption rates and falling data prices, complemented by a rising young population with disposable income and a preference for mobile-based entertainment. Government initiatives supporting digital infrastructure are also crucial.

Challenges Impacting Africa Gaming Market Growth

Challenges facing this market include inconsistent internet infrastructure across regions, piracy, and varying regulatory frameworks across countries. These factors hinder market expansion and limit potential revenue generation.

Key Players Shaping the Africa Gaming Market Market

- Celestial Games

- Kucheza

- Kuluya

- Microsoft Corporation

- Kagiso Interactive

- Gamesole

- Chopup

- Nyamakop

- Clockwork Acorn

- Sony Corporation

Significant Africa Gaming Market Industry Milestones

- November 2022: rain (South Africa) partners with NVIDIA to launch GeForce NOW, bringing high-performance cloud gaming to South Africa, significantly expanding access to a library of over 1400 games. This is a major step in improving gaming experience for millions of South African gamers.

- November 2022: Yandex Games launches in the MENA region, providing a platform for game developers and offering a diverse catalog of HTML5 games, potentially boosting local game development and market diversification.

Future Outlook for Africa Gaming Market Market

The African gaming market is poised for significant growth, driven by continued infrastructure improvements, increasing smartphone penetration, and the rising popularity of mobile gaming. Strategic investments in localized content, robust partnerships, and addressing infrastructural limitations will unlock substantial market potential. The market is ripe for innovation and disruption, providing substantial opportunities for businesses to expand within this rapidly evolving landscape.

Africa Gaming Market Segmentation

-

1. Platform

- 1.1. Browser PC

- 1.2. Smartphone

- 1.3. Tablets

- 1.4. Gaming Console

- 1.5. Downloaded/Box PC

Africa Gaming Market Segmentation By Geography

-

1. Africa

- 1.1. Nigeria

- 1.2. South Africa

- 1.3. Egypt

- 1.4. Kenya

- 1.5. Ethiopia

- 1.6. Morocco

- 1.7. Ghana

- 1.8. Algeria

- 1.9. Tanzania

- 1.10. Ivory Coast

Africa Gaming Market Regional Market Share

Geographic Coverage of Africa Gaming Market

Africa Gaming Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.62% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth in Young Population; Improvement in Technology and Internet Network Access

- 3.3. Market Restrains

- 3.3.1 Issues such as Piracy

- 3.3.2 Laws and Regulations

- 3.3.3 and Concerns Relating to Fraud During Gaming Transactions

- 3.4. Market Trends

- 3.4.1. Improvement in Technology and Internet Network Access

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa Gaming Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Platform

- 5.1.1. Browser PC

- 5.1.2. Smartphone

- 5.1.3. Tablets

- 5.1.4. Gaming Console

- 5.1.5. Downloaded/Box PC

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Africa

- 5.1. Market Analysis, Insights and Forecast - by Platform

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Celestial Games

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Kucheza

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Kuluya

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Microsoft Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Kagiso Interactive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Gamesole

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Chopup

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Nyamakop

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Clockwork Acorn

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Sony Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Celestial Games

List of Figures

- Figure 1: Africa Gaming Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Africa Gaming Market Share (%) by Company 2025

List of Tables

- Table 1: Africa Gaming Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 2: Africa Gaming Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Africa Gaming Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 4: Africa Gaming Market Revenue Million Forecast, by Country 2020 & 2033

- Table 5: Nigeria Africa Gaming Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: South Africa Africa Gaming Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Egypt Africa Gaming Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Kenya Africa Gaming Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Ethiopia Africa Gaming Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Morocco Africa Gaming Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Ghana Africa Gaming Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Algeria Africa Gaming Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Tanzania Africa Gaming Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Ivory Coast Africa Gaming Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa Gaming Market?

The projected CAGR is approximately 11.62%.

2. Which companies are prominent players in the Africa Gaming Market?

Key companies in the market include Celestial Games, Kucheza, Kuluya, Microsoft Corporation, Kagiso Interactive, Gamesole, Chopup, Nyamakop, Clockwork Acorn, Sony Corporation.

3. What are the main segments of the Africa Gaming Market?

The market segments include Platform.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.14 Million as of 2022.

5. What are some drivers contributing to market growth?

Growth in Young Population; Improvement in Technology and Internet Network Access.

6. What are the notable trends driving market growth?

Improvement in Technology and Internet Network Access.

7. Are there any restraints impacting market growth?

Issues such as Piracy. Laws and Regulations. and Concerns Relating to Fraud During Gaming Transactions.

8. Can you provide examples of recent developments in the market?

November 2022: rain, South Africa's 4G and 5G data network operator, stated the signing of a partnership agreement with NVIDIA to bring high-performance cloud gaming to South Africa with GeForce NOW, NVIDIA's premium cloud gaming service, which seamlessly streams PC games from the world's most potent GeForce-powered servers in the cloud at ultra-low latency. This partnership will allow millions of South African users to get the best gaming experience and access the top gaming titles and a streaming library of over 1400 games like A Plague's Tale: Requiem and Cyberpunk 2077 with over one hundred free-to-play titles like Fortnite and Genshin Impact.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa Gaming Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa Gaming Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa Gaming Market?

To stay informed about further developments, trends, and reports in the Africa Gaming Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence