Key Insights

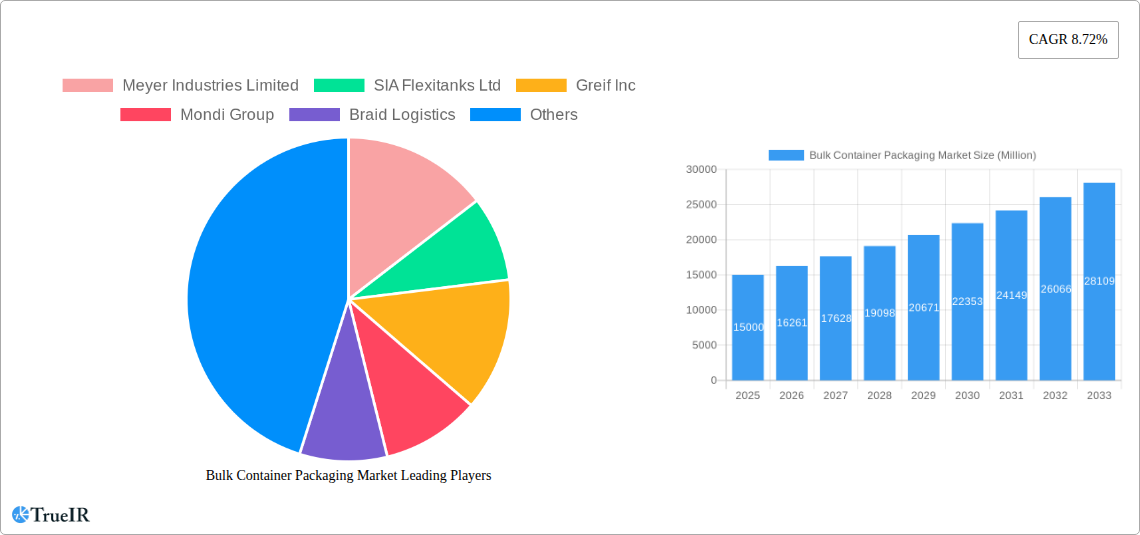

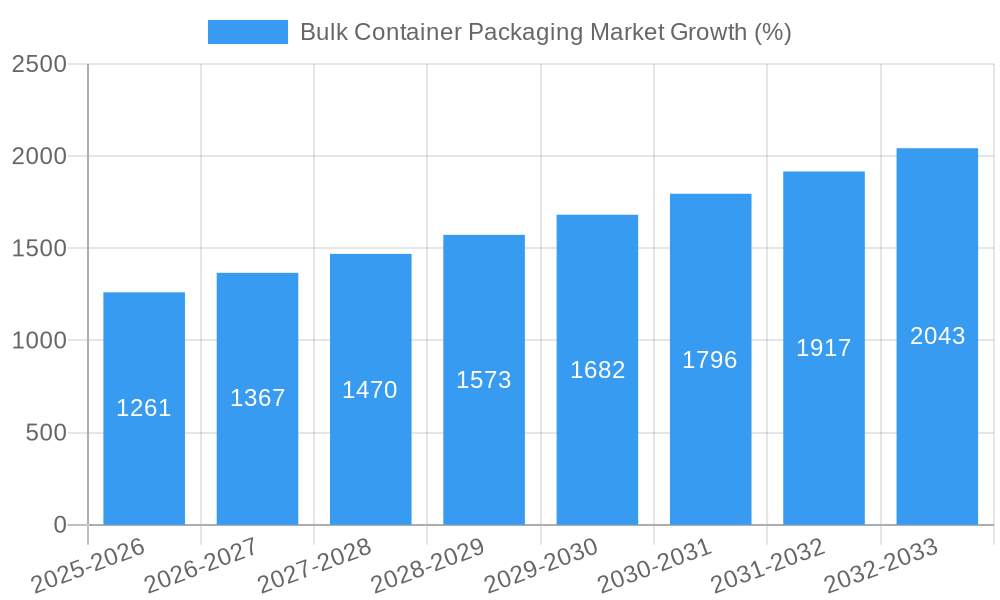

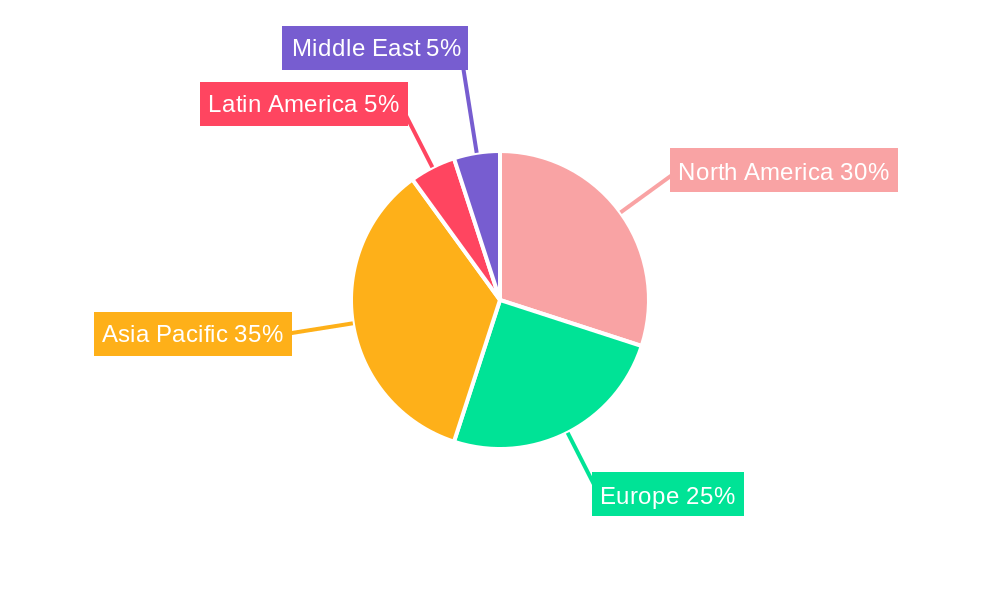

The global bulk container packaging market is experiencing robust growth, projected to reach a substantial size by 2033. A compound annual growth rate (CAGR) of 8.72% from 2019-2033 signifies a consistently expanding market driven by several key factors. The increasing demand from the chemicals and pharmaceuticals sector, fueled by rising production and stringent regulations regarding product safety and transportation, is a major contributor. Furthermore, the food and beverage industry's reliance on efficient and safe packaging solutions for diverse products boosts market growth. The rising adoption of sustainable and reusable packaging options, coupled with advancements in material science leading to lighter, stronger, and more environmentally friendly containers, are significant trends shaping the market. However, fluctuating raw material prices and the need for compliance with evolving international regulations pose challenges to market expansion. The market is segmented by end-user industry (chemicals and pharmaceuticals, food and beverages, other industries) and by type (drums, pails, material handling containers, rigid intermediate bulk containers, pallets, dunnage air bags, others). Major players like Greif Inc., Berry Global Inc., and SCHÜTZ GmbH & Co. KGaA are driving innovation and competition, fostering market expansion through strategic acquisitions and technological advancements. Geographic analysis indicates significant growth potential across various regions, particularly in rapidly developing economies of Asia-Pacific.

The market's segmentation allows for targeted strategies. The drums and pails segment dominates due to their versatility and established market presence. However, the rigid intermediate bulk containers (IBCs) segment is showing significant growth potential due to their higher capacity and efficiency in transporting large volumes of goods. The increasing focus on supply chain optimization and reduced logistics costs is also driving the adoption of more efficient bulk container packaging solutions. The continued expansion of e-commerce and the growth of the global supply chain will contribute to the sustained growth of the market throughout the forecast period, though challenges related to raw material prices and regulatory compliance will require careful navigation by industry players.

This dynamic report provides a comprehensive analysis of the Bulk Container Packaging Market, offering invaluable insights for businesses, investors, and industry professionals. With a detailed examination of market trends, competitive landscapes, and future growth projections spanning the period 2019-2033 (Study Period), this report uses 2025 as its Base Year and Estimated Year, and forecasts market performance from 2025-2033 (Forecast Period) based on the Historical Period of 2019-2024. The report leverages high-impact keywords to ensure optimal search engine visibility and features detailed segmentation by end-user industry (Chemicals and Pharmaceuticals, Food and Beverages, Other End-user Industries) and type (Drums, Pails, Material Handling Containers, Rigid Intermediate Bulk Containers, Pallets, Dunnage Air Bags, Other Types).

Bulk Container Packaging Market Market Structure & Competitive Landscape

The Bulk Container Packaging market exhibits a moderately concentrated structure, with a handful of major players holding significant market share. The Herfindahl-Hirschman Index (HHI) is estimated at xx, suggesting a competitive but not hyper-competitive landscape. Innovation drives significant market shifts, particularly in sustainable packaging materials and enhanced logistics solutions. Stringent regulatory frameworks concerning material safety and environmental impact increasingly shape market practices. Product substitution, primarily driven by advancements in lightweighting and recyclable materials, presents both opportunities and challenges for established players. The market is segmented by end-user industries, with Chemicals and Pharmaceuticals, and Food and Beverages representing the largest segments.

- Market Concentration: Estimated HHI of xx indicates a moderately concentrated market.

- Innovation Drivers: Sustainable materials (e.g., biodegradable plastics, recycled content), automated handling systems, improved barrier properties.

- Regulatory Impacts: Growing emphasis on reducing plastic waste, stricter safety standards for food and pharmaceutical packaging.

- Product Substitutes: Bio-based polymers, alternative packaging designs.

- M&A Trends: Strategic acquisitions to expand product portfolios and geographic reach. Recent transactions totaled approximately USD xx Million in the past five years. The acquisition of Lee Container Corp. by Greif exemplifies this trend.

Bulk Container Packaging Market Market Trends & Opportunities

The global Bulk Container Packaging market is experiencing robust growth, driven by factors such as increasing industrial production, rising e-commerce activities, and growing demand for efficient logistics solutions. The market size is projected to reach USD xx Million by 2033, exhibiting a CAGR of xx% during the forecast period. Technological advancements, such as the adoption of smart packaging solutions and improved material handling equipment, are significantly impacting market dynamics. Consumer preferences are shifting towards sustainable and eco-friendly packaging, creating new opportunities for businesses offering innovative solutions. Intensified competition among key players is driving innovation and efficiency improvements. Market penetration rates for sustainable packaging are steadily increasing, although significant regional variations exist.

Dominant Markets & Segments in Bulk Container Packaging Market

The North American region currently dominates the Bulk Container Packaging market, primarily driven by robust industrial output and favorable economic conditions. Within this region, the United States and Canada are the key contributors. The Chemicals and Pharmaceuticals segment holds the largest market share among the end-user industries, followed by the Food and Beverages segment. Rigid Intermediate Bulk Containers (IBCs) are the leading product type, characterized by their versatility and suitability for diverse applications.

Key Growth Drivers (North America):

- Strong industrial manufacturing base.

- Well-developed logistics infrastructure.

- Favorable regulatory environment.

Chemicals and Pharmaceuticals Segment Dominance:

- Stringent packaging requirements.

- High demand for specialized containers ensuring product integrity and safety.

Rigid IBC Market Leadership:

- Versatility and suitability across numerous applications.

- Cost-effectiveness compared to other packaging types.

Bulk Container Packaging Market Product Analysis

Recent product innovations focus on improved barrier properties, lightweighting, and enhanced recyclability. Advanced materials like high-performance polymers and bio-based alternatives are gaining traction. The key competitive advantage lies in offering sustainable, efficient, and cost-effective solutions that cater to specific end-user needs. New product developments constantly address supply chain challenges and evolving regulatory compliance needs, particularly related to environmental considerations and product safety.

Key Drivers, Barriers & Challenges in Bulk Container Packaging Market

Key Drivers:

- Growing industrialization and e-commerce boosting demand for efficient packaging.

- Increasing focus on sustainability and eco-friendly packaging materials.

- Advancements in materials science and manufacturing technologies.

Key Challenges:

- Fluctuations in raw material prices impacting production costs.

- Stringent environmental regulations and the need for compliance.

- Intense competition and price pressures from emerging market players. Supply chain disruptions, particularly observed during the post-pandemic era, continue to influence pricing and delivery timelines.

Growth Drivers in the Bulk Container Packaging Market Market

The market's growth is fueled by expanding industrial production across various sectors, the rising popularity of e-commerce, and a growing awareness of sustainable practices among consumers and businesses. Technological improvements, like lightweighting and automation, enhance efficiency and reduce costs, further promoting market expansion. Favorable government policies supporting sustainable packaging solutions are also contributing significantly.

Challenges Impacting Bulk Container Packaging Market Growth

Significant challenges include increasing raw material costs, stringent environmental regulations demanding compliance, and fierce competition from various market players. Supply chain disruptions, geopolitical instability, and fluctuating global demand also present obstacles to steady market growth.

Key Players Shaping the Bulk Container Packaging Market Market

- Meyer Industries Limited

- SIA Flexitanks Ltd

- Greif Inc (Greif Inc)

- Mondi Group (Mondi Group)

- Braid Logistics

- Berry Global Inc (Berry Global Inc)

- Trans Ocean Bulk Logistics Ltd

- SCHÜTZ GmbH & Co KGaA (SCHÜTZ GmbH & Co KGaA)

- Signode Industrial Group (Signode Industrial Group)

- National Bulk Equipment Inc

Significant Bulk Container Packaging Market Industry Milestones

- December 2022: Greif Inc. acquires Lee Container Corp. for USD 300 Million, anticipating USD 6 Million in efficiency gains. This significantly expands Greif's market presence in high-performance barrier and blow-molded containers.

- March 2022: SIA Flexitanks Ltd. introduces the Trinity Tank, a three-pod Reefer Flexitank system with a 27,000-liter capacity, revolutionizing bulk liquid transportation.

Future Outlook for Bulk Container Packaging Market Market

The Bulk Container Packaging market is poised for continued growth, driven by ongoing industrial expansion, the surge in e-commerce, and increasing demand for sustainable packaging solutions. Strategic partnerships, product innovations, and expansion into emerging markets present significant opportunities for businesses. The market's future trajectory is positive, with considerable potential for further expansion and diversification.

Bulk Container Packaging Market Segmentation

-

1. Type

- 1.1. Drums

- 1.2. Pails

- 1.3. Material Handling Containers

- 1.4. Rigid Intermediate Bulk Containers

- 1.5. Pallets

- 1.6. Dunnage Air Bags

- 1.7. Other Types

-

2. End-user Industry

- 2.1. Chemicals and Pharmaceuticals

- 2.2. Food and Beverages

- 2.3. Other End-user Industries

Bulk Container Packaging Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East

Bulk Container Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.72% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increasing Use of Flexitank

- 3.2.2 among Regional End-user Industries; Growing Export of Bulk Container Packed Products

- 3.3. Market Restrains

- 3.3.1. Increasing Price Volatility of Raw Materials

- 3.4. Market Trends

- 3.4.1. Demand for Plastic-based Packaging Solution is Expected to be a Significant Factor in Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Bulk Container Packaging Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Drums

- 5.1.2. Pails

- 5.1.3. Material Handling Containers

- 5.1.4. Rigid Intermediate Bulk Containers

- 5.1.5. Pallets

- 5.1.6. Dunnage Air Bags

- 5.1.7. Other Types

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Chemicals and Pharmaceuticals

- 5.2.2. Food and Beverages

- 5.2.3. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Bulk Container Packaging Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Drums

- 6.1.2. Pails

- 6.1.3. Material Handling Containers

- 6.1.4. Rigid Intermediate Bulk Containers

- 6.1.5. Pallets

- 6.1.6. Dunnage Air Bags

- 6.1.7. Other Types

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Chemicals and Pharmaceuticals

- 6.2.2. Food and Beverages

- 6.2.3. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Bulk Container Packaging Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Drums

- 7.1.2. Pails

- 7.1.3. Material Handling Containers

- 7.1.4. Rigid Intermediate Bulk Containers

- 7.1.5. Pallets

- 7.1.6. Dunnage Air Bags

- 7.1.7. Other Types

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Chemicals and Pharmaceuticals

- 7.2.2. Food and Beverages

- 7.2.3. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Bulk Container Packaging Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Drums

- 8.1.2. Pails

- 8.1.3. Material Handling Containers

- 8.1.4. Rigid Intermediate Bulk Containers

- 8.1.5. Pallets

- 8.1.6. Dunnage Air Bags

- 8.1.7. Other Types

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Chemicals and Pharmaceuticals

- 8.2.2. Food and Beverages

- 8.2.3. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Latin America Bulk Container Packaging Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Drums

- 9.1.2. Pails

- 9.1.3. Material Handling Containers

- 9.1.4. Rigid Intermediate Bulk Containers

- 9.1.5. Pallets

- 9.1.6. Dunnage Air Bags

- 9.1.7. Other Types

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Chemicals and Pharmaceuticals

- 9.2.2. Food and Beverages

- 9.2.3. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East Bulk Container Packaging Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Drums

- 10.1.2. Pails

- 10.1.3. Material Handling Containers

- 10.1.4. Rigid Intermediate Bulk Containers

- 10.1.5. Pallets

- 10.1.6. Dunnage Air Bags

- 10.1.7. Other Types

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Chemicals and Pharmaceuticals

- 10.2.2. Food and Beverages

- 10.2.3. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. North America Bulk Container Packaging Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Europe Bulk Container Packaging Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Asia Pacific Bulk Container Packaging Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Latin America Bulk Container Packaging Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Middle East Bulk Container Packaging Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Meyer Industries Limited

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 SIA Flexitanks Ltd

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Greif Inc

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Mondi Group

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Braid Logistics

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Berry Global Inc

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Trans Ocean Bulk Logistics Ltd

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 SCHÜTZ GmbH & Co KGaA

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Signode Industrial Group

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 National Bulk Equipment Inc

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.1 Meyer Industries Limited

List of Figures

- Figure 1: Global Bulk Container Packaging Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Bulk Container Packaging Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Bulk Container Packaging Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Bulk Container Packaging Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Bulk Container Packaging Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Bulk Container Packaging Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Bulk Container Packaging Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America Bulk Container Packaging Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America Bulk Container Packaging Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East Bulk Container Packaging Market Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East Bulk Container Packaging Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Bulk Container Packaging Market Revenue (Million), by Type 2024 & 2032

- Figure 13: North America Bulk Container Packaging Market Revenue Share (%), by Type 2024 & 2032

- Figure 14: North America Bulk Container Packaging Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 15: North America Bulk Container Packaging Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 16: North America Bulk Container Packaging Market Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Bulk Container Packaging Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Bulk Container Packaging Market Revenue (Million), by Type 2024 & 2032

- Figure 19: Europe Bulk Container Packaging Market Revenue Share (%), by Type 2024 & 2032

- Figure 20: Europe Bulk Container Packaging Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 21: Europe Bulk Container Packaging Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 22: Europe Bulk Container Packaging Market Revenue (Million), by Country 2024 & 2032

- Figure 23: Europe Bulk Container Packaging Market Revenue Share (%), by Country 2024 & 2032

- Figure 24: Asia Pacific Bulk Container Packaging Market Revenue (Million), by Type 2024 & 2032

- Figure 25: Asia Pacific Bulk Container Packaging Market Revenue Share (%), by Type 2024 & 2032

- Figure 26: Asia Pacific Bulk Container Packaging Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 27: Asia Pacific Bulk Container Packaging Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 28: Asia Pacific Bulk Container Packaging Market Revenue (Million), by Country 2024 & 2032

- Figure 29: Asia Pacific Bulk Container Packaging Market Revenue Share (%), by Country 2024 & 2032

- Figure 30: Latin America Bulk Container Packaging Market Revenue (Million), by Type 2024 & 2032

- Figure 31: Latin America Bulk Container Packaging Market Revenue Share (%), by Type 2024 & 2032

- Figure 32: Latin America Bulk Container Packaging Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 33: Latin America Bulk Container Packaging Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 34: Latin America Bulk Container Packaging Market Revenue (Million), by Country 2024 & 2032

- Figure 35: Latin America Bulk Container Packaging Market Revenue Share (%), by Country 2024 & 2032

- Figure 36: Middle East Bulk Container Packaging Market Revenue (Million), by Type 2024 & 2032

- Figure 37: Middle East Bulk Container Packaging Market Revenue Share (%), by Type 2024 & 2032

- Figure 38: Middle East Bulk Container Packaging Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 39: Middle East Bulk Container Packaging Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 40: Middle East Bulk Container Packaging Market Revenue (Million), by Country 2024 & 2032

- Figure 41: Middle East Bulk Container Packaging Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Bulk Container Packaging Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Bulk Container Packaging Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global Bulk Container Packaging Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 4: Global Bulk Container Packaging Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Bulk Container Packaging Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Bulk Container Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Global Bulk Container Packaging Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Bulk Container Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Bulk Container Packaging Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Bulk Container Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Bulk Container Packaging Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Bulk Container Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global Bulk Container Packaging Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Bulk Container Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global Bulk Container Packaging Market Revenue Million Forecast, by Type 2019 & 2032

- Table 16: Global Bulk Container Packaging Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 17: Global Bulk Container Packaging Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global Bulk Container Packaging Market Revenue Million Forecast, by Type 2019 & 2032

- Table 19: Global Bulk Container Packaging Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 20: Global Bulk Container Packaging Market Revenue Million Forecast, by Country 2019 & 2032

- Table 21: Global Bulk Container Packaging Market Revenue Million Forecast, by Type 2019 & 2032

- Table 22: Global Bulk Container Packaging Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 23: Global Bulk Container Packaging Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Global Bulk Container Packaging Market Revenue Million Forecast, by Type 2019 & 2032

- Table 25: Global Bulk Container Packaging Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 26: Global Bulk Container Packaging Market Revenue Million Forecast, by Country 2019 & 2032

- Table 27: Global Bulk Container Packaging Market Revenue Million Forecast, by Type 2019 & 2032

- Table 28: Global Bulk Container Packaging Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 29: Global Bulk Container Packaging Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Bulk Container Packaging Market?

The projected CAGR is approximately 8.72%.

2. Which companies are prominent players in the Bulk Container Packaging Market?

Key companies in the market include Meyer Industries Limited, SIA Flexitanks Ltd, Greif Inc, Mondi Group, Braid Logistics, Berry Global Inc, Trans Ocean Bulk Logistics Ltd, SCHÜTZ GmbH & Co KGaA, Signode Industrial Group, National Bulk Equipment Inc.

3. What are the main segments of the Bulk Container Packaging Market?

The market segments include Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Use of Flexitank. among Regional End-user Industries; Growing Export of Bulk Container Packed Products.

6. What are the notable trends driving market growth?

Demand for Plastic-based Packaging Solution is Expected to be a Significant Factor in Growth.

7. Are there any restraints impacting market growth?

Increasing Price Volatility of Raw Materials.

8. Can you provide examples of recent developments in the market?

December 2022, Lee Container Corp. Inc., a producer of high-performance barriers and conventional blow-molded containers, was acquired by Greif, a global leader in industrial packaging products and services, for USD 300 million. Greif predicts that by integrating Lee Container's operations, it will be able to increase efficiency and performance by at least USD 6 million over the next two years. With a focus on growth-oriented clients in the agricultural, other specialized chemicals, oil & lubricant, and pet care markets in North America, Lee Container Corporation, Inc. is among the top makers of high-performance barrier and conventional blow-molded containers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Bulk Container Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Bulk Container Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Bulk Container Packaging Market?

To stay informed about further developments, trends, and reports in the Bulk Container Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence