Key Insights

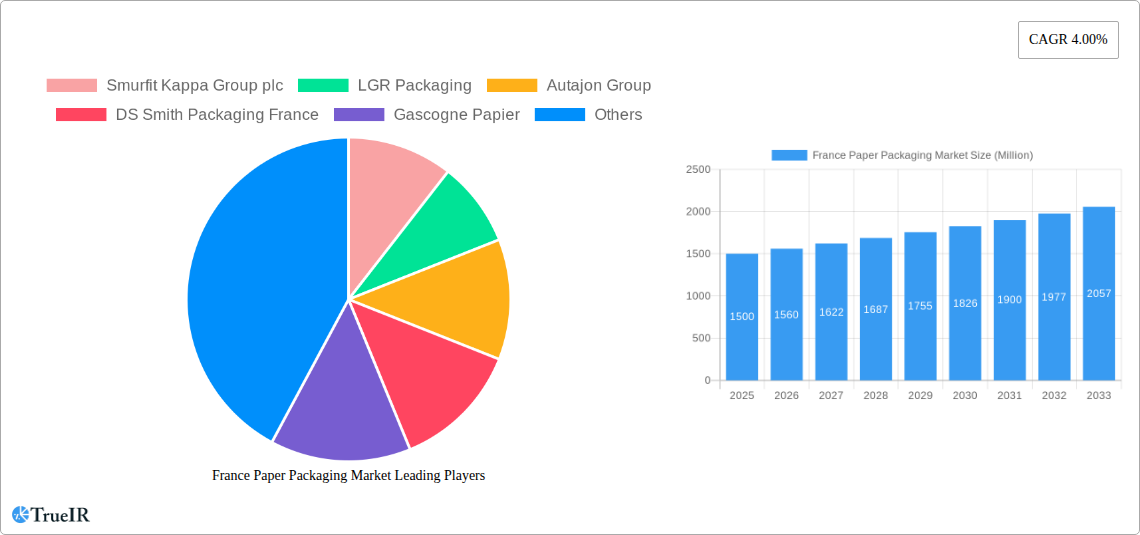

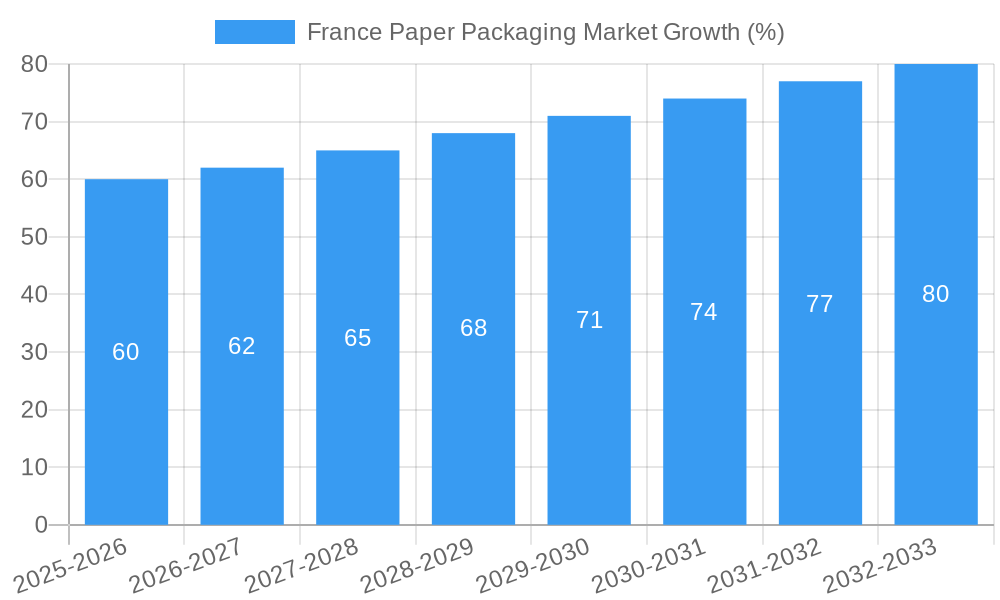

The French paper packaging market, valued at approximately €1.5 billion in 2025, is projected to experience steady growth, exhibiting a Compound Annual Growth Rate (CAGR) of 4% from 2025 to 2033. This expansion is primarily driven by the burgeoning food and beverage sector, coupled with increasing demand for sustainable and eco-friendly packaging solutions within the home and personal care, and healthcare industries. The preference for corrugated boxes and folding cartons, owing to their versatility and recyclability, further fuels market growth. Leading players like Smurfit Kappa Group plc, DS Smith Packaging France, and Autajon Group are strategically investing in advanced technologies and sustainable practices to cater to the evolving consumer preferences and stringent environmental regulations. Kraft paper, a key raw material, is witnessing increased demand, mirroring the overall market growth trajectory. While challenges such as fluctuations in raw material prices and the increasing adoption of alternative packaging materials exist, the overall market outlook remains positive, fueled by the consistent growth in e-commerce and the rising awareness regarding environmental sustainability.

However, potential restraints include volatility in raw material costs (particularly pulp and paper), pressure from alternative packaging materials (e.g., plastics), and the need for ongoing innovation to meet evolving consumer demands for enhanced product protection and aesthetic appeal. Segmentation analysis reveals that corrugated boxes constitute the largest product segment, followed by folding cartons. The food and beverage industry dominates end-user applications, reflecting the vital role of paper packaging in preserving freshness and ensuring product safety. The market's future trajectory hinges on successfully navigating these challenges through innovation, focusing on sustainable practices, and leveraging the market's strengths, like the strong demand for recyclable packaging. The French market is expected to see a gradual increase in market share of sustainable packaging options, driving further growth in specific segments.

France Paper Packaging Market: A Comprehensive Report (2019-2033)

This dynamic report provides a comprehensive analysis of the France paper packaging market, offering invaluable insights for businesses operating within or considering entry into this lucrative sector. With a detailed examination of market structure, competitive landscape, trends, and future outlook, this report is an essential resource for strategic decision-making. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. Market value is expressed in Millions.

France Paper Packaging Market Market Structure & Competitive Landscape

The France paper packaging market exhibits a moderately concentrated structure, with several key players dominating significant segments. The market concentration ratio (CR4) is estimated at xx%, indicating the presence of both large multinational corporations and smaller specialized players. Innovation is a key driver, with companies constantly striving to develop sustainable and efficient packaging solutions. Stringent environmental regulations significantly influence market dynamics, pushing companies towards eco-friendly materials and processes. Product substitutes, such as plastic packaging, present a constant challenge, but the growing preference for sustainable options is creating opportunities for paper-based alternatives. The market is segmented by product type (corrugated boxes, folding cartons, kraft paper) and end-user industries (food, beverage, home and personal care, healthcare, and others). Mergers and acquisitions (M&A) activity is moderate, with xx M&A deals recorded between 2019 and 2024.

- Market Concentration: CR4 estimated at xx%

- Innovation Drivers: Sustainability, efficiency, recyclability

- Regulatory Impacts: Stringent environmental regulations driving eco-friendly solutions

- Product Substitutes: Plastic packaging, representing a competitive challenge

- End-User Segmentation: Diverse end-user industries, with varying packaging requirements

- M&A Trends: Moderate activity with xx deals between 2019 and 2024.

France Paper Packaging Market Market Trends & Opportunities

The France paper packaging market is experiencing significant growth, driven by several factors. The market size is estimated at xx Million in 2025, with a projected CAGR of xx% during the forecast period (2025-2033). Technological advancements, including improved printing techniques and sustainable material innovations, are transforming the industry. Consumer preferences are shifting towards environmentally friendly packaging options, boosting demand for recyclable and compostable paper-based solutions. The competitive landscape is dynamic, with companies focusing on differentiation through product innovation, sustainability initiatives, and efficient supply chains. Market penetration of paper-based packaging is currently at xx%, with significant growth potential in various end-user segments.

Dominant Markets & Segments in France Paper Packaging Market

The food and beverage sector represents the largest segment within the French paper packaging market, accounting for xx% of the total market value in 2025. The Corrugated Box segment is currently the largest product segment.

Key Growth Drivers for Food & Beverage:

- Increasing demand for convenient and shelf-stable food products.

- Growing consumer preference for sustainable and recyclable packaging.

- Strong regulatory focus on food safety and hygiene.

Key Growth Drivers for Corrugated Box Segment:

- Versatility and suitability for a wide range of products.

- Cost-effectiveness compared to other packaging options.

- Strong demand from the e-commerce sector.

The Ile-de-France region is the dominant market within France, fueled by its high population density and robust industrial activity.

France Paper Packaging Market Product Analysis

The French paper packaging market showcases continuous product innovation. Advancements in printing technologies allow for high-quality graphics and branding, enhancing product appeal. New materials and coatings provide improved barrier properties and protection against moisture and damage. Sustainable options such as recyclable and compostable packaging are gaining significant traction, addressing growing environmental concerns. The market favors products with excellent printability, strength, and barrier properties tailored to specific end-user requirements.

Key Drivers, Barriers & Challenges in France Paper Packaging Market

Key Drivers: Growing consumer demand for eco-friendly packaging, technological advancements leading to improved packaging solutions, and increasing e-commerce activity driving demand for robust shipping solutions are key drivers. Government regulations promoting sustainability are further boosting the market.

Challenges: Fluctuations in raw material prices (e.g., pulp), intense competition from alternative packaging materials (e.g., plastics), and maintaining efficient and resilient supply chains in the face of global uncertainties are key challenges. Stringent environmental regulations can also increase production costs.

Growth Drivers in the France Paper Packaging Market Market

The market is propelled by the increasing adoption of sustainable packaging solutions, driven by consumer preference and stringent environmental regulations. Technological advancements in printing and coating technologies are enhancing product appeal and functionality. E-commerce growth fuels demand for robust shipping packaging.

Challenges Impacting France Paper Packaging Market Growth

Supply chain disruptions and price volatility of raw materials pose significant challenges. Intense competition from alternative packaging materials and maintaining compliance with evolving environmental regulations are key obstacles to market growth.

Key Players Shaping the France Paper Packaging Market Market

- Smurfit Kappa Group plc

- LGR Packaging

- Autajon Group

- DS Smith Packaging France

- Gascogne Papier

- LACAUX Freres

- MM PACKAGING GmbH

- Tecnografica S p a

- gKRAFT Paper

- Graphic Packaging International

- International Paper

Significant France Paper Packaging Market Industry Milestones

- September 2022: Graphic Packaging International's investment in a G. Mondini Trave 350 tray sealer expands its PaperSeal range, boosting sustainable packaging options for food products.

- March 2022: DS Smith's EUR 750,000 investment in a new state-of-the-art laboratory underlines its commitment to innovation and sustainability in fiber-based packaging.

Future Outlook for France Paper Packaging Market Market

The France paper packaging market is poised for continued growth, driven by sustainability trends and technological innovation. Strategic partnerships, investments in R&D, and expansion into new market segments will be key factors shaping the future of the market. Opportunities lie in developing customized packaging solutions for specific industries and exploring new eco-friendly materials. The market presents substantial growth potential for companies that can effectively address the challenges and capitalize on emerging trends.

France Paper Packaging Market Segmentation

-

1. Product

- 1.1. Corrugated Box

- 1.2. Folding Carton

- 1.3. Kraft Paper

-

2. End-user Industry

- 2.1. Food

- 2.2. Beverage

- 2.3. Home and Personal Care

- 2.4. Healthcare

- 2.5. Other End-user Industries

France Paper Packaging Market Segmentation By Geography

- 1. France

France Paper Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Eco-friendly Packaging Solutions; Growing E-commerce Industry

- 3.3. Market Restrains

- 3.3.1. Strict Environmental Regulation Regarding Deforestation

- 3.4. Market Trends

- 3.4.1. Increasing Growth of E-commerce Sales

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. France Paper Packaging Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Corrugated Box

- 5.1.2. Folding Carton

- 5.1.3. Kraft Paper

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Food

- 5.2.2. Beverage

- 5.2.3. Home and Personal Care

- 5.2.4. Healthcare

- 5.2.5. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. France

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Smurfit Kappa Group plc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 LGR Packaging

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Autajon Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 DS Smith Packaging France

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Gascogne Papier

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 LACAUX Freres

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 MM PACKAGING GmbH

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Tecnografica S p a

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 gKRAFT Paper*List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Graphic Packaging International

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 International Paper

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Smurfit Kappa Group plc

List of Figures

- Figure 1: France Paper Packaging Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: France Paper Packaging Market Share (%) by Company 2024

List of Tables

- Table 1: France Paper Packaging Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: France Paper Packaging Market Revenue Million Forecast, by Product 2019 & 2032

- Table 3: France Paper Packaging Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 4: France Paper Packaging Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: France Paper Packaging Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: France Paper Packaging Market Revenue Million Forecast, by Product 2019 & 2032

- Table 7: France Paper Packaging Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 8: France Paper Packaging Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the France Paper Packaging Market?

The projected CAGR is approximately 4.00%.

2. Which companies are prominent players in the France Paper Packaging Market?

Key companies in the market include Smurfit Kappa Group plc, LGR Packaging, Autajon Group, DS Smith Packaging France, Gascogne Papier, LACAUX Freres, MM PACKAGING GmbH, Tecnografica S p a, gKRAFT Paper*List Not Exhaustive, Graphic Packaging International, International Paper.

3. What are the main segments of the France Paper Packaging Market?

The market segments include Product, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Eco-friendly Packaging Solutions; Growing E-commerce Industry.

6. What are the notable trends driving market growth?

Increasing Growth of E-commerce Sales.

7. Are there any restraints impacting market growth?

Strict Environmental Regulation Regarding Deforestation.

8. Can you provide examples of recent developments in the market?

September 2022 - Graphic Packaging International announced an investment in a G.Mondini Trave 350 tray sealer to increase the availability of its PaperSeal range of fiber-based trays in the U.S. and Canada. Developed in collaboration with G. Mondini, one of the leaders in tray sealing technology, the PaperSeal tray is an ideal packaging solution for businesses choosing a more sustainable way to package fresh and processed meat, chilled and frozen meals, cheese, snacks, and more.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "France Paper Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the France Paper Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the France Paper Packaging Market?

To stay informed about further developments, trends, and reports in the France Paper Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence