Key Insights

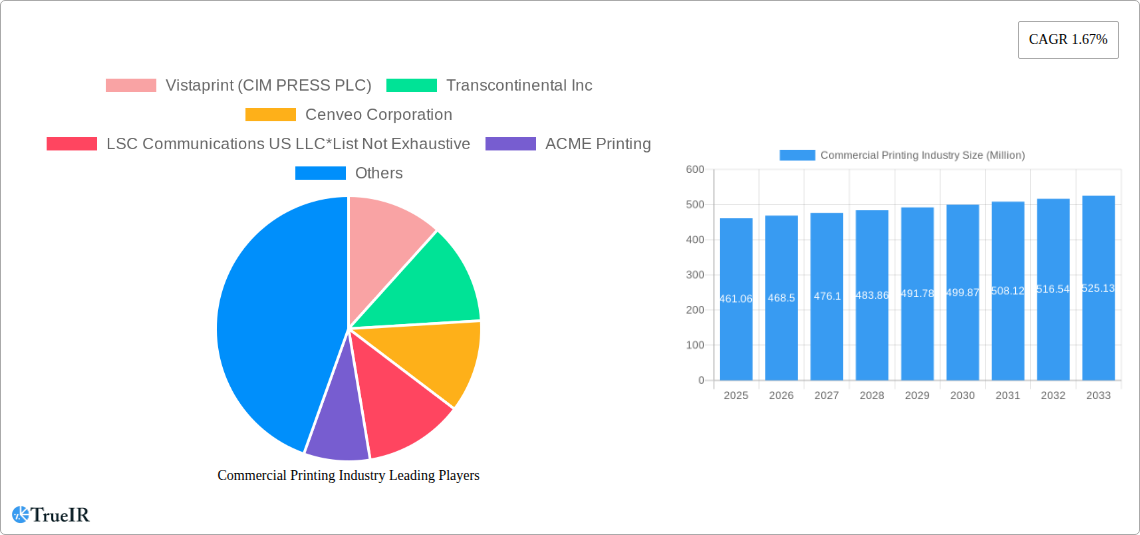

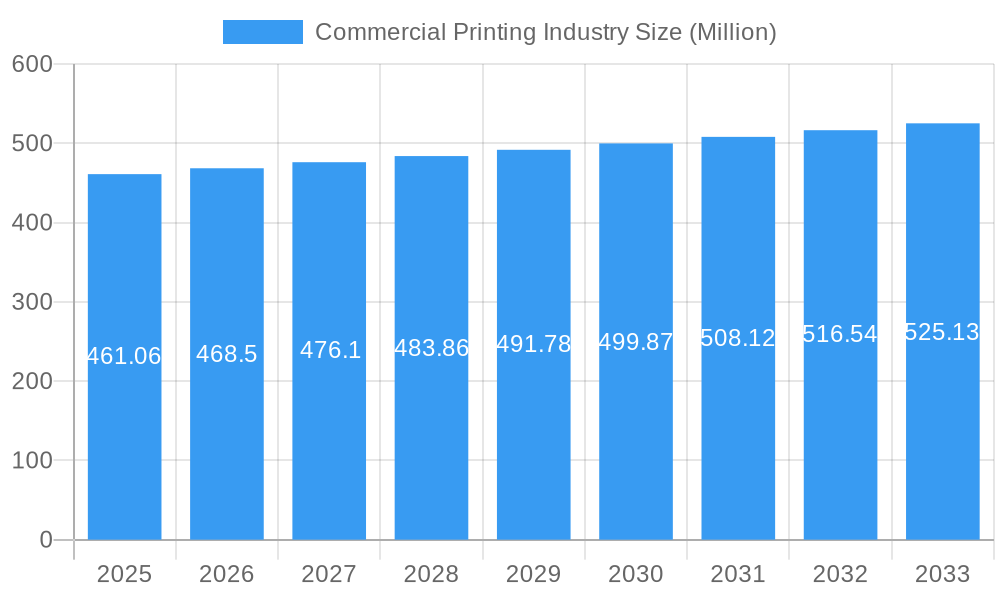

The global commercial printing industry, currently valued at $461.06 million in 2025, is projected to experience moderate growth with a Compound Annual Growth Rate (CAGR) of 1.67% from 2025 to 2033. This growth is driven by factors such as the continued demand for packaging solutions across diverse sectors, including food and beverage, pharmaceuticals, and consumer goods. The increasing use of personalized marketing materials and the need for high-quality print advertising in niche markets also contribute to market expansion. Technological advancements in printing techniques, specifically the adoption of inkjet and digital printing methods for faster turnaround times and customized outputs, are significant trends influencing market dynamics. Conversely, the rise of digital marketing channels and the associated decline in traditional print advertising pose a significant restraint on market growth. The industry is segmented by printing type (offset lithography, inkjet, flexographic, screen, gravure, and others) and application (packaging, advertising, and publishing). Offset lithography currently dominates the market due to its cost-effectiveness for large-volume printing, while inkjet printing is gaining traction due to its versatility and suitability for personalized campaigns. The packaging segment holds the largest market share owing to the persistent demand for printed packaging across various industries. Major players like Vistaprint, Transcontinental Inc., and R.R. Donnelley & Sons compete in a market characterized by consolidation and a shift towards specialized printing services.

Commercial Printing Industry Market Size (In Million)

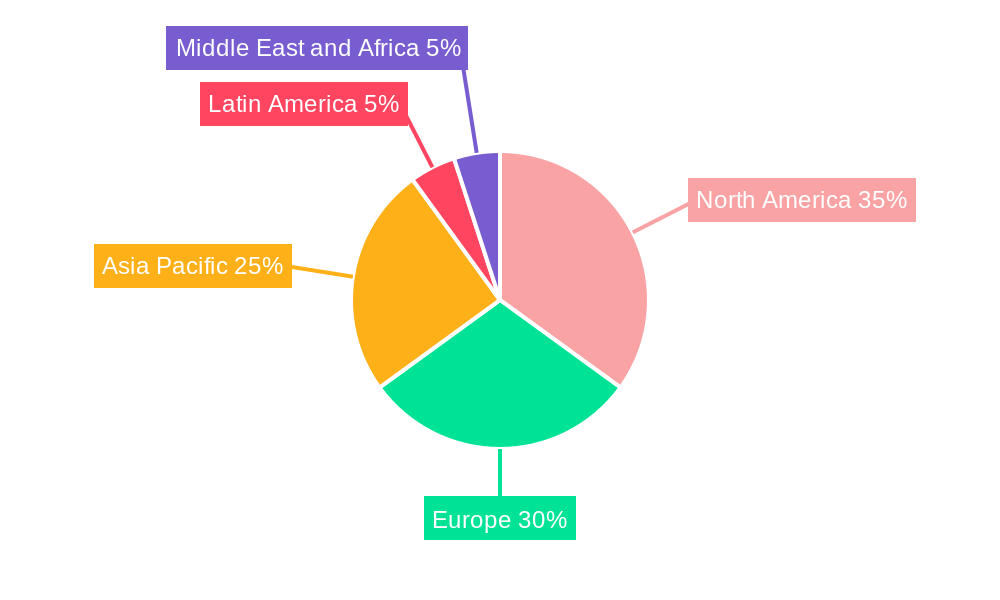

The geographical distribution of the commercial printing market reflects varying levels of economic development and adoption of print media. While North America and Europe currently hold significant market share, the Asia-Pacific region is anticipated to exhibit robust growth due to rapid industrialization and a burgeoning consumer market. The Latin America and Middle East & Africa regions are projected to show moderate growth, driven by expanding economies and increased demand for printed materials in specific sectors. Competition among established players and the entry of new players offering specialized services will shape the competitive landscape in the coming years. The industry is expected to witness increased investment in sustainable printing technologies and a greater emphasis on environmentally friendly practices in response to growing environmental concerns.

Commercial Printing Industry Company Market Share

Commercial Printing Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the global commercial printing industry, projecting a market valued at $XX Million by 2033. The study covers the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. Discover key trends, competitive dynamics, and growth opportunities within this dynamic sector.

Commercial Printing Industry Market Structure & Competitive Landscape

The commercial printing industry is characterized by a moderately concentrated market structure, with several large players commanding significant market share. Concentration ratios vary by segment, with higher concentration observed in certain specialized areas like large-scale packaging printing. The market is dynamic, driven by technological innovation, evolving consumer preferences, and ongoing mergers and acquisitions (M&A) activity. Between 2019 and 2024, the industry witnessed approximately XX Million USD in M&A transactions, reflecting consolidation and strategic expansion.

- Key Players: Vistaprint (CIM PRESS PLC), Transcontinental Inc, Cenveo Corporation, LSC Communications US LLC, ACME Printing, R R Donnelley & Sons, Toppan Co Limited (and others).

- Innovation Drivers: Advancements in digital printing technologies, sustainable printing solutions, and personalization capabilities are reshaping the competitive landscape.

- Regulatory Impacts: Environmental regulations related to waste management and ink composition are influencing industry practices and driving the adoption of eco-friendly solutions.

- Product Substitutes: The rise of digital marketing and electronic communication poses a significant challenge to traditional print media, creating a need for innovation and differentiation.

- End-User Segmentation: The industry caters to diverse end-users, including publishing houses, advertising agencies, packaging companies, and businesses requiring marketing materials.

Commercial Printing Industry Market Trends & Opportunities

The commercial printing market is experiencing a complex interplay of challenges and opportunities. While the overall market size is projected to reach $XX Million by 2033, exhibiting a CAGR of XX% during the forecast period, significant shifts are occurring. Technological advancements, particularly in digital printing and personalized marketing solutions, are driving growth in niche segments. However, the industry faces headwinds from the increasing adoption of digital media and the need to adapt to changing consumer preferences towards sustainable and environmentally friendly practices. Market penetration rates vary across applications, with packaging and advertising showing relatively stronger growth compared to publishing, which continues to face significant disruption from digital alternatives.

Dominant Markets & Segments in Commercial Printing Industry

The North American and European markets currently dominate the global commercial printing landscape, accounting for approximately XX% of the total market value in 2025. However, Asia-Pacific is witnessing significant growth, driven by rising disposable incomes and expanding industrialization.

By Type:

- Offset Lithography: Remains the dominant printing method due to its high-volume, cost-effectiveness, and high-quality output, though facing pressure from digital options.

- Inkjet: Experiencing substantial growth, particularly in personalized and on-demand printing applications.

- Flexographic: Strong in packaging and labeling, benefiting from material innovations and increased demand for flexible packaging.

- Screen and Gravure: Niches markets, with specialized applications and relatively slower growth rates.

- Other Types: This category encompasses emerging technologies and specialized printing methods, offering incremental growth opportunities.

By Application:

- Packaging: The fastest-growing segment, driven by increased consumer goods production, e-commerce growth, and the need for innovative packaging solutions.

- Advertising: While facing challenges from digital alternatives, it remains a relevant segment, particularly for high-impact and premium print materials.

- Publishing: Faces significant pressure from digital media but maintains relevance for high-quality books, magazines, and specialized publications.

Key Growth Drivers:

- Infrastructure Development: Improved logistics and supply chain networks contribute to efficient printing and distribution.

- Government Policies: Policies supporting sustainable practices and technological advancements can stimulate market growth.

Commercial Printing Industry Product Analysis

The commercial printing industry is witnessing a wave of product innovation, driven by the convergence of digital and traditional technologies. Advancements in inks, substrates, and printing processes are enhancing quality, speed, and sustainability. Products are increasingly tailored to meet specific application needs, with a growing emphasis on personalization and customization options. Competitive advantages are derived from technological leadership, cost-efficiency, environmental responsibility, and strong customer relationships.

Key Drivers, Barriers & Challenges in Commercial Printing Industry

Key Drivers: Technological advancements in digital printing, growing demand for personalized and customized products, and increased focus on sustainable printing practices are key drivers. Economic growth, particularly in emerging markets, further fuels demand.

Key Challenges: The shift towards digital media presents a major challenge, along with increasing competition, rising raw material costs, stringent environmental regulations, and the complexities of global supply chains. These factors result in an estimated XX Million USD of lost revenue annually in 2025 due to supply chain disruptions.

Growth Drivers in the Commercial Printing Industry Market

Technological innovation in digital printing, personalized marketing, and sustainable solutions remain key growth drivers. Economic expansion in developing countries and government support for eco-friendly printing contribute significantly.

Challenges Impacting Commercial Printing Industry Growth

Intense competition, evolving consumer preferences, and regulatory complexities pose significant challenges. Supply chain disruptions and fluctuations in raw material costs impact profitability.

Key Players Shaping the Commercial Printing Industry Market

Significant Commercial Printing Industry Industry Milestones

- June 2022: Toppan developed a light-reactive hologram for enhanced security features in printed materials. This innovation addresses the growing need for anti-counterfeiting measures.

- May 2022: Siegwerk launched SICURA Litho Pack ECO, a sustainable UV offset ink with over 40% renewable components, promoting environmentally responsible printing practices.

Future Outlook for Commercial Printing Industry Market

The commercial printing industry is expected to experience moderate growth over the next decade. Opportunities lie in specialized printing segments, personalized marketing solutions, and sustainable packaging. Companies adapting to digital transformation and embracing innovation will be best positioned for success.

Commercial Printing Industry Segmentation

-

1. Printing Type

- 1.1. Offset Lithography

- 1.2. Inkjet

- 1.3. Flexographic

- 1.4. Screen

- 1.5. Gravure

- 1.6. Other Printing Types

-

2. Application

- 2.1. Packaging

- 2.2. Advertising

-

2.3. Publishing

- 2.3.1. Books

- 2.3.2. Magazines

- 2.3.3. Newspapers

- 2.3.4. Other Publishing

- 2.4. Other Applications

Commercial Printing Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

Commercial Printing Industry Regional Market Share

Geographic Coverage of Commercial Printing Industry

Commercial Printing Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1.67% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increased Demand for Promotional Materials from the Retail

- 3.2.2 Food

- 3.2.3 and Beverage Industries; Introduction of Eco-friendly Practices

- 3.3. Market Restrains

- 3.3.1. Increase in Digitization and Rising Dependence on Feedstock Prices

- 3.4. Market Trends

- 3.4.1. Packaging Segment Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Commercial Printing Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Printing Type

- 5.1.1. Offset Lithography

- 5.1.2. Inkjet

- 5.1.3. Flexographic

- 5.1.4. Screen

- 5.1.5. Gravure

- 5.1.6. Other Printing Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Packaging

- 5.2.2. Advertising

- 5.2.3. Publishing

- 5.2.3.1. Books

- 5.2.3.2. Magazines

- 5.2.3.3. Newspapers

- 5.2.3.4. Other Publishing

- 5.2.4. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia

- 5.3.4. Australia and New Zealand

- 5.3.5. Latin America

- 5.3.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Printing Type

- 6. North America Commercial Printing Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Printing Type

- 6.1.1. Offset Lithography

- 6.1.2. Inkjet

- 6.1.3. Flexographic

- 6.1.4. Screen

- 6.1.5. Gravure

- 6.1.6. Other Printing Types

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Packaging

- 6.2.2. Advertising

- 6.2.3. Publishing

- 6.2.3.1. Books

- 6.2.3.2. Magazines

- 6.2.3.3. Newspapers

- 6.2.3.4. Other Publishing

- 6.2.4. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Printing Type

- 7. Europe Commercial Printing Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Printing Type

- 7.1.1. Offset Lithography

- 7.1.2. Inkjet

- 7.1.3. Flexographic

- 7.1.4. Screen

- 7.1.5. Gravure

- 7.1.6. Other Printing Types

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Packaging

- 7.2.2. Advertising

- 7.2.3. Publishing

- 7.2.3.1. Books

- 7.2.3.2. Magazines

- 7.2.3.3. Newspapers

- 7.2.3.4. Other Publishing

- 7.2.4. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Printing Type

- 8. Asia Commercial Printing Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Printing Type

- 8.1.1. Offset Lithography

- 8.1.2. Inkjet

- 8.1.3. Flexographic

- 8.1.4. Screen

- 8.1.5. Gravure

- 8.1.6. Other Printing Types

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Packaging

- 8.2.2. Advertising

- 8.2.3. Publishing

- 8.2.3.1. Books

- 8.2.3.2. Magazines

- 8.2.3.3. Newspapers

- 8.2.3.4. Other Publishing

- 8.2.4. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Printing Type

- 9. Australia and New Zealand Commercial Printing Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Printing Type

- 9.1.1. Offset Lithography

- 9.1.2. Inkjet

- 9.1.3. Flexographic

- 9.1.4. Screen

- 9.1.5. Gravure

- 9.1.6. Other Printing Types

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Packaging

- 9.2.2. Advertising

- 9.2.3. Publishing

- 9.2.3.1. Books

- 9.2.3.2. Magazines

- 9.2.3.3. Newspapers

- 9.2.3.4. Other Publishing

- 9.2.4. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Printing Type

- 10. Latin America Commercial Printing Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Printing Type

- 10.1.1. Offset Lithography

- 10.1.2. Inkjet

- 10.1.3. Flexographic

- 10.1.4. Screen

- 10.1.5. Gravure

- 10.1.6. Other Printing Types

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Packaging

- 10.2.2. Advertising

- 10.2.3. Publishing

- 10.2.3.1. Books

- 10.2.3.2. Magazines

- 10.2.3.3. Newspapers

- 10.2.3.4. Other Publishing

- 10.2.4. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Printing Type

- 11. Middle East and Africa Commercial Printing Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Printing Type

- 11.1.1. Offset Lithography

- 11.1.2. Inkjet

- 11.1.3. Flexographic

- 11.1.4. Screen

- 11.1.5. Gravure

- 11.1.6. Other Printing Types

- 11.2. Market Analysis, Insights and Forecast - by Application

- 11.2.1. Packaging

- 11.2.2. Advertising

- 11.2.3. Publishing

- 11.2.3.1. Books

- 11.2.3.2. Magazines

- 11.2.3.3. Newspapers

- 11.2.3.4. Other Publishing

- 11.2.4. Other Applications

- 11.1. Market Analysis, Insights and Forecast - by Printing Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Vistaprint (CIM PRESS PLC)

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Transcontinental Inc

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Cenveo Corporation

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 LSC Communications US LLC*List Not Exhaustive

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 ACME Printing

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 R R Donnelley & Sons

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Toppan Co Limited

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.1 Vistaprint (CIM PRESS PLC)

List of Figures

- Figure 1: Global Commercial Printing Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Commercial Printing Industry Revenue (Million), by Printing Type 2025 & 2033

- Figure 3: North America Commercial Printing Industry Revenue Share (%), by Printing Type 2025 & 2033

- Figure 4: North America Commercial Printing Industry Revenue (Million), by Application 2025 & 2033

- Figure 5: North America Commercial Printing Industry Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Commercial Printing Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Commercial Printing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Commercial Printing Industry Revenue (Million), by Printing Type 2025 & 2033

- Figure 9: Europe Commercial Printing Industry Revenue Share (%), by Printing Type 2025 & 2033

- Figure 10: Europe Commercial Printing Industry Revenue (Million), by Application 2025 & 2033

- Figure 11: Europe Commercial Printing Industry Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe Commercial Printing Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Commercial Printing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Commercial Printing Industry Revenue (Million), by Printing Type 2025 & 2033

- Figure 15: Asia Commercial Printing Industry Revenue Share (%), by Printing Type 2025 & 2033

- Figure 16: Asia Commercial Printing Industry Revenue (Million), by Application 2025 & 2033

- Figure 17: Asia Commercial Printing Industry Revenue Share (%), by Application 2025 & 2033

- Figure 18: Asia Commercial Printing Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Commercial Printing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Australia and New Zealand Commercial Printing Industry Revenue (Million), by Printing Type 2025 & 2033

- Figure 21: Australia and New Zealand Commercial Printing Industry Revenue Share (%), by Printing Type 2025 & 2033

- Figure 22: Australia and New Zealand Commercial Printing Industry Revenue (Million), by Application 2025 & 2033

- Figure 23: Australia and New Zealand Commercial Printing Industry Revenue Share (%), by Application 2025 & 2033

- Figure 24: Australia and New Zealand Commercial Printing Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Australia and New Zealand Commercial Printing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Commercial Printing Industry Revenue (Million), by Printing Type 2025 & 2033

- Figure 27: Latin America Commercial Printing Industry Revenue Share (%), by Printing Type 2025 & 2033

- Figure 28: Latin America Commercial Printing Industry Revenue (Million), by Application 2025 & 2033

- Figure 29: Latin America Commercial Printing Industry Revenue Share (%), by Application 2025 & 2033

- Figure 30: Latin America Commercial Printing Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Latin America Commercial Printing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 32: Middle East and Africa Commercial Printing Industry Revenue (Million), by Printing Type 2025 & 2033

- Figure 33: Middle East and Africa Commercial Printing Industry Revenue Share (%), by Printing Type 2025 & 2033

- Figure 34: Middle East and Africa Commercial Printing Industry Revenue (Million), by Application 2025 & 2033

- Figure 35: Middle East and Africa Commercial Printing Industry Revenue Share (%), by Application 2025 & 2033

- Figure 36: Middle East and Africa Commercial Printing Industry Revenue (Million), by Country 2025 & 2033

- Figure 37: Middle East and Africa Commercial Printing Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Commercial Printing Industry Revenue Million Forecast, by Printing Type 2020 & 2033

- Table 2: Global Commercial Printing Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Global Commercial Printing Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Commercial Printing Industry Revenue Million Forecast, by Printing Type 2020 & 2033

- Table 5: Global Commercial Printing Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Global Commercial Printing Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Commercial Printing Industry Revenue Million Forecast, by Printing Type 2020 & 2033

- Table 8: Global Commercial Printing Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 9: Global Commercial Printing Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global Commercial Printing Industry Revenue Million Forecast, by Printing Type 2020 & 2033

- Table 11: Global Commercial Printing Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 12: Global Commercial Printing Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Commercial Printing Industry Revenue Million Forecast, by Printing Type 2020 & 2033

- Table 14: Global Commercial Printing Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 15: Global Commercial Printing Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Commercial Printing Industry Revenue Million Forecast, by Printing Type 2020 & 2033

- Table 17: Global Commercial Printing Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 18: Global Commercial Printing Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 19: Global Commercial Printing Industry Revenue Million Forecast, by Printing Type 2020 & 2033

- Table 20: Global Commercial Printing Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 21: Global Commercial Printing Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Commercial Printing Industry?

The projected CAGR is approximately 1.67%.

2. Which companies are prominent players in the Commercial Printing Industry?

Key companies in the market include Vistaprint (CIM PRESS PLC), Transcontinental Inc, Cenveo Corporation, LSC Communications US LLC*List Not Exhaustive, ACME Printing, R R Donnelley & Sons, Toppan Co Limited.

3. What are the main segments of the Commercial Printing Industry?

The market segments include Printing Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 461.06 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Demand for Promotional Materials from the Retail. Food. and Beverage Industries; Introduction of Eco-friendly Practices.

6. What are the notable trends driving market growth?

Packaging Segment Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

Increase in Digitization and Rising Dependence on Feedstock Prices.

8. Can you provide examples of recent developments in the market?

June 2022: Toppan created a hologram that could respond to bright light by displaying text and images. This made verification easier for those who do not have specialized hardware or a QR code.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Commercial Printing Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Commercial Printing Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Commercial Printing Industry?

To stay informed about further developments, trends, and reports in the Commercial Printing Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence