Key Insights

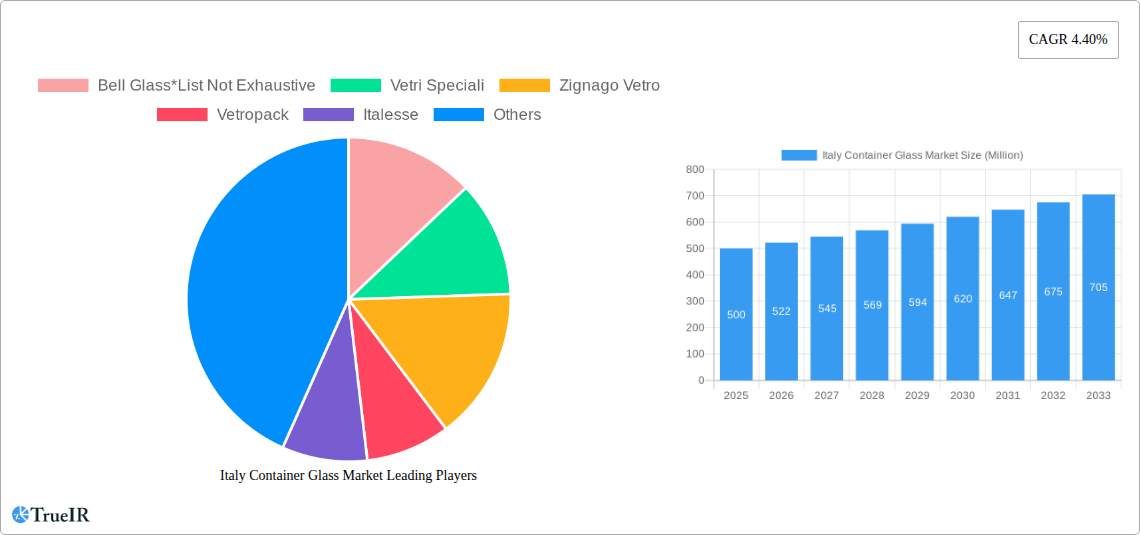

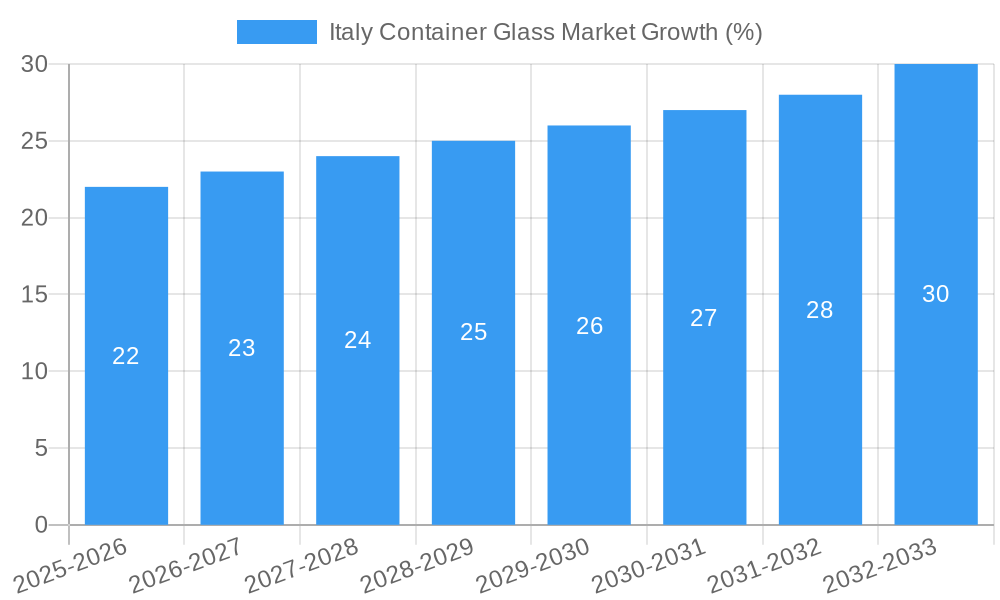

The Italy container glass market, valued at approximately €[Estimate based on market size XX and value unit Million. Let's assume XX = 500 for illustrative purposes. Therefore, market size is €500 million in 2025] in 2025, is projected to experience steady growth with a CAGR of 4.40% from 2025 to 2033. This growth is fueled by several key drivers. The burgeoning food and beverage sector in Italy, with its emphasis on premium packaging and sustainable materials, is a significant contributor. The increasing popularity of bottled water and premium alcoholic beverages further boosts demand. Furthermore, the cosmetics industry's preference for glass packaging, owing to its perceived quality and recyclability, contributes significantly to market expansion. The growing emphasis on sustainable and eco-friendly packaging solutions across various sectors is another crucial factor driving market growth. However, challenges remain. Fluctuations in raw material prices, particularly energy costs for glass manufacturing, and the emergence of competitive alternative packaging materials, such as plastics and aluminum, pose potential restraints.

Market segmentation reveals a diverse landscape. The beverage industry holds the largest market share, followed by the food sector, with cosmetics and pharmaceuticals also making substantial contributions. Leading players like Bell Glass, Vetri Speciali, Zignago Vetro, and others compete intensely, often focusing on product innovation, specialized designs, and efficient supply chains to cater to the evolving needs of their diverse customer base. The regional focus remains largely on Italy, reflecting the strong domestic demand and established manufacturing infrastructure. The forecast period (2025-2033) anticipates a continued, albeit moderate, expansion in line with the overall positive outlook for the Italian economy and its expanding consumer market, particularly for premium and sustainable products. Continued growth is expected to be driven by the sustained focus on eco-friendly packaging options.

Italy Container Glass Market: A Comprehensive Report (2019-2033)

This dynamic report offers an in-depth analysis of the Italy container glass market, providing crucial insights for industry stakeholders. Covering the period 2019-2033, with a base year of 2025, this study delves into market structure, competitive dynamics, growth drivers, and future projections. Leveraging high-volume keywords like "Italy container glass market," "glass manufacturing Italy," "Italian glass industry," and "container glass market size," this report ensures maximum visibility and engagement.

Italy Container Glass Market Market Structure & Competitive Landscape

The Italian container glass market exhibits a moderately concentrated structure, with a Herfindahl-Hirschman Index (HHI) estimated at xx in 2025. Key players such as Bell Glass, Vetri Speciali, Zignago Vetro, Vetropack, Italesse, Vetroelite, SAIDA Group, Vetro Plastica Laziale, COVIM, VDGlass, and Vetreria Etrusca contribute significantly to the overall market share, although the exact distribution remains dynamic. The market is characterized by both organic growth and strategic mergers and acquisitions (M&A) activities, with an estimated xx Million in M&A volume during 2019-2024. Innovation in production processes, such as the adoption of hydrogen-based technologies (detailed in Industry Developments), drives market evolution. Regulatory changes impacting packaging materials and environmental sustainability also shape the competitive landscape, influencing product design and manufacturing methods. The market faces pressures from substitute packaging materials, particularly plastics, necessitating continuous innovation and differentiation strategies. End-user segmentation, primarily across beverage, food, cosmetics, pharmaceuticals, and other verticals, influences product specifications and demand patterns.

- Market Concentration: Moderate, with HHI estimated at xx in 2025.

- Innovation Drivers: Hydrogen-based technologies, sustainable packaging solutions.

- Regulatory Impacts: Environmental regulations, packaging directives.

- Product Substitutes: Plastics, alternative packaging materials.

- M&A Trends: xx Million in M&A volume during 2019-2024, indicating strategic consolidation.

- End-User Segmentation: Beverage, Food, Cosmetics, Pharmaceuticals, Other.

Italy Container Glass Market Market Trends & Opportunities

The Italy container glass market is projected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), driven by factors including growing demand from the food and beverage sectors, evolving consumer preferences for sustainable packaging, and technological advancements in glass manufacturing. Market penetration rates vary across different end-user segments, with the beverage sector exhibiting higher adoption rates. Technological shifts towards energy-efficient production processes and the increased use of lightweight glass containers contribute to market expansion. The competitive landscape is characterized by both established players and emerging companies, leading to increased innovation and diversification of products and services. However, challenges such as fluctuations in raw material costs and the growing availability of alternative packaging materials represent potential headwinds. Opportunities lie in developing specialized glass containers, catering to niche market segments, and focusing on environmentally friendly manufacturing practices. The market size is estimated at xx Million in 2025 and is projected to reach xx Million by 2033.

Dominant Markets & Segments in Italy Container Glass Market

The Italian beverage sector holds the largest share of the container glass market, exhibiting strong growth potential due to the popularity of bottled beverages. The food sector is a close second, driven by demand for premium food packaging and convenient options. Within these segments, the demand for sustainable and lightweight glass containers is accelerating.

- Beverage: High growth due to bottled drink consumption; increasing demand for premium glass bottles.

- Food: Strong market share, driven by consumer preference for glass jars and bottles for various foods.

- Cosmetics: Steady growth, owing to the aesthetic appeal and perceived quality associated with glass packaging.

- Pharmaceuticals: Stable demand driven by the requirement for safe and tamper-evident packaging.

- Other: Includes diverse applications such as decorative items and specialized containers; this segment shows modest growth.

Growth drivers for the dominant segments include increasing consumer disposable income, evolving lifestyle choices, and supportive government policies promoting sustainable packaging materials. The robust food and beverage industry in Italy, combined with its reputation for high-quality products, significantly contributes to the market's dominance in these areas.

Italy Container Glass Market Product Analysis

The Italian container glass market showcases a range of products tailored to specific end-user needs. Innovations focus on lightweight designs to reduce transportation costs and environmental impact, and the use of diverse shapes and colors for enhanced branding and visual appeal. Advances in glass production processes, including the adoption of hydrogen-based technologies, are enhancing sustainability. This competition fosters innovation, promoting a diverse range of products to meet specific requirements from various sectors.

Key Drivers, Barriers & Challenges in Italy Container Glass Market

Key Drivers: Growing demand for sustainable packaging, increasing consumer preference for glass, technological advancements in production processes, government regulations supporting eco-friendly packaging. The "Divina" project, aiming for reduced emissions, is a significant driver towards sustainability.

Challenges: Fluctuations in raw material costs (e.g., silica sand, soda ash), intense competition from alternative packaging materials (e.g., plastics), and regulatory hurdles related to waste management and environmental compliance. Supply chain disruptions, as seen during various global events, also represent significant hurdles, impacting production and delivery times. These challenges might lead to price increases and market instability, impacting market growth.

Growth Drivers in the Italy Container Glass Market Market

Technological advancements, especially in hydrogen-based production to reduce emissions, are a significant driver. The growing demand for sustainable packaging and increasing consumer awareness of environmental issues is pushing growth. Government regulations encouraging eco-friendly packaging further propel market expansion.

Challenges Impacting Italy Container Glass Market Growth

Raw material price volatility, competition from alternative packaging, and supply chain disruptions remain significant barriers. Stringent environmental regulations and waste management complexities, along with energy costs related to the production process, contribute to the challenges.

Key Players Shaping the Italy Container Glass Market Market

- Bell Glass

- Vetri Speciali

- Zignago Vetro

- Vetropack

- Italesse

- Vetroelite

- SAIDA Group

- Vetro Plastica Laziale

- COVIM

- VDGlass

- Vetreria Etrusca

Significant Italy Container Glass Market Industry Milestones

- February 2021: Ardagh Group launched Absolut's 'Absolut Movement' vodka bottle, showcasing innovative design and highlighting the market's focus on aesthetics and branding.

- July 2021: The 'Divina' project, a collaboration among glass manufacturers and energy companies, commenced, signifying a significant push towards sustainable production using hydrogen technology.

Future Outlook for Italy Container Glass Market Market

The Italy container glass market is poised for steady growth, driven by continuous innovation in production, a growing focus on sustainability, and the increasing demand for high-quality glass packaging across various sectors. Strategic partnerships aimed at improving efficiency and reducing environmental impact will play a crucial role in shaping the market's trajectory. The market's potential is strengthened by its integration within a strong Italian food and beverage industry and increasing consumer appreciation for premium packaging solutions.

Italy Container Glass Market Segmentation

-

1. End-user Vertical

-

1.1. Beverages*

-

1.1.1. Alcoholi

- 1.1.1.1. Beer and Cider

- 1.1.1.2. Wine and Spirits

-

1.1.2. Non-Alco

- 1.1.2.1. Carbonated Soft Drinks

- 1.1.2.2. Juices

- 1.1.2.3. Water

- 1.1.2.4. Dairy Based Drinks

- 1.1.2.5. Flavored Drinks

-

1.1.1. Alcoholi

- 1.2. Food

- 1.3. Cosmetics

- 1.4. Pharmaceutical

- 1.5. Other End-user Verticals

-

1.1. Beverages*

Italy Container Glass Market Segmentation By Geography

- 1. Italy

Italy Container Glass Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.40% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Wine Production in Italy; Increasing Adoption of Glass Container Packaging in Pharmaceutical Industry

- 3.3. Market Restrains

- 3.3.1. Availablity of the Substitute can Hinder the Growth of the Market

- 3.4. Market Trends

- 3.4.1. Growing Wine Consumption and Increasing Adoption of Glass Packaging in Food and Condiment Sector

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Italy Container Glass Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.1.1. Beverages*

- 5.1.1.1. Alcoholi

- 5.1.1.1.1. Beer and Cider

- 5.1.1.1.2. Wine and Spirits

- 5.1.1.2. Non-Alco

- 5.1.1.2.1. Carbonated Soft Drinks

- 5.1.1.2.2. Juices

- 5.1.1.2.3. Water

- 5.1.1.2.4. Dairy Based Drinks

- 5.1.1.2.5. Flavored Drinks

- 5.1.1.1. Alcoholi

- 5.1.2. Food

- 5.1.3. Cosmetics

- 5.1.4. Pharmaceutical

- 5.1.5. Other End-user Verticals

- 5.1.1. Beverages*

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Italy

- 5.1. Market Analysis, Insights and Forecast - by End-user Vertical

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Bell Glass*List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Vetri Speciali

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Zignago Vetro

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Vetropack

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Italesse

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Vetroelite

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 SAIDA Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Vetro Plastica Laziale

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 COVIM

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 VDGlass

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Vetreria Etrusca

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Bell Glass*List Not Exhaustive

List of Figures

- Figure 1: Italy Container Glass Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Italy Container Glass Market Share (%) by Company 2024

List of Tables

- Table 1: Italy Container Glass Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Italy Container Glass Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 3: Italy Container Glass Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Italy Container Glass Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Italy Container Glass Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 6: Italy Container Glass Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Italy Container Glass Market?

The projected CAGR is approximately 4.40%.

2. Which companies are prominent players in the Italy Container Glass Market?

Key companies in the market include Bell Glass*List Not Exhaustive, Vetri Speciali, Zignago Vetro, Vetropack, Italesse, Vetroelite, SAIDA Group, Vetro Plastica Laziale, COVIM, VDGlass, Vetreria Etrusca.

3. What are the main segments of the Italy Container Glass Market?

The market segments include End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Wine Production in Italy; Increasing Adoption of Glass Container Packaging in Pharmaceutical Industry.

6. What are the notable trends driving market growth?

Growing Wine Consumption and Increasing Adoption of Glass Packaging in Food and Condiment Sector.

7. Are there any restraints impacting market growth?

Availablity of the Substitute can Hinder the Growth of the Market.

8. Can you provide examples of recent developments in the market?

July 2021 - An Italian group comprising glass manufacturers, furnace suppliers, and energy companies has begun a collaboration to reduce glass industry emissions through hydrogen.The group consists of Snam, RINA, Bormioli Luigi, Bormioli Rocco, Stara Glass, UNI.GE, Stazione Sperimentale del Vetro, IFRF Italia, SGRPRO and RJC SOFT. The 'Divina' project (Decarbonisation of the Glass Industry: Hydrogen and New Equipment), coordinated by Snam, RINA, and Bormioli, aims to reduce emissions in the glass melting stage, which accounts for more than 50% of total energy consumption throughout the production process.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Italy Container Glass Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Italy Container Glass Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Italy Container Glass Market?

To stay informed about further developments, trends, and reports in the Italy Container Glass Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence