Key Insights

The Middle East and Africa Nuclear Power Plant Equipment market is projected for robust expansion, driven by escalating energy demands and regional initiatives to diversify energy sources beyond fossil fuels. The market is anticipated to achieve a Compound Annual Growth Rate (CAGR) of 8.5% from 2024 to 2033. The market size in 2024 was estimated at $3.25 billion. This growth is underpinned by several key factors: a surge in investments in new nuclear power plants and infrastructure upgrades across several nations, and advancements in reactor technologies, particularly Pressurized Water Reactors (PWR) and Pressurized Heavy Water Reactors (PHWR). Demand for both island and auxiliary equipment is expected to be strong, especially in countries like South Africa, Sudan, and Kenya, presenting significant opportunities for equipment suppliers. Potential challenges include high initial investment costs, regulatory complexities, and public perception. Nonetheless, the long-term outlook remains optimistic due to increasing energy needs and governmental commitment to developing a diversified and sustainable energy portfolio.

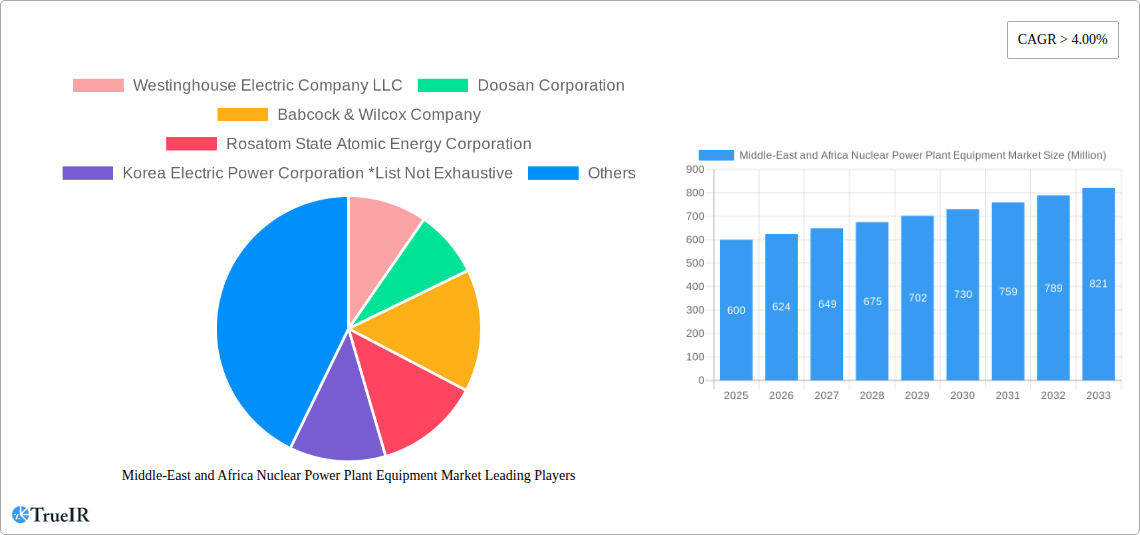

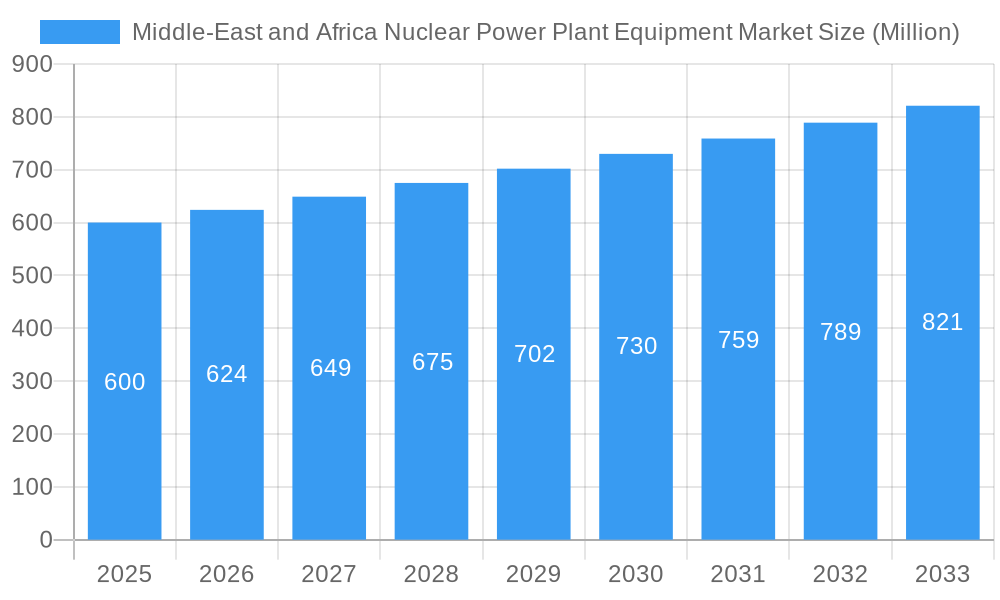

Middle-East and Africa Nuclear Power Plant Equipment Market Market Size (In Billion)

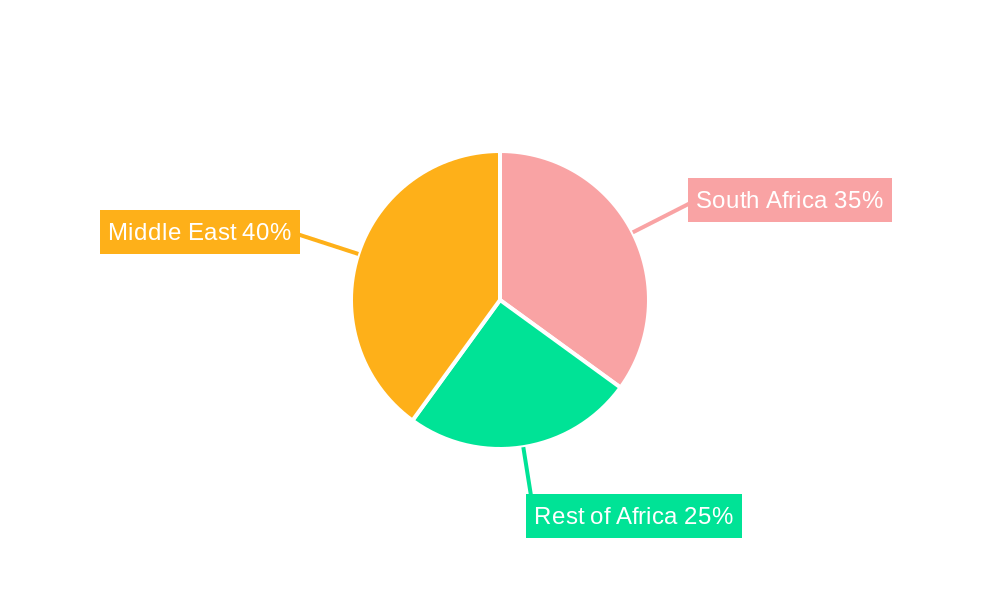

Market segmentation reveals the prevalence of PWR and PHWR reactor types, aligning with global trends. The market is further divided into Island Equipment and Auxiliary Equipment, indicating strong demand across all nuclear power plant infrastructure components. Key market participants, including Westinghouse, Doosan, Babcock & Wilcox, Rosatom, and Mitsubishi Heavy Industries, are leveraging their expertise to secure market share. Geographic analysis highlights significant potential in African nations such as South Africa, Sudan, Uganda, Tanzania, and Kenya, reflecting regional variations in market penetration and growth prospects. Future market dynamics will be significantly shaped by the successful execution and timelines of ongoing and planned nuclear power projects within the region.

Middle-East and Africa Nuclear Power Plant Equipment Market Company Market Share

Middle East & Africa Nuclear Power Plant Equipment Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Middle East and Africa Nuclear Power Plant Equipment market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market trends, competitive dynamics, and future growth potential. The report leverages extensive data analysis and expert insights to provide a clear understanding of this dynamic and evolving market. The total market size is projected to reach xx Million by 2033, exhibiting a robust CAGR of xx% during the forecast period (2025-2033).

Middle-East and Africa Nuclear Power Plant Equipment Market Market Structure & Competitive Landscape

The Middle East and Africa Nuclear Power Plant Equipment market is characterized by a moderately concentrated landscape, with a few key players holding significant market share. However, the market is witnessing increased competition from new entrants and expansion by existing players. Innovation is a crucial driver, with companies investing heavily in advanced reactor technologies and equipment to enhance efficiency, safety, and cost-effectiveness. Stringent regulatory frameworks and safety standards significantly influence market dynamics. The availability of substitute energy sources presents a challenge, necessitating continuous innovation and competitive pricing. The market is segmented by end-user (government agencies, private power producers), and we observe a growing trend towards public-private partnerships. M&A activities have been moderate in recent years, with a total transaction volume of approximately xx Million in the past five years, reflecting strategic consolidation efforts within the industry. Concentration ratios are currently estimated at xx%, indicating moderate market concentration. Future projections suggest increasing competition, potentially driving this ratio lower.

Middle-East and Africa Nuclear Power Plant Equipment Market Market Trends & Opportunities

The Middle East and Africa Nuclear Power Plant Equipment market is experiencing significant growth driven by increasing energy demand, coupled with the need for diversification of energy sources away from reliance on fossil fuels. Several countries in the region are actively pursuing nuclear energy programs, creating substantial opportunities for equipment suppliers. Technological advancements in reactor designs, particularly the development of smaller modular reactors (SMRs), are opening new avenues for market expansion. Consumer preferences are shifting towards cleaner and more sustainable energy solutions, favoring nuclear power's low-carbon footprint. The competitive landscape is dynamic, with both established players and emerging companies vying for market share through technological innovation, strategic partnerships, and cost optimization strategies. The market is projected to grow at a CAGR of xx% from 2025 to 2033, driven by government initiatives and increasing investments in infrastructure development. Market penetration rates for nuclear power are expected to rise significantly in several key markets within the region during the forecast period.

Dominant Markets & Segments in Middle-East and Africa Nuclear Power Plant Equipment Market

Leading Region: Egypt is currently the leading market in the region, followed by UAE and South Africa, driven by major projects underway and government commitment to expanding nuclear power capacity.

Leading Country: Egypt holds the dominant position due to its large-scale nuclear power plant projects under construction, particularly the El Dabaa plant.

Leading Reactor Type: Pressurized Water Reactor (PWR) holds the largest market share due to its proven technology and widespread adoption globally.

Leading Carrier Type: Island Equipment constitutes the largest segment due to its vital role in the core functionality of nuclear power plants.

Key Growth Drivers:

- Government Policies: Strong governmental support and policy frameworks favoring nuclear power development are fueling market growth.

- Infrastructure Development: The ongoing construction of numerous nuclear power plants across the region presents significant opportunities.

- Energy Security Concerns: The need for reliable and sustainable energy sources is a major driver for nuclear power adoption.

- Foreign Investments: Significant foreign investments in nuclear power projects are further boosting the growth of the market.

Middle-East and Africa Nuclear Power Plant Equipment Market Product Analysis

Technological advancements are driving innovation in nuclear power plant equipment. Modern reactors are designed with enhanced safety features, improved efficiency, and reduced waste generation. The focus on smaller, modular reactor designs is increasing the market accessibility for smaller nations and reducing capital costs. The competitive advantage lies in offering advanced technology, competitive pricing, and robust after-sales support. These factors are critical for securing contracts and maintaining a strong market position.

Key Drivers, Barriers & Challenges in Middle-East and Africa Nuclear Power Plant Equipment Market

Key Drivers: Rising energy demands, government support for nuclear power, and the need for clean energy solutions are major drivers. Specific examples include Egypt's El Dabaa plant and planned projects in other nations. Technological advancements such as SMRs are also driving growth.

Challenges: High upfront capital costs, stringent safety regulations, potential public opposition to nuclear power, and the complexity of the supply chain pose significant challenges. Supply chain disruptions can cause project delays and increased costs, impacting overall market growth by an estimated xx%. Regulatory hurdles create uncertainties and complicate project approvals.

Growth Drivers in the Middle-East and Africa Nuclear Power Plant Equipment Market Market

The growth of the Middle East and Africa nuclear power plant equipment market is fueled by rising energy demand, governmental initiatives promoting nuclear power adoption, and growing foreign investments in nuclear infrastructure projects. Technological advancements in reactor designs and equipment further enhance market prospects.

Challenges Impacting Middle-East and Africa Nuclear Power Plant Equipment Market Growth

Significant challenges include the high initial capital investment required for nuclear power projects, stringent safety regulations and licensing processes, potential public opposition to nuclear technology, and the complexity and vulnerability of the global supply chain. These challenges can lead to project delays, cost overruns, and potentially hinder market growth.

Key Players Shaping the Middle-East and Africa Nuclear Power Plant Equipment Market Market

Significant Middle-East and Africa Nuclear Power Plant Equipment Market Industry Milestones

- November 2022: Doosan Enerbility wins USD 1.2 Billion contract for El Dabaa nuclear plant (Egypt).

- August 2022: KHNP signs contract with Atomstroyexport for construction at El Dabaa plant.

- May 2022: IAEA approves Uganda's plan for a 2 GW nuclear power station.

Future Outlook for Middle-East and Africa Nuclear Power Plant Equipment Market Market

The Middle East and Africa nuclear power plant equipment market is poised for significant growth in the coming years. Continued government support, rising energy demand, and technological advancements in reactor designs will drive market expansion. Strategic partnerships and investments in infrastructure development will further contribute to the market's growth trajectory. The market presents promising opportunities for companies that can provide innovative, safe, and cost-effective solutions.

Middle-East and Africa Nuclear Power Plant Equipment Market Segmentation

-

1. Reactor Type

- 1.1. Pressurized Water Reactor

- 1.2. Pressurized Heavy Water Reactor

- 1.3. Other Reactor Types

-

2. Carrier Type

- 2.1. Island Equipment

- 2.2. Auxiliary Equipment

- 2.3. Research Reactor

-

3. Geogrpahy

-

3.1. Middle-East and Africa

- 3.1.1. The United Arab Emirates

- 3.1.2. Saudi Arabia

- 3.1.3. South Africa

- 3.1.4. Rest of Middle-East and Africa

-

3.1. Middle-East and Africa

Middle-East and Africa Nuclear Power Plant Equipment Market Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle-East and Africa Nuclear Power Plant Equipment Market Regional Market Share

Geographic Coverage of Middle-East and Africa Nuclear Power Plant Equipment Market

Middle-East and Africa Nuclear Power Plant Equipment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Global Inclination toward Renewable-based Power Generation4.; Increased Power Demand in Line with the Increasing Population

- 3.3. Market Restrains

- 3.3.1. 4.; High Initial Cost

- 3.4. Market Trends

- 3.4.1. Pressurized Water Reactors to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle-East and Africa Nuclear Power Plant Equipment Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Reactor Type

- 5.1.1. Pressurized Water Reactor

- 5.1.2. Pressurized Heavy Water Reactor

- 5.1.3. Other Reactor Types

- 5.2. Market Analysis, Insights and Forecast - by Carrier Type

- 5.2.1. Island Equipment

- 5.2.2. Auxiliary Equipment

- 5.2.3. Research Reactor

- 5.3. Market Analysis, Insights and Forecast - by Geogrpahy

- 5.3.1. Middle-East and Africa

- 5.3.1.1. The United Arab Emirates

- 5.3.1.2. Saudi Arabia

- 5.3.1.3. South Africa

- 5.3.1.4. Rest of Middle-East and Africa

- 5.3.1. Middle-East and Africa

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Reactor Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Westinghouse Electric Company LLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Doosan Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Babcock & Wilcox Company

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Rosatom State Atomic Energy Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Korea Electric Power Corporation *List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 JSC Atomstroyexport

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Mitsubishi Heavy Industries Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Westinghouse Electric Company LLC

List of Figures

- Figure 1: Middle-East and Africa Nuclear Power Plant Equipment Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Middle-East and Africa Nuclear Power Plant Equipment Market Share (%) by Company 2025

List of Tables

- Table 1: Middle-East and Africa Nuclear Power Plant Equipment Market Revenue billion Forecast, by Reactor Type 2020 & 2033

- Table 2: Middle-East and Africa Nuclear Power Plant Equipment Market Revenue billion Forecast, by Carrier Type 2020 & 2033

- Table 3: Middle-East and Africa Nuclear Power Plant Equipment Market Revenue billion Forecast, by Geogrpahy 2020 & 2033

- Table 4: Middle-East and Africa Nuclear Power Plant Equipment Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Middle-East and Africa Nuclear Power Plant Equipment Market Revenue billion Forecast, by Reactor Type 2020 & 2033

- Table 6: Middle-East and Africa Nuclear Power Plant Equipment Market Revenue billion Forecast, by Carrier Type 2020 & 2033

- Table 7: Middle-East and Africa Nuclear Power Plant Equipment Market Revenue billion Forecast, by Geogrpahy 2020 & 2033

- Table 8: Middle-East and Africa Nuclear Power Plant Equipment Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Saudi Arabia Middle-East and Africa Nuclear Power Plant Equipment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: United Arab Emirates Middle-East and Africa Nuclear Power Plant Equipment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Israel Middle-East and Africa Nuclear Power Plant Equipment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Qatar Middle-East and Africa Nuclear Power Plant Equipment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Kuwait Middle-East and Africa Nuclear Power Plant Equipment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Oman Middle-East and Africa Nuclear Power Plant Equipment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Bahrain Middle-East and Africa Nuclear Power Plant Equipment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Jordan Middle-East and Africa Nuclear Power Plant Equipment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Lebanon Middle-East and Africa Nuclear Power Plant Equipment Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle-East and Africa Nuclear Power Plant Equipment Market?

The projected CAGR is approximately 8.5%.

2. Which companies are prominent players in the Middle-East and Africa Nuclear Power Plant Equipment Market?

Key companies in the market include Westinghouse Electric Company LLC, Doosan Corporation, Babcock & Wilcox Company, Rosatom State Atomic Energy Corporation, Korea Electric Power Corporation *List Not Exhaustive, JSC Atomstroyexport, Mitsubishi Heavy Industries Ltd.

3. What are the main segments of the Middle-East and Africa Nuclear Power Plant Equipment Market?

The market segments include Reactor Type, Carrier Type, Geogrpahy.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.25 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Global Inclination toward Renewable-based Power Generation4.; Increased Power Demand in Line with the Increasing Population.

6. What are the notable trends driving market growth?

Pressurized Water Reactors to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; High Initial Cost.

8. Can you provide examples of recent developments in the market?

In November 2022, Doosan Enerbility was awarded a contract worth KRW1.6 trillion (USD1.2 billion) by Korea Hydro and Nuclear Power (KHNP) to build the turbine islands of the El Dabaa nuclear power plant under construction in Egypt. In August 2022, KHNP signed a contract with Rosatom subsidiary Atomstroyexport (ASE) to construct 82 buildings and structures at the four units of Egypt's first nuclear power plant, including the turbine buildings, water treatment, and air conditioning systems. KHNP has now subcontracted Doosan Enerbility to construct 32 structures, including the turbine buildings.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle-East and Africa Nuclear Power Plant Equipment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle-East and Africa Nuclear Power Plant Equipment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle-East and Africa Nuclear Power Plant Equipment Market?

To stay informed about further developments, trends, and reports in the Middle-East and Africa Nuclear Power Plant Equipment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence