Key Insights

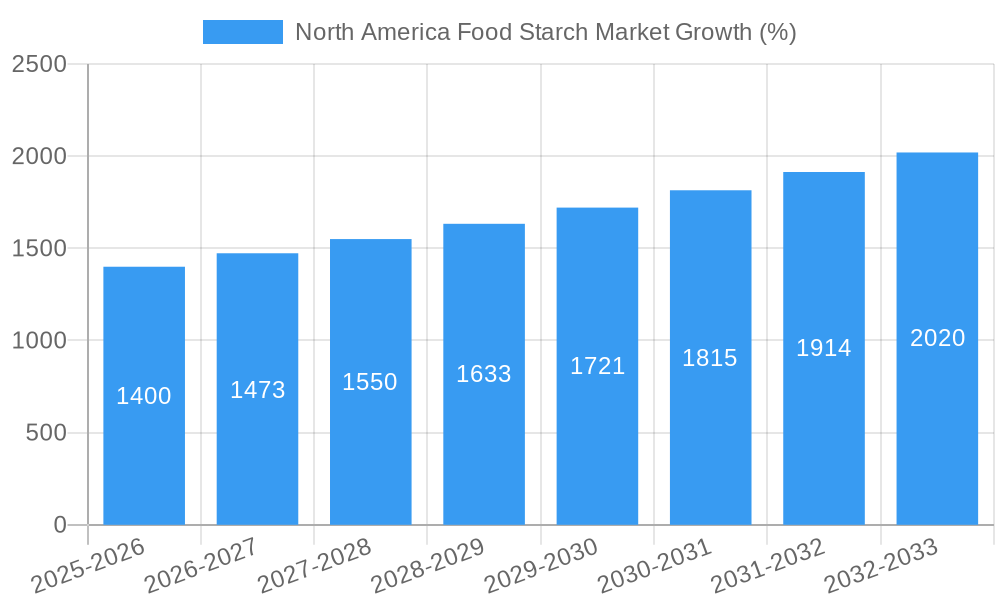

The North America food starch market, valued at approximately $X billion in 2025 (assuming a logical extrapolation based on the provided CAGR of 5.60% and a 2019-2024 historical period), is poised for robust growth throughout the forecast period (2025-2033). This expansion is driven primarily by the increasing demand for processed foods, particularly in the bakery, confectionery, and convenience food sectors. The rising popularity of ready-to-eat meals and snacks, coupled with changing consumer lifestyles and preferences for convenient food options, fuels this market segment's expansion. Furthermore, the functional properties of food starches—their ability to thicken, stabilize, and add texture to various food products—contribute significantly to their widespread adoption across diverse food applications. Native starches, derived mainly from corn and potato sources, continue to dominate the market, but the growing demand for modified starches with enhanced functionalities is expected to drive segment-specific growth. Leading players like ADM, Ingredion Inc., and Cargill Inc. are investing significantly in research and development to innovate and introduce new modified starches catering to the evolving needs of food manufacturers.

The market's growth trajectory is, however, influenced by certain restraining factors. Fluctuations in raw material prices, particularly corn and potato prices, can significantly impact the overall cost of production, potentially limiting profitability. Moreover, the increasing consumer awareness regarding the health implications of processed foods, including concerns about high carbohydrate content, might present challenges. However, the market is expected to overcome these challenges due to the ongoing innovation in starch modification technologies which focus on developing healthier and more functional starches. The growth is projected to be particularly strong in the United States, driven by a large population and a thriving food processing industry. Canada and Mexico also contribute significantly, reflecting consistent demand from both domestic and export markets. The market's segmentation by type (native and modified starch) and application (bakery, dairy, etc.) provides a granular view of market dynamics, enabling businesses to develop tailored strategies for specific segments.

North America Food Starch Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the North America food starch market, covering market size, growth projections, key segments, competitive landscape, and future trends. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report offers invaluable insights for industry stakeholders, including manufacturers, distributors, investors, and regulatory bodies. It leverages extensive data and expert analysis to paint a clear picture of this dynamic market.

North America Food Starch Market Structure & Competitive Landscape

The North America food starch market exhibits a moderately concentrated structure, with key players like ADM, Ingredion Inc, Cargill Inc, and others holding significant market share. The market's concentration ratio (CR4) is estimated at xx%, indicating the presence of both large established players and smaller niche players. Innovation is a key driver, with companies continually developing new starch types and functionalities to cater to evolving consumer demands for clean-label products and improved food textures. Regulatory landscape influences the market through food safety standards and labeling requirements. Substitutes such as hydrocolloids and other thickening agents exist, but starch maintains its dominance due to cost-effectiveness and established functionality. The end-user segmentation is diverse, spanning across bakery, dairy, confectionery, convenience foods, and beverages. M&A activity has been moderate in recent years, with xx mergers and acquisitions recorded between 2019 and 2024, primarily focused on expanding product portfolios and geographic reach.

- Market Concentration: CR4 estimated at xx%

- Innovation Drivers: Development of clean-label starches, functional starches, and organic options

- Regulatory Impacts: Adherence to food safety and labeling standards

- Product Substitutes: Hydrocolloids, other thickening agents

- End-User Segmentation: Bakery, Dairy, Confectionery, Convenience Foods, Beverages

- M&A Trends: xx M&A transactions between 2019 and 2024

North America Food Starch Market Trends & Opportunities

The North America food starch market is projected to experience robust growth, with a CAGR of xx% during the forecast period (2025-2033). This growth is fueled by several factors, including rising demand for convenient and processed foods, increasing consumer preference for clean-label products, and the expanding use of starch in various food applications. Technological advancements are also contributing to market expansion, with the introduction of novel starch modification techniques leading to enhanced functionalities and improved product characteristics. Furthermore, the growing health-conscious consumer base is driving demand for organic and functional starches. Competitive dynamics are characterized by product innovation, brand building, and strategic partnerships. Market penetration rates for specific starch types and applications vary, with native corn starch maintaining significant market share due to its wide applications and cost-effectiveness.

Dominant Markets & Segments in North America Food Starch Market

The United States dominates the North America food starch market, owing to its large food processing industry and high consumption of processed foods. Within the market segmentation:

- Type: Modified starch holds a larger market share compared to native starch, driven by its enhanced functionalities and versatility.

- Source: Corn starch is the dominant source, benefiting from its abundant availability and cost-effectiveness. However, demand for other sources like potato, tapioca, and rice starch is also increasing due to consumer preference for variety and specific functionalities.

- Application: Bakery and confectionery sectors are major consumers of food starch. Convenience foods and dairy also contribute significantly.

Key Growth Drivers:

- Robust Food Processing Industry in the US

- Growing demand for convenience and processed foods

- Rising consumer preference for clean label and organic options.

- Technological advancements leading to enhanced starch functionalities.

North America Food Starch Market Product Analysis

Technological advancements in starch modification are driving product innovation, leading to the development of starches with tailored properties for specific food applications. For example, the launch of multifunctional starches that enable cleaner labels in dairy products represents a key advancement. These innovations enhance texture, stability, and other desirable characteristics in food products, creating a competitive advantage for manufacturers. The market is witnessing the rise of organic and non-GMO starches in response to rising consumer demand for natural ingredients.

Key Drivers, Barriers & Challenges in North America Food Starch Market

Key Drivers:

- Growing demand for processed foods and convenience foods.

- Increasing adoption of modified starches for enhanced functionalities.

- Rising consumer demand for clean-label, organic and Non-GMO starches.

Challenges:

- Fluctuations in raw material prices (e.g., corn, potato) impacting profitability.

- Stringent regulatory requirements for food safety and labeling, adding compliance costs.

- Intense competition from substitute ingredients, such as hydrocolloids.

- Supply chain disruptions can impact availability and increase costs. The impact of these disruptions in 2022-2024 caused a xx% increase in starch prices.

Growth Drivers in the North America Food Starch Market

The market is driven by increasing demand for processed foods, technological advancements in starch modification, and the growth of health-conscious consumers seeking cleaner label products. The rise of convenient ready-to-eat meals and snacks is a significant contributor. The development of starches with improved functionality, like cleaner-label options for dairy, also fuels expansion.

Challenges Impacting North America Food Starch Market Growth

Fluctuating raw material prices, stringent regulations, and competition from alternative thickening agents pose significant challenges. Supply chain vulnerabilities and geopolitical instability also contribute to uncertainty. The increased need for compliance with strict labelling regulations adds to the cost of production.

Key Players Shaping the North America Food Starch Market

- ADM

- Tereos SA

- Ingredion Inc

- AGRANA Beteiligungs-AG

- Grain Processing Corporation

- Cargill Inc

- National Starch Food Innovation

- Roquette Freres

- Tate & Lyle

- Royal Avebe

Significant North America Food Starch Market Industry Milestones

- July 2020: Ingredion Inc launched an organic line of native starches (Purity Bio 201, Purity Bio 301, Purity Bio 805), expanding its organic product portfolio and catering to the growing demand for clean-label ingredients.

- 2020: Ingredion Inc launched organic native rice starches, targeting the ready-meal, dressing, sauce, and soup markets, highlighting the increasing focus on organic and functional starches.

- April 2022: Royal Avebe launched Etenia ES, a multifunctional starch for creamy clean-label dairy products, showcasing innovation in starch modification for specific applications.

Future Outlook for North America Food Starch Market

The North America food starch market is poised for continued growth driven by innovation in starch modification, expanding applications in health-conscious food products, and consistent demand from established sectors. Strategic partnerships, investment in R&D, and expansion into new markets will further fuel market expansion. The focus on sustainability and reduction of environmental impact will also play a crucial role in shaping the future of the market.

North America Food Starch Market Segmentation

-

1. Type

- 1.1. Native Starch

- 1.2. Modified Starch

-

2. Source

- 2.1. Corn

- 2.2. Potato

- 2.3. Wheat

- 2.4. Tapioca

- 2.5. Rice

- 2.6. Others

-

3. Application

- 3.1. Bakery

- 3.2. Dairy

- 3.3. Confetionery

- 3.4. Convenince Foods

- 3.5. Beverages

- 3.6. Others

-

4. Geography

- 4.1. United States

- 4.2. Canada

- 4.3. Mexico

- 4.4. Rest of North America

North America Food Starch Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

- 4. Rest of North America

North America Food Starch Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.60% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Wide Applications and Functionality; Demand For Gluten-Free Products

- 3.3. Market Restrains

- 3.3.1. Easy Availability of Economically Feasible Alternatives

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Clean-label Ingredients

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Food Starch Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Native Starch

- 5.1.2. Modified Starch

- 5.2. Market Analysis, Insights and Forecast - by Source

- 5.2.1. Corn

- 5.2.2. Potato

- 5.2.3. Wheat

- 5.2.4. Tapioca

- 5.2.5. Rice

- 5.2.6. Others

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Bakery

- 5.3.2. Dairy

- 5.3.3. Confetionery

- 5.3.4. Convenince Foods

- 5.3.5. Beverages

- 5.3.6. Others

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.4.4. Rest of North America

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. United States

- 5.5.2. Canada

- 5.5.3. Mexico

- 5.5.4. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United States North America Food Starch Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Native Starch

- 6.1.2. Modified Starch

- 6.2. Market Analysis, Insights and Forecast - by Source

- 6.2.1. Corn

- 6.2.2. Potato

- 6.2.3. Wheat

- 6.2.4. Tapioca

- 6.2.5. Rice

- 6.2.6. Others

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Bakery

- 6.3.2. Dairy

- 6.3.3. Confetionery

- 6.3.4. Convenince Foods

- 6.3.5. Beverages

- 6.3.6. Others

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. United States

- 6.4.2. Canada

- 6.4.3. Mexico

- 6.4.4. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Canada North America Food Starch Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Native Starch

- 7.1.2. Modified Starch

- 7.2. Market Analysis, Insights and Forecast - by Source

- 7.2.1. Corn

- 7.2.2. Potato

- 7.2.3. Wheat

- 7.2.4. Tapioca

- 7.2.5. Rice

- 7.2.6. Others

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Bakery

- 7.3.2. Dairy

- 7.3.3. Confetionery

- 7.3.4. Convenince Foods

- 7.3.5. Beverages

- 7.3.6. Others

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. United States

- 7.4.2. Canada

- 7.4.3. Mexico

- 7.4.4. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Mexico North America Food Starch Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Native Starch

- 8.1.2. Modified Starch

- 8.2. Market Analysis, Insights and Forecast - by Source

- 8.2.1. Corn

- 8.2.2. Potato

- 8.2.3. Wheat

- 8.2.4. Tapioca

- 8.2.5. Rice

- 8.2.6. Others

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Bakery

- 8.3.2. Dairy

- 8.3.3. Confetionery

- 8.3.4. Convenince Foods

- 8.3.5. Beverages

- 8.3.6. Others

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. United States

- 8.4.2. Canada

- 8.4.3. Mexico

- 8.4.4. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of North America North America Food Starch Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Native Starch

- 9.1.2. Modified Starch

- 9.2. Market Analysis, Insights and Forecast - by Source

- 9.2.1. Corn

- 9.2.2. Potato

- 9.2.3. Wheat

- 9.2.4. Tapioca

- 9.2.5. Rice

- 9.2.6. Others

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Bakery

- 9.3.2. Dairy

- 9.3.3. Confetionery

- 9.3.4. Convenince Foods

- 9.3.5. Beverages

- 9.3.6. Others

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. United States

- 9.4.2. Canada

- 9.4.3. Mexico

- 9.4.4. Rest of North America

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. United States North America Food Starch Market Analysis, Insights and Forecast, 2019-2031

- 11. Canada North America Food Starch Market Analysis, Insights and Forecast, 2019-2031

- 12. Mexico North America Food Starch Market Analysis, Insights and Forecast, 2019-2031

- 13. Rest of North America North America Food Starch Market Analysis, Insights and Forecast, 2019-2031

- 14. Competitive Analysis

- 14.1. Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 ADM

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Tereos SA

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Ingredion Inc

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 AGRANA Beteiligungs-AG

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Grain Processing Corporation

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 cargill Inc

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 National Starch Food Innovation

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Roquette Freres

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Tate & Lyle

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Royal Avebe

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.1 ADM

List of Figures

- Figure 1: North America Food Starch Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Food Starch Market Share (%) by Company 2024

List of Tables

- Table 1: North America Food Starch Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Food Starch Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: North America Food Starch Market Revenue Million Forecast, by Source 2019 & 2032

- Table 4: North America Food Starch Market Revenue Million Forecast, by Application 2019 & 2032

- Table 5: North America Food Starch Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 6: North America Food Starch Market Revenue Million Forecast, by Region 2019 & 2032

- Table 7: North America Food Starch Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: United States North America Food Starch Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Canada North America Food Starch Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Mexico North America Food Starch Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of North America North America Food Starch Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: North America Food Starch Market Revenue Million Forecast, by Type 2019 & 2032

- Table 13: North America Food Starch Market Revenue Million Forecast, by Source 2019 & 2032

- Table 14: North America Food Starch Market Revenue Million Forecast, by Application 2019 & 2032

- Table 15: North America Food Starch Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 16: North America Food Starch Market Revenue Million Forecast, by Country 2019 & 2032

- Table 17: North America Food Starch Market Revenue Million Forecast, by Type 2019 & 2032

- Table 18: North America Food Starch Market Revenue Million Forecast, by Source 2019 & 2032

- Table 19: North America Food Starch Market Revenue Million Forecast, by Application 2019 & 2032

- Table 20: North America Food Starch Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 21: North America Food Starch Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: North America Food Starch Market Revenue Million Forecast, by Type 2019 & 2032

- Table 23: North America Food Starch Market Revenue Million Forecast, by Source 2019 & 2032

- Table 24: North America Food Starch Market Revenue Million Forecast, by Application 2019 & 2032

- Table 25: North America Food Starch Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 26: North America Food Starch Market Revenue Million Forecast, by Country 2019 & 2032

- Table 27: North America Food Starch Market Revenue Million Forecast, by Type 2019 & 2032

- Table 28: North America Food Starch Market Revenue Million Forecast, by Source 2019 & 2032

- Table 29: North America Food Starch Market Revenue Million Forecast, by Application 2019 & 2032

- Table 30: North America Food Starch Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 31: North America Food Starch Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Food Starch Market?

The projected CAGR is approximately 5.60%.

2. Which companies are prominent players in the North America Food Starch Market?

Key companies in the market include ADM, Tereos SA, Ingredion Inc, AGRANA Beteiligungs-AG, Grain Processing Corporation, cargill Inc, National Starch Food Innovation, Roquette Freres, Tate & Lyle, Royal Avebe.

3. What are the main segments of the North America Food Starch Market?

The market segments include Type, Source, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Wide Applications and Functionality; Demand For Gluten-Free Products.

6. What are the notable trends driving market growth?

Increasing Demand for Clean-label Ingredients.

7. Are there any restraints impacting market growth?

Easy Availability of Economically Feasible Alternatives.

8. Can you provide examples of recent developments in the market?

In April 2022, Royal Avebe launched Etenia ES, a new multifunctional starch that is modified to use as an ingredient in creamy clean-label dairy products.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Food Starch Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Food Starch Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Food Starch Market?

To stay informed about further developments, trends, and reports in the North America Food Starch Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence