Key Insights

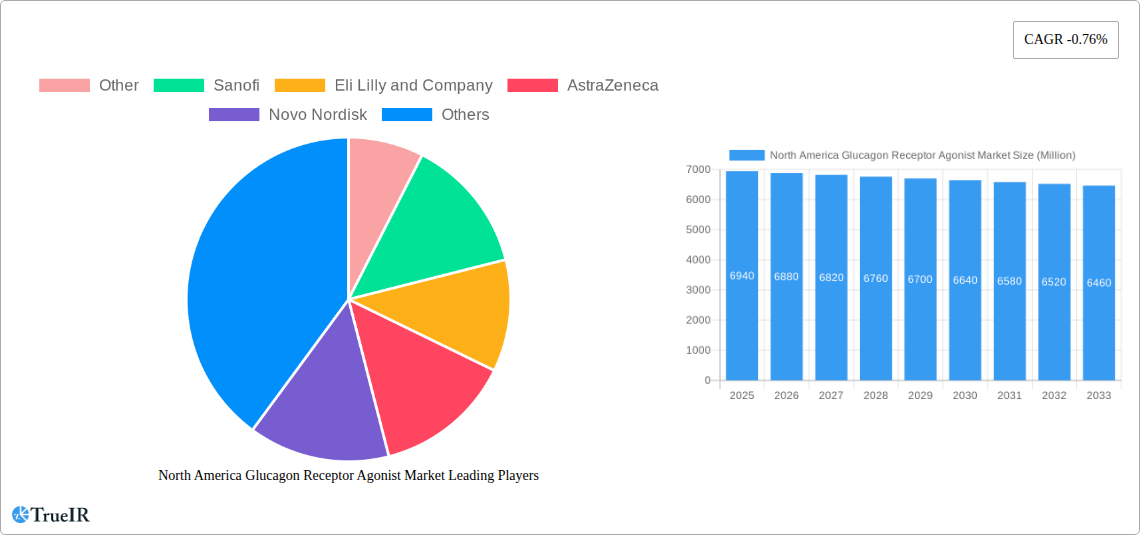

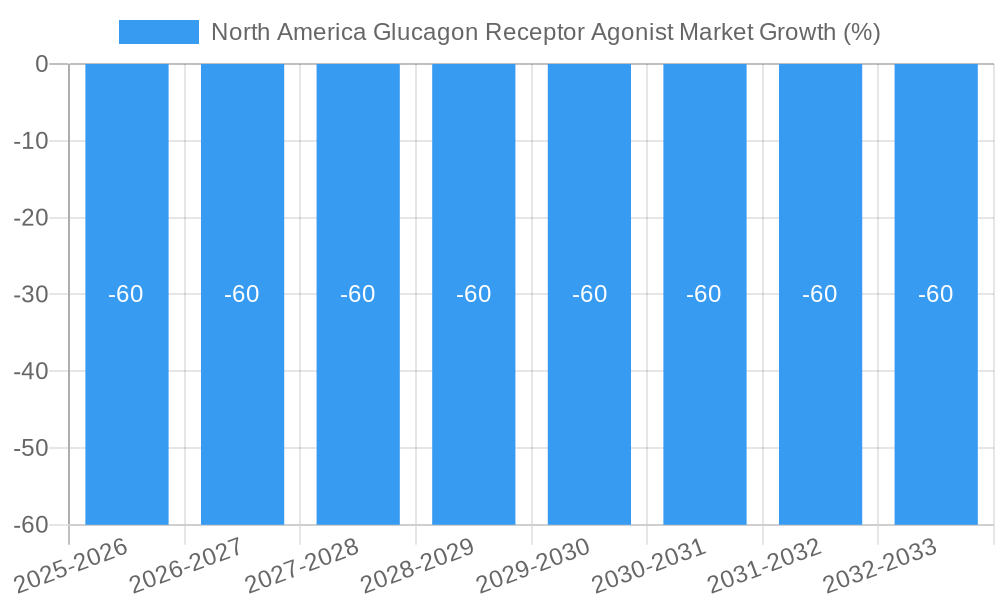

The North American glucagon receptor agonist (GRA) market, valued at $6.94 billion in 2025, is projected to experience a modest decline in the forecast period (2025-2033), reflected in its negative CAGR of -0.76%. This seemingly counterintuitive trend, despite the significant medical need for effective type 2 diabetes treatments, likely stems from several factors. The market's maturity, with established drugs like Bydureon (Liraglutide), Victoza (Lixisenatide), Lyxumia (Semaglutide), and Trulicity (Dulaglutide) already holding substantial market share, contributes to slower growth. Furthermore, the introduction of newer, potentially more effective, or more convenient therapies (such as GLP-1 receptor agonists delivered via different routes or with modified pharmacokinetics) could influence market share dynamics and limit the overall growth of GRAs specifically. Competition among established pharmaceutical giants like Novo Nordisk, Eli Lilly and Company, AstraZeneca, Sanofi, and Pfizer, along with other players, further intensifies market pressures. While the aging population and increasing prevalence of type 2 diabetes in North America remain key drivers, the market's relatively slow growth underscores the ongoing evolution and competition within the broader diabetes treatment landscape.

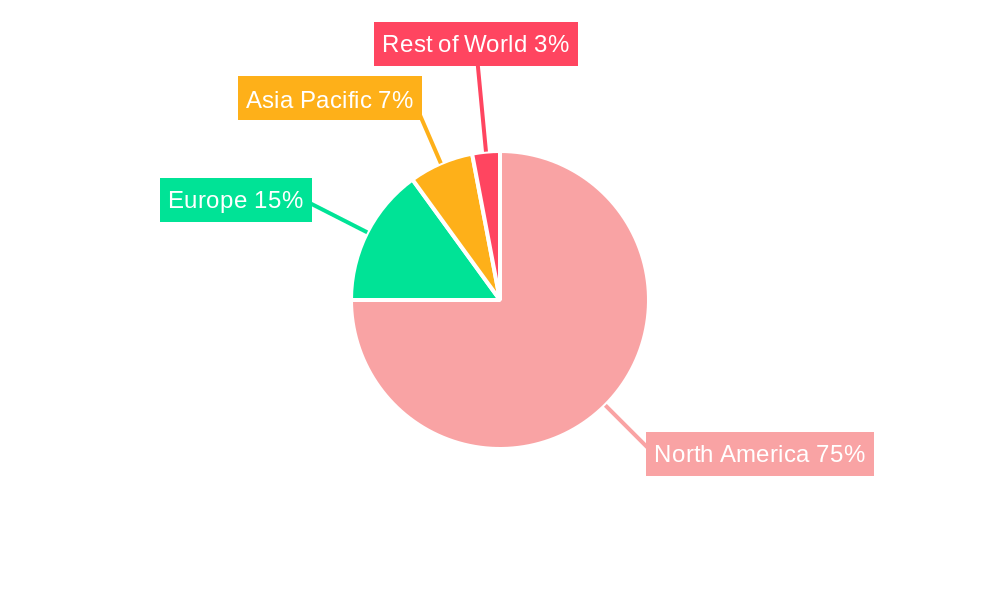

Within North America, the United States is expected to be the largest market segment, given its higher prevalence of diabetes and greater healthcare spending capacity compared to Canada and Mexico. However, increasing healthcare costs and the price sensitivity of some insurers and patients could act as restraints on market expansion. The segment breakdown by drug indicates that Liraglutide, Lixisenatide, Semaglutide, and Dulaglutide dominate the market, reflecting the established clinical efficacy and market penetration of these specific GRAs. Future growth may depend on the successful launch of novel GRA formulations, potentially addressing limitations of existing treatments or offering improved convenience and patient compliance. Pricing strategies and the effectiveness of marketing campaigns by major pharmaceutical companies will also influence the market’s trajectory throughout the forecast period.

North America Glucagon Receptor Agonist Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the North America Glucagon Receptor Agonist market, covering the period 2019-2033. With a focus on key market segments, competitive dynamics, and future growth projections, this report is an essential resource for industry stakeholders, investors, and researchers. The report leverages extensive market research and data analysis to offer actionable insights and forecasts, empowering informed decision-making.

North America Glucagon Receptor Agonist Market Structure & Competitive Landscape

The North America Glucagon Receptor Agonist market is characterized by a moderately concentrated landscape, with key players like Novo Nordisk, Eli Lilly and Company, Sanofi, AstraZeneca, and Pfizer holding significant market share. The market exhibits strong innovation drivers, fueled by the ongoing need for effective treatments for type 2 diabetes and obesity. Regulatory approvals, such as the FDA's approval of semaglutide (Wegovy) for pediatric obesity, significantly impact market growth. Product substitutes, primarily other anti-diabetic medications and weight-loss therapies, pose a competitive challenge. The market demonstrates strong end-user segmentation, catering to both adult and pediatric populations with varying treatment needs. M&A activity remains moderate, with a focus on strategic acquisitions to enhance product portfolios and expand market reach. The 4-firm concentration ratio is estimated at xx% for 2024, indicating a moderately concentrated market. M&A volume in the last 5 years averaged xx deals annually. Future market dynamics will likely be influenced by the introduction of innovative therapies and the ongoing regulatory landscape.

North America Glucagon Receptor Agonist Market Market Trends & Opportunities

The North America Glucagon Receptor Agonist market is experiencing robust growth, driven by the increasing prevalence of type 2 diabetes and obesity. The market size reached an estimated $xx Million in 2024 and is projected to reach $xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033). Technological advancements, particularly in the development of novel GLP-1 receptor agonists with enhanced efficacy and tolerability profiles, are key growth catalysts. Consumer preferences are shifting towards convenient, once-weekly formulations, creating significant opportunities for manufacturers. The market penetration rate for glucagon receptor agonists in the treatment of type 2 diabetes is currently estimated at xx% and is expected to increase to xx% by 2033. Intense competition among established players and the emergence of new entrants are shaping market dynamics. The growing demand for personalized medicine and the focus on improving patient outcomes are also driving market growth.

Dominant Markets & Segments in North America Glucagon Receptor Agonist Market

The United States represents the dominant market within North America, driven by high prevalence rates of type 2 diabetes and obesity, robust healthcare infrastructure, and high expenditure on healthcare. Among the various segments, drugs such as Dulaglutide and Trulicity (Exenatide) currently hold a substantial market share, while Bydureon (Liraglutide), Victoza (Lixisenatide), and Lyxumia (Semaglutide) contribute significantly to market revenue.

- Key Growth Drivers for the US Market:

- High prevalence of type 2 diabetes and obesity.

- Advanced healthcare infrastructure and access to specialized care.

- High healthcare expenditure and insurance coverage.

- Favorable regulatory environment promoting innovation.

The detailed analysis reveals that the strong growth observed in these segments can be attributed to the high effectiveness and favorable safety profiles of the respective drugs. The increasing awareness of the benefits of these medications among both healthcare professionals and patients contributes significantly to the market dominance of these segments. The ongoing research and development efforts focused on improving the efficacy and safety profile of these drugs are also expected to contribute to further market growth in the coming years.

North America Glucagon Receptor Agonist Market Product Analysis

The North America Glucagon Receptor Agonist market showcases continuous product innovation, with a focus on developing novel formulations (e.g., once-weekly injections) and improved delivery systems to enhance patient compliance and therapeutic efficacy. These advancements, coupled with a focus on addressing unmet medical needs in diabetes and obesity management, have resulted in a wide range of products with varying mechanisms of action and clinical profiles, catering to diverse patient populations and their specific needs. The competitive advantage stems from factors like superior efficacy, improved safety profiles, ease of administration, and cost-effectiveness.

Key Drivers, Barriers & Challenges in North America Glucagon Receptor Agonist Market

Key Drivers: The increasing prevalence of type 2 diabetes and obesity, coupled with technological advancements leading to improved drug efficacy and convenience (e.g., once-weekly injections), are major drivers. Favorable regulatory environments and expanding insurance coverage further stimulate market growth.

Challenges: High research and development costs, stringent regulatory pathways, and potential side effects associated with some glucagon receptor agonists pose challenges. Furthermore, intense competition among established pharmaceutical companies necessitates continuous innovation and strategic partnerships to maintain a competitive edge. Supply chain disruptions can impact product availability and market stability. The overall market size is impacted negatively by xx million dollars due to these challenges.

Growth Drivers in the North America Glucagon Receptor Agonist Market Market

The increasing prevalence of type 2 diabetes and obesity is a primary driver, fueled by lifestyle factors and aging populations. Technological advancements, including the development of novel, more effective agonists, and convenient formulations (e.g., once-weekly injections) significantly contribute. Favorable regulatory environments and reimbursement policies, along with robust healthcare infrastructure in North America, also fuel market expansion.

Challenges Impacting North America Glucagon Receptor Agonist Market Growth

High drug development costs and stringent regulatory approvals create hurdles for new entrants. Intense competition among established players necessitates continuous innovation. Supply chain disruptions can lead to drug shortages, impacting market stability. Potential side effects and safety concerns can limit market penetration. Overall, these factors create a complex and dynamic environment.

Key Players Shaping the North America Glucagon Receptor Agonist Market Market

Significant North America Glucagon Receptor Agonist Market Industry Milestones

- May 2022: The U.S. Food and Drug Administration approved Eli Lilly and Company's Mounjaro (tirzepatide) injection as an adjunct to diet and exercise to enhance glycemic control in adult patients with type 2 diabetes.

- January 2023: The U.S. Food and Drug Administration approved semaglutide (Wegovy- Novo Nordisk) for treating obesity in pediatric patients 12 years and older.

These approvals significantly expanded the market addressable population and market potential for glucagon receptor agonists.

Future Outlook for North America Glucagon Receptor Agonist Market Market

The North America Glucagon Receptor Agonist market is poised for continued growth, driven by the increasing prevalence of chronic diseases, ongoing innovation in drug development, and expanding treatment guidelines. Strategic partnerships, acquisitions, and the development of novel formulations will be key to driving market expansion. The market presents significant opportunities for companies with a robust pipeline of innovative products and a strong focus on unmet medical needs in diabetes and obesity management. The potential for personalized medicine and further market penetration in underserved populations will also contribute to future growth.

North America Glucagon Receptor Agonist Market Segmentation

-

1. Drugs

-

1.1. Dulaglutide

- 1.1.1. Trulicity

-

1.2. Exenatide

- 1.2.1. Byetta

- 1.2.2. Bydureon

-

1.3. Liraglutide

- 1.3.1. Victoza

-

1.4. Lixisenatide

- 1.4.1. Lyxumia

-

1.5. Semaglutide

- 1.5.1. Ozempic

-

1.1. Dulaglutide

-

2. Geography

- 2.1. United States

- 2.2. Canada

- 2.3. Rest of North America

North America Glucagon Receptor Agonist Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Rest of North America

North America Glucagon Receptor Agonist Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of -0.76% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising R&D Focus on the Development of Biotechnology-engineered Anti-cancer Drugs; Rapid Growth in the Usage of Pre-filled Syringes for Biologics; Increased Outsourcing Activities Across Value Chain Expected to Boost Supply of Injectable Products

- 3.3. Market Restrains

- 3.3.1. High Expenses Associated with Inventory Management; Availability of Alternate Drug Delivery Methods

- 3.4. Market Trends

- 3.4.1. Liraglutide Segment holds the highest market share in the North American Glucagon-like Peptide-1 (GLP-1) Agonists Market in the current year

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Glucagon Receptor Agonist Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Drugs

- 5.1.1. Dulaglutide

- 5.1.1.1. Trulicity

- 5.1.2. Exenatide

- 5.1.2.1. Byetta

- 5.1.2.2. Bydureon

- 5.1.3. Liraglutide

- 5.1.3.1. Victoza

- 5.1.4. Lixisenatide

- 5.1.4.1. Lyxumia

- 5.1.5. Semaglutide

- 5.1.5.1. Ozempic

- 5.1.1. Dulaglutide

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. United States

- 5.2.2. Canada

- 5.2.3. Rest of North America

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Drugs

- 6. United States North America Glucagon Receptor Agonist Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Drugs

- 6.1.1. Dulaglutide

- 6.1.1.1. Trulicity

- 6.1.2. Exenatide

- 6.1.2.1. Byetta

- 6.1.2.2. Bydureon

- 6.1.3. Liraglutide

- 6.1.3.1. Victoza

- 6.1.4. Lixisenatide

- 6.1.4.1. Lyxumia

- 6.1.5. Semaglutide

- 6.1.5.1. Ozempic

- 6.1.1. Dulaglutide

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. United States

- 6.2.2. Canada

- 6.2.3. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Drugs

- 7. Canada North America Glucagon Receptor Agonist Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Drugs

- 7.1.1. Dulaglutide

- 7.1.1.1. Trulicity

- 7.1.2. Exenatide

- 7.1.2.1. Byetta

- 7.1.2.2. Bydureon

- 7.1.3. Liraglutide

- 7.1.3.1. Victoza

- 7.1.4. Lixisenatide

- 7.1.4.1. Lyxumia

- 7.1.5. Semaglutide

- 7.1.5.1. Ozempic

- 7.1.1. Dulaglutide

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. United States

- 7.2.2. Canada

- 7.2.3. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Drugs

- 8. Rest of North America North America Glucagon Receptor Agonist Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Drugs

- 8.1.1. Dulaglutide

- 8.1.1.1. Trulicity

- 8.1.2. Exenatide

- 8.1.2.1. Byetta

- 8.1.2.2. Bydureon

- 8.1.3. Liraglutide

- 8.1.3.1. Victoza

- 8.1.4. Lixisenatide

- 8.1.4.1. Lyxumia

- 8.1.5. Semaglutide

- 8.1.5.1. Ozempic

- 8.1.1. Dulaglutide

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. United States

- 8.2.2. Canada

- 8.2.3. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Drugs

- 9. United States North America Glucagon Receptor Agonist Market Analysis, Insights and Forecast, 2019-2031

- 10. Canada North America Glucagon Receptor Agonist Market Analysis, Insights and Forecast, 2019-2031

- 11. Mexico North America Glucagon Receptor Agonist Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of North America North America Glucagon Receptor Agonist Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Other

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Sanofi

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Eli Lilly and Company

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 AstraZeneca

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Novo Nordisk

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Pfizer

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.1 Other

List of Figures

- Figure 1: North America Glucagon Receptor Agonist Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Glucagon Receptor Agonist Market Share (%) by Company 2024

List of Tables

- Table 1: North America Glucagon Receptor Agonist Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Glucagon Receptor Agonist Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: North America Glucagon Receptor Agonist Market Revenue Million Forecast, by Drugs 2019 & 2032

- Table 4: North America Glucagon Receptor Agonist Market Volume K Unit Forecast, by Drugs 2019 & 2032

- Table 5: North America Glucagon Receptor Agonist Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 6: North America Glucagon Receptor Agonist Market Volume K Unit Forecast, by Geography 2019 & 2032

- Table 7: North America Glucagon Receptor Agonist Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: North America Glucagon Receptor Agonist Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 9: North America Glucagon Receptor Agonist Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: North America Glucagon Receptor Agonist Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 11: United States North America Glucagon Receptor Agonist Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United States North America Glucagon Receptor Agonist Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 13: Canada North America Glucagon Receptor Agonist Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Canada North America Glucagon Receptor Agonist Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 15: Mexico North America Glucagon Receptor Agonist Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Mexico North America Glucagon Receptor Agonist Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: Rest of North America North America Glucagon Receptor Agonist Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Rest of North America North America Glucagon Receptor Agonist Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 19: North America Glucagon Receptor Agonist Market Revenue Million Forecast, by Drugs 2019 & 2032

- Table 20: North America Glucagon Receptor Agonist Market Volume K Unit Forecast, by Drugs 2019 & 2032

- Table 21: North America Glucagon Receptor Agonist Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 22: North America Glucagon Receptor Agonist Market Volume K Unit Forecast, by Geography 2019 & 2032

- Table 23: North America Glucagon Receptor Agonist Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: North America Glucagon Receptor Agonist Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 25: North America Glucagon Receptor Agonist Market Revenue Million Forecast, by Drugs 2019 & 2032

- Table 26: North America Glucagon Receptor Agonist Market Volume K Unit Forecast, by Drugs 2019 & 2032

- Table 27: North America Glucagon Receptor Agonist Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 28: North America Glucagon Receptor Agonist Market Volume K Unit Forecast, by Geography 2019 & 2032

- Table 29: North America Glucagon Receptor Agonist Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: North America Glucagon Receptor Agonist Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 31: North America Glucagon Receptor Agonist Market Revenue Million Forecast, by Drugs 2019 & 2032

- Table 32: North America Glucagon Receptor Agonist Market Volume K Unit Forecast, by Drugs 2019 & 2032

- Table 33: North America Glucagon Receptor Agonist Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 34: North America Glucagon Receptor Agonist Market Volume K Unit Forecast, by Geography 2019 & 2032

- Table 35: North America Glucagon Receptor Agonist Market Revenue Million Forecast, by Country 2019 & 2032

- Table 36: North America Glucagon Receptor Agonist Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Glucagon Receptor Agonist Market?

The projected CAGR is approximately -0.76%.

2. Which companies are prominent players in the North America Glucagon Receptor Agonist Market?

Key companies in the market include Other, Sanofi, Eli Lilly and Company, AstraZeneca, Novo Nordisk, Pfizer.

3. What are the main segments of the North America Glucagon Receptor Agonist Market?

The market segments include Drugs, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.94 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising R&D Focus on the Development of Biotechnology-engineered Anti-cancer Drugs; Rapid Growth in the Usage of Pre-filled Syringes for Biologics; Increased Outsourcing Activities Across Value Chain Expected to Boost Supply of Injectable Products.

6. What are the notable trends driving market growth?

Liraglutide Segment holds the highest market share in the North American Glucagon-like Peptide-1 (GLP-1) Agonists Market in the current year.

7. Are there any restraints impacting market growth?

High Expenses Associated with Inventory Management; Availability of Alternate Drug Delivery Methods.

8. Can you provide examples of recent developments in the market?

January 2023: The U.S. Food and Drug Administration approved semaglutide (Wegovy- Novo Nordisk) for treating obesity in pediatric patients 12 years and older. The approval was granted following the results of a phase 3a study published in the New England Journal of Medicine. Participants in the trial were given semaglutide or a placebo for 68 weeks alongside lifestyle intervention. Safety, efficacy, and tolerability were compared between these 2 groups.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Glucagon Receptor Agonist Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Glucagon Receptor Agonist Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Glucagon Receptor Agonist Market?

To stay informed about further developments, trends, and reports in the North America Glucagon Receptor Agonist Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence