Key Insights

The North American wearable security device market is experiencing robust growth, driven by increasing concerns about personal safety and the rising adoption of smart wearable technology. The market, estimated at $XX million in 2025, is projected to exhibit a Compound Annual Growth Rate (CAGR) of 45.60% from 2025 to 2033. This rapid expansion is fueled by several key factors. Firstly, the increasing prevalence of crime and safety concerns, particularly among vulnerable populations like the elderly, is driving demand for wearable devices offering features such as GPS tracking, emergency SOS buttons, and fall detection. Secondly, technological advancements leading to smaller, more comfortable, and energy-efficient devices are enhancing user experience and expanding market appeal. Furthermore, the integration of advanced sensors, like motion and environmental sensors, within these devices is enabling sophisticated monitoring capabilities, facilitating proactive responses to potential threats. The market is segmented by device type (wristwear, bodywear & footwear, others), application (health & wellness, safety monitoring, home rehabilitation, others), and sensor type (health, environmental, MEMS, motion, others). The United States and Canada currently dominate the North American market, due to higher disposable incomes and a greater acceptance of smart technology.

However, market growth is not without its challenges. High initial costs of wearable security devices, particularly those with advanced features, can act as a significant restraint, limiting adoption among certain demographics. Furthermore, data privacy and security concerns surrounding the collection and storage of personal location data need to be addressed to build greater consumer trust and confidence. Despite these challenges, the long-term outlook for the North American wearable security device market remains positive, with continued innovation and technological advancements expected to drive further expansion in the coming years. The increasing integration of wearable security devices with other smart home and healthcare systems will also create new opportunities for growth. Key players such as Infineon Technologies AG, NXP Semiconductors, and STMicroelectronics are actively contributing to this market expansion through continuous product development and strategic partnerships.

North America Wearable Security Device Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the North America wearable security device market, covering the period from 2019 to 2033. It offers invaluable insights into market trends, competitive dynamics, and growth opportunities, enabling stakeholders to make informed strategic decisions. The report leverages extensive data analysis and industry expertise to provide a precise forecast, estimating a market value of xx Million by 2025 and projecting a robust CAGR of xx% during the forecast period (2025-2033).

North America Wearable Security Device Market Structure & Competitive Landscape

The North America wearable security device market exhibits a moderately consolidated structure, with several key players holding significant market share. The market concentration ratio (CR4) is estimated at xx%, indicating a relatively competitive landscape. However, ongoing mergers and acquisitions (M&A) activity, with an estimated xx M&A deals concluded between 2019-2024, suggests a trend towards consolidation. Innovation is a crucial driver, with companies continuously developing advanced sensor technologies and integrating artificial intelligence (AI) for enhanced security features. Regulatory changes related to data privacy and security significantly influence market dynamics. Product substitution, particularly the adoption of newer, more sophisticated devices, poses a challenge to existing players. The end-user segmentation is diverse, encompassing various industries like healthcare, law enforcement, and consumer electronics.

- Market Concentration: CR4 estimated at xx%

- M&A Activity: Approximately xx deals between 2019 and 2024

- Key Innovation Drivers: AI integration, advanced sensor technologies

- Regulatory Impacts: Data privacy regulations, security standards

- Product Substitutes: Emerging technologies, innovative device features

- End-User Segmentation: Healthcare, law enforcement, consumer electronics

North America Wearable Security Device Market Trends & Opportunities

The North America wearable security device market is experiencing significant growth, driven by increasing demand for personal safety and security, alongside the rising adoption of connected devices. The market size reached xx Million in 2024 and is projected to reach xx Million by 2025, showcasing substantial growth. This expansion is fueled by technological advancements, particularly in areas like miniaturization of sensors, improved battery life, and enhanced connectivity. Consumer preference for convenient and discreet security solutions is also a key factor. The market is marked by intense competition, with established players and new entrants vying for market share. The rising penetration rate of smartphones and other wearable technologies creates vast opportunities for integrating security features into these devices, fostering market expansion. The CAGR for the forecast period (2025-2033) is estimated at xx%, indicating sustained growth potential.

Dominant Markets & Segments in North America Wearable Security Device Market

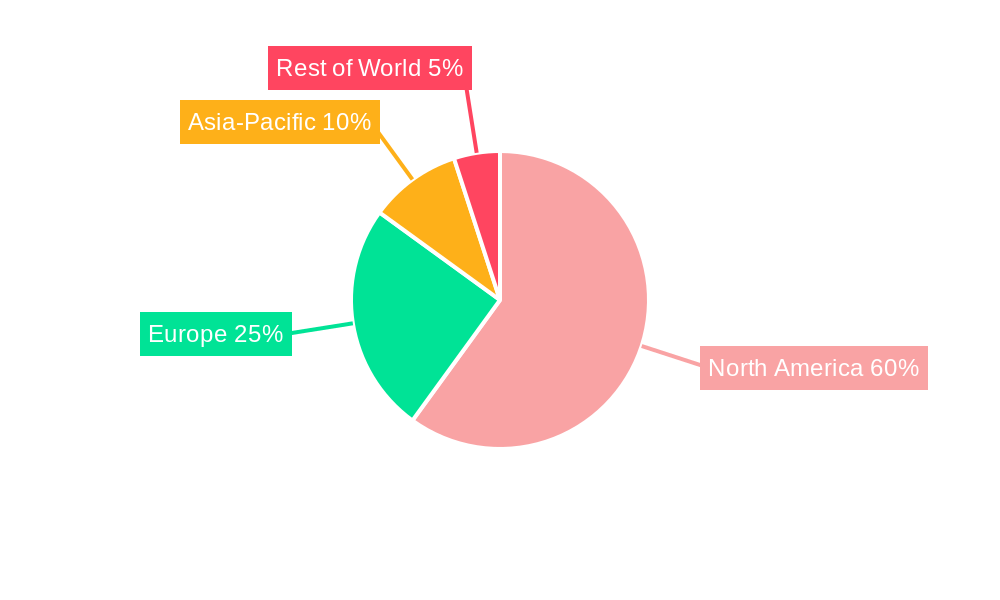

The United States dominates the North America wearable security device market, accounting for the largest market share due to high consumer spending on security products, advanced technological infrastructure, and strong government support for technology-driven security solutions.

- By Device: Wristwear holds the largest segment share driven by its convenience and widespread acceptance.

- By Application: The Health & Wellness segment demonstrates high growth potential due to increasing health consciousness and advancements in health monitoring technologies.

- By Type: MEMS sensors are the dominant type, offering high sensitivity and miniaturization capabilities.

Key Growth Drivers:

- Strong consumer demand for personal safety and security products.

- Technological advancements in sensor technology and connectivity.

- Government initiatives promoting public safety and security.

- Growing adoption of connected devices and smart homes.

Canada presents a significant yet smaller market compared to the US, with growth opportunities mainly concentrated in urban areas. The Others segment within the device category displays significant growth potential owing to the emergence of innovative wearable technologies. Similarly, the safety monitoring and home rehabilitation applications show considerable growth potential, driven by escalating concerns over home security and increased awareness of elderly care.

North America Wearable Security Device Market Product Analysis

The North America wearable security device market features a wide range of products, from simple personal emergency response systems (PERS) to advanced devices incorporating GPS tracking, biometric authentication, and environmental sensors. Technological advancements focus on enhancing accuracy, miniaturization, power efficiency, and integration with other smart devices. Products with user-friendly interfaces and seamless integration into existing security systems gain a significant competitive advantage. The market is witnessing a trend toward multi-functional devices offering a combination of security and health monitoring features.

Key Drivers, Barriers & Challenges in North America Wearable Security Device Market

Key Drivers:

- Rising concerns about personal safety and security, particularly in urban areas.

- Advancements in sensor and communication technologies enabling smaller, more powerful devices.

- Government regulations promoting the adoption of security technologies.

- Growing integration of wearable devices with other smart devices.

Key Challenges:

- High initial investment costs for advanced devices.

- Concerns regarding data privacy and security breaches.

- Interoperability issues between different wearable devices and platforms.

- Competition from established players and new market entrants.

- Supply chain disruptions affecting the availability of essential components.

Growth Drivers in the North America Wearable Security Device Market Market

The market's growth is driven by technological innovations, increasing personal safety concerns, and rising disposable incomes. Advancements in sensor technology, improved battery life, and more sophisticated data analytics contribute to market expansion. Government initiatives promoting public safety also bolster growth. The rising popularity of smart homes and connected devices creates synergistic opportunities for integrating wearable security into broader home security systems.

Challenges Impacting North America Wearable Security Device Market Growth

Challenges include data privacy concerns, stringent regulations, and the high cost of advanced devices. Supply chain disruptions and cybersecurity threats further hinder market growth. Competitive pressure from established players and emerging technologies also presents a significant challenge.

Key Players Shaping the North America Wearable Security Device Market Market

- Infineon Technologies AG

- NXP Semiconductors N.V.

- STMicroelectronics

- Bosch Sensortec GmbH (Robert Bosch GmbH)

- TE Connectivity Ltd

- Texas Instruments Incorporated

- Analog Devices Inc

- Freescale Semiconductor Inc

- InvenSense Inc

- Panasonic Corporation

Significant North America Wearable Security Device Market Industry Milestones

- September 2020: Apple launched the Apple Watch Series 6, incorporating blood oxygen monitoring, impacting the health and wellness segment.

- October 2020: Focus on augmented reality head-mounted displays for aviation applications, highlighting the expansion of wearable technology into specialized sectors.

Future Outlook for North America Wearable Security Device Market Market

The North America wearable security device market is poised for continued growth, driven by ongoing technological advancements and increasing demand for enhanced security solutions. The integration of AI and machine learning will create more sophisticated and proactive security systems. The expansion into new application areas, such as industrial safety and environmental monitoring, will provide further growth catalysts. Strategic partnerships and acquisitions will likely shape the market landscape in the coming years.

North America Wearable Security Device Market Segmentation

-

1. Type

- 1.1. Health Sensors

- 1.2. Environmental Sensors

- 1.3. MEMS Sensors

- 1.4. Motion Sensors

- 1.5. Others

-

2. Device

- 2.1. Wristwear

- 2.2. Bodywear & Footwear

- 2.3. Others

-

3. Application

- 3.1. Health & Wellness

- 3.2. Safety Monitoring

- 3.3. Home Rehabilitation

- 3.4. Others

North America Wearable Security Device Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Wearable Security Device Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 45.60% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rapid technological developments and miniaturization of sensors; Increasing applications in the industrial sector

- 3.3. Market Restrains

- 3.3.1. High initial costs for large scale implementation in industries

- 3.4. Market Trends

- 3.4.1. Increase in demand of wearable fitness devices is driving the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Wearable Security Device Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Health Sensors

- 5.1.2. Environmental Sensors

- 5.1.3. MEMS Sensors

- 5.1.4. Motion Sensors

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Device

- 5.2.1. Wristwear

- 5.2.2. Bodywear & Footwear

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Health & Wellness

- 5.3.2. Safety Monitoring

- 5.3.3. Home Rehabilitation

- 5.3.4. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United States North America Wearable Security Device Market Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America Wearable Security Device Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America Wearable Security Device Market Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America Wearable Security Device Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Infineon Technologies AG

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 NXP Semiconductors N V

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 STMicroelectronics

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Bosch Sensortec GmbH (Robert Bosch GmbH)*List Not Exhaustive

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 TE Connectivity Ltd

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Texas Instruments Incorporated

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Analog Devices Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Freescale Semiconductor Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 InvenSense Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Panasonic Corporation

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Infineon Technologies AG

List of Figures

- Figure 1: North America Wearable Security Device Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Wearable Security Device Market Share (%) by Company 2024

List of Tables

- Table 1: North America Wearable Security Device Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Wearable Security Device Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: North America Wearable Security Device Market Revenue Million Forecast, by Device 2019 & 2032

- Table 4: North America Wearable Security Device Market Revenue Million Forecast, by Application 2019 & 2032

- Table 5: North America Wearable Security Device Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: North America Wearable Security Device Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States North America Wearable Security Device Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada North America Wearable Security Device Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico North America Wearable Security Device Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of North America North America Wearable Security Device Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: North America Wearable Security Device Market Revenue Million Forecast, by Type 2019 & 2032

- Table 12: North America Wearable Security Device Market Revenue Million Forecast, by Device 2019 & 2032

- Table 13: North America Wearable Security Device Market Revenue Million Forecast, by Application 2019 & 2032

- Table 14: North America Wearable Security Device Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: United States North America Wearable Security Device Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Canada North America Wearable Security Device Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Mexico North America Wearable Security Device Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Wearable Security Device Market?

The projected CAGR is approximately 45.60%.

2. Which companies are prominent players in the North America Wearable Security Device Market?

Key companies in the market include Infineon Technologies AG, NXP Semiconductors N V, STMicroelectronics, Bosch Sensortec GmbH (Robert Bosch GmbH)*List Not Exhaustive, TE Connectivity Ltd, Texas Instruments Incorporated, Analog Devices Inc, Freescale Semiconductor Inc, InvenSense Inc, Panasonic Corporation.

3. What are the main segments of the North America Wearable Security Device Market?

The market segments include Type, Device, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rapid technological developments and miniaturization of sensors; Increasing applications in the industrial sector.

6. What are the notable trends driving market growth?

Increase in demand of wearable fitness devices is driving the market.

7. Are there any restraints impacting market growth?

High initial costs for large scale implementation in industries.

8. Can you provide examples of recent developments in the market?

September 2020: Apple launched the Apple watch series 6, which is the latest smartwatch that enables blood oxygen monitoring and measures oxygen saturation in the blood for a better understanding of fitness and wellness.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Wearable Security Device Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Wearable Security Device Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Wearable Security Device Market?

To stay informed about further developments, trends, and reports in the North America Wearable Security Device Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence