Key Insights

The India Indoor LED Lighting Market is experiencing robust growth, driven by increasing consumer preference for energy-efficient and cost-effective lighting solutions, coupled with government initiatives promoting energy conservation. The market, valued at approximately ₹150 billion (estimated based on a typical market size for a developing nation with similar characteristics and the provided CAGR) in 2025, is projected to exhibit a Compound Annual Growth Rate (CAGR) of 9.80% from 2025 to 2033. This growth is fueled by factors such as rising disposable incomes, increasing urbanization leading to higher demand in residential and commercial sectors, and the burgeoning adoption of smart home technologies which integrate LED lighting systems. Significant market segments include residential, commercial, and industrial & warehouse lighting, with the residential segment currently holding the largest market share due to widespread housing construction and renovation projects. Agricultural lighting, a niche segment, is also showing promising growth potential due to increased awareness of its benefits for crop yield enhancement.

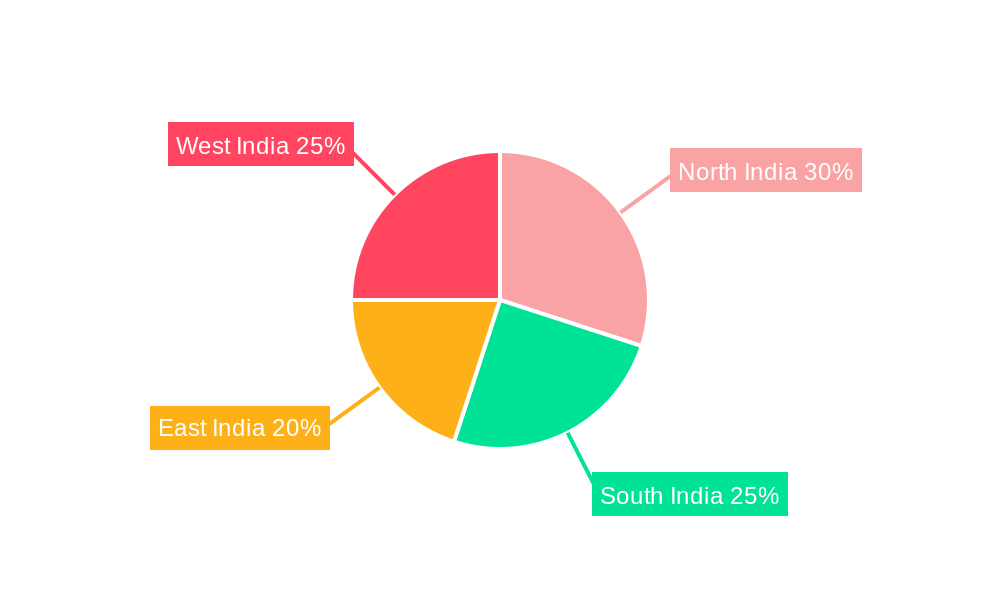

Key players like Syska, Bajaj, Wipro, Havells, Surya Roshni, OPPLE, Eveready, Crompton Greaves, Signify (Philips), and Orient Electric are actively shaping the market through product innovation, strategic partnerships, and expansion into diverse segments. However, challenges such as intense competition, fluctuating raw material prices, and the need to overcome consumer resistance to higher initial investment costs for LED lighting compared to traditional options remain. Regional variations exist, with markets in North and West India exhibiting faster growth rates compared to the East and South due to factors such as higher levels of urbanization and industrialization in those regions. The market's future trajectory will be influenced by technological advancements in LED technology, government policies supporting energy efficiency, and growing awareness among consumers regarding the long-term cost savings associated with LED lighting. The forecast period of 2025-2033 offers substantial opportunities for existing and new players to capitalize on this expanding market.

India Indoor LED Lighting Market: A Comprehensive Report (2019-2033)

This dynamic report provides a detailed analysis of the burgeoning India Indoor LED Lighting Market, offering invaluable insights for stakeholders seeking to capitalize on its immense growth potential. With a comprehensive study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report leverages extensive market research and data analysis to deliver actionable intelligence. The report covers market size, segmentation, competitive landscape, key players, and future growth projections, empowering businesses to make informed strategic decisions.

India Indoor LED Lighting Market Structure & Competitive Landscape

The Indian indoor LED lighting market exhibits a moderately consolidated structure, with a handful of major players dominating the landscape. The Herfindahl-Hirschman Index (HHI) for 2024 was estimated at xx, indicating a moderately concentrated market. This concentration is driven by brand recognition, established distribution networks, and economies of scale enjoyed by leading players. However, the market also shows signs of increasing dynamism with the entry of new players and technological advancements.

Innovation Drivers: The market is fueled by continuous innovation in LED technology, focusing on energy efficiency, smart features (like Signify's WiZ system), and aesthetically pleasing designs to cater to diverse consumer preferences.

Regulatory Impacts: Government initiatives promoting energy efficiency and the adoption of sustainable technologies are significantly impacting market growth, creating a favorable environment for LED adoption. Furthermore, regulations around energy labeling and import duties also affect the market dynamics.

Product Substitutes: While CFLs and traditional incandescent bulbs remain in use, their market share is steadily declining due to the superior energy efficiency and longer lifespan of LEDs, rendering them less competitive.

End-User Segmentation: The market is segmented into residential, commercial, industrial, and agricultural sectors, each with its own unique growth drivers and challenges. Residential lighting currently holds the largest market share, driven by increasing urbanization and rising disposable incomes.

M&A Trends: The market has witnessed a notable increase in mergers and acquisitions (M&A) activity in recent years, as exemplified by Bajaj Electricals' acquisition of Starlite Lighting in May 2023. The number of M&A transactions in the past five years totaled xx, reflecting a consolidation trend within the industry. These activities are primarily driven by the need for companies to expand their product portfolios, strengthen their market position, and access new technologies.

India Indoor LED Lighting Market Market Trends & Opportunities

The India Indoor LED Lighting market is experiencing robust growth, projected to reach xx Million by 2033, registering a CAGR of xx% during the forecast period (2025-2033). This growth is driven by several factors including rising consumer awareness of energy efficiency, increasing government support for energy-saving initiatives, and the decreasing cost of LED lighting products. Technological advancements, including the integration of smart features and the introduction of innovative LED designs, are further propelling market expansion. Market penetration rates are steadily increasing, with LEDs progressively replacing traditional lighting solutions in both urban and rural areas. The shift towards smart homes and buildings is also a key opportunity, driving demand for connected LED lighting systems. Competitive dynamics are intense, with leading players focusing on product differentiation, brand building, and strategic partnerships to gain market share.

Dominant Markets & Segments in India Indoor LED Lighting Market

The residential sector currently dominates the Indian indoor LED lighting market, accounting for approximately xx% of the overall market share in 2024. This dominance is fueled by factors such as:

- Rising urbanization and disposable incomes: Increased urbanization leads to a higher demand for housing, driving up demand for lighting solutions.

- Growing preference for energy-efficient lighting: Consumers are increasingly aware of the benefits of energy-efficient lighting solutions.

- Government initiatives promoting energy conservation: Government policies and initiatives aimed at promoting energy efficiency support the growth of the residential lighting sector.

The commercial segment is also a significant contributor, driven by the growth of the retail, hospitality, and office sectors. The industrial and agricultural segments are witnessing growth due to the increasing adoption of energy-efficient solutions in factories and farms.

India Indoor LED Lighting Market Product Analysis

The Indian indoor LED lighting market offers a diverse range of products, from basic LED bulbs to sophisticated smart lighting systems. Technological advancements are focused on enhancing energy efficiency, improving light quality, and integrating smart features. Companies are increasingly incorporating features like dimmability, color-tuning, and smart connectivity to enhance user experience. These innovative products are well-positioned to cater to the evolving needs of consumers and businesses, driving market growth.

Key Drivers, Barriers & Challenges in India Indoor LED Lighting Market

Key Drivers: The market is driven by increasing energy awareness, government incentives for energy-efficient technologies, falling LED prices, and the growing adoption of smart homes and buildings. Technological advancements continue to drive innovation and enhance product offerings.

Key Challenges: Key challenges include intense competition, the presence of counterfeit products, inconsistent supply chains leading to potential shortages, and complex regulatory frameworks that can impact market entry. Furthermore, consumer awareness in rural areas remains relatively low compared to urban areas.

Growth Drivers in the India Indoor LED Lighting Market Market

Technological advancements, such as improved energy efficiency and smart features, are key growth drivers. Government initiatives promoting energy conservation and the falling cost of LED lighting are also propelling market growth. The increasing demand from various sectors, including residential, commercial, and industrial, contributes to the overall growth of the market.

Challenges Impacting India Indoor LED Lighting Market Growth

The market faces challenges from intense competition, the prevalence of counterfeit products impacting brand trust and profitability, and potentially unstable supply chains. Regulatory hurdles and bureaucratic processes can delay market entry and expansion, while inconsistent consumer awareness across different regions of the country creates varying adoption rates.

Key Players Shaping the India Indoor LED Lighting Market Market

- Syska Led Lights Private Limited

- Bajaj Electrical Ltd

- Wipro Lighting Limited

- Havells India Ltd

- Surya Roshni Limited

- OPPLE Lighting Co Ltd

- Eveready Industries India Limited

- Crompton Greaves Consumer Electricals Limited

- Signify (Philips)

- Orient Electric Limited

Significant India Indoor LED Lighting Market Industry Milestones

- May 2023: Bajaj Electricals acquires JV firm Starlite Lighting, expanding its LED product portfolio.

- August 2023: Signify introduces an A-class LED tube, significantly improving energy efficiency.

- September 2023: Signify launches new features and products for its WiZ smart lighting system, including SpaceSense motion detection technology.

Future Outlook for India Indoor LED Lighting Market Market

The India Indoor LED Lighting Market is poised for sustained growth, driven by continuous technological innovation, supportive government policies, and rising consumer demand for energy-efficient and smart lighting solutions. Strategic opportunities exist in expanding into rural markets, developing innovative products catering to specific segment needs, and leveraging the growing demand for smart home integration. The market presents significant potential for both established players and new entrants who can effectively navigate the competitive landscape and address the challenges outlined in this report.

India Indoor LED Lighting Market Segmentation

-

1. Indoor Lighting

- 1.1. Agricultural Lighting

-

1.2. Commercial

- 1.2.1. Office

- 1.2.2. Retail

- 1.2.3. Others

- 1.3. Industrial and Warehouse

- 1.4. Residential

India Indoor LED Lighting Market Segmentation By Geography

- 1. India

India Indoor LED Lighting Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.80% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Higher Consumer Awareness and Government Regulations Mandating the Installation of Smart Meters; Increased Investments in Smart Grid Projects; Investments in Smart City Developments

- 3.3. Market Restrains

- 3.3.1. High Installation Cost and Longer ROI Period; Longer Replacement Cycle of Water Meters

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Indoor LED Lighting Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Indoor Lighting

- 5.1.1. Agricultural Lighting

- 5.1.2. Commercial

- 5.1.2.1. Office

- 5.1.2.2. Retail

- 5.1.2.3. Others

- 5.1.3. Industrial and Warehouse

- 5.1.4. Residential

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. India

- 5.1. Market Analysis, Insights and Forecast - by Indoor Lighting

- 6. North India India Indoor LED Lighting Market Analysis, Insights and Forecast, 2019-2031

- 7. South India India Indoor LED Lighting Market Analysis, Insights and Forecast, 2019-2031

- 8. East India India Indoor LED Lighting Market Analysis, Insights and Forecast, 2019-2031

- 9. West India India Indoor LED Lighting Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Syska Led Lights Private Limited

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Bajaj Electrical Ltd

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Wipro Lighting Limited (Wipro Enterprises Ltd

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Havells India Ltd

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Surya Roshni Limited

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 OPPLE Lighting Co Ltd

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Eveready Industries India Limited

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Crompton Greaves Consumer Electricals Limited

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Signify (Philips)

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Orient Electric Limited

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Syska Led Lights Private Limited

List of Figures

- Figure 1: India Indoor LED Lighting Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Indoor LED Lighting Market Share (%) by Company 2024

List of Tables

- Table 1: India Indoor LED Lighting Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Indoor LED Lighting Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: India Indoor LED Lighting Market Revenue Million Forecast, by Indoor Lighting 2019 & 2032

- Table 4: India Indoor LED Lighting Market Volume K Unit Forecast, by Indoor Lighting 2019 & 2032

- Table 5: India Indoor LED Lighting Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: India Indoor LED Lighting Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 7: India Indoor LED Lighting Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: India Indoor LED Lighting Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 9: North India India Indoor LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: North India India Indoor LED Lighting Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 11: South India India Indoor LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: South India India Indoor LED Lighting Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 13: East India India Indoor LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: East India India Indoor LED Lighting Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 15: West India India Indoor LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: West India India Indoor LED Lighting Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: India Indoor LED Lighting Market Revenue Million Forecast, by Indoor Lighting 2019 & 2032

- Table 18: India Indoor LED Lighting Market Volume K Unit Forecast, by Indoor Lighting 2019 & 2032

- Table 19: India Indoor LED Lighting Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: India Indoor LED Lighting Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Indoor LED Lighting Market?

The projected CAGR is approximately 9.80%.

2. Which companies are prominent players in the India Indoor LED Lighting Market?

Key companies in the market include Syska Led Lights Private Limited, Bajaj Electrical Ltd, Wipro Lighting Limited (Wipro Enterprises Ltd, Havells India Ltd, Surya Roshni Limited, OPPLE Lighting Co Ltd, Eveready Industries India Limited, Crompton Greaves Consumer Electricals Limited, Signify (Philips), Orient Electric Limited.

3. What are the main segments of the India Indoor LED Lighting Market?

The market segments include Indoor Lighting.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Higher Consumer Awareness and Government Regulations Mandating the Installation of Smart Meters; Increased Investments in Smart Grid Projects; Investments in Smart City Developments.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

High Installation Cost and Longer ROI Period; Longer Replacement Cycle of Water Meters.

8. Can you provide examples of recent developments in the market?

September 2023: Signify introduced a new app, features, and products for its WiZ smart lighting system to enhance users’ daily convenience. The new offerings include SpaceSense, a motion detection technology for lighting systems that don’t require any sensor to be installed.August 2023: Signify introduced an A-class LED tube, which consumes 60% less energy than a standard Philips LED. The MASTER LEDtube UE expands the energy-efficient products that meet the A-grade criteria of the new EU energy labeling and eco-design framework through technological innovation.May 2023: Bajaj Electricals acquires JV firm Starlite Lighting. This venture is engaged in the manufacturing of products including LEDs, CFL, and consumer electrical appliances.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Indoor LED Lighting Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Indoor LED Lighting Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Indoor LED Lighting Market?

To stay informed about further developments, trends, and reports in the India Indoor LED Lighting Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence