Key Insights

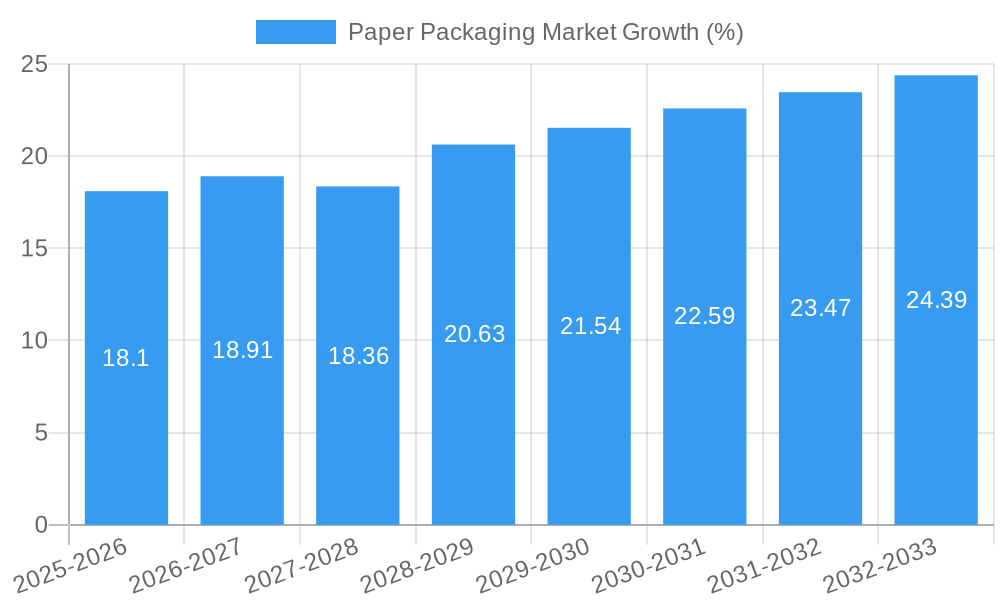

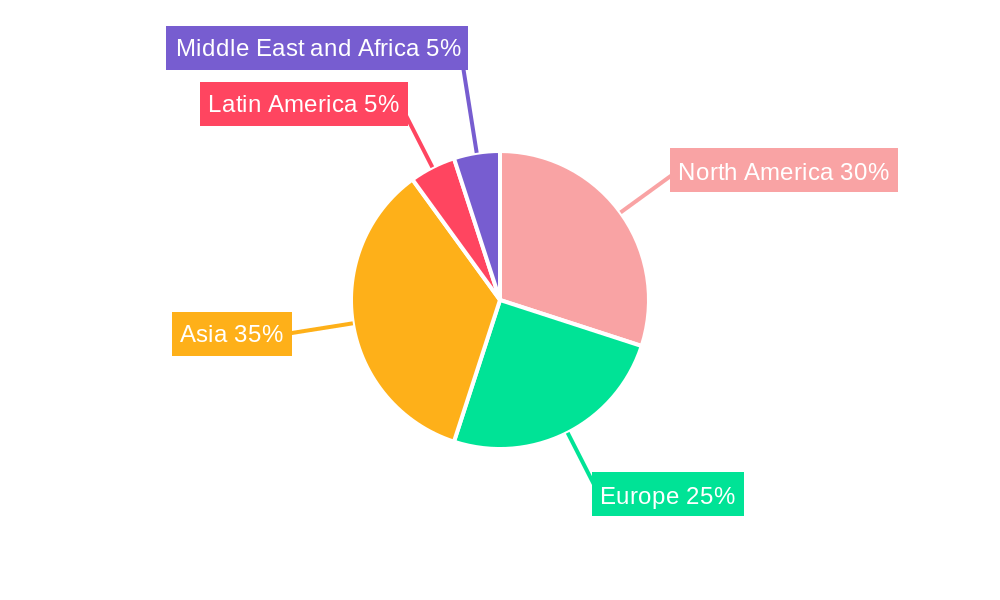

The global paper packaging market, valued at $398.65 million in 2025, is projected to experience robust growth, driven by the increasing demand for sustainable and eco-friendly packaging solutions across various end-use industries. The market's Compound Annual Growth Rate (CAGR) of 4.68% from 2019 to 2024 indicates a consistent upward trajectory, expected to continue through 2033. Key drivers include the rising e-commerce sector, necessitating efficient and protective packaging, and a growing consumer preference for sustainable and recyclable options. The expanding food and beverage industry, particularly in developing economies, further fuels market growth. Within the segment breakdown, corrugated boxes dominate due to their versatility and cost-effectiveness, followed by folding cartons, which are popular for their attractive branding capabilities. The healthcare and personal care sectors exhibit significant demand for specialized paper packaging solutions that ensure product safety and hygiene. Regional analysis indicates strong growth in Asia, driven by rapid economic development and increasing consumer spending in countries like China and India. North America and Europe also maintain substantial market shares, leveraging established infrastructure and high consumer awareness of sustainable packaging practices. However, fluctuations in raw material prices and environmental regulations present challenges to market growth. Leading players like WestRock Company, Smurfit Kappa Group, and Sonoco Products Company are actively investing in research and development to offer innovative and sustainable solutions, shaping the future landscape of the paper packaging market.

The forecast period (2025-2033) anticipates continued expansion, fueled by ongoing technological advancements in packaging design and manufacturing processes. Companies are focusing on improving the recyclability and biodegradability of their products to meet evolving consumer demands and stricter environmental regulations. The market is also witnessing a rise in customized and personalized packaging options, responding to the increasing need for brand differentiation and improved consumer engagement. While challenges remain, such as price volatility and competition from alternative packaging materials, the overall outlook for the paper packaging market remains positive, promising considerable growth and innovation in the coming years. Further diversification into specialized packaging applications, particularly in sectors like pharmaceuticals and electronics, is expected to drive market expansion.

Paper Packaging Market Report: A Comprehensive Analysis (2019-2033)

This dynamic report provides a comprehensive analysis of the global Paper Packaging Market, offering invaluable insights for stakeholders across the value chain. Leveraging extensive market research and data from 2019-2024 (historical period), with a base year of 2025 and a forecast period extending to 2033, this report unveils key trends, opportunities, and challenges shaping this dynamic sector. The market is projected to reach xx Million by 2033, exhibiting a robust CAGR of xx%.

Paper Packaging Market Market Structure & Competitive Landscape

The paper packaging market is characterized by a moderately concentrated structure, with several multinational corporations commanding significant market share. Key players such as WestRock Company, Smurfit Kappa Group, Sonoco Products Company, Nippon Paper Industries Ltd, DS Smith PLC, Mondi Group, International Paper Company, Eastern Pak Limited, Packaging Corporation of America, and Cascades Inc., compete intensely, driving innovation and efficiency improvements. The market's Herfindahl-Hirschman Index (HHI) is estimated at xx, indicating a moderately consolidated landscape.

- Innovation Drivers: Sustainability concerns, coupled with growing e-commerce and food & beverage demand, are major drivers. Companies are investing heavily in eco-friendly materials, such as recycled paper and biodegradable coatings, to meet evolving consumer preferences.

- Regulatory Impacts: Stringent environmental regulations, particularly those concerning plastic waste reduction, are shaping the market. Governments worldwide are incentivizing the use of sustainable packaging solutions, creating favorable conditions for paper packaging.

- Product Substitutes: While plastics and other materials remain competitors, paper packaging's renewability and recyclability are providing a competitive edge. Advancements in barrier coatings and functional enhancements are further mitigating the limitations of paper packaging.

- End-User Segmentation: The market is highly segmented by end-use industries, with food, beverage, and e-commerce sectors demonstrating substantial growth. The healthcare and personal care segments are also experiencing significant expansion due to growing demand for safe, secure, and sustainable packaging solutions.

- M&A Trends: Consolidation is evident through strategic mergers and acquisitions (M&A). Over the past five years, the M&A volume in the paper packaging sector has averaged xx deals annually, signifying a trend of industry consolidation and expansion. This reflects the pursuit of economies of scale, enhanced technological capabilities, and broader market reach.

Paper Packaging Market Market Trends & Opportunities

The global paper packaging market is experiencing significant growth, driven by several key factors. The rising global population, particularly in developing economies, is fueling increased demand for packaged goods. Simultaneously, the burgeoning e-commerce sector is driving demand for robust, protective packaging solutions for efficient shipping and delivery. Consumer preference shifts towards eco-friendly and sustainable packaging, further support this market's expansion.

Technological advancements are also contributing to market growth. Companies are continuously innovating to develop more sustainable and functional paper packaging options. Improved barrier coatings enhance the preservation capabilities of paper-based solutions, and smart packaging technologies that integrate digital features provide unique opportunities for brand engagement and product traceability. Furthermore, the rising adoption of flexible paper packaging is significantly contributing to the market's growth, catering to evolving consumer preferences for convenient and portable products. The market penetration rate for sustainable paper packaging is estimated at xx% in 2025, with projections of xx% by 2033, reflecting a significant shift towards eco-conscious choices.

Dominant Markets & Segments in Paper Packaging Market

The North American region currently holds the largest market share, driven by robust demand from the food & beverage, e-commerce and healthcare sectors. However, the Asia-Pacific region is projected to exhibit the highest growth rate over the forecast period, fueled by rapid economic expansion and increasing consumer spending.

- By Product: Corrugated boxes dominate the market due to their versatility and cost-effectiveness, holding xx% of the market share. Folding cartons are the second largest segment, with significant applications in the food and personal care industries. Other types of paper packaging, such as bags and pouches, are experiencing steady growth.

- By End User Industry: The food and beverage sector remains the dominant end-user industry, accounting for approximately xx% of market demand, largely driven by increasing demand for processed food and convenient meal options. The e-commerce segment showcases the fastest growth trajectory, driven by the rising popularity of online shopping and home deliveries.

- By Grade: Containerboard commands a significant market share (xx%) due to its widespread use in the production of corrugated boxes. Carton board demonstrates healthy growth owing to increased demand in folding cartons across various end-use segments.

Key Growth Drivers:

- North America: Robust e-commerce sector, stringent environmental regulations, and increasing consumer awareness of sustainable packaging.

- Asia-Pacific: Rapid economic growth, expanding middle class, and increasing demand for packaged goods.

- Europe: Growing focus on sustainable packaging and implementation of strict environmental policies.

Paper Packaging Market Product Analysis

Significant advancements in barrier technology are enabling paper packaging to compete effectively with plastic alternatives. Biodegradable and compostable coatings are improving the sustainability profile of paper packaging. Moreover, innovations in design and functionality are enhancing the user experience and shelf life of packaged products, providing manufacturers with a range of competitive advantages.

Key Drivers, Barriers & Challenges in Paper Packaging Market

Key Drivers:

The escalating demand for sustainable and eco-friendly packaging is a significant driver, fueled by growing environmental concerns and government regulations targeting plastic waste. Furthermore, advancements in barrier coatings and printing technologies are enhancing the functionality and aesthetics of paper-based solutions. Finally, the expanding e-commerce sector is creating considerable demand for durable and protective packaging.

Challenges and Restraints:

Fluctuations in raw material prices, particularly pulp, represent a significant challenge for the paper packaging industry. Supply chain disruptions and transportation costs can impact profitability and delivery timelines. Moreover, intense competition from alternative packaging materials, including plastics, necessitates continuous innovation and cost optimization.

Growth Drivers in the Paper Packaging Market Market

The growing emphasis on sustainability, driven by consumer demand and governmental policies, is a primary growth catalyst. The increasing demand for convenience and e-commerce is further fueling market expansion. Advancements in barrier technology are improving the functionality of paper packaging, allowing it to compete effectively with traditional materials.

Challenges Impacting Paper Packaging Market Growth

Price volatility of raw materials poses a key challenge, impacting production costs and margins. Furthermore, the complexity of recycling infrastructure in certain regions hinders the full realization of the benefits of sustainable paper packaging. Competition from alternative materials also presents a constant pressure on market players.

Key Players Shaping the Paper Packaging Market Market

- WestRock Company

- Smurfit Kappa Group

- Sonoco Products Company

- Nippon Paper Industries Ltd

- DS Smith PLC

- Mondi Group

- International Paper Company

- Eastern Pak Limited

- Packaging Corporation of America

- Cascades Inc

Significant Paper Packaging Market Industry Milestones

- January 2024: ITC Sunfeast Farmlite launched a digestive biscuit in 100% paper packaging, marking a significant step towards sustainable packaging in the food industry.

- March 2024: Sealed Air's development of a new paper bottom web, reducing plastic consumption by 77%, showcases a significant technological advancement towards sustainable alternatives.

Future Outlook for Paper Packaging Market Market

The global paper packaging market is poised for sustained growth, driven by the increasing adoption of sustainable packaging solutions and the expansion of e-commerce. Strategic investments in research and development, coupled with a focus on innovation, will further propel market expansion. The continued demand for convenient and environmentally friendly packaging options presents substantial opportunities for market players.

Paper Packaging Market Segmentation

-

1. Grade

-

1.1. Carton Board

- 1.1.1. Solid Bleached Sulphate (SBS)

- 1.1.2. Solid Unbleached Sulphate (SUS)

- 1.1.3. Folding Boxboard (FBB)

- 1.1.4. Coated Recycled Board (CRB)

- 1.1.5. Uncoated Recycled Board (URB)

- 1.1.6. Othder Graes

-

1.2. Containerboard

- 1.2.1. White-top Kraftliner

- 1.2.2. Other Kraftliners

- 1.2.3. White top Testliner

- 1.2.4. Other Testliners

- 1.2.5. Semi Chemical Fluting

- 1.2.6. Recycled Fluting

-

1.1. Carton Board

-

2. Product

- 2.1. Folding Cartons

- 2.2. Corrugated Boxes

- 2.3. Other Types

-

3. End User Industry

- 3.1. Food

- 3.2. Beverage

- 3.3. Healthcare

- 3.4. Personal Care

- 3.5. Household Care

- 3.6. Electrical Products

- 3.7. Other End User Industries

Paper Packaging Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. Italy

- 2.4. France

-

3. Asia

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia and New Zealand

-

4. Latin America

- 4.1. Brazil

- 4.2. Mexico

-

5. Middle East and Africa

- 5.1. United Arab Emirates

- 5.2. Saudi Arabia

- 5.3. South Africa

Paper Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.68% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Development of Barrier-coated Paperboard Products; Growing Consumer Awareness on Paper Packaging

- 3.3. Market Restrains

- 3.3.1. Effects of Deforestation on Paper Packaging; Increasing Operational Costs

- 3.4. Market Trends

- 3.4.1. The Food and Beverage Segments are Expected to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Paper Packaging Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Grade

- 5.1.1. Carton Board

- 5.1.1.1. Solid Bleached Sulphate (SBS)

- 5.1.1.2. Solid Unbleached Sulphate (SUS)

- 5.1.1.3. Folding Boxboard (FBB)

- 5.1.1.4. Coated Recycled Board (CRB)

- 5.1.1.5. Uncoated Recycled Board (URB)

- 5.1.1.6. Othder Graes

- 5.1.2. Containerboard

- 5.1.2.1. White-top Kraftliner

- 5.1.2.2. Other Kraftliners

- 5.1.2.3. White top Testliner

- 5.1.2.4. Other Testliners

- 5.1.2.5. Semi Chemical Fluting

- 5.1.2.6. Recycled Fluting

- 5.1.1. Carton Board

- 5.2. Market Analysis, Insights and Forecast - by Product

- 5.2.1. Folding Cartons

- 5.2.2. Corrugated Boxes

- 5.2.3. Other Types

- 5.3. Market Analysis, Insights and Forecast - by End User Industry

- 5.3.1. Food

- 5.3.2. Beverage

- 5.3.3. Healthcare

- 5.3.4. Personal Care

- 5.3.5. Household Care

- 5.3.6. Electrical Products

- 5.3.7. Other End User Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Grade

- 6. North America Paper Packaging Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Grade

- 6.1.1. Carton Board

- 6.1.1.1. Solid Bleached Sulphate (SBS)

- 6.1.1.2. Solid Unbleached Sulphate (SUS)

- 6.1.1.3. Folding Boxboard (FBB)

- 6.1.1.4. Coated Recycled Board (CRB)

- 6.1.1.5. Uncoated Recycled Board (URB)

- 6.1.1.6. Othder Graes

- 6.1.2. Containerboard

- 6.1.2.1. White-top Kraftliner

- 6.1.2.2. Other Kraftliners

- 6.1.2.3. White top Testliner

- 6.1.2.4. Other Testliners

- 6.1.2.5. Semi Chemical Fluting

- 6.1.2.6. Recycled Fluting

- 6.1.1. Carton Board

- 6.2. Market Analysis, Insights and Forecast - by Product

- 6.2.1. Folding Cartons

- 6.2.2. Corrugated Boxes

- 6.2.3. Other Types

- 6.3. Market Analysis, Insights and Forecast - by End User Industry

- 6.3.1. Food

- 6.3.2. Beverage

- 6.3.3. Healthcare

- 6.3.4. Personal Care

- 6.3.5. Household Care

- 6.3.6. Electrical Products

- 6.3.7. Other End User Industries

- 6.1. Market Analysis, Insights and Forecast - by Grade

- 7. Europe Paper Packaging Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Grade

- 7.1.1. Carton Board

- 7.1.1.1. Solid Bleached Sulphate (SBS)

- 7.1.1.2. Solid Unbleached Sulphate (SUS)

- 7.1.1.3. Folding Boxboard (FBB)

- 7.1.1.4. Coated Recycled Board (CRB)

- 7.1.1.5. Uncoated Recycled Board (URB)

- 7.1.1.6. Othder Graes

- 7.1.2. Containerboard

- 7.1.2.1. White-top Kraftliner

- 7.1.2.2. Other Kraftliners

- 7.1.2.3. White top Testliner

- 7.1.2.4. Other Testliners

- 7.1.2.5. Semi Chemical Fluting

- 7.1.2.6. Recycled Fluting

- 7.1.1. Carton Board

- 7.2. Market Analysis, Insights and Forecast - by Product

- 7.2.1. Folding Cartons

- 7.2.2. Corrugated Boxes

- 7.2.3. Other Types

- 7.3. Market Analysis, Insights and Forecast - by End User Industry

- 7.3.1. Food

- 7.3.2. Beverage

- 7.3.3. Healthcare

- 7.3.4. Personal Care

- 7.3.5. Household Care

- 7.3.6. Electrical Products

- 7.3.7. Other End User Industries

- 7.1. Market Analysis, Insights and Forecast - by Grade

- 8. Asia Paper Packaging Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Grade

- 8.1.1. Carton Board

- 8.1.1.1. Solid Bleached Sulphate (SBS)

- 8.1.1.2. Solid Unbleached Sulphate (SUS)

- 8.1.1.3. Folding Boxboard (FBB)

- 8.1.1.4. Coated Recycled Board (CRB)

- 8.1.1.5. Uncoated Recycled Board (URB)

- 8.1.1.6. Othder Graes

- 8.1.2. Containerboard

- 8.1.2.1. White-top Kraftliner

- 8.1.2.2. Other Kraftliners

- 8.1.2.3. White top Testliner

- 8.1.2.4. Other Testliners

- 8.1.2.5. Semi Chemical Fluting

- 8.1.2.6. Recycled Fluting

- 8.1.1. Carton Board

- 8.2. Market Analysis, Insights and Forecast - by Product

- 8.2.1. Folding Cartons

- 8.2.2. Corrugated Boxes

- 8.2.3. Other Types

- 8.3. Market Analysis, Insights and Forecast - by End User Industry

- 8.3.1. Food

- 8.3.2. Beverage

- 8.3.3. Healthcare

- 8.3.4. Personal Care

- 8.3.5. Household Care

- 8.3.6. Electrical Products

- 8.3.7. Other End User Industries

- 8.1. Market Analysis, Insights and Forecast - by Grade

- 9. Latin America Paper Packaging Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Grade

- 9.1.1. Carton Board

- 9.1.1.1. Solid Bleached Sulphate (SBS)

- 9.1.1.2. Solid Unbleached Sulphate (SUS)

- 9.1.1.3. Folding Boxboard (FBB)

- 9.1.1.4. Coated Recycled Board (CRB)

- 9.1.1.5. Uncoated Recycled Board (URB)

- 9.1.1.6. Othder Graes

- 9.1.2. Containerboard

- 9.1.2.1. White-top Kraftliner

- 9.1.2.2. Other Kraftliners

- 9.1.2.3. White top Testliner

- 9.1.2.4. Other Testliners

- 9.1.2.5. Semi Chemical Fluting

- 9.1.2.6. Recycled Fluting

- 9.1.1. Carton Board

- 9.2. Market Analysis, Insights and Forecast - by Product

- 9.2.1. Folding Cartons

- 9.2.2. Corrugated Boxes

- 9.2.3. Other Types

- 9.3. Market Analysis, Insights and Forecast - by End User Industry

- 9.3.1. Food

- 9.3.2. Beverage

- 9.3.3. Healthcare

- 9.3.4. Personal Care

- 9.3.5. Household Care

- 9.3.6. Electrical Products

- 9.3.7. Other End User Industries

- 9.1. Market Analysis, Insights and Forecast - by Grade

- 10. Middle East and Africa Paper Packaging Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Grade

- 10.1.1. Carton Board

- 10.1.1.1. Solid Bleached Sulphate (SBS)

- 10.1.1.2. Solid Unbleached Sulphate (SUS)

- 10.1.1.3. Folding Boxboard (FBB)

- 10.1.1.4. Coated Recycled Board (CRB)

- 10.1.1.5. Uncoated Recycled Board (URB)

- 10.1.1.6. Othder Graes

- 10.1.2. Containerboard

- 10.1.2.1. White-top Kraftliner

- 10.1.2.2. Other Kraftliners

- 10.1.2.3. White top Testliner

- 10.1.2.4. Other Testliners

- 10.1.2.5. Semi Chemical Fluting

- 10.1.2.6. Recycled Fluting

- 10.1.1. Carton Board

- 10.2. Market Analysis, Insights and Forecast - by Product

- 10.2.1. Folding Cartons

- 10.2.2. Corrugated Boxes

- 10.2.3. Other Types

- 10.3. Market Analysis, Insights and Forecast - by End User Industry

- 10.3.1. Food

- 10.3.2. Beverage

- 10.3.3. Healthcare

- 10.3.4. Personal Care

- 10.3.5. Household Care

- 10.3.6. Electrical Products

- 10.3.7. Other End User Industries

- 10.1. Market Analysis, Insights and Forecast - by Grade

- 11. North America Paper Packaging Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 12. Europe Paper Packaging Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 United Kingdom

- 12.1.3 Italy

- 12.1.4 France

- 13. Asia Paper Packaging Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 India

- 13.1.4 Australia and New Zealand

- 14. Latin America Paper Packaging Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 Brazil

- 14.1.2 Mexico

- 15. Middle East and Africa Paper Packaging Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 United Arab Emirates

- 15.1.2 Saudi Arabia

- 15.1.3 South Africa

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 WestRock Company

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Smurfit Kappa Group

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Sonoco Products Compan

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Nippon Paper Industries Ltd

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 DS Smith PLC

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Mondi Group

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 International Paper Company

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Eastern Pak Limited

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Packaging Corporation of America

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Cascades Inc

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.1 WestRock Company

List of Figures

- Figure 1: Global Paper Packaging Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Paper Packaging Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Paper Packaging Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Paper Packaging Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Paper Packaging Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Paper Packaging Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Paper Packaging Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America Paper Packaging Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America Paper Packaging Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East and Africa Paper Packaging Market Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East and Africa Paper Packaging Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Paper Packaging Market Revenue (Million), by Grade 2024 & 2032

- Figure 13: North America Paper Packaging Market Revenue Share (%), by Grade 2024 & 2032

- Figure 14: North America Paper Packaging Market Revenue (Million), by Product 2024 & 2032

- Figure 15: North America Paper Packaging Market Revenue Share (%), by Product 2024 & 2032

- Figure 16: North America Paper Packaging Market Revenue (Million), by End User Industry 2024 & 2032

- Figure 17: North America Paper Packaging Market Revenue Share (%), by End User Industry 2024 & 2032

- Figure 18: North America Paper Packaging Market Revenue (Million), by Country 2024 & 2032

- Figure 19: North America Paper Packaging Market Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe Paper Packaging Market Revenue (Million), by Grade 2024 & 2032

- Figure 21: Europe Paper Packaging Market Revenue Share (%), by Grade 2024 & 2032

- Figure 22: Europe Paper Packaging Market Revenue (Million), by Product 2024 & 2032

- Figure 23: Europe Paper Packaging Market Revenue Share (%), by Product 2024 & 2032

- Figure 24: Europe Paper Packaging Market Revenue (Million), by End User Industry 2024 & 2032

- Figure 25: Europe Paper Packaging Market Revenue Share (%), by End User Industry 2024 & 2032

- Figure 26: Europe Paper Packaging Market Revenue (Million), by Country 2024 & 2032

- Figure 27: Europe Paper Packaging Market Revenue Share (%), by Country 2024 & 2032

- Figure 28: Asia Paper Packaging Market Revenue (Million), by Grade 2024 & 2032

- Figure 29: Asia Paper Packaging Market Revenue Share (%), by Grade 2024 & 2032

- Figure 30: Asia Paper Packaging Market Revenue (Million), by Product 2024 & 2032

- Figure 31: Asia Paper Packaging Market Revenue Share (%), by Product 2024 & 2032

- Figure 32: Asia Paper Packaging Market Revenue (Million), by End User Industry 2024 & 2032

- Figure 33: Asia Paper Packaging Market Revenue Share (%), by End User Industry 2024 & 2032

- Figure 34: Asia Paper Packaging Market Revenue (Million), by Country 2024 & 2032

- Figure 35: Asia Paper Packaging Market Revenue Share (%), by Country 2024 & 2032

- Figure 36: Latin America Paper Packaging Market Revenue (Million), by Grade 2024 & 2032

- Figure 37: Latin America Paper Packaging Market Revenue Share (%), by Grade 2024 & 2032

- Figure 38: Latin America Paper Packaging Market Revenue (Million), by Product 2024 & 2032

- Figure 39: Latin America Paper Packaging Market Revenue Share (%), by Product 2024 & 2032

- Figure 40: Latin America Paper Packaging Market Revenue (Million), by End User Industry 2024 & 2032

- Figure 41: Latin America Paper Packaging Market Revenue Share (%), by End User Industry 2024 & 2032

- Figure 42: Latin America Paper Packaging Market Revenue (Million), by Country 2024 & 2032

- Figure 43: Latin America Paper Packaging Market Revenue Share (%), by Country 2024 & 2032

- Figure 44: Middle East and Africa Paper Packaging Market Revenue (Million), by Grade 2024 & 2032

- Figure 45: Middle East and Africa Paper Packaging Market Revenue Share (%), by Grade 2024 & 2032

- Figure 46: Middle East and Africa Paper Packaging Market Revenue (Million), by Product 2024 & 2032

- Figure 47: Middle East and Africa Paper Packaging Market Revenue Share (%), by Product 2024 & 2032

- Figure 48: Middle East and Africa Paper Packaging Market Revenue (Million), by End User Industry 2024 & 2032

- Figure 49: Middle East and Africa Paper Packaging Market Revenue Share (%), by End User Industry 2024 & 2032

- Figure 50: Middle East and Africa Paper Packaging Market Revenue (Million), by Country 2024 & 2032

- Figure 51: Middle East and Africa Paper Packaging Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Paper Packaging Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Paper Packaging Market Revenue Million Forecast, by Grade 2019 & 2032

- Table 3: Global Paper Packaging Market Revenue Million Forecast, by Product 2019 & 2032

- Table 4: Global Paper Packaging Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 5: Global Paper Packaging Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Paper Packaging Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States Paper Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada Paper Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Paper Packaging Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Germany Paper Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: United Kingdom Paper Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Italy Paper Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: France Paper Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global Paper Packaging Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: China Paper Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Japan Paper Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: India Paper Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Australia and New Zealand Paper Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Global Paper Packaging Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Brazil Paper Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Mexico Paper Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Global Paper Packaging Market Revenue Million Forecast, by Country 2019 & 2032

- Table 23: United Arab Emirates Paper Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Saudi Arabia Paper Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: South Africa Paper Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Global Paper Packaging Market Revenue Million Forecast, by Grade 2019 & 2032

- Table 27: Global Paper Packaging Market Revenue Million Forecast, by Product 2019 & 2032

- Table 28: Global Paper Packaging Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 29: Global Paper Packaging Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: United States Paper Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Canada Paper Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Global Paper Packaging Market Revenue Million Forecast, by Grade 2019 & 2032

- Table 33: Global Paper Packaging Market Revenue Million Forecast, by Product 2019 & 2032

- Table 34: Global Paper Packaging Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 35: Global Paper Packaging Market Revenue Million Forecast, by Country 2019 & 2032

- Table 36: Germany Paper Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: United Kingdom Paper Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Italy Paper Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: France Paper Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Global Paper Packaging Market Revenue Million Forecast, by Grade 2019 & 2032

- Table 41: Global Paper Packaging Market Revenue Million Forecast, by Product 2019 & 2032

- Table 42: Global Paper Packaging Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 43: Global Paper Packaging Market Revenue Million Forecast, by Country 2019 & 2032

- Table 44: China Paper Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Japan Paper Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: India Paper Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Australia and New Zealand Paper Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Global Paper Packaging Market Revenue Million Forecast, by Grade 2019 & 2032

- Table 49: Global Paper Packaging Market Revenue Million Forecast, by Product 2019 & 2032

- Table 50: Global Paper Packaging Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 51: Global Paper Packaging Market Revenue Million Forecast, by Country 2019 & 2032

- Table 52: Brazil Paper Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: Mexico Paper Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Global Paper Packaging Market Revenue Million Forecast, by Grade 2019 & 2032

- Table 55: Global Paper Packaging Market Revenue Million Forecast, by Product 2019 & 2032

- Table 56: Global Paper Packaging Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 57: Global Paper Packaging Market Revenue Million Forecast, by Country 2019 & 2032

- Table 58: United Arab Emirates Paper Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: Saudi Arabia Paper Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: South Africa Paper Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Paper Packaging Market?

The projected CAGR is approximately 4.68%.

2. Which companies are prominent players in the Paper Packaging Market?

Key companies in the market include WestRock Company, Smurfit Kappa Group, Sonoco Products Compan, Nippon Paper Industries Ltd, DS Smith PLC, Mondi Group, International Paper Company, Eastern Pak Limited, Packaging Corporation of America, Cascades Inc.

3. What are the main segments of the Paper Packaging Market?

The market segments include Grade, Product, End User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 398.65 Million as of 2022.

5. What are some drivers contributing to market growth?

Development of Barrier-coated Paperboard Products; Growing Consumer Awareness on Paper Packaging.

6. What are the notable trends driving market growth?

The Food and Beverage Segments are Expected to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Effects of Deforestation on Paper Packaging; Increasing Operational Costs.

8. Can you provide examples of recent developments in the market?

March 2024: Sealed Air developed a new paper bottom web to meet the needs of food processors, retailers, and consumers looking to reduce plastic consumption and meet paper packaging demand. CRYOVAC’s new barrier formable paper, branded under Sealed Air, is made of 90% fibers certified by the FSC. According to SEE, this paper bottom web can reduce plastic by 77% when replacing PET/PE bottom web packaging.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Paper Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Paper Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Paper Packaging Market?

To stay informed about further developments, trends, and reports in the Paper Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence