Key Insights

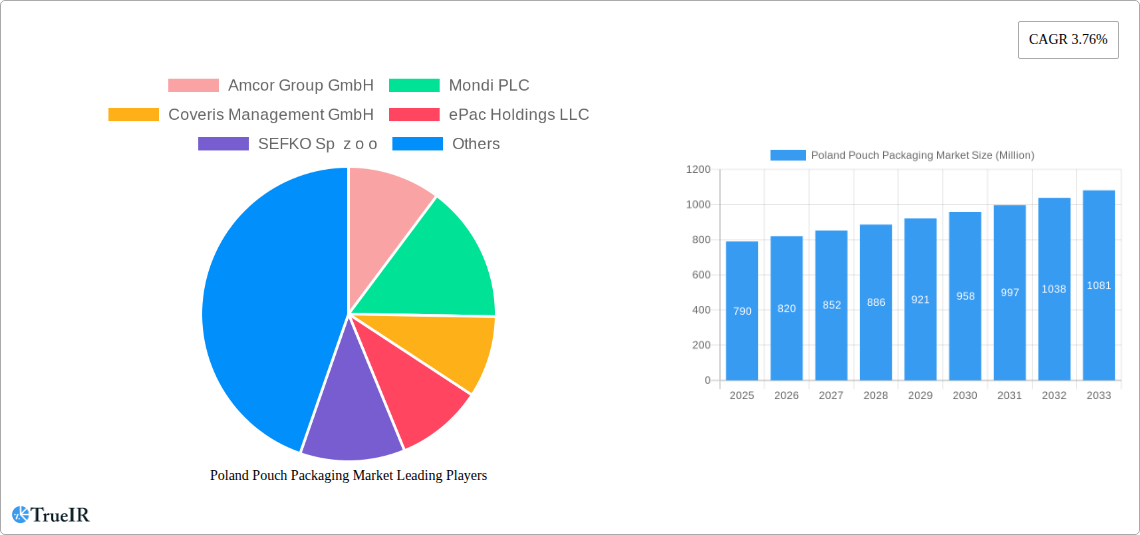

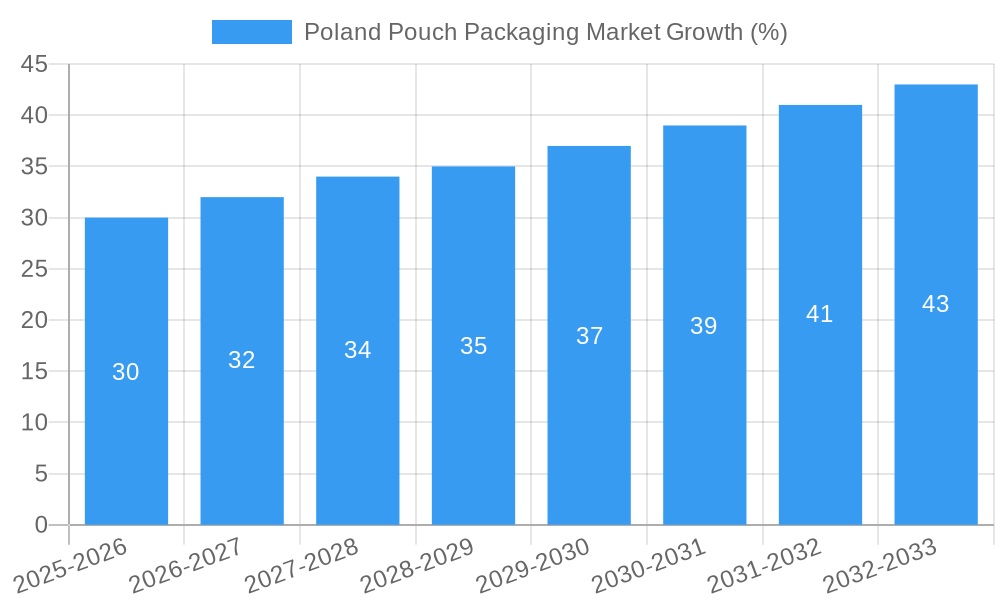

The Poland pouch packaging market, valued at approximately $790 million in 2025, is projected to experience steady growth, driven by increasing consumer demand for convenient and shelf-stable food products. The rising popularity of flexible packaging formats, particularly stand-up pouches and spouted pouches, is a significant factor contributing to this expansion. Key drivers include the growing e-commerce sector, which necessitates robust and lightweight packaging for efficient shipping, and the increasing preference for single-serve and portion-controlled products among consumers. Furthermore, advancements in packaging materials, including sustainable and recyclable options, are influencing market trends. While challenges exist, such as fluctuating raw material prices and stringent regulations regarding food safety and environmental impact, the overall market outlook remains positive. The market's growth is expected to be fueled by the food and beverage sector, with significant contributions also anticipated from the personal care and healthcare segments.

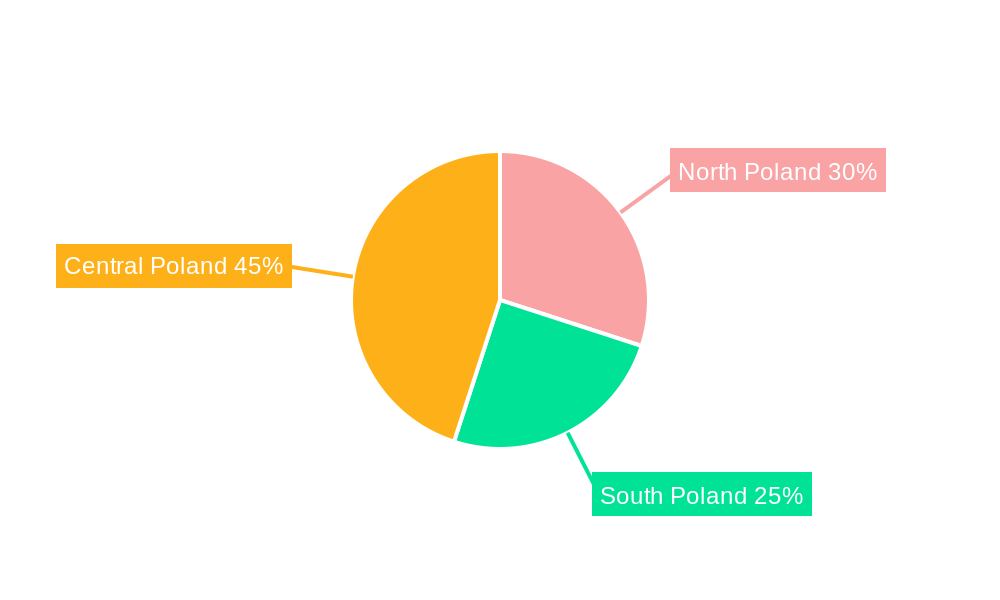

Despite potential restraints like fluctuating raw material costs and regulatory pressures, the predicted Compound Annual Growth Rate (CAGR) of 3.76% suggests a robust and expanding market. Major players like Amcor, Mondi, Coveris, and ePac are likely to continue their dominance, although smaller, niche players specializing in sustainable or innovative packaging solutions could also experience growth. Regional variations within Poland might exist, influenced by factors like population density and consumer preferences, though detailed regional data is unavailable for a comprehensive analysis at this time. The forecast period of 2025-2033 suggests a continued upward trajectory, presenting opportunities for market expansion and innovation in material science and packaging design.

Poland Pouch Packaging Market: A Comprehensive Report (2019-2033)

This dynamic report provides a detailed analysis of the Poland pouch packaging market, offering invaluable insights for businesses, investors, and industry professionals. The study covers the period 2019-2033, with a focus on the base year 2025 and a forecast period extending to 2033. Expect in-depth analysis of market size, growth drivers, competitive landscape, and future outlook, supported by robust data and expert insights. The report is optimized for high search rankings, utilizing relevant keywords to ensure maximum visibility and engagement. The market is projected to reach xx Million by 2033, presenting significant opportunities for growth and investment.

Poland Pouch Packaging Market Structure & Competitive Landscape

The Polish pouch packaging market exhibits a moderately concentrated structure, with a Herfindahl-Hirschman Index (HHI) of xx in 2025. Key players like Amcor Group GmbH, Mondi PLC, and Coveris Management GmbH hold significant market share, driving innovation and shaping market trends. However, the presence of smaller, specialized companies like SEFKO Sp z o o and Pakmar Sp z o o signifies a dynamic competitive landscape.

- Market Concentration: The HHI suggests a moderately concentrated market, indicating the presence of both major players and smaller niche businesses.

- Innovation Drivers: Sustainability concerns and increasing demand for flexible packaging are driving innovation in materials and manufacturing processes.

- Regulatory Impacts: EU regulations on food safety and waste management significantly influence packaging choices. Compliance costs represent a key challenge for market players.

- Product Substitutes: Rigid packaging remains a significant substitute, particularly for products requiring robust protection. However, the cost-effectiveness and convenience of pouches are increasingly influencing consumer and producer decisions.

- End-User Segmentation: The market caters to a diverse range of end-users, including food and beverage, healthcare, personal care, and industrial sectors. Growth is particularly strong in the food and beverage sector, driven by convenience and extended shelf life.

- M&A Trends: The recent acquisition of Hadepol Flexo by Coveris Management GmbH highlights the ongoing consolidation within the market. An estimated xx Million in M&A activity is expected between 2025 and 2033, driven by expansion strategies and increased market competitiveness.

Poland Pouch Packaging Market Market Trends & Opportunities

The Poland pouch packaging market is experiencing robust growth, with a projected Compound Annual Growth Rate (CAGR) of xx% between 2025 and 2033. This growth is fuelled by several key factors:

- Market Size Growth: The market size is expected to increase from xx Million in 2025 to xx Million by 2033, indicating significant expansion potential. Market penetration rates are increasing due to the growing popularity of flexible packaging among various end-use industries, as consumer demand for convenient, environmentally friendly packaging increases.

- Technological Shifts: The adoption of advanced technologies like sustainable material development, improved barrier properties and high speed filling techniques is enhancing efficiency, reducing costs and boosting production rates.

- Consumer Preferences: Consumers are increasingly drawn to convenient and environmentally responsible packaging solutions, driving demand for recyclable and compostable pouches.

- Competitive Dynamics: The market is highly competitive, with existing players expanding their product portfolios and new entrants vying for market share.

Dominant Markets & Segments in Poland Pouch Packaging Market

The food and beverage sector represents the dominant segment within the Polish pouch packaging market, driven by high demand for convenience, extended shelf life, and cost-effectiveness.

- Key Growth Drivers (Food & Beverage):

- Increasing disposable incomes and changing lifestyles.

- Rising demand for ready-to-eat meals and on-the-go snacks.

- Growing adoption of retort pouch technology for extended shelf life.

- Market Dominance: The food and beverage segment accounts for xx% of the total market value in 2025, further solidifying its position as the leading sector. The region of xx is expected to lead the market's growth due to increased infrastructure development and government support for the food processing industry.

Poland Pouch Packaging Market Product Analysis

Product innovation within the Polish pouch packaging market focuses on improved barrier properties to extend shelf life, enhanced sustainability through the use of recycled and compostable materials, and advanced printing technologies for enhanced branding and marketing. Stand-up pouches and spouted pouches are especially popular due to their convenience and ease of use. Competition centers around superior material performance, cost efficiency and advanced printing capabilities.

Key Drivers, Barriers & Challenges in Poland Pouch Packaging Market

Key Drivers: Increasing demand for convenient food packaging, growing adoption of sustainable packaging solutions, and technological advancements in materials and manufacturing processes. Government initiatives promoting sustainable packaging and waste reduction also contribute to market growth.

Key Challenges: Fluctuating raw material prices, increasing pressure to incorporate sustainable materials, and the need to comply with stringent regulatory standards pose significant challenges. Supply chain disruptions arising from geopolitical instability and economic uncertainties can also hinder growth.

Growth Drivers in the Poland Pouch Packaging Market Market

The market's growth is spurred by increasing consumer demand for convenient packaging, particularly in the food and beverage sector. Government support for sustainable packaging, technological advancements in material science, and the rise of e-commerce are further driving factors.

Challenges Impacting Poland Pouch Packaging Market Growth

Price volatility of raw materials, stringent regulations related to food safety and waste management, and competition from alternative packaging types present significant challenges. Supply chain vulnerabilities and a dependence on imported materials also pose risks.

Key Players Shaping the Poland Pouch Packaging Market Market

- Amcor Group GmbH

- Mondi PLC

- Coveris Management GmbH

- ePac Holdings LLC

- SEFKO Sp z o o

- Pakmar Sp z o o

- Sonoco Products Company

- Tetra Pak

Significant Poland Pouch Packaging Market Industry Milestones

- June 2024: Coveris Management GmbH acquires Hadepol Flexo, strengthening its position in Central and Eastern Europe.

- March 2024: Amcor Group GmbH wins eight Flexible Packaging Achievement Awards, showcasing its innovation and leadership.

Future Outlook for Poland Pouch Packaging Market Market

The Polish pouch packaging market is poised for continued growth, driven by increasing consumer demand for sustainable and convenient packaging solutions. Opportunities lie in developing innovative, eco-friendly materials and technologies. The market's future success hinges on adapting to evolving consumer preferences and regulatory changes, while navigating the complexities of the global supply chain.

Poland Pouch Packaging Market Segmentation

-

1. Material Type

- 1.1. Plastic

- 1.2. Paper

- 1.3. Aluminum Foil

-

2. Resin Type - Plastic

- 2.1. Polyethylene

- 2.2. Polypropylene

- 2.3. PET

- 2.4. PVC

- 2.5. EVOH

- 2.6. Other Resins

-

3. Type

- 3.1. Standard

- 3.2. Aseptic

- 3.3. Retort

- 3.4. Hot Fill

-

4. Product

- 4.1. Flat (Pillow & Side-Seal)

- 4.2. Stand-up

-

5. End-User Industry

-

5.1. Food

- 5.1.1. Candy & Confectionery

- 5.1.2. Frozen Foods

- 5.1.3. Fresh Produce

- 5.1.4. Dairy Products

- 5.1.5. Dry Foods

- 5.1.6. Meat, Poultry, And Seafood

- 5.1.7. Pet Food

- 5.1.8. Other Fo

- 5.2. Medical and Pharmaceutical

- 5.3. Personal Care and Household Care

- 5.4. Other En

-

5.1. Food

Poland Pouch Packaging Market Segmentation By Geography

- 1. Poland

Poland Pouch Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.76% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The Rising Food Processing Sector in the Country; Growing Demand of Sustainable Pouch Packaging in Poland

- 3.3. Market Restrains

- 3.3.1. The Rising Food Processing Sector in the Country; Growing Demand of Sustainable Pouch Packaging in Poland

- 3.4. Market Trends

- 3.4.1. The Standard Pouch Segment is Expected to Hold the Largest Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Poland Pouch Packaging Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 5.1.1. Plastic

- 5.1.2. Paper

- 5.1.3. Aluminum Foil

- 5.2. Market Analysis, Insights and Forecast - by Resin Type - Plastic

- 5.2.1. Polyethylene

- 5.2.2. Polypropylene

- 5.2.3. PET

- 5.2.4. PVC

- 5.2.5. EVOH

- 5.2.6. Other Resins

- 5.3. Market Analysis, Insights and Forecast - by Type

- 5.3.1. Standard

- 5.3.2. Aseptic

- 5.3.3. Retort

- 5.3.4. Hot Fill

- 5.4. Market Analysis, Insights and Forecast - by Product

- 5.4.1. Flat (Pillow & Side-Seal)

- 5.4.2. Stand-up

- 5.5. Market Analysis, Insights and Forecast - by End-User Industry

- 5.5.1. Food

- 5.5.1.1. Candy & Confectionery

- 5.5.1.2. Frozen Foods

- 5.5.1.3. Fresh Produce

- 5.5.1.4. Dairy Products

- 5.5.1.5. Dry Foods

- 5.5.1.6. Meat, Poultry, And Seafood

- 5.5.1.7. Pet Food

- 5.5.1.8. Other Fo

- 5.5.2. Medical and Pharmaceutical

- 5.5.3. Personal Care and Household Care

- 5.5.4. Other En

- 5.5.1. Food

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Poland

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Amcor Group GmbH

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Mondi PLC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Coveris Management GmbH

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 ePac Holdings LLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 SEFKO Sp z o o

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Pakmar Sp z o o

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Sonoco Products Company

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Tetra Pa

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Amcor Group GmbH

List of Figures

- Figure 1: Poland Pouch Packaging Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Poland Pouch Packaging Market Share (%) by Company 2024

List of Tables

- Table 1: Poland Pouch Packaging Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Poland Pouch Packaging Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Poland Pouch Packaging Market Revenue Million Forecast, by Material Type 2019 & 2032

- Table 4: Poland Pouch Packaging Market Volume Billion Forecast, by Material Type 2019 & 2032

- Table 5: Poland Pouch Packaging Market Revenue Million Forecast, by Resin Type - Plastic 2019 & 2032

- Table 6: Poland Pouch Packaging Market Volume Billion Forecast, by Resin Type - Plastic 2019 & 2032

- Table 7: Poland Pouch Packaging Market Revenue Million Forecast, by Type 2019 & 2032

- Table 8: Poland Pouch Packaging Market Volume Billion Forecast, by Type 2019 & 2032

- Table 9: Poland Pouch Packaging Market Revenue Million Forecast, by Product 2019 & 2032

- Table 10: Poland Pouch Packaging Market Volume Billion Forecast, by Product 2019 & 2032

- Table 11: Poland Pouch Packaging Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 12: Poland Pouch Packaging Market Volume Billion Forecast, by End-User Industry 2019 & 2032

- Table 13: Poland Pouch Packaging Market Revenue Million Forecast, by Region 2019 & 2032

- Table 14: Poland Pouch Packaging Market Volume Billion Forecast, by Region 2019 & 2032

- Table 15: Poland Pouch Packaging Market Revenue Million Forecast, by Material Type 2019 & 2032

- Table 16: Poland Pouch Packaging Market Volume Billion Forecast, by Material Type 2019 & 2032

- Table 17: Poland Pouch Packaging Market Revenue Million Forecast, by Resin Type - Plastic 2019 & 2032

- Table 18: Poland Pouch Packaging Market Volume Billion Forecast, by Resin Type - Plastic 2019 & 2032

- Table 19: Poland Pouch Packaging Market Revenue Million Forecast, by Type 2019 & 2032

- Table 20: Poland Pouch Packaging Market Volume Billion Forecast, by Type 2019 & 2032

- Table 21: Poland Pouch Packaging Market Revenue Million Forecast, by Product 2019 & 2032

- Table 22: Poland Pouch Packaging Market Volume Billion Forecast, by Product 2019 & 2032

- Table 23: Poland Pouch Packaging Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 24: Poland Pouch Packaging Market Volume Billion Forecast, by End-User Industry 2019 & 2032

- Table 25: Poland Pouch Packaging Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Poland Pouch Packaging Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Poland Pouch Packaging Market?

The projected CAGR is approximately 3.76%.

2. Which companies are prominent players in the Poland Pouch Packaging Market?

Key companies in the market include Amcor Group GmbH, Mondi PLC, Coveris Management GmbH, ePac Holdings LLC, SEFKO Sp z o o, Pakmar Sp z o o, Sonoco Products Company, Tetra Pa.

3. What are the main segments of the Poland Pouch Packaging Market?

The market segments include Material Type, Resin Type - Plastic, Type, Product, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.79 Million as of 2022.

5. What are some drivers contributing to market growth?

The Rising Food Processing Sector in the Country; Growing Demand of Sustainable Pouch Packaging in Poland.

6. What are the notable trends driving market growth?

The Standard Pouch Segment is Expected to Hold the Largest Market Share.

7. Are there any restraints impacting market growth?

The Rising Food Processing Sector in the Country; Growing Demand of Sustainable Pouch Packaging in Poland.

8. Can you provide examples of recent developments in the market?

June 2024: Coveris Management GmbH, a UK packaging company, successfully acquired Hadepol Flexo, a key player in the Polish packaging market. This strategic move bolstered the company's presence in Central and Eastern Europe, promising an expanded clientele.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Poland Pouch Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Poland Pouch Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Poland Pouch Packaging Market?

To stay informed about further developments, trends, and reports in the Poland Pouch Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence