Key Insights

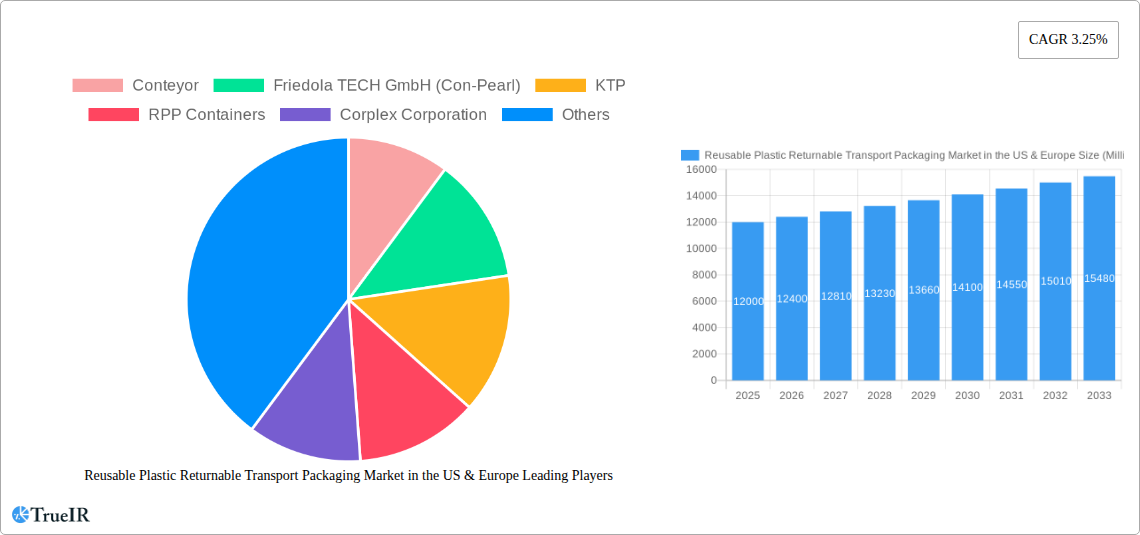

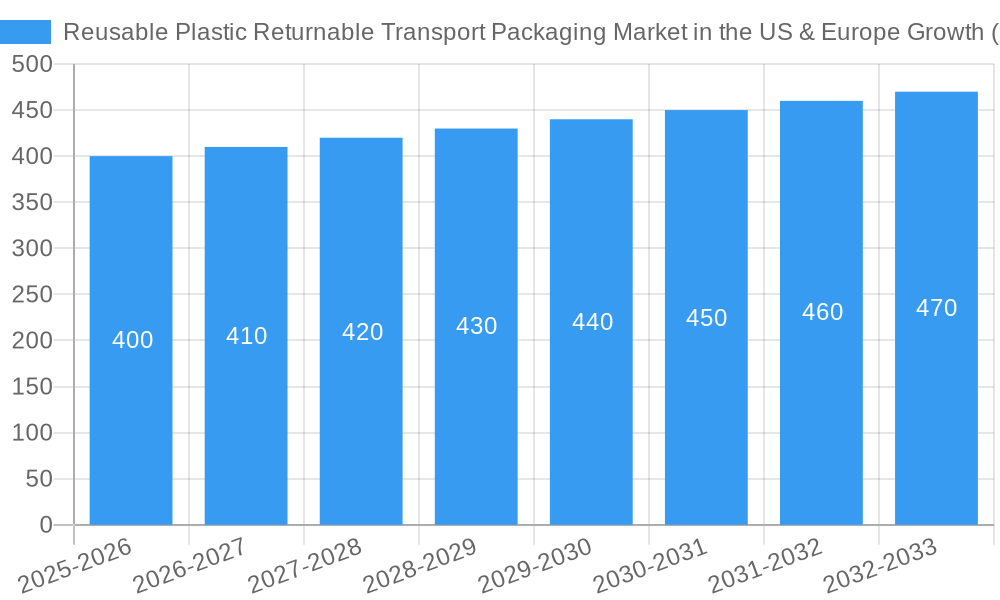

The Reusable Plastic Returnable Transport Packaging (RPTP) market in the US and Europe is experiencing robust growth, driven by increasing demand for sustainable and efficient logistics solutions across various industries. The market, valued at approximately $22.52 billion in 2025 (based on the provided global figure, we can assume a significant portion is attributable to US and European markets, given their advanced economies and high logistics activity), is projected to expand steadily over the forecast period (2025-2033). A compound annual growth rate (CAGR) of 3.25% globally suggests similar, albeit potentially slightly higher growth in these key regions due to strong regulatory pressure towards reducing waste and increasing the adoption of circular economy practices. Key drivers include the rising adoption of e-commerce, leading to increased demand for efficient and reusable packaging, stringent environmental regulations promoting sustainable alternatives to single-use packaging, and the growing focus on supply chain optimization to reduce costs and enhance efficiency. The segment showing the most promise appears to be reusable plastic containers, driven by their versatility and suitability for a wide array of products and industries, particularly food and beverage and consumer durables.

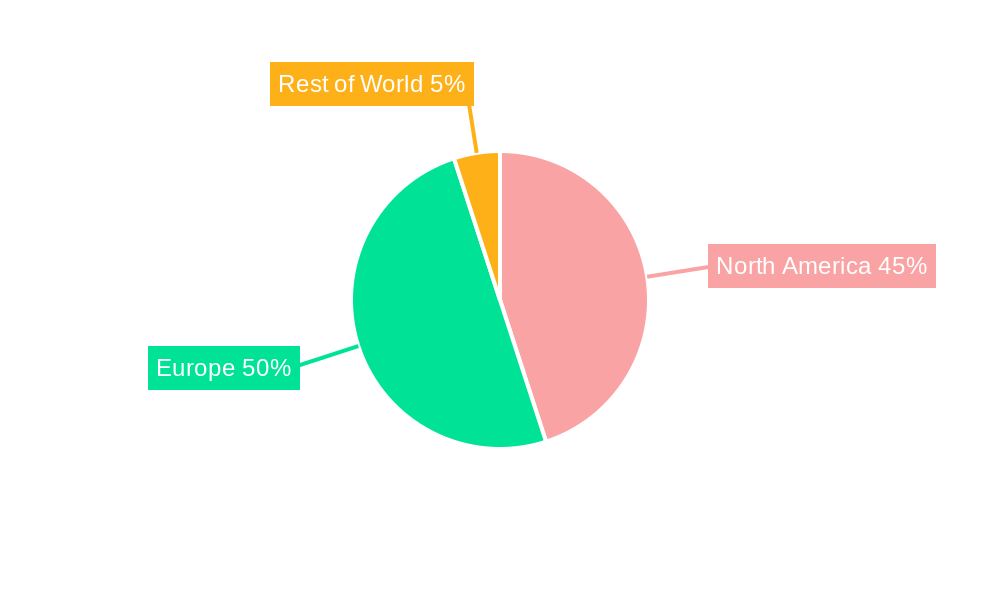

Significant market trends include the increasing adoption of lightweight and durable RPTP solutions, innovation in material science leading to more recyclable and sustainable options, and the rise of digital tracking and management systems to improve the efficiency of RPTP usage and traceability. While there are potential restraints such as high initial investment costs for implementing RPTP systems and the potential for damage or loss of reusable containers, the long-term economic and environmental benefits significantly outweigh these challenges. The market is highly competitive, with key players focusing on product innovation, strategic partnerships, and geographic expansion to strengthen their market positions. The European market, with its strong focus on sustainability and its mature economies, is anticipated to represent a substantial portion of the total market size within the US and European regions. Germany, France, and the UK are expected to be leading contributors within Europe, driven by robust manufacturing and logistics sectors.

Reusable Plastic Returnable Transport Packaging Market in the US & Europe: A Comprehensive Market Report (2019-2033)

This dynamic report provides a deep dive into the Reusable Plastic Returnable Transport Packaging market in the US and Europe, offering invaluable insights for businesses, investors, and industry stakeholders. Leveraging extensive market research and data analysis spanning the period 2019-2033 (historical period: 2019-2024; base year: 2025; forecast period: 2025-2033), this report delivers a 360° view of the market's current state and future trajectory. The report is meticulously structured to provide clear, concise, and actionable intelligence.

Reusable Plastic Returnable Transport Packaging Market in the US & Europe Market Structure & Competitive Landscape

This section analyzes the competitive intensity and structural dynamics within the US and European Reusable Plastic Returnable Transport Packaging market. We explore market concentration, using metrics like the Herfindahl-Hirschman Index (HHI) to assess the level of competition (xx). The report also investigates innovation drivers, such as advancements in materials science and automation, and examines the impact of regulatory frameworks (e.g., environmental regulations driving adoption of reusable packaging) on market growth. Further analysis includes an evaluation of existing product substitutes (e.g., single-use packaging) and their market share (xx%), along with a detailed segmentation by end-user verticals.

- Market Concentration: The market exhibits a (moderately concentrated/fragmented) structure, with the top 5 players holding an estimated xx% market share (2024).

- Innovation Drivers: Focus on lightweighting, improved durability, and enhanced hygiene features is driving innovation.

- Regulatory Impact: Stringent environmental regulations in the EU and increasing sustainability concerns in the US are positively impacting market growth.

- Product Substitutes: Single-use packaging continues to pose a challenge, with its market share gradually declining.

- End-user Segmentation: The market is segmented by food and beverage, automotive, consumer durables, and industrial sectors. The food and beverage sector holds a significant share (xx%), driven by increased demand for sustainable packaging solutions.

- M&A Trends: The report documents xx M&A activities observed in the period 2019-2024, indicating a moderately active consolidation trend in the market. (Further detail on specific M&A activities and their impact will be included in the full report).

Reusable Plastic Returnable Transport Packaging Market in the US & Europe Market Trends & Opportunities

This section delves into the market's size, growth trajectory, and key opportunities. We project a Compound Annual Growth Rate (CAGR) of xx% for the forecast period (2025-2033), reaching a market size of $xx Million by 2033. This growth is fueled by several factors, including increasing demand for sustainable packaging, rising adoption of e-commerce and its associated supply chain complexities, and technological advancements leading to innovative product designs with improved efficiency and cost-effectiveness. We also analyze consumer preferences, shifting towards environmentally friendly solutions, and the evolving competitive landscape, characterized by both established players and emerging innovative companies. Market penetration rates vary by segment and region. The food and beverage industry, for instance, shows a higher rate of adoption (xx%) compared to other sectors, primarily driven by the need to maintain product quality and hygiene. Technological shifts towards automation in warehousing and logistics are further accelerating market growth.

Dominant Markets & Segments in Reusable Plastic Returnable Transport Packaging Market in the US & Europe

This section identifies the leading regions, countries, and product segments within the market.

Dominant Regions: (Further analysis of specific regions within the US and Europe is provided in the full report)

- By Product: Reusable Plastic Containers is the dominant segment, holding an estimated xx% market share, followed by Pallets (xx%) and IBCs (xx%). Growth in this segment is primarily driven by the increasing demand for efficient and reusable transport solutions within the logistics industry.

- By End-user Vertical: The Food and Beverage sector demonstrates the strongest market dominance, representing xx% of the overall market. This is attributed to strict hygiene requirements and increasing consumer demand for sustainable packaging in this sector.

Key Growth Drivers:

- Increased focus on sustainability and environmental regulations.

- Demand for efficient logistics and supply chain optimization.

- Technological advancements leading to improved product designs.

- Rising e-commerce adoption increasing packaging demand.

Detailed analysis of market dominance for each segment is detailed in the full report.

Reusable Plastic Returnable Transport Packaging Market in the US & Europe Product Analysis

The market offers a diverse range of products, including reusable plastic containers, pallets, corrugated boxes and panels, IBCs, crates and totes, and other product types. Innovation is centered around improving durability, hygiene, and ease of handling through material science advancements and design optimization. Technological integration, such as RFID tagging for tracking and management, is becoming increasingly common. The focus is on designing products that seamlessly integrate into existing supply chain infrastructures, minimizing disruption and maximizing efficiency. This includes compatibility with automated handling equipment and optimized stacking capabilities for efficient storage and transportation. Competitive advantages are derived from product features like superior durability, lightweight designs for reduced transportation costs, and hygienic properties to ensure food safety.

Key Drivers, Barriers & Challenges in Reusable Plastic Returnable Transport Packaging Market in the US & Europe

Key Drivers: The market's growth is primarily driven by increasing awareness of environmental sustainability, stringent regulations on single-use plastics, and the need for efficient and cost-effective supply chain solutions. Technological advancements in materials and automation are further accelerating market adoption.

Challenges and Restraints: High upfront investment costs associated with switching to reusable packaging can deter some businesses. Supply chain complexities and the need for robust reverse logistics systems present further obstacles. Competition from single-use packaging, especially in price-sensitive segments, remains a significant challenge. Fluctuations in raw material prices can also impact market dynamics. For example, a xx% increase in polypropylene prices in 2022 resulted in a xx% increase in packaging costs.

Growth Drivers in the Reusable Plastic Returnable Transport Packaging Market in the US & Europe Market

The market's expansion is propelled by factors such as increasing consumer preference for sustainable packaging, stricter environmental regulations on single-use plastics, and rising e-commerce, demanding more efficient logistics. Technological improvements in material science and automation are enhancing product features, leading to greater adoption. Economic benefits, including cost savings from reduced waste and improved supply chain efficiency, also play a significant role.

Challenges Impacting Reusable Plastic Returnable Transport Packaging Market in the US & Europe Growth

Challenges include the relatively high initial investment required to transition to reusable packaging systems, complexities in implementing efficient reverse logistics, and the ongoing competition from cheaper, single-use alternatives. Regulatory variations across different regions within the US and Europe create further complexities for businesses operating across multiple markets.

Key Players Shaping the Reusable Plastic Returnable Transport Packaging Market in the US & Europe Market

- Conteyor

- Friedola TECH GmbH (Con-Pearl)

- KTP

- RPP Containers

- Corplex Corporation

- Schaefer Systems International Inc

- Kiga

- Tosca Ltd

- CABKA

- Soehner Plastics LLC

- IFCO Systems

- Wellplast

- Soehner

- Sustainable Transport Packaging (Reusable Transport Packaging)

- WI Sales

- Wisechemann

- Orbis Corporation (Menasha Corporation)

- Duro-Therm

- Auer

Significant Reusable Plastic Returnable Transport Packaging Market in the US & Europe Industry Milestones

- June 2022: Orbis Corporation launched the new p3 Pallet, a durable, lightweight, stackable, and hygienic reusable plastic pallet designed for seamless integration with automated and manual material handling equipment. This launch signifies a significant step towards enhancing sustainable handling practices within the food and beverage, CPG, and primary packaging sectors.

Future Outlook for Reusable Plastic Returnable Transport Packaging Market in the US & Europe Market

The market is poised for sustained growth, driven by ongoing environmental concerns, evolving consumer preferences, and the imperative for efficient supply chain management. Strategic opportunities lie in developing innovative product designs that address specific industry needs, optimizing reverse logistics systems, and expanding into new geographical markets. The market’s potential is significant, particularly considering the increasing focus on sustainability and circular economy principles across both the US and European markets.

Reusable Plastic Returnable Transport Packaging Market in the US & Europe Segmentation

-

1. Product

- 1.1. Reusable Plastic Containers

- 1.2. Pallets

- 1.3. Corrugated Boxes and Panels

- 1.4. IBCs

- 1.5. Crates and Totes

- 1.6. Other Product Types

-

2. End-user Vertical

- 2.1. Food and Beverage

- 2.2. Automotive

- 2.3. Consumer Durables

- 2.4. Industrial (including Chemicals)

- 2.5. Other End-user verticals

Reusable Plastic Returnable Transport Packaging Market in the US & Europe Segmentation By Geography

- 1. United States

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Spain

- 2.5. Rest of Europe

Reusable Plastic Returnable Transport Packaging Market in the US & Europe REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.25% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Favorable Governmental Regulations; Automation to Increase the Demand for Reusable Plastic RTP

- 3.3. Market Restrains

- 3.3.1. Resistance to Process Change by Various Stakeholders; Availability of Alternative Materials

- 3.4. Market Trends

- 3.4.1. Pallets to Account for Major Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Reusable Plastic Returnable Transport Packaging Market in the US & Europe Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Reusable Plastic Containers

- 5.1.2. Pallets

- 5.1.3. Corrugated Boxes and Panels

- 5.1.4. IBCs

- 5.1.5. Crates and Totes

- 5.1.6. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.2.1. Food and Beverage

- 5.2.2. Automotive

- 5.2.3. Consumer Durables

- 5.2.4. Industrial (including Chemicals)

- 5.2.5. Other End-user verticals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.3.2. Europe

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. United States Reusable Plastic Returnable Transport Packaging Market in the US & Europe Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Reusable Plastic Containers

- 6.1.2. Pallets

- 6.1.3. Corrugated Boxes and Panels

- 6.1.4. IBCs

- 6.1.5. Crates and Totes

- 6.1.6. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 6.2.1. Food and Beverage

- 6.2.2. Automotive

- 6.2.3. Consumer Durables

- 6.2.4. Industrial (including Chemicals)

- 6.2.5. Other End-user verticals

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Europe Reusable Plastic Returnable Transport Packaging Market in the US & Europe Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Reusable Plastic Containers

- 7.1.2. Pallets

- 7.1.3. Corrugated Boxes and Panels

- 7.1.4. IBCs

- 7.1.5. Crates and Totes

- 7.1.6. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 7.2.1. Food and Beverage

- 7.2.2. Automotive

- 7.2.3. Consumer Durables

- 7.2.4. Industrial (including Chemicals)

- 7.2.5. Other End-user verticals

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Germany Reusable Plastic Returnable Transport Packaging Market in the US & Europe Analysis, Insights and Forecast, 2019-2031

- 9. France Reusable Plastic Returnable Transport Packaging Market in the US & Europe Analysis, Insights and Forecast, 2019-2031

- 10. Italy Reusable Plastic Returnable Transport Packaging Market in the US & Europe Analysis, Insights and Forecast, 2019-2031

- 11. United Kingdom Reusable Plastic Returnable Transport Packaging Market in the US & Europe Analysis, Insights and Forecast, 2019-2031

- 12. Netherlands Reusable Plastic Returnable Transport Packaging Market in the US & Europe Analysis, Insights and Forecast, 2019-2031

- 13. Sweden Reusable Plastic Returnable Transport Packaging Market in the US & Europe Analysis, Insights and Forecast, 2019-2031

- 14. Rest of Europe Reusable Plastic Returnable Transport Packaging Market in the US & Europe Analysis, Insights and Forecast, 2019-2031

- 15. Competitive Analysis

- 15.1. Market Share Analysis 2024

- 15.2. Company Profiles

- 15.2.1 Conteyor

- 15.2.1.1. Overview

- 15.2.1.2. Products

- 15.2.1.3. SWOT Analysis

- 15.2.1.4. Recent Developments

- 15.2.1.5. Financials (Based on Availability)

- 15.2.2 Friedola TECH GmbH (Con-Pearl)

- 15.2.2.1. Overview

- 15.2.2.2. Products

- 15.2.2.3. SWOT Analysis

- 15.2.2.4. Recent Developments

- 15.2.2.5. Financials (Based on Availability)

- 15.2.3 KTP

- 15.2.3.1. Overview

- 15.2.3.2. Products

- 15.2.3.3. SWOT Analysis

- 15.2.3.4. Recent Developments

- 15.2.3.5. Financials (Based on Availability)

- 15.2.4 RPP Containers

- 15.2.4.1. Overview

- 15.2.4.2. Products

- 15.2.4.3. SWOT Analysis

- 15.2.4.4. Recent Developments

- 15.2.4.5. Financials (Based on Availability)

- 15.2.5 Corplex Corporation

- 15.2.5.1. Overview

- 15.2.5.2. Products

- 15.2.5.3. SWOT Analysis

- 15.2.5.4. Recent Developments

- 15.2.5.5. Financials (Based on Availability)

- 15.2.6 Schaefer Systems International Inc

- 15.2.6.1. Overview

- 15.2.6.2. Products

- 15.2.6.3. SWOT Analysis

- 15.2.6.4. Recent Developments

- 15.2.6.5. Financials (Based on Availability)

- 15.2.7 Kiga

- 15.2.7.1. Overview

- 15.2.7.2. Products

- 15.2.7.3. SWOT Analysis

- 15.2.7.4. Recent Developments

- 15.2.7.5. Financials (Based on Availability)

- 15.2.8 Tosca Ltd

- 15.2.8.1. Overview

- 15.2.8.2. Products

- 15.2.8.3. SWOT Analysis

- 15.2.8.4. Recent Developments

- 15.2.8.5. Financials (Based on Availability)

- 15.2.9 CABKA

- 15.2.9.1. Overview

- 15.2.9.2. Products

- 15.2.9.3. SWOT Analysis

- 15.2.9.4. Recent Developments

- 15.2.9.5. Financials (Based on Availability)

- 15.2.10 Sohner Plastics LLC

- 15.2.10.1. Overview

- 15.2.10.2. Products

- 15.2.10.3. SWOT Analysis

- 15.2.10.4. Recent Developments

- 15.2.10.5. Financials (Based on Availability)

- 15.2.11 IFCO Systems

- 15.2.11.1. Overview

- 15.2.11.2. Products

- 15.2.11.3. SWOT Analysis

- 15.2.11.4. Recent Developments

- 15.2.11.5. Financials (Based on Availability)

- 15.2.12 Wellplast

- 15.2.12.1. Overview

- 15.2.12.2. Products

- 15.2.12.3. SWOT Analysis

- 15.2.12.4. Recent Developments

- 15.2.12.5. Financials (Based on Availability)

- 15.2.13 Soehner

- 15.2.13.1. Overview

- 15.2.13.2. Products

- 15.2.13.3. SWOT Analysis

- 15.2.13.4. Recent Developments

- 15.2.13.5. Financials (Based on Availability)

- 15.2.14 Sustainable Transport Packaging (Reusable Transport Packaging)

- 15.2.14.1. Overview

- 15.2.14.2. Products

- 15.2.14.3. SWOT Analysis

- 15.2.14.4. Recent Developments

- 15.2.14.5. Financials (Based on Availability)

- 15.2.15 WI Sales*List Not Exhaustive

- 15.2.15.1. Overview

- 15.2.15.2. Products

- 15.2.15.3. SWOT Analysis

- 15.2.15.4. Recent Developments

- 15.2.15.5. Financials (Based on Availability)

- 15.2.16 Wisechemann

- 15.2.16.1. Overview

- 15.2.16.2. Products

- 15.2.16.3. SWOT Analysis

- 15.2.16.4. Recent Developments

- 15.2.16.5. Financials (Based on Availability)

- 15.2.17 Orbis Corporation (Menasha Corporation)

- 15.2.17.1. Overview

- 15.2.17.2. Products

- 15.2.17.3. SWOT Analysis

- 15.2.17.4. Recent Developments

- 15.2.17.5. Financials (Based on Availability)

- 15.2.18 Duro-Therm

- 15.2.18.1. Overview

- 15.2.18.2. Products

- 15.2.18.3. SWOT Analysis

- 15.2.18.4. Recent Developments

- 15.2.18.5. Financials (Based on Availability)

- 15.2.19 Auer

- 15.2.19.1. Overview

- 15.2.19.2. Products

- 15.2.19.3. SWOT Analysis

- 15.2.19.4. Recent Developments

- 15.2.19.5. Financials (Based on Availability)

- 15.2.1 Conteyor

List of Figures

- Figure 1: Reusable Plastic Returnable Transport Packaging Market in the US & Europe Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Reusable Plastic Returnable Transport Packaging Market in the US & Europe Share (%) by Company 2024

List of Tables

- Table 1: Reusable Plastic Returnable Transport Packaging Market in the US & Europe Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Reusable Plastic Returnable Transport Packaging Market in the US & Europe Revenue Million Forecast, by Product 2019 & 2032

- Table 3: Reusable Plastic Returnable Transport Packaging Market in the US & Europe Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 4: Reusable Plastic Returnable Transport Packaging Market in the US & Europe Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Reusable Plastic Returnable Transport Packaging Market in the US & Europe Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Germany Reusable Plastic Returnable Transport Packaging Market in the US & Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: France Reusable Plastic Returnable Transport Packaging Market in the US & Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Italy Reusable Plastic Returnable Transport Packaging Market in the US & Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United Kingdom Reusable Plastic Returnable Transport Packaging Market in the US & Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Netherlands Reusable Plastic Returnable Transport Packaging Market in the US & Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Sweden Reusable Plastic Returnable Transport Packaging Market in the US & Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Europe Reusable Plastic Returnable Transport Packaging Market in the US & Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Reusable Plastic Returnable Transport Packaging Market in the US & Europe Revenue Million Forecast, by Product 2019 & 2032

- Table 14: Reusable Plastic Returnable Transport Packaging Market in the US & Europe Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 15: Reusable Plastic Returnable Transport Packaging Market in the US & Europe Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Reusable Plastic Returnable Transport Packaging Market in the US & Europe Revenue Million Forecast, by Product 2019 & 2032

- Table 17: Reusable Plastic Returnable Transport Packaging Market in the US & Europe Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 18: Reusable Plastic Returnable Transport Packaging Market in the US & Europe Revenue Million Forecast, by Country 2019 & 2032

- Table 19: United Kingdom Reusable Plastic Returnable Transport Packaging Market in the US & Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Germany Reusable Plastic Returnable Transport Packaging Market in the US & Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: France Reusable Plastic Returnable Transport Packaging Market in the US & Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Spain Reusable Plastic Returnable Transport Packaging Market in the US & Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Rest of Europe Reusable Plastic Returnable Transport Packaging Market in the US & Europe Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Reusable Plastic Returnable Transport Packaging Market in the US & Europe?

The projected CAGR is approximately 3.25%.

2. Which companies are prominent players in the Reusable Plastic Returnable Transport Packaging Market in the US & Europe?

Key companies in the market include Conteyor, Friedola TECH GmbH (Con-Pearl), KTP, RPP Containers, Corplex Corporation, Schaefer Systems International Inc, Kiga, Tosca Ltd, CABKA, Sohner Plastics LLC, IFCO Systems, Wellplast, Soehner, Sustainable Transport Packaging (Reusable Transport Packaging), WI Sales*List Not Exhaustive, Wisechemann, Orbis Corporation (Menasha Corporation), Duro-Therm, Auer.

3. What are the main segments of the Reusable Plastic Returnable Transport Packaging Market in the US & Europe?

The market segments include Product, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 22.52 Million as of 2022.

5. What are some drivers contributing to market growth?

Favorable Governmental Regulations; Automation to Increase the Demand for Reusable Plastic RTP.

6. What are the notable trends driving market growth?

Pallets to Account for Major Market Share.

7. Are there any restraints impacting market growth?

Resistance to Process Change by Various Stakeholders; Availability of Alternative Materials.

8. Can you provide examples of recent developments in the market?

June 2022 - Orbis corporation has introduced the new p3 Pallet to its suite of reusable plastic pallet offerings to improve sustainable handling in primary packaging, food and beverage, and CPG applications. The size of the Pallet is 40,48 inches, a durable, lightweight, stackable, hygienic packaging solution that integrates seamlessly with both automatic and manual material handling equipment

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Reusable Plastic Returnable Transport Packaging Market in the US & Europe," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Reusable Plastic Returnable Transport Packaging Market in the US & Europe report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Reusable Plastic Returnable Transport Packaging Market in the US & Europe?

To stay informed about further developments, trends, and reports in the Reusable Plastic Returnable Transport Packaging Market in the US & Europe, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence