Key Insights

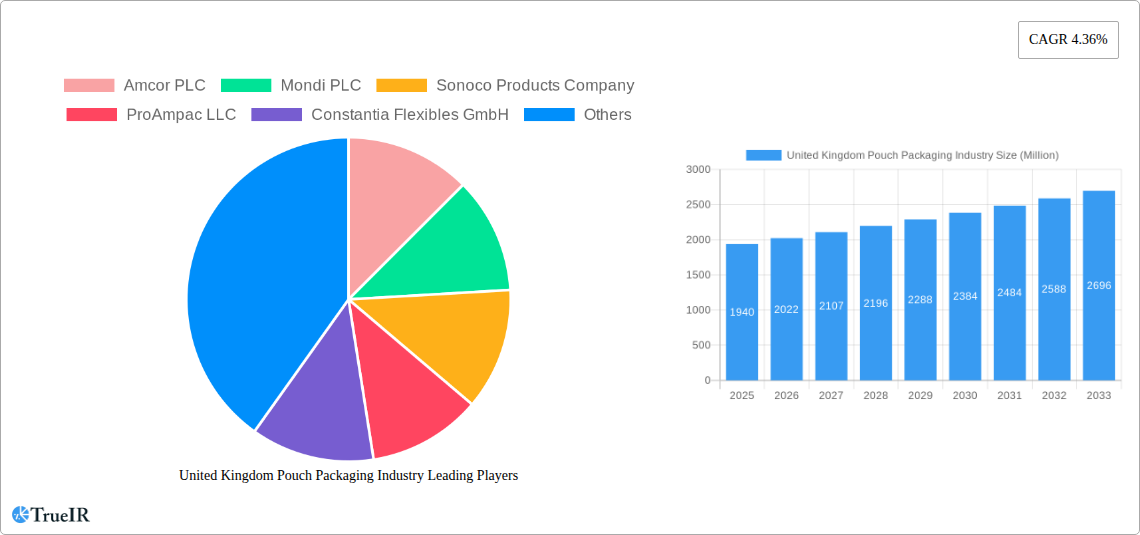

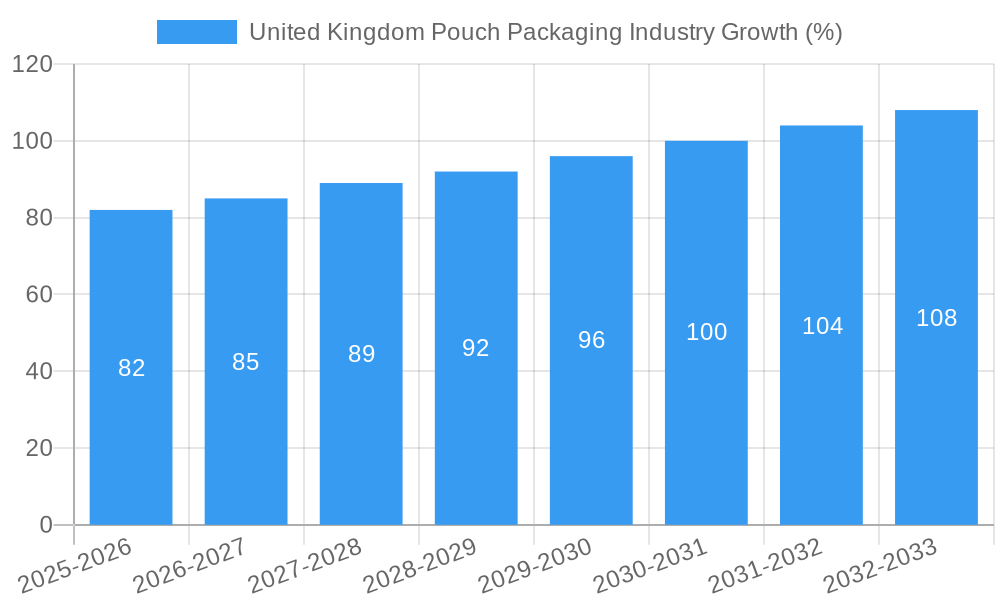

The United Kingdom pouch packaging market, valued at approximately £1.94 billion in 2025, is projected to experience steady growth, driven by several key factors. The increasing demand for convenient and portable food products, coupled with the rising popularity of e-commerce and online grocery shopping, fuels the adoption of flexible pouch packaging. Sustainability concerns are also playing a significant role, with manufacturers increasingly adopting eco-friendly materials like recyclable and compostable pouches. Furthermore, advancements in pouch packaging technology, such as stand-up pouches with resealable closures and innovative barrier films, are enhancing product shelf life and appeal to consumers. This trend is expected to continue, with a projected Compound Annual Growth Rate (CAGR) of 4.36% from 2025 to 2033. The market is segmented by material type (plastic, paper, etc.), packaging type (stand-up pouches, three-side seal pouches, etc.), and end-use industry (food, beverage, personal care, etc.). Major players, such as Amcor PLC, Mondi PLC, and Sonoco Products Company, are actively investing in research and development to improve packaging solutions and meet the evolving consumer needs.

Despite the positive growth outlook, certain challenges exist. Fluctuations in raw material prices, especially for plastics, and increasing environmental regulations can impact profitability. However, the long-term growth prospects remain strong, particularly given the ongoing shift towards e-commerce and the increasing consumer demand for sustainable and convenient packaging options. The market's competitive landscape is characterized by both large multinational corporations and smaller specialized packaging companies, fostering innovation and diverse product offerings. The UK market's robust economy and established food and beverage industry provide a strong foundation for continued growth within the pouch packaging sector.

United Kingdom Pouch Packaging Industry: Market Report 2019-2033

This comprehensive report provides a detailed analysis of the United Kingdom pouch packaging industry, offering invaluable insights for businesses, investors, and stakeholders. Covering the period from 2019 to 2033, with a focus on 2025, this report leverages extensive market research to deliver a dynamic and actionable overview of this rapidly evolving sector. Expect in-depth analysis of market size, key players, emerging trends, and future growth projections. The report utilizes high-volume keywords like "UK pouch packaging market," "flexible packaging UK," "recyclable pouches UK," and "pouch packaging industry trends," ensuring maximum visibility and relevance in search engine results.

United Kingdom Pouch Packaging Industry Market Structure & Competitive Landscape

The UK pouch packaging market exhibits a moderately concentrated structure, with a few major players holding significant market share. The Herfindahl-Hirschman Index (HHI) for 2024 is estimated at xx, indicating a moderately competitive landscape. Innovation plays a crucial role, driven by consumer demand for sustainable and convenient packaging solutions. Stringent UK regulations regarding food safety and recyclability significantly impact market dynamics. Key product substitutes include rigid containers and bottles, although pouches maintain a competitive edge due to their cost-effectiveness and versatility.

End-user segmentation is diverse, encompassing the food & beverage, personal care, and healthcare industries. Mergers and acquisitions (M&A) activity has been moderate in recent years, with xx deals recorded between 2019 and 2024, driven primarily by consolidation efforts and expansion into new market segments.

- Market Concentration: Moderately concentrated, HHI (2024): xx

- Innovation Drivers: Sustainability, convenience, and enhanced functionality.

- Regulatory Impacts: Stringent food safety and recyclability regulations.

- Product Substitutes: Rigid containers, bottles.

- End-User Segmentation: Food & beverage, personal care, healthcare.

- M&A Trends: Moderate activity, xx deals (2019-2024).

United Kingdom Pouch Packaging Industry Market Trends & Opportunities

The UK pouch packaging market is experiencing robust growth, with a projected Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Market size in 2025 is estimated at £xx Million, driven by increasing demand for convenient and sustainable packaging across various sectors. Technological advancements, particularly in flexible packaging materials and barrier technologies, are fueling market expansion. Consumer preferences are shifting towards eco-friendly packaging, prompting significant innovation in recyclable and compostable pouch solutions. The competitive landscape is dynamic, with established players and new entrants vying for market share. Market penetration rate for recyclable pouches is expected to reach xx% by 2033.

Dominant Markets & Segments in United Kingdom Pouch Packaging Industry

The food and beverage segment dominates the UK pouch packaging market, accounting for approximately xx% of the total market share in 2025. This is driven by the increasing popularity of convenient food and beverage products, particularly in the ready-to-eat and on-the-go segments. Growth is significantly fueled by favorable demographics, changing consumer preferences, and the development of innovative pouch designs optimized for specific food products.

- Key Growth Drivers (Food & Beverage Segment):

- Growing demand for convenient food and beverages.

- Increased adoption of flexible packaging in the retail sector.

- Technological advancements in barrier and sealant technologies.

- Government regulations supporting sustainable packaging.

United Kingdom Pouch Packaging Industry Product Analysis

The UK pouch packaging market showcases a diverse range of products, including stand-up pouches, spouted pouches, and flat pouches, each tailored to specific applications. Technological advancements focus on improved barrier properties, enhanced recyclability, and the incorporation of smart packaging features. These innovations cater to evolving consumer demands for sustainability and convenience, providing a competitive advantage in the market.

Key Drivers, Barriers & Challenges in United Kingdom Pouch Packaging Industry

Key Drivers:

- Rising demand for convenient and portable packaging solutions.

- Growing popularity of e-commerce and online grocery shopping.

- Increasing consumer awareness of sustainable packaging practices.

- Government incentives and regulations promoting recyclable packaging.

Challenges:

- Fluctuating raw material prices impacting production costs.

- Stringent environmental regulations related to packaging waste.

- Intense competition from established and emerging players. The market is saturated with numerous players, leading to price wars and thin margins.

Growth Drivers in the United Kingdom Pouch Packaging Industry Market

The UK pouch packaging market is propelled by the growing demand for convenient packaging solutions, particularly among on-the-go consumers. Increased e-commerce activity further fuels market growth, as pouches offer efficient and cost-effective shipping. Government initiatives promoting sustainable packaging and the use of recyclable materials create additional growth momentum.

Challenges Impacting United Kingdom Pouch Packaging Industry Growth

Significant challenges include fluctuating raw material costs, increasing regulatory scrutiny related to packaging waste, and intense competition. These factors contribute to price pressures and margin compression, affecting the overall profitability of the industry.

Key Players Shaping the United Kingdom Pouch Packaging Industry Market

- Amcor PLC

- Mondi PLC

- Sonoco Products Company

- ProAmpac LLC

- Constantia Flexibles GmbH

- Surepak Innovative Packaging Solutions

- ePac Holdings LLC

- CS Flexible Pouches (Asteria Group)

- Elliot Packaging

Significant United Kingdom Pouch Packaging Industry Industry Milestones

- March 2024: Rose Marketing UK partnered with Perfetti Van Melle to launch Chupa Chups Slush Pouches, showcasing the growing demand for innovative pouch applications in the confectionery sector.

- March 2024: Capri-Sun launched fully recyclable pouches for its 200ml single-serve packs, highlighting the industry's shift towards sustainable packaging solutions and a commitment to reducing its carbon footprint by 25%.

Future Outlook for United Kingdom Pouch Packaging Industry Market

The UK pouch packaging market is poised for continued growth, driven by increasing demand for sustainable and convenient packaging options. Strategic partnerships, technological advancements, and a focus on eco-friendly materials will shape the future of the industry. Companies are expected to focus on innovation to address consumer demand for environmentally conscious packaging, resulting in a sustainable and thriving market.

United Kingdom Pouch Packaging Industry Segmentation

-

1. Material

-

1.1. Plastic

- 1.1.1. Polyethylene

- 1.1.2. Polypropylene

- 1.1.3. PET

- 1.1.4. PVC

- 1.1.5. EVOH

- 1.1.6. Other Resins

- 1.2. Paper

- 1.3. Aluminum

-

1.1. Plastic

-

2. Product

- 2.1. Flat (Pillow & Side-Seal)

- 2.2. Stand-up

-

3. End-User Industry

-

3.1. Food

- 3.1.1. Candy & Confectionery

- 3.1.2. Frozen Foods

- 3.1.3. Fresh Produce

- 3.1.4. Dairy Products

- 3.1.5. Dry Foods

- 3.1.6. Meat, Poultry, And Seafood

- 3.1.7. Pet Food

- 3.1.8. Other Fo

- 3.2. Beverage

- 3.3. Medical and Pharmaceutical

- 3.4. Personal Care and Household Care

- 3.5. Other En

-

3.1. Food

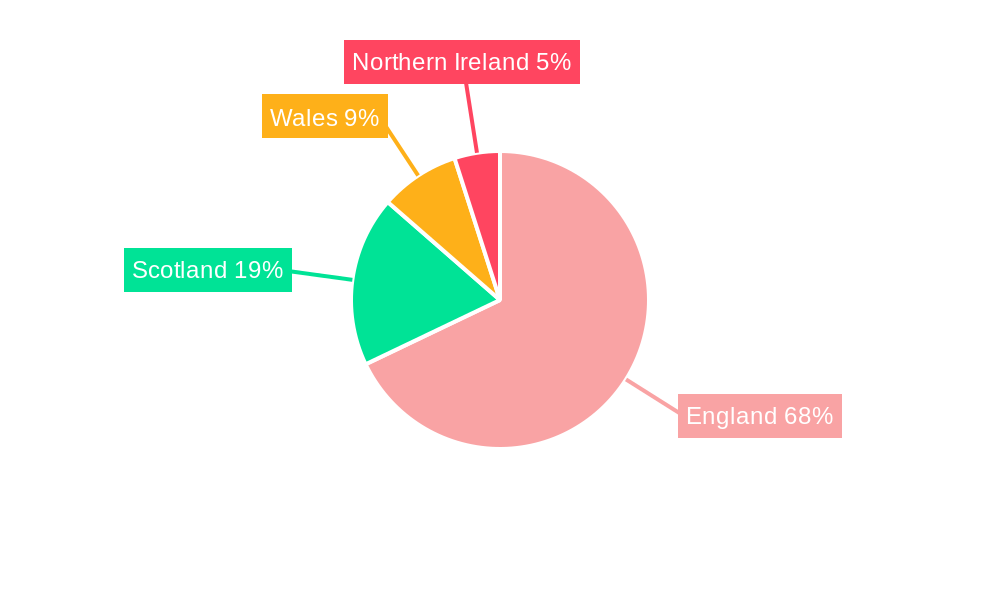

United Kingdom Pouch Packaging Industry Segmentation By Geography

- 1. United Kingdom

United Kingdom Pouch Packaging Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.36% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Demand from the Food and Beverage Industry to Push the Market's Growth

- 3.3. Market Restrains

- 3.3.1. Demand from the Food and Beverage Industry to Push the Market's Growth

- 3.4. Market Trends

- 3.4.1. Increasing Adoption of Lightweight Packaging Methods

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Kingdom Pouch Packaging Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Plastic

- 5.1.1.1. Polyethylene

- 5.1.1.2. Polypropylene

- 5.1.1.3. PET

- 5.1.1.4. PVC

- 5.1.1.5. EVOH

- 5.1.1.6. Other Resins

- 5.1.2. Paper

- 5.1.3. Aluminum

- 5.1.1. Plastic

- 5.2. Market Analysis, Insights and Forecast - by Product

- 5.2.1. Flat (Pillow & Side-Seal)

- 5.2.2. Stand-up

- 5.3. Market Analysis, Insights and Forecast - by End-User Industry

- 5.3.1. Food

- 5.3.1.1. Candy & Confectionery

- 5.3.1.2. Frozen Foods

- 5.3.1.3. Fresh Produce

- 5.3.1.4. Dairy Products

- 5.3.1.5. Dry Foods

- 5.3.1.6. Meat, Poultry, And Seafood

- 5.3.1.7. Pet Food

- 5.3.1.8. Other Fo

- 5.3.2. Beverage

- 5.3.3. Medical and Pharmaceutical

- 5.3.4. Personal Care and Household Care

- 5.3.5. Other En

- 5.3.1. Food

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United Kingdom

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Amcor PLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Mondi PLC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Sonoco Products Company

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 ProAmpac LLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Constantia Flexibles GmbH

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Surepak Innovative Packaging Solutions

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 ePac Holdings LLC

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 CS Flexible Pouches (Asteria Group)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Elliot Packaging10 2 Heat Map Analysi

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Amcor PLC

List of Figures

- Figure 1: United Kingdom Pouch Packaging Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United Kingdom Pouch Packaging Industry Share (%) by Company 2024

List of Tables

- Table 1: United Kingdom Pouch Packaging Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United Kingdom Pouch Packaging Industry Volume Billion Forecast, by Region 2019 & 2032

- Table 3: United Kingdom Pouch Packaging Industry Revenue Million Forecast, by Material 2019 & 2032

- Table 4: United Kingdom Pouch Packaging Industry Volume Billion Forecast, by Material 2019 & 2032

- Table 5: United Kingdom Pouch Packaging Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 6: United Kingdom Pouch Packaging Industry Volume Billion Forecast, by Product 2019 & 2032

- Table 7: United Kingdom Pouch Packaging Industry Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 8: United Kingdom Pouch Packaging Industry Volume Billion Forecast, by End-User Industry 2019 & 2032

- Table 9: United Kingdom Pouch Packaging Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 10: United Kingdom Pouch Packaging Industry Volume Billion Forecast, by Region 2019 & 2032

- Table 11: United Kingdom Pouch Packaging Industry Revenue Million Forecast, by Material 2019 & 2032

- Table 12: United Kingdom Pouch Packaging Industry Volume Billion Forecast, by Material 2019 & 2032

- Table 13: United Kingdom Pouch Packaging Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 14: United Kingdom Pouch Packaging Industry Volume Billion Forecast, by Product 2019 & 2032

- Table 15: United Kingdom Pouch Packaging Industry Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 16: United Kingdom Pouch Packaging Industry Volume Billion Forecast, by End-User Industry 2019 & 2032

- Table 17: United Kingdom Pouch Packaging Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: United Kingdom Pouch Packaging Industry Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Kingdom Pouch Packaging Industry?

The projected CAGR is approximately 4.36%.

2. Which companies are prominent players in the United Kingdom Pouch Packaging Industry?

Key companies in the market include Amcor PLC, Mondi PLC, Sonoco Products Company, ProAmpac LLC, Constantia Flexibles GmbH, Surepak Innovative Packaging Solutions, ePac Holdings LLC, CS Flexible Pouches (Asteria Group), Elliot Packaging10 2 Heat Map Analysi.

3. What are the main segments of the United Kingdom Pouch Packaging Industry?

The market segments include Material, Product, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.94 Million as of 2022.

5. What are some drivers contributing to market growth?

Demand from the Food and Beverage Industry to Push the Market's Growth.

6. What are the notable trends driving market growth?

Increasing Adoption of Lightweight Packaging Methods.

7. Are there any restraints impacting market growth?

Demand from the Food and Beverage Industry to Push the Market's Growth.

8. Can you provide examples of recent developments in the market?

March 2024: Rose Marketing UK, a confectionery and drinks distributor, partnered with Perfetti Van Melle to launch Chupa Chups Slush Pouches in Cola and Strawberry varieties. The new Chupa Chups Slush Pouches offer the taste of Chupa Chups as an ambient frozen slush. The slushes are made with natural fruit and are available in two flavors: strawberry and cola.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Kingdom Pouch Packaging Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Kingdom Pouch Packaging Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Kingdom Pouch Packaging Industry?

To stay informed about further developments, trends, and reports in the United Kingdom Pouch Packaging Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence