Key Insights

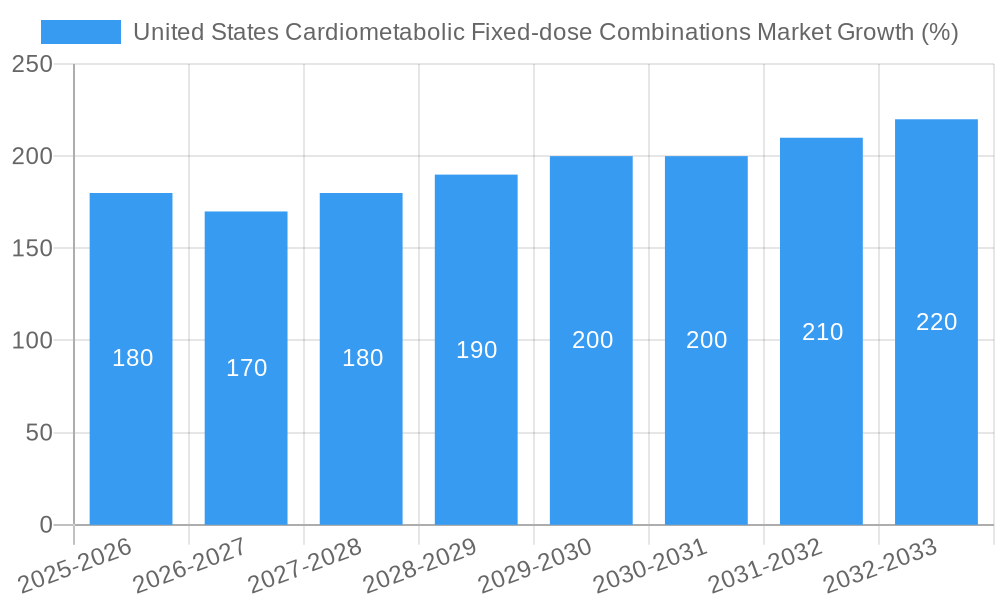

The United States cardiometabolic fixed-dose combinations market is a significant sector experiencing steady growth, projected to reach a value of $4.64 billion in 2025. A compound annual growth rate (CAGR) of 3.74% from 2019 to 2033 indicates a consistent upward trajectory, driven primarily by the increasing prevalence of chronic cardiometabolic diseases such as hypertension, diabetes, and dyslipidemia, particularly among the aging population. The rising adoption of combination therapies offering improved patient compliance and efficacy, coupled with the ongoing development of innovative drug formulations, further fuels market expansion. Key market players like Pfizer, Sanofi, and Novo Nordisk are continuously investing in research and development to enhance treatment options and capture a larger market share. While potential cost constraints and the emergence of biosimilars present some challenges, the overall market outlook remains positive due to the persistent need for effective and convenient management of cardiometabolic conditions.

The market segmentation, while not explicitly provided, likely incorporates variations in drug combinations (e.g., hypertension/diabetes, hypertension/dyslipidemia), dosage forms (tablets, capsules), and distribution channels (hospitals, pharmacies). Competitive rivalry is intense among major pharmaceutical companies, leading to continuous innovation and strategic partnerships to maintain a competitive edge. Future market growth will depend on factors such as advancements in combination therapies, successful clinical trials of newer drug candidates, pricing strategies, and evolving healthcare policies influencing drug accessibility and affordability within the United States. The increasing focus on preventative care and patient education programs is expected to further propel market expansion over the forecast period.

This comprehensive report provides a detailed analysis of the United States Cardiometabolic Fixed-dose Combinations market, offering invaluable insights for stakeholders across the pharmaceutical and healthcare industries. Covering the period from 2019 to 2033, with a focus on the 2025-2033 forecast period, this report leverages extensive market research to provide a clear understanding of market dynamics, competitive landscapes, and future growth potential.

United States Cardiometabolic Fixed-dose Combinations Market Market Structure & Competitive Landscape

The United States cardiometabolic fixed-dose combinations market exhibits a moderately concentrated structure, with a few major players holding significant market share. The Herfindahl-Hirschman Index (HHI) for 2024 is estimated at xx, indicating a moderately competitive landscape. Innovation is a key driver, fueled by the ongoing need for improved efficacy, safety, and patient compliance in managing cardiometabolic diseases. Stringent regulatory approvals from the FDA significantly impact market entry and product lifecycle management. Generic competition and the emergence of biosimilars exert pressure on pricing and profitability. The market is segmented by therapeutic area (e.g., diabetes, hypertension, dyslipidemia), dosage form, and route of administration. Mergers and acquisitions (M&A) activity has been relatively high in recent years, with xx major deals recorded between 2019 and 2024, primarily driven by strategic expansion and portfolio diversification.

- Market Concentration: HHI (2024): xx

- Innovation Drivers: Development of novel fixed-dose combinations with improved efficacy and reduced side effects.

- Regulatory Impacts: Stringent FDA approvals impact time-to-market and product lifecycles.

- Product Substitutes: Generic drugs and biosimilars exert competitive pressure.

- End-User Segmentation: Patients with diabetes, hypertension, dyslipidemia, and other cardiometabolic conditions.

- M&A Trends: xx major M&A deals between 2019 and 2024.

United States Cardiometabolic Fixed-dose Combinations Market Market Trends & Opportunities

The United States cardiometabolic fixed-dose combinations market is experiencing robust growth, driven by the rising prevalence of cardiometabolic diseases, an aging population, and increasing healthcare expenditure. The market size is projected to reach $xx Million by 2025, exhibiting a CAGR of xx% during the forecast period (2025-2033). Technological advancements, such as the development of personalized medicine and targeted therapies, are transforming the market landscape. Consumer preferences are shifting towards convenient, once-daily regimens and combination therapies offering improved adherence. Competitive dynamics are intense, with major pharmaceutical companies investing heavily in R&D and strategic collaborations to gain a competitive edge. Market penetration rates for novel fixed-dose combinations are expected to increase significantly due to the advantages they offer in terms of efficacy and convenience.

Dominant Markets & Segments in United States Cardiometabolic Fixed-dose Combinations Market

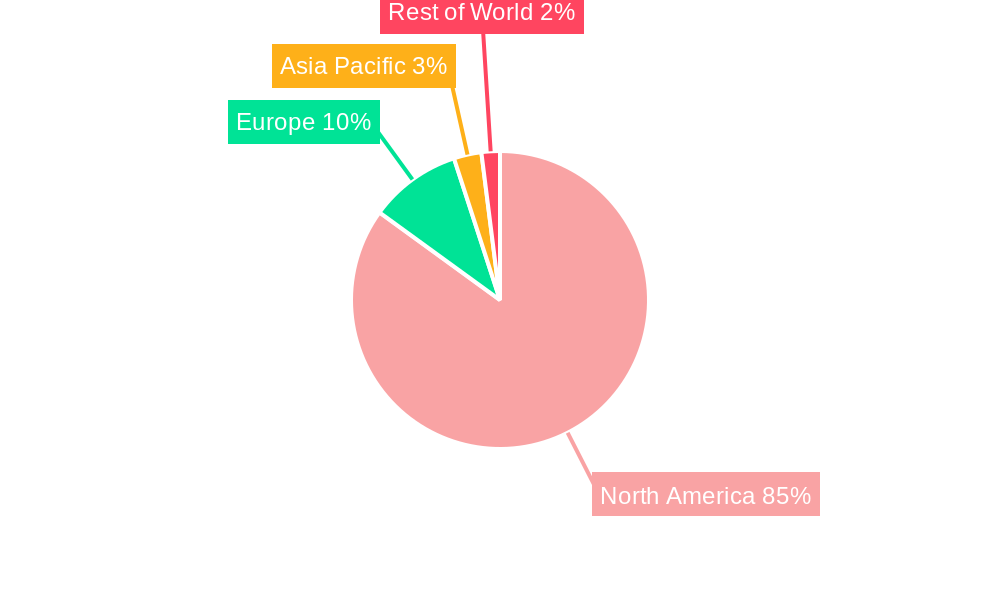

The dominant segments within the United States cardiometabolic fixed-dose combinations market are diabetes and hypertension therapies. These segments benefit from a large patient population and a significant unmet medical need. The Northeast and South regions of the U.S. exhibit higher market penetration due to factors such as higher prevalence rates of cardiometabolic diseases and greater healthcare infrastructure.

- Key Growth Drivers:

- High Prevalence of Cardiometabolic Diseases: Rising incidence of diabetes, hypertension, and dyslipidemia.

- Aging Population: The growing number of elderly individuals increases the demand for cardiometabolic therapies.

- Increased Healthcare Expenditure: Higher spending on healthcare fuels market growth.

- Technological Advancements: Innovation in drug delivery systems and combination therapies.

- Favorable Government Policies and Reimbursement: Government initiatives promoting prevention and management of cardiometabolic diseases.

United States Cardiometabolic Fixed-dose Combinations Market Product Analysis

Product innovation in this market focuses on developing fixed-dose combinations with improved efficacy, safety, and patient convenience. This includes once-daily formulations, novel drug delivery systems, and combinations targeting multiple cardiometabolic risk factors. These advancements aim to enhance patient compliance and improve clinical outcomes. The market shows a growing trend towards personalized medicine, tailoring treatment to individual patient characteristics. The success of these products depends on their efficacy, safety profile, and ease of use, influencing their market acceptance.

Key Drivers, Barriers & Challenges in United States Cardiometabolic Fixed-dose Combinations Market

Key Drivers: The rising prevalence of chronic diseases like diabetes and hypertension, coupled with technological advancements in drug delivery and combination therapies, are major drivers of market growth. Government initiatives and increased healthcare spending further contribute to the expansion.

Key Barriers & Challenges: Stringent regulatory approvals, potential side effects, and the high cost of drug development present significant challenges. Competition from generic drugs and biosimilars impacts profitability. Supply chain disruptions can cause shortages and delays, affecting market stability. Furthermore, ensuring patient adherence to complex treatment regimens remains a persistent hurdle. Quantifiable impact of these barriers are estimated to decrease market growth by xx% annually.

Growth Drivers in the United States Cardiometabolic Fixed-dose Combinations Market Market

The market is propelled by the escalating prevalence of cardiometabolic disorders, a burgeoning elderly population, and expanding healthcare spending. Technological breakthroughs in drug delivery and combination therapies, coupled with favorable government policies supporting disease management, further accelerate growth. The increasing focus on personalized medicine also drives innovation.

Challenges Impacting United States Cardiometabolic Fixed-dose Combinations Market Growth

Significant challenges include stringent regulatory procedures delaying product launches, the high cost of research and development, and the risk of adverse drug events. Furthermore, the intense competition from generic drugs and biosimilars creates pricing pressures, impacting market profitability. Disruptions in the supply chain can impede the market's steady expansion.

Key Players Shaping the United States Cardiometabolic Fixed-dose Combinations Market Market

- Pfizer Inc

- Sandoz AG

- Sanofi

- Merck & Co Inc

- Novo Nordisk A/S

- Boehringer Ingelheim International GmbH

- Azurity Pharmaceuticals Inc

- Rehab-Robotics Company Limited

- AstraZeneca

Significant United States Cardiometabolic Fixed-dose Combinations Market Industry Milestones

- September 2024: Eli Lilly and Company published positive topline results from the QWINT-1 and QWINT-3, phase 3 clinical trials evaluating once-weekly insulin efsitora alfa (efsitora) in adults with type 2 diabetes. This could lead to a significant shift in diabetes management.

- August 2024: NewAmsterdam Pharma initiated a Phase III trial for a fixed-dose combination of obicetrapib and ezetimibe, potentially expanding treatment options for dyslipidemia. Results are anticipated by October 2024.

- March 2024: Empros Pharma began dosing subjects in a Phase III trial for an obesity fixed-dose combination therapy, indicating progress in addressing this growing health concern.

Future Outlook for United States Cardiometabolic Fixed-dose Combinations Market Market

The future of the U.S. cardiometabolic fixed-dose combinations market is bright, driven by ongoing technological innovation, the persistent high prevalence of target diseases, and continued investment in R&D. Strategic partnerships and acquisitions will likely shape the competitive landscape. The market is poised for sustained growth, driven by the development of novel therapies, personalized medicine approaches, and improved patient access to effective treatments. Opportunities exist for companies focusing on innovative formulations, digital health integration, and addressing unmet needs within specific patient populations.

United States Cardiometabolic Fixed-dose Combinations Market Segmentation

-

1. Disease Type

- 1.1. Hypertension

- 1.2. Diabetes

- 1.3. Dyslipidemia

- 1.4. Others

-

2. Formulation Type

- 2.1. Oral Tablets and Capsules

- 2.2. Injectable Combinations

United States Cardiometabolic Fixed-dose Combinations Market Segmentation By Geography

- 1. United States

United States Cardiometabolic Fixed-dose Combinations Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.74% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Prevalence of Cardiometabolic Diseases Across the Country; Continuous Innovations in Drug Formulation and Delivery

- 3.3. Market Restrains

- 3.3.1. Increasing Prevalence of Cardiometabolic Diseases Across the Country; Continuous Innovations in Drug Formulation and Delivery

- 3.4. Market Trends

- 3.4.1. Hypertension is Expected to Hold a Significant Market Share Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Cardiometabolic Fixed-dose Combinations Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Disease Type

- 5.1.1. Hypertension

- 5.1.2. Diabetes

- 5.1.3. Dyslipidemia

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Formulation Type

- 5.2.1. Oral Tablets and Capsules

- 5.2.2. Injectable Combinations

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Disease Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Pfizer Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Sandoz AG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Sanofi

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Merck & Co Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Novo Nordisk A/S

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Boehringer Ingelheim International GmbH

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Azurity Pharmaceuticals Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Rehab-Robotics Company Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 AstraZeneca*List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Pfizer Inc

List of Figures

- Figure 1: United States Cardiometabolic Fixed-dose Combinations Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United States Cardiometabolic Fixed-dose Combinations Market Share (%) by Company 2024

List of Tables

- Table 1: United States Cardiometabolic Fixed-dose Combinations Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United States Cardiometabolic Fixed-dose Combinations Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: United States Cardiometabolic Fixed-dose Combinations Market Revenue Million Forecast, by Disease Type 2019 & 2032

- Table 4: United States Cardiometabolic Fixed-dose Combinations Market Volume Billion Forecast, by Disease Type 2019 & 2032

- Table 5: United States Cardiometabolic Fixed-dose Combinations Market Revenue Million Forecast, by Formulation Type 2019 & 2032

- Table 6: United States Cardiometabolic Fixed-dose Combinations Market Volume Billion Forecast, by Formulation Type 2019 & 2032

- Table 7: United States Cardiometabolic Fixed-dose Combinations Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: United States Cardiometabolic Fixed-dose Combinations Market Volume Billion Forecast, by Region 2019 & 2032

- Table 9: United States Cardiometabolic Fixed-dose Combinations Market Revenue Million Forecast, by Disease Type 2019 & 2032

- Table 10: United States Cardiometabolic Fixed-dose Combinations Market Volume Billion Forecast, by Disease Type 2019 & 2032

- Table 11: United States Cardiometabolic Fixed-dose Combinations Market Revenue Million Forecast, by Formulation Type 2019 & 2032

- Table 12: United States Cardiometabolic Fixed-dose Combinations Market Volume Billion Forecast, by Formulation Type 2019 & 2032

- Table 13: United States Cardiometabolic Fixed-dose Combinations Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: United States Cardiometabolic Fixed-dose Combinations Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Cardiometabolic Fixed-dose Combinations Market?

The projected CAGR is approximately 3.74%.

2. Which companies are prominent players in the United States Cardiometabolic Fixed-dose Combinations Market?

Key companies in the market include Pfizer Inc, Sandoz AG, Sanofi, Merck & Co Inc, Novo Nordisk A/S, Boehringer Ingelheim International GmbH, Azurity Pharmaceuticals Inc, Rehab-Robotics Company Limited, AstraZeneca*List Not Exhaustive.

3. What are the main segments of the United States Cardiometabolic Fixed-dose Combinations Market?

The market segments include Disease Type, Formulation Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.64 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Prevalence of Cardiometabolic Diseases Across the Country; Continuous Innovations in Drug Formulation and Delivery.

6. What are the notable trends driving market growth?

Hypertension is Expected to Hold a Significant Market Share Over the Forecast Period.

7. Are there any restraints impacting market growth?

Increasing Prevalence of Cardiometabolic Diseases Across the Country; Continuous Innovations in Drug Formulation and Delivery.

8. Can you provide examples of recent developments in the market?

September 2024: Eli Lilly and Company published positive topline results from the QWINT-1 and QWINT-3, phase 3 clinical trials, which evaluated once-weekly insulin efsitora alfa (efsitora) in adults with type 2 diabetes who were either insulin-naïve or had switched from daily basal insulin injections.August 2024: NewAmsterdam Pharma initiated a phase III randomized trial in the United States to evaluate the efficacy, safety, and tolerability of the fixed-dose combination of obicetrapib 10 mg and ezetimibe 10 mg as an adjunct to diet and maximally tolerated lipid-lowering therapy. The study started in August 2024, and the results are expected by October 2024.March 2024: Empros Pharma initiated the dosing of the first subjects in its obesity fixed-dose combination therapy during a Phase III trial b in the United States.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Cardiometabolic Fixed-dose Combinations Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Cardiometabolic Fixed-dose Combinations Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Cardiometabolic Fixed-dose Combinations Market?

To stay informed about further developments, trends, and reports in the United States Cardiometabolic Fixed-dose Combinations Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence