Key Insights

The Africa Facility Management (FM) market is experiencing robust growth, projected to reach \$27.21 million in 2025 and expand at a Compound Annual Growth Rate (CAGR) of 6.06% from 2025 to 2033. This expansion is driven by several key factors. Firstly, increasing urbanization and the development of sophisticated infrastructure across major African economies like South Africa, Egypt, and Nigeria are creating a substantial demand for professional facility management services. Secondly, a rising number of multinational corporations and large domestic enterprises are outsourcing their FM needs to focus on core competencies. This trend is particularly strong in the commercial and infrastructural sectors, while institutional and industrial segments are also showing promising growth. The adoption of integrated facility management (IFM) solutions, offering comprehensive services under a single contract, is further accelerating market expansion, as companies seek cost efficiencies and improved operational efficiency. Finally, a growing awareness of sustainability and corporate social responsibility is driving the demand for environmentally friendly FM practices.

However, certain constraints may impede market growth. These include a lack of skilled FM professionals in some regions, particularly outside of major urban centers. Furthermore, the relatively nascent stage of the FM sector in several African countries poses a challenge to widespread adoption of advanced technologies and best practices. Despite these restraints, the long-term outlook remains positive. The expanding middle class, increasing foreign direct investment, and ongoing infrastructure development initiatives are expected to propel continuous market growth throughout the forecast period. The market segmentation by facility type (single, bundled, integrated), end-user (commercial, infrastructural, etc.), and country (South Africa, Egypt, Nigeria, etc.) provides a detailed understanding of the market’s varied dynamics and growth opportunities within specific niches. This insight can be leveraged by both established players and new entrants to strategically position themselves for success in this dynamic and rapidly expanding market.

Africa Facility Management Market: A Comprehensive Report (2019-2033)

This dynamic report provides a deep dive into the burgeoning Africa Facility Management Market, offering invaluable insights for investors, industry professionals, and strategic decision-makers. Spanning the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033, this analysis leverages robust data and expert perspectives to illuminate current market dynamics and future growth trajectories. The report explores market segmentation by facility management type (Single, Bundled, Integrated), end-user (Commercial, Infrastructural, Institutional, Industrial, Other), and country (South Africa, Egypt, Nigeria, Rest of Africa), pinpointing key opportunities and challenges within this rapidly evolving landscape. The market is projected to reach xx Million by 2033, exhibiting a notable CAGR of xx%.

Africa Facility Management Market Market Structure & Competitive Landscape

The African facility management market exhibits a moderately concentrated structure, with several key players vying for market share. Benchmark Facilities Management, Integrico Private Limited, EFS Facilities Management Africa, G4S Africa, Bidvest Facilities Management, Apleona GmbH, Emdad Facility Management, Contrack Facilities Management S A E, and Broll Nigeria are among the prominent companies shaping the landscape. The market's competitive intensity is driven by factors including pricing pressures, service differentiation, and technological advancements.

- Market Concentration: The Herfindahl-Hirschman Index (HHI) for the market is estimated at xx, suggesting a moderately concentrated market.

- Innovation Drivers: Technological advancements in building management systems (BMS), IoT-enabled solutions, and sustainable practices are key innovation drivers.

- Regulatory Impacts: Government regulations concerning building codes, safety standards, and environmental sustainability influence market growth and operational practices.

- Product Substitutes: Limited direct substitutes exist; however, in-house facility management teams represent a potential competitive threat.

- End-User Segmentation: The Commercial sector dominates, followed by Infrastructural and Institutional segments.

- M&A Trends: The market has witnessed xx mergers and acquisitions in the past five years, indicating consolidation trends. The total value of these transactions is estimated at xx Million.

Africa Facility Management Market Market Trends & Opportunities

The African facility management market is characterized by robust growth, fueled by rapid urbanization, increasing infrastructure development, and rising awareness of the importance of efficient facility management practices. The market is projected to experience significant expansion, driven by several key factors:

- Market Size Growth: The market size is estimated at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a substantial CAGR.

- Technological Shifts: The adoption of smart building technologies, IoT sensors, and data analytics is transforming operational efficiency and service delivery. Market penetration of smart building technologies is currently at xx% and expected to reach xx% by 2033.

- Consumer Preferences: Growing emphasis on sustainability, enhanced security, and improved workplace environments shapes end-user demands.

- Competitive Dynamics: Intense competition necessitates continuous innovation and service differentiation to retain market share.

Dominant Markets & Segments in Africa Facility Management Market

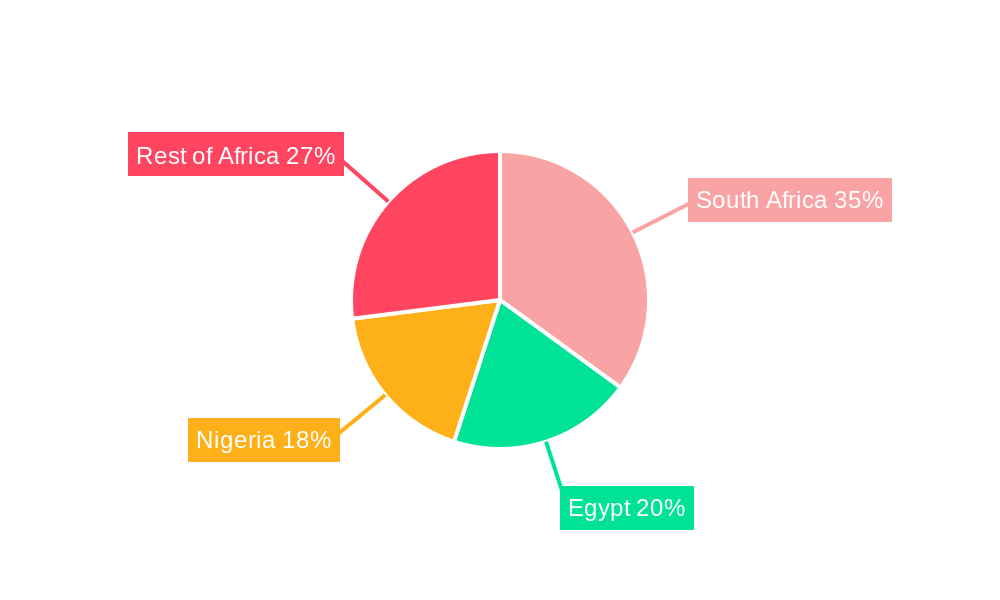

By Country: South Africa holds the largest market share, followed by Egypt and Nigeria. Strong economic growth, significant infrastructure investments, and a relatively mature market contribute to South Africa's dominance. Nigeria’s rapid urbanization and expanding industrial sector are driving its market growth.

By Type of Facility Management: Integrated Facility Management is gaining traction, driven by its comprehensive service offerings. The increasing demand for bundled services is also observed.

By End User: The Commercial sector represents the largest segment, followed by the Infrastructural sector, reflecting the significant investments in commercial real estate and infrastructure projects. Growth drivers in each segment include:

- Commercial: Expansion of retail spaces, office buildings, and hospitality facilities.

- Infrastructural: Government initiatives focused on infrastructure development, including transportation and energy projects.

- Institutional: Investment in educational facilities and healthcare infrastructure.

- Industrial: Growth in manufacturing and logistics sectors.

Africa Facility Management Market Product Analysis

Technological advancements are driving innovation in facility management services. Smart building technologies, including IoT-enabled sensors and building management systems (BMS), are enhancing operational efficiency, reducing energy consumption, and optimizing resource allocation. Cloud-based platforms and data analytics are improving decision-making, predictive maintenance, and service delivery. The integration of these technologies offers significant competitive advantages, attracting clients seeking optimized facilities and cost-effective solutions.

Key Drivers, Barriers & Challenges in Africa Facility Management Market

Key Drivers:

Rapid urbanization, rising disposable incomes, growing awareness of facility management benefits, and government investments in infrastructure are propelling market growth. The increasing adoption of sustainable building practices and technological advancements also contribute to market expansion.

Challenges:

- Regulatory Hurdles: Inconsistent regulations and bureaucratic processes across different regions impede market development. xx% of companies face significant delays due to regulatory complexities.

- Supply Chain Issues: Inadequate infrastructure and logistics challenges can disrupt the supply chain, impacting project timelines and costs. xx% of projects experienced delays due to supply chain disruptions.

- Competitive Pressures: Intense competition among established and emerging players necessitates continuous innovation and cost optimization to maintain profitability.

Growth Drivers in the Africa Facility Management Market Market

The market's growth is driven by factors such as rapid urbanization leading to increased demand for commercial and residential spaces, government investments in infrastructure development, and the growing adoption of sustainable practices in building management. The increasing penetration of technology, including IoT and AI, also fuels market growth by improving operational efficiency and cost-effectiveness.

Challenges Impacting Africa Facility Management Market Growth

Significant challenges include infrastructural limitations affecting service delivery, skilled labor shortages hindering operational efficiency, and inconsistent regulatory frameworks across countries creating uncertainties for businesses. Furthermore, economic volatility and currency fluctuations impact investment decisions and project feasibility.

Key Players Shaping the Africa Facility Management Market Market

- Benchmark Facilities Management

- Integrico Private Limited

- EFS Facilities Management Africa

- G4S Africa

- Bidvest Facilities Management

- Apleona GmbH

- Emdad Facility Management

- Contrack Facilities Management S A E

- Broll Nigeria

Significant Africa Facility Management Market Industry Milestones

- September 2022: Launch of the Boardwalk Mall in Port Elizabeth, South Africa, a USD 36.2 Million investment boosting economic activity and creating opportunities for facility management services.

- September 2022: IntegriCo's innovative use of recycled plastics in creating railroad ties showcases sustainable practices impacting the market's focus on eco-friendly solutions.

Future Outlook for Africa Facility Management Market Market

The African facility management market presents significant opportunities for growth. Continued urbanization, infrastructure development, and technological advancements will drive market expansion. Strategic partnerships, investments in technology, and expansion into underserved markets represent key strategies for success in this dynamic sector. The market is poised for sustained growth, presenting attractive investment opportunities and a promising future for both established and emerging players.

Africa Facility Management Market Segmentation

-

1. Type of Facility Management

- 1.1. Single Facility Management

- 1.2. Bundled Facility Management

- 1.3. Integrated Facility Management

-

2. End User

- 2.1. Commercial

- 2.2. Infrastructural

- 2.3. Institutional

- 2.4. Industrial

- 2.5. Other End-users

Africa Facility Management Market Segmentation By Geography

-

1. Africa

- 1.1. Nigeria

- 1.2. South Africa

- 1.3. Egypt

- 1.4. Kenya

- 1.5. Ethiopia

- 1.6. Morocco

- 1.7. Ghana

- 1.8. Algeria

- 1.9. Tanzania

- 1.10. Ivory Coast

Africa Facility Management Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.06% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing demand for outsourced FM in Africa; Infrastructural development in the region continue to open up new opportunities for FM vendors; Investments in the Private sector to drive growth

- 3.3. Market Restrains

- 3.3.1. High license Fees and time taking procedure; Strict regulations regarding gateways and landing stations

- 3.4. Market Trends

- 3.4.1. Infrastructural Development Continue to Open Up new Opportunities for FM Vendors

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa Facility Management Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type of Facility Management

- 5.1.1. Single Facility Management

- 5.1.2. Bundled Facility Management

- 5.1.3. Integrated Facility Management

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Commercial

- 5.2.2. Infrastructural

- 5.2.3. Institutional

- 5.2.4. Industrial

- 5.2.5. Other End-users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Africa

- 5.1. Market Analysis, Insights and Forecast - by Type of Facility Management

- 6. South Africa Africa Facility Management Market Analysis, Insights and Forecast, 2019-2031

- 7. Sudan Africa Facility Management Market Analysis, Insights and Forecast, 2019-2031

- 8. Uganda Africa Facility Management Market Analysis, Insights and Forecast, 2019-2031

- 9. Tanzania Africa Facility Management Market Analysis, Insights and Forecast, 2019-2031

- 10. Kenya Africa Facility Management Market Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Africa Africa Facility Management Market Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Benchmark Facilities Management

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Integrico Private Limited

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 EFS Facilities Management Africa

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 G4S Africa

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Bidvest Facilities Management

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Apleona GmbH

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Emdad Facility Management

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Contrack Facilities Management S A E

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Broll Nigeria

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.1 Benchmark Facilities Management

List of Figures

- Figure 1: Africa Facility Management Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Africa Facility Management Market Share (%) by Company 2024

List of Tables

- Table 1: Africa Facility Management Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Africa Facility Management Market Revenue Million Forecast, by Type of Facility Management 2019 & 2032

- Table 3: Africa Facility Management Market Revenue Million Forecast, by End User 2019 & 2032

- Table 4: Africa Facility Management Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Africa Facility Management Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: South Africa Africa Facility Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Sudan Africa Facility Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Uganda Africa Facility Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Tanzania Africa Facility Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Kenya Africa Facility Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of Africa Africa Facility Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Africa Facility Management Market Revenue Million Forecast, by Type of Facility Management 2019 & 2032

- Table 13: Africa Facility Management Market Revenue Million Forecast, by End User 2019 & 2032

- Table 14: Africa Facility Management Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Nigeria Africa Facility Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: South Africa Africa Facility Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Egypt Africa Facility Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Kenya Africa Facility Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Ethiopia Africa Facility Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Morocco Africa Facility Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Ghana Africa Facility Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Algeria Africa Facility Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Tanzania Africa Facility Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Ivory Coast Africa Facility Management Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa Facility Management Market?

The projected CAGR is approximately 6.06%.

2. Which companies are prominent players in the Africa Facility Management Market?

Key companies in the market include Benchmark Facilities Management, Integrico Private Limited, EFS Facilities Management Africa, G4S Africa, Bidvest Facilities Management, Apleona GmbH, Emdad Facility Management, Contrack Facilities Management S A E, Broll Nigeria.

3. What are the main segments of the Africa Facility Management Market?

The market segments include Type of Facility Management, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 27.21 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing demand for outsourced FM in Africa; Infrastructural development in the region continue to open up new opportunities for FM vendors; Investments in the Private sector to drive growth.

6. What are the notable trends driving market growth?

Infrastructural Development Continue to Open Up new Opportunities for FM Vendors .

7. Are there any restraints impacting market growth?

High license Fees and time taking procedure; Strict regulations regarding gateways and landing stations.

8. Can you provide examples of recent developments in the market?

September 2022: A brand-new shopping center called the Boardwalk Mall is being built within the Boardwalk district of Port Elizabeth, South Africa. A total of USD 36.2 million is being invested in the development of the new shopping center over two phases. Such advances are strengthening the nation's economy and are critical in creating growth prospects for facility management services.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa Facility Management Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa Facility Management Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa Facility Management Market?

To stay informed about further developments, trends, and reports in the Africa Facility Management Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence