Key Insights

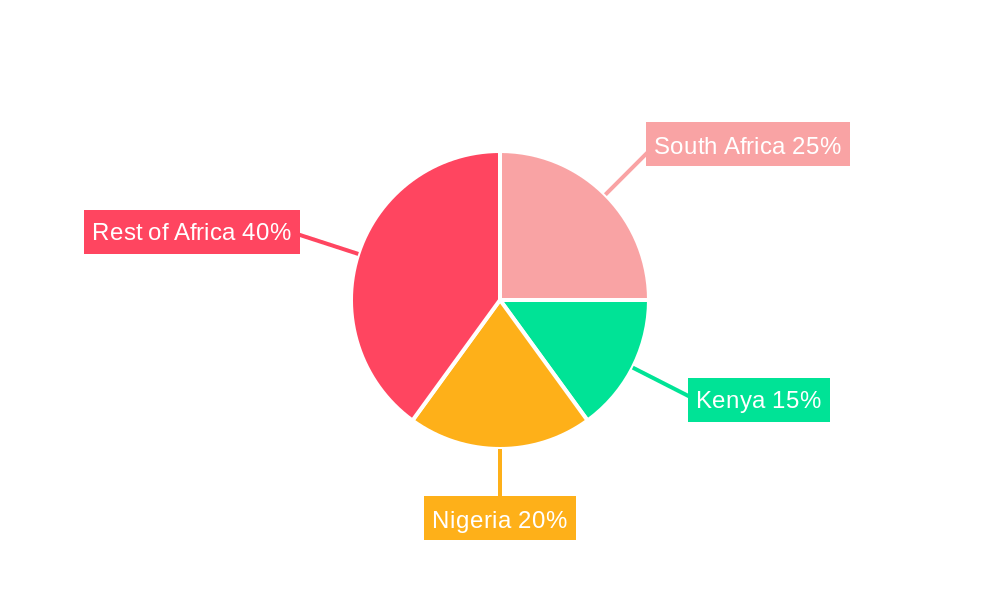

The Africa portable generator market, valued at approximately $XX million in 2025, is projected to experience robust growth, driven by increasing electricity demand, particularly in underserved rural areas and for backup power in urban centers. A compound annual growth rate (CAGR) of 5.70% is anticipated from 2025 to 2033, indicating a significant market expansion. Key drivers include rising industrialization across several African nations, expanding infrastructure projects necessitating reliable power solutions, and the growing adoption of portable generators in residential settings due to frequent power outages. The market segmentation reveals a strong demand across various capacities (below 5 kW, 5-10 kW, above 10 kW), with the below 5kW segment likely dominating due to affordability and suitability for household needs. End-user segments show substantial contributions from residential, commercial, and industrial applications, reflecting the widespread need for portable power across different sectors. Diesel generators currently hold a significant market share in the fuel type segment, but growing environmental concerns and the availability of alternative fuel types (gas, and other fuels) are expected to gradually shift the landscape. Major players like AKSA, Kohler, Atlas Copco, Cummins, Denyo, Wärtsilä, Kirloskar, Caterpillar, and Mitsubishi Heavy Industries are competing in this dynamic market. The regional breakdown highlights significant growth potential in countries like South Africa, Kenya, and Nigeria, reflecting their developing economies and expanding infrastructure. However, challenges such as high initial investment costs and limited access to financing in certain regions may act as market restraints.

The forecast period (2025-2033) presents considerable opportunities for portable generator manufacturers and distributors. Strategic investments in expanding distribution networks, offering financing options, and focusing on environmentally friendly fuel types will be crucial for capturing market share. Furthermore, adapting products to specific local needs and regulations within different African countries will be vital for success. The increasing adoption of renewable energy sources could potentially impact long-term growth, but the immediate demand for reliable backup power ensures a sustained market for portable generators in the foreseeable future. The competitive landscape requires companies to emphasize product innovation, quality, and after-sales service to maintain a leading position within the market.

Africa Portable Generator Market: A Comprehensive Report (2019-2033)

This dynamic report provides a comprehensive analysis of the Africa Portable Generator Market, offering invaluable insights for industry stakeholders, investors, and strategists. Leveraging extensive research and data analysis across the historical period (2019-2024), base year (2025), and forecast period (2025-2033), this report unveils the market's current state and future trajectory. With a market value projected to reach xx Million by 2033, the report identifies key growth drivers, challenges, and opportunities within this rapidly evolving sector.

Africa Portable Generator Market Market Structure & Competitive Landscape

The African portable generator market exhibits a moderately concentrated structure, with key players such as AKSA power generation, Kohler Co, Atlas Copco AB, Cummins Inc, Denyo Co Ltd, Wartsila, Kirloskar Oil Engines Ltd, Caterpillar, and Mitsubishi Heavy Industries Ltd holding significant market share. However, the market also accommodates a diverse range of smaller, regional players. Innovation is a primary driver, with companies continually enhancing generator efficiency, fuel flexibility, and technological integration (IoT capabilities). Regulatory frameworks related to emissions and safety standards significantly influence market dynamics. Product substitution is a factor, primarily from renewable energy sources, though the reliance on portable generators in many areas remains high. The end-user segmentation is diverse, encompassing residential, commercial, and industrial sectors, with varying needs and preferences shaping product demand. While precise M&A volume data is unavailable, we observe a moderate level of mergers and acquisitions activity among smaller players seeking expansion and increased market share. Concentration ratios (xx%) reflect the current market structure, with potential for moderate shifts as the market evolves.

Africa Portable Generator Market Market Trends & Opportunities

The Africa Portable Generator Market is experiencing robust growth, driven by factors including increasing urbanization, expanding industrial activity, and unreliable power grids across many regions. The market size is projected to demonstrate a CAGR of xx% during the forecast period (2025-2033), reaching a projected value of xx Million by 2033. Technological advancements, particularly in fuel efficiency and IoT integration, are reshaping the market landscape. Consumers are increasingly prioritizing fuel-efficient models, quiet operation, and robust performance, driving demand for advanced generators. Competitive dynamics are characterized by intense rivalry focused on price competitiveness, technological innovation, and after-sales service. Market penetration rates are highest in regions with limited grid infrastructure, while growth opportunities exist in rapidly developing urban areas and industrial centers.

Dominant Markets & Segments in Africa Portable Generator Market

The African portable generator market shows diverse regional variations. Nigeria and South Africa currently represent leading markets, driven by higher populations, substantial industrial activity, and a persistent need for backup power solutions.

- By Capacity: The 5-10 kW segment holds the largest market share, catering to a wide range of residential and small commercial needs. The Above 10 kW segment is experiencing accelerated growth due to increased industrial demand. The Below 5 kW segment is still vital for households and smaller businesses.

- By End User: The commercial and industrial sectors show highest growth due to the increasing need for reliable power in businesses and factories. The residential sector remains a significant contributor due to inconsistent power supply.

- By Fuel Type: Diesel generators dominate the market due to their reliability and power output; however, the growing availability of natural gas is fueling a shift towards gas-powered generators.

Key growth drivers include:

- Inadequate Power Infrastructure: The primary catalyst for growth is the pervasive lack of consistent electricity supply across much of Africa.

- Economic Growth and Industrialization: Expanding economies and industrial sectors increase the demand for reliable power sources.

- Government Initiatives: Investment in infrastructure and supportive policies encourage greater adoption.

Africa Portable Generator Market Product Analysis

Portable generator technology in Africa is undergoing a significant transformation. Innovations focus on improving fuel efficiency, reducing emissions, and incorporating smart features such as remote monitoring and diagnostics via IoT connectivity. Competitive advantages are derived from superior fuel efficiency, quieter operation, durability, and readily available after-sales support. The market is shifting towards generators that offer enhanced reliability and user-friendliness, addressing critical consumer needs in diverse operating conditions.

Key Drivers, Barriers & Challenges in Africa Portable Generator Market

Key Drivers:

- Rapid urbanization and industrialization fueling demand.

- Growing adoption of IoT-enabled generators with smart features.

- Government initiatives supporting infrastructure development.

Key Challenges:

- High initial investment costs can hinder adoption among low-income households.

- Fluctuating fuel prices create uncertainty and operational expense.

- Supply chain complexities and logistics challenges impact product availability and cost. These challenges translate to an estimated xx% reduction in market growth potential.

Growth Drivers in the Africa Portable Generator Market Market

The key growth drivers include increasing urbanization, industrial expansion, inadequate electricity infrastructure, rising consumer disposable incomes, and supportive government policies promoting power generation investment. These factors collectively drive sustained market expansion.

Challenges Impacting Africa Portable Generator Market Growth

Challenges include high initial costs, fluctuating fuel prices, limited access to financing, and distribution complexities in remote areas, resulting in reduced market penetration in certain segments. Regulatory hurdles concerning emission standards also present a barrier to growth.

Key Players Shaping the Africa Portable Generator Market Market

- AKSA power generation

- Kohler Co

- Atlas Copco AB

- Cummins Inc

- Denyo Co Ltd

- Wartsila

- Kirloskar Oil Engines Ltd

- Caterpillar

- Mitsubishi Heavy Industries Ltd

- List Not Exhaustive

Significant Africa Portable Generator Market Industry Milestones

- August 2022: Kirloskar Oil Engines launched a new line of IoT-enabled gas generators, signifying a shift towards cleaner and more technologically advanced power solutions. This launch has broadened the market appeal and further driven adoption.

Future Outlook for Africa Portable Generator Market Market

The Africa portable generator market is poised for continued growth, driven by ongoing infrastructure development, expanding industrialization, and increasing urbanization. Opportunities exist in developing innovative, fuel-efficient generators, expanding distribution networks, and partnering with local governments to address energy access challenges. The market's future is promising, with substantial potential for expansion across various segments and geographical regions.

Africa Portable Generator Market Segmentation

-

1. Capacity

- 1.1. Below 5 kW

- 1.2. 5-10 kW

- 1.3. Above 10 kW

-

2. End User

- 2.1. Residential

- 2.2. Commercial

- 2.3. Industrial

-

3. Fuel Type

- 3.1. Gas

- 3.2. Diesel

- 3.3. Other Fuel Types

-

4. Geography

- 4.1. Nigeria

- 4.2. South Africa

- 4.3. Algeria

- 4.4. Kenya

- 4.5. Rest of Africa

Africa Portable Generator Market Segmentation By Geography

- 1. Nigeria

- 2. South Africa

- 3. Algeria

- 4. Kenya

- 5. Rest of Africa

Africa Portable Generator Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.70% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Supply and Consumption of Gas-based Systems in Various End-user Industry4.; Implementation of stricter emission regulations worldwide

- 3.3. Market Restrains

- 3.3.1. 4.; Growing Inclination towards Renewable Sources

- 3.4. Market Trends

- 3.4.1. Diesel Segment to have a Significant Share in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa Portable Generator Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Capacity

- 5.1.1. Below 5 kW

- 5.1.2. 5-10 kW

- 5.1.3. Above 10 kW

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.2.3. Industrial

- 5.3. Market Analysis, Insights and Forecast - by Fuel Type

- 5.3.1. Gas

- 5.3.2. Diesel

- 5.3.3. Other Fuel Types

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. Nigeria

- 5.4.2. South Africa

- 5.4.3. Algeria

- 5.4.4. Kenya

- 5.4.5. Rest of Africa

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Nigeria

- 5.5.2. South Africa

- 5.5.3. Algeria

- 5.5.4. Kenya

- 5.5.5. Rest of Africa

- 5.1. Market Analysis, Insights and Forecast - by Capacity

- 6. Nigeria Africa Portable Generator Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Capacity

- 6.1.1. Below 5 kW

- 6.1.2. 5-10 kW

- 6.1.3. Above 10 kW

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Residential

- 6.2.2. Commercial

- 6.2.3. Industrial

- 6.3. Market Analysis, Insights and Forecast - by Fuel Type

- 6.3.1. Gas

- 6.3.2. Diesel

- 6.3.3. Other Fuel Types

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. Nigeria

- 6.4.2. South Africa

- 6.4.3. Algeria

- 6.4.4. Kenya

- 6.4.5. Rest of Africa

- 6.1. Market Analysis, Insights and Forecast - by Capacity

- 7. South Africa Africa Portable Generator Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Capacity

- 7.1.1. Below 5 kW

- 7.1.2. 5-10 kW

- 7.1.3. Above 10 kW

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Residential

- 7.2.2. Commercial

- 7.2.3. Industrial

- 7.3. Market Analysis, Insights and Forecast - by Fuel Type

- 7.3.1. Gas

- 7.3.2. Diesel

- 7.3.3. Other Fuel Types

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. Nigeria

- 7.4.2. South Africa

- 7.4.3. Algeria

- 7.4.4. Kenya

- 7.4.5. Rest of Africa

- 7.1. Market Analysis, Insights and Forecast - by Capacity

- 8. Algeria Africa Portable Generator Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Capacity

- 8.1.1. Below 5 kW

- 8.1.2. 5-10 kW

- 8.1.3. Above 10 kW

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Residential

- 8.2.2. Commercial

- 8.2.3. Industrial

- 8.3. Market Analysis, Insights and Forecast - by Fuel Type

- 8.3.1. Gas

- 8.3.2. Diesel

- 8.3.3. Other Fuel Types

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. Nigeria

- 8.4.2. South Africa

- 8.4.3. Algeria

- 8.4.4. Kenya

- 8.4.5. Rest of Africa

- 8.1. Market Analysis, Insights and Forecast - by Capacity

- 9. Kenya Africa Portable Generator Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Capacity

- 9.1.1. Below 5 kW

- 9.1.2. 5-10 kW

- 9.1.3. Above 10 kW

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Residential

- 9.2.2. Commercial

- 9.2.3. Industrial

- 9.3. Market Analysis, Insights and Forecast - by Fuel Type

- 9.3.1. Gas

- 9.3.2. Diesel

- 9.3.3. Other Fuel Types

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. Nigeria

- 9.4.2. South Africa

- 9.4.3. Algeria

- 9.4.4. Kenya

- 9.4.5. Rest of Africa

- 9.1. Market Analysis, Insights and Forecast - by Capacity

- 10. Rest of Africa Africa Portable Generator Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Capacity

- 10.1.1. Below 5 kW

- 10.1.2. 5-10 kW

- 10.1.3. Above 10 kW

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Residential

- 10.2.2. Commercial

- 10.2.3. Industrial

- 10.3. Market Analysis, Insights and Forecast - by Fuel Type

- 10.3.1. Gas

- 10.3.2. Diesel

- 10.3.3. Other Fuel Types

- 10.4. Market Analysis, Insights and Forecast - by Geography

- 10.4.1. Nigeria

- 10.4.2. South Africa

- 10.4.3. Algeria

- 10.4.4. Kenya

- 10.4.5. Rest of Africa

- 10.1. Market Analysis, Insights and Forecast - by Capacity

- 11. South Africa Africa Portable Generator Market Analysis, Insights and Forecast, 2019-2031

- 12. Sudan Africa Portable Generator Market Analysis, Insights and Forecast, 2019-2031

- 13. Uganda Africa Portable Generator Market Analysis, Insights and Forecast, 2019-2031

- 14. Tanzania Africa Portable Generator Market Analysis, Insights and Forecast, 2019-2031

- 15. Kenya Africa Portable Generator Market Analysis, Insights and Forecast, 2019-2031

- 16. Rest of Africa Africa Portable Generator Market Analysis, Insights and Forecast, 2019-2031

- 17. Competitive Analysis

- 17.1. Market Share Analysis 2024

- 17.2. Company Profiles

- 17.2.1 AKSA power generation

- 17.2.1.1. Overview

- 17.2.1.2. Products

- 17.2.1.3. SWOT Analysis

- 17.2.1.4. Recent Developments

- 17.2.1.5. Financials (Based on Availability)

- 17.2.2 Kohler Co

- 17.2.2.1. Overview

- 17.2.2.2. Products

- 17.2.2.3. SWOT Analysis

- 17.2.2.4. Recent Developments

- 17.2.2.5. Financials (Based on Availability)

- 17.2.3 Atlas Copco AB

- 17.2.3.1. Overview

- 17.2.3.2. Products

- 17.2.3.3. SWOT Analysis

- 17.2.3.4. Recent Developments

- 17.2.3.5. Financials (Based on Availability)

- 17.2.4 Cummins Inc

- 17.2.4.1. Overview

- 17.2.4.2. Products

- 17.2.4.3. SWOT Analysis

- 17.2.4.4. Recent Developments

- 17.2.4.5. Financials (Based on Availability)

- 17.2.5 Denyo Co Ltd

- 17.2.5.1. Overview

- 17.2.5.2. Products

- 17.2.5.3. SWOT Analysis

- 17.2.5.4. Recent Developments

- 17.2.5.5. Financials (Based on Availability)

- 17.2.6 Wartsila

- 17.2.6.1. Overview

- 17.2.6.2. Products

- 17.2.6.3. SWOT Analysis

- 17.2.6.4. Recent Developments

- 17.2.6.5. Financials (Based on Availability)

- 17.2.7 Kirloskar Oil Engines Ltd

- 17.2.7.1. Overview

- 17.2.7.2. Products

- 17.2.7.3. SWOT Analysis

- 17.2.7.4. Recent Developments

- 17.2.7.5. Financials (Based on Availability)

- 17.2.8 Caterpillar

- 17.2.8.1. Overview

- 17.2.8.2. Products

- 17.2.8.3. SWOT Analysis

- 17.2.8.4. Recent Developments

- 17.2.8.5. Financials (Based on Availability)

- 17.2.9 Mitsubishi Heavy Industries Ltd *List Not Exhaustive

- 17.2.9.1. Overview

- 17.2.9.2. Products

- 17.2.9.3. SWOT Analysis

- 17.2.9.4. Recent Developments

- 17.2.9.5. Financials (Based on Availability)

- 17.2.1 AKSA power generation

List of Figures

- Figure 1: Africa Portable Generator Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Africa Portable Generator Market Share (%) by Company 2024

List of Tables

- Table 1: Africa Portable Generator Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Africa Portable Generator Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Africa Portable Generator Market Revenue Million Forecast, by Capacity 2019 & 2032

- Table 4: Africa Portable Generator Market Volume K Unit Forecast, by Capacity 2019 & 2032

- Table 5: Africa Portable Generator Market Revenue Million Forecast, by End User 2019 & 2032

- Table 6: Africa Portable Generator Market Volume K Unit Forecast, by End User 2019 & 2032

- Table 7: Africa Portable Generator Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 8: Africa Portable Generator Market Volume K Unit Forecast, by Fuel Type 2019 & 2032

- Table 9: Africa Portable Generator Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 10: Africa Portable Generator Market Volume K Unit Forecast, by Geography 2019 & 2032

- Table 11: Africa Portable Generator Market Revenue Million Forecast, by Region 2019 & 2032

- Table 12: Africa Portable Generator Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 13: Africa Portable Generator Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Africa Portable Generator Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 15: South Africa Africa Portable Generator Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: South Africa Africa Portable Generator Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: Sudan Africa Portable Generator Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Sudan Africa Portable Generator Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 19: Uganda Africa Portable Generator Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Uganda Africa Portable Generator Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 21: Tanzania Africa Portable Generator Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Tanzania Africa Portable Generator Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 23: Kenya Africa Portable Generator Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Kenya Africa Portable Generator Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 25: Rest of Africa Africa Portable Generator Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Rest of Africa Africa Portable Generator Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 27: Africa Portable Generator Market Revenue Million Forecast, by Capacity 2019 & 2032

- Table 28: Africa Portable Generator Market Volume K Unit Forecast, by Capacity 2019 & 2032

- Table 29: Africa Portable Generator Market Revenue Million Forecast, by End User 2019 & 2032

- Table 30: Africa Portable Generator Market Volume K Unit Forecast, by End User 2019 & 2032

- Table 31: Africa Portable Generator Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 32: Africa Portable Generator Market Volume K Unit Forecast, by Fuel Type 2019 & 2032

- Table 33: Africa Portable Generator Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 34: Africa Portable Generator Market Volume K Unit Forecast, by Geography 2019 & 2032

- Table 35: Africa Portable Generator Market Revenue Million Forecast, by Country 2019 & 2032

- Table 36: Africa Portable Generator Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 37: Africa Portable Generator Market Revenue Million Forecast, by Capacity 2019 & 2032

- Table 38: Africa Portable Generator Market Volume K Unit Forecast, by Capacity 2019 & 2032

- Table 39: Africa Portable Generator Market Revenue Million Forecast, by End User 2019 & 2032

- Table 40: Africa Portable Generator Market Volume K Unit Forecast, by End User 2019 & 2032

- Table 41: Africa Portable Generator Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 42: Africa Portable Generator Market Volume K Unit Forecast, by Fuel Type 2019 & 2032

- Table 43: Africa Portable Generator Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 44: Africa Portable Generator Market Volume K Unit Forecast, by Geography 2019 & 2032

- Table 45: Africa Portable Generator Market Revenue Million Forecast, by Country 2019 & 2032

- Table 46: Africa Portable Generator Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 47: Africa Portable Generator Market Revenue Million Forecast, by Capacity 2019 & 2032

- Table 48: Africa Portable Generator Market Volume K Unit Forecast, by Capacity 2019 & 2032

- Table 49: Africa Portable Generator Market Revenue Million Forecast, by End User 2019 & 2032

- Table 50: Africa Portable Generator Market Volume K Unit Forecast, by End User 2019 & 2032

- Table 51: Africa Portable Generator Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 52: Africa Portable Generator Market Volume K Unit Forecast, by Fuel Type 2019 & 2032

- Table 53: Africa Portable Generator Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 54: Africa Portable Generator Market Volume K Unit Forecast, by Geography 2019 & 2032

- Table 55: Africa Portable Generator Market Revenue Million Forecast, by Country 2019 & 2032

- Table 56: Africa Portable Generator Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 57: Africa Portable Generator Market Revenue Million Forecast, by Capacity 2019 & 2032

- Table 58: Africa Portable Generator Market Volume K Unit Forecast, by Capacity 2019 & 2032

- Table 59: Africa Portable Generator Market Revenue Million Forecast, by End User 2019 & 2032

- Table 60: Africa Portable Generator Market Volume K Unit Forecast, by End User 2019 & 2032

- Table 61: Africa Portable Generator Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 62: Africa Portable Generator Market Volume K Unit Forecast, by Fuel Type 2019 & 2032

- Table 63: Africa Portable Generator Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 64: Africa Portable Generator Market Volume K Unit Forecast, by Geography 2019 & 2032

- Table 65: Africa Portable Generator Market Revenue Million Forecast, by Country 2019 & 2032

- Table 66: Africa Portable Generator Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 67: Africa Portable Generator Market Revenue Million Forecast, by Capacity 2019 & 2032

- Table 68: Africa Portable Generator Market Volume K Unit Forecast, by Capacity 2019 & 2032

- Table 69: Africa Portable Generator Market Revenue Million Forecast, by End User 2019 & 2032

- Table 70: Africa Portable Generator Market Volume K Unit Forecast, by End User 2019 & 2032

- Table 71: Africa Portable Generator Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 72: Africa Portable Generator Market Volume K Unit Forecast, by Fuel Type 2019 & 2032

- Table 73: Africa Portable Generator Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 74: Africa Portable Generator Market Volume K Unit Forecast, by Geography 2019 & 2032

- Table 75: Africa Portable Generator Market Revenue Million Forecast, by Country 2019 & 2032

- Table 76: Africa Portable Generator Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa Portable Generator Market?

The projected CAGR is approximately 5.70%.

2. Which companies are prominent players in the Africa Portable Generator Market?

Key companies in the market include AKSA power generation, Kohler Co, Atlas Copco AB, Cummins Inc, Denyo Co Ltd, Wartsila, Kirloskar Oil Engines Ltd, Caterpillar, Mitsubishi Heavy Industries Ltd *List Not Exhaustive.

3. What are the main segments of the Africa Portable Generator Market?

The market segments include Capacity, End User, Fuel Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Supply and Consumption of Gas-based Systems in Various End-user Industry4.; Implementation of stricter emission regulations worldwide.

6. What are the notable trends driving market growth?

Diesel Segment to have a Significant Share in the Market.

7. Are there any restraints impacting market growth?

4.; Growing Inclination towards Renewable Sources.

8. Can you provide examples of recent developments in the market?

In August 2022, Kirloskar Oil Engines launched a new product i.e Gas Power Generation. These backup power solutions providers create alternative fuel-based Genset options. These IoT-enabled gas generators on PNG not only function effectively even in subzero temperatures, but they also come with a digital monitoring system that enables users to remotely check the generator's performance and key metrics in real time from virtually anywhere. Additionally, compared to a conventional generating set, the emission and noise levels are significantly lower.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa Portable Generator Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa Portable Generator Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa Portable Generator Market?

To stay informed about further developments, trends, and reports in the Africa Portable Generator Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence