Key Insights

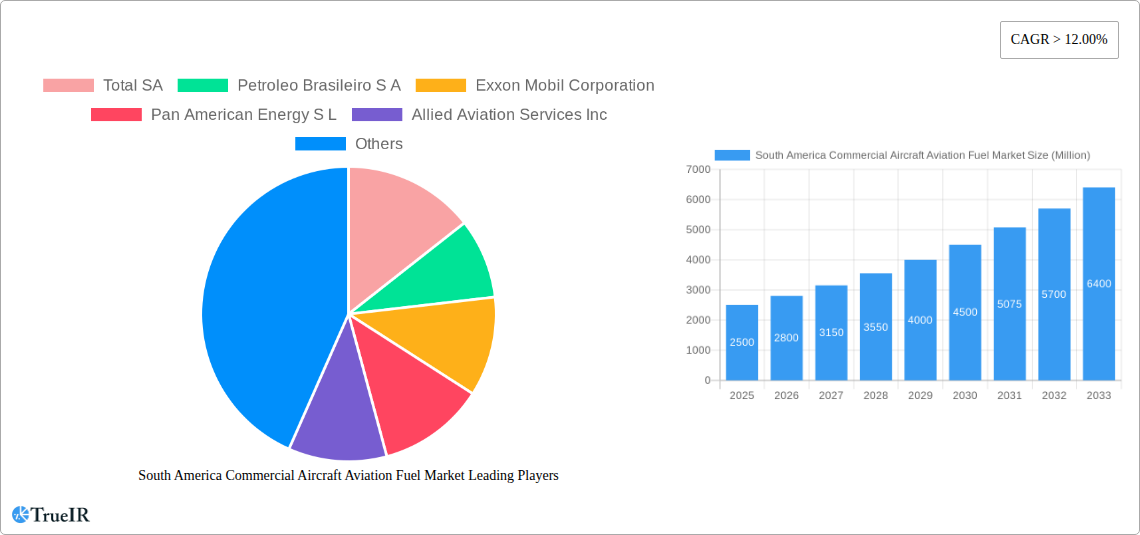

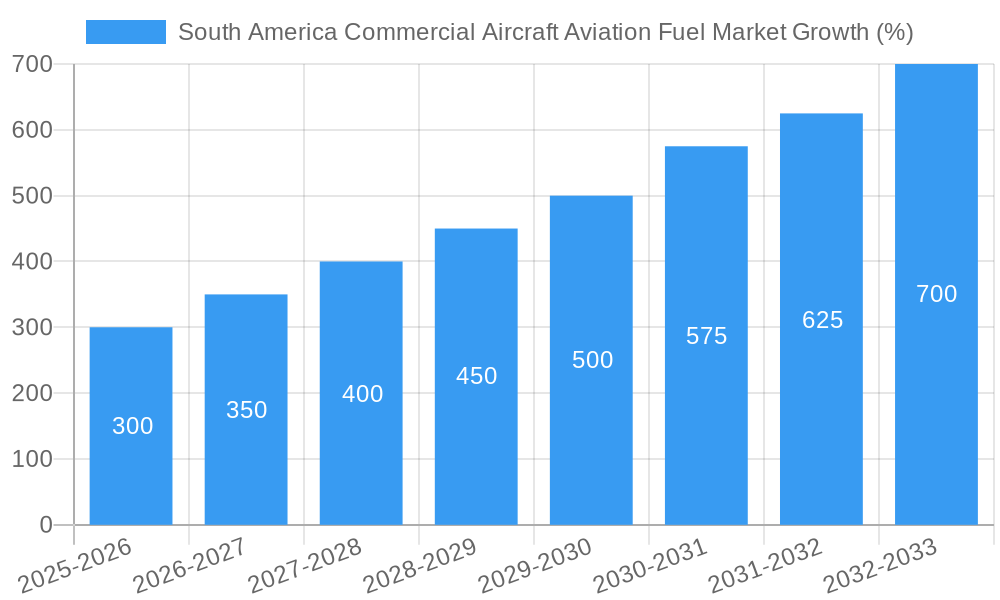

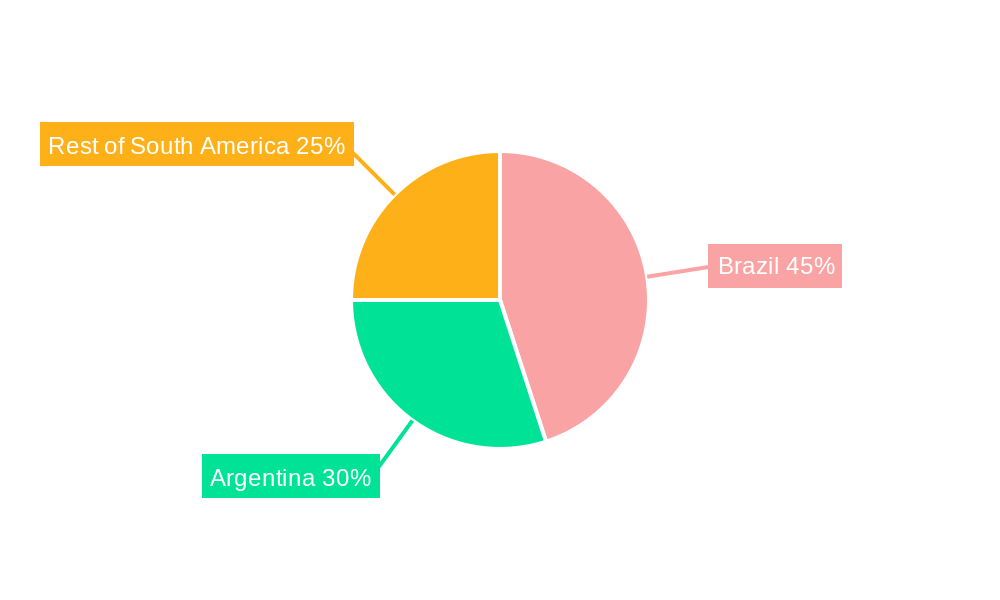

The South American commercial aircraft aviation fuel market, valued at approximately $X million in 2025, is projected to experience robust growth, exceeding a 12% Compound Annual Growth Rate (CAGR) through 2033. This expansion is driven by several key factors. Firstly, the burgeoning air travel sector in South America, fueled by increasing disposable incomes and tourism, significantly boosts demand for aviation fuel. Secondly, the region's expanding airline networks and the introduction of newer, more fuel-efficient aircraft contribute to market growth. Furthermore, government initiatives promoting sustainable aviation and investments in airport infrastructure are creating a positive environment for market expansion. However, the market faces certain challenges, including price volatility in crude oil and concerns about the environmental impact of traditional aviation fuels. This is leading to an increasing adoption of sustainable aviation biofuels, although their current market share remains relatively small. The market segmentation reveals that Commercial Airplanes constitute the largest segment by aircraft type, while Airlines dominate the end-user segment. ATF (Air Turbine Fuel) is the leading fuel type, but the market share of Aviation Biofuel is expected to gradually increase over the forecast period due to environmental regulations and the rising awareness of sustainable practices. Brazil and Argentina are the leading markets within South America, driven by their larger airline industries and robust economic activity.

The competitive landscape is characterized by a mix of international and regional players. Major oil and gas companies like Total SA, Petroleo Brasileiro S.A., Exxon Mobil Corporation, and Shell play a significant role in the supply chain. Regional fuel suppliers and aviation service providers also contribute substantially to the market. The strategic partnerships, investments in infrastructure, and diversification into biofuels by key players will play an increasingly important role in shaping the market's trajectory in the coming years. The overall outlook for the South American commercial aircraft aviation fuel market remains positive, with growth expected to be driven by a combination of factors including increasing air travel, technological advancements, and a gradual shift towards sustainable aviation fuels.

South America Commercial Aircraft Aviation Fuel Market: A Comprehensive Report (2019-2033)

This dynamic report provides an in-depth analysis of the South America Commercial Aircraft Aviation Fuel Market, offering invaluable insights for industry stakeholders. Spanning the period from 2019 to 2033, with a focus on 2025, this study unveils market trends, competitive dynamics, and future growth prospects. The report utilizes rigorous data analysis and expert insights to provide a 360-degree view of this vital sector. Maximize your strategic planning with this essential resource.

South America Commercial Aircraft Aviation Fuel Market Market Structure & Competitive Landscape

This section analyzes the competitive landscape and market structure of the South America Commercial Aircraft Aviation Fuel Market. We examine market concentration, identifying the dominant players and their respective market shares. The 2025 market concentration ratio (CR4) is estimated at xx%, indicating a moderately concentrated market. Key factors shaping the competitive dynamics are explored, including innovation drivers such as the development of sustainable aviation fuels (SAF), regulatory impacts like emission reduction policies, and the presence of product substitutes like biofuels. The report further investigates end-user segmentation across airlines, cargo carriers, and private aircraft owners, examining their respective fuel demands and preferences. Finally, an analysis of mergers and acquisitions (M&A) activity in the sector is presented, with an estimated xx Million USD in M&A volume during the 2019-2024 historical period. The qualitative assessment includes a detailed examination of collaborative agreements and strategic partnerships within the industry, highlighting their influence on market share and innovation.

- Market Concentration: CR4 (2025) estimated at xx%

- Innovation Drivers: SAF development, technological advancements in fuel efficiency.

- Regulatory Impacts: Emission reduction targets, fuel quality standards.

- Product Substitutes: Biofuels, alternative energy sources.

- End-User Segmentation: Airlines (xx%), Cargo Carriers (xx%), Private Aircraft Owners (xx%).

- M&A Activity (2019-2024): Estimated xx Million USD

South America Commercial Aircraft Aviation Fuel Market Market Trends & Opportunities

This section details the market size, growth trajectory, and emerging opportunities within the South America Commercial Aircraft Aviation Fuel Market. The market experienced significant growth during the historical period (2019-2024), with an estimated CAGR of xx%. The projected CAGR for the forecast period (2025-2033) stands at xx%, driven by factors such as increasing air passenger traffic, expansion of air cargo operations, and the growing adoption of business aviation. Technological advancements in aircraft design and fuel efficiency play a crucial role, alongside shifts in consumer preferences towards sustainable travel options. Competitive dynamics are characterized by intense rivalry among major players, leading to strategic investments in infrastructure development and fuel supply chain optimization. Market penetration rates for different fuel types are analyzed, highlighting the growing demand for ATF and the nascent but promising adoption of aviation biofuels. This section further explores regional variations in market growth and identifies key underserved areas with high growth potential. The analysis incorporates detailed market sizing and forecasting techniques to offer a comprehensive picture of future trends and opportunities.

Dominant Markets & Segments in South America Commercial Aircraft Aviation Fuel Market

This section identifies the leading regions, countries, and segments within the South America Commercial Aircraft Aviation Fuel Market.

Dominant Segments:

- Fuel Type: Air Turbine Fuel (ATF) holds the largest market share, exceeding xx Million in 2025, driven by its widespread use in commercial and business aviation. Aviation biofuel is a rapidly growing segment, projected to reach xx Million by 2033, fueled by increasing environmental concerns. AVGAS maintains a relatively smaller market share, catering mainly to smaller aircraft.

- Aircraft Type: Commercial Airplanes account for the largest share of fuel consumption, followed by Business Jets and Turboprops.

- End User: Airlines dominate the market, consuming the majority of aviation fuel.

Key Growth Drivers:

- Brazil: Strong economic growth, increasing air travel demand.

- Colombia: Expanding airport infrastructure, rising tourism.

- Chile: Growth in air cargo operations, international connectivity.

Market Dominance Analysis: Brazil dominates the South American aviation fuel market due to its large domestic air travel market and significant presence of major oil companies. The country's robust economy, increasing disposable incomes, and expanding middle class contribute to higher air travel demand and subsequently increased fuel consumption.

South America Commercial Aircraft Aviation Fuel Market Product Analysis

The South America Commercial Aircraft Aviation Fuel Market is primarily driven by the demand for Air Turbine Fuel (ATF), with a gradual increase in the adoption of aviation biofuels driven by sustainability initiatives. Continuous technological improvements focus on enhancing fuel efficiency and reducing emissions, leading to the development of advanced ATF formulations and the exploration of novel biofuel blends. The market witnesses competition based on product quality, price competitiveness, and reliable supply chain networks. The focus is on delivering high-quality fuel that meets stringent industry standards while optimizing supply chain logistics for timely and efficient delivery across diverse geographical locations.

Key Drivers, Barriers & Challenges in South America Commercial Aircraft Aviation Fuel Market

Key Drivers:

- Increasing air passenger traffic, driven by economic growth and tourism.

- Expansion of air cargo operations to meet growing e-commerce demand.

- Government initiatives to improve airport infrastructure and air connectivity.

- Growing adoption of business aviation.

Challenges and Restraints:

- Price Volatility: Fluctuations in crude oil prices directly impact aviation fuel costs.

- Regulatory Complexity: Varied regulations across South American countries can create operational challenges.

- Supply Chain Disruptions: Infrastructure limitations and logistical challenges can affect fuel supply.

- Environmental Concerns: Growing pressure to reduce carbon emissions from aviation. The lack of widespread biofuel infrastructure presents a significant barrier to growth.

Growth Drivers in the South America Commercial Aircraft Aviation Fuel Market Market

The South America Commercial Aircraft Aviation Fuel Market's growth is fueled by several factors. Firstly, rising disposable incomes and increased tourism are driving a surge in air passenger numbers. Secondly, the expanding e-commerce sector is significantly boosting the air cargo industry. Thirdly, government investments in airport infrastructure and air connectivity are creating a more favorable environment for the industry. Finally, the growing business aviation segment is adding to the demand for aviation fuel.

Challenges Impacting South America Commercial Aircraft Aviation Fuel Market Growth

Several factors pose challenges to the market's growth. Price volatility in crude oil creates uncertainty for fuel costs. Complex and varied regulations across South American countries can hinder operational efficiency. Supply chain limitations, including infrastructure deficiencies, create logistical hurdles. Finally, growing environmental concerns and pressure to reduce carbon emissions from aviation add another layer of complexity.

Key Players Shaping the South America Commercial Aircraft Aviation Fuel Market Market

- TotalEnergies SE

- Petroleo Brasileiro S A

- Exxon Mobil Corporation

- Pan American Energy S L

- Allied Aviation Services Inc

- Royal Dutch Shell PLC

- BP PLC

- Repsol SA

Significant South America Commercial Aircraft Aviation Fuel Market Industry Milestones

- 2021: Implementation of new emission reduction targets by several South American governments.

- 2022: Launch of a new sustainable aviation fuel (SAF) blending facility in Brazil.

- 2023: Significant investment in airport infrastructure upgrades across the region.

- 2024: Several major airlines announce commitments to increase the use of SAF.

Future Outlook for South America Commercial Aircraft Aviation Fuel Market Market

The South America Commercial Aircraft Aviation Fuel Market is poised for continued growth, driven by sustained economic expansion, increasing air travel demand, and infrastructure development. The growing adoption of sustainable aviation fuels presents a significant opportunity for market players to invest in green technologies and reduce their environmental footprint. Strategic partnerships and investments in sustainable solutions will be crucial for navigating the challenges of price volatility and environmental regulations, unlocking the market's substantial growth potential.

South America Commercial Aircraft Aviation Fuel Market Segmentation

-

1. Fuel Type

- 1.1. Air Turbine Fuel (ATF)

- 1.2. Aviation Biofuel

- 1.3. AVGAS

-

2. Geography

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Colombia

- 2.4. Rest of South America

South America Commercial Aircraft Aviation Fuel Market Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Colombia

- 4. Rest of South America

South America Commercial Aircraft Aviation Fuel Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 12.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Rising Industrialization across the Globe4.; Increasing Utilization of Natural Gas

- 3.3. Market Restrains

- 3.3.1. 4.; High Cost of Installation and Maintenance

- 3.4. Market Trends

- 3.4.1. ATF to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Commercial Aircraft Aviation Fuel Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Fuel Type

- 5.1.1. Air Turbine Fuel (ATF)

- 5.1.2. Aviation Biofuel

- 5.1.3. AVGAS

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Brazil

- 5.2.2. Argentina

- 5.2.3. Colombia

- 5.2.4. Rest of South America

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Brazil

- 5.3.2. Argentina

- 5.3.3. Colombia

- 5.3.4. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by Fuel Type

- 6. Brazil South America Commercial Aircraft Aviation Fuel Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Fuel Type

- 6.1.1. Air Turbine Fuel (ATF)

- 6.1.2. Aviation Biofuel

- 6.1.3. AVGAS

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Brazil

- 6.2.2. Argentina

- 6.2.3. Colombia

- 6.2.4. Rest of South America

- 6.1. Market Analysis, Insights and Forecast - by Fuel Type

- 7. Argentina South America Commercial Aircraft Aviation Fuel Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Fuel Type

- 7.1.1. Air Turbine Fuel (ATF)

- 7.1.2. Aviation Biofuel

- 7.1.3. AVGAS

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Brazil

- 7.2.2. Argentina

- 7.2.3. Colombia

- 7.2.4. Rest of South America

- 7.1. Market Analysis, Insights and Forecast - by Fuel Type

- 8. Colombia South America Commercial Aircraft Aviation Fuel Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Fuel Type

- 8.1.1. Air Turbine Fuel (ATF)

- 8.1.2. Aviation Biofuel

- 8.1.3. AVGAS

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. Brazil

- 8.2.2. Argentina

- 8.2.3. Colombia

- 8.2.4. Rest of South America

- 8.1. Market Analysis, Insights and Forecast - by Fuel Type

- 9. Rest of South America South America Commercial Aircraft Aviation Fuel Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Fuel Type

- 9.1.1. Air Turbine Fuel (ATF)

- 9.1.2. Aviation Biofuel

- 9.1.3. AVGAS

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. Brazil

- 9.2.2. Argentina

- 9.2.3. Colombia

- 9.2.4. Rest of South America

- 9.1. Market Analysis, Insights and Forecast - by Fuel Type

- 10. Brazil South America Commercial Aircraft Aviation Fuel Market Analysis, Insights and Forecast, 2019-2031

- 11. Argentina South America Commercial Aircraft Aviation Fuel Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of South America South America Commercial Aircraft Aviation Fuel Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Total SA

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Petroleo Brasileiro S A

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Exxon Mobil Corporation

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Pan American Energy S L

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Allied Aviation Services Inc

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Royal Dutch Shell PLC

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 BP PLC

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Repsol SA

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.1 Total SA

List of Figures

- Figure 1: South America Commercial Aircraft Aviation Fuel Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South America Commercial Aircraft Aviation Fuel Market Share (%) by Company 2024

List of Tables

- Table 1: South America Commercial Aircraft Aviation Fuel Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South America Commercial Aircraft Aviation Fuel Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 3: South America Commercial Aircraft Aviation Fuel Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 4: South America Commercial Aircraft Aviation Fuel Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: South America Commercial Aircraft Aviation Fuel Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Brazil South America Commercial Aircraft Aviation Fuel Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Argentina South America Commercial Aircraft Aviation Fuel Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Rest of South America South America Commercial Aircraft Aviation Fuel Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: South America Commercial Aircraft Aviation Fuel Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 10: South America Commercial Aircraft Aviation Fuel Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 11: South America Commercial Aircraft Aviation Fuel Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: South America Commercial Aircraft Aviation Fuel Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 13: South America Commercial Aircraft Aviation Fuel Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 14: South America Commercial Aircraft Aviation Fuel Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: South America Commercial Aircraft Aviation Fuel Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 16: South America Commercial Aircraft Aviation Fuel Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 17: South America Commercial Aircraft Aviation Fuel Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: South America Commercial Aircraft Aviation Fuel Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 19: South America Commercial Aircraft Aviation Fuel Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 20: South America Commercial Aircraft Aviation Fuel Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Commercial Aircraft Aviation Fuel Market?

The projected CAGR is approximately > 12.00%.

2. Which companies are prominent players in the South America Commercial Aircraft Aviation Fuel Market?

Key companies in the market include Total SA, Petroleo Brasileiro S A, Exxon Mobil Corporation, Pan American Energy S L, Allied Aviation Services Inc, Royal Dutch Shell PLC, BP PLC, Repsol SA.

3. What are the main segments of the South America Commercial Aircraft Aviation Fuel Market?

The market segments include Fuel Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Rising Industrialization across the Globe4.; Increasing Utilization of Natural Gas.

6. What are the notable trends driving market growth?

ATF to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; High Cost of Installation and Maintenance.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Commercial Aircraft Aviation Fuel Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Commercial Aircraft Aviation Fuel Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Commercial Aircraft Aviation Fuel Market?

To stay informed about further developments, trends, and reports in the South America Commercial Aircraft Aviation Fuel Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence