Key Insights

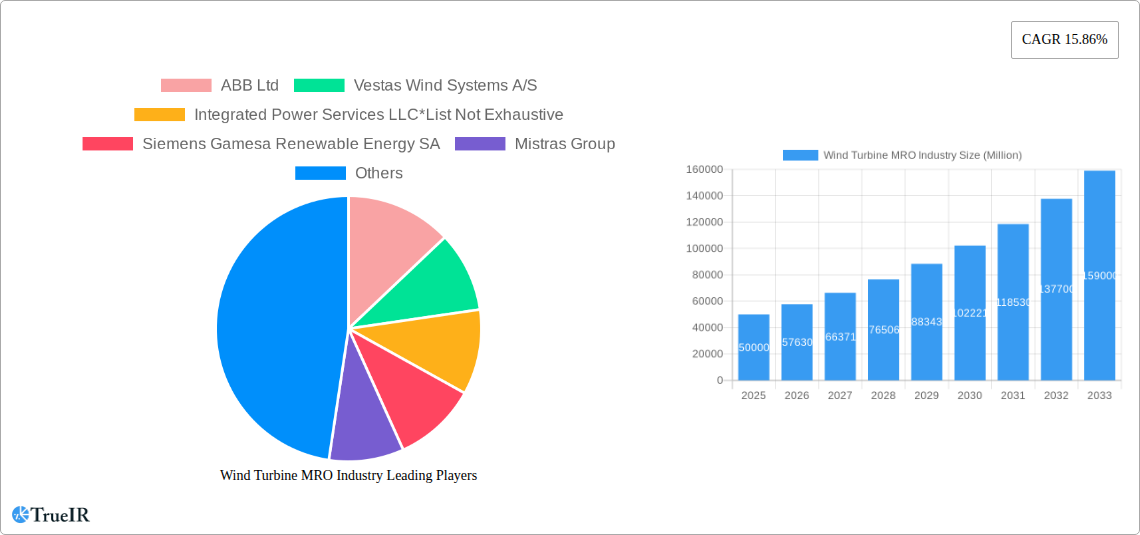

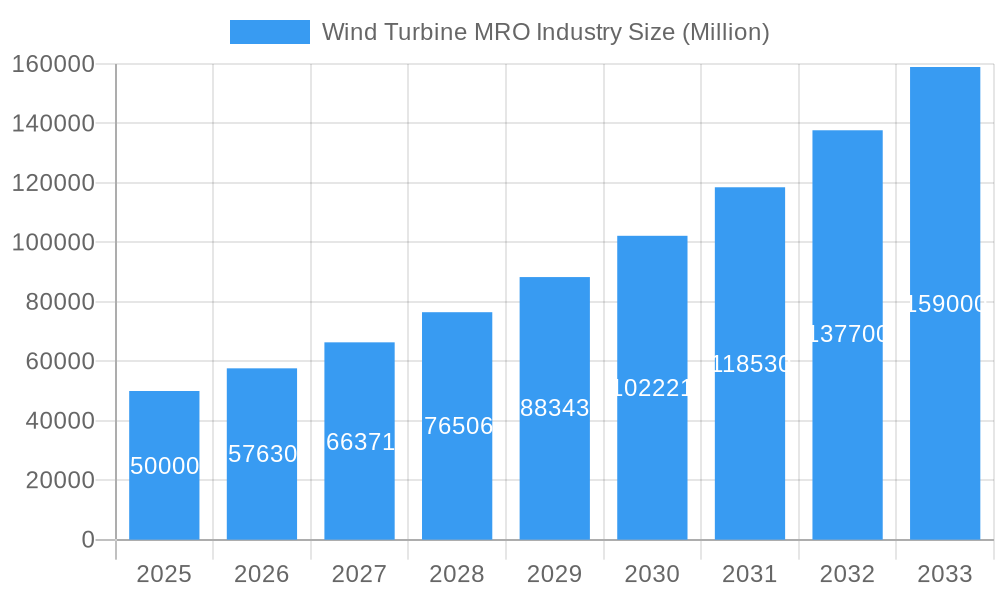

The global wind turbine maintenance, repair, and overhaul (MRO) market is experiencing robust growth, driven by the increasing number of installed wind turbines globally and the aging fleet requiring more frequent maintenance. The market's Compound Annual Growth Rate (CAGR) of 15.86% from 2019 to 2024 signifies substantial expansion, and this upward trajectory is expected to continue through 2033. Key drivers include stringent regulatory compliance requirements for turbine safety and efficiency, the rising demand for renewable energy, and technological advancements leading to improved turbine lifespan management strategies. The diverse market segmentation, encompassing various service types (maintenance, repair, overhaul), components (gearboxes, generators, rotor blades, and others), and deployment locations (onshore and offshore), presents lucrative opportunities for specialized players. Offshore wind farms, while presenting unique challenges, also offer significant growth potential due to their larger capacity and longer operational lifespans. The competitive landscape includes a mix of established industry giants like ABB, Vestas, Siemens Gamesa, and GE, alongside specialized MRO service providers. Growth may be somewhat constrained by the cyclical nature of the renewable energy sector and the potential for fluctuating commodity prices impacting operational costs.

Wind Turbine MRO Industry Market Size (In Billion)

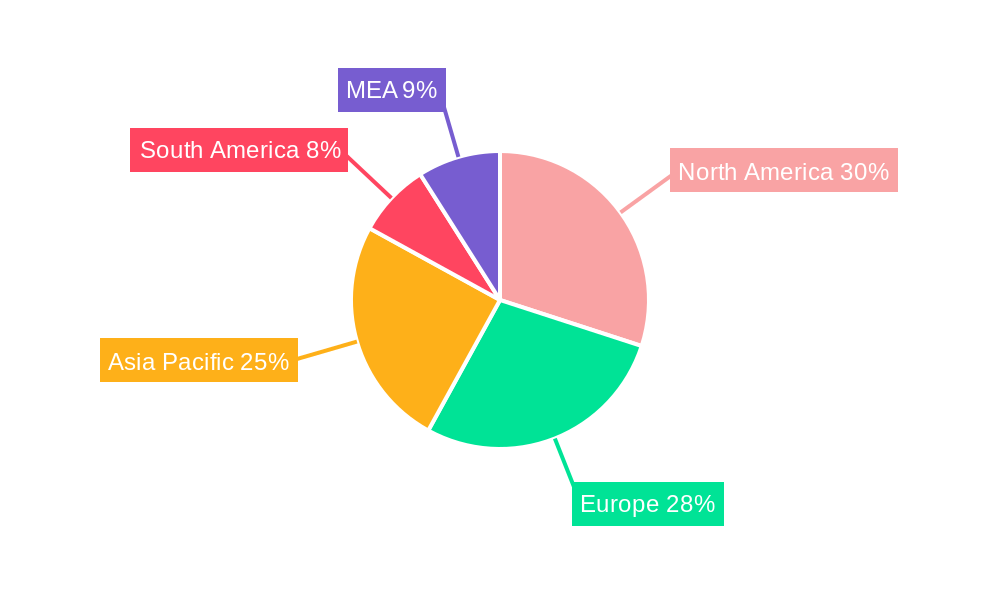

The geographic distribution of the wind turbine MRO market reflects the global concentration of wind energy installations. North America, Europe, and Asia Pacific currently hold significant market shares, with the latter expected to experience the fastest growth due to aggressive renewable energy targets in countries like China and India. However, emerging markets in South America, the Middle East, and Africa also present untapped potential, as these regions expand their wind energy capacity. The market is characterized by a need for specialized skills and advanced technologies to handle complex turbine systems, creating opportunities for companies offering advanced diagnostics and predictive maintenance solutions. Strategic partnerships and mergers and acquisitions are expected to shape the competitive landscape as companies seek to expand their service offerings and geographical reach. The overall outlook remains strongly positive, indicating a significant and sustained growth path for the wind turbine MRO market in the coming decade.

Wind Turbine MRO Industry Company Market Share

Wind Turbine MRO Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the global Wind Turbine MRO (Maintenance, Repair, and Overhaul) industry, offering invaluable insights for investors, industry professionals, and strategic decision-makers. With a focus on market trends, competitive dynamics, and future growth potential, this report covers the period from 2019 to 2033, with a base year of 2025 and a forecast period spanning 2025-2033. The study encompasses a market size exceeding $XX Million in 2025 and projects significant growth throughout the forecast period.

Wind Turbine MRO Industry Market Structure & Competitive Landscape

The Wind Turbine MRO market is characterized by a moderately concentrated landscape, with several major players holding significant market share. However, the presence of numerous smaller, specialized firms contributes to a dynamic and competitive environment. The market's structure is influenced by several factors, including:

- Market Concentration: The Herfindahl-Hirschman Index (HHI) for the Wind Turbine MRO market is estimated at xx in 2025, indicating a moderately concentrated market. This is influenced by the large-scale operations of key players such as Siemens Gamesa Renewable Energy, Vestas Wind Systems, and GE Renewable Energy.

- Innovation Drivers: Continuous technological advancements in wind turbine design, materials science, and digitalization are driving innovation in MRO services, leading to improved efficiency, reduced downtime, and optimized maintenance strategies. The push for predictive maintenance using IoT sensors and AI-driven analytics is a major force.

- Regulatory Impacts: Government policies promoting renewable energy and stricter environmental regulations are significant drivers for growth. Furthermore, subsidies and tax incentives for wind energy projects create demand for reliable and efficient MRO services.

- Product Substitutes: While direct substitutes for Wind Turbine MRO are limited, indirect competition arises from alternative energy sources and the operational efficiency of wind turbines themselves. Improvements in turbine design leading to longer lifespans might slightly decrease the demand for MRO in the long run.

- End-User Segmentation: The market serves a diverse range of end-users, including Independent Power Producers (IPPs), utility companies, and private wind farm operators. Each segment exhibits different MRO needs based on factors such as fleet size, technology, and budget constraints.

- M&A Trends: The Wind Turbine MRO sector has witnessed a moderate level of mergers and acquisitions (M&A) activity in recent years, primarily driven by companies seeking to expand their service portfolio, geographical reach, and technological capabilities. The total value of M&A transactions in the period 2019-2024 is estimated at $XX Million.

Wind Turbine MRO Industry Market Trends & Opportunities

The global Wind Turbine MRO market is experiencing robust growth, driven by the increasing adoption of wind energy globally. The market size is projected to reach $XX Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during the forecast period. This growth is fueled by several key trends:

- Increased Wind Energy Capacity: The global expansion of wind energy projects, both onshore and offshore, is significantly boosting demand for MRO services. The rise in renewable energy targets set by governments worldwide is a key factor driving capacity additions.

- Aging Wind Turbine Fleet: The increasing age of existing wind turbines requires more frequent and complex maintenance procedures, creating substantial MRO opportunities. This trend is particularly prominent in older installations.

- Technological Advancements: The integration of advanced technologies, such as predictive maintenance, remote diagnostics, and drone-based inspections, is enhancing the efficiency and effectiveness of MRO services. This leads to improved cost optimization and reduced downtime for wind farms.

- Offshore Wind Growth: The rapid growth of the offshore wind sector presents significant opportunities for specialized MRO providers. Offshore wind turbines require complex and specialized maintenance due to their challenging operational environment.

- Competitive Landscape: The competitive landscape is characterized by the presence of both large multinational corporations and specialized niche players. This fosters innovation and competition, contributing to enhanced service quality and cost-effectiveness.

- Market Penetration: The market penetration rate of advanced MRO technologies (e.g., predictive maintenance) is steadily increasing, reflecting the industry's adoption of digital solutions. A projected xx% market penetration is anticipated by 2033.

Dominant Markets & Segments in Wind Turbine MRO Industry

The Wind Turbine MRO market is geographically diverse, with significant growth observed across various regions. However, several regions and segments stand out as dominant:

- Leading Regions: Europe and North America currently dominate the market, owing to the high concentration of wind energy installations and advanced MRO infrastructure. Asia-Pacific is witnessing rapid growth and is projected to become a significant market in the coming years.

- Leading Countries: Germany, the United States, China, and the United Kingdom are some of the leading national markets.

- Dominant Service Types: Maintenance accounts for the largest segment of the MRO market, followed by repair and overhaul services. The increasing complexity of wind turbines drives demand for comprehensive overhaul services.

- Dominant Components: Gearboxes, generators, and rotor blades are major components requiring frequent MRO interventions due to their critical role in turbine operation and susceptibility to wear and tear.

- Deployment Location: Onshore wind farms currently represent a larger share of the MRO market than offshore installations, primarily due to the higher number of onshore wind turbines. However, the rapidly growing offshore wind sector is expected to significantly increase MRO demand in the future.

Key Growth Drivers:

- Favorable Government Policies: Government support for renewable energy, including tax incentives and subsidies, significantly boosts demand for wind energy and consequently MRO services.

- Robust Infrastructure Development: Investments in grid infrastructure and electricity transmission networks facilitate the integration of renewable energy sources and support the growth of the wind energy sector.

- Technological Innovation: The constant development and implementation of new technologies in wind turbine design and MRO services optimize efficiency, reduce downtime, and improve operational performance.

- Environmental Concerns: The increasing emphasis on reducing carbon emissions and combating climate change fuels the adoption of renewable energy technologies, including wind power.

Wind Turbine MRO Industry Product Analysis

The Wind Turbine MRO industry offers a range of products and services tailored to the specific needs of wind farm operators. These include specialized tools and equipment for maintenance, repair, and overhaul, advanced diagnostic software for predictive maintenance, and comprehensive service contracts covering various aspects of turbine operation. Technological advancements such as AI-powered predictive maintenance and remote diagnostics are improving the efficiency and effectiveness of MRO services. This leads to optimized maintenance schedules, reduced downtime, and improved overall cost efficiency for wind farm operators, which in turn increases the market appeal of these services.

Key Drivers, Barriers & Challenges in Wind Turbine MRO Industry

Key Drivers:

The Wind Turbine MRO market is primarily propelled by the escalating demand for wind energy, technological advancements in predictive maintenance and remote diagnostics, and supportive government policies promoting renewable energy sources.

Key Challenges and Restraints:

The industry faces several challenges, including the high cost of offshore wind turbine maintenance, supply chain disruptions impacting the availability of spare parts, and intense competition among MRO providers. The overall impact of these factors on market growth can be quantified through a reduced CAGR, estimated at a xx% reduction compared to the initial projection without these factors.

Growth Drivers in the Wind Turbine MRO Industry Market

The growth of the Wind Turbine MRO market is strongly driven by increasing wind energy capacity additions globally, aging wind turbine fleets demanding more frequent maintenance, and technological innovations enhancing the efficiency and effectiveness of MRO services. Government policies supporting renewable energy, coupled with the rising environmental awareness are further contributing factors.

Challenges Impacting Wind Turbine MRO Industry Growth

Challenges include the high costs associated with offshore wind turbine maintenance, logistical complexities of accessing remote wind farms, the need for skilled labor, and potential supply chain disruptions affecting spare part availability. Regulatory uncertainties and competition among various providers also pose significant hurdles to growth.

Key Players Shaping the Wind Turbine MRO Industry Market

- ABB Ltd

- Vestas Wind Systems A/S

- Integrated Power Services LLC

- Siemens Gamesa Renewable Energy SA

- Mistras Group

- Moventas Gears Oy

- Suzlon Energy Ltd

- Dana SAC UK Ltd

- General Electric Company

- Nordex SE

- Stork (a Fluor Company)

- ZF Friedrichshafen AG

Significant Wind Turbine MRO Industry Industry Milestones

- February 2021: Siemens Gamesa Renewable Energy extends its O&M agreement for the 600 MW Gemini offshore wind farm until 2036, demonstrating long-term commitment and showcasing the increasing importance of extended service agreements.

- May 2021: GE Renewable Energy secures a 15-year full-service O&M contract for an 88 MW wind farm in Vietnam, highlighting the growing demand for comprehensive MRO solutions in emerging markets.

Future Outlook for Wind Turbine MRO Industry Market

The Wind Turbine MRO market is poised for continued robust growth, driven by several factors including the global expansion of wind energy projects, the increasing age of existing turbines, and ongoing technological advancements in MRO services. Strategic opportunities exist for companies that can offer innovative, cost-effective, and sustainable MRO solutions, particularly in the rapidly expanding offshore wind sector. The market's future potential is significant, with continued growth expected throughout the forecast period.

Wind Turbine MRO Industry Segmentation

-

1. Location of Deployment

- 1.1. Onshore

- 1.2. Offshore

-

2. Service Type

- 2.1. Maintenance

- 2.2. Repair

- 2.3. Overhaul

-

3. Component

- 3.1. Gearbox

- 3.2. Generators

- 3.3. Rotor Blades

- 3.4. Other Components

Wind Turbine MRO Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. South America

- 5. Middle East and Africa

Wind Turbine MRO Industry Regional Market Share

Geographic Coverage of Wind Turbine MRO Industry

Wind Turbine MRO Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15.09% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing Environmental Concerns4.; Supportive Government Policies

- 3.3. Market Restrains

- 3.3.1. 4.; High Initial Capital Investment

- 3.4. Market Trends

- 3.4.1. Offshore Wind Installations Expected to Witness Signifcant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Wind Turbine MRO Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 5.1.1. Onshore

- 5.1.2. Offshore

- 5.2. Market Analysis, Insights and Forecast - by Service Type

- 5.2.1. Maintenance

- 5.2.2. Repair

- 5.2.3. Overhaul

- 5.3. Market Analysis, Insights and Forecast - by Component

- 5.3.1. Gearbox

- 5.3.2. Generators

- 5.3.3. Rotor Blades

- 5.3.4. Other Components

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. South America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 6. North America Wind Turbine MRO Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 6.1.1. Onshore

- 6.1.2. Offshore

- 6.2. Market Analysis, Insights and Forecast - by Service Type

- 6.2.1. Maintenance

- 6.2.2. Repair

- 6.2.3. Overhaul

- 6.3. Market Analysis, Insights and Forecast - by Component

- 6.3.1. Gearbox

- 6.3.2. Generators

- 6.3.3. Rotor Blades

- 6.3.4. Other Components

- 6.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 7. Europe Wind Turbine MRO Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 7.1.1. Onshore

- 7.1.2. Offshore

- 7.2. Market Analysis, Insights and Forecast - by Service Type

- 7.2.1. Maintenance

- 7.2.2. Repair

- 7.2.3. Overhaul

- 7.3. Market Analysis, Insights and Forecast - by Component

- 7.3.1. Gearbox

- 7.3.2. Generators

- 7.3.3. Rotor Blades

- 7.3.4. Other Components

- 7.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 8. Asia Pacific Wind Turbine MRO Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 8.1.1. Onshore

- 8.1.2. Offshore

- 8.2. Market Analysis, Insights and Forecast - by Service Type

- 8.2.1. Maintenance

- 8.2.2. Repair

- 8.2.3. Overhaul

- 8.3. Market Analysis, Insights and Forecast - by Component

- 8.3.1. Gearbox

- 8.3.2. Generators

- 8.3.3. Rotor Blades

- 8.3.4. Other Components

- 8.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 9. South America Wind Turbine MRO Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 9.1.1. Onshore

- 9.1.2. Offshore

- 9.2. Market Analysis, Insights and Forecast - by Service Type

- 9.2.1. Maintenance

- 9.2.2. Repair

- 9.2.3. Overhaul

- 9.3. Market Analysis, Insights and Forecast - by Component

- 9.3.1. Gearbox

- 9.3.2. Generators

- 9.3.3. Rotor Blades

- 9.3.4. Other Components

- 9.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 10. Middle East and Africa Wind Turbine MRO Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 10.1.1. Onshore

- 10.1.2. Offshore

- 10.2. Market Analysis, Insights and Forecast - by Service Type

- 10.2.1. Maintenance

- 10.2.2. Repair

- 10.2.3. Overhaul

- 10.3. Market Analysis, Insights and Forecast - by Component

- 10.3.1. Gearbox

- 10.3.2. Generators

- 10.3.3. Rotor Blades

- 10.3.4. Other Components

- 10.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 ABB Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Vestas Wind Systems A/S

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Integrated Power Services LLC*List Not Exhaustive

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Siemens Gamesa Renewable Energy SA

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Mistras Group

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Moventas Gears Oy

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Suzlon Energy Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Dana SAC UK Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 General Electric Company

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Nordex SE

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Stork (a Fluor Company)

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 ZF Friedrichshafen AG

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 ABB Ltd

List of Figures

- Figure 1: Global Wind Turbine MRO Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Wind Turbine MRO Industry Revenue (undefined), by Location of Deployment 2025 & 2033

- Figure 3: North America Wind Turbine MRO Industry Revenue Share (%), by Location of Deployment 2025 & 2033

- Figure 4: North America Wind Turbine MRO Industry Revenue (undefined), by Service Type 2025 & 2033

- Figure 5: North America Wind Turbine MRO Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 6: North America Wind Turbine MRO Industry Revenue (undefined), by Component 2025 & 2033

- Figure 7: North America Wind Turbine MRO Industry Revenue Share (%), by Component 2025 & 2033

- Figure 8: North America Wind Turbine MRO Industry Revenue (undefined), by Country 2025 & 2033

- Figure 9: North America Wind Turbine MRO Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Wind Turbine MRO Industry Revenue (undefined), by Location of Deployment 2025 & 2033

- Figure 11: Europe Wind Turbine MRO Industry Revenue Share (%), by Location of Deployment 2025 & 2033

- Figure 12: Europe Wind Turbine MRO Industry Revenue (undefined), by Service Type 2025 & 2033

- Figure 13: Europe Wind Turbine MRO Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 14: Europe Wind Turbine MRO Industry Revenue (undefined), by Component 2025 & 2033

- Figure 15: Europe Wind Turbine MRO Industry Revenue Share (%), by Component 2025 & 2033

- Figure 16: Europe Wind Turbine MRO Industry Revenue (undefined), by Country 2025 & 2033

- Figure 17: Europe Wind Turbine MRO Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Wind Turbine MRO Industry Revenue (undefined), by Location of Deployment 2025 & 2033

- Figure 19: Asia Pacific Wind Turbine MRO Industry Revenue Share (%), by Location of Deployment 2025 & 2033

- Figure 20: Asia Pacific Wind Turbine MRO Industry Revenue (undefined), by Service Type 2025 & 2033

- Figure 21: Asia Pacific Wind Turbine MRO Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 22: Asia Pacific Wind Turbine MRO Industry Revenue (undefined), by Component 2025 & 2033

- Figure 23: Asia Pacific Wind Turbine MRO Industry Revenue Share (%), by Component 2025 & 2033

- Figure 24: Asia Pacific Wind Turbine MRO Industry Revenue (undefined), by Country 2025 & 2033

- Figure 25: Asia Pacific Wind Turbine MRO Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Wind Turbine MRO Industry Revenue (undefined), by Location of Deployment 2025 & 2033

- Figure 27: South America Wind Turbine MRO Industry Revenue Share (%), by Location of Deployment 2025 & 2033

- Figure 28: South America Wind Turbine MRO Industry Revenue (undefined), by Service Type 2025 & 2033

- Figure 29: South America Wind Turbine MRO Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 30: South America Wind Turbine MRO Industry Revenue (undefined), by Component 2025 & 2033

- Figure 31: South America Wind Turbine MRO Industry Revenue Share (%), by Component 2025 & 2033

- Figure 32: South America Wind Turbine MRO Industry Revenue (undefined), by Country 2025 & 2033

- Figure 33: South America Wind Turbine MRO Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Wind Turbine MRO Industry Revenue (undefined), by Location of Deployment 2025 & 2033

- Figure 35: Middle East and Africa Wind Turbine MRO Industry Revenue Share (%), by Location of Deployment 2025 & 2033

- Figure 36: Middle East and Africa Wind Turbine MRO Industry Revenue (undefined), by Service Type 2025 & 2033

- Figure 37: Middle East and Africa Wind Turbine MRO Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 38: Middle East and Africa Wind Turbine MRO Industry Revenue (undefined), by Component 2025 & 2033

- Figure 39: Middle East and Africa Wind Turbine MRO Industry Revenue Share (%), by Component 2025 & 2033

- Figure 40: Middle East and Africa Wind Turbine MRO Industry Revenue (undefined), by Country 2025 & 2033

- Figure 41: Middle East and Africa Wind Turbine MRO Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Wind Turbine MRO Industry Revenue undefined Forecast, by Location of Deployment 2020 & 2033

- Table 2: Global Wind Turbine MRO Industry Revenue undefined Forecast, by Service Type 2020 & 2033

- Table 3: Global Wind Turbine MRO Industry Revenue undefined Forecast, by Component 2020 & 2033

- Table 4: Global Wind Turbine MRO Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Global Wind Turbine MRO Industry Revenue undefined Forecast, by Location of Deployment 2020 & 2033

- Table 6: Global Wind Turbine MRO Industry Revenue undefined Forecast, by Service Type 2020 & 2033

- Table 7: Global Wind Turbine MRO Industry Revenue undefined Forecast, by Component 2020 & 2033

- Table 8: Global Wind Turbine MRO Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: Global Wind Turbine MRO Industry Revenue undefined Forecast, by Location of Deployment 2020 & 2033

- Table 10: Global Wind Turbine MRO Industry Revenue undefined Forecast, by Service Type 2020 & 2033

- Table 11: Global Wind Turbine MRO Industry Revenue undefined Forecast, by Component 2020 & 2033

- Table 12: Global Wind Turbine MRO Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Global Wind Turbine MRO Industry Revenue undefined Forecast, by Location of Deployment 2020 & 2033

- Table 14: Global Wind Turbine MRO Industry Revenue undefined Forecast, by Service Type 2020 & 2033

- Table 15: Global Wind Turbine MRO Industry Revenue undefined Forecast, by Component 2020 & 2033

- Table 16: Global Wind Turbine MRO Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 17: Global Wind Turbine MRO Industry Revenue undefined Forecast, by Location of Deployment 2020 & 2033

- Table 18: Global Wind Turbine MRO Industry Revenue undefined Forecast, by Service Type 2020 & 2033

- Table 19: Global Wind Turbine MRO Industry Revenue undefined Forecast, by Component 2020 & 2033

- Table 20: Global Wind Turbine MRO Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 21: Global Wind Turbine MRO Industry Revenue undefined Forecast, by Location of Deployment 2020 & 2033

- Table 22: Global Wind Turbine MRO Industry Revenue undefined Forecast, by Service Type 2020 & 2033

- Table 23: Global Wind Turbine MRO Industry Revenue undefined Forecast, by Component 2020 & 2033

- Table 24: Global Wind Turbine MRO Industry Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Wind Turbine MRO Industry?

The projected CAGR is approximately 15.09%.

2. Which companies are prominent players in the Wind Turbine MRO Industry?

Key companies in the market include ABB Ltd, Vestas Wind Systems A/S, Integrated Power Services LLC*List Not Exhaustive, Siemens Gamesa Renewable Energy SA, Mistras Group, Moventas Gears Oy, Suzlon Energy Ltd, Dana SAC UK Ltd, General Electric Company, Nordex SE, Stork (a Fluor Company), ZF Friedrichshafen AG.

3. What are the main segments of the Wind Turbine MRO Industry?

The market segments include Location of Deployment, Service Type, Component.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing Environmental Concerns4.; Supportive Government Policies.

6. What are the notable trends driving market growth?

Offshore Wind Installations Expected to Witness Signifcant Growth.

7. Are there any restraints impacting market growth?

4.; High Initial Capital Investment.

8. Can you provide examples of recent developments in the market?

In February 2021, Siemens Gamesa Renewable Energy signed an agreement with Gemini Consortium to extend the operation and maintenance service agreement for 600 MW Gemini's offshore wind energy farm in the Dutch North Sea until 2036. Furthermore, the original 15-year long-term plan (LTP) has been extended by five years and covers different upgrades and new services, providing more control over O&M.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Wind Turbine MRO Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Wind Turbine MRO Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Wind Turbine MRO Industry?

To stay informed about further developments, trends, and reports in the Wind Turbine MRO Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence