Key Insights

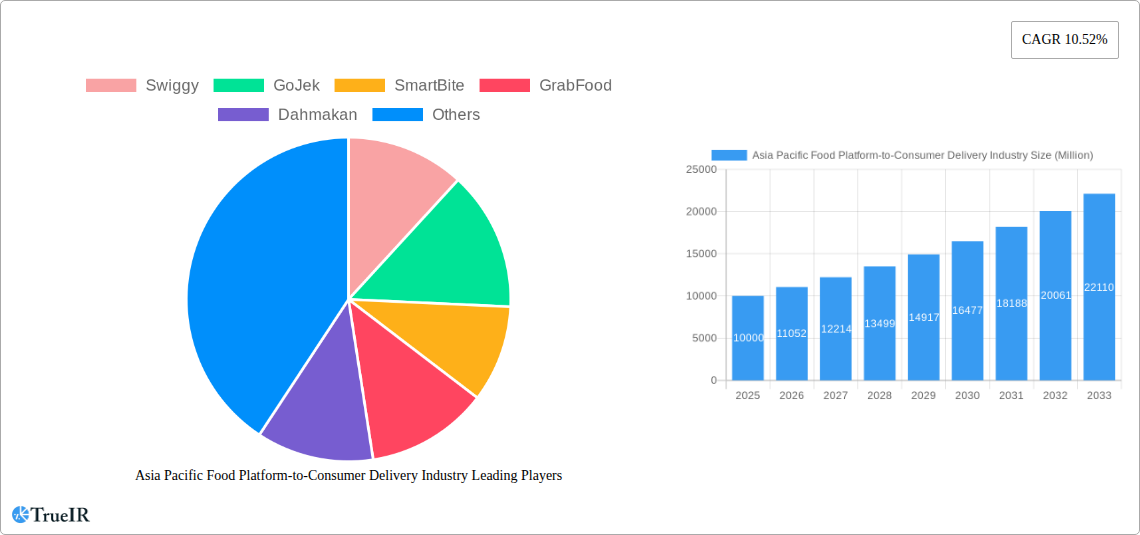

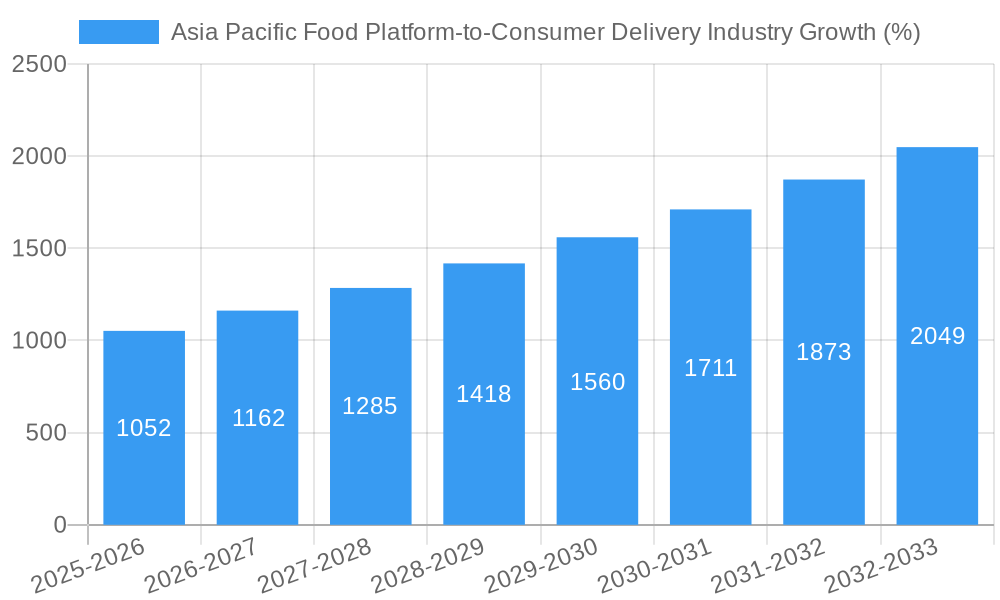

The Asia Pacific food platform-to-consumer delivery industry is experiencing robust growth, driven by increasing smartphone penetration, rising urbanization, and changing consumer lifestyles favoring convenience. The market, valued at approximately $XX million in 2025 (assuming a logical extrapolation from the provided CAGR of 10.52% and the unspecified 2019 market size), is projected to expand significantly over the forecast period (2025-2033). Key growth drivers include the rising popularity of online food ordering, the expansion of delivery networks into previously underserved areas, and the increasing adoption of diverse payment methods beyond cash-on-delivery. The market is segmented by product type (food delivery, grocery delivery, other), delivery method (home delivery, office delivery, other), and payment method (cash on delivery, online payment, other). India, China, and other densely populated nations within the Asia-Pacific region are major contributors to this growth, fueled by burgeoning middle classes and a preference for convenient food options. Competitive pressures among established players like Swiggy, GoJek, and GrabFood, along with the emergence of smaller, localized delivery services, are shaping the market landscape. While regulatory hurdles and challenges in maintaining consistent food quality across delivery networks may present restraints, the overall outlook for the industry remains positive, projected to maintain a strong CAGR through 2033.

The industry's success hinges on effective logistics management, technological advancements in order processing and routing, and building robust partnerships with restaurants and grocery stores. The increasing adoption of advanced analytics and data-driven insights will be crucial for optimizing delivery routes, predicting demand fluctuations, and personalizing customer experiences. Furthermore, the expansion of services to include grocery delivery and other non-food items adds significant potential for market diversification and growth. The continued focus on enhancing customer service, improving safety protocols, and adapting to evolving consumer preferences will determine the long-term success of players in this dynamic and competitive market. While challenges exist, including fluctuating fuel costs and the need for skilled delivery personnel, the predicted CAGR suggests a positive growth trajectory for the foreseeable future.

This comprehensive report provides an in-depth analysis of the Asia Pacific food platform-to-consumer delivery industry, covering the period 2019-2033. With a focus on market structure, competitive dynamics, key players, and future trends, this report is an invaluable resource for investors, industry professionals, and anyone seeking to understand this rapidly evolving sector. The report leverages extensive market research and data analysis to deliver actionable insights and forecasts, including projections for market size exceeding xx Million by 2033.

Asia Pacific Food Platform-to-Consumer Delivery Industry Market Structure & Competitive Landscape

This section analyzes the competitive landscape of the Asia Pacific food platform-to-consumer delivery market, examining market concentration, innovation, regulations, substitutes, and M&A activity. The study period (2019-2024) reveals a highly dynamic market with significant consolidation.

Market Concentration: The Herfindahl-Hirschman Index (HHI) for the Asia Pacific region shows a moderately concentrated market with a value of xx, indicating the presence of several large players and many smaller competitors. This suggests potential for further consolidation through mergers and acquisitions (M&A).

Innovation Drivers: Technological advancements such as AI-powered order optimization, drone delivery, and improved logistics software are driving efficiency and innovation within the sector. Furthermore, the development of specialized delivery solutions for different product types (e.g., temperature-sensitive goods) is creating new opportunities.

Regulatory Impacts: Government regulations regarding food safety, data privacy, and worker rights significantly impact the operating environment. Varying regulations across different countries within the Asia Pacific region create complexities for businesses operating across borders.

Product Substitutes: Traditional restaurant dining and grocery stores remain key substitutes for food delivery services. However, the convenience and expanding range of offerings provided by food delivery platforms continue to attract customers.

End-User Segmentation: The market caters to diverse end-user segments, including individual consumers, businesses (office delivery), and other institutions. Understanding the needs and preferences of each segment is crucial for success.

M&A Trends: The historical period witnessed xx Million in M&A activity, primarily focused on expanding market reach and technological capabilities. This trend is anticipated to continue, with larger players acquiring smaller companies to strengthen their market position.

Asia Pacific Food Platform-to-Consumer Delivery Industry Market Trends & Opportunities

This section details the market's growth trajectory, technological shifts, evolving consumer preferences, and competitive dynamics during the forecast period (2025-2033). The market is projected to witness substantial growth, driven by a combination of factors.

The Asia Pacific food platform-to-consumer delivery market is experiencing robust growth, with a Compound Annual Growth Rate (CAGR) of xx% projected between 2025 and 2033. Market penetration rates are increasing significantly, particularly in urban areas, fueled by rising disposable incomes, increasing smartphone penetration, and the growing popularity of online ordering and cashless payment systems. Technological advancements are enabling greater efficiency in logistics and order fulfillment, further accelerating market expansion. Changing consumer lifestyles, including increased demand for convenience and time-saving services, are also driving substantial growth. The competitive landscape is characterized by fierce rivalry among established players and the emergence of new entrants, leading to price wars and innovative service offerings. Strategic partnerships and alliances are becoming increasingly common as companies strive to enhance their capabilities and expand their reach.

Dominant Markets & Segments in Asia Pacific Food Platform-to-Consumer Delivery Industry

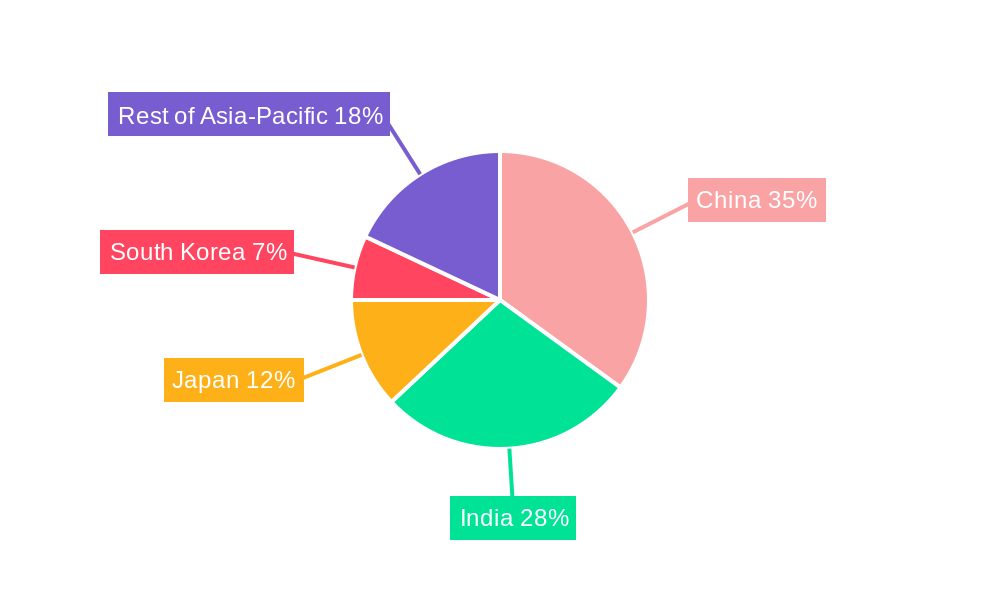

This section identifies the leading regions, countries, and segments within the Asia Pacific food delivery market.

Leading Regions/Countries: India and Indonesia are currently the dominant markets, driven by large populations, increasing urbanization, and rising smartphone penetration. Other significant markets include Singapore, China, and Australia.

Key Growth Drivers (by Segment):

Product Type:

- Food Delivery: Remains the largest segment, driven by consumer preference for convenience and variety.

- Grocery Delivery: Rapidly growing, facilitated by technological advancements and changing consumer behavior.

- Other: This includes specialized delivery segments like pharmaceuticals and other products. Growth is dependent on specific market needs and supporting infrastructure.

Delivery Method:

- Home Delivery: Remains the primary delivery method, benefiting from widespread addressable populations.

- Office Delivery: A significant segment, particularly in major urban areas. Growth tied to corporate adoption and office worker demographics.

- Other: This could include delivery to other locations, like hotels, based on localized demand.

Payment Method:

- Online Payment: Dominates due to increasing digitalization and greater convenience.

- Cash on Delivery: Still relevant in certain markets, although its usage is decreasing as online payment systems become more widespread.

- Other: This may include mobile wallets or alternative payment technologies.

Market Dominance Analysis: The dominance of specific markets and segments is driven by factors like infrastructure development, government policies supporting digitalization, and consumer adoption rates. For example, strong digital infrastructure and supportive government policies are crucial for the growth of online food delivery in many parts of Asia.

Asia Pacific Food Platform-to-Consumer Delivery Industry Product Analysis

The Asia Pacific food delivery market showcases continual product innovation, including advanced order management systems, real-time tracking, and diverse payment options. Technological advancements, particularly in logistics and delivery optimization, improve efficiency and customer satisfaction. The market displays a robust fit between these technological advancements and consumer demands for convenience, speed, and reliability.

Key Drivers, Barriers & Challenges in Asia Pacific Food Platform-to-Consumer Delivery Industry

Key Drivers:

- Technological advancements in logistics and order management.

- Rising disposable incomes and increased smartphone penetration.

- Changing consumer lifestyles and preferences for convenience.

- Government initiatives promoting digitalization and e-commerce.

Key Challenges and Restraints:

- Supply Chain Issues: Fluctuations in fuel prices and driver availability can significantly impact profitability. The estimated impact on the overall market is xx Million annually.

- Regulatory Hurdles: Inconsistencies in food safety regulations and labor laws across different jurisdictions present operational complexities.

- Competitive Pressures: Intense competition leads to price wars and reduced profit margins.

Growth Drivers in the Asia Pacific Food Platform-to-Consumer Delivery Industry Market

The growth of this market is primarily propelled by technological advancements, rising disposable incomes, and changing consumer lifestyles. Government support for e-commerce initiatives further bolsters growth.

Challenges Impacting Asia Pacific Food Platform-to-Consumer Delivery Industry Growth

Significant challenges include maintaining profitability amid competitive pricing, navigating regulatory complexities across different markets, and addressing fluctuating fuel costs and driver shortages which can lead to an estimated xx Million annual revenue loss.

Key Players Shaping the Asia Pacific Food Platform-to-Consumer Delivery Industry Market

Significant Asia Pacific Food Platform-to-Consumer Delivery Industry Industry Milestones

- August 2022: GrabFood launches in Phnom Penh, Cambodia, expanding its reach in Southeast Asia.

- August 2022: Uber Eats partners with MotionAds to offer additional income opportunities for delivery drivers.

- August 2022: Deliveroo Singapore collaborates with TreeDots to reduce food waste and operating costs.

Future Outlook for Asia Pacific Food Platform-to-Consumer Delivery Industry Market

The Asia Pacific food platform-to-consumer delivery market is poised for continued strong growth, driven by ongoing technological advancements, evolving consumer preferences, and increasing market penetration. Strategic partnerships, expansion into new markets, and innovative service offerings will be key to success for companies in this dynamic sector. The projected market size exceeding xx Million by 2033 underscores the significant potential for growth and investment in this sector.

Asia Pacific Food Platform-to-Consumer Delivery Industry Segmentation

-

1. Product type

- 1.1. Food delivery

- 1.2. Grocery delivery

- 1.3. Other

-

2. Method

- 2.1. Mome delivery

- 2.2. Office delivery

- 2.3. Other

-

3. Payment method

- 3.1. Cash on delivery

- 3.2. Online payment

- 3.3. Other

Asia Pacific Food Platform-to-Consumer Delivery Industry Segmentation By Geography

- 1. China

- 2. India

- 3. South Korea

- 4. Rest of Asia Pacific

Asia Pacific Food Platform-to-Consumer Delivery Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 10.52% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Mobile Penetration; Surge in Internet Penetration; Ease of Access and Discount on orders

- 3.3. Market Restrains

- 3.3.1. High Cost of Forestry Equipment; Lack of Information About Forestry Equipment

- 3.4. Market Trends

- 3.4.1. Smart Phones and Internet Penetrations in the region are driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Food Platform-to-Consumer Delivery Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product type

- 5.1.1. Food delivery

- 5.1.2. Grocery delivery

- 5.1.3. Other

- 5.2. Market Analysis, Insights and Forecast - by Method

- 5.2.1. Mome delivery

- 5.2.2. Office delivery

- 5.2.3. Other

- 5.3. Market Analysis, Insights and Forecast - by Payment method

- 5.3.1. Cash on delivery

- 5.3.2. Online payment

- 5.3.3. Other

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.4.2. India

- 5.4.3. South Korea

- 5.4.4. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product type

- 6. China Asia Pacific Food Platform-to-Consumer Delivery Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product type

- 6.1.1. Food delivery

- 6.1.2. Grocery delivery

- 6.1.3. Other

- 6.2. Market Analysis, Insights and Forecast - by Method

- 6.2.1. Mome delivery

- 6.2.2. Office delivery

- 6.2.3. Other

- 6.3. Market Analysis, Insights and Forecast - by Payment method

- 6.3.1. Cash on delivery

- 6.3.2. Online payment

- 6.3.3. Other

- 6.1. Market Analysis, Insights and Forecast - by Product type

- 7. India Asia Pacific Food Platform-to-Consumer Delivery Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product type

- 7.1.1. Food delivery

- 7.1.2. Grocery delivery

- 7.1.3. Other

- 7.2. Market Analysis, Insights and Forecast - by Method

- 7.2.1. Mome delivery

- 7.2.2. Office delivery

- 7.2.3. Other

- 7.3. Market Analysis, Insights and Forecast - by Payment method

- 7.3.1. Cash on delivery

- 7.3.2. Online payment

- 7.3.3. Other

- 7.1. Market Analysis, Insights and Forecast - by Product type

- 8. South Korea Asia Pacific Food Platform-to-Consumer Delivery Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product type

- 8.1.1. Food delivery

- 8.1.2. Grocery delivery

- 8.1.3. Other

- 8.2. Market Analysis, Insights and Forecast - by Method

- 8.2.1. Mome delivery

- 8.2.2. Office delivery

- 8.2.3. Other

- 8.3. Market Analysis, Insights and Forecast - by Payment method

- 8.3.1. Cash on delivery

- 8.3.2. Online payment

- 8.3.3. Other

- 8.1. Market Analysis, Insights and Forecast - by Product type

- 9. Rest of Asia Pacific Asia Pacific Food Platform-to-Consumer Delivery Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product type

- 9.1.1. Food delivery

- 9.1.2. Grocery delivery

- 9.1.3. Other

- 9.2. Market Analysis, Insights and Forecast - by Method

- 9.2.1. Mome delivery

- 9.2.2. Office delivery

- 9.2.3. Other

- 9.3. Market Analysis, Insights and Forecast - by Payment method

- 9.3.1. Cash on delivery

- 9.3.2. Online payment

- 9.3.3. Other

- 9.1. Market Analysis, Insights and Forecast - by Product type

- 10. China Asia Pacific Food Platform-to-Consumer Delivery Industry Analysis, Insights and Forecast, 2019-2031

- 11. Japan Asia Pacific Food Platform-to-Consumer Delivery Industry Analysis, Insights and Forecast, 2019-2031

- 12. India Asia Pacific Food Platform-to-Consumer Delivery Industry Analysis, Insights and Forecast, 2019-2031

- 13. South Korea Asia Pacific Food Platform-to-Consumer Delivery Industry Analysis, Insights and Forecast, 2019-2031

- 14. Taiwan Asia Pacific Food Platform-to-Consumer Delivery Industry Analysis, Insights and Forecast, 2019-2031

- 15. Australia Asia Pacific Food Platform-to-Consumer Delivery Industry Analysis, Insights and Forecast, 2019-2031

- 16. Rest of Asia-Pacific Asia Pacific Food Platform-to-Consumer Delivery Industry Analysis, Insights and Forecast, 2019-2031

- 17. Competitive Analysis

- 17.1. Market Share Analysis 2024

- 17.2. Company Profiles

- 17.2.1 Swiggy

- 17.2.1.1. Overview

- 17.2.1.2. Products

- 17.2.1.3. SWOT Analysis

- 17.2.1.4. Recent Developments

- 17.2.1.5. Financials (Based on Availability)

- 17.2.2 GoJek

- 17.2.2.1. Overview

- 17.2.2.2. Products

- 17.2.2.3. SWOT Analysis

- 17.2.2.4. Recent Developments

- 17.2.2.5. Financials (Based on Availability)

- 17.2.3 SmartBite

- 17.2.3.1. Overview

- 17.2.3.2. Products

- 17.2.3.3. SWOT Analysis

- 17.2.3.4. Recent Developments

- 17.2.3.5. Financials (Based on Availability)

- 17.2.4 GrabFood

- 17.2.4.1. Overview

- 17.2.4.2. Products

- 17.2.4.3. SWOT Analysis

- 17.2.4.4. Recent Developments

- 17.2.4.5. Financials (Based on Availability)

- 17.2.5 Dahmakan

- 17.2.5.1. Overview

- 17.2.5.2. Products

- 17.2.5.3. SWOT Analysis

- 17.2.5.4. Recent Developments

- 17.2.5.5. Financials (Based on Availability)

- 17.2.6 Delivery Guy

- 17.2.6.1. Overview

- 17.2.6.2. Products

- 17.2.6.3. SWOT Analysis

- 17.2.6.4. Recent Developments

- 17.2.6.5. Financials (Based on Availability)

- 17.2.7 Kims Kitchen

- 17.2.7.1. Overview

- 17.2.7.2. Products

- 17.2.7.3. SWOT Analysis

- 17.2.7.4. Recent Developments

- 17.2.7.5. Financials (Based on Availability)

- 17.2.8 Deliveroo

- 17.2.8.1. Overview

- 17.2.8.2. Products

- 17.2.8.3. SWOT Analysis

- 17.2.8.4. Recent Developments

- 17.2.8.5. Financials (Based on Availability)

- 17.2.1 Swiggy

List of Figures

- Figure 1: Asia Pacific Food Platform-to-Consumer Delivery Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia Pacific Food Platform-to-Consumer Delivery Industry Share (%) by Company 2024

List of Tables

- Table 1: Asia Pacific Food Platform-to-Consumer Delivery Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia Pacific Food Platform-to-Consumer Delivery Industry Revenue Million Forecast, by Product type 2019 & 2032

- Table 3: Asia Pacific Food Platform-to-Consumer Delivery Industry Revenue Million Forecast, by Method 2019 & 2032

- Table 4: Asia Pacific Food Platform-to-Consumer Delivery Industry Revenue Million Forecast, by Payment method 2019 & 2032

- Table 5: Asia Pacific Food Platform-to-Consumer Delivery Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Asia Pacific Food Platform-to-Consumer Delivery Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: China Asia Pacific Food Platform-to-Consumer Delivery Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Japan Asia Pacific Food Platform-to-Consumer Delivery Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: India Asia Pacific Food Platform-to-Consumer Delivery Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: South Korea Asia Pacific Food Platform-to-Consumer Delivery Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Taiwan Asia Pacific Food Platform-to-Consumer Delivery Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Australia Asia Pacific Food Platform-to-Consumer Delivery Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Asia-Pacific Asia Pacific Food Platform-to-Consumer Delivery Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Asia Pacific Food Platform-to-Consumer Delivery Industry Revenue Million Forecast, by Product type 2019 & 2032

- Table 15: Asia Pacific Food Platform-to-Consumer Delivery Industry Revenue Million Forecast, by Method 2019 & 2032

- Table 16: Asia Pacific Food Platform-to-Consumer Delivery Industry Revenue Million Forecast, by Payment method 2019 & 2032

- Table 17: Asia Pacific Food Platform-to-Consumer Delivery Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Asia Pacific Food Platform-to-Consumer Delivery Industry Revenue Million Forecast, by Product type 2019 & 2032

- Table 19: Asia Pacific Food Platform-to-Consumer Delivery Industry Revenue Million Forecast, by Method 2019 & 2032

- Table 20: Asia Pacific Food Platform-to-Consumer Delivery Industry Revenue Million Forecast, by Payment method 2019 & 2032

- Table 21: Asia Pacific Food Platform-to-Consumer Delivery Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Asia Pacific Food Platform-to-Consumer Delivery Industry Revenue Million Forecast, by Product type 2019 & 2032

- Table 23: Asia Pacific Food Platform-to-Consumer Delivery Industry Revenue Million Forecast, by Method 2019 & 2032

- Table 24: Asia Pacific Food Platform-to-Consumer Delivery Industry Revenue Million Forecast, by Payment method 2019 & 2032

- Table 25: Asia Pacific Food Platform-to-Consumer Delivery Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Asia Pacific Food Platform-to-Consumer Delivery Industry Revenue Million Forecast, by Product type 2019 & 2032

- Table 27: Asia Pacific Food Platform-to-Consumer Delivery Industry Revenue Million Forecast, by Method 2019 & 2032

- Table 28: Asia Pacific Food Platform-to-Consumer Delivery Industry Revenue Million Forecast, by Payment method 2019 & 2032

- Table 29: Asia Pacific Food Platform-to-Consumer Delivery Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Food Platform-to-Consumer Delivery Industry?

The projected CAGR is approximately 10.52%.

2. Which companies are prominent players in the Asia Pacific Food Platform-to-Consumer Delivery Industry?

Key companies in the market include Swiggy, GoJek, SmartBite, GrabFood, Dahmakan, Delivery Guy, Kims Kitchen, Deliveroo.

3. What are the main segments of the Asia Pacific Food Platform-to-Consumer Delivery Industry?

The market segments include Product type, Method , Payment method .

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Mobile Penetration; Surge in Internet Penetration; Ease of Access and Discount on orders.

6. What are the notable trends driving market growth?

Smart Phones and Internet Penetrations in the region are driving the Market.

7. Are there any restraints impacting market growth?

High Cost of Forestry Equipment; Lack of Information About Forestry Equipment.

8. Can you provide examples of recent developments in the market?

August 2022: The introduction of GrabFood in Phnom Penh was announced by Grab following a successful four-month "beta" test in the capital. GrabFood is the top meal delivery service in Southeast Asia, connecting customers to a wide range of food and drink options and providing on-demand delivery to customers' doors. With the new service, customers may save up to 50% when they order from GrabFood no matter how far away the restaurant or cafe is from the user's location.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Food Platform-to-Consumer Delivery Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Food Platform-to-Consumer Delivery Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Food Platform-to-Consumer Delivery Industry?

To stay informed about further developments, trends, and reports in the Asia Pacific Food Platform-to-Consumer Delivery Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence