Key Insights

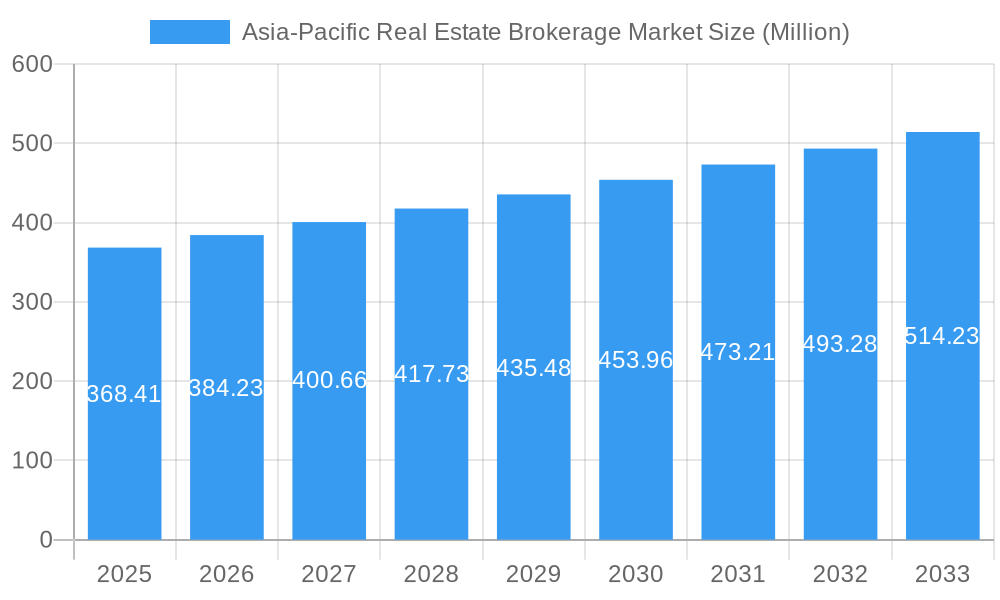

The Asia-Pacific real estate brokerage market, valued at $368.41 million in 2025, is projected to experience robust growth, driven by factors such as increasing urbanization, rising disposable incomes, and a surge in foreign direct investment across the region. The market's Compound Annual Growth Rate (CAGR) of 4.21% from 2025 to 2033 signifies a steady expansion, fueled by the growing demand for residential and commercial properties. This growth is further stimulated by the increasing adoption of technological advancements within the brokerage sector, improving efficiency and transparency in real estate transactions. Key players like CBRE Group, JLL, Colliers International, and Cushman & Wakefield are significantly shaping market dynamics through their extensive networks, innovative services, and strategic acquisitions. The market segmentation, while not explicitly detailed, likely includes residential, commercial, and industrial property brokerage, each exhibiting varying growth trajectories depending on regional economic conditions and investment patterns. Furthermore, government initiatives promoting real estate development and infrastructure projects in several Asia-Pacific countries contribute to market expansion.

Asia-Pacific Real Estate Brokerage Market Market Size (In Million)

Despite the positive outlook, the market faces challenges. These include regulatory hurdles in certain jurisdictions, fluctuating interest rates impacting affordability and investment decisions, and potential economic downturns which could temper growth. However, the long-term prospects remain promising given the region's demographic trends, sustained economic development, and the ongoing professionalization of the real estate brokerage industry. Competition among established and emerging players will intensify, leading to innovation in service offerings, marketing strategies, and technological integration to cater to evolving client needs and preferences. The market's expansion will also be influenced by factors such as sustainable development practices and the increasing demand for technologically advanced property management solutions. This dynamic landscape requires continuous adaptation and strategic planning from brokerage firms to remain competitive and capture market share in the coming years.

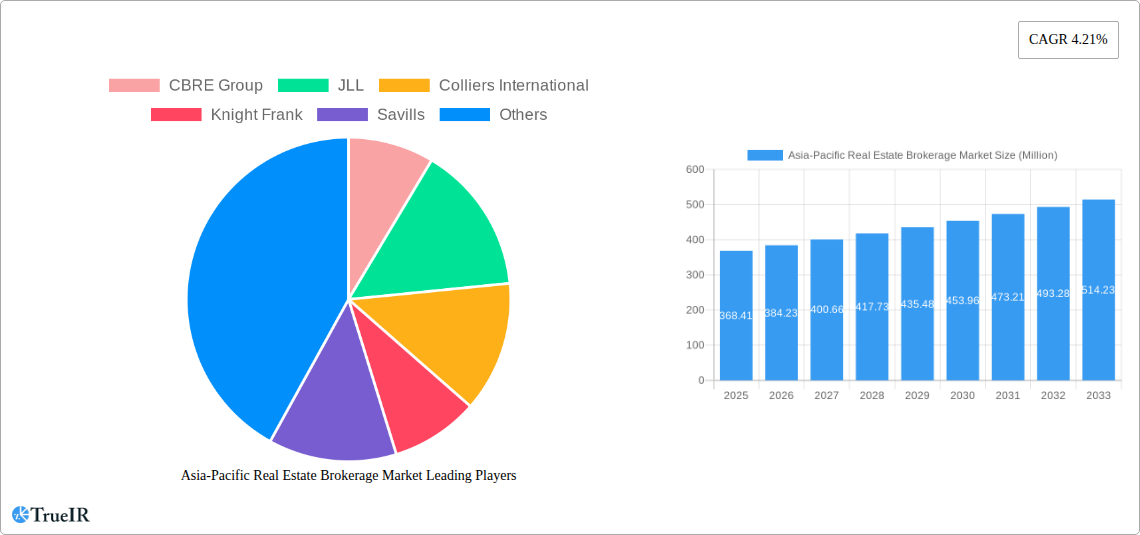

Asia-Pacific Real Estate Brokerage Market Company Market Share

Asia-Pacific Real Estate Brokerage Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Asia-Pacific real estate brokerage market, offering invaluable insights for investors, industry professionals, and strategic planners. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils the market's structure, competitive landscape, growth drivers, challenges, and future outlook. Leveraging extensive data and expert analysis, it empowers stakeholders to make informed decisions in this dynamic market.

Asia-Pacific Real Estate Brokerage Market Structure & Competitive Landscape

The Asia-Pacific real estate brokerage market exhibits a moderately concentrated structure, with a handful of multinational players dominating the landscape. The top players, including CBRE Group, JLL, Colliers International, Knight Frank, Savills, Cushman & Wakefield, Century 21 Real Estate, ERA Real Estate, RE/MAX, and Coldwell Banker, account for approximately xx% of the market share (2024). However, a significant number of smaller, regional players also contribute to the overall market activity.

Market Concentration: The Herfindahl-Hirschman Index (HHI) for the market is estimated at xx in 2024, indicating a moderately concentrated market. This concentration is largely influenced by the significant market share held by multinational firms with extensive global networks and brand recognition.

Innovation Drivers: Technological advancements, such as proptech solutions for property searches, virtual tours, and online transaction platforms, are key innovation drivers. Furthermore, the increasing demand for specialized brokerage services, catering to specific property types (commercial, residential, industrial) and client segments (high-net-worth individuals, institutional investors), drives innovation in service offerings.

Regulatory Impacts: Varying regulations across different Asia-Pacific countries significantly impact market dynamics. Licensing requirements, consumer protection laws, and foreign investment policies create diverse operational landscapes for brokerage firms. Compliance costs and varying regulatory frameworks constitute barriers to entry and expansion within the market.

Product Substitutes: Direct property sales between buyers and sellers pose a significant threat. The rise of online property portals also represents a substitute, although many consumers still value the expertise and guidance offered by experienced brokers.

End-User Segmentation: The market caters to a diverse range of end-users, including individual homebuyers and sellers, commercial real estate investors, developers, and institutional clients. Each segment exhibits distinct needs and preferences, influencing the service offerings and strategies adopted by brokerage firms.

M&A Trends: The Asia-Pacific real estate brokerage market has witnessed a considerable surge in mergers and acquisitions (M&A) activity in recent years. In 2024, the total value of M&A transactions in the region is estimated at approximately $xx Million. These transactions reflect the consolidation trend within the industry, as larger firms seek to expand their market share and geographic reach.

Asia-Pacific Real Estate Brokerage Market Market Trends & Opportunities

The Asia-Pacific real estate brokerage market is experiencing robust growth, driven by several key factors. The market size, valued at $xx Million in 2024, is projected to reach $xx Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by rapid urbanization, increasing disposable incomes, robust economic growth in several key Asian economies, and the growing preference for professionally managed real estate transactions.

Technological advancements, particularly in the realm of proptech, are transforming the market landscape. The adoption of digital marketing strategies, virtual property tours, and online transaction platforms is improving efficiency and enhancing customer experience. This has resulted in a xx% increase in online property transactions in the region between 2019 and 2024. Changing consumer preferences, particularly towards transparency, speed, and ease of transactions, are further driving market growth and demanding increased service quality from brokerage firms.

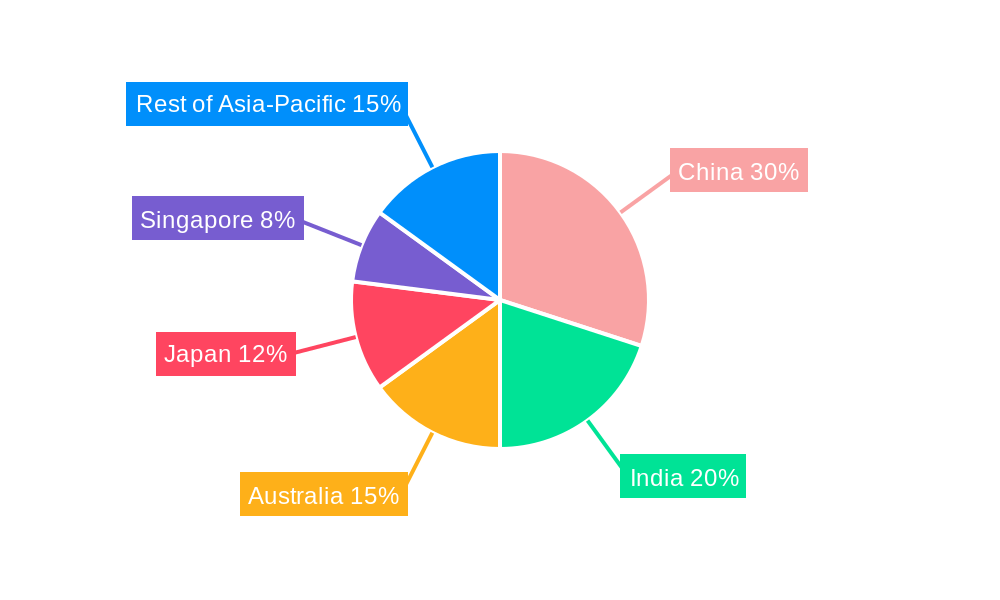

Dominant Markets & Segments in Asia-Pacific Real Estate Brokerage Market

The Asia-Pacific real estate brokerage market is characterized by diverse regional and segmental growth patterns. While several countries demonstrate strong growth trajectories, specific markets show distinct dominance within sub-regions. China and Australia represent the largest national markets, followed by Japan and India, in terms of market size and transaction value.

Key Growth Drivers:

- Robust Infrastructure Development: Significant investments in infrastructure projects, particularly in rapidly developing economies, are driving increased real estate demand and brokerage services.

- Favorable Government Policies: Policies promoting foreign direct investment (FDI) in real estate, streamlining regulatory processes, and stimulating housing development are fostering market growth.

- Growing Urbanization: Rapid urbanization in several key regions is creating a surge in demand for both residential and commercial properties, boosting brokerage activity.

- Rising Disposable Incomes: Increasing disposable incomes, particularly in the middle class, fuels demand for homeownership and investment properties, driving the need for brokerage services.

Market Dominance Analysis:

The dominance of specific markets is influenced by a combination of factors including economic development, regulatory frameworks, and the presence of major brokerage firms. The comparatively higher level of foreign investment and real estate development in markets like China and Australia contributes significantly to their leading market positions.

Asia-Pacific Real Estate Brokerage Market Product Analysis

The real estate brokerage industry offers a wide array of services, ranging from traditional sales and leasing services to specialized consulting and investment advisory roles. Technological advancements have led to the development of innovative products and services, including virtual property tours, online property platforms, and data-driven market analysis tools. These offerings cater to diverse consumer preferences, enhance transaction efficiency, and provide clients with a superior experience. The competitive advantage is shifting towards brokerage firms that effectively integrate technology into their service offerings and offer comprehensive solutions beyond traditional brokerage activities.

Key Drivers, Barriers & Challenges in Asia-Pacific Real Estate Brokerage Market

Key Drivers:

Rapid urbanization, rising disposable incomes, and supportive government policies are key drivers of market growth. Technological advancements, particularly in proptech, are revolutionizing the way real estate transactions are conducted, contributing significantly to market expansion. Furthermore, increased foreign direct investment in the real estate sector across the region is stimulating growth.

Challenges and Restraints:

Regulatory complexities, varying across different jurisdictions, create compliance challenges. Economic fluctuations and potential downturns in the real estate market represent significant threats to revenue generation. Intense competition among established and emerging brokerage firms puts pressure on profit margins. Supply chain disruptions (e.g., material shortages, construction delays) can impact development timelines, impacting the overall market.

Growth Drivers in the Asia-Pacific Real Estate Brokerage Market Market

Several factors contribute to the robust growth trajectory of the Asia-Pacific real estate brokerage market. These include a burgeoning middle class, urbanization, rising disposable incomes, and favourable government initiatives. Technological advancements, such as the integration of proptech solutions, are revolutionising transactions, improving efficiency, and enhancing customer experience. Increased foreign direct investment in the sector further boosts market activity.

Challenges Impacting Asia-Pacific Real Estate Brokerage Market Growth

The market faces significant challenges, including regulatory complexities, fluctuating economic conditions, and intensifying competition. Supply chain disruptions can impact construction and development timelines, affecting market performance. Moreover, market volatility, influenced by global economic trends and regional political factors, presents uncertainties for market participants.

Key Players Shaping the Asia-Pacific Real Estate Brokerage Market Market

- CBRE Group

- JLL

- Colliers International

- Knight Frank

- Savills

- Cushman & Wakefield

- Century 21 Real Estate

- ERA Real Estate

- RE/MAX

- Coldwell Banker

- 63 Other Companies

Significant Asia-Pacific Real Estate Brokerage Market Industry Milestones

- June 2024: Knight Frank, in collaboration with Bayleys, acquired a controlling stake in McGrath Limited, significantly impacting the Australian residential market.

- June 2024: REA Group completed its acquisition of Realtair, strengthening its agency services and technological capabilities.

Future Outlook for Asia-Pacific Real Estate Brokerage Market Market

The Asia-Pacific real estate brokerage market is poised for continued expansion, driven by sustained economic growth, urbanization, and technological innovation. Strategic partnerships, mergers and acquisitions, and the adoption of cutting-edge proptech solutions will shape the future market landscape. The focus on providing value-added services, personalized customer experiences, and data-driven insights will be crucial for success in this dynamic market.

Asia-Pacific Real Estate Brokerage Market Segmentation

-

1. Type

- 1.1. Residential

- 1.2. Non-Residential

-

2. Service

- 2.1. Sales

- 2.2. Rental

-

3. Geography

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. Australia

- 3.5. South Korea

- 3.6. Southeast Asia

- 3.7. Rest of Asia-Pacific

Asia-Pacific Real Estate Brokerage Market Segmentation By Geography

- 1. China

- 2. India

- 3. Japan

- 4. Australia

- 5. South Korea

- 6. Southeast Asia

- 7. Rest of Asia Pacific

Asia-Pacific Real Estate Brokerage Market Regional Market Share

Geographic Coverage of Asia-Pacific Real Estate Brokerage Market

Asia-Pacific Real Estate Brokerage Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.21% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Urbanization Driving the Market4.; Regulatory Environment Driving the Market

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Urbanization Driving the Market4.; Regulatory Environment Driving the Market

- 3.4. Market Trends

- 3.4.1. Demand for Residential Segment Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Real Estate Brokerage Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Residential

- 5.1.2. Non-Residential

- 5.2. Market Analysis, Insights and Forecast - by Service

- 5.2.1. Sales

- 5.2.2. Rental

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. China

- 5.3.2. India

- 5.3.3. Japan

- 5.3.4. Australia

- 5.3.5. South Korea

- 5.3.6. Southeast Asia

- 5.3.7. Rest of Asia-Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.4.2. India

- 5.4.3. Japan

- 5.4.4. Australia

- 5.4.5. South Korea

- 5.4.6. Southeast Asia

- 5.4.7. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. China Asia-Pacific Real Estate Brokerage Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Residential

- 6.1.2. Non-Residential

- 6.2. Market Analysis, Insights and Forecast - by Service

- 6.2.1. Sales

- 6.2.2. Rental

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. China

- 6.3.2. India

- 6.3.3. Japan

- 6.3.4. Australia

- 6.3.5. South Korea

- 6.3.6. Southeast Asia

- 6.3.7. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. India Asia-Pacific Real Estate Brokerage Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Residential

- 7.1.2. Non-Residential

- 7.2. Market Analysis, Insights and Forecast - by Service

- 7.2.1. Sales

- 7.2.2. Rental

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. China

- 7.3.2. India

- 7.3.3. Japan

- 7.3.4. Australia

- 7.3.5. South Korea

- 7.3.6. Southeast Asia

- 7.3.7. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Japan Asia-Pacific Real Estate Brokerage Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Residential

- 8.1.2. Non-Residential

- 8.2. Market Analysis, Insights and Forecast - by Service

- 8.2.1. Sales

- 8.2.2. Rental

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. China

- 8.3.2. India

- 8.3.3. Japan

- 8.3.4. Australia

- 8.3.5. South Korea

- 8.3.6. Southeast Asia

- 8.3.7. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Australia Asia-Pacific Real Estate Brokerage Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Residential

- 9.1.2. Non-Residential

- 9.2. Market Analysis, Insights and Forecast - by Service

- 9.2.1. Sales

- 9.2.2. Rental

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. China

- 9.3.2. India

- 9.3.3. Japan

- 9.3.4. Australia

- 9.3.5. South Korea

- 9.3.6. Southeast Asia

- 9.3.7. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. South Korea Asia-Pacific Real Estate Brokerage Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Residential

- 10.1.2. Non-Residential

- 10.2. Market Analysis, Insights and Forecast - by Service

- 10.2.1. Sales

- 10.2.2. Rental

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. China

- 10.3.2. India

- 10.3.3. Japan

- 10.3.4. Australia

- 10.3.5. South Korea

- 10.3.6. Southeast Asia

- 10.3.7. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Southeast Asia Asia-Pacific Real Estate Brokerage Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Residential

- 11.1.2. Non-Residential

- 11.2. Market Analysis, Insights and Forecast - by Service

- 11.2.1. Sales

- 11.2.2. Rental

- 11.3. Market Analysis, Insights and Forecast - by Geography

- 11.3.1. China

- 11.3.2. India

- 11.3.3. Japan

- 11.3.4. Australia

- 11.3.5. South Korea

- 11.3.6. Southeast Asia

- 11.3.7. Rest of Asia-Pacific

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Rest of Asia Pacific Asia-Pacific Real Estate Brokerage Market Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Type

- 12.1.1. Residential

- 12.1.2. Non-Residential

- 12.2. Market Analysis, Insights and Forecast - by Service

- 12.2.1. Sales

- 12.2.2. Rental

- 12.3. Market Analysis, Insights and Forecast - by Geography

- 12.3.1. China

- 12.3.2. India

- 12.3.3. Japan

- 12.3.4. Australia

- 12.3.5. South Korea

- 12.3.6. Southeast Asia

- 12.3.7. Rest of Asia-Pacific

- 12.1. Market Analysis, Insights and Forecast - by Type

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 CBRE Group

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 JLL

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Colliers International

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Knight Frank

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Savills

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Cushman & Wakefield

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Century 21 Real Estate

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 ERA Real Estate

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 RE/MAX

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Coldwell Banker**List Not Exhaustive 6 3 Other Companie

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 CBRE Group

List of Figures

- Figure 1: Asia-Pacific Real Estate Brokerage Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Real Estate Brokerage Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Real Estate Brokerage Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Asia-Pacific Real Estate Brokerage Market Volume Billion Forecast, by Type 2020 & 2033

- Table 3: Asia-Pacific Real Estate Brokerage Market Revenue Million Forecast, by Service 2020 & 2033

- Table 4: Asia-Pacific Real Estate Brokerage Market Volume Billion Forecast, by Service 2020 & 2033

- Table 5: Asia-Pacific Real Estate Brokerage Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 6: Asia-Pacific Real Estate Brokerage Market Volume Billion Forecast, by Geography 2020 & 2033

- Table 7: Asia-Pacific Real Estate Brokerage Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Asia-Pacific Real Estate Brokerage Market Volume Billion Forecast, by Region 2020 & 2033

- Table 9: Asia-Pacific Real Estate Brokerage Market Revenue Million Forecast, by Type 2020 & 2033

- Table 10: Asia-Pacific Real Estate Brokerage Market Volume Billion Forecast, by Type 2020 & 2033

- Table 11: Asia-Pacific Real Estate Brokerage Market Revenue Million Forecast, by Service 2020 & 2033

- Table 12: Asia-Pacific Real Estate Brokerage Market Volume Billion Forecast, by Service 2020 & 2033

- Table 13: Asia-Pacific Real Estate Brokerage Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 14: Asia-Pacific Real Estate Brokerage Market Volume Billion Forecast, by Geography 2020 & 2033

- Table 15: Asia-Pacific Real Estate Brokerage Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Asia-Pacific Real Estate Brokerage Market Volume Billion Forecast, by Country 2020 & 2033

- Table 17: Asia-Pacific Real Estate Brokerage Market Revenue Million Forecast, by Type 2020 & 2033

- Table 18: Asia-Pacific Real Estate Brokerage Market Volume Billion Forecast, by Type 2020 & 2033

- Table 19: Asia-Pacific Real Estate Brokerage Market Revenue Million Forecast, by Service 2020 & 2033

- Table 20: Asia-Pacific Real Estate Brokerage Market Volume Billion Forecast, by Service 2020 & 2033

- Table 21: Asia-Pacific Real Estate Brokerage Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 22: Asia-Pacific Real Estate Brokerage Market Volume Billion Forecast, by Geography 2020 & 2033

- Table 23: Asia-Pacific Real Estate Brokerage Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Asia-Pacific Real Estate Brokerage Market Volume Billion Forecast, by Country 2020 & 2033

- Table 25: Asia-Pacific Real Estate Brokerage Market Revenue Million Forecast, by Type 2020 & 2033

- Table 26: Asia-Pacific Real Estate Brokerage Market Volume Billion Forecast, by Type 2020 & 2033

- Table 27: Asia-Pacific Real Estate Brokerage Market Revenue Million Forecast, by Service 2020 & 2033

- Table 28: Asia-Pacific Real Estate Brokerage Market Volume Billion Forecast, by Service 2020 & 2033

- Table 29: Asia-Pacific Real Estate Brokerage Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 30: Asia-Pacific Real Estate Brokerage Market Volume Billion Forecast, by Geography 2020 & 2033

- Table 31: Asia-Pacific Real Estate Brokerage Market Revenue Million Forecast, by Country 2020 & 2033

- Table 32: Asia-Pacific Real Estate Brokerage Market Volume Billion Forecast, by Country 2020 & 2033

- Table 33: Asia-Pacific Real Estate Brokerage Market Revenue Million Forecast, by Type 2020 & 2033

- Table 34: Asia-Pacific Real Estate Brokerage Market Volume Billion Forecast, by Type 2020 & 2033

- Table 35: Asia-Pacific Real Estate Brokerage Market Revenue Million Forecast, by Service 2020 & 2033

- Table 36: Asia-Pacific Real Estate Brokerage Market Volume Billion Forecast, by Service 2020 & 2033

- Table 37: Asia-Pacific Real Estate Brokerage Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 38: Asia-Pacific Real Estate Brokerage Market Volume Billion Forecast, by Geography 2020 & 2033

- Table 39: Asia-Pacific Real Estate Brokerage Market Revenue Million Forecast, by Country 2020 & 2033

- Table 40: Asia-Pacific Real Estate Brokerage Market Volume Billion Forecast, by Country 2020 & 2033

- Table 41: Asia-Pacific Real Estate Brokerage Market Revenue Million Forecast, by Type 2020 & 2033

- Table 42: Asia-Pacific Real Estate Brokerage Market Volume Billion Forecast, by Type 2020 & 2033

- Table 43: Asia-Pacific Real Estate Brokerage Market Revenue Million Forecast, by Service 2020 & 2033

- Table 44: Asia-Pacific Real Estate Brokerage Market Volume Billion Forecast, by Service 2020 & 2033

- Table 45: Asia-Pacific Real Estate Brokerage Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 46: Asia-Pacific Real Estate Brokerage Market Volume Billion Forecast, by Geography 2020 & 2033

- Table 47: Asia-Pacific Real Estate Brokerage Market Revenue Million Forecast, by Country 2020 & 2033

- Table 48: Asia-Pacific Real Estate Brokerage Market Volume Billion Forecast, by Country 2020 & 2033

- Table 49: Asia-Pacific Real Estate Brokerage Market Revenue Million Forecast, by Type 2020 & 2033

- Table 50: Asia-Pacific Real Estate Brokerage Market Volume Billion Forecast, by Type 2020 & 2033

- Table 51: Asia-Pacific Real Estate Brokerage Market Revenue Million Forecast, by Service 2020 & 2033

- Table 52: Asia-Pacific Real Estate Brokerage Market Volume Billion Forecast, by Service 2020 & 2033

- Table 53: Asia-Pacific Real Estate Brokerage Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 54: Asia-Pacific Real Estate Brokerage Market Volume Billion Forecast, by Geography 2020 & 2033

- Table 55: Asia-Pacific Real Estate Brokerage Market Revenue Million Forecast, by Country 2020 & 2033

- Table 56: Asia-Pacific Real Estate Brokerage Market Volume Billion Forecast, by Country 2020 & 2033

- Table 57: Asia-Pacific Real Estate Brokerage Market Revenue Million Forecast, by Type 2020 & 2033

- Table 58: Asia-Pacific Real Estate Brokerage Market Volume Billion Forecast, by Type 2020 & 2033

- Table 59: Asia-Pacific Real Estate Brokerage Market Revenue Million Forecast, by Service 2020 & 2033

- Table 60: Asia-Pacific Real Estate Brokerage Market Volume Billion Forecast, by Service 2020 & 2033

- Table 61: Asia-Pacific Real Estate Brokerage Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 62: Asia-Pacific Real Estate Brokerage Market Volume Billion Forecast, by Geography 2020 & 2033

- Table 63: Asia-Pacific Real Estate Brokerage Market Revenue Million Forecast, by Country 2020 & 2033

- Table 64: Asia-Pacific Real Estate Brokerage Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Real Estate Brokerage Market?

The projected CAGR is approximately 4.21%.

2. Which companies are prominent players in the Asia-Pacific Real Estate Brokerage Market?

Key companies in the market include CBRE Group, JLL, Colliers International, Knight Frank, Savills, Cushman & Wakefield, Century 21 Real Estate, ERA Real Estate, RE/MAX, Coldwell Banker**List Not Exhaustive 6 3 Other Companie.

3. What are the main segments of the Asia-Pacific Real Estate Brokerage Market?

The market segments include Type, Service, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 368.41 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Urbanization Driving the Market4.; Regulatory Environment Driving the Market.

6. What are the notable trends driving market growth?

Demand for Residential Segment Driving the Market.

7. Are there any restraints impacting market growth?

4.; Increasing Urbanization Driving the Market4.; Regulatory Environment Driving the Market.

8. Can you provide examples of recent developments in the market?

June 2024: Knight Frank, a prominent global property consultancy, in collaboration with Bayleys, New Zealand's premier full-service real estate firm, successfully acquired McGrath Limited, a key player in the Australian residential real estate market. This acquisition, achieved through a controlling stake purchase via a scheme of arrangement, marks a significant milestone for both entities.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Real Estate Brokerage Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Real Estate Brokerage Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Real Estate Brokerage Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Real Estate Brokerage Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence