Key Insights

The India Commercial Building Construction market is poised for significant expansion, with a projected market size of 13891.51 million by 2033. This robust growth is underpinned by a Compound Annual Growth Rate (CAGR) of 12.1% from 2023. Key drivers include increasing urbanization, a growing middle class, and supportive government initiatives such as smart city development and affordable housing. The market is segmented by end-use, with office buildings expected to dominate, followed by retail and hospitality sectors. The North and West regions are anticipated to lead market expansion due to concentrated economic activity and infrastructure development.

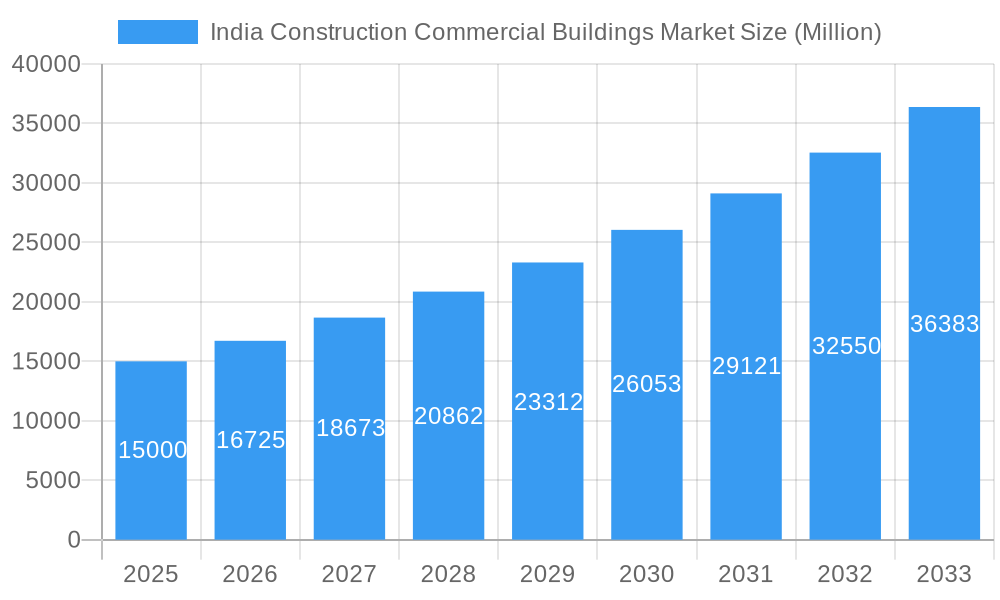

India Construction Commercial Buildings Market Market Size (In Billion)

Challenges such as land acquisition complexities, regulatory hurdles, and volatile material costs may moderate growth. Major industry players like Punjab Chemi Plants Limited and DLF Ltd are actively pursuing innovation in construction technologies and sustainable practices. Strategic partnerships, mergers, acquisitions, and technological advancements are key competitive strategies. The increasing adoption of eco-friendly building materials reflects a growing environmental consciousness. Future growth is expected to extend to tier-II and tier-III cities as urbanization spreads, although macroeconomic conditions and government policies will influence the real estate sector. The market presents substantial opportunities for investors and stakeholders.

India Construction Commercial Buildings Market Company Market Share

This comprehensive report analyzes the India Commercial Building Construction market from 2023 to 2033, with a specific focus on 2023. It offers critical insights into market dynamics, growth drivers, challenges, and future projections. The research provides detailed segmentation by end-use, including Office Building Construction, Retail Construction, Hospitality Construction, Institutional Construction, and Others, highlighting lucrative opportunities and emerging trends in the Indian commercial real estate landscape. The market size is projected to reach 13891.51 million by 2033.

India Construction Commercial Buildings Market Market Structure & Competitive Landscape

The Indian construction commercial buildings market exhibits a moderately concentrated structure, with a few large players dominating the landscape. The Herfindahl-Hirschman Index (HHI) for 2024 is estimated at xx, indicating a moderately competitive environment. However, the market also accommodates a significant number of smaller regional players.

Innovation Drivers: Technological advancements such as Building Information Modeling (BIM), prefabrication, and sustainable construction methods are significantly impacting the market. Increased adoption of these technologies is driving efficiency gains and reducing construction timelines.

Regulatory Impacts: Government policies focusing on infrastructure development, smart cities initiatives, and real estate regulations (like RERA) significantly influence market dynamics. These policies, while aiming to improve transparency and investor confidence, can also create complexities for businesses.

Product Substitutes: While traditional construction materials remain dominant, the increasing emphasis on sustainability is leading to greater adoption of eco-friendly alternatives, creating a shift in the material landscape.

End-User Segmentation: The market is segmented by end-use, with office building construction currently holding the largest share, followed by retail and hospitality sectors. The relative growth of these segments is subject to economic conditions and evolving preferences.

M&A Trends: The past five years have witnessed xx merger and acquisition (M&A) deals in the Indian commercial construction sector, primarily driven by consolidation among larger players seeking expansion and market share dominance. The total value of these deals is estimated to be xx Million.

India Construction Commercial Buildings Market Market Trends & Opportunities

The India construction commercial buildings market demonstrates robust growth potential, driven by rapid urbanization, increasing disposable incomes, and a burgeoning middle class. The market size is projected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), expanding from xx Million in 2025 to xx Million in 2033. This growth is fuelled by several factors:

- Technological advancements: Adoption of advanced construction technologies such as BIM, modular construction, and IoT-enabled building management systems is improving efficiency and project delivery times.

- Shifting consumer preferences: A preference for sustainable and environmentally friendly buildings is driving demand for green construction practices and materials.

- Competitive dynamics: The intense competition among construction firms is promoting innovation, cost optimization, and the delivery of high-quality projects. This intense competition is also driving the market towards improved customer service.

- Government initiatives: Initiatives such as "Make in India" and smart city projects are driving infrastructure development and creating ample opportunities for the commercial construction sector.

Market penetration rates for various technologies and sustainable materials are increasing steadily, although the penetration rate for modular construction is still relatively low. However, this is expected to improve significantly in the coming years. Overall, the market presents significant opportunities for growth and innovation.

Dominant Markets & Segments in India Construction Commercial Buildings Market

The dominant segment within the Indian construction commercial buildings market in 2025 is Office Building Construction. This is driven by the growth of the IT sector, increasing foreign direct investment, and the expansion of multinational corporations in India.

Key Growth Drivers for Office Building Construction:

- Robust IT sector growth: India's IT sector is experiencing phenomenal growth, fueling demand for modern office spaces in major cities.

- Favorable government policies: Government initiatives promoting ease of doing business and attracting foreign investment are positively impacting the demand for office spaces.

- Improved infrastructure: Ongoing infrastructure projects are enhancing connectivity and accessibility in various urban centers, further boosting demand.

- Growing urbanization: Rapid urbanization is creating a surge in demand for commercial real estate, particularly office spaces, in metropolitan areas.

Regional Dominance: The major metropolitan areas of Mumbai, Delhi-NCR, Bengaluru, Chennai, and Hyderabad currently account for the largest share of commercial building construction activities, driven by significant infrastructure development and economic activity.

India Construction Commercial Buildings Market Product Analysis

Technological advancements are revolutionizing the construction of commercial buildings in India. The increased adoption of prefabricated components, 3D printing technologies, and advanced building materials is leading to faster construction times, reduced costs, and improved quality. These innovations also contribute to the creation of more sustainable and energy-efficient buildings, responding to both market demand and regulatory pressures. The competitive advantage lies in efficiently integrating these technologies while maintaining affordability and quality.

Key Drivers, Barriers & Challenges in India Construction Commercial Buildings Market

Key Drivers:

- Rapid urbanization and infrastructure development: The expansion of cities and associated infrastructure needs drive demand.

- Growth of the IT and services sectors: These industries necessitate modern office spaces.

- Government initiatives: Policies supporting infrastructure projects and affordable housing.

- Increasing foreign investment: Attracts developers and construction projects.

Challenges:

- Land acquisition complexities: Lengthy processes and potential litigation delay projects. This impact is estimated to delay at least xx% of projects annually.

- Regulatory hurdles and bureaucratic delays: Navigating complex approvals can add significant costs and time.

- Supply chain disruptions: Material shortages and price volatility negatively affect construction costs and schedules. For example, steel price fluctuations in 2024 impacted project budgets by an estimated xx%.

- Skilled labor shortages: A lack of trained professionals hinders project completion timelines.

Growth Drivers in the India Construction Commercial Buildings Market Market

The primary growth drivers are a burgeoning middle class, increased disposable incomes, rising demand for modern commercial spaces, and favorable government policies supporting infrastructure development and smart cities initiatives. Technological advancements, especially in sustainable construction methods, are also bolstering market growth.

Challenges Impacting India Construction Commercial Buildings Market Growth

Key challenges include land acquisition complexities, regulatory hurdles, skilled labor shortages, and supply chain disruptions, all of which contribute to increased costs and project delays. Fluctuations in material prices also add to the uncertainty and negatively impact profit margins.

Key Players Shaping the India Construction Commercial Buildings Market Market

- Punjab Chemi Plants Limited (PCP International Ltd)

- Delhi Land And Finance Limited (DLF Ltd )

- Omaxe Ltd

- Unitech Group

- Oberoi Reality Ltd

- B L Kashyap and Sons Limited (BLK Ltd )

- NBCC Limited

- Sobha Limited

- Bharti Realty Ltd

- Prestige Group

Significant India Construction Commercial Buildings Market Industry Milestones

- 2022-Q3: Introduction of new building codes emphasizing sustainability.

- 2023-Q1: Significant investment by a major international construction firm in an Indian project.

- 2024-Q2: Launch of a large-scale green building initiative by the government.

Future Outlook for India Construction Commercial Buildings Market Market

The future outlook for the Indian construction commercial buildings market remains extremely positive, driven by sustained economic growth, urbanization, and increasing foreign investment. Strategic opportunities exist for companies that can leverage technological advancements, embrace sustainable practices, and effectively navigate regulatory complexities. The market is poised for continued expansion, presenting significant potential for both domestic and international players.

India Construction Commercial Buildings Market Segmentation

-

1. End Use

- 1.1. Office Building Construction

- 1.2. Retail Construction

- 1.3. Hospitality Construction

- 1.4. Institutional Construction

- 1.5. Others

India Construction Commercial Buildings Market Segmentation By Geography

- 1. India

India Construction Commercial Buildings Market Regional Market Share

Geographic Coverage of India Construction Commercial Buildings Market

India Construction Commercial Buildings Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Government Initiatives Promoting Affordable Housing; Economic Growth and Rising Disposable Incomes

- 3.3. Market Restrains

- 3.3.1. Shortage of Skilled Labor; Fluctuating Construction Materials Costs

- 3.4. Market Trends

- 3.4.1. Growth in Commercial Space Market unaffected

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Construction Commercial Buildings Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End Use

- 5.1.1. Office Building Construction

- 5.1.2. Retail Construction

- 5.1.3. Hospitality Construction

- 5.1.4. Institutional Construction

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. India

- 5.1. Market Analysis, Insights and Forecast - by End Use

- 6. North India India Construction Commercial Buildings Market Analysis, Insights and Forecast, 2020-2032

- 7. South India India Construction Commercial Buildings Market Analysis, Insights and Forecast, 2020-2032

- 8. East India India Construction Commercial Buildings Market Analysis, Insights and Forecast, 2020-2032

- 9. West India India Construction Commercial Buildings Market Analysis, Insights and Forecast, 2020-2032

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Punjab Chemi Plants Limited (PCP International Ltd)

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Delhi Land And Finance Limited (DLF Ltd )

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Omaxe Ltd

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Unitech Group

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Oberoi Reality Ltd

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 B L Kashyap and Sons Limited (BLK Ltd )

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 NBCC Limited

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Sobha Limited

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Bharti Realty Ltd

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Prestige Group

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Punjab Chemi Plants Limited (PCP International Ltd)

List of Figures

- Figure 1: India Construction Commercial Buildings Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: India Construction Commercial Buildings Market Share (%) by Company 2025

List of Tables

- Table 1: India Construction Commercial Buildings Market Revenue million Forecast, by Region 2020 & 2033

- Table 2: India Construction Commercial Buildings Market Revenue million Forecast, by End Use 2020 & 2033

- Table 3: India Construction Commercial Buildings Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: India Construction Commercial Buildings Market Revenue million Forecast, by Country 2020 & 2033

- Table 5: North India India Construction Commercial Buildings Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 6: South India India Construction Commercial Buildings Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 7: East India India Construction Commercial Buildings Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 8: West India India Construction Commercial Buildings Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 9: India Construction Commercial Buildings Market Revenue million Forecast, by End Use 2020 & 2033

- Table 10: India Construction Commercial Buildings Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Construction Commercial Buildings Market?

The projected CAGR is approximately 12.1%.

2. Which companies are prominent players in the India Construction Commercial Buildings Market?

Key companies in the market include Punjab Chemi Plants Limited (PCP International Ltd), Delhi Land And Finance Limited (DLF Ltd ), Omaxe Ltd, Unitech Group, Oberoi Reality Ltd, B L Kashyap and Sons Limited (BLK Ltd ), NBCC Limited, Sobha Limited, Bharti Realty Ltd, Prestige Group.

3. What are the main segments of the India Construction Commercial Buildings Market?

The market segments include End Use.

4. Can you provide details about the market size?

The market size is estimated to be USD 13891.51 million as of 2022.

5. What are some drivers contributing to market growth?

Government Initiatives Promoting Affordable Housing; Economic Growth and Rising Disposable Incomes.

6. What are the notable trends driving market growth?

Growth in Commercial Space Market unaffected.

7. Are there any restraints impacting market growth?

Shortage of Skilled Labor; Fluctuating Construction Materials Costs.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Construction Commercial Buildings Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Construction Commercial Buildings Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Construction Commercial Buildings Market?

To stay informed about further developments, trends, and reports in the India Construction Commercial Buildings Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence