Key Insights

The China residential real estate market is characterized by its dynamic nature and inherent complexities. Following a period of significant growth between 2019 and 2024, the market entered a consolidation phase in 2025. Government initiatives targeting speculative investment and housing affordability have significantly influenced market dynamics. Key drivers include ongoing urbanization, rising disposable incomes, particularly in major cities, and a shift in consumer preferences towards smaller, efficient urban dwellings. Challenges such as regional oversupply, substantial sector debt, and macroeconomic uncertainties persist. The market is anticipated to experience steady growth from 2025, underpinned by sustained urbanization and infrastructure development, leading to a more balanced and regulated environment.

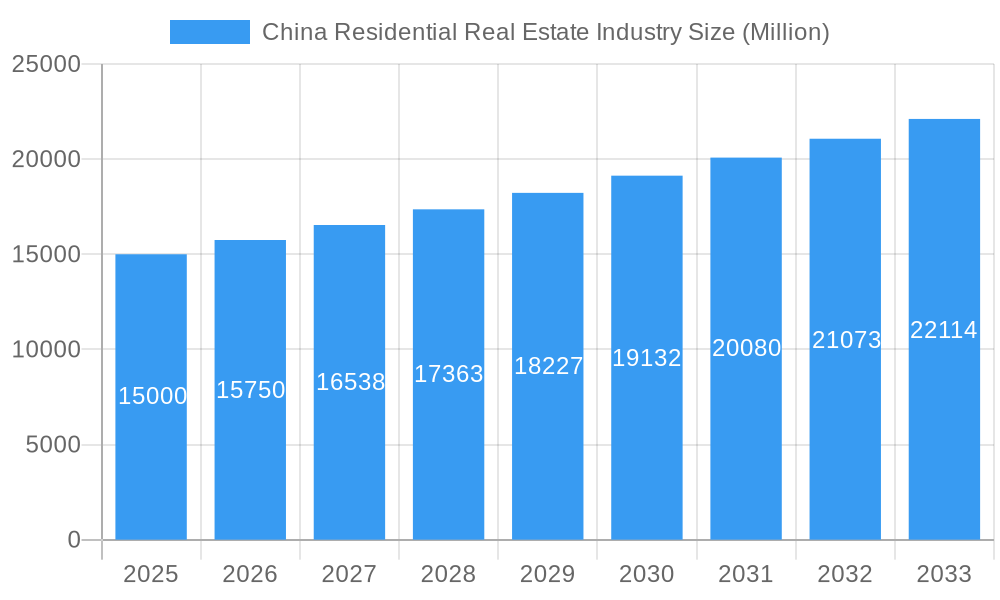

China Residential Real Estate Industry Market Size (In Billion)

Projections to 2033 indicate continued, albeit moderated, market expansion. Future performance will be shaped by demographic shifts, advancements in construction and property management technologies, and government policies promoting sustainable development. While explosive growth is less likely, the market is expected to retain substantial value, reflecting China's economic progress and persistent housing demand. Regional disparities will remain, with Tier 1 cities maintaining strong demand and pricing, while smaller cities' growth will depend on local economic conditions and infrastructure investment. Sustainable growth, affordability, and responsible development are critical for the sector's future success.

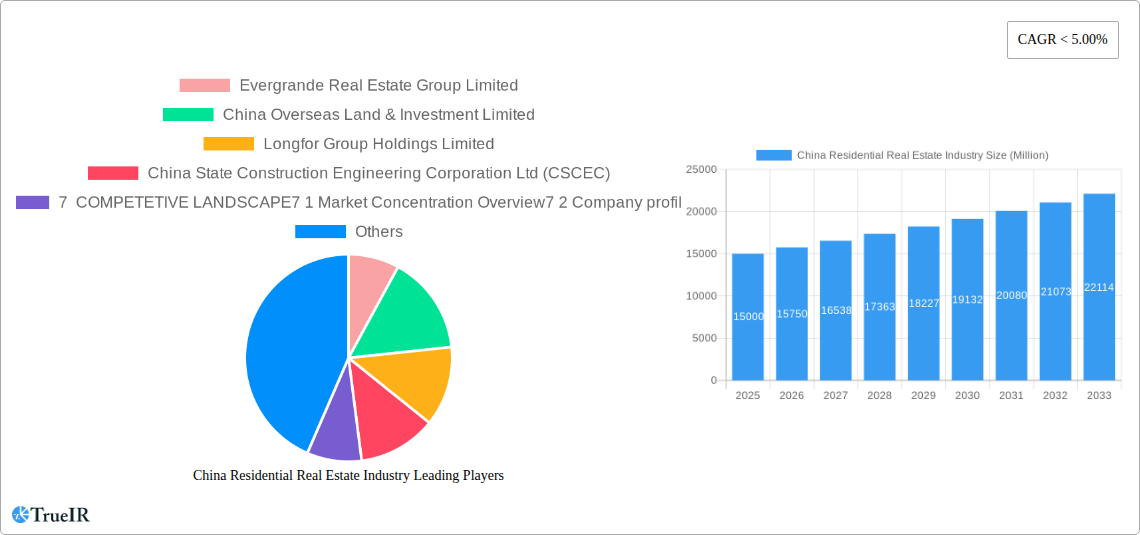

China Residential Real Estate Industry Company Market Share

China Residential Real Estate Industry Analysis: Trends and Forecasts (2019-2033)

This comprehensive report offers an in-depth analysis of the China residential real estate market, forecasting trends and opportunities from 2019 to 2033. It examines key players, market segments, and regulatory frameworks, providing essential insights for investors, developers, and industry professionals navigating this evolving landscape. The report incorporates data from the historical period (2019-2024), base year (2025), and forecasts market trends through 2033. The projected market size is 986.9 billion with a CAGR of 9.8% from 2025.

China Residential Real Estate Industry Market Structure & Competitive Landscape

This section analyzes the market concentration, innovation drivers, regulatory influence, product substitutes, end-user segmentation, and mergers & acquisitions (M&A) activity within the Chinese residential real estate sector. The market exhibits a high degree of concentration, with the top five developers controlling xx% of the market share in 2024. This concentration is expected to remain relatively stable, though the recent financial distress experienced by some large players, such as Evergrande, may lead to some restructuring and consolidation in the coming years.

- Market Concentration: The top 5 developers hold xx% market share (2024). The Herfindahl-Hirschman Index (HHI) is estimated at xx in 2024, indicating a highly concentrated market.

- Innovation Drivers: Technological advancements in construction techniques, smart home technologies, and sustainable building practices are driving innovation.

- Regulatory Impacts: Government policies, including regulations on land use, financing, and housing affordability, significantly influence market dynamics. Recent tightening of lending standards has had a noticeable impact on market activity.

- Product Substitutes: The main substitute for traditional housing is rental accommodation, which is gaining popularity, especially among younger generations.

- End-User Segmentation: The market is segmented by income level, age, family size, and location preferences. First-time homebuyers continue to make up a large proportion of the market.

- M&A Trends: M&A activity was robust in the years leading up to 2022, driven by both expansion and consolidation strategies. Post-2022, activity is expected to slow down due to regulatory and financial pressures. The total value of M&A transactions in 2024 was approximately $xx Million.

China Residential Real Estate Industry Market Trends & Opportunities

The China residential real estate market presents substantial opportunities and challenges. From 2019 to 2024, the market experienced a compound annual growth rate (CAGR) of xx%, with a total market size of approximately $xx Million in 2024. The market is projected to grow at a CAGR of xx% from 2025 to 2033, reaching a market size of $xx Million by 2033. This growth is driven by several factors, including increasing urbanization, rising disposable incomes, and government initiatives to support affordable housing. However, challenges such as rising construction costs, stringent regulatory policies, and debt concerns within the development sector require careful consideration. Technological advancements, such as the adoption of Building Information Modeling (BIM) and prefabricated construction, are streamlining the development process and boosting efficiency. Changing consumer preferences, such as a rising demand for sustainable and technologically advanced homes, influence market trends. Competitive dynamics are intense, with both established and emerging players vying for market share. Market penetration of smart home technology is expected to reach xx% by 2033, while the adoption of sustainable building practices will gradually increase, driven by government incentives and rising environmental awareness.

Dominant Markets & Segments in China Residential Real Estate Industry

Tier-1 cities, particularly Shenzhen, Beijing, Shanghai, and Guangzhou, continue to dominate the residential real estate market, attracting both domestic and international investment. However, growth in other key cities like Hangzhou and those in the Yangtze River Delta and Greater Bay Area is also significant. Apartments and condominiums represent the largest segment, while the demand for villas and landed houses remains relatively high in specific areas.

- Key Growth Drivers in Tier-1 Cities:

- Robust economic growth and job creation.

- Highly developed infrastructure and transportation networks.

- Strong government support for urban development.

- High concentration of affluent individuals.

- Key Growth Drivers in Other Key Cities:

- Increasing urbanization and population migration.

- Relatively lower housing prices compared to Tier-1 cities.

- Government initiatives to promote balanced regional development.

- Apartments & Condominiums: This segment is driven by high demand from first-time homebuyers and urban dwellers.

- Villas & Landed Houses: This segment caters to a higher-income demographic and is particularly popular in areas with well-established communities and ample green spaces. Growth in this segment is expected to be slower than for apartments.

China Residential Real Estate Industry Product Analysis

Product innovation focuses on improving energy efficiency, incorporating smart home technologies, and enhancing living spaces. The market sees increasing adoption of prefabricated construction methods and modular designs, aimed at reducing construction time and costs. These innovations improve the overall quality, energy efficiency, and functionality of residential properties, enhancing their market appeal and competitive advantage.

Key Drivers, Barriers & Challenges in China Residential Real Estate Industry

Key Drivers: Rapid urbanization, rising disposable incomes, government initiatives promoting affordable housing, and technological advancements in construction and design drive market growth. Supportive government policies, such as tax incentives and infrastructure investments, further stimulate market activity.

Challenges: The stringent regulatory environment, including restrictions on land supply and financing, poses significant challenges. Supply chain disruptions, particularly in the wake of the COVID-19 pandemic, have impacted construction timelines and costs. Intense competition among developers and fluctuations in consumer confidence also contribute to market volatility. For example, the debt crisis of Evergrande illustrated the potential impact of financial difficulties on the broader market. The impact of stringent regulatory policies and financing restrictions has resulted in a reduction in investment, estimated to affect xx% of new project starts in 2024.

Growth Drivers in the China Residential Real Estate Industry Market

Strong economic growth, supportive government policies, and technological advancements are key growth drivers. Urbanization continues to accelerate, fueling demand for residential properties. Government investments in infrastructure and improved transportation networks enhance the attractiveness of specific areas.

Challenges Impacting China Residential Real Estate Industry Growth

Regulatory complexities, including land-use restrictions and financing limitations, create hurdles. Supply chain disruptions and rising construction costs put upward pressure on prices. The intense competition between developers creates challenges in maintaining profitability and securing market share.

Key Players Shaping the China Residential Real Estate Industry Market

- Evergrande Real Estate Group Limited

- China Overseas Land & Investment Limited

- Longfor Group Holdings Limited

- China State Construction Engineering Corporation Ltd (CSCEC)

- Shimao Group Holdings Limited

- Sunac China Holdings Limited

- China Resources Land Limited

- China Vanke Co Ltd

- China Merchants Shekou Industrial Zone Holdings Co Ltd

- Country Garden Holdings Company Limited

Significant China Residential Real Estate Industry Industry Milestones

- February 2022: Dar Al-Arkan, a Saudi real estate corporation, established an office in Beijing, signifying increased international interest and collaboration opportunities.

- February 2022: China Evergrande Group sold stakes in four developments to state-owned firms for CNY 2.13 billion (USD 0.35 billion), highlighting the financial pressures faced by some major developers and the government's intervention to maintain social stability.

Future Outlook for China Residential Real Estate Industry Market

The market is poised for continued growth, driven by urbanization, rising incomes, and government support for affordable housing. Strategic opportunities lie in developing sustainable and technologically advanced properties to meet evolving consumer preferences. The market's long-term potential remains strong, despite short-term challenges.

China Residential Real Estate Industry Segmentation

-

1. Type

- 1.1. Apartments & Condominiums

- 1.2. Villas & Landed Houses

-

2. Key Cities

- 2.1. Shenzhen

- 2.2. Beijing

- 2.3. Shanghai

- 2.4. Hangzhou

- 2.5. Guangzhou

- 2.6. Other Key Cities

China Residential Real Estate Industry Segmentation By Geography

- 1. China

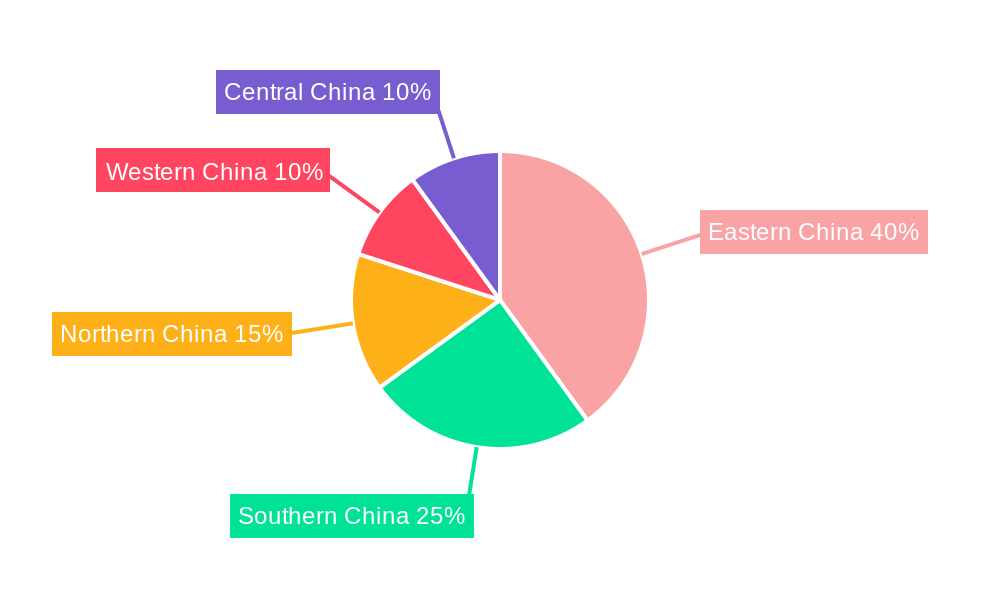

China Residential Real Estate Industry Regional Market Share

Geographic Coverage of China Residential Real Estate Industry

China Residential Real Estate Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Government Infrastructure Spending; Urbanization and Increasing Disposable Incomes

- 3.3. Market Restrains

- 3.3.1. Oversupply in the Real Estate; Labor Shortages

- 3.4. Market Trends

- 3.4.1. Urbanization Driving the Residential Real Estate Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Residential Real Estate Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Apartments & Condominiums

- 5.1.2. Villas & Landed Houses

- 5.2. Market Analysis, Insights and Forecast - by Key Cities

- 5.2.1. Shenzhen

- 5.2.2. Beijing

- 5.2.3. Shanghai

- 5.2.4. Hangzhou

- 5.2.5. Guangzhou

- 5.2.6. Other Key Cities

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Evergrande Real Estate Group Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 China Overseas Land & Investment Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Longfor Group Holdings Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 China State Construction Engineering Corporation Ltd (CSCEC)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 7 COMPETETIVE LANDSCAPE7 1 Market Concentration Overview7 2 Company profiles

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Shimao Group Holdings Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Sunac China Holdings Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 China Resources Land Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 China Vanke Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 China Merchants Shekou Industrial Zone Holdings Co Ltd **List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Country Garden Holdings Company Limited

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Evergrande Real Estate Group Limited

List of Figures

- Figure 1: China Residential Real Estate Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: China Residential Real Estate Industry Share (%) by Company 2025

List of Tables

- Table 1: China Residential Real Estate Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: China Residential Real Estate Industry Revenue billion Forecast, by Key Cities 2020 & 2033

- Table 3: China Residential Real Estate Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: China Residential Real Estate Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 5: China Residential Real Estate Industry Revenue billion Forecast, by Key Cities 2020 & 2033

- Table 6: China Residential Real Estate Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Residential Real Estate Industry?

The projected CAGR is approximately 9.8%.

2. Which companies are prominent players in the China Residential Real Estate Industry?

Key companies in the market include Evergrande Real Estate Group Limited, China Overseas Land & Investment Limited, Longfor Group Holdings Limited, China State Construction Engineering Corporation Ltd (CSCEC), 7 COMPETETIVE LANDSCAPE7 1 Market Concentration Overview7 2 Company profiles, Shimao Group Holdings Limited, Sunac China Holdings Limited, China Resources Land Limited, China Vanke Co Ltd, China Merchants Shekou Industrial Zone Holdings Co Ltd **List Not Exhaustive, Country Garden Holdings Company Limited.

3. What are the main segments of the China Residential Real Estate Industry?

The market segments include Type, Key Cities.

4. Can you provide details about the market size?

The market size is estimated to be USD 986.9 billion as of 2022.

5. What are some drivers contributing to market growth?

Government Infrastructure Spending; Urbanization and Increasing Disposable Incomes.

6. What are the notable trends driving market growth?

Urbanization Driving the Residential Real Estate Market.

7. Are there any restraints impacting market growth?

Oversupply in the Real Estate; Labor Shortages.

8. Can you provide examples of recent developments in the market?

February 2022: Dar Al-Arkan, a Saudi real estate corporation, announced the creation of an office in Beijing, China. The move is in accordance with Dar Al-strategic Arkan's expansion ambitions and builds on the company's global brand development efforts. The company's Beijing office is expected to serve a variety of tasks, including establishing joint ventures between Dar Al-Arkan and renowned Chinese real estate developers for both the Chinese and Saudi markets, as well as enhancing investment and knowledge-sharing opportunities between the two countries. Dar Al-office Arkan's will serve as a hub for Chinese enterprises and investors looking to expand, start businesses, or invest in the Kingdom.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Residential Real Estate Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Residential Real Estate Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Residential Real Estate Industry?

To stay informed about further developments, trends, and reports in the China Residential Real Estate Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence