Key Insights

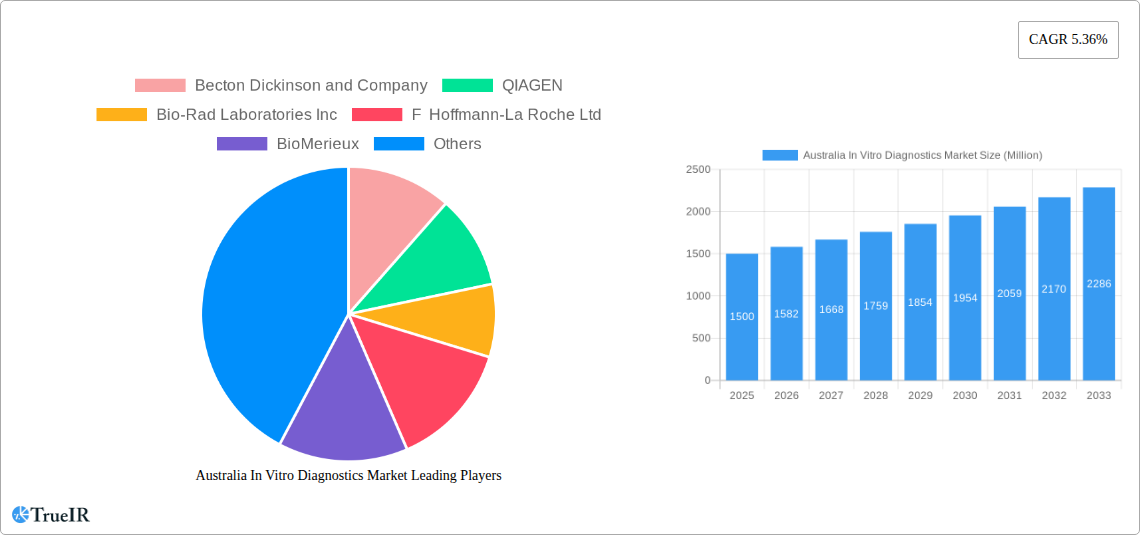

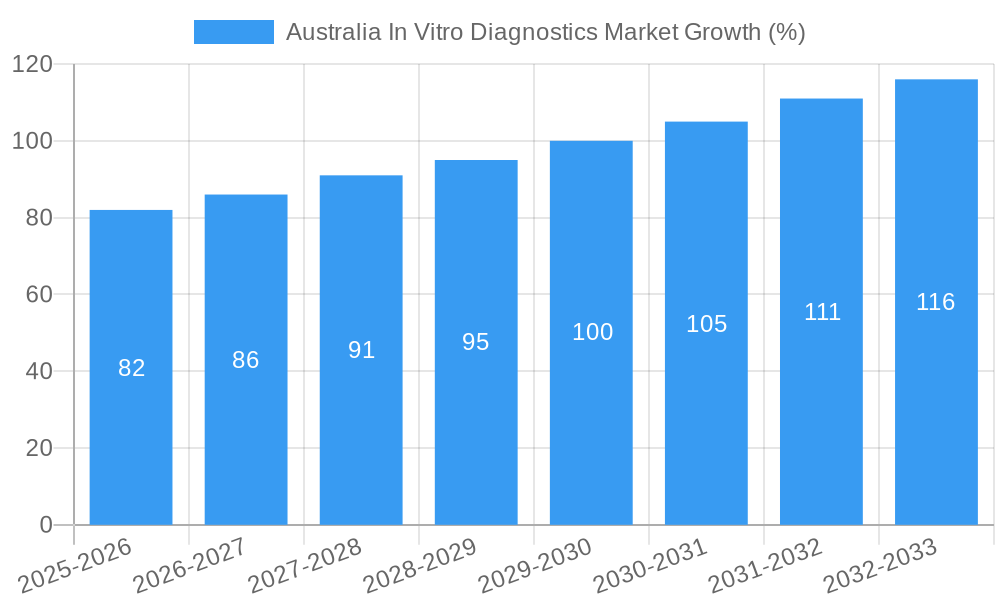

The Australian In Vitro Diagnostics (IVD) market, valued at approximately $1.5 billion in 2025, is projected to experience robust growth, driven by several key factors. Rising prevalence of chronic diseases like diabetes, cancer, and cardiovascular ailments necessitates increased diagnostic testing. Technological advancements in molecular diagnostics and automation are improving test accuracy, speed, and efficiency, leading to wider adoption. Furthermore, government initiatives promoting preventative healthcare and improved healthcare infrastructure are fueling market expansion. The market is segmented by test type (clinical chemistry, molecular diagnostics, immuno diagnostics, hematology, others), product type (instruments, reagents, others), application (infectious disease, diabetes, cancer, cardiology, autoimmune disease, others), and end-user (diagnostic laboratories, hospitals, others). The competitive landscape includes major global players such as Becton Dickinson, QIAGEN, Bio-Rad, Roche, BioMerieux, Siemens, Abbott, and Thermo Fisher Scientific, each vying for market share through product innovation and strategic partnerships. A steady CAGR of 5.36% from 2025 to 2033 suggests a substantial market expansion over the forecast period.

Despite its promising growth trajectory, the Australian IVD market faces certain challenges. High costs associated with advanced diagnostic technologies can limit accessibility, particularly in rural and remote areas. Stringent regulatory requirements and reimbursement policies can impact market entry and growth for new players. However, the increasing demand for personalized medicine and point-of-care diagnostics is expected to offset some of these restraints. The rising adoption of telemedicine and remote patient monitoring could also positively impact the market by increasing the need for rapid and accurate diagnostic testing outside of traditional healthcare settings. The forecast period reveals a consistently positive outlook, anticipating strong revenue growth across all segments. The continued investment in research and development by major players is further expected to fuel innovation and market expansion.

Australia In Vitro Diagnostics Market: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Australian In Vitro Diagnostics (IVD) market, offering valuable insights for stakeholders including manufacturers, investors, and healthcare professionals. The study period covers 2019-2033, with 2025 as the base and estimated year, and a forecast period of 2025-2033. The report leverages extensive data analysis to provide a granular understanding of market trends, segment performance, and competitive dynamics. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Australia In Vitro Diagnostics Market Market Structure & Competitive Landscape

The Australian IVD market exhibits a moderately concentrated structure, with key players like Becton Dickinson and Company, QIAGEN, Bio-Rad Laboratories Inc, F Hoffmann-La Roche Ltd, BioMérieux, Siemens AG, Abbott, and Thermo Fisher Scientific holding significant market share. The Herfindahl-Hirschman Index (HHI) is estimated at xx, indicating a moderately concentrated market. Innovation is a key driver, fueled by advancements in molecular diagnostics, automation, and point-of-care testing. Stringent regulatory oversight by the Therapeutic Goods Administration (TGA) shapes market practices, requiring robust quality control and compliance. Substitute products, such as traditional microscopy techniques, exist but are often less efficient and less accurate.

The market is segmented by end-user, primarily encompassing diagnostic laboratories, hospitals and clinics, and other end users. Diagnostic laboratories represent the largest segment, driven by increasing testing volumes and outsourcing trends. Mergers and acquisitions (M&A) activity has been relatively moderate in recent years, with xx M&A deals recorded between 2019 and 2024, primarily focused on strengthening product portfolios and expanding market reach. The average deal value is estimated at xx Million.

Australia In Vitro Diagnostics Market Market Trends & Opportunities

The Australian IVD market is experiencing robust growth driven by several factors. The increasing prevalence of chronic diseases such as diabetes, cancer, and cardiovascular diseases is boosting demand for diagnostic tests. Technological advancements, particularly in molecular diagnostics and automation, are enhancing testing accuracy, speed, and efficiency. The rising adoption of personalized medicine is creating opportunities for advanced diagnostic tools and tailored treatment plans. Furthermore, government initiatives aimed at improving healthcare infrastructure and access to diagnostic services are supporting market expansion. The market penetration rate for key diagnostic tests is increasing steadily, reaching xx% for [insert specific test type] in 2024. The overall market is expected to continue its growth trajectory, propelled by favorable demographic trends, technological innovation, and rising healthcare expenditure. The increasing adoption of telehealth and remote diagnostics also contributes to market growth, facilitating decentralized testing and expanding access to care.

Dominant Markets & Segments in Australia In Vitro Diagnostics Market

- By Test Type: Molecular diagnostics is the fastest-growing segment, driven by technological advancements and the increasing demand for early and accurate disease detection. Clinical chemistry remains a significant segment due to its broad applications across various disease areas.

- By Type of Product: Reagents constitute the largest segment, reflecting the high volume of tests conducted. Instruments are a significant segment, with demand driven by automation and the adoption of advanced diagnostic platforms.

- By Application: Infectious disease testing holds a prominent position, fueled by the ongoing need for rapid and accurate diagnosis of infectious agents. Cancer/Oncology is another major application area, reflecting the increasing prevalence of cancer and the need for effective screening and monitoring.

- By End User: Diagnostic laboratories are the dominant end-user segment, driven by their role as central testing hubs and increased outsourcing of diagnostic services. Hospitals and clinics are also significant contributors, owing to their direct involvement in patient care and in-house testing capabilities.

Key growth drivers include:

- Government funding: Increased government investment in healthcare infrastructure and diagnostic capabilities.

- Technological advancements: Continuous innovation in diagnostic technologies, leading to improved accuracy, speed, and cost-effectiveness.

- Rising prevalence of chronic diseases: The increasing burden of chronic conditions drives the demand for diagnostic testing.

Australia In Vitro Diagnostics Market Product Analysis

The Australian IVD market showcases a diverse range of products, from traditional clinical chemistry analyzers to sophisticated molecular diagnostic platforms. Technological advancements have led to the development of highly sensitive and specific assays, enabling early disease detection and improved patient management. Point-of-care testing (POCT) devices are gaining traction, offering rapid diagnostic capabilities in various settings. The competitive landscape is characterized by ongoing innovation, with companies continuously striving to improve product performance, reduce costs, and expand product portfolios to meet evolving market needs. The focus is on integrated systems, streamlined workflows, and enhanced data analytics capabilities for better disease management.

Key Drivers, Barriers & Challenges in Australia In Vitro Diagnostics Market

Key Drivers: Technological advancements (e.g., automation, AI-powered diagnostics), increasing prevalence of chronic diseases, growing healthcare expenditure, government initiatives promoting healthcare access.

Key Challenges: Stringent regulatory approvals (e.g., TGA regulations), high costs associated with advanced technologies, potential supply chain disruptions, intense competition among established players. The impact of these challenges is estimated to result in a xx% reduction in market growth in the next 3 years.

Growth Drivers in the Australia In Vitro Diagnostics Market Market

The Australian IVD market is driven by technological innovation, notably in molecular diagnostics and automation, which enhances diagnostic accuracy and efficiency. The rising prevalence of chronic diseases necessitates increased testing, fueling demand. Government initiatives supporting healthcare infrastructure and access to diagnostic services further stimulate market expansion.

Challenges Impacting Australia In Vitro Diagnostics Market Growth

Regulatory hurdles, primarily TGA approvals, impose complexities and increase time-to-market for new products. Supply chain vulnerabilities can lead to disruptions in reagent supply, impacting testing capacity. Intense competition among established multinational companies limits profit margins and necessitates constant innovation.

Key Players Shaping the Australia In Vitro Diagnostics Market Market

- Becton Dickinson and Company

- QIAGEN

- Bio-Rad Laboratories Inc

- F Hoffmann-La Roche Ltd

- BioMérieux

- Siemens AG

- Abbott

- Thermo Fisher Scientific

Significant Australia In Vitro Diagnostics Market Industry Milestones

- July 2022: Abbott's COVID-19 test kits received ARTG registration, ensuring legal supply in Australia, significantly impacting the infectious disease testing segment.

- June 2022: The collaboration between CerTest Biotec and BD to develop a monkeypox virus diagnostic test highlights the market's responsiveness to emerging infectious diseases.

Future Outlook for Australia In Vitro Diagnostics Market Market

The Australian IVD market is poised for continued growth, driven by technological advancements, increased healthcare spending, and the rising prevalence of chronic diseases. Opportunities exist in personalized medicine, point-of-care testing, and the integration of AI and big data analytics for improved diagnostic accuracy and patient management. The market's future trajectory hinges on addressing regulatory complexities, managing supply chain challenges, and fostering innovation to cater to the evolving healthcare landscape.

Australia In Vitro Diagnostics Market Segmentation

-

1. Test Type

- 1.1. Clinical Chemistry

- 1.2. Molecular Diagnostics

- 1.3. Immuno Diagnostics

- 1.4. Haematology

- 1.5. Other Test Types

-

2. Type of Product

- 2.1. Instruments

- 2.2. Reagents

- 2.3. Other Types of Product

-

3. Application

- 3.1. Infectious Disease

- 3.2. Diabetes

- 3.3. Cancer/Oncology

- 3.4. Cardiology

- 3.5. Autoimmune Disease

- 3.6. Other Applications

-

4. End User

- 4.1. Diagnostic Laboratories

- 4.2. Hospitals and Clinics

- 4.3. Other End Users

Australia In Vitro Diagnostics Market Segmentation By Geography

- 1. Australia

Australia In Vitro Diagnostics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.36% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. High Prevalence of Chronic Diseases; Increasing Use of Point-of-care (POC) Diagnostics; Advanced Technologies

- 3.3. Market Restrains

- 3.3.1. Stringent Regulations

- 3.4. Market Trends

- 3.4.1. The Molecular Diagnostics Segment is Expected to Hold a Major Market Share in the Australia In-vitro Diagnostics Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia In Vitro Diagnostics Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Test Type

- 5.1.1. Clinical Chemistry

- 5.1.2. Molecular Diagnostics

- 5.1.3. Immuno Diagnostics

- 5.1.4. Haematology

- 5.1.5. Other Test Types

- 5.2. Market Analysis, Insights and Forecast - by Type of Product

- 5.2.1. Instruments

- 5.2.2. Reagents

- 5.2.3. Other Types of Product

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Infectious Disease

- 5.3.2. Diabetes

- 5.3.3. Cancer/Oncology

- 5.3.4. Cardiology

- 5.3.5. Autoimmune Disease

- 5.3.6. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by End User

- 5.4.1. Diagnostic Laboratories

- 5.4.2. Hospitals and Clinics

- 5.4.3. Other End Users

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Test Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Becton Dickinson and Company

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 QIAGEN

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Bio-Rad Laboratories Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 F Hoffmann-La Roche Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 BioMerieux

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Siemens AG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Abbott

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Thermo Fisher Scientific

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Becton Dickinson and Company

List of Figures

- Figure 1: Australia In Vitro Diagnostics Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Australia In Vitro Diagnostics Market Share (%) by Company 2024

List of Tables

- Table 1: Australia In Vitro Diagnostics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Australia In Vitro Diagnostics Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Australia In Vitro Diagnostics Market Revenue Million Forecast, by Test Type 2019 & 2032

- Table 4: Australia In Vitro Diagnostics Market Volume K Unit Forecast, by Test Type 2019 & 2032

- Table 5: Australia In Vitro Diagnostics Market Revenue Million Forecast, by Type of Product 2019 & 2032

- Table 6: Australia In Vitro Diagnostics Market Volume K Unit Forecast, by Type of Product 2019 & 2032

- Table 7: Australia In Vitro Diagnostics Market Revenue Million Forecast, by Application 2019 & 2032

- Table 8: Australia In Vitro Diagnostics Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 9: Australia In Vitro Diagnostics Market Revenue Million Forecast, by End User 2019 & 2032

- Table 10: Australia In Vitro Diagnostics Market Volume K Unit Forecast, by End User 2019 & 2032

- Table 11: Australia In Vitro Diagnostics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 12: Australia In Vitro Diagnostics Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 13: Australia In Vitro Diagnostics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Australia In Vitro Diagnostics Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 15: Australia In Vitro Diagnostics Market Revenue Million Forecast, by Test Type 2019 & 2032

- Table 16: Australia In Vitro Diagnostics Market Volume K Unit Forecast, by Test Type 2019 & 2032

- Table 17: Australia In Vitro Diagnostics Market Revenue Million Forecast, by Type of Product 2019 & 2032

- Table 18: Australia In Vitro Diagnostics Market Volume K Unit Forecast, by Type of Product 2019 & 2032

- Table 19: Australia In Vitro Diagnostics Market Revenue Million Forecast, by Application 2019 & 2032

- Table 20: Australia In Vitro Diagnostics Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 21: Australia In Vitro Diagnostics Market Revenue Million Forecast, by End User 2019 & 2032

- Table 22: Australia In Vitro Diagnostics Market Volume K Unit Forecast, by End User 2019 & 2032

- Table 23: Australia In Vitro Diagnostics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Australia In Vitro Diagnostics Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia In Vitro Diagnostics Market?

The projected CAGR is approximately 5.36%.

2. Which companies are prominent players in the Australia In Vitro Diagnostics Market?

Key companies in the market include Becton Dickinson and Company, QIAGEN, Bio-Rad Laboratories Inc, F Hoffmann-La Roche Ltd, BioMerieux, Siemens AG, Abbott, Thermo Fisher Scientific.

3. What are the main segments of the Australia In Vitro Diagnostics Market?

The market segments include Test Type, Type of Product, Application, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

High Prevalence of Chronic Diseases; Increasing Use of Point-of-care (POC) Diagnostics; Advanced Technologies.

6. What are the notable trends driving market growth?

The Molecular Diagnostics Segment is Expected to Hold a Major Market Share in the Australia In-vitro Diagnostics Market.

7. Are there any restraints impacting market growth?

Stringent Regulations.

8. Can you provide examples of recent developments in the market?

July 2022: COVID-19 test kits were included in the Australian Register of Therapeutic Goods (ARTG) for legal supply in Australia by Abbott.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia In Vitro Diagnostics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia In Vitro Diagnostics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia In Vitro Diagnostics Market?

To stay informed about further developments, trends, and reports in the Australia In Vitro Diagnostics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence