Key Insights

The Canadian restaurant industry, valued at approximately $XX million in 2025, is experiencing robust growth, projected to maintain a Compound Annual Growth Rate (CAGR) of 26.40% from 2025 to 2033. This expansion is fueled by several key drivers. A rising population, increased disposable incomes, and shifting consumer preferences towards convenient and diverse dining experiences are significantly contributing to market growth. The industry's dynamism is further enhanced by the emergence of innovative food concepts, technological advancements in ordering and delivery systems (e.g., online ordering platforms, delivery apps), and a growing emphasis on sustainability and ethical sourcing within the supply chain. The increasing popularity of casual dining and quick-service restaurants (QSRs) is also a notable trend, alongside the rise of ghost kitchens and cloud kitchens catering to the booming food delivery sector. However, challenges remain, including increasing operating costs, labor shortages, and supply chain disruptions that can impact profitability. The industry’s segmentation across outlet types (chained, independent), locations (leisure, lodging, retail, standalone, travel), and foodservice types (cafes, bars) offers various investment and expansion opportunities. Companies like A&W, Yum! Brands, and Wendy's are key players, constantly adapting to evolving consumer demands.

The Canadian restaurant industry’s future trajectory hinges on effectively navigating these challenges and capitalizing on emerging opportunities. Strategic investments in technology, employee training, and sustainable practices will be crucial for sustained growth. Expansion into new markets, particularly within provinces exhibiting strong population growth, will likely be a key strategy for larger restaurant chains. The rise of health-conscious consumers presents another key avenue for growth, with many restaurants incorporating healthier menu options and promoting sustainable ingredients. Furthermore, tailored marketing and branding efforts to cater to diverse demographic segments will be necessary for maintaining a competitive edge in this dynamic market. Analyzing consumer trends and adapting swiftly to changing preferences will be essential for both established players and new entrants seeking to thrive in this exciting yet competitive landscape.

Canadian Restaurant Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Canadian restaurant industry, offering invaluable insights for investors, operators, and industry stakeholders. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report leverages rigorous data analysis to illuminate current market dynamics and future growth potential. The market is valued at XX Million in 2025 and is projected to reach XX Million by 2033, exhibiting a CAGR of XX%.

Canadian Restaurant Industry Market Structure & Competitive Landscape

The Canadian restaurant industry boasts a diverse ecosystem, encompassing large multinational chains and independent, locally-owned establishments. While market concentration remains relatively low, with the top five players holding an estimated [Insert Updated Percentage]% market share in 2025 (Source needed), the landscape is dynamic. This fragmentation fuels intense competition, driving continuous innovation and adaptable pricing strategies. However, a notable trend towards consolidation is emerging, evidenced by a surge in mergers and acquisitions (M&A) activity. The number of M&A deals within the sector experienced robust growth, rising from [Insert 2019 Figure] in 2019 to [Insert 2024 Figure] in 2024 (Source needed), reflecting a heightened interest in expansion and market share dominance. This trend is likely to reshape the competitive landscape in the coming years.

- Key Factors Shaping the Competitive Landscape:

- Innovation: Restaurants are increasingly leveraging menu innovation, technological advancements (e.g., online ordering systems, robust delivery partnerships, and personalized mobile apps), and loyalty programs to achieve competitive differentiation and enhance customer engagement.

- Regulation: Navigating a complex regulatory environment, including health and safety regulations, labor laws, and licensing requirements, poses significant operational challenges and directly impacts profitability and operational efficiency. Compliance and adaptation are critical for sustained success.

- Product Substitutes: The rise of meal kit delivery services and the continued expansion of grocery delivery platforms present a substantial competitive threat, demanding strategic adaptation and differentiation to retain market share.

- End-User Segmentation: Understanding diverse consumer segments based on demographics (age, income, location), lifestyle preferences (healthy eating trends, sustainability concerns, convenience-focused choices), and dining occasions (casual dining, fine dining, special events) is crucial for targeted marketing and menu development.

Canadian Restaurant Industry Market Trends & Opportunities

The Canadian restaurant market is exhibiting robust growth, fueled by several key factors: rising disposable incomes, evolving consumer preferences (e.g., increased demand for healthier options and personalized experiences), and ongoing urbanization trends. The market size, currently estimated at [Insert Updated 2025 Figure] Million in 2025 (Source needed), is projected to reach [Insert Updated 2033 Figure] Million by 2033 (Source needed). Technological advancements, including online ordering systems, delivery apps, and contactless payment options, are transforming customer experiences and creating exciting new avenues for growth. Consumers increasingly prioritize healthier choices, personalized dining experiences, and greater convenience, presenting significant opportunities for restaurants that can adapt and cater to these demands. The competitive landscape remains dynamic, with established chains and innovative newcomers vying for market share.

Dominant Markets & Segments in Canadian Restaurant Industry

Growth within the Canadian restaurant industry demonstrates notable regional variations. Ontario and British Columbia remain the largest markets, driven by high population density, robust tourism sectors, and thriving economic activity. However, other provinces are also experiencing significant growth, reflecting the expanding appeal of diverse culinary experiences across the nation.

- Key Growth Drivers:

- Outlet Type: Both chained outlets (leveraging economies of scale and brand recognition) and independent outlets (offering unique dining experiences and fostering strong community connections) are vital contributors to the market's overall growth.

- Location: The leisure and travel sectors are experiencing accelerated growth due to increased tourism and recreational activities, boosting demand in resort areas and popular tourist destinations. Retail locations also play a significant role in market expansion, particularly within urban and suburban centers.

- Foodservice Type: While cafes and bars maintain their enduring appeal, the fast-casual and quick-service segments are experiencing particularly rapid expansion, reflecting evolving consumer preferences for convenient and affordable meal options.

Canadian Restaurant Industry Product Analysis

Innovation in the Canadian restaurant industry focuses on menu diversification, personalized offerings, and technological integration. Restaurants are increasingly adopting technology to enhance operational efficiency, personalize customer experiences (e.g., loyalty programs, customized recommendations), and expand their reach through online ordering and delivery platforms. These innovations are crucial for staying competitive and meeting evolving consumer preferences. The market's success hinges on restaurants adapting to changing consumer demands for healthy, convenient, and technologically integrated dining experiences.

Key Drivers, Barriers & Challenges in Canadian Restaurant Industry

Key Drivers:

- Rising disposable incomes and evolving consumer preferences are driving demand for diverse and innovative dining experiences, including specialized cuisines and unique culinary offerings.

- Technological advancements continue to improve operational efficiency, streamline processes, and expand market reach through online ordering platforms, delivery services, and targeted digital marketing campaigns.

- Tourism and urbanization are contributing significantly to market expansion, creating opportunities in various segments and geographical locations.

Key Challenges:

- Supply Chain Disruptions: Fluctuating ingredient costs, supply chain bottlenecks, and geopolitical uncertainties pose significant threats to profitability and operational stability. The impact of these disruptions is estimated to have cost the industry [Insert Updated 2024 Figure] Million in 2024 (Source needed).

- Regulatory Hurdles: Strict health and safety regulations, labor laws, and licensing requirements increase operational complexities and necessitate significant investments in compliance measures.

- Intense Competition: The fragmented market necessitates continuous innovation, effective marketing strategies, and a keen understanding of consumer preferences to successfully compete and secure market share.

- Labor Shortages: The industry faces ongoing challenges related to attracting and retaining skilled employees, impacting operational efficiency and overall service quality.

- Inflationary Pressures: Rising costs for food, labor, and energy present significant challenges to profitability and necessitate effective cost management strategies.

Growth Drivers in the Canadian Restaurant Industry Market

The industry's growth is fueled by rising disposable incomes, a burgeoning tourism sector, and increasing urbanization. Technological advancements enhance operational efficiency and customer experience, further bolstering growth. Government initiatives supporting local businesses and tourism also contribute positively.

Challenges Impacting Canadian Restaurant Industry Growth

Significant challenges include supply chain volatility, labor shortages, and rising operating costs. Strict regulations and intense competition add to the pressures faced by restaurant operators, necessitating strategic adaptability and cost-optimization measures. Labor shortages alone are estimated to cost the industry XX Million in lost revenue in 2025.

Key Players Shaping the Canadian Restaurant Industry Market

- A & W Food Services of Canada Inc

- Yum! Brands Inc

- Northland Properties Corporation

- Doctor's Associates Inc

- Inspire Brands Inc

- Seven & I Holdings Co Ltd

- RECIPE Unlimited Corporation

- The Wendy's Company

- Domino's Pizza Inc

Significant Canadian Restaurant Industry Milestones

- November 2022: 7-Eleven launched three new licensed outlets in Edmonton, expanding its food offerings. This demonstrates a strategic move towards diversifying revenue streams and capturing a wider customer base.

- December 2022: 7-Eleven initiated a strategic expansion, converting existing restaurants into authorized outlets with fine dining options. This reflects a shift towards higher-value customer segments.

- December 2022: MTY Food Group acquired Wetzel’s Pretzels, expanding its portfolio and strengthening its market position. This acquisition signals a significant consolidation move in the industry.

Future Outlook for Canadian Restaurant Industry Market

The Canadian restaurant industry is poised for continued growth, driven by evolving consumer preferences, technological innovation, and strategic expansion by key players. The market will witness increased competition, but also new opportunities for operators who can adapt to the changing landscape and leverage technological advancements to enhance efficiency, personalize customer experiences, and expand their market reach. The industry will need to continue to adapt to ever changing circumstances in the years to come.

Canadian Restaurant Industry Segmentation

-

1. Foodservice Type

-

1.1. Cafes & Bars

-

1.1.1. By Cuisine

- 1.1.1.1. Bars & Pubs

- 1.1.1.2. Juice/Smoothie/Desserts Bars

- 1.1.1.3. Specialist Coffee & Tea Shops

-

1.1.1. By Cuisine

- 1.2. Cloud Kitchen

-

1.3. Full Service Restaurants

- 1.3.1. Asian

- 1.3.2. European

- 1.3.3. Latin American

- 1.3.4. Middle Eastern

- 1.3.5. North American

- 1.3.6. Other FSR Cuisines

-

1.4. Quick Service Restaurants

- 1.4.1. Bakeries

- 1.4.2. Burger

- 1.4.3. Ice Cream

- 1.4.4. Meat-based Cuisines

- 1.4.5. Pizza

- 1.4.6. Other QSR Cuisines

-

1.1. Cafes & Bars

-

2. Outlet

- 2.1. Chained Outlets

- 2.2. Independent Outlets

-

3. Location

- 3.1. Leisure

- 3.2. Lodging

- 3.3. Retail

- 3.4. Standalone

- 3.5. Travel

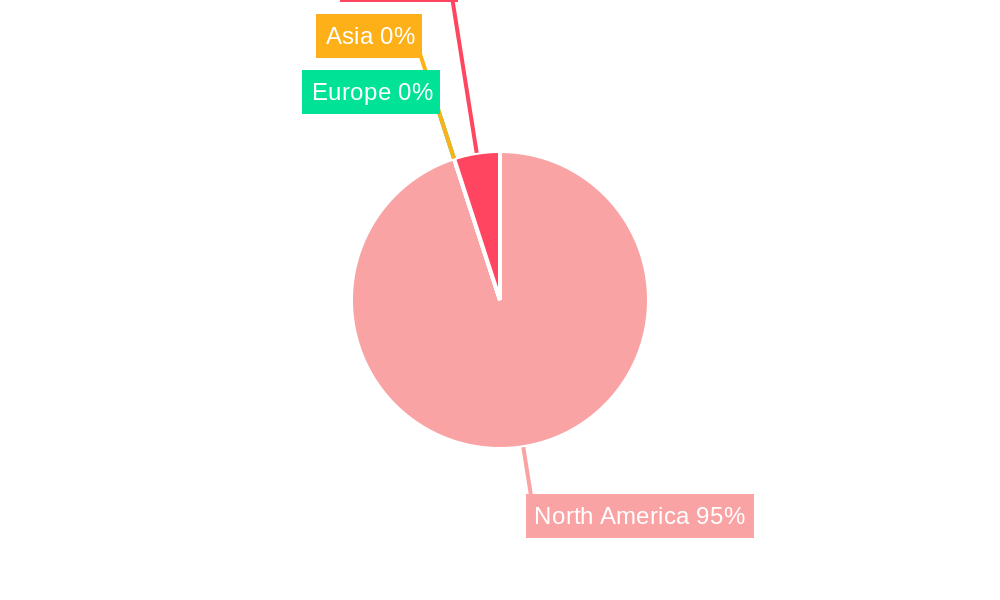

Canadian Restaurant Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Canadian Restaurant Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 26.40% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Urbanization; Growing Disposable Income

- 3.3. Market Restrains

- 3.3.1. High-price and additional delivery charges

- 3.4. Market Trends

- 3.4.1. Increase in number of QSRs and street food vendors owing to the rise in popularity of on-the-go meals

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Canadian Restaurant Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 5.1.1. Cafes & Bars

- 5.1.1.1. By Cuisine

- 5.1.1.1.1. Bars & Pubs

- 5.1.1.1.2. Juice/Smoothie/Desserts Bars

- 5.1.1.1.3. Specialist Coffee & Tea Shops

- 5.1.1.1. By Cuisine

- 5.1.2. Cloud Kitchen

- 5.1.3. Full Service Restaurants

- 5.1.3.1. Asian

- 5.1.3.2. European

- 5.1.3.3. Latin American

- 5.1.3.4. Middle Eastern

- 5.1.3.5. North American

- 5.1.3.6. Other FSR Cuisines

- 5.1.4. Quick Service Restaurants

- 5.1.4.1. Bakeries

- 5.1.4.2. Burger

- 5.1.4.3. Ice Cream

- 5.1.4.4. Meat-based Cuisines

- 5.1.4.5. Pizza

- 5.1.4.6. Other QSR Cuisines

- 5.1.1. Cafes & Bars

- 5.2. Market Analysis, Insights and Forecast - by Outlet

- 5.2.1. Chained Outlets

- 5.2.2. Independent Outlets

- 5.3. Market Analysis, Insights and Forecast - by Location

- 5.3.1. Leisure

- 5.3.2. Lodging

- 5.3.3. Retail

- 5.3.4. Standalone

- 5.3.5. Travel

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 6. North America Canadian Restaurant Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 6.1.1. Cafes & Bars

- 6.1.1.1. By Cuisine

- 6.1.1.1.1. Bars & Pubs

- 6.1.1.1.2. Juice/Smoothie/Desserts Bars

- 6.1.1.1.3. Specialist Coffee & Tea Shops

- 6.1.1.1. By Cuisine

- 6.1.2. Cloud Kitchen

- 6.1.3. Full Service Restaurants

- 6.1.3.1. Asian

- 6.1.3.2. European

- 6.1.3.3. Latin American

- 6.1.3.4. Middle Eastern

- 6.1.3.5. North American

- 6.1.3.6. Other FSR Cuisines

- 6.1.4. Quick Service Restaurants

- 6.1.4.1. Bakeries

- 6.1.4.2. Burger

- 6.1.4.3. Ice Cream

- 6.1.4.4. Meat-based Cuisines

- 6.1.4.5. Pizza

- 6.1.4.6. Other QSR Cuisines

- 6.1.1. Cafes & Bars

- 6.2. Market Analysis, Insights and Forecast - by Outlet

- 6.2.1. Chained Outlets

- 6.2.2. Independent Outlets

- 6.3. Market Analysis, Insights and Forecast - by Location

- 6.3.1. Leisure

- 6.3.2. Lodging

- 6.3.3. Retail

- 6.3.4. Standalone

- 6.3.5. Travel

- 6.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 7. South America Canadian Restaurant Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 7.1.1. Cafes & Bars

- 7.1.1.1. By Cuisine

- 7.1.1.1.1. Bars & Pubs

- 7.1.1.1.2. Juice/Smoothie/Desserts Bars

- 7.1.1.1.3. Specialist Coffee & Tea Shops

- 7.1.1.1. By Cuisine

- 7.1.2. Cloud Kitchen

- 7.1.3. Full Service Restaurants

- 7.1.3.1. Asian

- 7.1.3.2. European

- 7.1.3.3. Latin American

- 7.1.3.4. Middle Eastern

- 7.1.3.5. North American

- 7.1.3.6. Other FSR Cuisines

- 7.1.4. Quick Service Restaurants

- 7.1.4.1. Bakeries

- 7.1.4.2. Burger

- 7.1.4.3. Ice Cream

- 7.1.4.4. Meat-based Cuisines

- 7.1.4.5. Pizza

- 7.1.4.6. Other QSR Cuisines

- 7.1.1. Cafes & Bars

- 7.2. Market Analysis, Insights and Forecast - by Outlet

- 7.2.1. Chained Outlets

- 7.2.2. Independent Outlets

- 7.3. Market Analysis, Insights and Forecast - by Location

- 7.3.1. Leisure

- 7.3.2. Lodging

- 7.3.3. Retail

- 7.3.4. Standalone

- 7.3.5. Travel

- 7.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 8. Europe Canadian Restaurant Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 8.1.1. Cafes & Bars

- 8.1.1.1. By Cuisine

- 8.1.1.1.1. Bars & Pubs

- 8.1.1.1.2. Juice/Smoothie/Desserts Bars

- 8.1.1.1.3. Specialist Coffee & Tea Shops

- 8.1.1.1. By Cuisine

- 8.1.2. Cloud Kitchen

- 8.1.3. Full Service Restaurants

- 8.1.3.1. Asian

- 8.1.3.2. European

- 8.1.3.3. Latin American

- 8.1.3.4. Middle Eastern

- 8.1.3.5. North American

- 8.1.3.6. Other FSR Cuisines

- 8.1.4. Quick Service Restaurants

- 8.1.4.1. Bakeries

- 8.1.4.2. Burger

- 8.1.4.3. Ice Cream

- 8.1.4.4. Meat-based Cuisines

- 8.1.4.5. Pizza

- 8.1.4.6. Other QSR Cuisines

- 8.1.1. Cafes & Bars

- 8.2. Market Analysis, Insights and Forecast - by Outlet

- 8.2.1. Chained Outlets

- 8.2.2. Independent Outlets

- 8.3. Market Analysis, Insights and Forecast - by Location

- 8.3.1. Leisure

- 8.3.2. Lodging

- 8.3.3. Retail

- 8.3.4. Standalone

- 8.3.5. Travel

- 8.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 9. Middle East & Africa Canadian Restaurant Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 9.1.1. Cafes & Bars

- 9.1.1.1. By Cuisine

- 9.1.1.1.1. Bars & Pubs

- 9.1.1.1.2. Juice/Smoothie/Desserts Bars

- 9.1.1.1.3. Specialist Coffee & Tea Shops

- 9.1.1.1. By Cuisine

- 9.1.2. Cloud Kitchen

- 9.1.3. Full Service Restaurants

- 9.1.3.1. Asian

- 9.1.3.2. European

- 9.1.3.3. Latin American

- 9.1.3.4. Middle Eastern

- 9.1.3.5. North American

- 9.1.3.6. Other FSR Cuisines

- 9.1.4. Quick Service Restaurants

- 9.1.4.1. Bakeries

- 9.1.4.2. Burger

- 9.1.4.3. Ice Cream

- 9.1.4.4. Meat-based Cuisines

- 9.1.4.5. Pizza

- 9.1.4.6. Other QSR Cuisines

- 9.1.1. Cafes & Bars

- 9.2. Market Analysis, Insights and Forecast - by Outlet

- 9.2.1. Chained Outlets

- 9.2.2. Independent Outlets

- 9.3. Market Analysis, Insights and Forecast - by Location

- 9.3.1. Leisure

- 9.3.2. Lodging

- 9.3.3. Retail

- 9.3.4. Standalone

- 9.3.5. Travel

- 9.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 10. Asia Pacific Canadian Restaurant Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 10.1.1. Cafes & Bars

- 10.1.1.1. By Cuisine

- 10.1.1.1.1. Bars & Pubs

- 10.1.1.1.2. Juice/Smoothie/Desserts Bars

- 10.1.1.1.3. Specialist Coffee & Tea Shops

- 10.1.1.1. By Cuisine

- 10.1.2. Cloud Kitchen

- 10.1.3. Full Service Restaurants

- 10.1.3.1. Asian

- 10.1.3.2. European

- 10.1.3.3. Latin American

- 10.1.3.4. Middle Eastern

- 10.1.3.5. North American

- 10.1.3.6. Other FSR Cuisines

- 10.1.4. Quick Service Restaurants

- 10.1.4.1. Bakeries

- 10.1.4.2. Burger

- 10.1.4.3. Ice Cream

- 10.1.4.4. Meat-based Cuisines

- 10.1.4.5. Pizza

- 10.1.4.6. Other QSR Cuisines

- 10.1.1. Cafes & Bars

- 10.2. Market Analysis, Insights and Forecast - by Outlet

- 10.2.1. Chained Outlets

- 10.2.2. Independent Outlets

- 10.3. Market Analysis, Insights and Forecast - by Location

- 10.3.1. Leisure

- 10.3.2. Lodging

- 10.3.3. Retail

- 10.3.4. Standalone

- 10.3.5. Travel

- 10.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 11. United States Canadian Restaurant Industry Analysis, Insights and Forecast, 2019-2031

- 12. Canada Canadian Restaurant Industry Analysis, Insights and Forecast, 2019-2031

- 13. Mexico Canadian Restaurant Industry Analysis, Insights and Forecast, 2019-2031

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 A & W Food Services of Canada Inc

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Yum! Brands Inc

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Northland Properties Corporation

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Doctor's Associates Inc

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Inspire Brands Inc

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Seven & I Holdings Co Ltd

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 RECIPE Unlimited Corporation

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 The Wendy's Company

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Domino's Pizza Inc

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.1 A & W Food Services of Canada Inc

List of Figures

- Figure 1: Global Canadian Restaurant Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Canadian Restaurant Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Canadian Restaurant Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America Canadian Restaurant Industry Revenue (Million), by Foodservice Type 2024 & 2032

- Figure 5: North America Canadian Restaurant Industry Revenue Share (%), by Foodservice Type 2024 & 2032

- Figure 6: North America Canadian Restaurant Industry Revenue (Million), by Outlet 2024 & 2032

- Figure 7: North America Canadian Restaurant Industry Revenue Share (%), by Outlet 2024 & 2032

- Figure 8: North America Canadian Restaurant Industry Revenue (Million), by Location 2024 & 2032

- Figure 9: North America Canadian Restaurant Industry Revenue Share (%), by Location 2024 & 2032

- Figure 10: North America Canadian Restaurant Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: North America Canadian Restaurant Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: South America Canadian Restaurant Industry Revenue (Million), by Foodservice Type 2024 & 2032

- Figure 13: South America Canadian Restaurant Industry Revenue Share (%), by Foodservice Type 2024 & 2032

- Figure 14: South America Canadian Restaurant Industry Revenue (Million), by Outlet 2024 & 2032

- Figure 15: South America Canadian Restaurant Industry Revenue Share (%), by Outlet 2024 & 2032

- Figure 16: South America Canadian Restaurant Industry Revenue (Million), by Location 2024 & 2032

- Figure 17: South America Canadian Restaurant Industry Revenue Share (%), by Location 2024 & 2032

- Figure 18: South America Canadian Restaurant Industry Revenue (Million), by Country 2024 & 2032

- Figure 19: South America Canadian Restaurant Industry Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe Canadian Restaurant Industry Revenue (Million), by Foodservice Type 2024 & 2032

- Figure 21: Europe Canadian Restaurant Industry Revenue Share (%), by Foodservice Type 2024 & 2032

- Figure 22: Europe Canadian Restaurant Industry Revenue (Million), by Outlet 2024 & 2032

- Figure 23: Europe Canadian Restaurant Industry Revenue Share (%), by Outlet 2024 & 2032

- Figure 24: Europe Canadian Restaurant Industry Revenue (Million), by Location 2024 & 2032

- Figure 25: Europe Canadian Restaurant Industry Revenue Share (%), by Location 2024 & 2032

- Figure 26: Europe Canadian Restaurant Industry Revenue (Million), by Country 2024 & 2032

- Figure 27: Europe Canadian Restaurant Industry Revenue Share (%), by Country 2024 & 2032

- Figure 28: Middle East & Africa Canadian Restaurant Industry Revenue (Million), by Foodservice Type 2024 & 2032

- Figure 29: Middle East & Africa Canadian Restaurant Industry Revenue Share (%), by Foodservice Type 2024 & 2032

- Figure 30: Middle East & Africa Canadian Restaurant Industry Revenue (Million), by Outlet 2024 & 2032

- Figure 31: Middle East & Africa Canadian Restaurant Industry Revenue Share (%), by Outlet 2024 & 2032

- Figure 32: Middle East & Africa Canadian Restaurant Industry Revenue (Million), by Location 2024 & 2032

- Figure 33: Middle East & Africa Canadian Restaurant Industry Revenue Share (%), by Location 2024 & 2032

- Figure 34: Middle East & Africa Canadian Restaurant Industry Revenue (Million), by Country 2024 & 2032

- Figure 35: Middle East & Africa Canadian Restaurant Industry Revenue Share (%), by Country 2024 & 2032

- Figure 36: Asia Pacific Canadian Restaurant Industry Revenue (Million), by Foodservice Type 2024 & 2032

- Figure 37: Asia Pacific Canadian Restaurant Industry Revenue Share (%), by Foodservice Type 2024 & 2032

- Figure 38: Asia Pacific Canadian Restaurant Industry Revenue (Million), by Outlet 2024 & 2032

- Figure 39: Asia Pacific Canadian Restaurant Industry Revenue Share (%), by Outlet 2024 & 2032

- Figure 40: Asia Pacific Canadian Restaurant Industry Revenue (Million), by Location 2024 & 2032

- Figure 41: Asia Pacific Canadian Restaurant Industry Revenue Share (%), by Location 2024 & 2032

- Figure 42: Asia Pacific Canadian Restaurant Industry Revenue (Million), by Country 2024 & 2032

- Figure 43: Asia Pacific Canadian Restaurant Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Canadian Restaurant Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Canadian Restaurant Industry Revenue Million Forecast, by Foodservice Type 2019 & 2032

- Table 3: Global Canadian Restaurant Industry Revenue Million Forecast, by Outlet 2019 & 2032

- Table 4: Global Canadian Restaurant Industry Revenue Million Forecast, by Location 2019 & 2032

- Table 5: Global Canadian Restaurant Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Canadian Restaurant Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States Canadian Restaurant Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada Canadian Restaurant Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico Canadian Restaurant Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Canadian Restaurant Industry Revenue Million Forecast, by Foodservice Type 2019 & 2032

- Table 11: Global Canadian Restaurant Industry Revenue Million Forecast, by Outlet 2019 & 2032

- Table 12: Global Canadian Restaurant Industry Revenue Million Forecast, by Location 2019 & 2032

- Table 13: Global Canadian Restaurant Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 14: United States Canadian Restaurant Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Canada Canadian Restaurant Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Mexico Canadian Restaurant Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Global Canadian Restaurant Industry Revenue Million Forecast, by Foodservice Type 2019 & 2032

- Table 18: Global Canadian Restaurant Industry Revenue Million Forecast, by Outlet 2019 & 2032

- Table 19: Global Canadian Restaurant Industry Revenue Million Forecast, by Location 2019 & 2032

- Table 20: Global Canadian Restaurant Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 21: Brazil Canadian Restaurant Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Argentina Canadian Restaurant Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Rest of South America Canadian Restaurant Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Global Canadian Restaurant Industry Revenue Million Forecast, by Foodservice Type 2019 & 2032

- Table 25: Global Canadian Restaurant Industry Revenue Million Forecast, by Outlet 2019 & 2032

- Table 26: Global Canadian Restaurant Industry Revenue Million Forecast, by Location 2019 & 2032

- Table 27: Global Canadian Restaurant Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 28: United Kingdom Canadian Restaurant Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Germany Canadian Restaurant Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: France Canadian Restaurant Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Italy Canadian Restaurant Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Spain Canadian Restaurant Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Russia Canadian Restaurant Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Benelux Canadian Restaurant Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Nordics Canadian Restaurant Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Rest of Europe Canadian Restaurant Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Global Canadian Restaurant Industry Revenue Million Forecast, by Foodservice Type 2019 & 2032

- Table 38: Global Canadian Restaurant Industry Revenue Million Forecast, by Outlet 2019 & 2032

- Table 39: Global Canadian Restaurant Industry Revenue Million Forecast, by Location 2019 & 2032

- Table 40: Global Canadian Restaurant Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 41: Turkey Canadian Restaurant Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Israel Canadian Restaurant Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: GCC Canadian Restaurant Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: North Africa Canadian Restaurant Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: South Africa Canadian Restaurant Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Rest of Middle East & Africa Canadian Restaurant Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Global Canadian Restaurant Industry Revenue Million Forecast, by Foodservice Type 2019 & 2032

- Table 48: Global Canadian Restaurant Industry Revenue Million Forecast, by Outlet 2019 & 2032

- Table 49: Global Canadian Restaurant Industry Revenue Million Forecast, by Location 2019 & 2032

- Table 50: Global Canadian Restaurant Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 51: China Canadian Restaurant Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: India Canadian Restaurant Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: Japan Canadian Restaurant Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: South Korea Canadian Restaurant Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: ASEAN Canadian Restaurant Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Oceania Canadian Restaurant Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: Rest of Asia Pacific Canadian Restaurant Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canadian Restaurant Industry?

The projected CAGR is approximately 26.40%.

2. Which companies are prominent players in the Canadian Restaurant Industry?

Key companies in the market include A & W Food Services of Canada Inc, Yum! Brands Inc, Northland Properties Corporation, Doctor's Associates Inc, Inspire Brands Inc, Seven & I Holdings Co Ltd, RECIPE Unlimited Corporation, The Wendy's Company, Domino's Pizza Inc.

3. What are the main segments of the Canadian Restaurant Industry?

The market segments include Foodservice Type, Outlet, Location.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Urbanization; Growing Disposable Income.

6. What are the notable trends driving market growth?

Increase in number of QSRs and street food vendors owing to the rise in popularity of on-the-go meals.

7. Are there any restraints impacting market growth?

High-price and additional delivery charges.

8. Can you provide examples of recent developments in the market?

December 2022: 7-Eleven announced that it started increasing its footprint in Canada by converting a number of its restaurants into authorized outlets with fine dining seating.December 2022: MTY Food Group Inc., one of its wholly owned subsidiaries, acquired all of the issued and outstanding shares of COP WP Parent Inc. (Wetzel’s Pretzels) from CenterOak Partners. Wetzel’s Pretzels is an American chain of fast-food restaurants specializing in pretzels and hot dogs, operating in the United States, Canada, and Central America.November 2022: 7-Eleven declared the launch of its three new licensed 7-Eleven outlets in Edmonton with a few newly added food items on its menu.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canadian Restaurant Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canadian Restaurant Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canadian Restaurant Industry?

To stay informed about further developments, trends, and reports in the Canadian Restaurant Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence