Key Insights

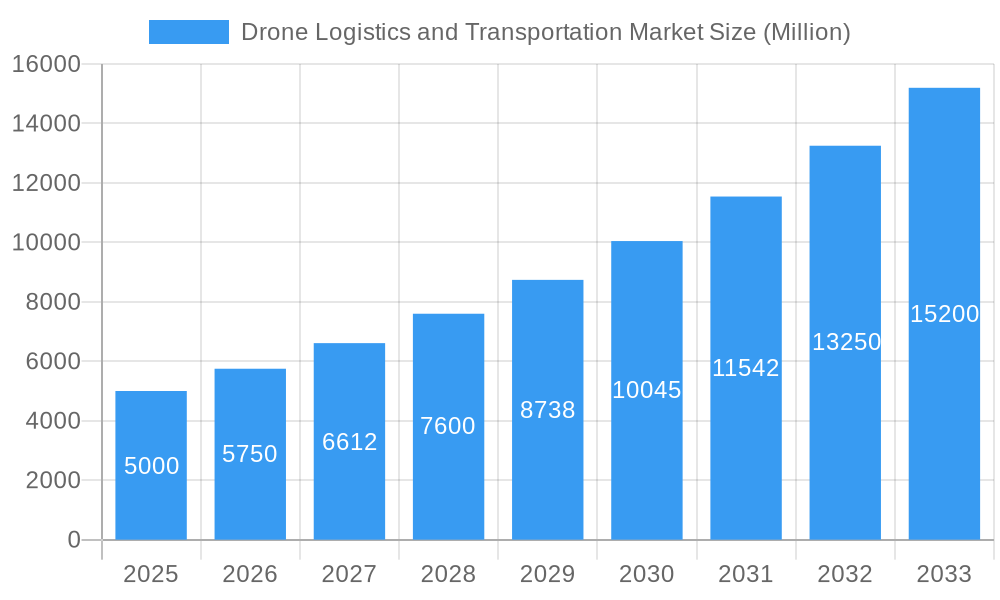

The drone logistics and transportation market is experiencing substantial expansion, propelled by the escalating demand for expedited, efficient, and cost-effective delivery solutions across diverse industries. With a robust Compound Annual Growth Rate (CAGR) projected to exceed 15% from 2019 to 2033, this sector demonstrates a strong growth trajectory. Key drivers include the burgeoning e-commerce sector, particularly for last-mile delivery, the critical need for efficient medical supply chains in remote areas, and the increasing integration of drones by military and commercial entities for surveillance and cargo operations. Technological advancements, including enhanced drone autonomy, extended flight durations, and improved payload capacities, are significantly contributing to market growth. While regulatory frameworks and safety considerations present challenges, ongoing technological innovation and supportive governmental policies are actively addressing these constraints. The market is segmented by sector (commercial, military) and application (retail & logistics, food delivery, medical supply), presenting considerable opportunities across all segments. North America, led by the United States, and the Asia-Pacific region, particularly China and India, are at the forefront, supported by advanced technological infrastructure and high adoption rates. Leading innovators include Zipline, Flirtey, and Matternet, alongside established logistics giants like Amazon and UPS integrating drone technology into their operations. These expanding applications and technological advancements promise sustained market growth.

Drone Logistics and Transportation Market Market Size (In Billion)

The forecast from 2025 to 2033 indicates continued strong expansion, with the market size anticipated to reach $2.1 billion. Persistent e-commerce growth and the rise of just-in-time delivery models will sustain demand. Addressing infrastructure limitations and implementing robust air traffic management systems are crucial for fully realizing the market's potential. The competitive landscape features a dynamic interplay between established logistics providers and specialized drone technology firms, fostering both collaboration and competition in solution development and deployment. Prioritizing safety, reliability, and regulatory compliance will be paramount for maintaining this positive growth trend.

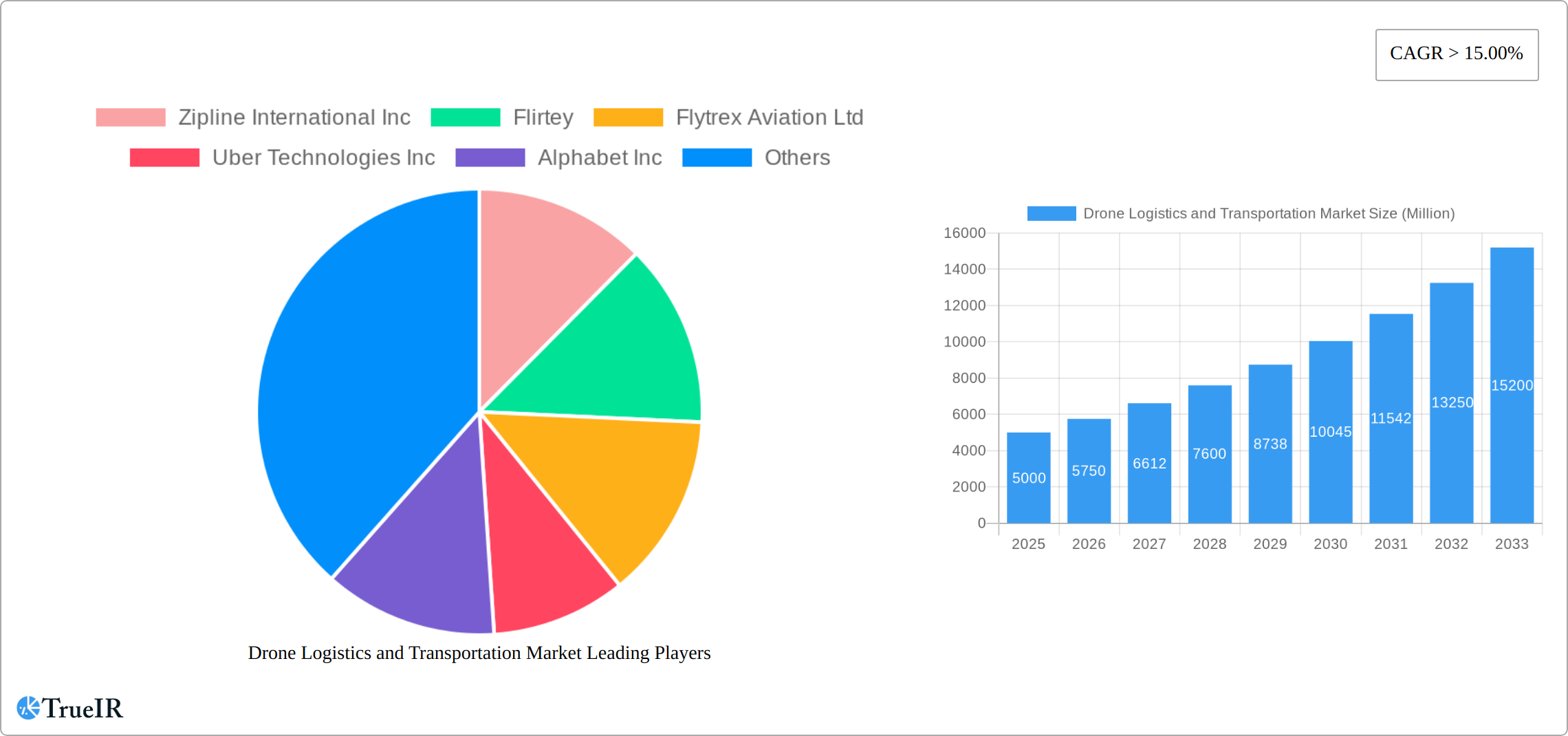

Drone Logistics and Transportation Market Company Market Share

Drone Logistics and Transportation Market: A Comprehensive Report (2019-2033)

This dynamic report provides a comprehensive analysis of the burgeoning Drone Logistics and Transportation Market, offering invaluable insights for investors, industry professionals, and strategic decision-makers. Leveraging extensive research and data analysis spanning the period 2019-2033 (Base Year: 2025, Forecast Period: 2025-2033), this report unravels the market's structure, competitive landscape, and future trajectory. With a focus on key segments – Commercial and Military sectors, and applications like Retail & Logistics, Food Delivery, and Medical Supply – this report illuminates the growth drivers, challenges, and opportunities shaping this rapidly evolving market. The estimated market size in 2025 is valued at xx Million, projecting significant growth throughout the forecast period.

Drone Logistics and Transportation Market Market Structure & Competitive Landscape

The drone logistics and transportation market presents a dynamic and evolving competitive landscape. While exhibiting characteristics of a moderately concentrated market structure, the presence of both established industry giants and agile, innovative startups contributes to a high degree of competition. The market concentration ratio (CR4) in 2025 is estimated at xx%, highlighting the interplay between established players and emerging disruptors. Several key factors significantly shape this landscape. Rapid advancements in battery technology, autonomous navigation systems, and increased payload capacities are continuously pushing the boundaries of what's possible. Simultaneously, the regulatory environment is in constant flux, creating both opportunities for growth and challenges for market participants, with varying degrees of drone integration across different global regions. While traditional transportation methods still maintain a significant market share, their dominance is progressively eroding as drone technology matures and offers compelling cost and time advantages, particularly for last-mile delivery. Market segmentation is primarily driven by application, with the Retail & Logistics sector currently dominating due to the explosive growth of e-commerce. Furthermore, the market is witnessing a surge in mergers and acquisitions (M&A) activity, with an estimated xx million in M&A deals concluded in 2024, signifying a trend of industry consolidation and expansion.

- Key Factors Influencing Market Structure and Competition:

- Technological Advancements: Rapid progress in AI, beyond visual line of sight (BVLOS) operations, and advanced sensor technologies.

- Regulatory Landscape: The evolving regulatory approvals and frameworks across different jurisdictions significantly impact market entry and expansion.

- Infrastructure Development: The development of specialized drone delivery hubs and supporting infrastructure is crucial for widespread adoption.

- Cost-Effectiveness: The ongoing comparison and competition with traditional logistics methods based on cost efficiency and speed.

- Consumer Demand: The increasing consumer demand for faster and more convenient delivery options is a primary growth driver.

Drone Logistics and Transportation Market Market Trends & Opportunities

The Drone Logistics and Transportation market is experiencing remarkable growth, driven by a confluence of factors. The market is projected to witness a Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033, expanding to an estimated xx Million by 2033. This robust growth is fueled by several key trends. Technological advancements, such as improved battery life and enhanced autonomous flight capabilities, are significantly impacting market penetration. Consumer preferences are shifting towards faster and more efficient delivery solutions, thereby augmenting the adoption of drone technology. Competitive dynamics are marked by both collaboration and competition, with established players partnering with startups to leverage specialized technologies and expertise. Market penetration rates are steadily increasing across various applications, particularly in sectors like e-commerce, healthcare, and emergency services. The commercial sector is experiencing higher growth rates compared to the military segment, mainly due to increasing investments in logistics and delivery infrastructure.

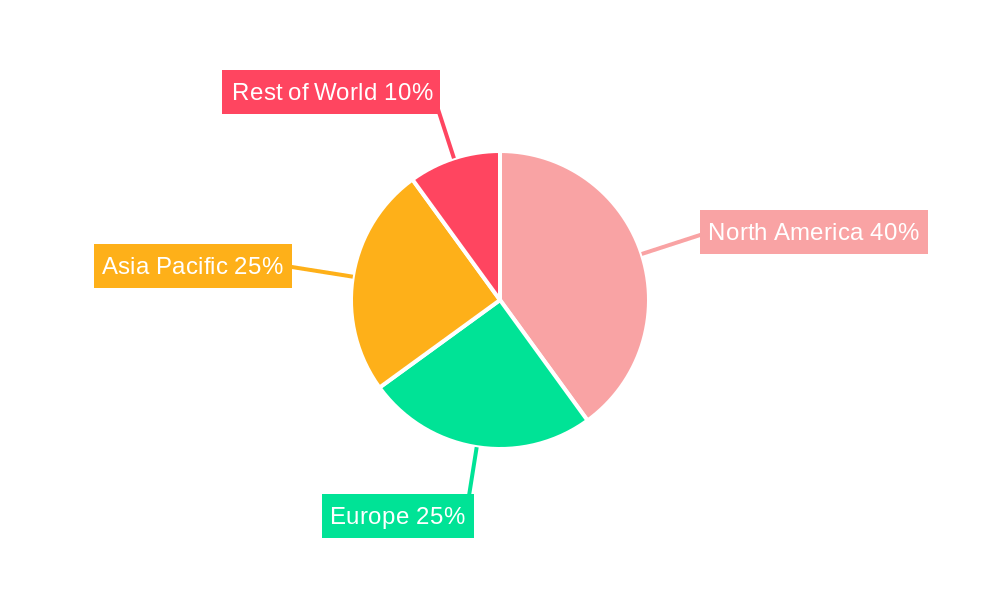

Dominant Markets & Segments in Drone Logistics and Transportation Market

North America currently holds the leading position in the global drone logistics and transportation market, driven by supportive regulatory environments and significant investment in technological innovation. Within the sector, the commercial sector is the dominant force, largely fueled by the robust growth of e-commerce and the compelling need for efficient last-mile delivery solutions. In terms of applications, the Retail and Logistics sector maintains its leading position, followed by rapidly growing segments such as Food Delivery and Medical Supply. These latter sectors are experiencing remarkable growth driven by increased demand and the potential for transformative improvements in healthcare logistics, including faster delivery of time-sensitive medical supplies and improved patient outcomes.

- Key Growth Drivers by Region and Application:

- North America: Strong regulatory support, robust technology infrastructure, high levels of consumer adoption, and substantial venture capital investment.

- Commercial Sector: The ongoing e-commerce boom, the persistent demand for faster delivery times, and the potential for cost optimization in logistics.

- Retail & Logistics Application: The continued expansion of the e-commerce market and the crucial need for efficient last-mile delivery solutions.

- Food Delivery Application: The rise of on-demand food delivery services and the resulting demand for rapid and reliable delivery times.

- Medical Supply Application: The time-critical nature of medical deliveries and the immense potential to improve healthcare outcomes through faster and more efficient delivery.

Drone Logistics and Transportation Market Product Analysis

The Drone Logistics and Transportation market showcases diverse product innovations, including specialized drones designed for various payloads and operational conditions. These advancements range from improved battery technology, which extends flight range and operational time, to advanced sensor integration for enhanced situational awareness and autonomous navigation. The competitive advantage lies in delivering superior payload capacity, range, reliability, and safety features, while adhering to evolving regulatory compliance requirements. The market demonstrates a strong inclination toward integration with existing logistics infrastructure and efficient software solutions for flight planning, monitoring, and fleet management.

Key Drivers, Barriers & Challenges in Drone Logistics and Transportation Market

Key Drivers:

The market's growth trajectory is propelled by several key factors. Significant technological advancements, including improvements in battery technology, enhanced autonomous flight capabilities, and increasingly sophisticated sensor integration are driving innovation and market expansion. Economic factors, particularly the growing demand for expedited delivery options and the potential for considerable cost reductions in logistics, represent significant market drivers. Furthermore, supportive government regulations and policies designed to encourage drone adoption further accelerate market growth.

Challenges and Restraints:

Despite the significant growth potential, the market faces considerable challenges. Regulatory hurdles, including complex airspace management and stringent safety regulations, create uncertainty and delays. Supply chain disruptions, particularly concerning crucial components such as batteries and sensors, pose significant risks to market stability. High upfront investment costs and the need for specialized skilled personnel can hinder wider market adoption. Lastly, fierce competition among established players and emerging startups creates a dynamic and potentially disruptive market landscape. Annual losses attributed to regulatory delays are estimated at xx million, highlighting the significant impact of regulatory uncertainties.

Growth Drivers in the Drone Logistics and Transportation Market Market

The growth of the drone logistics and transportation market is propelled by several key drivers. Technological advancements, particularly in battery technology and autonomous flight systems, enhance efficiency and expand operational capabilities. The increasing demand for faster and more efficient delivery solutions, driven by e-commerce and consumer expectations, further stimulates market growth. Furthermore, supportive government regulations and policies aimed at fostering drone adoption are crucial in shaping a positive market environment.

Challenges Impacting Drone Logistics and Transportation Market Growth

Several critical factors are currently hindering the full growth potential of the drone logistics and transportation market. The complexity and continuous evolution of regulatory frameworks often create uncertainty and delay market entry for new players. Vulnerabilities within the supply chain, especially regarding essential components, pose substantial risks to market stability and reliability. Intense competition among both established industry leaders and innovative new entrants necessitates a constant focus on innovation and strategic adaptation to maintain a competitive edge in this rapidly evolving market.

Key Players Shaping the Drone Logistics and Transportation Market Market

Significant Drone Logistics and Transportation Market Industry Milestones

- 2020: Amazon secures FAA approval for BVLOS drone delivery operations.

- 2021: Zipline expands its medical delivery operations to multiple African countries.

- 2022: Matternet launches its autonomous drone delivery system in urban environments.

- 2023: Several major logistics companies announce partnerships to develop and deploy drone delivery fleets.

- 2024: Significant investments are made in developing drone-specific infrastructure and air traffic management systems.

Future Outlook for Drone Logistics and Transportation Market Market

The future of the Drone Logistics and Transportation market is exceedingly promising. Continued technological advancements, increasing regulatory clarity, and growing consumer demand will propel significant market expansion. Strategic partnerships between technology companies, logistics providers, and regulatory bodies will be instrumental in shaping the market's future. The market is poised for substantial growth, with opportunities for innovation and diversification across various sectors and applications.

Drone Logistics and Transportation Market Segmentation

-

1. Sector

- 1.1. Commercial

- 1.2. Military

-

2. Application

- 2.1. Retail and Logistics

- 2.2. Food Delivery

- 2.3. Medical Supply

Drone Logistics and Transportation Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. France

- 2.3. Germany

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

- 4. Rest of the World

Drone Logistics and Transportation Market Regional Market Share

Geographic Coverage of Drone Logistics and Transportation Market

Drone Logistics and Transportation Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 45.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. The Retail and Logistics Segment to Witness Rapid Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Drone Logistics and Transportation Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 5.1.1. Commercial

- 5.1.2. Military

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Retail and Logistics

- 5.2.2. Food Delivery

- 5.2.3. Medical Supply

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 6. North America Drone Logistics and Transportation Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Sector

- 6.1.1. Commercial

- 6.1.2. Military

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Retail and Logistics

- 6.2.2. Food Delivery

- 6.2.3. Medical Supply

- 6.1. Market Analysis, Insights and Forecast - by Sector

- 7. Europe Drone Logistics and Transportation Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Sector

- 7.1.1. Commercial

- 7.1.2. Military

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Retail and Logistics

- 7.2.2. Food Delivery

- 7.2.3. Medical Supply

- 7.1. Market Analysis, Insights and Forecast - by Sector

- 8. Asia Pacific Drone Logistics and Transportation Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Sector

- 8.1.1. Commercial

- 8.1.2. Military

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Retail and Logistics

- 8.2.2. Food Delivery

- 8.2.3. Medical Supply

- 8.1. Market Analysis, Insights and Forecast - by Sector

- 9. Rest of the World Drone Logistics and Transportation Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Sector

- 9.1.1. Commercial

- 9.1.2. Military

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Retail and Logistics

- 9.2.2. Food Delivery

- 9.2.3. Medical Supply

- 9.1. Market Analysis, Insights and Forecast - by Sector

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Zipline International Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Flirtey

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Flytrex Aviation Ltd

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Uber Technologies Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Alphabet Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 DH

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Matternet

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Workhorse Group Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Amazon com Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Drone Delivery Canada

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 United Parcel Service of America Inc

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 Zipline International Inc

List of Figures

- Figure 1: Global Drone Logistics and Transportation Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Drone Logistics and Transportation Market Revenue (billion), by Sector 2025 & 2033

- Figure 3: North America Drone Logistics and Transportation Market Revenue Share (%), by Sector 2025 & 2033

- Figure 4: North America Drone Logistics and Transportation Market Revenue (billion), by Application 2025 & 2033

- Figure 5: North America Drone Logistics and Transportation Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Drone Logistics and Transportation Market Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Drone Logistics and Transportation Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Drone Logistics and Transportation Market Revenue (billion), by Sector 2025 & 2033

- Figure 9: Europe Drone Logistics and Transportation Market Revenue Share (%), by Sector 2025 & 2033

- Figure 10: Europe Drone Logistics and Transportation Market Revenue (billion), by Application 2025 & 2033

- Figure 11: Europe Drone Logistics and Transportation Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe Drone Logistics and Transportation Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Drone Logistics and Transportation Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Drone Logistics and Transportation Market Revenue (billion), by Sector 2025 & 2033

- Figure 15: Asia Pacific Drone Logistics and Transportation Market Revenue Share (%), by Sector 2025 & 2033

- Figure 16: Asia Pacific Drone Logistics and Transportation Market Revenue (billion), by Application 2025 & 2033

- Figure 17: Asia Pacific Drone Logistics and Transportation Market Revenue Share (%), by Application 2025 & 2033

- Figure 18: Asia Pacific Drone Logistics and Transportation Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Drone Logistics and Transportation Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World Drone Logistics and Transportation Market Revenue (billion), by Sector 2025 & 2033

- Figure 21: Rest of the World Drone Logistics and Transportation Market Revenue Share (%), by Sector 2025 & 2033

- Figure 22: Rest of the World Drone Logistics and Transportation Market Revenue (billion), by Application 2025 & 2033

- Figure 23: Rest of the World Drone Logistics and Transportation Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: Rest of the World Drone Logistics and Transportation Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Rest of the World Drone Logistics and Transportation Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Drone Logistics and Transportation Market Revenue billion Forecast, by Sector 2020 & 2033

- Table 2: Global Drone Logistics and Transportation Market Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Global Drone Logistics and Transportation Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Drone Logistics and Transportation Market Revenue billion Forecast, by Sector 2020 & 2033

- Table 5: Global Drone Logistics and Transportation Market Revenue billion Forecast, by Application 2020 & 2033

- Table 6: Global Drone Logistics and Transportation Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Drone Logistics and Transportation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Drone Logistics and Transportation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Global Drone Logistics and Transportation Market Revenue billion Forecast, by Sector 2020 & 2033

- Table 10: Global Drone Logistics and Transportation Market Revenue billion Forecast, by Application 2020 & 2033

- Table 11: Global Drone Logistics and Transportation Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: United Kingdom Drone Logistics and Transportation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: France Drone Logistics and Transportation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Germany Drone Logistics and Transportation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Rest of Europe Drone Logistics and Transportation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Global Drone Logistics and Transportation Market Revenue billion Forecast, by Sector 2020 & 2033

- Table 17: Global Drone Logistics and Transportation Market Revenue billion Forecast, by Application 2020 & 2033

- Table 18: Global Drone Logistics and Transportation Market Revenue billion Forecast, by Country 2020 & 2033

- Table 19: China Drone Logistics and Transportation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: India Drone Logistics and Transportation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Japan Drone Logistics and Transportation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: South Korea Drone Logistics and Transportation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Rest of Asia Pacific Drone Logistics and Transportation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Global Drone Logistics and Transportation Market Revenue billion Forecast, by Sector 2020 & 2033

- Table 25: Global Drone Logistics and Transportation Market Revenue billion Forecast, by Application 2020 & 2033

- Table 26: Global Drone Logistics and Transportation Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Drone Logistics and Transportation Market?

The projected CAGR is approximately 45.5%.

2. Which companies are prominent players in the Drone Logistics and Transportation Market?

Key companies in the market include Zipline International Inc, Flirtey, Flytrex Aviation Ltd, Uber Technologies Inc, Alphabet Inc, DH, Matternet, Workhorse Group Inc, Amazon com Inc, Drone Delivery Canada, United Parcel Service of America Inc.

3. What are the main segments of the Drone Logistics and Transportation Market?

The market segments include Sector, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.1 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

The Retail and Logistics Segment to Witness Rapid Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Drone Logistics and Transportation Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Drone Logistics and Transportation Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Drone Logistics and Transportation Market?

To stay informed about further developments, trends, and reports in the Drone Logistics and Transportation Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence