Key Insights

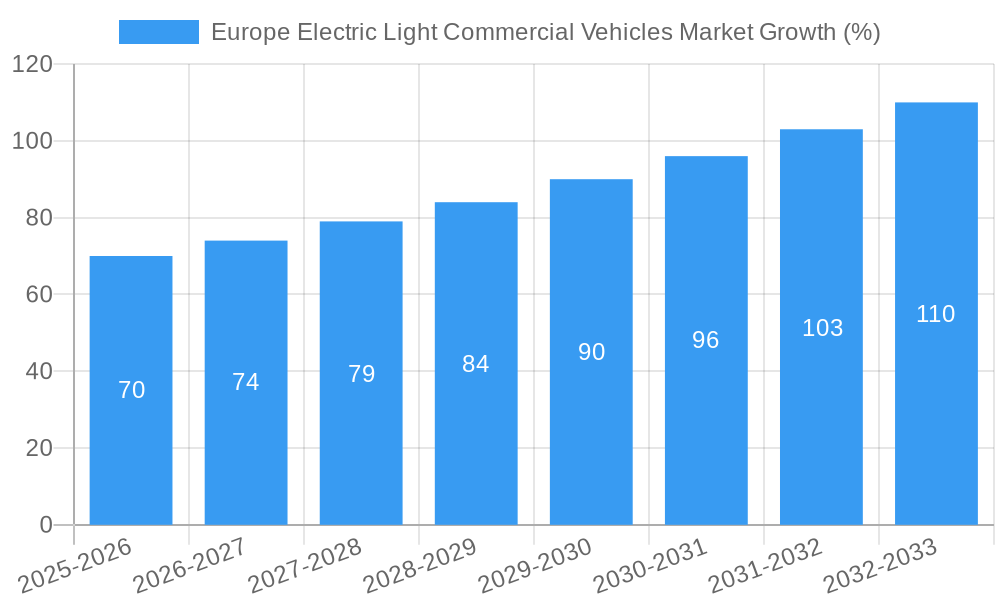

The European electric light commercial vehicle (eLCV) market is experiencing robust growth, driven by stringent emission regulations, increasing environmental awareness, and advancements in battery technology. The market, valued at approximately €[Estimate based on market size XX and value unit - assume XX is a number like 1000 for example purposes. This will result in an estimated market size in 2025 of 1000 million euros] million in 2025, is projected to exhibit a Compound Annual Growth Rate (CAGR) exceeding 6.59% from 2025 to 2033. This growth is fueled by several key factors. Firstly, governments across Europe are implementing stricter emission standards, incentivizing the adoption of electric vehicles to reduce carbon footprints. Secondly, rising fuel prices and concerns about air quality in urban areas are pushing businesses to opt for cleaner, more cost-effective alternatives like eLCVs. Furthermore, technological advancements, leading to improved battery range, faster charging times, and reduced vehicle costs, are making eLCVs a more attractive proposition for businesses. Key segments within the market include various vehicle configurations (light commercial vehicles), fuel categories (BEV, FCEV, HEV, PHEV), and numerous European countries such as Germany, France, UK, and the Nordics. Germany, France, and the UK are anticipated to remain dominant markets due to their established automotive industries and supportive government policies.

The market's growth, however, faces certain challenges. High initial purchase costs compared to conventional vehicles, limited charging infrastructure in certain regions, and concerns about battery lifespan and performance in varied climates represent significant restraints. Nevertheless, ongoing investments in charging infrastructure, advancements in battery technology, and continued government support are expected to mitigate these challenges. The competitive landscape is diverse, with major automotive manufacturers like Volkswagen, Daimler, Peugeot, and Nissan competing alongside newer entrants like Arrival and ADDAX Motors. The success of these companies will depend on their ability to innovate, adapt to evolving market demands, and offer competitive pricing and superior vehicle performance, particularly in terms of range and charging capabilities. The forecast period of 2025-2033 promises significant expansion for the European eLCV market, driven by a confluence of technological advancements, policy support, and rising environmental consciousness.

Europe Electric Light Commercial Vehicles Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the Europe Electric Light Commercial Vehicles market, offering invaluable insights for stakeholders across the automotive and energy sectors. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils market trends, competitive dynamics, and future growth projections. We analyze market size, segmentation (by vehicle configuration, fuel category, and country), and key players, including Peugeot S A, Nissan Motor Co Ltd, Volkswagen AG, Fiat Chrysler Automobiles N V, Daimler AG (Mercedes-Benz AG), ARRIVAL LTD, Volvo Group, ADDAX MOTORS NV, Groupe Renault, Toyota Motor Corporation, Ford Motor Company, and Maxus. The report also explores the impact of recent industry developments and regulatory changes on market growth.

Europe Electric Light Commercial Vehicles Market Market Structure & Competitive Landscape

The European electric light commercial vehicle (e-LCV) market exhibits a moderately concentrated structure, with a Herfindahl-Hirschman Index (HHI) estimated at xx in 2025. Established automotive giants like Volkswagen AG, Daimler AG (Mercedes-Benz AG), and Renault Group hold significant market share, leveraging their extensive distribution networks and brand recognition. However, the emergence of new entrants, such as Arrival Ltd and ADDAX MOTORS NV, is intensifying competition and driving innovation.

- Market Concentration: The HHI suggests a moderately competitive landscape, with potential for further consolidation through mergers and acquisitions (M&A). The estimated xx Million in M&A activity in the last five years underscores this trend.

- Innovation Drivers: Stringent emission regulations, coupled with growing consumer demand for sustainable transportation solutions, are pushing technological advancements in battery technology, charging infrastructure, and vehicle design.

- Regulatory Impacts: The EU's ambitious emission reduction targets are creating a favorable regulatory environment for e-LCVs, with incentives and subsidies stimulating market growth. However, inconsistencies in regulations across different European countries pose challenges to market expansion.

- Product Substitutes: While internal combustion engine (ICE) vehicles remain a primary substitute, their competitiveness is waning due to rising fuel costs and environmental concerns. The emergence of alternative fuel options, like hydrogen fuel cell vehicles (FCEVs), also presents a longer-term challenge.

- End-User Segmentation: The e-LCV market caters to a diverse range of end-users, including logistics companies, delivery services, municipal authorities, and small businesses. Each segment exhibits unique requirements regarding vehicle capacity, range, and charging infrastructure.

- M&A Trends: Strategic acquisitions of smaller e-LCV manufacturers and battery technology companies are expected to accelerate, allowing larger players to expand their product portfolios and enhance their technological capabilities.

Europe Electric Light Commercial Vehicles Market Market Trends & Opportunities

The European e-LCV market is experiencing robust growth, driven by a confluence of factors. The market size is projected to reach xx Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This expansion is fueled by increasing environmental awareness, supportive government policies, and advancements in battery technology, leading to improved vehicle performance and affordability. Market penetration rates are steadily increasing, with BEVs (Battery Electric Vehicles) gaining significant traction over PHEVs (Plug-in Hybrid Electric Vehicles). Technological shifts towards solid-state batteries and improved fast-charging infrastructure are poised to accelerate this trend. Consumer preferences are shifting towards sustainable transport, with businesses increasingly adopting e-LCVs to reduce their carbon footprint and enhance their brand image. Intense competition among established and emerging players is driving innovation and resulting in a wider range of vehicle options. The market is rife with opportunities for companies specializing in charging infrastructure, battery technology, and vehicle-to-grid (V2G) solutions.

Dominant Markets & Segments in Europe Electric Light Commercial Vehicles Market

While the entire European market is growing, certain regions and segments exhibit more significant growth potential. Germany, France, and the UK are currently leading the market, due to strong government support, well-developed charging infrastructure, and high consumer awareness. However, rapid growth is anticipated in other countries, such as Norway, Sweden, and the Netherlands, driven by ambitious emission reduction targets and robust incentives.

- Leading Regions: Germany, France, UK, Norway, Sweden.

- Leading Segment (Vehicle Configuration): Light vans are currently the dominant segment, but demand for other configurations is projected to increase as technology advances and specific needs are met.

- Leading Segment (Fuel Category): BEVs are the fastest-growing fuel category due to cost reductions and technological advancements.

- Growth Drivers:

- Government Incentives and Regulations: Subsidies, tax breaks, and stringent emission norms are propelling market adoption.

- Expanding Charging Infrastructure: Increased investment in public and private charging stations is crucial for overcoming range anxiety.

- Technological Advancements: Improvements in battery technology, charging speeds, and vehicle range are enhancing consumer appeal.

The dominance of these leading segments is driven by a combination of factors including supportive government policies, established charging infrastructure, and high consumer acceptance of electric vehicles. However, other segments are also showing considerable promise and are expected to grow rapidly in the future.

Europe Electric Light Commercial Vehicles Market Product Analysis

The e-LCV market features a diverse range of vehicles tailored to specific needs, from compact city vans to larger delivery trucks. Key product innovations include advancements in battery technology, resulting in extended range and faster charging times. Improved vehicle design focuses on optimizing cargo space and fuel efficiency. Competitive advantages often revolve around superior technology, enhanced connectivity features, and robust after-sales support. The market is witnessing a strong shift towards modular platforms and customizable vehicle configurations to cater to the diverse needs of various end-users.

Key Drivers, Barriers & Challenges in Europe Electric Light Commercial Vehicles Market

Key Drivers: Stringent emission regulations, rising fuel costs, and increasing environmental awareness are pushing the adoption of e-LCVs. Government incentives, technological advancements, and improved charging infrastructure are further accelerating market growth.

Challenges: The high initial cost of e-LCVs remains a significant barrier to entry for many small businesses. Range anxiety and limited charging infrastructure in certain regions continue to be a concern. Supply chain disruptions and the availability of critical battery materials pose challenges to production capacity. Competition from established players and new entrants intensifies pressure on profit margins. The lack of standardized charging technology and regulations across various European countries remains a significant challenge.

Growth Drivers in the Europe Electric Light Commercial Vehicles Market Market

The European e-LCV market is driven by stringent emission regulations, growing environmental concerns, and government incentives, resulting in a significant reduction in operating costs compared to ICE vehicles. Technological advancements, such as improved battery technology and faster charging infrastructure, are also contributing to market expansion.

Challenges Impacting Europe Electric Light Commercial Vehicles Market Growth

High initial purchase price of e-LCVs compared to conventional vehicles coupled with limited charging infrastructure, particularly in rural areas, presents a barrier to wider adoption. Supply chain constraints and the availability of raw materials for battery production create potential bottlenecks. Fluctuations in electricity prices also impact the overall cost of ownership.

Key Players Shaping the Europe Electric Light Commercial Vehicles Market Market

- Peugeot S A

- Nissan Motor Co Ltd

- Volkswagen AG

- Fiat Chrysler Automobiles N V

- Daimler AG (Mercedes-Benz AG)

- ARRIVAL LTD

- Volvo Group

- ADDAX MOTORS NV

- Groupe Renault

- Toyota Motor Corporation

- Ford Motor Company

- Maxus

Significant Europe Electric Light Commercial Vehicles Market Industry Milestones

- May 2023: Mercedes Benz Vans launches its electric small van, the eCitan, for inner-city deliveries, offering two versions (4498 mm and 5922 mm). This launch expands the range of electric vehicles available for urban logistics.

- June 2023: FORD NEXT launches a pilot program providing flexible electric vehicle leasing solutions for Uber drivers in select U.S. markets. This initiative aims to increase the adoption of electric vehicles within the ride-sharing sector.

- June 2023: Mercedes-Benz expands the availability of its DRIVE PILOT (SAE Level 3) system to California, marking a significant step towards the wider adoption of autonomous driving technology. This development, while in the U.S., signifies technological progress impacting global market expectations.

Future Outlook for Europe Electric Light Commercial Vehicles Market Market

The European e-LCV market is poised for continued strong growth, driven by technological advancements, supportive government policies, and increasing consumer demand for sustainable transportation. Opportunities abound for companies that can innovate in battery technology, charging infrastructure, and vehicle design. The market is expected to see further consolidation as established players and new entrants compete for market share. The increasing focus on sustainable logistics and the emergence of new business models, such as vehicle subscription services, will further shape the market landscape.

Europe Electric Light Commercial Vehicles Market Segmentation

-

1. Vehicle Configuration

- 1.1. Light Commercial Vehicles

-

2. Fuel Category

- 2.1. BEV

- 2.2. FCEV

- 2.3. HEV

- 2.4. PHEV

Europe Electric Light Commercial Vehicles Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Electric Light Commercial Vehicles Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 6.59% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Air Pollution Awareness and Health Concern is Driving the Demand

- 3.3. Market Restrains

- 3.3.1. High Cost of Installation Related to Industrial Robots

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Electric Light Commercial Vehicles Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Configuration

- 5.1.1. Light Commercial Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Fuel Category

- 5.2.1. BEV

- 5.2.2. FCEV

- 5.2.3. HEV

- 5.2.4. PHEV

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Configuration

- 6. Germany Europe Electric Light Commercial Vehicles Market Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Electric Light Commercial Vehicles Market Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Electric Light Commercial Vehicles Market Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Electric Light Commercial Vehicles Market Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Electric Light Commercial Vehicles Market Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Electric Light Commercial Vehicles Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Electric Light Commercial Vehicles Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Peugeot S A

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Nissan Motor Co Ltd

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Volkswagen AG

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Fiat Chrysler Automobiles N V

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Daimler AG (Mercedes-Benz AG)

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 ARRIVAL LTD

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Volvo Grou

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 ADDAX MOTORS NV

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Groupe Renault

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Toyota Motor Corporation

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Ford Motor Company

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Maxus

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.1 Peugeot S A

List of Figures

- Figure 1: Europe Electric Light Commercial Vehicles Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Electric Light Commercial Vehicles Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Electric Light Commercial Vehicles Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Electric Light Commercial Vehicles Market Revenue Million Forecast, by Vehicle Configuration 2019 & 2032

- Table 3: Europe Electric Light Commercial Vehicles Market Revenue Million Forecast, by Fuel Category 2019 & 2032

- Table 4: Europe Electric Light Commercial Vehicles Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Europe Electric Light Commercial Vehicles Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Germany Europe Electric Light Commercial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: France Europe Electric Light Commercial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Italy Europe Electric Light Commercial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United Kingdom Europe Electric Light Commercial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Netherlands Europe Electric Light Commercial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Sweden Europe Electric Light Commercial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Europe Europe Electric Light Commercial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Europe Electric Light Commercial Vehicles Market Revenue Million Forecast, by Vehicle Configuration 2019 & 2032

- Table 14: Europe Electric Light Commercial Vehicles Market Revenue Million Forecast, by Fuel Category 2019 & 2032

- Table 15: Europe Electric Light Commercial Vehicles Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: United Kingdom Europe Electric Light Commercial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Germany Europe Electric Light Commercial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: France Europe Electric Light Commercial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Italy Europe Electric Light Commercial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Spain Europe Electric Light Commercial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Netherlands Europe Electric Light Commercial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Belgium Europe Electric Light Commercial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Sweden Europe Electric Light Commercial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Norway Europe Electric Light Commercial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Poland Europe Electric Light Commercial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Denmark Europe Electric Light Commercial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Electric Light Commercial Vehicles Market?

The projected CAGR is approximately > 6.59%.

2. Which companies are prominent players in the Europe Electric Light Commercial Vehicles Market?

Key companies in the market include Peugeot S A, Nissan Motor Co Ltd, Volkswagen AG, Fiat Chrysler Automobiles N V, Daimler AG (Mercedes-Benz AG), ARRIVAL LTD, Volvo Grou, ADDAX MOTORS NV, Groupe Renault, Toyota Motor Corporation, Ford Motor Company, Maxus.

3. What are the main segments of the Europe Electric Light Commercial Vehicles Market?

The market segments include Vehicle Configuration, Fuel Category.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Air Pollution Awareness and Health Concern is Driving the Demand.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

High Cost of Installation Related to Industrial Robots.

8. Can you provide examples of recent developments in the market?

June 2023: Mercedes-Benz DRIVE PILOT expands U.S. availability to California and introduce a SAE Level 3 system in a standard-production vehicle for use on public freeways in the most populous state in the U.S.June 2023: FORD NEXT launches New pilot program creates flexible electric solutions for drivers who use the Uber platform in select U.S. markets, allowing them to lease a vehicle for more customized time periods.May 2023: Mercedes Benz Vans is launching its electric small van for innercity deliveries and servicing operations. eCitan is a vehicle panel with 2 options such as the compact version of 4498 mm and 5922 mm.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Electric Light Commercial Vehicles Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Electric Light Commercial Vehicles Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Electric Light Commercial Vehicles Market?

To stay informed about further developments, trends, and reports in the Europe Electric Light Commercial Vehicles Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence