Key Insights

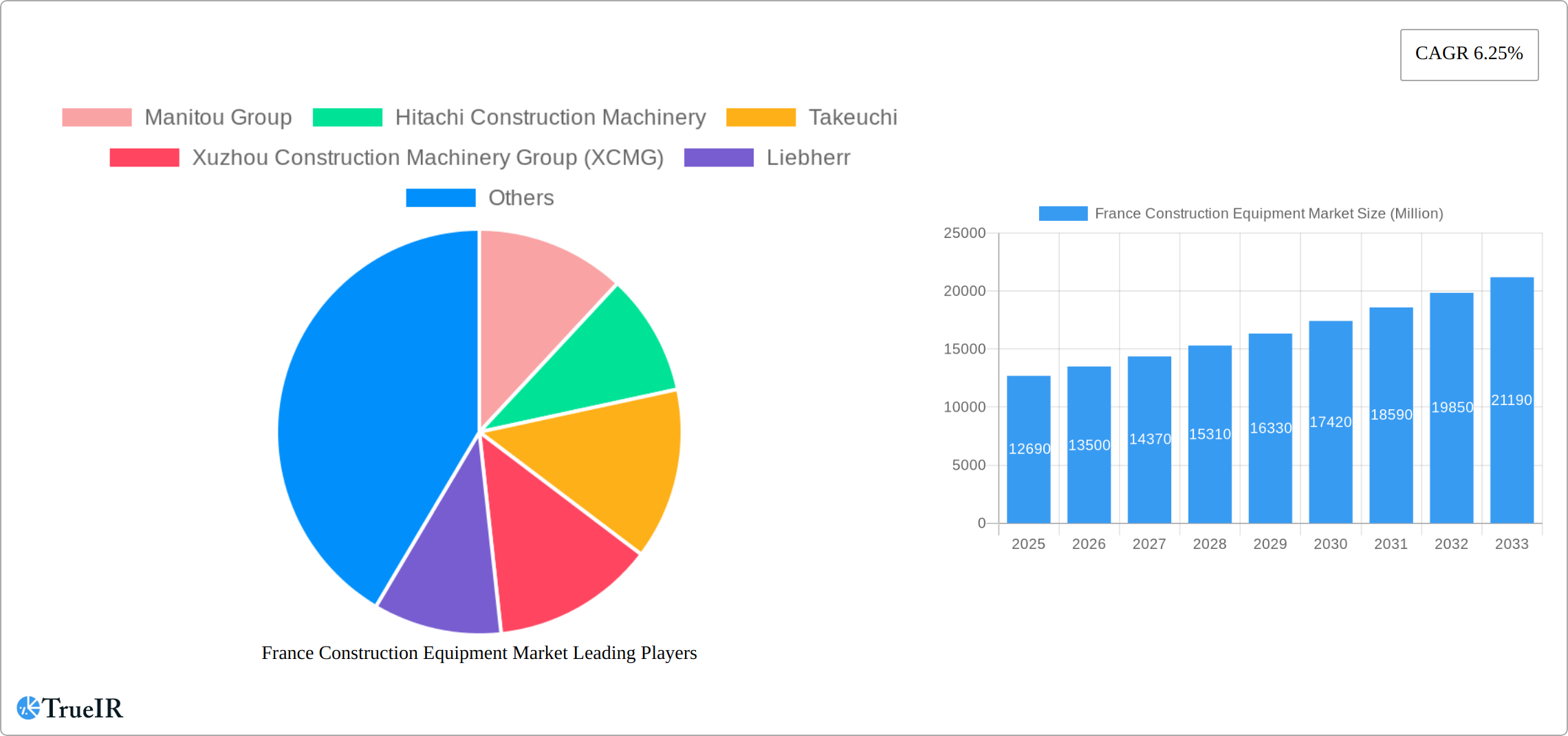

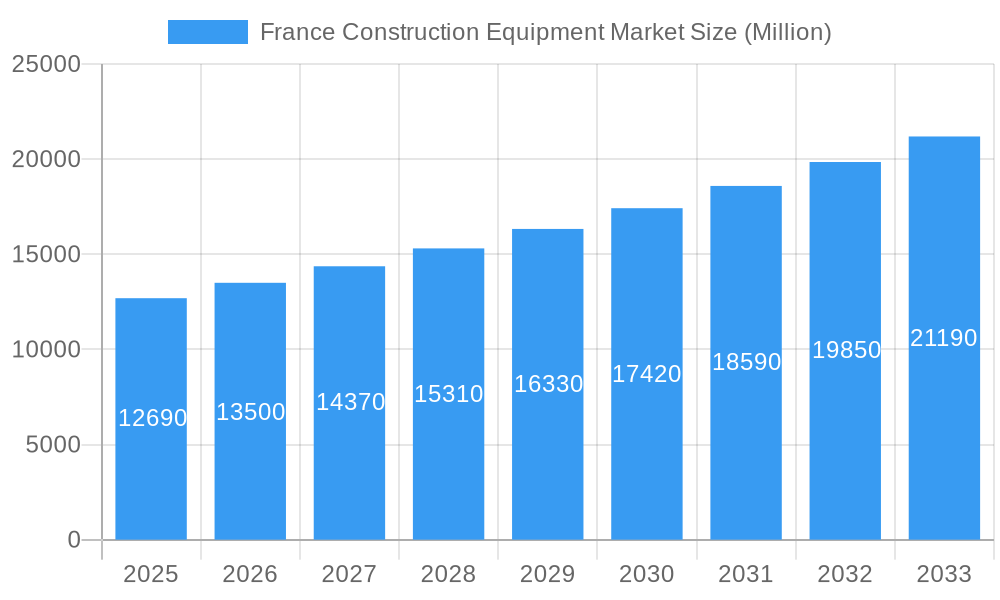

The France construction equipment market, valued at €12.69 billion in 2025, is projected to experience robust growth, driven by a Compound Annual Growth Rate (CAGR) of 6.25% from 2025 to 2033. This expansion is fueled by several key factors. Significant investments in infrastructure development projects across France, particularly in urban renewal and transportation networks, are creating a strong demand for earthmoving equipment, road construction machinery (like asphalt pavers), and material handling equipment (including articulated boom lifts and other specialized tools). Furthermore, the increasing adoption of technologically advanced equipment, such as electric/hybrid models, is contributing to market growth. This trend is driven by stricter emission regulations and a growing focus on sustainability within the construction sector. The market is segmented by equipment type (earthmoving, road construction, material handling), drive type (hydraulic, electric/hybrid), and specific equipment categories (bulldozers, dumpers, concrete pumps, etc.). While challenges exist, such as potential fluctuations in raw material prices and skilled labor shortages, the overall market outlook remains positive, driven by sustained government investments and a robust construction industry.

France Construction Equipment Market Market Size (In Billion)

The leading players in the French construction equipment market, including global giants like Caterpillar, Komatsu, and Volvo Construction Equipment, alongside regional and specialized manufacturers such as Manitou Group and Liebherr, are actively competing to capture market share. Their strategies often involve focusing on product innovation, strategic partnerships, and adapting to evolving customer needs. The competitive landscape is marked by both intense rivalry and collaborations, resulting in a dynamic market with frequent technological advancements and product launches. The market's future will likely witness continued consolidation, with larger players acquiring smaller firms to enhance their market reach and product portfolios. Further growth will depend on the overall health of the French economy, and ongoing government support for infrastructure projects. Market segmentation is becoming increasingly important, allowing companies to better target their products to specific construction applications and customer requirements.

France Construction Equipment Market Company Market Share

France Construction Equipment Market: A Comprehensive Report (2019-2033)

This dynamic report provides a detailed analysis of the France construction equipment market, offering invaluable insights for industry professionals, investors, and strategic planners. With a comprehensive study period spanning 2019-2033 (Base Year: 2025, Estimated Year: 2025, Forecast Period: 2025-2033, Historical Period: 2019-2024), this report delves into market size, segmentation, competitive dynamics, and future growth prospects. It leverages high-impact keywords like "France Construction Equipment Market," "Construction Equipment Sales France," "Hydraulic Excavators France," and "Electric Construction Equipment France" to ensure maximum search engine visibility.

France Construction Equipment Market Structure & Competitive Landscape

The French construction equipment market exhibits a moderately concentrated structure, with several multinational giants and domestic players vying for market share. The Herfindahl-Hirschman Index (HHI) for 2024 is estimated at xx, indicating a moderately competitive landscape. Innovation is a key driver, with companies focusing on developing fuel-efficient, technologically advanced equipment to meet stringent environmental regulations and evolving customer needs. Regulatory impacts, particularly those related to emissions and safety, significantly influence market dynamics. Product substitutes, such as alternative construction methods and software solutions, pose a growing challenge. The market is segmented by end-user, encompassing construction companies of various sizes, infrastructure developers, and government agencies. M&A activity has been relatively moderate in recent years, with xx major deals recorded between 2019 and 2024, primarily driven by strategies to expand geographical reach and product portfolios.

- Market Concentration: HHI (2024): xx

- Innovation Drivers: Focus on electric/hybrid, automation, and digitalization.

- Regulatory Impacts: Stringent emission standards and safety regulations.

- Product Substitutes: Alternative construction methods, digital project management tools.

- End-User Segmentation: Construction companies (large, medium, small), infrastructure developers, government entities.

- M&A Trends: xx major deals (2019-2024), focusing on expansion and portfolio diversification.

France Construction Equipment Market Trends & Opportunities

The France construction equipment market is projected to experience a CAGR of xx% during the forecast period (2025-2033), driven by robust infrastructure development projects and a growing construction sector. Technological advancements, such as the integration of telematics and IoT, are transforming the industry, enabling remote monitoring and predictive maintenance. Consumer preferences are shifting toward more sustainable and efficient equipment, increasing the demand for electric/hybrid models. Competitive dynamics are intense, with manufacturers engaging in price wars and product differentiation strategies to gain market share. The market penetration of electric/hybrid construction equipment is expected to reach xx% by 2033, reflecting growing environmental concerns and government incentives. This presents significant opportunities for companies offering innovative, sustainable solutions. Furthermore, the increasing adoption of digital technologies, such as Building Information Modeling (BIM), is also creating opportunities for equipment manufacturers that offer integrated digital solutions.

Dominant Markets & Segments in France Construction Equipment Market

The Ile-de-France region stands as the most dominant market within France, primarily due to its unparalleled concentration of active construction sites and large-scale infrastructure development projects. Among equipment categories, earthmoving equipment commands the largest market share, closely followed by road construction equipment. While hydraulic drive types continue to maintain their dominance, the electric/hybrid segment is experiencing a noteworthy surge in growth. This expansion is largely attributed to increasingly stringent environmental regulations and rapid technological advancements that promote sustainability.

-

Key Growth Drivers:

- Sustained and robust infrastructure investment initiatives by the French government.

- Continued expansion in both residential and commercial construction sectors.

- Accelerating urbanization trends and the ongoing modernization of existing infrastructure.

- Government-led incentives and support for the adoption of sustainable construction technologies.

-

Market Dominance Analysis: As previously noted, the Ile-de-France region leads in overall market share, a direct consequence of its high density of construction projects. The earthmoving and road construction equipment segments are paramount due to the substantial requirements for infrastructure development and ongoing maintenance. The hydraulic drive type continues to hold the largest market share; however, the electric/hybrid segment is exhibiting rapid expansion driven by heightened environmental awareness and the impact of rising fuel costs.

France Construction Equipment Market Product Analysis

Technological advancements in the construction equipment sector are predominantly focused on achieving enhanced operational efficiency, minimizing environmental emissions, and improving operator safety. Electric and hybrid drive systems are progressively gaining traction, offering significant environmental benefits alongside reduced operational expenditures. Furthermore, sophisticated features such as telematics for remote monitoring and management, and increasingly, autonomous operational capabilities are being integrated into modern machinery. These innovations are designed to significantly boost productivity and optimize overall equipment performance, directly addressing the market's escalating demand for sustainable and highly efficient solutions that align with evolving industry standards and environmental objectives.

Key Drivers, Barriers & Challenges in France Construction Equipment Market

Key Drivers: Government investment in infrastructure projects, growing urbanization, increasing demand for construction services. Technological advancements leading to enhanced efficiency and safety features are also strong drivers.

Key Challenges: Supply chain disruptions causing equipment shortages and price increases, stringent environmental regulations increasing manufacturing costs, intense competition from both domestic and international players.

Growth Drivers in the France Construction Equipment Market Market

The French construction equipment market is propelled by a confluence of significant growth catalysts. These include strong government support for infrastructure development projects, the ongoing trend of increasing urbanization, a steady rise in overall construction activities across various sectors, and continuous technological advancements enhancing equipment capabilities. Moreover, a crucial factor is the implementation of favorable government policies that actively promote sustainability and encourage the wider adoption of eco-friendly construction equipment, thereby shaping market demand towards greener alternatives.

Challenges Impacting France Construction Equipment Market Growth

Several key challenges are currently impacting the growth trajectory of the France construction equipment market. These include ongoing supply chain disruptions which affect the availability and timely delivery of components, coupled with escalating raw material costs that place pressure on manufacturing expenses. The rigorous implementation of stringent environmental regulations, while beneficial in the long term, also presents adaptation challenges for some stakeholders. Furthermore, the market is characterized by intense competition among established and emerging industry players, which can influence pricing strategies and market share dynamics.

Key Players Shaping the France Construction Equipment Market Market

Significant France Construction Equipment Market Industry Milestones

- October 2022: Liebherr-France SAS wins Bauma Innovation Award for its hydrogen-powered excavator.

- February 2023: Hitachi Construction Machinery announces an 8% price increase on its equipment.

- June 2023: Liebherr-France SAS invests Euro 170 million (USD 182 million) in a new manufacturing facility.

Future Outlook for France Construction Equipment Market Market

The future outlook for the France construction equipment market is decidedly positive, signaling continued growth and evolution. This upward trajectory is underpinned by sustained infrastructure investment, the relentless pace of technological advancements, and a growing imperative for sustainable construction solutions. Significant opportunities are anticipated for companies that can adeptly offer innovative product portfolios, deliver highly efficient service and support, and demonstrate an unwavering commitment to environmental responsibility. The market's increasing embrace of digitalization and automation technologies will also pave the way for specialized players to thrive and introduce value-added solutions.

France Construction Equipment Market Segmentation

-

1. Equipment Type

-

1.1. Earthmoving Equipment

- 1.1.1. Excavators

- 1.1.2. Backhoe Loaders

- 1.1.3. Motor Graders

- 1.1.4. Other Earthmoving Equipment (Bull Dozers, etc.)

-

1.2. Road Construction Equipment

- 1.2.1. Road Rollers

- 1.2.2. Asphalt Pavers

-

1.3. Material Handling Equipment

- 1.3.1. Cranes

- 1.3.2. Forklift & Telescopic Handlers

- 1.3.3. Other Ma

- 1.4. Other Co

-

1.1. Earthmoving Equipment

-

2. Drive Type

- 2.1. Hydraulic

- 2.2. Electric/Hybrid

France Construction Equipment Market Segmentation By Geography

- 1. France

France Construction Equipment Market Regional Market Share

Geographic Coverage of France Construction Equipment Market

France Construction Equipment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.25% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Government Spending on Construction and Infrastructure Development

- 3.3. Market Restrains

- 3.3.1. High Cost of Replacement and Maintenance

- 3.4. Market Trends

- 3.4.1. Increasing Government Spending on Construction and Infrastructure Development

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. France Construction Equipment Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Equipment Type

- 5.1.1. Earthmoving Equipment

- 5.1.1.1. Excavators

- 5.1.1.2. Backhoe Loaders

- 5.1.1.3. Motor Graders

- 5.1.1.4. Other Earthmoving Equipment (Bull Dozers, etc.)

- 5.1.2. Road Construction Equipment

- 5.1.2.1. Road Rollers

- 5.1.2.2. Asphalt Pavers

- 5.1.3. Material Handling Equipment

- 5.1.3.1. Cranes

- 5.1.3.2. Forklift & Telescopic Handlers

- 5.1.3.3. Other Ma

- 5.1.4. Other Co

- 5.1.1. Earthmoving Equipment

- 5.2. Market Analysis, Insights and Forecast - by Drive Type

- 5.2.1. Hydraulic

- 5.2.2. Electric/Hybrid

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. France

- 5.1. Market Analysis, Insights and Forecast - by Equipment Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Manitou Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Hitachi Construction Machinery

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Takeuchi

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Xuzhou Construction Machinery Group (XCMG)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Liebherr

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Toyota Material Handling

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Kobelco

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 JCB

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Volvo Construction Equipment

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Kubota

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Hyundai Construction Equipment

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Komatsu

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Yanmar

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Konecrane

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Caterpillar

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.1 Manitou Group

List of Figures

- Figure 1: France Construction Equipment Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: France Construction Equipment Market Share (%) by Company 2025

List of Tables

- Table 1: France Construction Equipment Market Revenue Million Forecast, by Equipment Type 2020 & 2033

- Table 2: France Construction Equipment Market Revenue Million Forecast, by Drive Type 2020 & 2033

- Table 3: France Construction Equipment Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: France Construction Equipment Market Revenue Million Forecast, by Equipment Type 2020 & 2033

- Table 5: France Construction Equipment Market Revenue Million Forecast, by Drive Type 2020 & 2033

- Table 6: France Construction Equipment Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the France Construction Equipment Market?

The projected CAGR is approximately 6.25%.

2. Which companies are prominent players in the France Construction Equipment Market?

Key companies in the market include Manitou Group, Hitachi Construction Machinery, Takeuchi, Xuzhou Construction Machinery Group (XCMG), Liebherr, Toyota Material Handling, Kobelco, JCB, Volvo Construction Equipment, Kubota, Hyundai Construction Equipment, Komatsu, Yanmar, Konecrane, Caterpillar.

3. What are the main segments of the France Construction Equipment Market?

The market segments include Equipment Type, Drive Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 12.69 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Government Spending on Construction and Infrastructure Development.

6. What are the notable trends driving market growth?

Increasing Government Spending on Construction and Infrastructure Development.

7. Are there any restraints impacting market growth?

High Cost of Replacement and Maintenance.

8. Can you provide examples of recent developments in the market?

June 2023: Liebherr-France SAS, a prominent construction equipment company operating in France, made a significant investment of Euro 170 million (USD 182 million) to establish a state-of-the-art manufacturing facility in Alsace, France. This strategic move aims to enhance and fortify the company's local supply chain infrastructure.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "France Construction Equipment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the France Construction Equipment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the France Construction Equipment Market?

To stay informed about further developments, trends, and reports in the France Construction Equipment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence