Key Insights

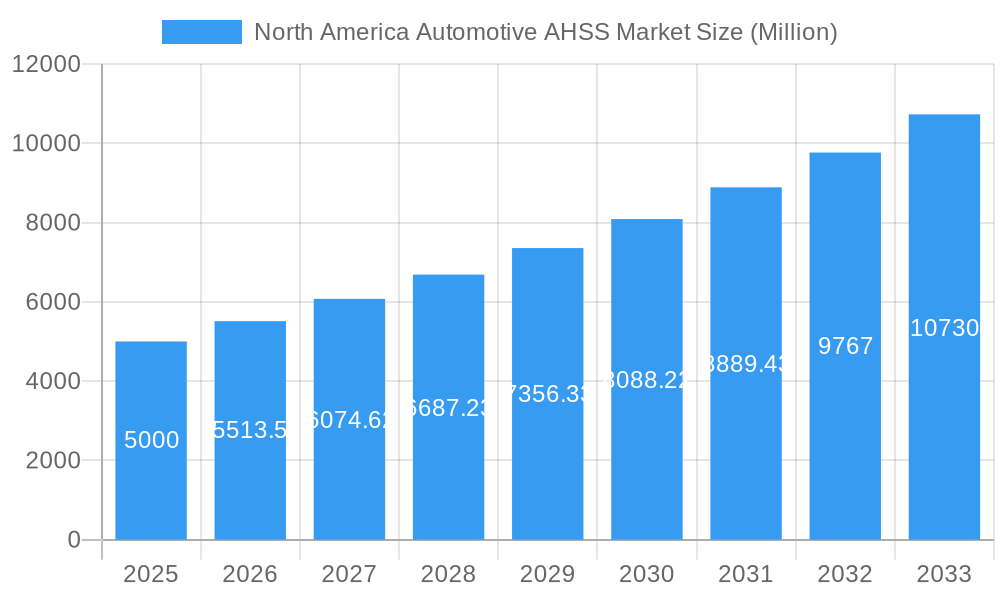

The North America Automotive Advanced High-Strength Steel (AHSS) market is poised for substantial growth, driven by the imperative for lightweight vehicle construction to enhance fuel efficiency and comply with evolving emission standards. The market, valued at approximately $26269.5 million in the base year 2025, is projected to expand at a Compound Annual Growth Rate (CAGR) of 10.27% from 2025 to 2033. This upward trajectory is propelled by increasing electric vehicle (EV) adoption, where lighter chassis are critical for extended battery range. Innovations in AHSS manufacturing are also enhancing material performance and cost-effectiveness, further stimulating demand. While passenger vehicles currently lead market share, the commercial vehicle segment is anticipated to witness significant expansion, reflecting the demand for fuel-efficient heavy-duty transport. Key industry players are actively investing in research and development to refine AHSS properties and solidify their market positions. The United States, as a dominant automotive manufacturing center, significantly influences the regional market dynamics.

North America Automotive AHSS Market Market Size (In Billion)

Despite the positive outlook, the market encounters certain challenges. Volatility in raw material prices, notably iron ore, can affect AHSS production costs and profitability. Supply chain vulnerabilities and geopolitical instability also present potential risks to sustained market expansion. Nevertheless, the long-term prospects for the North America Automotive AHSS market remain robust, underpinned by ongoing technological advancements and the persistent focus on lightweight design and enhanced vehicle safety. Strategic segmentation across applications (structural assemblies, closures, bumpers, suspension) and vehicle types offers valuable opportunities for market participants to develop targeted strategies and capitalize on the sector's growth potential.

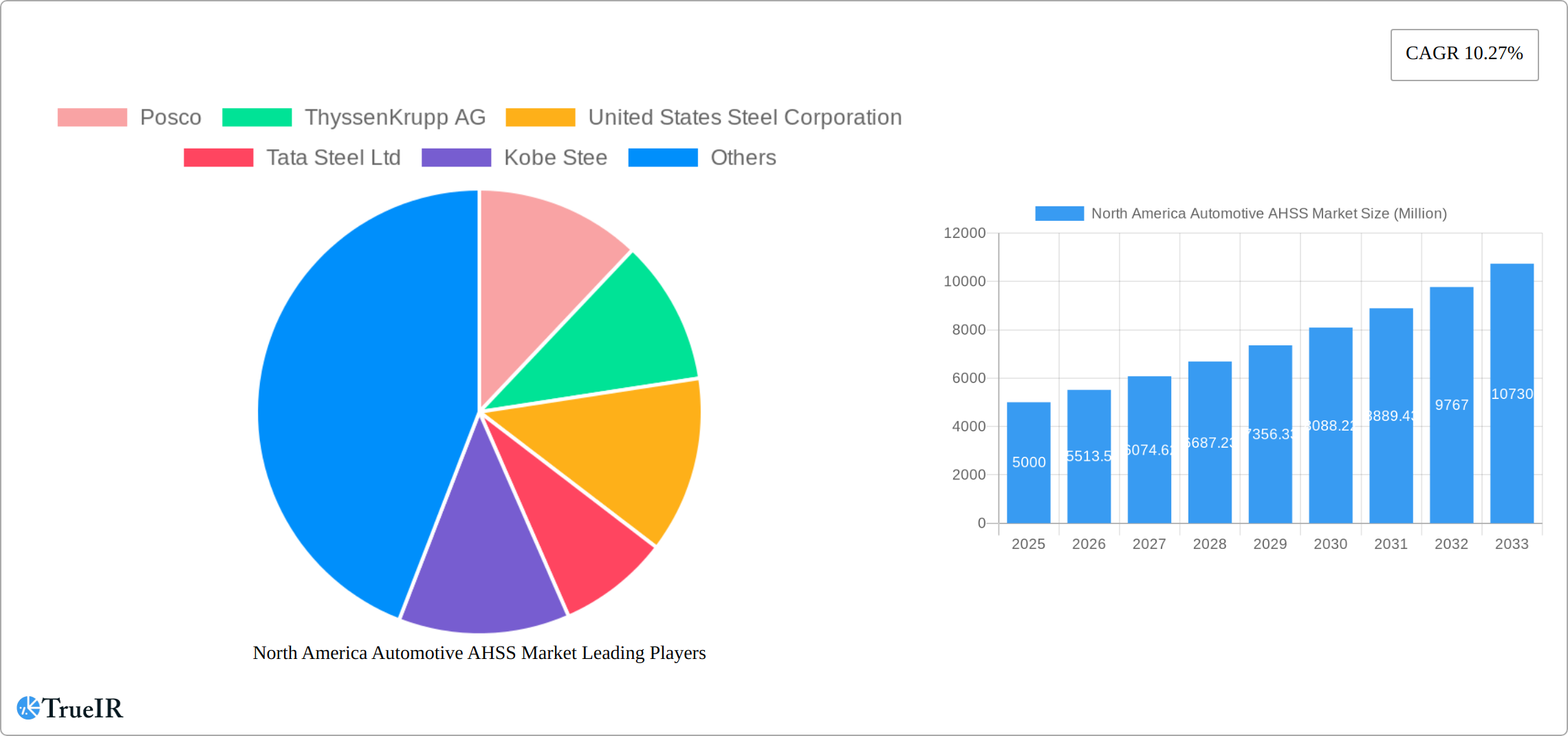

North America Automotive AHSS Market Company Market Share

North America Automotive AHSS Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the North America Automotive Advanced High-Strength Steel (AHSS) market, offering invaluable insights for stakeholders across the automotive and steel industries. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market trends, competitive dynamics, and future growth potential. The study encompasses detailed segmentation by application type (Structural Assembly & Closures, Bumpers, Suspension, Others) and vehicle type (Passenger Vehicles, Commercial Cars), providing a granular understanding of market performance across various segments. The report also identifies key players shaping the market, including Posco, ThyssenKrupp AG, United States Steel Corporation, Tata Steel Ltd, Kobe Steel, Arcelor Mittal SA, and Ak Steel Holding Corp, analyzing their strategies and market positions.

North America Automotive AHSS Market Structure & Competitive Landscape

The North America Automotive AHSS market exhibits a moderately concentrated structure, with a Herfindahl-Hirschman Index (HHI) of xx in 2025. This concentration is driven by the presence of a few large multinational steel producers, including ArcelorMittal SA and United States Steel Corporation, which command significant market share. However, the market is also characterized by increasing competition from other established players and the potential entry of new participants. Innovation plays a crucial role, with companies constantly striving to enhance AHSS grades with improved tensile strength, formability, and weldability. Stringent regulatory mandates pertaining to fuel efficiency and vehicle safety, particularly in North America, significantly influence the demand for AHSS. Product substitution, primarily from aluminum and other advanced materials, remains a considerable challenge. The market is primarily driven by end-users in the automotive sector. Mergers and acquisitions (M&A) activity has been moderate in recent years, with a total M&A volume of approximately xx Million USD during the period 2019-2024, reflecting consolidation efforts among smaller players seeking greater scale and market reach.

- Market Concentration: HHI of xx in 2025.

- Innovation Drivers: Improved tensile strength, formability, and weldability of AHSS grades.

- Regulatory Impacts: Fuel efficiency and safety standards.

- Product Substitutes: Aluminum and other advanced materials.

- End-User Segmentation: Primarily automotive manufacturers.

- M&A Trends: Moderate activity, xx Million USD in M&A volume (2019-2024).

North America Automotive AHSS Market Trends & Opportunities

The North America Automotive AHSS market is experiencing robust growth, driven by increasing demand from the automotive industry. The market size is estimated at xx Million USD in 2025, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is attributed to several factors, including the rising adoption of lightweight vehicles to enhance fuel efficiency and reduce emissions. Technological advancements, such as the development of advanced AHSS grades with superior mechanical properties, are contributing to broader adoption. Consumer preferences for safer and fuel-efficient vehicles further bolster market demand. Intense competition among steel manufacturers is driving innovation and price competitiveness. Market penetration of AHSS in the automotive sector is expected to increase from xx% in 2025 to xx% by 2033, driven by the growing adoption of lightweighting strategies across vehicle platforms.

Dominant Markets & Segments in North America Automotive AHSS Market

The United States holds the largest market share within North America, driven by a robust automotive manufacturing sector. Within the application types, Structural Assembly & Closures segment dominates the market, accounting for xx% of the total demand in 2025. Passenger Vehicles constitute the majority of AHSS consumption compared to Commercial Cars.

Key Growth Drivers in the United States:

- Strong automotive manufacturing base

- High demand for lightweight vehicles

- Favorable government regulations and incentives

Key Growth Drivers in Structural Assembly & Closures Segment:

- Critical role in vehicle safety and structural integrity

- Higher AHSS usage compared to other segments

- Continuous advancements in AHSS grades

Market Dominance Analysis: The United States’ large automotive manufacturing sector and the Structural Assembly & Closures segment's role in vehicle safety drive market dominance.

North America Automotive AHSS Market Product Analysis

The automotive AHSS market is characterized by continuous product innovation. Manufacturers are focusing on developing high-strength grades with improved formability, weldability, and corrosion resistance to meet the evolving requirements of automotive design and manufacturing. These advancements enable the creation of lighter and safer vehicles, meeting stringent fuel efficiency and safety regulations. The competitive advantage in this market rests on offering advanced AHSS grades with enhanced properties, cost-effective manufacturing processes, and reliable supply chains.

Key Drivers, Barriers & Challenges in North America Automotive AHSS Market

Key Drivers: The North American automotive industry is experiencing a significant surge in demand for lightweight vehicles, primarily propelled by increasingly stringent fuel efficiency mandates and evolving consumer preferences for eco-friendly transportation. This drive towards lighter vehicles is further bolstered by continuous technological advancements in metallurgy, leading to the development of advanced high-strength steel (AHSS) grades with enhanced properties like improved crashworthiness, superior formability, and greater tensile strength. Complementing these market dynamics, government support plays a crucial role. Initiatives such as tax incentives for fuel-efficient vehicle production, subsidies for research and development in advanced materials, and regulatory frameworks that encourage the adoption of lighter materials are actively shaping the AHSS landscape.

Key Challenges: Despite robust growth prospects, the North America Automotive AHSS market faces several hurdles. Volatility in raw material prices, particularly for iron ore and scrap steel, poses a significant challenge to cost predictability and profit margins for steel manufacturers. The market is characterized by intense competition among established and emerging steel producers, driving a constant need for innovation and cost optimization. Furthermore, the potential substitution by alternative lightweight materials such as aluminum alloys and carbon fiber composites presents a continuous competitive threat, necessitating ongoing efforts to demonstrate AHSS's cost-effectiveness and performance advantages. Supply chain disruptions, exacerbated by geopolitical events and logistical complexities, have also impacted the market, leading to an estimated 10-15% increase in production costs in 2024, as manufacturers grapple with material availability and transportation challenges.

Growth Drivers in the North America Automotive AHSS Market Market

The escalating demand for lightweight vehicles, driven by the imperative to meet stringent fuel efficiency standards and reduce carbon emissions, is a foundational growth engine for the North America Automotive AHSS market. Automakers are actively seeking materials that can reduce vehicle weight without compromising safety or performance, making AHSS an ideal solution. Technological advancements are continuously refining the properties of AHSS, offering a wider spectrum of grades with tailored characteristics for specific applications, thereby expanding its adoption across various vehicle components, from body-in-white structures to safety systems. Government support, through initiatives like emission reduction targets, tax credits for fuel-efficient vehicle purchases, and R&D funding for advanced manufacturing, further stimulates the demand for lighter and more efficient vehicles, directly benefiting the AHSS market. The increasing focus on vehicle electrification also plays a role, as reducing battery weight and improving range are critical, and AHSS contributes to this by enabling lighter chassis designs.

Challenges Impacting North America Automotive AHSS Market Growth

Fluctuating raw material prices impact production costs, and intense competition puts downward pressure on pricing. Supply chain disruptions can lead to production delays and shortages and the potential substitution by alternative materials poses a significant challenge.

Key Players Shaping the North America Automotive AHSS Market Market

- Posco

- ThyssenKrupp AG

- United States Steel Corporation

- Tata Steel Ltd

- Kobe Steel

- Arcelor Mittal SA

- Ak Steel Holding Corp

- Bao Steel Group

- NS BlueScope Steel

Significant North America Automotive AHSS Market Industry Milestones

- 2020: Posco introduces a groundbreaking new generation of ultra-high-strength AHSS grades, enhancing formability and enabling more complex component designs for automotive manufacturers.

- 2022: ArcelorMittal SA announces a substantial strategic investment in expanding its North American AHSS production capacity, signaling strong confidence in the region's future demand and aiming to better serve its automotive clients.

- 2023: Tata Steel Ltd significantly broadens its AHSS product portfolio, launching innovative solutions tailored for the evolving needs of the North American automotive sector, with a focus on improved safety and efficiency.

- 2024: Several leading AHSS manufacturers in North America report increased R&D efforts focused on developing hybrid AHSS materials that combine the strengths of steel with other lightweight materials, aiming to offer a cost-effective path to further weight reduction.

Future Outlook for North America Automotive AHSS Market Market

The North America Automotive AHSS market is poised for continued growth, driven by the sustained demand for lightweight vehicles and ongoing technological advancements in AHSS. Strategic partnerships and investments in research and development will play a critical role in shaping the market's future. The growing adoption of electric vehicles is expected to further drive demand for AHSS due to their need for lightweighting to extend battery range. Opportunities exist for manufacturers to focus on developing advanced AHSS grades with superior properties and cost-effective manufacturing processes to capture greater market share.

North America Automotive AHSS Market Segmentation

-

1. Application Type

- 1.1. Structural Assembly & Closures

- 1.2. Bumpers

- 1.3. Suspension

- 1.4. Others

-

2. Vehicle Type

- 2.1. Passenger Vehicles

- 2.2. Commercial Cars

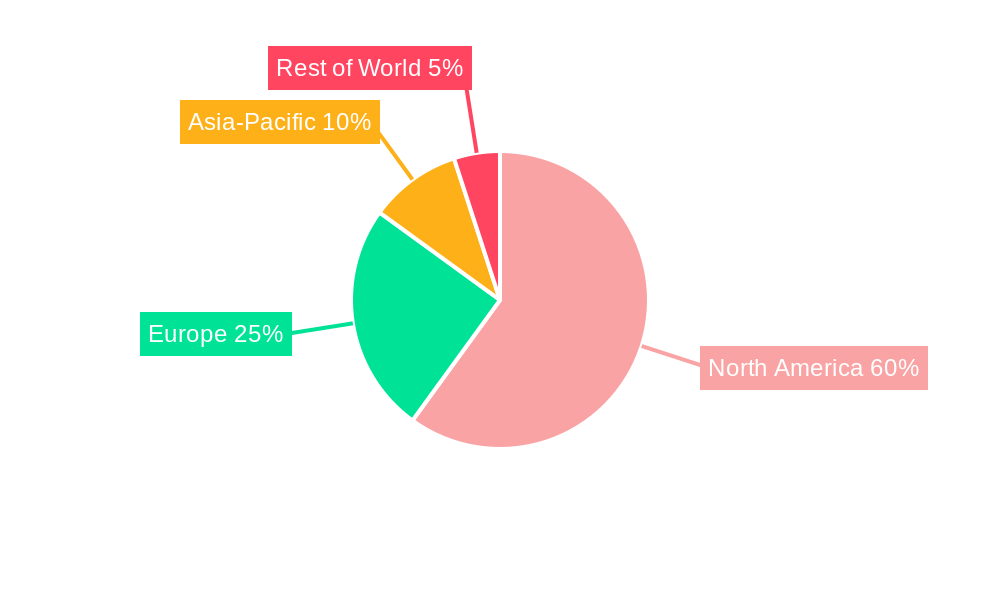

North America Automotive AHSS Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Rest Of North America

North America Automotive AHSS Market Regional Market Share

Geographic Coverage of North America Automotive AHSS Market

North America Automotive AHSS Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.27% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Travel and Tourism to Fuel Market Demand

- 3.3. Market Restrains

- 3.3.1. High Maintenance cost of RV Rental Fleets

- 3.4. Market Trends

- 3.4.1. Continuous Evolution in automotive AHSS technology

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Automotive AHSS Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application Type

- 5.1.1. Structural Assembly & Closures

- 5.1.2. Bumpers

- 5.1.3. Suspension

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.2.1. Passenger Vehicles

- 5.2.2. Commercial Cars

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Rest Of North America

- 5.1. Market Analysis, Insights and Forecast - by Application Type

- 6. United States North America Automotive AHSS Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application Type

- 6.1.1. Structural Assembly & Closures

- 6.1.2. Bumpers

- 6.1.3. Suspension

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.2.1. Passenger Vehicles

- 6.2.2. Commercial Cars

- 6.1. Market Analysis, Insights and Forecast - by Application Type

- 7. Canada North America Automotive AHSS Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application Type

- 7.1.1. Structural Assembly & Closures

- 7.1.2. Bumpers

- 7.1.3. Suspension

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.2.1. Passenger Vehicles

- 7.2.2. Commercial Cars

- 7.1. Market Analysis, Insights and Forecast - by Application Type

- 8. Rest Of North America North America Automotive AHSS Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application Type

- 8.1.1. Structural Assembly & Closures

- 8.1.2. Bumpers

- 8.1.3. Suspension

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.2.1. Passenger Vehicles

- 8.2.2. Commercial Cars

- 8.1. Market Analysis, Insights and Forecast - by Application Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Posco

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 ThyssenKrupp AG

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 United States Steel Corporation

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Tata Steel Ltd

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Kobe Stee

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Arcelor Mittal SA

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Ak Steel Holding Corp

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.1 Posco

List of Figures

- Figure 1: North America Automotive AHSS Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: North America Automotive AHSS Market Share (%) by Company 2025

List of Tables

- Table 1: North America Automotive AHSS Market Revenue million Forecast, by Application Type 2020 & 2033

- Table 2: North America Automotive AHSS Market Revenue million Forecast, by Vehicle Type 2020 & 2033

- Table 3: North America Automotive AHSS Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: North America Automotive AHSS Market Revenue million Forecast, by Application Type 2020 & 2033

- Table 5: North America Automotive AHSS Market Revenue million Forecast, by Vehicle Type 2020 & 2033

- Table 6: North America Automotive AHSS Market Revenue million Forecast, by Country 2020 & 2033

- Table 7: North America Automotive AHSS Market Revenue million Forecast, by Application Type 2020 & 2033

- Table 8: North America Automotive AHSS Market Revenue million Forecast, by Vehicle Type 2020 & 2033

- Table 9: North America Automotive AHSS Market Revenue million Forecast, by Country 2020 & 2033

- Table 10: North America Automotive AHSS Market Revenue million Forecast, by Application Type 2020 & 2033

- Table 11: North America Automotive AHSS Market Revenue million Forecast, by Vehicle Type 2020 & 2033

- Table 12: North America Automotive AHSS Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Automotive AHSS Market?

The projected CAGR is approximately 10.27%.

2. Which companies are prominent players in the North America Automotive AHSS Market?

Key companies in the market include Posco, ThyssenKrupp AG, United States Steel Corporation, Tata Steel Ltd, Kobe Stee, Arcelor Mittal SA, Ak Steel Holding Corp.

3. What are the main segments of the North America Automotive AHSS Market?

The market segments include Application Type, Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 26269.5 million as of 2022.

5. What are some drivers contributing to market growth?

Increased Travel and Tourism to Fuel Market Demand.

6. What are the notable trends driving market growth?

Continuous Evolution in automotive AHSS technology.

7. Are there any restraints impacting market growth?

High Maintenance cost of RV Rental Fleets.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Automotive AHSS Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Automotive AHSS Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Automotive AHSS Market?

To stay informed about further developments, trends, and reports in the North America Automotive AHSS Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence