Key Insights

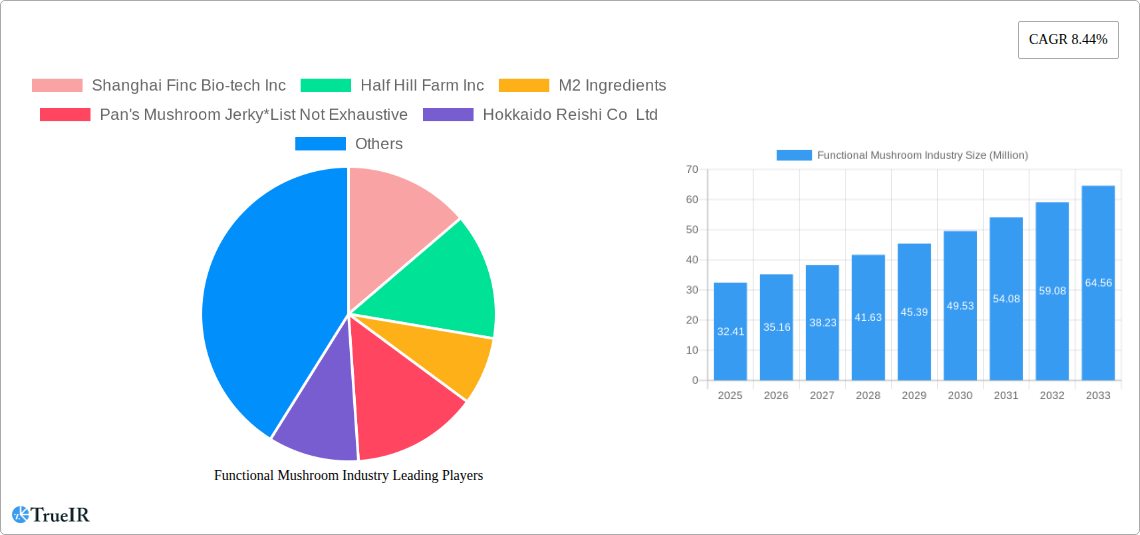

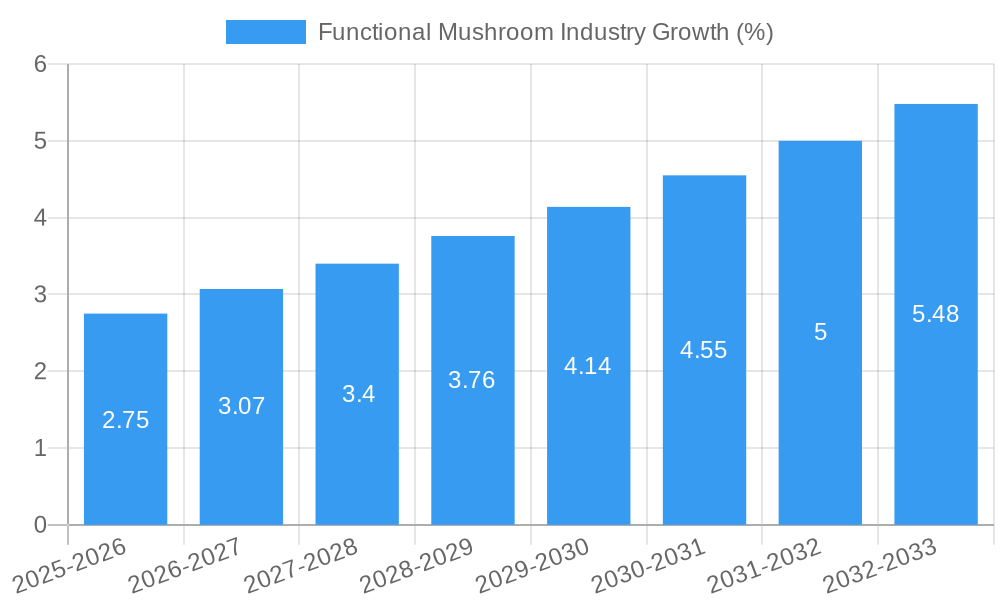

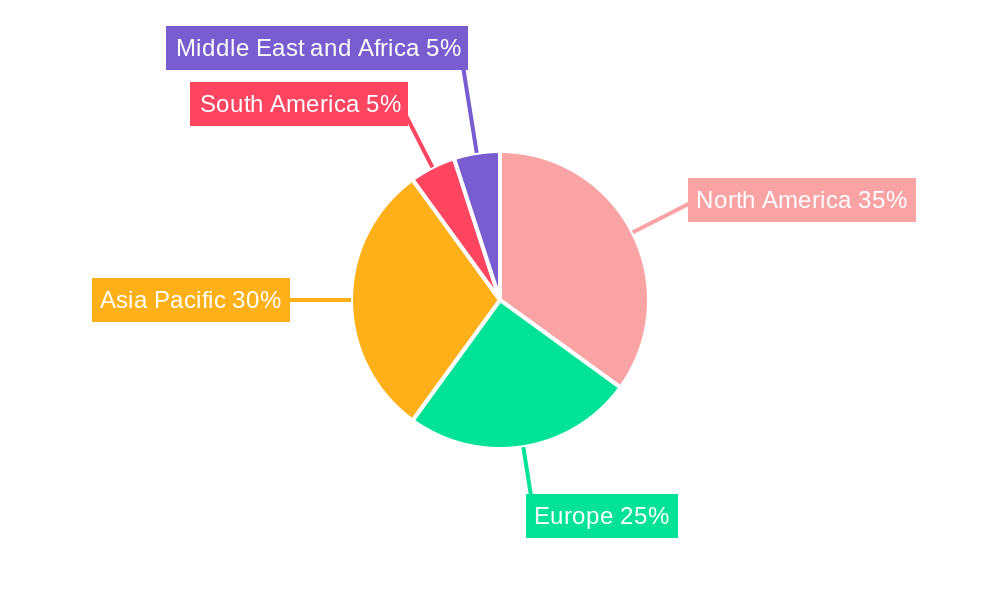

The functional mushroom market, valued at $32.41 million in 2025, is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) of 8.44% from 2025 to 2033. This expansion is driven by increasing consumer awareness of the health benefits associated with functional mushrooms, particularly their immune-boosting properties and potential to support cognitive function. Rising demand for natural and holistic health solutions, coupled with the incorporation of functional mushrooms into diverse product categories like food and beverages, dietary supplements, and personal care items, fuels this market growth. The diverse range of mushroom types available, including Reishi, Cordyceps, Lion's Mane, Turkey Tail, Shiitake, and Chaga, caters to a wide spectrum of consumer needs and preferences, further contributing to market expansion. Geographic growth is expected to be diverse, with North America and Asia-Pacific leading the way, driven by strong consumer demand and established market presence of key players. However, challenges remain including the need for standardized quality control and regulation within the industry to ensure product consistency and safety. Further research and development efforts focusing on exploring the full potential of functional mushrooms and their applications in various health and wellness domains will significantly enhance market growth and consumer trust.

The market segmentation reveals the significant roles of dietary supplements and food & beverage applications. Dietary supplements leverage the potent health benefits of functional mushrooms for targeted health goals. Food and beverage manufacturers integrate these mushrooms for their unique flavors and purported health benefits, leading to wider market penetration. The leading companies in this industry are continuously innovating to enhance product quality, expand distribution channels, and educate consumers about the benefits of functional mushrooms. This concerted effort, coupled with a growing understanding of the science behind functional mushrooms, paints a positive outlook for substantial growth in the coming years. The significant regional variations reflect cultural preferences and varying levels of awareness surrounding functional mushrooms; as consumer education and availability increase, this will likely lead to more balanced regional growth in the future.

Functional Mushroom Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the global functional mushroom industry, projecting robust growth from USD xx Million in 2025 to USD xx Million by 2033, exhibiting a CAGR of xx%. The study period spans 2019-2033, with 2025 as the base and estimated year. This in-depth analysis covers market structure, competitive landscape, trends, opportunities, and challenges, offering invaluable insights for businesses and investors in this rapidly expanding sector.

Functional Mushroom Industry Market Structure & Competitive Landscape

The functional mushroom market is characterized by a moderately fragmented landscape, with a Herfindahl-Hirschman Index (HHI) of xx in 2024. Several key players dominate specific segments, but significant opportunities exist for smaller companies to innovate and capture market share. Concentration ratios vary significantly across different product types and geographical regions.

- Market Concentration: The top 5 companies hold approximately xx% of the global market share, indicating a moderate level of concentration. However, a significant number of smaller players, particularly in regional markets, contribute to the overall market size.

- Innovation Drivers: Research and development efforts focusing on new extraction methods, product formulations, and clinical trials are driving innovation. Consumer demand for natural health solutions and functional foods fuels further innovation.

- Regulatory Impacts: Varying regulations across different countries impact market entry and product development. Harmonization of regulations is crucial for industry growth. Specific regulations impacting labeling, safety, and efficacy are addressed within the full report.

- Product Substitutes: Other dietary supplements and herbal remedies present competition. However, the unique health benefits attributed to functional mushrooms provide a competitive edge.

- End-User Segmentation: The market is segmented by applications including food & beverage, dietary supplements, personal care, and pharmaceuticals. Food & beverage currently holds the largest share.

- M&A Trends: The past five years have witnessed xx mergers and acquisitions, with an average deal value of USD xx Million. Consolidation is anticipated to continue as larger players seek to expand their product portfolios and geographic reach.

Functional Mushroom Industry Market Trends & Opportunities

The functional mushroom market is experiencing exponential growth, fueled by increasing consumer awareness of health benefits, a preference for natural and plant-based products, and the expanding application in food and beverage products. The market exhibits a significant growth trajectory, driven by rising disposable incomes, increasing health consciousness, and a growing demand for natural health solutions. This growth is further propelled by the diverse range of potential health benefits associated with functional mushrooms. Technological advancements in extraction and cultivation methods are also contributing to market expansion, allowing for increased production efficiency and improved product quality.

The market is poised for significant growth, driven by several key factors, including:

- Rising consumer awareness: Increased knowledge of functional mushrooms' health benefits is driving demand.

- Health & wellness trend: Consumers are actively seeking natural alternatives for health and wellness.

- Product diversification: Innovation in product formats caters to diverse consumer preferences.

- Technological advancements: Improved cultivation and extraction methods enhance efficiency and quality.

- Market penetration: The market penetration rate for functional mushroom products is still relatively low, indicating substantial growth potential.

Dominant Markets & Segments in Functional Mushroom Industry

The dietary supplements segment accounts for the largest market share, driven by growing health consciousness and increasing demand for natural health solutions. Geographically, North America currently dominates the market, followed by Europe and Asia.

Key Growth Drivers by Segment:

- Dietary Supplements: High demand for natural health supplements, growing awareness of health benefits, increased accessibility through online retailers and health stores.

- Food and Beverage: Rising demand for functional foods and beverages, incorporation into various food and drink products, increased consumer acceptance of unique flavors and textures.

- Reishi: Strong reputation for immune support, increased research and clinical trials, expanding product range (e.g., extracts, capsules, beverages).

- Cordyceps: Known for energy-boosting and athletic performance enhancement properties, increasing popularity amongst athletes and health-conscious individuals, expanding market in sports nutrition.

- Lions Mane: Known for cognitive function improvement and potential neuroprotective properties, rising demand amongst aging populations and those concerned about brain health.

- Turkey Tail: Known for its immune-modulating properties, increasing adoption in complementary and alternative medicine (CAM).

- Shiitake: Widely consumed culinary mushroom, functional benefits, broadening market reach through food & beverage products.

- Chaga: Known for its antioxidant and anti-inflammatory properties, growing popularity as a functional ingredient, expanding use in teas and extracts.

Geographic Dominance: North America holds the largest market share, attributed to high consumer disposable income, health awareness, strong regulatory landscape, and extensive retail distribution networks. Europe is a fast-growing region. Asia presents significant untapped potential due to its large population and increasing health consciousness.

Functional Mushroom Industry Product Analysis

Product innovation centers on enhancing bioavailability, improving taste and texture, and expanding applications in novel food products and nutraceuticals. Technological advances in extraction methods and cultivation techniques deliver higher-quality extracts with improved efficacy. The market offers a diverse range of products catering to various consumer needs and preferences. The focus is on creating consumer-friendly products with enhanced bioavailability and palatability.

Key Drivers, Barriers & Challenges in Functional Mushroom Industry

Key Drivers:

- Growing health consciousness: Consumers are increasingly seeking natural health solutions.

- Technological advancements: Improved cultivation and extraction techniques enhance efficiency and quality.

- Expanding applications: Functional mushrooms are incorporated into diverse products (food, beverages, supplements).

- Rising disposable income: Increased purchasing power fuels demand for premium health products.

Challenges:

- Regulatory hurdles: Varying regulations across countries complicate market entry and product development.

- Supply chain issues: Ensuring consistent quality and sustainable sourcing of raw materials.

- Competitive pressures: Intense competition from other dietary supplements and functional foods.

- Consumer education: Raising awareness about the benefits of functional mushrooms is crucial.

- Estimated impact of regulatory hurdles on market growth: xx% reduction in potential growth over the forecast period.

Growth Drivers in the Functional Mushroom Industry Market

Growth is primarily driven by rising consumer awareness of health benefits, the growing popularity of natural health products, and technological advancements that improve cultivation efficiency and product quality. Government support for research and development further enhances growth prospects. Investment in innovative product formats and formulations also plays a crucial role.

Challenges Impacting Functional Mushroom Industry Growth

Challenges include inconsistent supply chain management, potentially leading to price volatility. Difficulties in obtaining consistent quality raw materials are a restraint. Regulatory complexities differ across global regions, complicating product approvals. Maintaining consistent product quality requires rigorous quality control procedures throughout the supply chain.

Key Players Shaping the Functional Mushroom Industry Market

- Shanghai Finc Bio-tech Inc

- Half Hill Farm Inc

- M2 Ingredients

- Pan's Mushroom Jerky

- Hokkaido Reishi Co Ltd

- Mitoku Company Ltd

- Lianfeng (Suizhou) Food Co Ltd

- Hirano Mushroom LLC

- CNC Exotic Mushrooms

- Nammex

Significant Functional Mushroom Industry Milestones

- June 2021: The Marley partnered up with Silo Wellness Inc. to launch Marley One, a functional and psychedelic mushroom consumer brand.

- December 2021: Psyence Group Inc.'s Goodmind partnered with Vida e Caffè to launch its functional mushroom brand in South Africa.

- September 2022: Innomy secured €1.3 million (USD 1.26 million) in funding to expand its mushroom-based meat substitute business in Europe.

Future Outlook for Functional Mushroom Industry Market

The functional mushroom market presents significant growth opportunities, driven by increasing consumer demand for natural health solutions, expanding product applications, and ongoing research and development. Strategic partnerships and collaborations will play a crucial role in accelerating market expansion and capturing untapped potential in emerging markets. The industry is well-positioned for continued growth, with innovations driving both the product and the market.

Functional Mushroom Industry Segmentation

-

1. Product Type

- 1.1. Reishi

- 1.2. Cordyceps

- 1.3. Lions Mane

- 1.4. Turkey Tail

- 1.5. Shiitake

- 1.6. Chaga

- 1.7. Other Product Types

-

2. Application

- 2.1. Food and Beverage

- 2.2. Dietary Supplements

- 2.3. Personal Care

- 2.4. Pharmaceutical

Functional Mushroom Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Russia

- 2.5. Italy

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. South Africa

- 5.2. Saudi Arabia

- 5.3. Rest of Middle East and Africa

Functional Mushroom Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.44% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Convenience and Processed Foods Drives Demand; Expanding Cosmetic and Personal Care Industries Utilize Gelatin for Various Purposes

- 3.3. Market Restrains

- 3.3.1. Fluctuations in Raw Material Proces Affecting Production Costs

- 3.4. Market Trends

- 3.4.1. Surge in Demand for Functional Food and Nutraceutical

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Functional Mushroom Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Reishi

- 5.1.2. Cordyceps

- 5.1.3. Lions Mane

- 5.1.4. Turkey Tail

- 5.1.5. Shiitake

- 5.1.6. Chaga

- 5.1.7. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Food and Beverage

- 5.2.2. Dietary Supplements

- 5.2.3. Personal Care

- 5.2.4. Pharmaceutical

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Functional Mushroom Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Reishi

- 6.1.2. Cordyceps

- 6.1.3. Lions Mane

- 6.1.4. Turkey Tail

- 6.1.5. Shiitake

- 6.1.6. Chaga

- 6.1.7. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Food and Beverage

- 6.2.2. Dietary Supplements

- 6.2.3. Personal Care

- 6.2.4. Pharmaceutical

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Functional Mushroom Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Reishi

- 7.1.2. Cordyceps

- 7.1.3. Lions Mane

- 7.1.4. Turkey Tail

- 7.1.5. Shiitake

- 7.1.6. Chaga

- 7.1.7. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Food and Beverage

- 7.2.2. Dietary Supplements

- 7.2.3. Personal Care

- 7.2.4. Pharmaceutical

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Functional Mushroom Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Reishi

- 8.1.2. Cordyceps

- 8.1.3. Lions Mane

- 8.1.4. Turkey Tail

- 8.1.5. Shiitake

- 8.1.6. Chaga

- 8.1.7. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Food and Beverage

- 8.2.2. Dietary Supplements

- 8.2.3. Personal Care

- 8.2.4. Pharmaceutical

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. South America Functional Mushroom Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Reishi

- 9.1.2. Cordyceps

- 9.1.3. Lions Mane

- 9.1.4. Turkey Tail

- 9.1.5. Shiitake

- 9.1.6. Chaga

- 9.1.7. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Food and Beverage

- 9.2.2. Dietary Supplements

- 9.2.3. Personal Care

- 9.2.4. Pharmaceutical

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Middle East and Africa Functional Mushroom Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Reishi

- 10.1.2. Cordyceps

- 10.1.3. Lions Mane

- 10.1.4. Turkey Tail

- 10.1.5. Shiitake

- 10.1.6. Chaga

- 10.1.7. Other Product Types

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Food and Beverage

- 10.2.2. Dietary Supplements

- 10.2.3. Personal Care

- 10.2.4. Pharmaceutical

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. North America Functional Mushroom Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 11.1.3 Mexico

- 11.1.4 Rest of North America

- 12. Europe Functional Mushroom Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 United Kingdom

- 12.1.3 France

- 12.1.4 Russia

- 12.1.5 Italy

- 12.1.6 Rest of Europe

- 13. Asia Pacific Functional Mushroom Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 India

- 13.1.4 Australia

- 13.1.5 Rest of Asia Pacific

- 14. South America Functional Mushroom Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 Brazil

- 14.1.2 Argentina

- 14.1.3 Rest of South America

- 15. Middle East and Africa Functional Mushroom Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 South Africa

- 15.1.2 Saudi Arabia

- 15.1.3 Rest of Middle East and Africa

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Shanghai Finc Bio-tech Inc

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Half Hill Farm Inc

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 M2 Ingredients

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Pan's Mushroom Jerky*List Not Exhaustive

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Hokkaido Reishi Co Ltd

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Mitoku Company Ltd

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Lianfeng (Suizhou) Food Co Ltd

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Hirano Mushroom LLC

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 CNC Exotic Mushrooms

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Nammex

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.1 Shanghai Finc Bio-tech Inc

List of Figures

- Figure 1: Global Functional Mushroom Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Functional Mushroom Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Functional Mushroom Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Functional Mushroom Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Functional Mushroom Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Functional Mushroom Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Functional Mushroom Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Functional Mushroom Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: South America Functional Mushroom Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East and Africa Functional Mushroom Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East and Africa Functional Mushroom Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Functional Mushroom Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 13: North America Functional Mushroom Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 14: North America Functional Mushroom Industry Revenue (Million), by Application 2024 & 2032

- Figure 15: North America Functional Mushroom Industry Revenue Share (%), by Application 2024 & 2032

- Figure 16: North America Functional Mushroom Industry Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Functional Mushroom Industry Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Functional Mushroom Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 19: Europe Functional Mushroom Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 20: Europe Functional Mushroom Industry Revenue (Million), by Application 2024 & 2032

- Figure 21: Europe Functional Mushroom Industry Revenue Share (%), by Application 2024 & 2032

- Figure 22: Europe Functional Mushroom Industry Revenue (Million), by Country 2024 & 2032

- Figure 23: Europe Functional Mushroom Industry Revenue Share (%), by Country 2024 & 2032

- Figure 24: Asia Pacific Functional Mushroom Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 25: Asia Pacific Functional Mushroom Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 26: Asia Pacific Functional Mushroom Industry Revenue (Million), by Application 2024 & 2032

- Figure 27: Asia Pacific Functional Mushroom Industry Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Functional Mushroom Industry Revenue (Million), by Country 2024 & 2032

- Figure 29: Asia Pacific Functional Mushroom Industry Revenue Share (%), by Country 2024 & 2032

- Figure 30: South America Functional Mushroom Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 31: South America Functional Mushroom Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 32: South America Functional Mushroom Industry Revenue (Million), by Application 2024 & 2032

- Figure 33: South America Functional Mushroom Industry Revenue Share (%), by Application 2024 & 2032

- Figure 34: South America Functional Mushroom Industry Revenue (Million), by Country 2024 & 2032

- Figure 35: South America Functional Mushroom Industry Revenue Share (%), by Country 2024 & 2032

- Figure 36: Middle East and Africa Functional Mushroom Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 37: Middle East and Africa Functional Mushroom Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 38: Middle East and Africa Functional Mushroom Industry Revenue (Million), by Application 2024 & 2032

- Figure 39: Middle East and Africa Functional Mushroom Industry Revenue Share (%), by Application 2024 & 2032

- Figure 40: Middle East and Africa Functional Mushroom Industry Revenue (Million), by Country 2024 & 2032

- Figure 41: Middle East and Africa Functional Mushroom Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Functional Mushroom Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Functional Mushroom Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Global Functional Mushroom Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Global Functional Mushroom Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Functional Mushroom Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States Functional Mushroom Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada Functional Mushroom Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico Functional Mushroom Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of North America Functional Mushroom Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Functional Mushroom Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Germany Functional Mushroom Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United Kingdom Functional Mushroom Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: France Functional Mushroom Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Russia Functional Mushroom Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Italy Functional Mushroom Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Rest of Europe Functional Mushroom Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Global Functional Mushroom Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: China Functional Mushroom Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Japan Functional Mushroom Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: India Functional Mushroom Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Australia Functional Mushroom Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Rest of Asia Pacific Functional Mushroom Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Global Functional Mushroom Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Brazil Functional Mushroom Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Argentina Functional Mushroom Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Rest of South America Functional Mushroom Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Global Functional Mushroom Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 28: South Africa Functional Mushroom Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Saudi Arabia Functional Mushroom Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Rest of Middle East and Africa Functional Mushroom Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Global Functional Mushroom Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 32: Global Functional Mushroom Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 33: Global Functional Mushroom Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 34: United States Functional Mushroom Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Canada Functional Mushroom Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Mexico Functional Mushroom Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Rest of North America Functional Mushroom Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Global Functional Mushroom Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 39: Global Functional Mushroom Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 40: Global Functional Mushroom Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 41: Germany Functional Mushroom Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: United Kingdom Functional Mushroom Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: France Functional Mushroom Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Russia Functional Mushroom Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Italy Functional Mushroom Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Rest of Europe Functional Mushroom Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Global Functional Mushroom Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 48: Global Functional Mushroom Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 49: Global Functional Mushroom Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 50: China Functional Mushroom Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: Japan Functional Mushroom Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: India Functional Mushroom Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: Australia Functional Mushroom Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Rest of Asia Pacific Functional Mushroom Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: Global Functional Mushroom Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 56: Global Functional Mushroom Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 57: Global Functional Mushroom Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 58: Brazil Functional Mushroom Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: Argentina Functional Mushroom Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: Rest of South America Functional Mushroom Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 61: Global Functional Mushroom Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 62: Global Functional Mushroom Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 63: Global Functional Mushroom Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 64: South Africa Functional Mushroom Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 65: Saudi Arabia Functional Mushroom Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 66: Rest of Middle East and Africa Functional Mushroom Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Functional Mushroom Industry?

The projected CAGR is approximately 8.44%.

2. Which companies are prominent players in the Functional Mushroom Industry?

Key companies in the market include Shanghai Finc Bio-tech Inc, Half Hill Farm Inc, M2 Ingredients, Pan's Mushroom Jerky*List Not Exhaustive, Hokkaido Reishi Co Ltd, Mitoku Company Ltd, Lianfeng (Suizhou) Food Co Ltd, Hirano Mushroom LLC, CNC Exotic Mushrooms, Nammex.

3. What are the main segments of the Functional Mushroom Industry?

The market segments include Product Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 32.41 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Convenience and Processed Foods Drives Demand; Expanding Cosmetic and Personal Care Industries Utilize Gelatin for Various Purposes.

6. What are the notable trends driving market growth?

Surge in Demand for Functional Food and Nutraceutical.

7. Are there any restraints impacting market growth?

Fluctuations in Raw Material Proces Affecting Production Costs.

8. Can you provide examples of recent developments in the market?

September 2022: Innomy, a Spanish business focused on mushroom-based meat substitutes, revealed it has secured €1.3 million(USD 1.26 million) in a Pre Series A fundraising round to expand, market, and sell its products throughout Europe. According to Innomy, mycelium has a high nutritional value, low cholesterol, and low saturated fat content, making it one of the most promising protein sources for the future.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Functional Mushroom Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Functional Mushroom Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Functional Mushroom Industry?

To stay informed about further developments, trends, and reports in the Functional Mushroom Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence