Key Insights

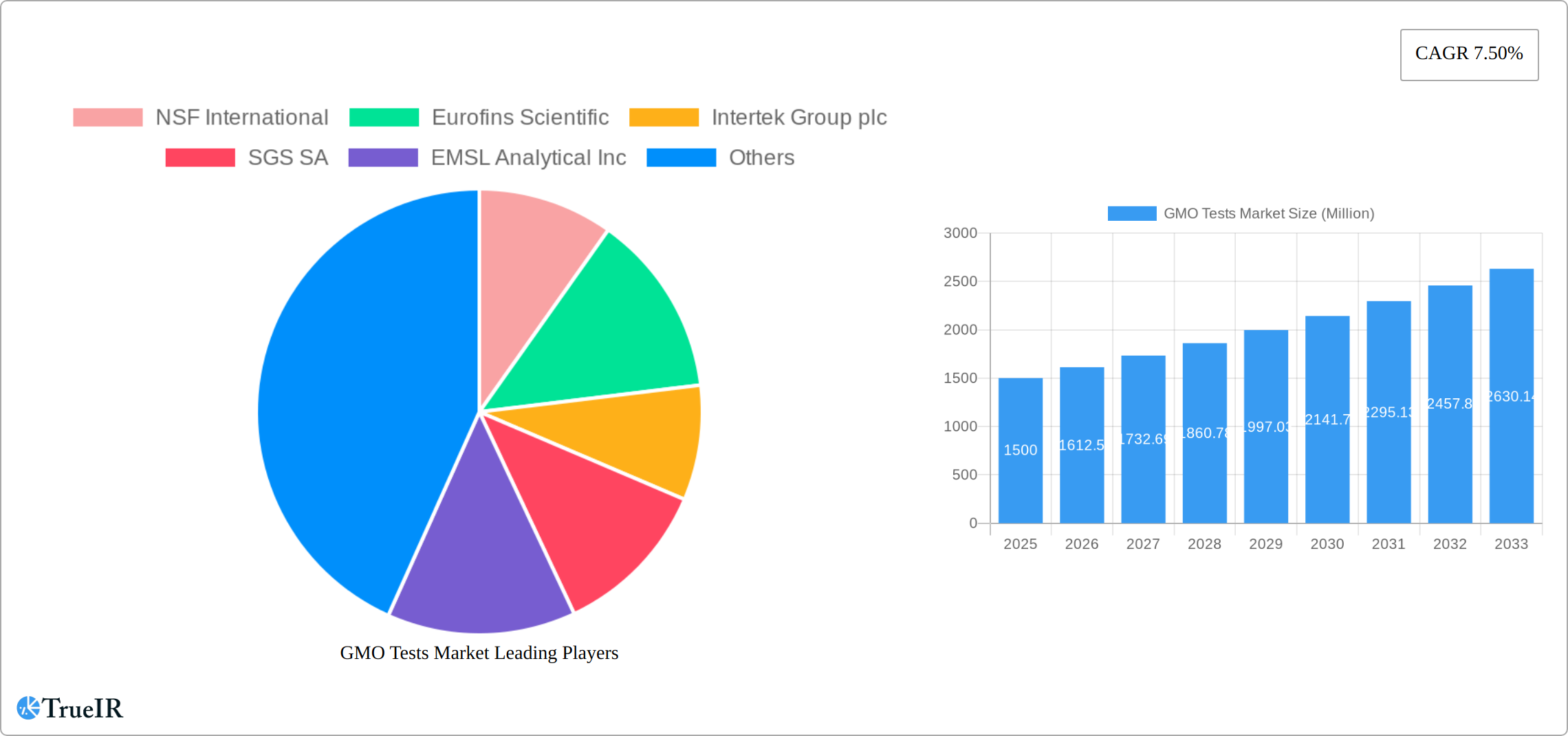

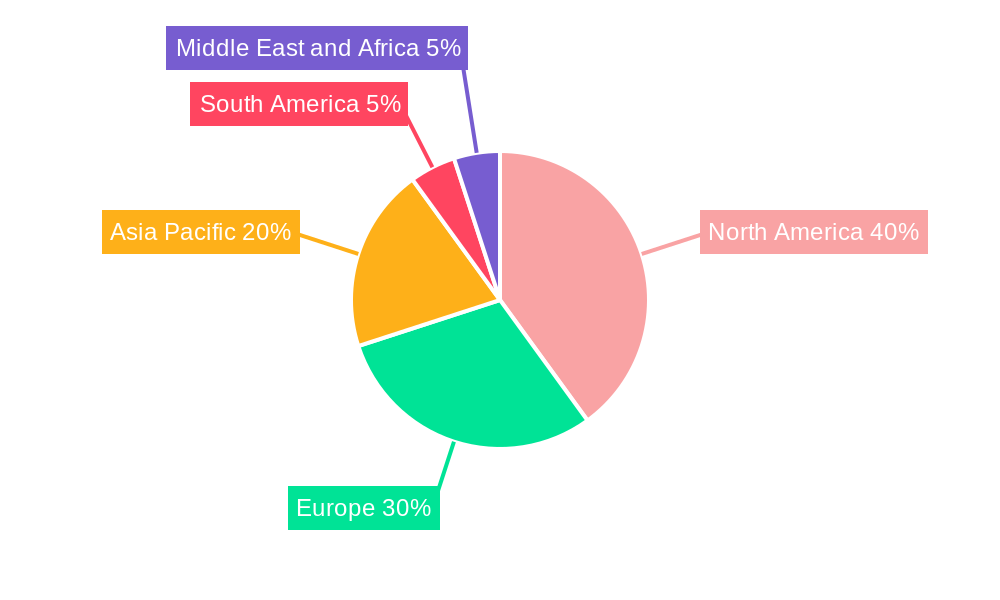

The GMO Tests market, valued at approximately $XX million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 7.50% from 2025 to 2033. This expansion is fueled by several key drivers. Increasing consumer demand for transparency in food labeling, coupled with stricter government regulations regarding GMO content in food products, is significantly boosting the market. Advancements in testing technologies, such as the development of more rapid, sensitive, and cost-effective Polymerase Chain Reaction (PCR), ELISA, and strip tests (lateral flow devices), are also contributing to market growth. The growing awareness of potential health and environmental impacts associated with GMOs further stimulates demand for accurate and reliable testing solutions. North America and Europe currently hold significant market shares, driven by established regulatory frameworks and higher consumer awareness. However, the Asia-Pacific region is poised for substantial growth, fueled by increasing food production and a rising middle class with greater purchasing power and a growing demand for safe and traceable food products. Market restraints include the high cost of some testing methods, particularly for smaller businesses or developing countries, and the potential for false positives or negatives, necessitating robust quality control and standardization procedures. The market is segmented by technology (PCR, ELISA, strip tests), reflecting the diversity of approaches used for GMO detection. Major players like NSF International, Eurofins Scientific, and Intertek Group plc are driving innovation and expanding their market presence through strategic partnerships and acquisitions.

The forecast period of 2025-2033 will likely witness a consolidation of market players, with larger companies acquiring smaller ones to expand their service portfolio and geographical reach. The continued refinement of existing technologies, alongside the emergence of new, more efficient testing methods, will be pivotal in shaping the future of the GMO Tests market. The market's success will largely depend on the ongoing efforts to address regulatory complexities, ensure the affordability of testing, and maintain high accuracy to satisfy both consumer and regulatory demands. Technological advancements promising faster and more affordable testing, coupled with increasing consumer awareness and stringent regulatory mandates, will continue to propel the market towards significant growth throughout the forecast period. The continued focus on transparency and traceability across the food supply chain suggests a very positive outlook for the GMO testing market for the foreseeable future.

GMO Tests Market: A Comprehensive Report (2019-2033)

This dynamic report provides a comprehensive analysis of the GMO Tests market, offering invaluable insights for industry stakeholders, investors, and researchers. Leveraging extensive data analysis from 2019 to 2033 (base year 2025, estimated year 2025, forecast period 2025-2033), this report meticulously examines market size, growth trajectory, technological advancements, competitive dynamics, and future prospects. The global GMO Tests market is projected to reach xx Million by 2033, exhibiting a robust CAGR of xx% during the forecast period.

GMO Tests Market Market Structure & Competitive Landscape

The GMO Tests market exhibits a moderately concentrated structure, with several key players vying for market share. The top five companies—NSF International, Eurofins Scientific, Intertek Group plc, SGS SA, and EMSL Analytical Inc—hold approximately xx% of the global market share in 2025, indicating moderate consolidation. However, the presence of numerous smaller players, particularly in niche segments, creates a dynamic competitive landscape. Innovation plays a crucial role, with companies investing heavily in developing advanced testing technologies like next-generation sequencing and CRISPR-based detection methods. Regulatory landscapes vary across countries, impacting market access and standardization. Substitutes, primarily traditional methods like visual inspection, exist but are increasingly challenged by the higher accuracy and speed of modern GMO testing techniques. The end-user segment is primarily comprised of food producers, regulatory agencies, and research institutions. The market has witnessed several mergers and acquisitions (M&A) in the past few years, indicating strategic consolidation. The estimated M&A volume during the historical period (2019-2024) was xx deals, with a focus on expanding geographical reach and technological capabilities. The market will likely see further consolidation in the coming years, with larger players acquiring smaller companies to enhance their market presence and technology portfolio.

GMO Tests Market Market Trends & Opportunities

The GMO Tests market is experiencing robust growth, fueled by a confluence of factors. Increasing consumer demand for transparency and traceability in the food supply chain is a primary driver. Stringent government regulations regarding GMO labeling, particularly in regions with heightened consumer awareness, are significantly impacting market expansion. Furthermore, the global genetically modified (GM) crop market's continued expansion necessitates reliable and efficient testing solutions. The market, valued at xx Million USD in 2025, is projected to reach xx Million USD by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of xx%. This growth trajectory is largely attributable to continuous technological advancements.

A key trend is the market shift towards high-throughput screening technologies such as PCR (Polymerase Chain Reaction) and ELISA (Enzyme-linked Immunosorbent Assay). These methods offer faster, more precise, and often more sensitive GMO detection compared to traditional techniques. The market penetration of these advanced technologies is estimated at xx% in 2025 and is projected to increase to xx% by 2033. This adoption is driven by the need for quicker turnaround times and greater accuracy in identifying even trace amounts of GMO material. This increasing demand is further amplified by the growing consumer preference for non-GMO products, fueling the need for accurate and reliable testing solutions. The expanding regulatory landscape, with increasing stringency in labeling requirements worldwide, further bolsters market demand, creating a favorable environment for continued growth.

Dominant Markets & Segments in GMO Tests Market

North America currently dominates the GMO Tests market, propelled by robust regulatory frameworks, strong consumer awareness regarding GMOs, and widespread adoption of advanced testing technologies. The United States, in particular, plays a significant role due to its stringent labeling regulations and well-developed testing infrastructure. Key growth drivers within this region include:

- Stringent regulatory environment: Mandatory GMO labeling in the U.S. fuels the demand for comprehensive testing services.

- Advanced infrastructure: The presence of sophisticated testing facilities and a skilled workforce facilitates efficient and accurate testing.

- High consumer awareness and demand: Significant consumer preference for non-GMO products drives the need for reliable GMO testing.

Analyzing the technology segments, Polymerase Chain Reaction (PCR) technology commands the largest market share, exceeding xx Million USD in 2025. Its high sensitivity, specificity, and speed make it the preferred method for detecting even trace amounts of GMOs. ELISA tests are experiencing growth, particularly in developing economies, due to their cost-effectiveness and relative simplicity. The strip test segment offers convenience and portability, making it suitable for point-of-care and on-site testing, expanding access to testing in diverse settings.

GMO Tests Market Product Analysis

The GMO Tests market offers a range of products, including PCR-based kits, ELISA assays, and lateral flow devices, each catering to different needs and budgets. Recent innovations focus on developing faster, more sensitive, and cost-effective testing methods. These innovations target a broader market by improving accessibility and reducing the time required to obtain results. The competitive advantage lies in the speed, accuracy, and cost-effectiveness of the tests, combined with comprehensive data management solutions to meet the traceability demands of the food industry.

Key Drivers, Barriers & Challenges in GMO Tests Market

Key Drivers: Technological advancements, such as the development of faster and more accurate testing methods, are significant drivers. Growing consumer demand for non-GMO products fuels market growth. Stringent government regulations regarding GMO labeling and traceability create a mandatory testing environment. Expansion of genetically modified crop cultivation in various regions also increases the need for GMO testing.

Challenges: Regulatory complexities and variations across countries create barriers to market entry and standardization. Supply chain disruptions due to global events can impact the availability of testing materials. Intense competition amongst numerous players, some with significant resources, creates pressure on pricing and profit margins.

Growth Drivers in the GMO Tests Market Market

The GMO Tests market's growth is primarily driven by several key factors. Technological innovation is paramount, with continuous advancements leading to faster, more accurate, and more cost-effective testing methods. The rising consumer demand for transparency and traceability in the food supply chain is another significant driver, pushing for stricter regulations and increased testing. This, coupled with increasingly stringent global regulations mandating GMO labeling, further fuels market expansion. The expanding global market for GM crops also necessitates robust and reliable testing solutions to ensure compliance and maintain consumer confidence.

Challenges Impacting GMO Tests Market Growth

Significant challenges include regulatory inconsistencies across global markets, creating compliance difficulties. Supply chain vulnerabilities make reagent access unpredictable. The highly competitive market with several large players keeps pricing under pressure, potentially affecting profitability.

Key Players Shaping the GMO Tests Market Market

- NSF International

- Eurofins Scientific

- Intertek Group plc

- SGS SA

- EMSL Analytical Inc

- Mérieux NutriSciences Corporation

- ALS Limited

- Bureau Veritas

Significant GMO Tests Market Industry Milestones

- 2020: Eurofins Scientific launched a new rapid PCR-based GMO testing kit, enhancing speed and efficiency.

- 2021: NSF International's acquisition of a smaller GMO testing company expanded its market reach and service capabilities.

- 2022: SGS SA introduced a novel ELISA-based test with improved sensitivity, leading to more accurate results.

- 2023: The publication of updated GMO testing guidelines by a major regulatory body standardized testing procedures and improved industry practices.

Future Outlook for GMO Tests Market Market

The GMO Tests market is poised for significant growth, driven by continuous technological advancements and increasingly stringent regulations. Strategic partnerships and acquisitions will likely further shape the market landscape. The market presents lucrative opportunities for companies offering innovative, cost-effective, and accurate GMO testing solutions, particularly those catering to emerging economies and specialized applications.

GMO Tests Market Segmentation

-

1. Technology

- 1.1. Polymerase Chain Reaction

- 1.2. ELISA Test

- 1.3. Strip test (Lateral Flow Device or Dipstick)

GMO Tests Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. Italy

- 2.4. France

- 2.5. Russia

- 2.6. Spain

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. South Africa

- 5.2. United Arab Emirates

- 5.3. Rest of Middle East and Africa

GMO Tests Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Incidences of Food Allergies; Favorable Government Initiatives and Regulations for Food Safety

- 3.3. Market Restrains

- 3.3.1. Inconsistencies Involved in Food Allergen Declarations

- 3.4. Market Trends

- 3.4.1. PCR Technique Holds a Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global GMO Tests Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Polymerase Chain Reaction

- 5.1.2. ELISA Test

- 5.1.3. Strip test (Lateral Flow Device or Dipstick)

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. South America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. North America GMO Tests Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 6.1.1. Polymerase Chain Reaction

- 6.1.2. ELISA Test

- 6.1.3. Strip test (Lateral Flow Device or Dipstick)

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 7. Europe GMO Tests Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 7.1.1. Polymerase Chain Reaction

- 7.1.2. ELISA Test

- 7.1.3. Strip test (Lateral Flow Device or Dipstick)

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 8. Asia Pacific GMO Tests Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 8.1.1. Polymerase Chain Reaction

- 8.1.2. ELISA Test

- 8.1.3. Strip test (Lateral Flow Device or Dipstick)

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 9. South America GMO Tests Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 9.1.1. Polymerase Chain Reaction

- 9.1.2. ELISA Test

- 9.1.3. Strip test (Lateral Flow Device or Dipstick)

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 10. Middle East and Africa GMO Tests Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 10.1.1. Polymerase Chain Reaction

- 10.1.2. ELISA Test

- 10.1.3. Strip test (Lateral Flow Device or Dipstick)

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 11. North America GMO Tests Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 11.1.3 Mexico

- 11.1.4 Rest of North America

- 12. Europe GMO Tests Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 United Kingdom

- 12.1.3 Italy

- 12.1.4 France

- 12.1.5 Russia

- 12.1.6 Spain

- 12.1.7 Rest of Europe

- 13. Asia Pacific GMO Tests Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 India

- 13.1.2 China

- 13.1.3 Japan

- 13.1.4 Australia

- 13.1.5 Rest of Asia Pacific

- 14. South America GMO Tests Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 Brazil

- 14.1.2 Argentina

- 14.1.3 Rest of South America

- 15. Middle East and Africa GMO Tests Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 South Africa

- 15.1.2 United Arab Emirates

- 15.1.3 Rest of Middle East and Africa

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 NSF International

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Eurofins Scientific

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Intertek Group plc

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 SGS SA

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 EMSL Analytical Inc

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Merieux NutriSciences Corporation

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 ALS Limited

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Bureau Veritas*List Not Exhaustive

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.1 NSF International

List of Figures

- Figure 1: Global GMO Tests Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America GMO Tests Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America GMO Tests Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe GMO Tests Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe GMO Tests Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific GMO Tests Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific GMO Tests Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America GMO Tests Market Revenue (Million), by Country 2024 & 2032

- Figure 9: South America GMO Tests Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East and Africa GMO Tests Market Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East and Africa GMO Tests Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America GMO Tests Market Revenue (Million), by Technology 2024 & 2032

- Figure 13: North America GMO Tests Market Revenue Share (%), by Technology 2024 & 2032

- Figure 14: North America GMO Tests Market Revenue (Million), by Country 2024 & 2032

- Figure 15: North America GMO Tests Market Revenue Share (%), by Country 2024 & 2032

- Figure 16: Europe GMO Tests Market Revenue (Million), by Technology 2024 & 2032

- Figure 17: Europe GMO Tests Market Revenue Share (%), by Technology 2024 & 2032

- Figure 18: Europe GMO Tests Market Revenue (Million), by Country 2024 & 2032

- Figure 19: Europe GMO Tests Market Revenue Share (%), by Country 2024 & 2032

- Figure 20: Asia Pacific GMO Tests Market Revenue (Million), by Technology 2024 & 2032

- Figure 21: Asia Pacific GMO Tests Market Revenue Share (%), by Technology 2024 & 2032

- Figure 22: Asia Pacific GMO Tests Market Revenue (Million), by Country 2024 & 2032

- Figure 23: Asia Pacific GMO Tests Market Revenue Share (%), by Country 2024 & 2032

- Figure 24: South America GMO Tests Market Revenue (Million), by Technology 2024 & 2032

- Figure 25: South America GMO Tests Market Revenue Share (%), by Technology 2024 & 2032

- Figure 26: South America GMO Tests Market Revenue (Million), by Country 2024 & 2032

- Figure 27: South America GMO Tests Market Revenue Share (%), by Country 2024 & 2032

- Figure 28: Middle East and Africa GMO Tests Market Revenue (Million), by Technology 2024 & 2032

- Figure 29: Middle East and Africa GMO Tests Market Revenue Share (%), by Technology 2024 & 2032

- Figure 30: Middle East and Africa GMO Tests Market Revenue (Million), by Country 2024 & 2032

- Figure 31: Middle East and Africa GMO Tests Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global GMO Tests Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global GMO Tests Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 3: Global GMO Tests Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global GMO Tests Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: United States GMO Tests Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Canada GMO Tests Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Mexico GMO Tests Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Rest of North America GMO Tests Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global GMO Tests Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Germany GMO Tests Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: United Kingdom GMO Tests Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Italy GMO Tests Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: France GMO Tests Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Russia GMO Tests Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Spain GMO Tests Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Rest of Europe GMO Tests Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Global GMO Tests Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: India GMO Tests Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: China GMO Tests Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Japan GMO Tests Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Australia GMO Tests Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Rest of Asia Pacific GMO Tests Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Global GMO Tests Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Brazil GMO Tests Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Argentina GMO Tests Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Rest of South America GMO Tests Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Global GMO Tests Market Revenue Million Forecast, by Country 2019 & 2032

- Table 28: South Africa GMO Tests Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: United Arab Emirates GMO Tests Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Rest of Middle East and Africa GMO Tests Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Global GMO Tests Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 32: Global GMO Tests Market Revenue Million Forecast, by Country 2019 & 2032

- Table 33: United States GMO Tests Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Canada GMO Tests Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Mexico GMO Tests Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Rest of North America GMO Tests Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Global GMO Tests Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 38: Global GMO Tests Market Revenue Million Forecast, by Country 2019 & 2032

- Table 39: Germany GMO Tests Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom GMO Tests Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Italy GMO Tests Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: France GMO Tests Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Russia GMO Tests Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Spain GMO Tests Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Rest of Europe GMO Tests Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Global GMO Tests Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 47: Global GMO Tests Market Revenue Million Forecast, by Country 2019 & 2032

- Table 48: India GMO Tests Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: China GMO Tests Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Japan GMO Tests Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: Australia GMO Tests Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Rest of Asia Pacific GMO Tests Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: Global GMO Tests Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 54: Global GMO Tests Market Revenue Million Forecast, by Country 2019 & 2032

- Table 55: Brazil GMO Tests Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Argentina GMO Tests Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: Rest of South America GMO Tests Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: Global GMO Tests Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 59: Global GMO Tests Market Revenue Million Forecast, by Country 2019 & 2032

- Table 60: South Africa GMO Tests Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 61: United Arab Emirates GMO Tests Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 62: Rest of Middle East and Africa GMO Tests Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the GMO Tests Market?

The projected CAGR is approximately 7.50%.

2. Which companies are prominent players in the GMO Tests Market?

Key companies in the market include NSF International, Eurofins Scientific, Intertek Group plc, SGS SA, EMSL Analytical Inc, Merieux NutriSciences Corporation, ALS Limited, Bureau Veritas*List Not Exhaustive.

3. What are the main segments of the GMO Tests Market?

The market segments include Technology.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Incidences of Food Allergies; Favorable Government Initiatives and Regulations for Food Safety.

6. What are the notable trends driving market growth?

PCR Technique Holds a Significant Market Share.

7. Are there any restraints impacting market growth?

Inconsistencies Involved in Food Allergen Declarations.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "GMO Tests Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the GMO Tests Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the GMO Tests Market?

To stay informed about further developments, trends, and reports in the GMO Tests Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence