Key Insights

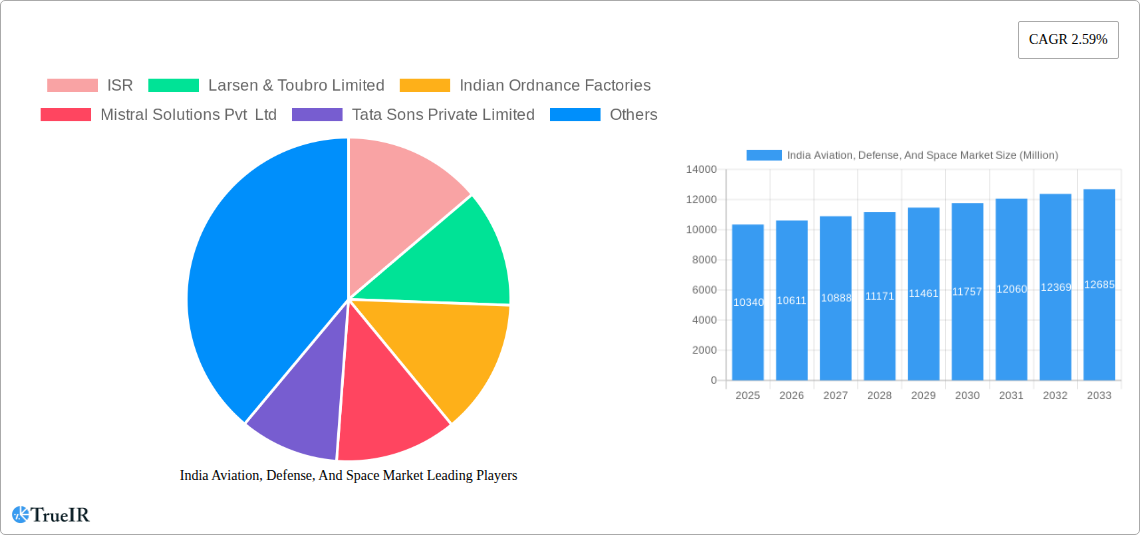

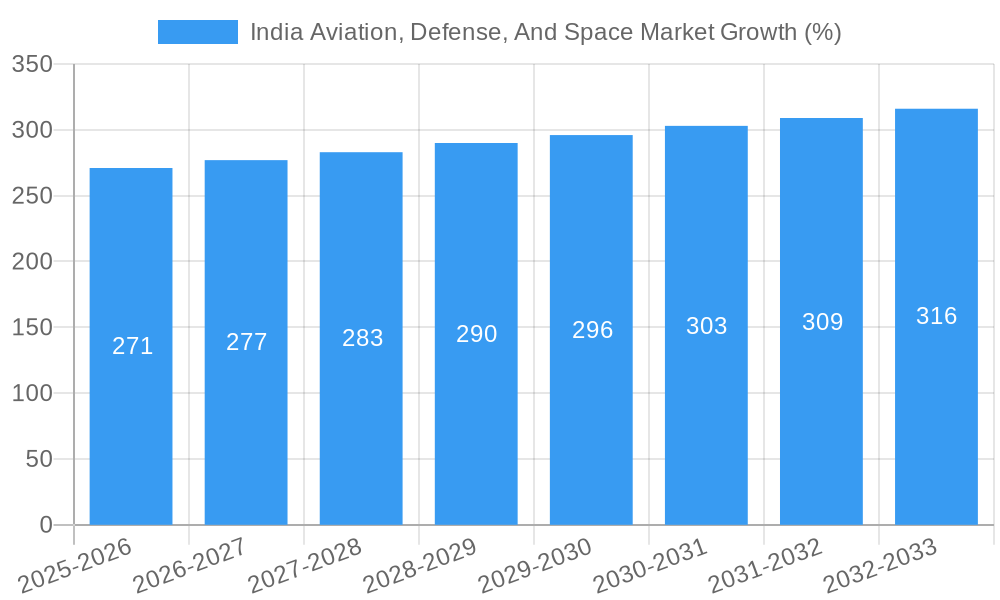

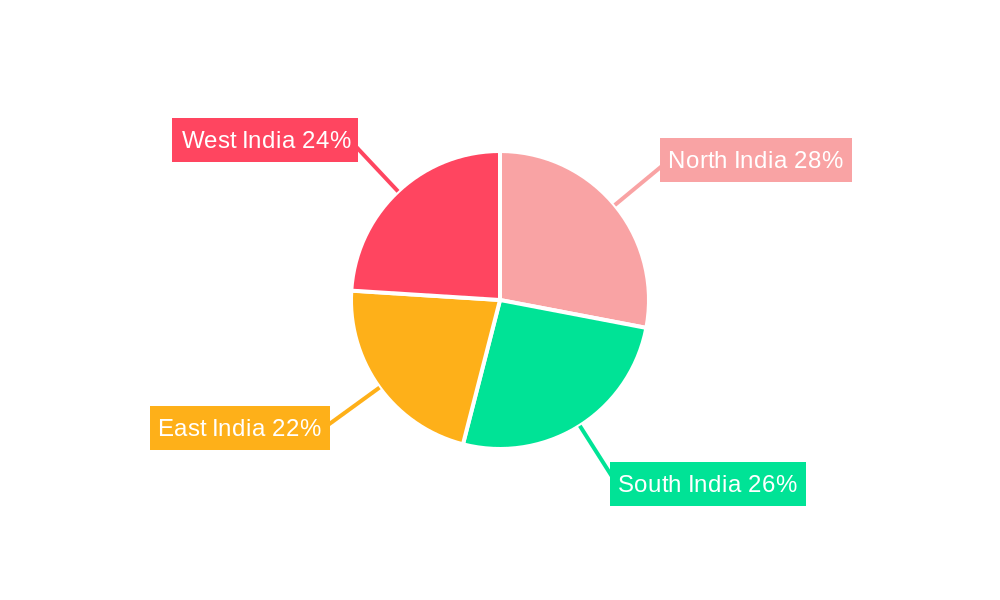

The India Aviation, Defense, and Space market, valued at ₹10.34 billion in 2025, exhibits robust growth potential, projected to expand at a CAGR of 2.59% from 2025 to 2033. This growth is driven by increasing government expenditure on defense modernization, a burgeoning civil aviation sector fueled by rising air travel demand, and the nation's ambitious space exploration programs. Significant investments in indigenous technology development and collaborations with international players further contribute to the market's expansion. Key segments include the Air Force (aircraft, weapons, MRO), Army (armored vehicles, weapons, MRO), Navy (naval vessels, aircraft, weapons, MRO), Space (satellite launch vehicles), and Civil Aviation (commercial and business aircraft, MRO). The market is characterized by a diverse landscape of both established players like Hindustan Aeronautics Limited (HAL), Larsen & Toubro Limited, and Bharat Electronics Limited (BEL), and emerging private sector companies like Mistral Solutions Pvt Ltd and Tata Sons Private Limited. Regional variations in market growth are expected, reflecting differences in infrastructure development and defense priorities across North, South, East, and West India. The increasing focus on enhancing cybersecurity and developing advanced technologies like AI and machine learning in defense systems will further shape the industry's trajectory in the coming years.

The competitive landscape is dynamic, with both domestic and international companies vying for market share. While government policies supporting indigenization are fostering domestic growth, the market also sees active participation from global aerospace and defense companies. Challenges include the need for continuous technological advancements to remain globally competitive and addressing infrastructure limitations in some regions. Nevertheless, India's strategic geographic location, growing economic strength, and commitment to national security ensure the long-term growth prospects of the aviation, defense, and space sector remain positive, attracting substantial investments and fostering innovation within the industry.

India Aviation, Defense, and Space Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the dynamic Indian Aviation, Defense, and Space market, offering invaluable insights for investors, industry professionals, and strategic decision-makers. Covering the period 2019-2033, with a focus on 2025, this report meticulously examines market size, growth trajectories, key players, and future opportunities across various segments.

India Aviation, Defense, And Space Market Market Structure & Competitive Landscape

The Indian aviation, defense, and space market exhibits a complex structure characterized by a mix of public and private sector participation. Market concentration varies significantly across segments. For instance, the space launch vehicle segment is relatively concentrated, with ISRO playing a dominant role. Conversely, the civil aviation sector showcases higher competition among various domestic and international airlines.

The market is driven by continuous technological innovation, particularly in areas such as UAV technology, advanced materials for aerospace applications, and satellite communication systems. Stringent regulatory frameworks, primarily driven by the Ministry of Defence and the Directorate General of Civil Aviation (DGCA), significantly shape industry practices and investment decisions. Product substitutes, such as drone technology potentially replacing some manned aircraft functionalities, are also influencing market dynamics. The end-user segments comprise the Indian Air Force, Army, Navy, and the burgeoning commercial aviation sector, each presenting unique market characteristics and procurement processes.

Mergers and acquisitions (M&A) activity has been moderate but is expected to increase in the coming years. The estimated volume of M&A deals in the defense sector from 2019-2024 is approximately xx Million USD, driven by the consolidation of smaller companies and strategic alliances to secure government contracts. Further, the government's push for "Make in India" is expected to spur domestic M&A activity among smaller players seeking to enhance their technological capabilities and production capacity.

- Market Concentration: Varies across segments, with some exhibiting high concentration (e.g., space launch vehicles), while others are more fragmented (e.g., civil aviation). Quantitative data on concentration ratios will be provided in the full report.

- Innovation Drivers: Technological advancements in UAVs, aerospace materials, and satellite communication systems.

- Regulatory Impacts: Stringent regulations from the Ministry of Defence and DGCA significantly influence market dynamics.

- Product Substitutes: Emergence of drone technology influencing the demand for traditional aircraft.

- End-User Segmentation: Indian Air Force, Army, Navy, and commercial aviation sector.

- M&A Trends: Moderate activity, expected to increase due to "Make in India" initiatives and the need for consolidation.

India Aviation, Defense, And Space Market Market Trends & Opportunities

The Indian aviation, defense, and space market is poised for significant growth driven by increasing defense budgets, modernization of armed forces, and expansion of the civil aviation sector. The market size is projected to reach xx Million USD by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033).

Technological shifts are transforming the landscape, with increasing adoption of advanced technologies like artificial intelligence (AI), machine learning (ML), and the Internet of Things (IoT) in various applications. Consumer preferences are shifting towards more fuel-efficient and technologically advanced aircraft, driving innovation in aircraft design and manufacturing.

Competitive dynamics are characterized by both domestic and international players vying for market share. Increased domestic participation is evident in the growing prominence of companies such as HAL, BEL, and private sector players responding to government initiatives. The market penetration rate for domestically manufactured defense equipment is projected to increase from xx% in 2025 to xx% by 2033, reflecting the success of the "Make in India" policy. However, international players continue to hold significant influence, particularly in the high-technology segments.

The report will further delve into market segmentation, analyzing the growth of each sector – aviation, defense, and space – with specific data on CAGR and market penetration rates for each sub-segment. The analysis includes both the domestic and export markets, providing a comprehensive understanding of the overall market opportunity.

Dominant Markets & Segments in India Aviation, Defense, And Space Market

The Indian defense sector presents the largest market segment within the overall aviation, defense, and space market, fueled by substantial government investments in modernizing its armed forces. The Air Force segment, driven by the need for advanced combat aircraft and UAVs, represents a significant portion of this market. Within civil aviation, the commercial aircraft segment dominates, fueled by the rapid expansion of Air India and other low-cost carriers (LCCs).

- Key Growth Drivers:

- Increased Defense Budgets: Significant allocation of funds for modernization of the armed forces.

- Government Initiatives: "Make in India" initiative promoting domestic manufacturing.

- Infrastructure Development: Expansion of airports and related infrastructure.

- Rising Air Passenger Traffic: Growth in both domestic and international passenger numbers.

- Space Exploration Ambitions: ISRO's continued expansion in satellite launches and space research.

The dominance of specific regions within India varies across segments. For example, regions with significant defense manufacturing facilities (e.g., Bangalore, Hyderabad) tend to dominate the defense segment, while major metropolitan areas with large airports and robust air traffic networks are pivotal in the civil aviation sector. The detailed analysis in the full report will provide a precise geographical breakdown of market share.

India Aviation, Defense, And Space Market Product Analysis

The Indian market showcases a diverse range of products and services, from indigenous combat aircraft like the Tejas to imported commercial jets and cutting-edge satellite technology. Significant innovations are evident in the development of indigenous UAVs, advanced materials for aerospace applications, and the design and manufacturing of next-generation combat systems. The success of these products depends on factors such as technological maturity, cost-effectiveness, and integration with existing systems. The "Make in India" initiative further incentivizes the development of indigenously produced systems to reduce reliance on foreign suppliers.

Key Drivers, Barriers & Challenges in India Aviation, Defense, And Space Market

Key Drivers: Increased defense expenditure, modernization of armed forces, expansion of the commercial aviation sector, government initiatives like "Make in India," and technological advancements in areas like UAVs and space technology are pivotal drivers.

Key Barriers and Challenges: Supply chain disruptions, particularly for critical components sourced internationally, pose significant challenges. Regulatory complexities and bureaucratic hurdles often slow down project approvals and implementation. Intense competition from both domestic and international players necessitates a constant drive for innovation and cost-competitiveness. Import substitution and indigenization efforts require significant investment in R&D and manufacturing capacity.

Growth Drivers in the India Aviation, Defense, And Space Market Market

Technological advancements, supportive government policies (like "Make in India"), and increasing defense budgets are primary growth drivers. The expansion of the commercial aviation sector and rising demand for air travel further contribute to the market's expansion. The burgeoning space sector, driven by ISRO's ambitious plans, also offers significant growth opportunities.

Challenges Impacting India Aviation, Defense, And Space Market Growth

Regulatory hurdles, dependence on foreign suppliers for certain critical technologies, and infrastructure limitations pose significant challenges. The need for substantial investments in R&D and manufacturing infrastructure to support the "Make in India" initiative is also a critical factor impacting growth. Competition from established international players remains a persistent challenge for domestic firms.

Key Players Shaping the India Aviation, Defense, And Space Market Market

- ISR

- Larsen & Toubro Limited

- Indian Ordnance Factories

- Mistral Solutions Pvt Ltd

- Tata Sons Private Limited

- Goa Shipyard Limited

- Kalyani Steels Ltd (KSL)

- Hindustan Aeronautics Limited (HAL)

- Hinduja Group

- Mahindra & Mahindra Limited

- Adani Group

- Bharat Electronics Limited (BEL)

Significant India Aviation, Defense, And Space Market Industry Milestones

- December 2023: The Indian government approved defense acquisition projects worth USD 2.67 Million, including 97 Tejas light combat aircraft and 156 Prachand combat helicopters, with 98% of procurement sourced domestically.

- February 2023: Air India selected Boeing aircraft (737 MAX, 787 Dreamliner, and 777X), planning to acquire 190 737 MAXs with options for 50 more.

Future Outlook for India Aviation, Defense, And Space Market Market

The Indian aviation, defense, and space market is projected to experience robust growth, driven by sustained government investment, technological advancements, and a growing domestic industry. The "Make in India" initiative will continue to be a key catalyst, promoting indigenous innovation and technological self-reliance. Strategic partnerships between domestic and international players will further shape the market landscape, presenting significant opportunities for growth and expansion in the coming years. The increasing focus on space exploration and the development of advanced defense systems will drive further expansion in these sub-sectors.

India Aviation, Defense, And Space Market Segmentation

-

1. Air Force

- 1.1. Combat a

- 1.2. Weapons and Munitions

- 1.3. MRO

-

2. Army

- 2.1. Armored Vehicles, Helicopters, and UAVs

- 2.2. Weapons and Munitions

- 2.3. MRO

-

3. Navy

- 3.1. Naval Ve

- 3.2. Weapons and Munitions

- 3.3. MRO

-

4. Space

- 4.1. Satellite

- 4.2. Launch Vehicles and Rovers

-

5. Civil Aviation

- 5.1. Commercial Aircraft

- 5.2. Business Jet

- 5.3. MRO

India Aviation, Defense, And Space Market Segmentation By Geography

- 1. India

India Aviation, Defense, And Space Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.59% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Civil Aviation Segment to Showcase Remarkable Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Aviation, Defense, And Space Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Air Force

- 5.1.1. Combat a

- 5.1.2. Weapons and Munitions

- 5.1.3. MRO

- 5.2. Market Analysis, Insights and Forecast - by Army

- 5.2.1. Armored Vehicles, Helicopters, and UAVs

- 5.2.2. Weapons and Munitions

- 5.2.3. MRO

- 5.3. Market Analysis, Insights and Forecast - by Navy

- 5.3.1. Naval Ve

- 5.3.2. Weapons and Munitions

- 5.3.3. MRO

- 5.4. Market Analysis, Insights and Forecast - by Space

- 5.4.1. Satellite

- 5.4.2. Launch Vehicles and Rovers

- 5.5. Market Analysis, Insights and Forecast - by Civil Aviation

- 5.5.1. Commercial Aircraft

- 5.5.2. Business Jet

- 5.5.3. MRO

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. India

- 5.1. Market Analysis, Insights and Forecast - by Air Force

- 6. North India India Aviation, Defense, And Space Market Analysis, Insights and Forecast, 2019-2031

- 7. South India India Aviation, Defense, And Space Market Analysis, Insights and Forecast, 2019-2031

- 8. East India India Aviation, Defense, And Space Market Analysis, Insights and Forecast, 2019-2031

- 9. West India India Aviation, Defense, And Space Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 ISR

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Larsen & Toubro Limited

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Indian Ordnance Factories

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Mistral Solutions Pvt Ltd

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Tata Sons Private Limited

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Goa Shipyard Limited

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Kalyani Steels Ltd (KSL)

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Hindustan Aeronautics Limited (HAL)

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Hinduja Group

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Mahindra & Mahindra Limited

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Adani Group

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Bharat Electronics Limited (BEL)

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.1 ISR

List of Figures

- Figure 1: India Aviation, Defense, And Space Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Aviation, Defense, And Space Market Share (%) by Company 2024

List of Tables

- Table 1: India Aviation, Defense, And Space Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Aviation, Defense, And Space Market Revenue Million Forecast, by Air Force 2019 & 2032

- Table 3: India Aviation, Defense, And Space Market Revenue Million Forecast, by Army 2019 & 2032

- Table 4: India Aviation, Defense, And Space Market Revenue Million Forecast, by Navy 2019 & 2032

- Table 5: India Aviation, Defense, And Space Market Revenue Million Forecast, by Space 2019 & 2032

- Table 6: India Aviation, Defense, And Space Market Revenue Million Forecast, by Civil Aviation 2019 & 2032

- Table 7: India Aviation, Defense, And Space Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: India Aviation, Defense, And Space Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: North India India Aviation, Defense, And Space Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: South India India Aviation, Defense, And Space Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: East India India Aviation, Defense, And Space Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: West India India Aviation, Defense, And Space Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: India Aviation, Defense, And Space Market Revenue Million Forecast, by Air Force 2019 & 2032

- Table 14: India Aviation, Defense, And Space Market Revenue Million Forecast, by Army 2019 & 2032

- Table 15: India Aviation, Defense, And Space Market Revenue Million Forecast, by Navy 2019 & 2032

- Table 16: India Aviation, Defense, And Space Market Revenue Million Forecast, by Space 2019 & 2032

- Table 17: India Aviation, Defense, And Space Market Revenue Million Forecast, by Civil Aviation 2019 & 2032

- Table 18: India Aviation, Defense, And Space Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Aviation, Defense, And Space Market?

The projected CAGR is approximately 2.59%.

2. Which companies are prominent players in the India Aviation, Defense, And Space Market?

Key companies in the market include ISR, Larsen & Toubro Limited, Indian Ordnance Factories, Mistral Solutions Pvt Ltd, Tata Sons Private Limited, Goa Shipyard Limited, Kalyani Steels Ltd (KSL), Hindustan Aeronautics Limited (HAL), Hinduja Group, Mahindra & Mahindra Limited, Adani Group, Bharat Electronics Limited (BEL).

3. What are the main segments of the India Aviation, Defense, And Space Market?

The market segments include Air Force, Army, Navy, Space, Civil Aviation.

4. Can you provide details about the market size?

The market size is estimated to be USD 10.34 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Civil Aviation Segment to Showcase Remarkable Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

December 2023: The Indian government announced that they have accorded initial approval for defense acquisition projects worth USD 2.67 million. The project will include the acquisition of 97 Tejas light combat aircraft and 156 Prachand combat helicopters. Moreover, 98% of the total procurement will be sourced from domestic industries, thereby giving a significant boost to the Indian defense industry.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Aviation, Defense, And Space Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Aviation, Defense, And Space Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Aviation, Defense, And Space Market?

To stay informed about further developments, trends, and reports in the India Aviation, Defense, And Space Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence