Key Insights

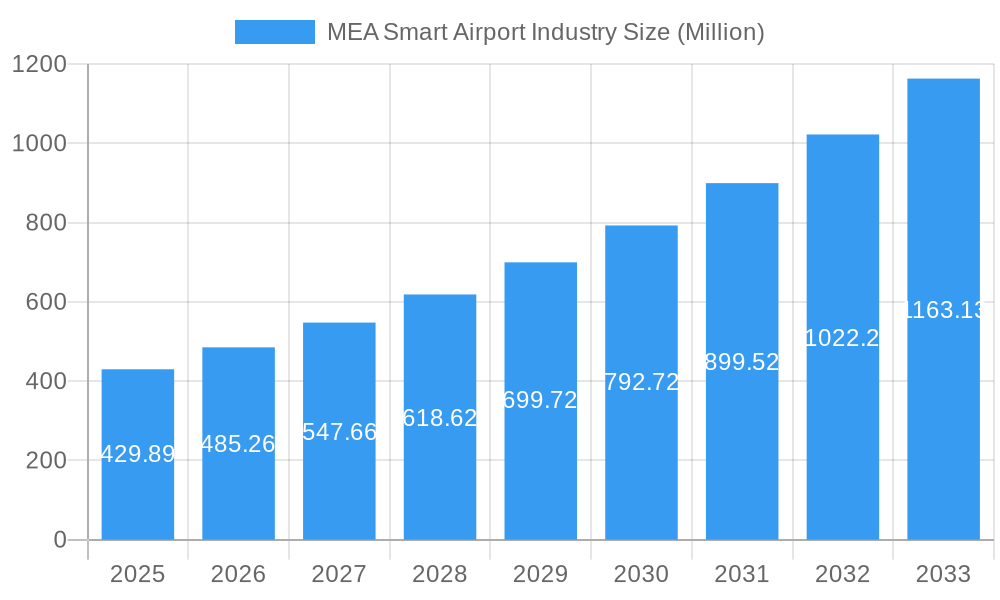

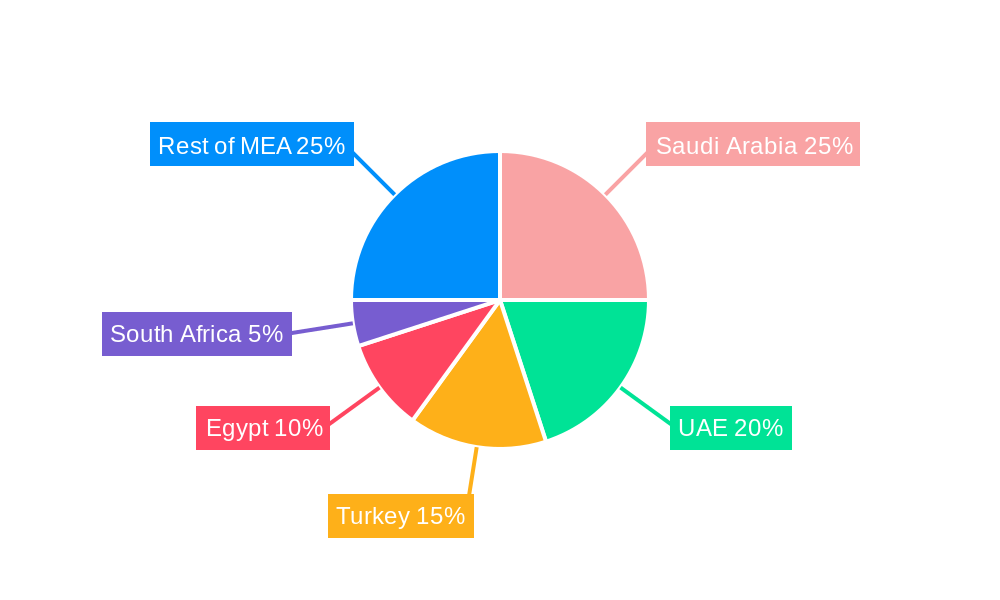

The Middle East and Africa (MEA) smart airport market is experiencing robust growth, projected to reach \$429.89 million in 2025 and exhibiting a Compound Annual Growth Rate (CAGR) of 12.99% from 2025 to 2033. This expansion is driven by increasing passenger traffic, the need for enhanced security and operational efficiency, and government initiatives promoting technological advancements within the aviation sector. Key technological segments fueling this growth include security systems (e.g., biometric screening and advanced surveillance), communication systems (ensuring seamless connectivity for passengers and staff), and air/ground traffic control systems optimized for improved safety and efficiency. The integration of these technologies streamlines passenger flow, enhances baggage handling, and optimizes ground operations, leading to improved overall airport experience and reduced operational costs. Furthermore, the rising adoption of cloud computing, big data analytics, and the Internet of Things (IoT) is further accelerating the market's expansion. While data limitations restrict a precise regional breakdown, high-growth potential is observed in regions such as Saudi Arabia, the United Arab Emirates, Turkey, and Egypt, spurred by significant investments in airport infrastructure and modernization projects.

MEA Smart Airport Industry Market Size (In Million)

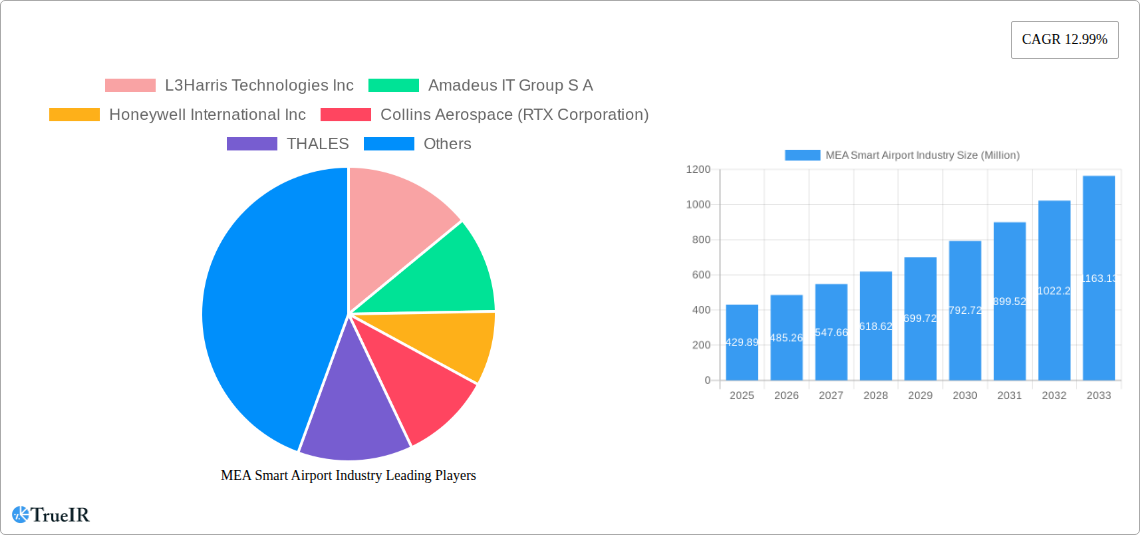

The market's growth is, however, not without its challenges. High initial investment costs associated with implementing smart airport technologies can act as a restraint, particularly for smaller airports. Cybersecurity concerns surrounding the interconnected nature of these systems also require careful consideration and mitigation. Furthermore, integrating legacy systems with new technologies can present integration complexities. Nevertheless, the long-term benefits of improved efficiency, enhanced security, and enhanced passenger experience are expected to outweigh these challenges, ensuring continued robust market growth in the MEA region throughout the forecast period. Companies like L3Harris Technologies, Amadeus IT Group, Honeywell, and Thales are key players shaping this evolving landscape through their innovative solutions and technological advancements. The focus on passenger experience, operational optimization, and security upgrades will remain the cornerstones of future development within the MEA smart airport ecosystem.

MEA Smart Airport Industry Company Market Share

MEA Smart Airport Industry: A Comprehensive Market Report (2019-2033)

This dynamic report provides a detailed analysis of the MEA Smart Airport Industry, offering invaluable insights for stakeholders seeking to navigate this rapidly evolving market. The study period spans from 2019 to 2033, with 2025 serving as both the base and estimated year. The forecast period covers 2025-2033, while the historical period encompasses 2019-2024. This report leverages extensive market research and data analysis to provide a holistic view of the industry, including market sizing (reaching xx Million by 2033), growth trajectories (projected CAGR of xx%), and key competitive dynamics.

MEA Smart Airport Industry Market Structure & Competitive Landscape

The MEA smart airport market exhibits a moderately concentrated structure, with several key players vying for market share. The Herfindahl-Hirschman Index (HHI) is estimated at xx, indicating a relatively competitive yet consolidated landscape. Innovation is a crucial driver, particularly in areas like AI-powered security systems and advanced air traffic management solutions. Regulatory frameworks across MEA countries significantly influence market dynamics, impacting technology adoption and investment decisions. Substitute technologies, such as legacy systems, present competition, but the advantages of smart airport solutions in terms of efficiency and security are driving market growth.

- End-user segmentation: The market is segmented by airports based on size (large, medium, small) and ownership (public, private).

- M&A activity: The volume of M&A transactions in the sector has increased steadily over the historical period, with xx Million in deals closed during 2019-2024. This trend is expected to continue, driven by companies seeking to expand their technological capabilities and market reach.

MEA Smart Airport Industry Market Trends & Opportunities

The MEA smart airport market is experiencing robust growth, fueled by increasing passenger traffic, government initiatives promoting modernization, and a surge in investments in airport infrastructure. The market size is projected to reach xx Million by 2033, exhibiting a CAGR of xx%. Several key trends are shaping the industry's trajectory:

- Technological advancements: The integration of AI, IoT, big data analytics, and cloud computing is revolutionizing airport operations. This includes automation of processes, enhanced security measures, and personalized passenger experiences.

- Growing passenger demand: The region's rapidly expanding middle class is fueling increased air travel, placing pressure on airports to enhance efficiency and improve passenger experiences. This increasing demand is driving investments in smart technologies to manage capacity and improve throughput.

- Government policies and initiatives: Many MEA governments are actively promoting smart airport development through regulatory changes, funding programs, and strategic partnerships to facilitate innovation and technological upgrades.

- Competitive dynamics: Intense competition among technology providers is driving innovation and price reductions, while alliances between technology providers and airport operators are emerging as a key strategy for growth.

Dominant Markets & Segments in MEA Smart Airport Industry

The UAE currently leads the MEA smart airport market, followed by Saudi Arabia and Qatar. The rapid infrastructure development and significant investments in these countries are crucial factors driving this dominance. Among segments, Air/Ground Traffic Control and Passenger, Cargo, and Baggage Control are experiencing the fastest growth.

- Key Growth Drivers in the UAE:

- Significant investments in airport infrastructure.

- Strong government support for technological advancements.

- Large influx of tourists and increased air traffic.

- Key Growth Drivers in Saudi Arabia:

- Vision 2030 initiatives promoting economic diversification and tourism.

- Investments in new airports and modernization of existing facilities.

- Focus on improving air traffic management efficiency.

- Dominant Segments: Air/Ground Traffic Control systems are currently a leading segment due to the need for improved efficiency and safety; Passenger, Cargo, and Baggage Control is also rapidly growing due to the increasing demand for smoother passenger journeys.

MEA Smart Airport Industry Product Analysis

The MEA smart airport industry witnesses constant product innovation, focusing on enhanced security, efficiency, and passenger experience. New applications emerge continuously, integrating AI for predictive maintenance, improved baggage handling, and real-time passenger flow management. Competitive advantages lie in the integration of various technologies, user-friendly interfaces, robust security measures, and scalability to accommodate future growth. Products are evolving towards more integrated and modular solutions, allowing airports to customize their deployments to meet their specific needs and budget constraints.

Key Drivers, Barriers & Challenges in MEA Smart Airport Industry

Key Drivers: Technological advancements (AI, IoT, cloud computing), growing passenger traffic, government investments in infrastructure, and increasing demand for improved passenger experience drive market growth. The push towards greater operational efficiency and enhanced security also fuels this growth.

Challenges: High initial investment costs, regulatory complexities, cybersecurity concerns, integration challenges with legacy systems, and potential skills gaps in managing and maintaining these advanced systems pose challenges to market expansion. Supply chain disruptions, especially during periods of global uncertainty, can impact project timelines and budgets. The lack of standardization across different airport systems can also complicate the adoption of innovative solutions.

Growth Drivers in the MEA Smart Airport Industry Market

The growth of the MEA smart airport market is being propelled by rising passenger numbers, increasing government investments in modernization, and the need for enhanced operational efficiency and security. Technological advancements, particularly in AI, IoT, and cloud computing, are significantly contributing to innovation and the development of integrated solutions. Regulatory changes supporting digital transformation are further driving the adoption of smart technologies.

Challenges Impacting MEA Smart Airport Industry Growth

The industry faces hurdles including the high cost of implementation, cybersecurity threats, data privacy concerns, and the need for skilled workforce. The integration of various technologies can also prove challenging, as can navigating the complex regulatory landscape in different countries of the MEA region. Supply chain issues and geopolitical instability can further hinder growth.

Key Players Shaping the MEA Smart Airport Industry Market

Significant MEA Smart Airport Industry Industry Milestones

- 2021-Q3: Dubai International Airport launched a new AI-powered passenger flow management system.

- 2022-Q1: Amadeus IT Group signed a major contract with a leading MEA airline for its smart airport solutions.

- 2023-Q2: Several MEA airports invested heavily in upgrading their security systems to incorporate biometrics and AI-driven threat detection.

- 2024-Q4: A significant merger between two key players in the air traffic control segment reshaped the competitive landscape. (Specific details on the merger would be included in the full report).

Future Outlook for MEA Smart Airport Industry Market

The MEA smart airport market is poised for continued strong growth, driven by ongoing investments in infrastructure, technological advancements, and government support. Strategic opportunities exist in the development and deployment of innovative solutions that address specific regional challenges, such as enhancing security, improving efficiency, and personalizing the passenger experience. The market's potential for growth remains high, with significant opportunities for both established players and new entrants.

MEA Smart Airport Industry Segmentation

-

1. Technology

- 1.1. Security Systems

- 1.2. Communication Systems

- 1.3. Air/Ground Traffic Control

- 1.4. Passenger, Cargo, and Baggage Control

- 1.5. Ground Handling Systems

- 1.6. Other Technologies

-

2. Geography

-

2.1. Middle-East and Africa

- 2.1.1. Saudi Arabia

- 2.1.2. United Arab Emirates

- 2.1.3. Turkey

- 2.1.4. Egypt

- 2.1.5. South Africa

- 2.1.6. Rest of Middle-East and Africa

-

2.1. Middle-East and Africa

MEA Smart Airport Industry Segmentation By Geography

-

1. Middle East and Africa

- 1.1. Saudi

- 2. United

-

3. Turkey

- 3.1. Egypt

- 3.2. South

- 4. Rest

MEA Smart Airport Industry Regional Market Share

Geographic Coverage of MEA Smart Airport Industry

MEA Smart Airport Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.99% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Security Systems to Dominate Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global MEA Smart Airport Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Security Systems

- 5.1.2. Communication Systems

- 5.1.3. Air/Ground Traffic Control

- 5.1.4. Passenger, Cargo, and Baggage Control

- 5.1.5. Ground Handling Systems

- 5.1.6. Other Technologies

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Middle-East and Africa

- 5.2.1.1. Saudi Arabia

- 5.2.1.2. United Arab Emirates

- 5.2.1.3. Turkey

- 5.2.1.4. Egypt

- 5.2.1.5. South Africa

- 5.2.1.6. Rest of Middle-East and Africa

- 5.2.1. Middle-East and Africa

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Middle East and Africa

- 5.3.2. United

- 5.3.3. Turkey

- 5.3.4. Rest

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. Middle East and Africa MEA Smart Airport Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 6.1.1. Security Systems

- 6.1.2. Communication Systems

- 6.1.3. Air/Ground Traffic Control

- 6.1.4. Passenger, Cargo, and Baggage Control

- 6.1.5. Ground Handling Systems

- 6.1.6. Other Technologies

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Middle-East and Africa

- 6.2.1.1. Saudi Arabia

- 6.2.1.2. United Arab Emirates

- 6.2.1.3. Turkey

- 6.2.1.4. Egypt

- 6.2.1.5. South Africa

- 6.2.1.6. Rest of Middle-East and Africa

- 6.2.1. Middle-East and Africa

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 7. United MEA Smart Airport Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 7.1.1. Security Systems

- 7.1.2. Communication Systems

- 7.1.3. Air/Ground Traffic Control

- 7.1.4. Passenger, Cargo, and Baggage Control

- 7.1.5. Ground Handling Systems

- 7.1.6. Other Technologies

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Middle-East and Africa

- 7.2.1.1. Saudi Arabia

- 7.2.1.2. United Arab Emirates

- 7.2.1.3. Turkey

- 7.2.1.4. Egypt

- 7.2.1.5. South Africa

- 7.2.1.6. Rest of Middle-East and Africa

- 7.2.1. Middle-East and Africa

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 8. Turkey MEA Smart Airport Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 8.1.1. Security Systems

- 8.1.2. Communication Systems

- 8.1.3. Air/Ground Traffic Control

- 8.1.4. Passenger, Cargo, and Baggage Control

- 8.1.5. Ground Handling Systems

- 8.1.6. Other Technologies

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. Middle-East and Africa

- 8.2.1.1. Saudi Arabia

- 8.2.1.2. United Arab Emirates

- 8.2.1.3. Turkey

- 8.2.1.4. Egypt

- 8.2.1.5. South Africa

- 8.2.1.6. Rest of Middle-East and Africa

- 8.2.1. Middle-East and Africa

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 9. Rest MEA Smart Airport Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 9.1.1. Security Systems

- 9.1.2. Communication Systems

- 9.1.3. Air/Ground Traffic Control

- 9.1.4. Passenger, Cargo, and Baggage Control

- 9.1.5. Ground Handling Systems

- 9.1.6. Other Technologies

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. Middle-East and Africa

- 9.2.1.1. Saudi Arabia

- 9.2.1.2. United Arab Emirates

- 9.2.1.3. Turkey

- 9.2.1.4. Egypt

- 9.2.1.5. South Africa

- 9.2.1.6. Rest of Middle-East and Africa

- 9.2.1. Middle-East and Africa

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 L3Harris Technologies Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Amadeus IT Group S A

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Honeywell International Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Collins Aerospace (RTX Corporation)

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 THALES

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Sabre GLBL Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Cisco Systems Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Siemens AG

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 International Business Machines Corporation (IBM)

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 NATS Holdings Limited

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 SITA

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Indra Sistemas S A

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.1 L3Harris Technologies Inc

List of Figures

- Figure 1: Global MEA Smart Airport Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Middle East and Africa MEA Smart Airport Industry Revenue (Million), by Technology 2025 & 2033

- Figure 3: Middle East and Africa MEA Smart Airport Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 4: Middle East and Africa MEA Smart Airport Industry Revenue (Million), by Geography 2025 & 2033

- Figure 5: Middle East and Africa MEA Smart Airport Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 6: Middle East and Africa MEA Smart Airport Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: Middle East and Africa MEA Smart Airport Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: United MEA Smart Airport Industry Revenue (Million), by Technology 2025 & 2033

- Figure 9: United MEA Smart Airport Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 10: United MEA Smart Airport Industry Revenue (Million), by Geography 2025 & 2033

- Figure 11: United MEA Smart Airport Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 12: United MEA Smart Airport Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: United MEA Smart Airport Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Turkey MEA Smart Airport Industry Revenue (Million), by Technology 2025 & 2033

- Figure 15: Turkey MEA Smart Airport Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 16: Turkey MEA Smart Airport Industry Revenue (Million), by Geography 2025 & 2033

- Figure 17: Turkey MEA Smart Airport Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 18: Turkey MEA Smart Airport Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Turkey MEA Smart Airport Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest MEA Smart Airport Industry Revenue (Million), by Technology 2025 & 2033

- Figure 21: Rest MEA Smart Airport Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 22: Rest MEA Smart Airport Industry Revenue (Million), by Geography 2025 & 2033

- Figure 23: Rest MEA Smart Airport Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 24: Rest MEA Smart Airport Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Rest MEA Smart Airport Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global MEA Smart Airport Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 2: Global MEA Smart Airport Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 3: Global MEA Smart Airport Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global MEA Smart Airport Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 5: Global MEA Smart Airport Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 6: Global MEA Smart Airport Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Saudi MEA Smart Airport Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Global MEA Smart Airport Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 9: Global MEA Smart Airport Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 10: Global MEA Smart Airport Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Global MEA Smart Airport Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 12: Global MEA Smart Airport Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 13: Global MEA Smart Airport Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 14: Egypt MEA Smart Airport Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: South MEA Smart Airport Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global MEA Smart Airport Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 17: Global MEA Smart Airport Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 18: Global MEA Smart Airport Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the MEA Smart Airport Industry?

The projected CAGR is approximately 12.99%.

2. Which companies are prominent players in the MEA Smart Airport Industry?

Key companies in the market include L3Harris Technologies Inc, Amadeus IT Group S A, Honeywell International Inc, Collins Aerospace (RTX Corporation), THALES, Sabre GLBL Inc, Cisco Systems Inc, Siemens AG, International Business Machines Corporation (IBM), NATS Holdings Limited, SITA, Indra Sistemas S A.

3. What are the main segments of the MEA Smart Airport Industry?

The market segments include Technology, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 429.89 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Security Systems to Dominate Market Share.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "MEA Smart Airport Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the MEA Smart Airport Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the MEA Smart Airport Industry?

To stay informed about further developments, trends, and reports in the MEA Smart Airport Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence