Key Insights

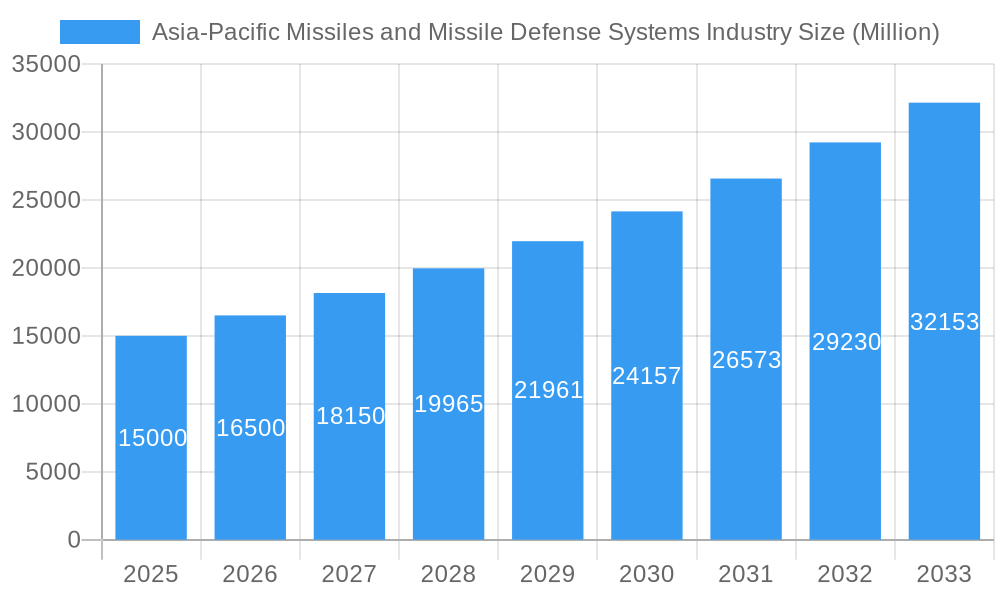

The Asia-Pacific missiles and missile defense systems market is poised for significant expansion, propelled by escalating geopolitical complexities, augmented defense expenditures, and the imperative for enhanced regional security. The market, estimated at $64.26 billion in the base year 2025, is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.43% through 2033. This growth trajectory is underpinned by several critical drivers: increased military modernization and investment in advanced arsenals by key nations like China, India, and Japan; the strategic necessity to counter the proliferation of advanced weaponry; and continuous technological innovation in missile guidance, propulsion, and countermeasures. Air-to-air and surface-to-air missile segments are anticipated to lead this expansion, addressing critical airspace security needs.

Asia-Pacific Missiles and Missile Defense Systems Industry Market Size (In Billion)

Despite a positive outlook, the market faces potential headwinds. Supply chain vulnerabilities for essential components and raw materials may impede progress. Additionally, the substantial investment required for developing and sustaining advanced defense systems could influence adoption rates in certain nations. The competitive landscape is characterized by established global defense contractors such as Raytheon, Lockheed Martin, and Thales, alongside robust indigenous defense capabilities emerging in China and India. Nonetheless, sustained investment in research and development is expected to foster ongoing technological advancements and the deployment of sophisticated defense strategies, ensuring the continued growth of this vital market sector within the Asia-Pacific region.

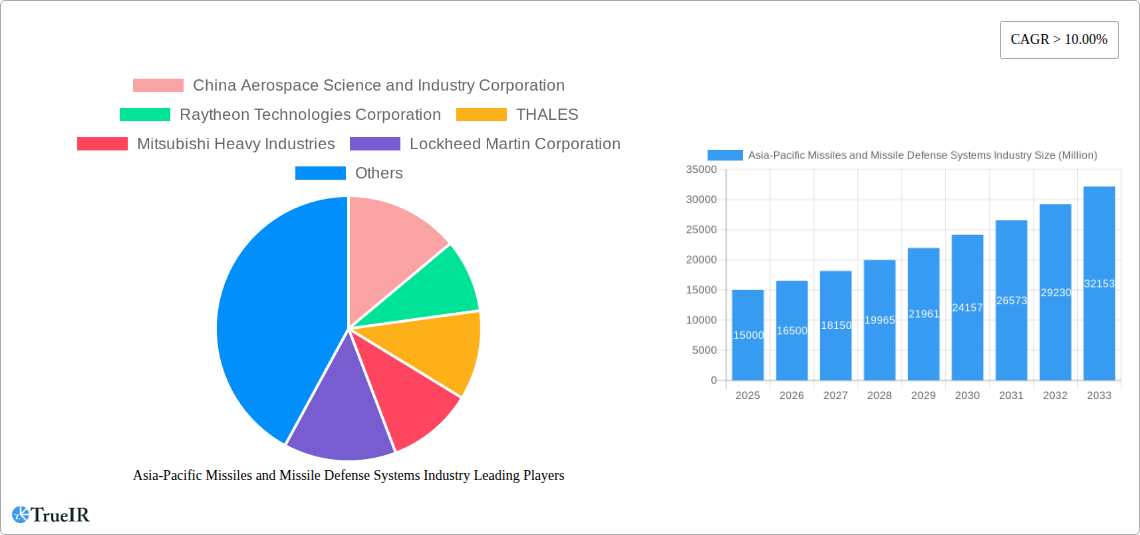

Asia-Pacific Missiles and Missile Defense Systems Industry Company Market Share

Asia-Pacific Missiles and Missile Defense Systems Industry: A Comprehensive Market Report (2019-2033)

This dynamic report provides a deep dive into the Asia-Pacific missiles and missile defense systems market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Leveraging extensive research and data analysis spanning the period 2019-2033 (base year 2025, forecast period 2025-2033), this report unveils the market's structure, trends, opportunities, and challenges. With a focus on key players like China Aerospace Science and Industry Corporation, Raytheon Technologies Corporation, and Lockheed Martin Corporation, this report is essential for navigating the complexities of this rapidly evolving sector. Expect detailed analysis of market segments including short, medium, intermediate, and intercontinental range missiles, as well as air-to-air, air-to-surface, surface-to-surface, and surface-to-air missile systems, along with missile defense systems. The report also incorporates the latest industry developments, including recent missile launches and successful tests.

Asia-Pacific Missiles and Missile Defense Systems Industry Market Structure & Competitive Landscape

The Asia-Pacific missiles and missile defense systems market exhibits a moderately concentrated structure, with a few dominant players holding significant market share. The Herfindahl-Hirschman Index (HHI) is estimated at xx in 2025, indicating a moderately consolidated market. Innovation drives intense competition, characterized by continuous advancements in missile technology, including hypersonic capabilities and improved guidance systems. Stringent regulatory frameworks governing the development, production, and export of missiles significantly impact market dynamics. The presence of substitute technologies, such as cyber warfare and electronic countermeasures, presents competitive pressures. End-user segmentation is primarily driven by national defense forces, with increasing adoption by regional security forces. M&A activity has been moderate in recent years, with an estimated xx Million USD in transactions during 2019-2024, primarily focused on technology acquisitions and strategic partnerships.

- Market Concentration: Moderately concentrated, with an estimated HHI of xx in 2025.

- Innovation Drivers: Hypersonic missiles, AI-powered guidance systems, improved propulsion technologies.

- Regulatory Impacts: Strict export controls, licensing requirements, and international treaties significantly affect market growth.

- Product Substitutes: Cyber warfare, electronic countermeasures, and advanced surveillance systems.

- End-User Segmentation: Primarily national defense forces, with increasing adoption by regional security forces.

- M&A Trends: Moderate activity (xx Million USD in 2019-2024), focused on technology and strategic partnerships.

Asia-Pacific Missiles and Missile Defense Systems Industry Market Trends & Opportunities

The Asia-Pacific missiles and missile defense systems market is projected to experience robust growth, driven by escalating geopolitical tensions, rising defense budgets, and technological advancements. The market size is estimated at xx Million USD in 2025 and is forecast to reach xx Million USD by 2033, registering a Compound Annual Growth Rate (CAGR) of xx% during the forecast period. The increasing adoption of sophisticated missile defense systems, particularly in countries like India, China, and South Korea, is a significant growth driver. Technological shifts toward hypersonic missiles and improved accuracy are reshaping the competitive landscape. Consumer preferences (governments) are leaning towards systems with enhanced capabilities and cost-effectiveness. The market is characterized by intense competition, with established players continually striving to innovate and differentiate their offerings. Market penetration rates are increasing gradually, particularly for advanced missile defense systems in key markets.

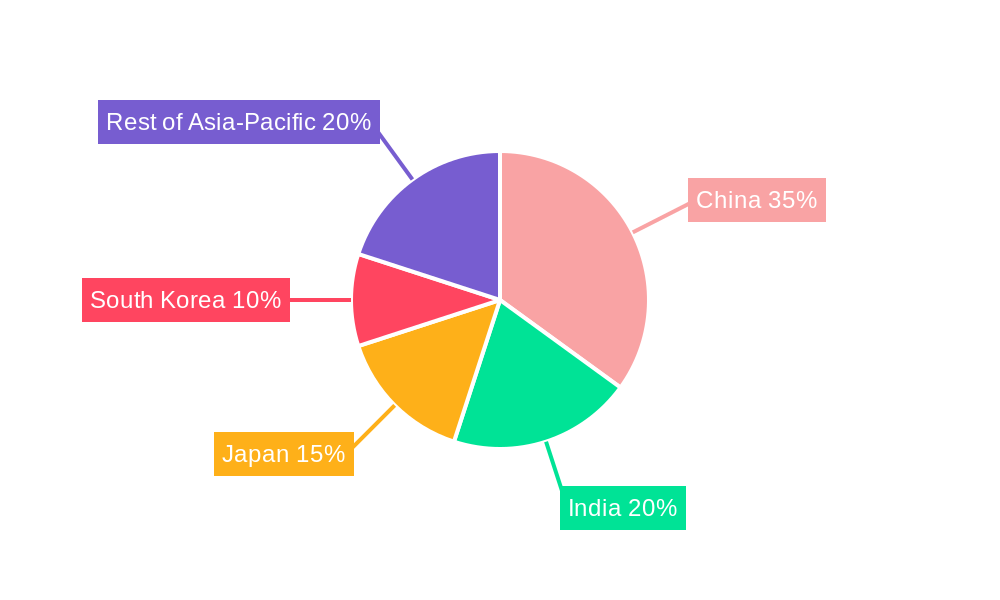

Dominant Markets & Segments in Asia-Pacific Missiles and Missile Defense Systems Industry

China and India are currently the dominant markets in the Asia-Pacific region, accounting for a significant portion of overall demand. This dominance is driven by escalating geopolitical tensions and substantial investments in defense modernization programs. The surface-to-surface missile segment holds the largest market share, followed by air-to-surface and surface-to-air missile systems. The demand for missile defense systems is also growing rapidly. Growth in this sector is heavily influenced by technological advancements, strategic partnerships, and national security considerations.

- Key Growth Drivers in China: Rapid economic growth, rising defense expenditure, and ambition to become a global military power.

- Key Growth Drivers in India: Increased border tensions with neighboring countries, and strategic focus on national security.

- Key Growth Drivers in Surface-to-Surface Missiles: Expanding range capabilities, enhanced precision, and cost-effectiveness.

- Key Growth Drivers in Missile Defense Systems: Rising geopolitical tensions and the need for improved national security.

Asia-Pacific Missiles and Missile Defense Systems Industry Product Analysis

The Asia-Pacific missiles and missile defense systems market is characterized by continuous product innovation. Technological advancements are driving the development of hypersonic missiles with increased speed and maneuverability. Manufacturers are focusing on enhancing missile accuracy, range, and payload capacity. These advancements are improving the effectiveness and versatility of both offensive and defensive missile systems. The market fit for these innovations is strong due to growing demand for advanced defense capabilities.

Key Drivers, Barriers & Challenges in Asia-Pacific Missiles and Missile Defense Systems Industry

Key Drivers: The primary drivers include rising geopolitical instability, increased defense spending by key nations, technological advancements in missile technology, and the need for robust national security. Examples include the development of hypersonic weapons and AI-enhanced guidance systems.

Challenges & Restraints: Key challenges include stringent export controls, complex regulatory landscapes, and the high cost of research and development. Supply chain disruptions, particularly concerning critical components and materials, pose significant risks. Intense competition from both domestic and international players also puts downward pressure on profit margins. The estimated impact of supply chain issues on market growth is around xx% annually.

Growth Drivers in the Asia-Pacific Missiles and Missile Defense Systems Industry Market

The market is propelled by rising geopolitical tensions, substantial increases in defense budgets across the region, and ongoing technological breakthroughs, particularly in hypersonic and precision-guided munitions. Government policies prioritizing national security and military modernization further accelerate market growth. This is coupled with an increasing emphasis on indigenous defense manufacturing capabilities in several nations.

Challenges Impacting Asia-Pacific Missiles and Missile Defense Systems Industry Growth

Significant challenges include stringent export controls, potentially causing supply chain disruptions and limiting access to advanced technologies. Complex regulatory landscapes create obstacles to market entry and expansion. Furthermore, intensifying competition amongst numerous domestic and international players impacts profit margins and restricts rapid growth.

Key Players Shaping the Asia-Pacific Missiles and Missile Defense Systems Industry Market

- China Aerospace Science and Industry Corporation

- Raytheon Technologies Corporation

- THALES

- Mitsubishi Heavy Industries

- Lockheed Martin Corporation

- Defense Research and Development Organization

- JSC Tactical Missiles Corporation

- MBDA Inc

- Rafael Advanced Defense Systems Ltd

- Israel Aerospace Industries

- Kongsberg Gruppen AS

Significant Asia-Pacific Missiles and Missile Defense Systems Industry Industry Milestones

- December 2022: DRDO successfully test-fired the Agni-V, a long-range nuclear-capable missile, demonstrating advancements in India's ballistic missile capabilities.

- March 2023: North Korea's launch of unidentified ballistic missiles highlights ongoing regional instability and the need for advanced missile defense systems.

Future Outlook for Asia-Pacific Missiles and Missile Defense Systems Industry Market

The Asia-Pacific missiles and missile defense systems market is poised for continued growth, driven by sustained geopolitical tensions and ongoing technological innovation. The development of hypersonic weapons and advanced missile defense systems will continue to shape market dynamics. Strategic opportunities exist for companies that can effectively address the evolving needs of regional defense forces while adapting to technological advancements and regulatory frameworks. The market presents significant potential for growth, particularly in the areas of missile defense systems and advanced precision-guided munitions.

Asia-Pacific Missiles and Missile Defense Systems Industry Segmentation

-

1. Range

- 1.1. Short

- 1.2. Medium

- 1.3. Intermediate

- 1.4. Intercontinental

-

2. Type

- 2.1. Missile Defense Systems

- 2.2. Air-to-air missiles

- 2.3. Air-to-surface missiles

- 2.4. Surface-to-surface missiles

- 2.5. Surface-to-air missiles

-

3. Geography

-

3.1. Asia-Pacific

- 3.1.1. China

- 3.1.2. India

- 3.1.3. South Korea

- 3.1.4. Japan

- 3.1.5. Rest of Asia-Pacific

-

3.1. Asia-Pacific

Asia-Pacific Missiles and Missile Defense Systems Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. South Korea

- 1.4. Japan

- 1.5. Rest of Asia Pacific

Asia-Pacific Missiles and Missile Defense Systems Industry Regional Market Share

Geographic Coverage of Asia-Pacific Missiles and Missile Defense Systems Industry

Asia-Pacific Missiles and Missile Defense Systems Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.43% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Intercontinental Missiles are Anticipated to Register the Highest CAGR During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Missiles and Missile Defense Systems Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Range

- 5.1.1. Short

- 5.1.2. Medium

- 5.1.3. Intermediate

- 5.1.4. Intercontinental

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Missile Defense Systems

- 5.2.2. Air-to-air missiles

- 5.2.3. Air-to-surface missiles

- 5.2.4. Surface-to-surface missiles

- 5.2.5. Surface-to-air missiles

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Asia-Pacific

- 5.3.1.1. China

- 5.3.1.2. India

- 5.3.1.3. South Korea

- 5.3.1.4. Japan

- 5.3.1.5. Rest of Asia-Pacific

- 5.3.1. Asia-Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Range

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 China Aerospace Science and Industry Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Raytheon Technologies Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 THALES

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Mitsubishi Heavy Industries

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Lockheed Martin Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Defense Research and Development Organization

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 JSC Tactical Missiles Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 MBDA Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Rafael Advanced Defense Systems Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Israel Aerospace Industries

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Kongsberg Gruppen AS

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 China Aerospace Science and Industry Corporation

List of Figures

- Figure 1: Asia-Pacific Missiles and Missile Defense Systems Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Missiles and Missile Defense Systems Industry Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Missiles and Missile Defense Systems Industry Revenue billion Forecast, by Range 2020 & 2033

- Table 2: Asia-Pacific Missiles and Missile Defense Systems Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 3: Asia-Pacific Missiles and Missile Defense Systems Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: Asia-Pacific Missiles and Missile Defense Systems Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Asia-Pacific Missiles and Missile Defense Systems Industry Revenue billion Forecast, by Range 2020 & 2033

- Table 6: Asia-Pacific Missiles and Missile Defense Systems Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 7: Asia-Pacific Missiles and Missile Defense Systems Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: Asia-Pacific Missiles and Missile Defense Systems Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: China Asia-Pacific Missiles and Missile Defense Systems Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: India Asia-Pacific Missiles and Missile Defense Systems Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: South Korea Asia-Pacific Missiles and Missile Defense Systems Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Japan Asia-Pacific Missiles and Missile Defense Systems Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Rest of Asia Pacific Asia-Pacific Missiles and Missile Defense Systems Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Missiles and Missile Defense Systems Industry?

The projected CAGR is approximately 7.43%.

2. Which companies are prominent players in the Asia-Pacific Missiles and Missile Defense Systems Industry?

Key companies in the market include China Aerospace Science and Industry Corporation, Raytheon Technologies Corporation, THALES, Mitsubishi Heavy Industries, Lockheed Martin Corporation, Defense Research and Development Organization, JSC Tactical Missiles Corporation, MBDA Inc, Rafael Advanced Defense Systems Ltd, Israel Aerospace Industries, Kongsberg Gruppen AS.

3. What are the main segments of the Asia-Pacific Missiles and Missile Defense Systems Industry?

The market segments include Range, Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 64.26 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Intercontinental Missiles are Anticipated to Register the Highest CAGR During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In December 2022, DRDO successfully test-fired the Agni-V, a long-range nuclear-capable missile to boost its defense capabilities amid border tensions with China.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Missiles and Missile Defense Systems Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Missiles and Missile Defense Systems Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Missiles and Missile Defense Systems Industry?

To stay informed about further developments, trends, and reports in the Asia-Pacific Missiles and Missile Defense Systems Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence