Key Insights

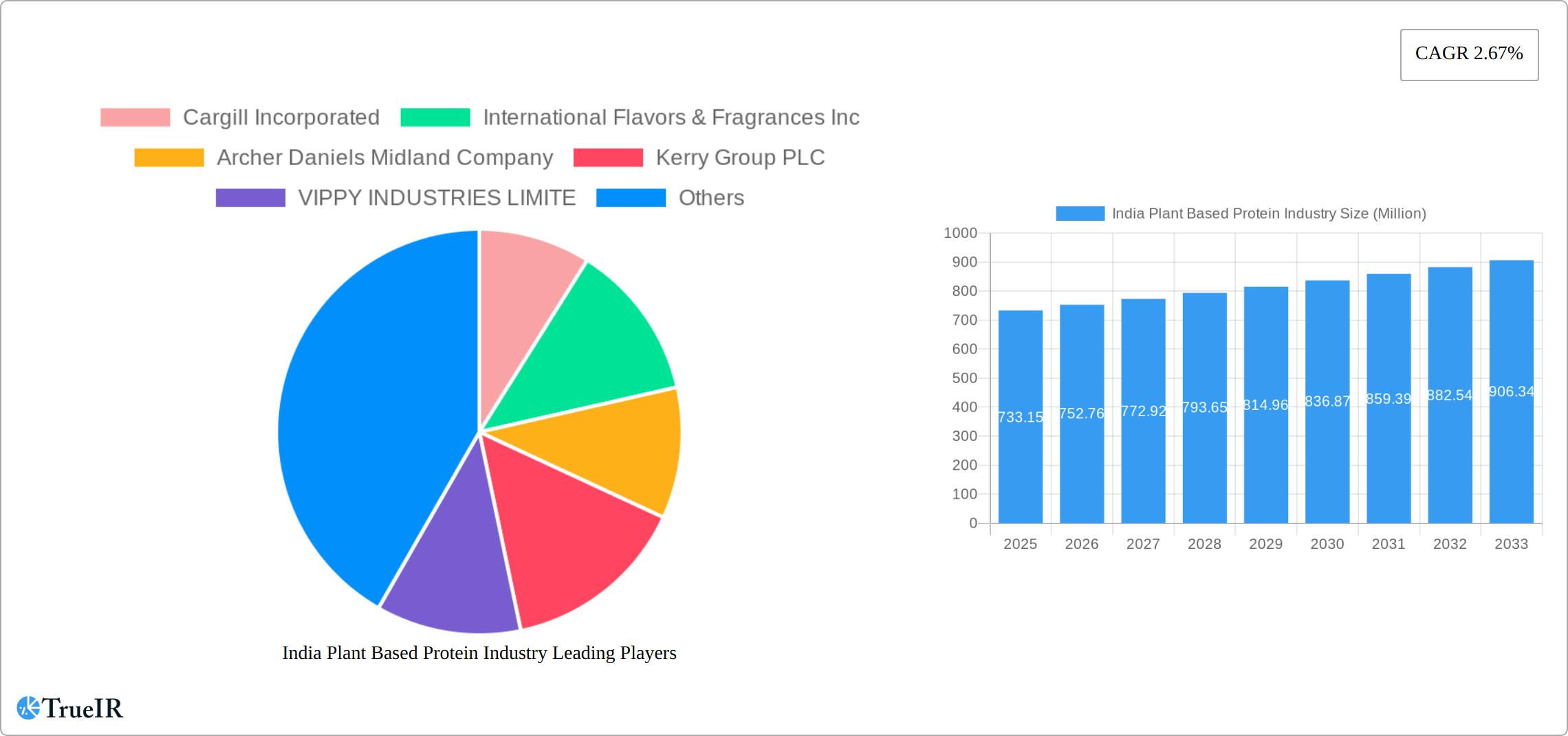

The India plant-based protein market, valued at $733.15 million in 2025, is poised for steady growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 2.67% from 2025 to 2033. This growth is fueled by several key factors. Increasing consumer awareness of the health benefits associated with plant-based diets, including reduced risk of heart disease and improved digestive health, is a significant driver. The rising popularity of veganism and vegetarianism, particularly among younger demographics, further contributes to market expansion. Furthermore, the growing demand for sustainable and ethical food sources is pushing consumers towards plant-based protein alternatives. The increasing prevalence of food allergies and intolerances is also contributing to this shift, as plant-based proteins offer a viable alternative for individuals with sensitivities to dairy or other animal proteins. Finally, the burgeoning fitness and sports nutrition sector is creating significant demand for plant-based protein powders and supplements.

Segmentation within the market reveals strong performance across various protein types, including soy, pea, and rice proteins, and end-use applications. The food and beverage sector is a major consumer, followed by the animal feed and sports/performance nutrition segments. Regional variations within India exist, with the North and South regions likely exhibiting stronger growth due to higher disposable incomes and greater awareness of health and wellness trends. However, the market also shows promising growth potential across East and West India, driven by expanding urbanization and rising consumer demand for healthier alternatives. Major players like Cargill, ADM, and Kerry Group are actively involved, indicating the market's maturity and attractiveness for foreign and domestic investments. Continued innovation in product development, focusing on taste, texture, and functionality of plant-based proteins, will be crucial for sustaining this growth trajectory.

India Plant Based Protein Industry: A Comprehensive Market Report (2019-2033)

This dynamic report provides a deep dive into the burgeoning India plant-based protein industry, offering invaluable insights for investors, industry players, and researchers. Leveraging extensive market research and data analysis from 2019-2024 (historical period), 2025 (base and estimated year), and projecting to 2033 (forecast period), this report unveils the market's structure, competitive landscape, growth drivers, and future potential. The report reveals key trends, dominant segments, and the role of major players like Cargill, ADM, and Roquette in shaping this rapidly evolving market. Expect detailed analysis of market size (in Millions), CAGR, and market penetration rates, enabling informed decision-making and strategic planning.

India Plant Based Protein Industry Market Structure & Competitive Landscape

The Indian plant-based protein market is characterized by a moderately concentrated structure, with a Herfindahl-Hirschman Index (HHI) estimated at xx in 2025. Key players, including Cargill Incorporated, Archer Daniels Midland Company, and Roquette Frère, exert significant influence, although several smaller regional players also contribute substantially. Innovation is a crucial driver, with companies focusing on developing novel protein sources and formulations to cater to diverse consumer preferences and end-use applications. Regulatory frameworks, while evolving, are generally supportive of the industry's growth. Product substitutes, such as traditional animal proteins, pose a significant challenge. However, increasing consumer awareness of health and environmental benefits is driving market expansion. The market is witnessing increased M&A activity, with xx major deals recorded between 2019 and 2024, reflecting consolidation and expansion efforts. End-user segmentation includes animal feed, food and beverages, and sports/performance nutrition, each exhibiting unique growth trajectories.

- Market Concentration: HHI estimated at xx in 2025.

- Innovation Drivers: Development of novel protein sources, sustainable production methods.

- Regulatory Impacts: Generally supportive, with ongoing evolution.

- Product Substitutes: Traditional animal proteins.

- End-User Segmentation: Animal feed, Food & Beverages, Sports/Performance Nutrition.

- M&A Trends: xx major deals between 2019 and 2024.

India Plant Based Protein Industry Market Trends & Opportunities

The Indian plant-based protein market exhibits robust growth, with a projected market size of xx Million in 2025 and xx Million by 2033. This translates to a CAGR of xx% during the forecast period. Technological advancements in protein extraction and processing are creating opportunities for enhanced product quality and cost efficiency. Consumer preferences are shifting towards healthier, more sustainable food choices, fueling the demand for plant-based alternatives. Competitive dynamics are intense, with both established players and emerging startups vying for market share. Increased investments in research and development, coupled with strategic partnerships and acquisitions, are shaping the market landscape. Market penetration rates are increasing steadily, driven by the growing adoption of plant-based diets and rising consumer awareness.

Dominant Markets & Segments in India Plant Based Protein Industry

The Indian plant-based protein market exhibits robust growth, particularly in the North and West regions, driven by higher disposable incomes and increased consumer awareness. Soy protein currently holds the largest market share, followed by pea protein. Rice protein and other novel sources show significant future growth potential. The food and beverage sector is the primary end-user, followed by animal feed and the sports/performance nutrition segments. Regional variations exist, with certain areas showing stronger adoption rates than others due to factors such as cultural preferences and access to information.

- Soy Protein: Market dominance is attributed to established production infrastructure, versatile applications across various food products, and cost-effectiveness in certain applications.

- Pea Protein: Rapid growth is fueled by its rising popularity as a clean-label ingredient, recognized health benefits (high protein content, fiber), and strong sustainability credentials.

- Rice Protein: Emerging as a key player, leveraging its hypoallergenic nature and growing demand for alternative protein sources with mild flavor profiles.

- Food & Beverages: This segment's dominance stems from the increasing consumer demand for plant-based meat alternatives, dairy alternatives (like plant-based yogurt and milk), and protein-enriched beverages.

- Animal Feed: Growth is driven by the need for sustainable and cost-effective protein sources in animal feed formulations, addressing increasing concerns about the environmental impact of traditional animal agriculture.

India Plant Based Protein Industry Product Analysis

Technological advancements in protein extraction, isolation, and formulation are driving the development of innovative plant-based protein products with improved functionality, texture, and taste. These products cater to diverse applications across the food and beverage, animal feed, and sports nutrition industries. The competitive advantage lies in delivering high-quality, cost-effective products that meet specific consumer needs and preferences. Companies are increasingly focusing on developing sustainable and ethically sourced ingredients to appeal to environmentally conscious consumers.

Key Drivers, Barriers & Challenges in India Plant Based Protein Industry

Key Drivers:

- Growing Health Consciousness: Consumers are increasingly seeking healthier dietary options, driving demand for plant-based proteins rich in essential amino acids and fiber.

- Sustainability Concerns: Rising awareness of the environmental impact of animal agriculture is pushing consumers towards more sustainable plant-based alternatives.

- Expanding Vegan and Vegetarian Population: India's large vegetarian population, coupled with the growing adoption of vegan lifestyles, significantly boosts the market demand.

- Government Support: Government initiatives promoting sustainable agriculture and plant-based food systems provide a favorable environment for industry growth.

- Technological Advancements: Innovations in protein extraction and processing are improving the quality, taste, and functionality of plant-based proteins, making them more appealing to consumers.

Challenges:

- Cost Competitiveness: Plant-based proteins often face challenges in competing with the lower cost of traditional animal proteins.

- Technological Gaps: Access to advanced processing technologies is limited, potentially hindering the production of high-quality, cost-effective plant-based protein products.

- Supply Chain Inefficiencies: Inconsistencies in supply chain management can lead to disruptions and affect the overall market stability.

- Regulatory Landscape: Lack of standardized quality control and regulatory complexities create hurdles for industry growth, potentially resulting in an estimated xx Million loss in potential revenue annually.

- Consumer Perception: Overcoming consumer perceptions regarding taste, texture, and nutritional value remains a crucial challenge.

Growth Drivers in the India Plant Based Protein Industry Market

Technological advancements in protein extraction and processing are significantly improving the quality and functionality of plant-based proteins, making them more appealing and competitive with traditional protein sources. Coupled with this are increasing consumer awareness of the health and sustainability benefits of plant-based diets, creating a strong demand pull. Government support for sustainable agriculture and favorable regulatory frameworks further contribute to market expansion. The burgeoning demand across food and beverage, animal feed, and sports nutrition sectors fuels this continuous market growth.

Challenges Impacting India Plant Based Protein Industry Growth

High production costs, particularly in scaling up operations to meet growing demand, remain a significant hurdle for many players. The limited availability of advanced processing technologies restricts the capacity for high-quality production. Potential supply chain disruptions, often exacerbated by weather patterns and infrastructure limitations, impact consistent product availability. Regulatory complexities, including the lack of standardized quality control mechanisms, contribute to increased costs and potential market inefficiencies. Finally, intense competition and the need to continually meet evolving consumer expectations add further layers of complexity.

Key Players Shaping the India Plant Based Protein Industry Market

- Cargill Incorporated

- International Flavors & Fragrances Inc

- Archer Daniels Midland Company

- Kerry Group PLC

- VIPPY INDUSTRIES LIMITE

- Südzucker AG

- Ingredion Incorporated

- Roquette Frère

- Ruchi Soya Industries Ltd

- DuPont Nutrition & Health

Significant India Plant Based Protein Industry Industry Milestones

- June 2022: Roquette launched its Nutralys rice protein line, significantly expanding the range of available meat substitute options in the Indian market.

- May 2022: BENEO (Südzucker subsidiary) acquired Meatless BV, strengthening its position in providing texturizing solutions crucial for the development of appealing plant-based products.

- April 2021: ADM's opening of a cutting-edge plant-based innovation lab in Singapore signifies a strategic focus on the Asia-Pacific market, including India, indicating significant investment and interest in the region's potential.

Future Outlook for India Plant Based Protein Industry Market

The India plant-based protein market is poised for significant growth, driven by increasing consumer demand for healthy and sustainable food options. Strategic investments in research and development, coupled with technological advancements and supportive government policies, will further enhance market expansion. Opportunities abound for companies that can develop innovative, high-quality products that meet the evolving needs of consumers. The market is expected to witness further consolidation through mergers and acquisitions, leading to increased efficiency and market dominance by key players.

India Plant Based Protein Industry Segmentation

-

1. Protein Type

- 1.1. Hemp Protein

- 1.2. Pea Protein

- 1.3. Potato Protein

- 1.4. Rice Protein

- 1.5. Soy Protein

- 1.6. Wheat Protein

- 1.7. Other Plant Protein

-

2. End User

- 2.1. Animal Feed

-

2.2. Food and Beverages

-

2.2.1. By Sub End User

- 2.2.1.1. Bakery

- 2.2.1.2. Breakfast Cereals

- 2.2.1.3. Condiments/Sauces

- 2.2.1.4. Confectionery

- 2.2.1.5. Dairy and Dairy Alternative Products

- 2.2.1.6. Meat/Poultry/Seafood and Meat Alternative Products

- 2.2.1.7. RTE/RTC Food Products

- 2.2.1.8. Snacks

-

2.2.1. By Sub End User

- 2.3. Personal Care and Cosmetics

-

2.4. Supplements

- 2.4.1. Baby Food and Infant Formula

- 2.4.2. Elderly Nutrition and Medical Nutrition

- 2.4.3. Sport/Performance Nutrition

India Plant Based Protein Industry Segmentation By Geography

- 1. India

India Plant Based Protein Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.67% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Organic Plant Proteins; Increasing Application of Pea Protein in Food and Beverages

- 3.3. Market Restrains

- 3.3.1. Presence of Alternative protein sources

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Plant Based Protein Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Protein Type

- 5.1.1. Hemp Protein

- 5.1.2. Pea Protein

- 5.1.3. Potato Protein

- 5.1.4. Rice Protein

- 5.1.5. Soy Protein

- 5.1.6. Wheat Protein

- 5.1.7. Other Plant Protein

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Animal Feed

- 5.2.2. Food and Beverages

- 5.2.2.1. By Sub End User

- 5.2.2.1.1. Bakery

- 5.2.2.1.2. Breakfast Cereals

- 5.2.2.1.3. Condiments/Sauces

- 5.2.2.1.4. Confectionery

- 5.2.2.1.5. Dairy and Dairy Alternative Products

- 5.2.2.1.6. Meat/Poultry/Seafood and Meat Alternative Products

- 5.2.2.1.7. RTE/RTC Food Products

- 5.2.2.1.8. Snacks

- 5.2.2.1. By Sub End User

- 5.2.3. Personal Care and Cosmetics

- 5.2.4. Supplements

- 5.2.4.1. Baby Food and Infant Formula

- 5.2.4.2. Elderly Nutrition and Medical Nutrition

- 5.2.4.3. Sport/Performance Nutrition

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Protein Type

- 6. North India India Plant Based Protein Industry Analysis, Insights and Forecast, 2019-2031

- 7. South India India Plant Based Protein Industry Analysis, Insights and Forecast, 2019-2031

- 8. East India India Plant Based Protein Industry Analysis, Insights and Forecast, 2019-2031

- 9. West India India Plant Based Protein Industry Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Cargill Incorporated

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 International Flavors & Fragrances Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Archer Daniels Midland Company

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Kerry Group PLC

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 VIPPY INDUSTRIES LIMITE

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Südzucker AG

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Ingredion Incorporated

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Roquette Frère

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Ruchi Soya Industries Ltd

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 DuPont Nutrition & Health

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Cargill Incorporated

List of Figures

- Figure 1: India Plant Based Protein Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Plant Based Protein Industry Share (%) by Company 2024

List of Tables

- Table 1: India Plant Based Protein Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Plant Based Protein Industry Volume K Tons Forecast, by Region 2019 & 2032

- Table 3: India Plant Based Protein Industry Revenue Million Forecast, by Protein Type 2019 & 2032

- Table 4: India Plant Based Protein Industry Volume K Tons Forecast, by Protein Type 2019 & 2032

- Table 5: India Plant Based Protein Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 6: India Plant Based Protein Industry Volume K Tons Forecast, by End User 2019 & 2032

- Table 7: India Plant Based Protein Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: India Plant Based Protein Industry Volume K Tons Forecast, by Region 2019 & 2032

- Table 9: India Plant Based Protein Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: India Plant Based Protein Industry Volume K Tons Forecast, by Country 2019 & 2032

- Table 11: North India India Plant Based Protein Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: North India India Plant Based Protein Industry Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 13: South India India Plant Based Protein Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: South India India Plant Based Protein Industry Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 15: East India India Plant Based Protein Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: East India India Plant Based Protein Industry Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 17: West India India Plant Based Protein Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: West India India Plant Based Protein Industry Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 19: India Plant Based Protein Industry Revenue Million Forecast, by Protein Type 2019 & 2032

- Table 20: India Plant Based Protein Industry Volume K Tons Forecast, by Protein Type 2019 & 2032

- Table 21: India Plant Based Protein Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 22: India Plant Based Protein Industry Volume K Tons Forecast, by End User 2019 & 2032

- Table 23: India Plant Based Protein Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 24: India Plant Based Protein Industry Volume K Tons Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Plant Based Protein Industry?

The projected CAGR is approximately 2.67%.

2. Which companies are prominent players in the India Plant Based Protein Industry?

Key companies in the market include Cargill Incorporated, International Flavors & Fragrances Inc, Archer Daniels Midland Company, Kerry Group PLC, VIPPY INDUSTRIES LIMITE, Südzucker AG, Ingredion Incorporated, Roquette Frère, Ruchi Soya Industries Ltd , DuPont Nutrition & Health.

3. What are the main segments of the India Plant Based Protein Industry?

The market segments include Protein Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 733.15 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Organic Plant Proteins; Increasing Application of Pea Protein in Food and Beverages.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Presence of Alternative protein sources.

8. Can you provide examples of recent developments in the market?

June 2022: Roquette, a plant-based protein manufacturer, released two novel rice proteins to address the market demand for meat substitute applications. The new Nutralys rice protein line includes a rice protein isolate and a rice protein concentrate. May 2022: BENEO, a subsidiary of Südzucker, entered a purchase agreement to acquire Meatless BV, a producer of functional ingredients. BENEO is expanding its existing product offering with the acquisition to offer an even broader range of texturizing solutions for meat and fish alternatives.April 2021: ADM opened a new, cutting-edge plant-based innovation lab located in ADM’s Biopolis research hub in Singapore. The lab develops advanced products and customized solutions to meet the growing food and beverage demand in the Asia-Pacific region. The ADM Biopolis research hub in Singapore features a wide range of capabilities, including a food and flavor analytic lab, beverage and dairy applications lab and pilot plant, bakery and confectionery lab, meat and savory lab, sweet and savory creation lab, sensory evaluation facilities, customer innovation center, and a new plant-based innovation lab.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Plant Based Protein Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Plant Based Protein Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Plant Based Protein Industry?

To stay informed about further developments, trends, and reports in the India Plant Based Protein Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence